Vecima Networks Inc. (“Vecima” or the “Company”)

(TSX: VCM) announced today that its second quarter financial

results will reflect impacts related to adjustments in the timing

of some of its largest customers’ cable and fiber upgrades, as well

as certain transitory events including, but not limited to, foreign

exchange volatility, costs associated with workforce reductions

announced in December, and a temporary shift in product mix that

has resulted in a lower gross margin. The Company expects to report

second quarter revenue of $71.2 million, a gross margin of 36.4%,

Adjusted EBITDA of $1.1 million, and a loss per share of $0.32.

Full financial results for the second quarter are expected to be

released on February 13, 2025.

“Notwithstanding the challenges faced in Q2, we achieved

significant milestones during the quarter that position us for

strong future growth,” said Sumit Kumar, President and Chief

Executive Officer of Vecima. “We also moved forward decisively with

cost reductions to better align our teams and program investments

with customer needs and to enhance operating efficiency going

forward. Our workforce restructuring initiatives, while resulting

in one-time costs that impacted Q2 results, are expected to deliver

ongoing annualized cash savings of approximately $17.5

million.”

Going forward, Vecima recognizes that demand volatility could

continue into the second half of fiscal 2025 depending on customer

project timing. Delays to date in the timing of customer network

upgrades have primarily reflected ongoing system-level field

qualifications, which are typically challenging for customers

undertaking very large system upgrades. Vecima’s technology has

performed exceptionally well through these qualification processes

and the Company anticipates increased product rollouts once

qualifications are completed. The prospect of trade actions between

the U.S. and Canada has added further uncertainty to the outlook,

potentially impacting a diverse array of businesses and sectors,

including Vecima and its competitors. With approximately 90% of its

sales in the U.S., an estimated half of which the Company believes

could potentially be exposed to tariff actions, Vecima is underway

with plans to mitigate potential risks, regardless of the outcome

of current tariff discussions.

“Vecima is a strong, proven company with a long history of

responding quickly and successfully to changing business

conditions,” added Mr. Kumar. “While accurate forecasting in the

near and medium term will be more difficult in light of the current

trade and timing uncertainties, adapting to rapidly changing

business environments is one of our core strengths. We are moving

forward with global market share leadership in the high-growth DAA

and IPTV markets, a proven track record as a provider of innovative

technology, services, and products to the world’s most

sophisticated cable and broadcast providers, and compelling

opportunities provided by our growing portfolio of next-generation

solutions. We remain confident in our future growth prospects and

our ability to continue creating strong value for our customers and

shareholders.”

About Vecima Networks

Vecima Networks Inc. (TSX: VCM) is leading the global evolution

to the multi-gigabit, content-rich networks of the future. Our

talented people deliver future-ready software, services, and

integrated platforms that power broadband and video streaming

networks, monitor and manage transportation, and transform

experiences in homes, businesses, and everywhere people connect. We

help our customers evolve their networks with cloud-based solutions

that deliver ground-breaking speed, superior video quality, and

exciting new services to their subscribers. There is power in

connectivity – it enables people, businesses, and communities to

grow and thrive. Learn more at www.vecima.com.

Cautionary Statement Regarding Forward-Looking

Statements

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information is generally identifiable by use of the words

“believes”, “may”, “plans”, “will”, “anticipates”, “intends”,

“could”, “estimates”, “expects”, “forecasts”, “projects” and

similar expressions, and the negative of such expressions.

Forward-looking information in this news release includes, but is

not limited to, any statements respecting: the timing of Vecima's

customers' cable and fiber upgrades; the transitory nature of the

impact on Vecima of workforce reduction costs; the timing of the

release of and the actual financial results for the second quarter;

management's expectations around Vecima's future growth and

financial results; enhancement of future operational efficiency;

volatility of customer demand; changes to product rollouts;

potential trade actions between the U.S. and Canada; the degree to

which the Company's sales are exposed to tariff actions; mitigation

of tariff risks; global market share leadership in and the growth

of the DAA and IPTV markets; and management's expectations

surrounding the degree to which Vecima will create shareholder and

customer value. The forward-looking statements are based on the

current expectations of the management of Vecima and are inherently

subject to uncertainties and changes in circumstances and their

potential effects and speak only as of the date of such statement.

There can be no assurance that future developments will be those

that have been anticipated.

Forward-looking information in this news release also includes

future-oriented financial information or financial outlook within

the meaning of securities laws, such as information regarding

Vecima’s second quarter revenue, gross margin, adjusted EBITDA and

adjusted loss per share; and expected ongoing annualized cash

savings associated with Vecima's restructuring initiatives.

A more complete discussion of the risks and uncertainties facing

Vecima is disclosed under the heading “Risk Factors” in the

Company’s Annual Information Form dated September 19, 2024, as well

as the Company’s continuous disclosure filings with Canadian

securities regulatory authorities available at www.sedarplus.ca.

All forward-looking information herein is qualified in its entirety

by this cautionary statement, and Vecima disclaims any obligation

to revise or update any such forward-looking information or to

publicly announce the result of any revisions to any of the

forward-looking information contained herein to reflect future

results, events or developments, except as required by law.

Non-IFRS Measures and Reconciliation of Non-IFRS

Measure

This press release contains references to Adjusted EBITDA, a

non-IFRS measure. Non-IFRS financial measures are used by

management to evaluate the performance of the Company and do not

have any meaning prescribed by IFRS and therefore may not be

comparable to similar measures presented by other reporting

issuers. Non-IFRS financial measures used herein have been applied

on a consistent basis.

The following table reconciles net income for the period to

EBITDA and Adjusted EBITDA. The term “EBITDA” refers to net income

or net loss as typically reported in the IFRS financial statements,

excluding any amounts included in net income or net loss for income

taxes, interest expense, and depreciation and amortization for

PP&E, right-of-use assets, deferred development and intangible

assets. The term “Adjusted EBITDA” refers to EBITDA adjusted for:

gains and losses on sale of PP&E, intangible assets, and assets

held for sale; impairment of PP&E; impairment of deferred

development costs and other intangible assets; restructuring costs;

and share-based compensation expense. The Company believes that

Adjusted EBITDA is useful supplemental information for management

and for investors because it provides for the analysis of the

Company’s results exclusive of certain non-cash items and other

items which do not directly correlate to our business of selling

broadband access products, content delivery and storage products

and services or supplying telematic services. EBITDA and Adjusted

EBITDA are not recognized measures under IFRS and, accordingly,

investors are cautioned that EBITDA and Adjusted EBITDA should not

be construed as alternatives to net income, determined in

accordance with IFRS, or as indicators of the Company’s financial

performance or as measures of its liquidity and cash flows.

Calculation of Adjusted EBITDA

Three months ended December

31,

Six months ended December

31,

(in thousands of dollars)

2024

2023

2024

2023

Net income (loss) (1)

$

(7,885

)

$

3,589

$

(5,740

)

$

5,334

Income tax expense (recovery)

(2,135

)

1,247

(1,599

)

907

Interest expense

2,346

1,662

4,746

2,362

Depreciation of property, plant and

equipment

1,101

844

1,960

1,676

Depreciation of right-of-use assets

373

334

735

659

Amortization of deferred development

costs

3,848

3,486

7,382

6,636

Amortization of intangible assets

836

816

1,651

1,632

EBITDA

(1,516

)

11,978

9,135

19,206

Loss on sale of property, plant and

equipment

79

18

99

19

Share-based compensation

462

257

1,008

513

Warrants expense (recovery)

(871

)

217

(765

)

855

Acquisition-related costs

130

–

387

–

Restructuring costs

2,798

–

2,798

–

Adjusted EBITDA

$

1,082

$

12,470

$

12,662

$

20,593

Percentage of sales

2

%

20

%

8

%

17

%

(1) Net income (loss) includes foreign exchange gains (losses)

in the amount of $(4,272) and $1,837 for the three months ended

December 31, 2024 and 2023, respectively; and $(3,764) and $1,253

for the six months ended December 31, 2024 and 2023,

respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206266700/en/

Vecima Networks Investor Relations - 250-881-1982

invest@vecima.com

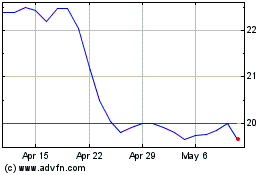

Vecima Networks (TSX:VCM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vecima Networks (TSX:VCM)

Historical Stock Chart

From Feb 2024 to Feb 2025