Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the

“Company”) today announced its unaudited financial results for the

quarter ended September 30, 2021, which were highlighted by

reported cash of $16.0 million and substantial progress toward

completion of the Definitive Feasibility Study (“DFS”) for Vista’s

100% owned Mt Todd gold project (“Mt Todd” or the “Project”). All

dollar amounts in this press release are in U.S. dollars.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20211027006120/en/

Figure 1 – Relationship of known

structural trends relative to existing mineral deposits and

exploration targets. (Graphic: Business Wire)

Frederick H. Earnest, President and Chief Executive Officer of

Vista, commented, “Our activities during the third quarter focused

on increasing shareholder value. The DFS is nearing completion and

remains on budget. Mine planning using a higher gold price is

expected to increase reserves and extend the life of mine. We

started Phase 3 drilling of our exploration program and plan to

drill an additional 2,650 meters, for approximately 9,000 meters of

total drilling. Results of the drilling program have been very

positive. Every drill hole has intersected mineralization,

consistent with our geologic model.”

Mr. Earnest continued, “We significantly strengthened our

balance sheet, with quarter-end cash of approximately $16.0

million. We believe our existing cash will fund the Company’s value

enhancing programs, continue to fund working capital, and

strengthen our position in discussions with potential

partners.”

Important Recent Developments

- The Mt Todd DFS engineering and design are 80% complete, on

track and on budget;

- Completed Phase 2 of the ongoing exploration drilling program

and started Phase 3 drilling; and

- Ended Q3 2021 with cash and cash equivalents of $16.0 million

and zero debt.

Definitive Feasibility Study

Engineering and design for the Mt Todd DFS are 80% complete.

With new mine plans at higher gold prices, the DFS is expected to

result in a larger reserve and longer mine life. This DFS will

address recommendations from the 2019 pre-feasibility study,

reflect minor updates of the Project design to be consistent with

the approved Mine Management Plan, and advance the level of

engineering and detailed costing in all areas of the Project. We

are also evaluating several trade-off opportunities (e.g., contract

power generation, contract mining and autonomous truck

haulage).

Accretive Development Strategy

The process to seek a strategic partner is advancing, despite

COVID-related travel restrictions. In particular, mining companies

outside Australia have been hindered in their ability to complete

site visits and perform other in-country due diligence activities.

Nonetheless, we continued to see strong interest in Mt Todd. The

Australian government recently announced it will begin to ease

international travel restrictions for its fully vaccinated citizens

and permanent residents beginning in November. The Australian

government is working to define a plan to allow international

travel by foreigners, but this will likely not occur until sometime

in early 2022. Once Australia’s borders re-open, we expect

opportunities for on-site due diligence to increase.

Positive Drilling Results

To demonstrate the resource potential at Mt Todd, the Company is

drilling exploration targets adjacent to the Batman deposit and

extending northeast to the Quigleys deposit, all within our mining

licenses. The drilling program has focused on identifying

connecting structures and mineralization between previously

interpreted discreet deposits and the potential for efficient

resource growth with future drilling along strike from the Batman

deposit approximately 1.9 Km north to the Golf-Tollis/Penguin

targets. Two principal types of structures are present in Figure 1;

the red dashed lines represent structures with Batman-style sheeted

vein mineralization and the light blue lines represent the

connecting structures. The dark blue dashed lines show what are

believed to be faults.

To date, Vista has completed 18 planned holes and drilled 6,365

meters in Phases 1 and 2 of the current program. Every drill hole

has intersected mineralization consistent with our geologic model.

Phase 3 drilling started in September and will include an

additional 2,650 meters of drilling extending to Quigleys. Drilling

is expected to continue into 2022. Our goal is to demonstrate the

regional potential along a ~5.4 Km portion of the +24 Km

Batman-Driffield Trend and to outline areas where future drilling

can be undertaken to efficiently define additional gold

resources.

Summary of Q3 2021 Financial Results

On September 30, 2021, cash and cash equivalents totaled $16.0

million, which included net proceeds of $12.3 million from the

Company’s July 2021 public offering.

Vista reported a net loss of $3.1 million or $0.02 per share for

the three months ended September 30, 2021, compared to net income

of $4.2 million or $0.05 per share reported for the three months

ended September 30, 2020. The three month period ended September

30, 2020 included a gain of $3.5 million related to the sale of the

Los Reyes project. The loss for the current quarter was in line

with management’s expectations.

Management Conference Call

Management’s quarterly conference call to review financial

results for the quarter ended September 30, 2021 and to discuss

corporate and project activities is scheduled on Thursday, October

28, 2021 at 10:00 am MDT (12:00 pm EDT).

Participant Toll Free: (844) 898-8648 Participant International:

(647) 689-4225 Conference ID: 8590039

This call will also be archived and available at

www.vistagold.com after October 28, 2021. Audio replay will be

available through November 18, 2021 by calling toll-free in North

America (855) 859-2056 or (404) 537-3406.

If you are unable to access the audio or phone-in on the day of

the conference call, please email your questions to

ir@vistagold.com.

About Vista Gold Corp.

Vista is a gold project developer. The Company’s flagship asset

is the Mt Todd gold project located in the Tier 1, mining friendly

jurisdiction of Northern Territory, Australia. Situated

approximately 250 km southeast of Darwin, Mt Todd is the largest

undeveloped gold project in Australia and, if developed as

presently designed, would potentially be Australia’s fourth largest

gold producer on an annual basis, with lowest tertile in-country

and global all-in sustaining costs. All major operating and

environmental permits have now been approved.

For further information, please contact Pamela Solly, Vice

President of Investor Relations, at (720) 981-1185.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the U.S. Securities Act of 1933, as amended, and

U.S. Securities Exchange Act of 1934, as amended, and

forward-looking information within the meaning of Canadian

securities laws. All statements, other than statements of

historical facts, included in this press release that address

activities, events or developments that we expect or anticipate

will or may occur in the future, including such things as our

belief that management is nearing completion of a DFS; our

expectation that the DFS will address recommendations from the 2019

pre-feasibility study and include minor updates of the Project

design to be consistent with the approved Mining Management Plan

and engineering and detailed costing in areas of the Project; our

belief that using a higher gold price for mine planning purposes is

expected to increase reserves and the life of mine; our expectation

that our existing cash will fund the Company’s value enhancing

programs, continue to fund working capital, and strengthen our

position in discussions with potential partners; our expectation to

drill an additional 2,650 meters in Phase 3 of the drill program

and continue drilling into 2022; our expectation to advance on-site

due diligence activities with potential partners once Australia’s

borders re-open; and our belief that Mt Todd is the largest

undeveloped gold project in Australia and, if developed as

presently designed, would potentially be Australia’s fourth largest

gold producer on an annual basis, with lowest tertile in-country

and global all-in sustaining costs are forward-looking statements

and forward-looking information. The material factors and

assumptions used to develop the forward-looking statements and

forward-looking information contained in this press release include

the following: our approved business plans, exploration and assay

results, results of our test work for process area improvements,

mineral resource and reserve estimates and results of preliminary

economic assessments, prefeasibility studies and feasibility

studies on our projects, if any, our experience with regulators,

and positive changes to current economic conditions and the price

of gold. When used in this press release, the words “optimistic,”

“potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,”

“may,” “will,” “if,” “anticipate,” and similar expressions are

intended to identify forward-looking statements and forward-looking

information. These statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such statements. Such factors include,

among others, uncertainties inherent in the exploration of mineral

properties, the possibility that future exploration results will

not be consistent with the Company’s expectations; there being no

assurance that the exploration program or programs of the Company

will result in expanded mineral resources; uncertainty of resource

and reserve estimates, uncertainty as to the Company’s future

operating costs and ability to raise capital; risks relating to

cost increases for capital and operating costs; risks of shortages

and fluctuating costs of equipment or supplies; risks relating to

fluctuations in the price of gold; the inherently hazardous nature

of mining-related activities; potential effects on our operations

of environmental regulations in the countries in which it operates;

risks due to legal proceedings; risks relating to political and

economic instability in certain countries in which it operates;

uncertainty as to the results of bulk metallurgical test work; and

uncertainty as to completion of critical milestones for Mt Todd; as

well as those factors discussed under the headings “Note Regarding

Forward-Looking Statements” and “Risk Factors” in the Company’s

latest Annual Report on Form 10-K as filed February 25, 2021 and

other documents filed with the U.S. Securities and Exchange

Commission and Canadian securities regulatory authorities. Although

we have attempted to identify important factors that could cause

actual results to differ materially from those described in

forward-looking statements and forward-looking information, there

may be other factors that cause results not to be as anticipated,

estimated or intended. Except as required by law, we assume no

obligation to publicly update any forward-looking statements or

forward-looking information; whether as a result of new

information, future events or otherwise.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission (“SEC”)

limits disclosure for U.S. reporting purposes to mineral deposits

that a company can economically and legally extract or produce. The

technical reports referenced in this press release uses the terms

defined in Canadian National Instrument 43-101 – Standards of

Disclosure for Mineral Projects (“NI 43-101”) and the Canadian

Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM

Definition Standards on Mineral Resources and Mineral Reserves,

adopted by the CIM Council, as amended (the “CIM Definition

Standards”). These standards are not the same as reserves under the

SEC’s Industry Guide 7 and may not constitute reserves or resources

under the SEC’s newly adopted disclosure rules to modernize mineral

property disclosure requirements (“SEC Modernization Rules”), which

became effective February 25, 2019 and will be applicable to the

Company in its annual report for the fiscal year ending December

31, 2021. Under the currently applicable SEC Industry Guide 7

standards, a “final” or “bankable” feasibility study is required to

report reserves, the three-year historical average price is used in

any reserve or cash flow analysis to designate reserves and all

necessary permits and government approvals must be filed with the

appropriate governmental authority. Additionally, the technical

reports uses the terms “measured resources”, “indicated resources”,

and “measured & indicated resources”. We advise U.S. investors

that while these terms are Canadian mining terms as defined in

accordance with NI 43-101, such terms are not recognized under SEC

Industry Guide 7 and normally are not permitted to be used in

reports and registration statements filed with the SEC. Mineral

resources described in the technical reports have a great amount of

uncertainty as to their economic and legal feasibility. The SEC

normally only permits issuers to report mineralization that does

not constitute SEC Industry Guide 7 compliant “reserves” as

in-place tonnage and grade, without reference to unit measures.

“Inferred resources” have a great amount of uncertainty as to their

existence, and great uncertainty as to their economic and legal

feasibility. It cannot be assumed that any or all part of an

inferred resource will ever be upgraded to a higher category.

U.S. Investors are cautioned not to assume that any part or all

of mineral deposits in these categories will ever be converted into

SEC Industry Guide 7 reserves.

Under the SEC Modernization Rules, the definitions of “proven

mineral reserves” and “probable mineral reserves” have been amended

to be substantially similar to the corresponding CIM Definition

Standards and the SEC has added definitions to recognize “measured

mineral resources”, “indicated mineral resources” and “inferred

mineral resources” which are also substantially similar to the

corresponding CIM Definition Standard. However there are

differences between the definitions and standards under the SEC

Modernization Rules and those under the CIM Definition Standards

and therefore once the Company begins reporting under the SEC

Modernization Rules there is no assurance that the Company’s

mineral reserve and mineral estimates will be the same as those

reported under CIM Definition Standards as contained in the

technical reports prepared under CIM Definition Standards or that

the economics for the Mt Todd project estimated in such technical

reports will be the same as those estimated in any technical report

prepared by the Company under the SEC Modernization Rules in the

future.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211027006120/en/

Pamela Solly, Vice President of Investor Relations (720)

981-1185

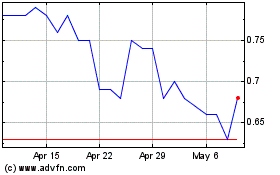

Vista Gold (TSX:VGZ)

Historical Stock Chart

From Feb 2025 to Mar 2025

Vista Gold (TSX:VGZ)

Historical Stock Chart

From Mar 2024 to Mar 2025