Wallbridge Mining Company Limited (TSX: WM, OTCQB:

WLBMF) (“

Wallbridge” or the

“

Company”) announced today that it has acquired

1,487,500 units (each, a “

Unit”) of NorthX Nickel

Corp. (formerly Archer Exploration Corp.)

(“

Archer”) (CSE:NIX) (“

NorthX”)

at a price of $0.24 per Unit for a total purchase price of

$357,000, by way of non-brokered private placement (the

“

Offering”).

Each Unit is comprised of one common share

(each, a “Common Share”) and one common share

purchase warrant of NorthX (each, a “Warrant”).

Each Warrant entitles the holder thereof to acquire one Common

Share at a price of $0.36 at any time during the 36-month period

following the closing of the Offering. The Warrants are subject to

an accelerated expiry date, which comes into effect after November

3, 2024 if the closing price of the Common Shares on the Canadian

Securities Exchange is equal to or greater than $0.72 for a period

of 10 consecutive trading days (the “Acceleration

Event”). If the Acceleration Event occurs, NorthX may

provide an expiry acceleration notice (the

“Notice”) to Warrant holders and the expiry date

of the Warrants will be deemed to be 30 days from the date of the

Notice.

Immediately prior to the closing of the

Offering, Wallbridge owned 3,007,293 Common Shares, which

represented 15.84% of the issued and outstanding Common Shares on a

non-diluted basis. Following the Offering, Wallbridge owns

4,494,793 Common Shares and 1,487,500 Warrants, representing 15.79%

of the issued and outstanding Common Shares on a non-diluted basis

and 19.98% of the issued and outstanding Common Shares on a

partially diluted basis, assuming the exercise of the Warrants.

On July 12, 2022, Wallbridge entered into an

asset purchase agreement with Archer, pursuant to which the Company

received common shares of Archer as part of the consideration for

the disposition of its portfolio of nickel assets (the

“Transaction”). As part of the Transaction,

Wallbridge entered into an investor rights agreement (the

“IRA”). Pursuant to the IRA, Wallbridge has the

right to nominate two (2) candidates for election as directors of

NorthX so long as it maintains ownership of at least 10% of the

issued and outstanding Common Shares on a partially-diluted basis,

as calculated in accordance with the IRA. The IRA also provides the

acquiror: (i) a pro rata pre-emptive right, (ii) top-up rights, and

(iii) a standard piggyback registration right subject to

underwriter cutback, so long as Wallbridge holds at least 10% of

the issued and outstanding Common Shares on a partially diluted

basis, as calculated in accordance with the IRA.

Wallbridge acquired the Units for investment

purposes and may, depending on market and other conditions,

increase or decrease its beneficial ownership of Common Shares or

other securities of NorthX whether in the open market, by privately

negotiated agreement or otherwise.

This press release is being issued pursuant to

NI 62-103 – The Early Warning System and Related Take-Over Bid and

Insider Reporting Issues, which also requires a report to be filed

in accordance with applicable securities laws (the “Early

Warning Report”). A copy of the Early Warning Report will

be available under Wallbridge’s and NorthX’s profiles on SEDAR+ at

www.sedarplus.ca.

About Wallbridge Mining

Wallbridge is focused on creating value through

the exploration and sustainable development of gold projects along

the Detour-Fenelon Gold Trend in Québec’s Northern Abitibi region

while respecting the environment and communities where it

operates.

Wallbridge’s most advanced projects, Fenelon

Gold (“Fenelon”) and Martiniere Gold

(“Martiniere”) incorporate a combined 3.05 million

ounces of indicated gold resources and 2.35 million ounces of

inferred gold resources. Fenelon and Martiniere are located within

an 830 square kilometre exploration land package controlled by

Wallbridge.

Wallbridge has reported a positive Preliminary

Economic Assessment (“PEA”) at Fenelon that

estimates average annual gold production of 212,000 ounces over 12

years (see Wallbridge press release of June 26, 2023).

Wallbridge also holds a 15.79% interest in

NorthX Nickel Corp., on a non-diluted basis, as a result of the

sale of the Company’s portfolio of nickel assets in Ontario and

Québec in November of 2022 and the Company’s subsequent acquisition

of additional Common Shares and Warrants by way of private

placement by NorthX in May of 2024.

For further information please visit the

Company’s website at https://wallbridgemining.com/ or contact:

Wallbridge Mining Company

Limited

Brian Penny, CPA, CMA

Chief Executive OfficerTel: (416) 716-8346

Email: bpenny@wallbridgemining.com

Victoria Vargas, B.Sc. (Hon.) Economics,

MBACapital Markets AdvisorEmail: vvargas@wallbridgemining.com

Cautionary Note Regarding

Forward-Looking Information

The information in this document may contain

forward-looking statements or information (collectively,

“FLI”) within the meaning of applicable Canadian

securities legislation. FLI is based on expectations, estimates,

projections and interpretations as at the date of this

document.

All statements, other than statements of

historical fact, included herein are FLI that involve various

risks, assumptions, estimates and uncertainties. Generally, FLI can

be identified by the use of statements that include, but are not

limited to, words such as “seeks”, “believes”, “anticipates”,

“plans”, “continues”, “budget”, “scheduled”, “estimates”,

“expects”, “forecasts”, “intends”, “projects”, “predicts”,

“proposes”, "potential", “targets” and variations of such words and

phrases, or by statements that certain actions, events or results

“may”, “will”, “could”, “would”, “should” or “might”, “be taken”,

“occur” or “be achieved.”

FLI in this document may include, but is not

limited to: statements regarding the results of the PEA; the

potential future performance of the Common Shares; future drill

results; the Company’s ability to convert inferred resources into

measured and indicated resources; environmental matters;

stakeholder engagement and relationships; parameters and methods

used to estimate the MRE’s at Fenelon and Martiniere (collectively

the “Deposits”); the prospects, if any, of the

Deposits; future drilling at the Deposits; and the significance of

historic exploration activities and results.

FLI is designed to help you understand

management’s current views of its near- and longer-term prospects,

and it may not be appropriate for other purposes. FLI by their

nature are based on assumptions and involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance, or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such FLI. Although the FLI

contained in this document is based upon what management believes,

or believed at the time, to be reasonable assumptions, the Company

cannot assure shareholders and prospective purchasers of securities

of the Company that actual results will be consistent with such

FLI, as there may be other factors that cause results not to be as

anticipated, estimated or intended, and neither the Company nor any

other person assumes responsibility for the accuracy and

completeness of any such FLI. Except as required by law, the

Company does not undertake, and assumes no obligation, to update or

revise any such FLI contained in this document to reflect new

events or circumstances. Unless otherwise noted, this document has

been prepared based on information available as of the date of this

document. Accordingly, you should not place undue reliance on the

FLI, or information contained herein.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in FLI.

Assumptions upon which FLI is based, without

limitation, include: the results of exploration activities, the

Company’s financial position and general economic conditions; the

ability of exploration activities to accurately predict

mineralization; the accuracy of geological modelling; the ability

of the Company to complete further exploration activities; the

legitimacy of title and property interests in the Deposits; the

accuracy of key assumptions, parameters or methods used to estimate

the MREs and in the PEA; the ability of the Company to obtain

required approvals; geological, mining and exploration technical

problems; failure of equipment or processes to operate as

anticipated; the evolution of the global economic climate; metal

prices; foreign exchange rates; environmental expectations;

community and non-governmental actions; and, the Company’s ability

to secure required funding. Risks and uncertainties about

Wallbridge's business are discussed in the disclosure materials

filed with the securities regulatory authorities in Canada, which

are available at www.sedarplus.ca.

Cautionary Notes to United States

Investors

Wallbridge prepares its disclosure in accordance

with NI 43-101 which differs from the requirements of the U.S.

Securities and Exchange Commission (the

"SEC"). Terms relating to mineral properties,

mineralization and estimates of mineral reserves and mineral

resources and economic studies used herein are defined in

accordance with NI 43-101 under the guidelines set out in CIM

Definition Standards on Mineral Resources and Mineral Reserves,

adopted by the Canadian Institute of Mining, Metallurgy and

Petroleum Council on May 19, 2014, as amended. NI 43-101 differs

significantly from the disclosure requirements of the SEC generally

applicable to US companies. As such, the information presented

herein concerning mineral properties, mineralization and estimates

of mineral reserves and mineral resources may not be comparable to

similar information made public by U.S. companies subject to the

reporting and disclosure requirements under the U.S. federal

securities laws and the rules and regulations thereunder.

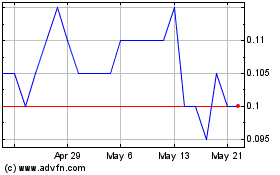

Wallbridge Mining (TSX:WM)

Historical Stock Chart

From Jan 2025 to Feb 2025

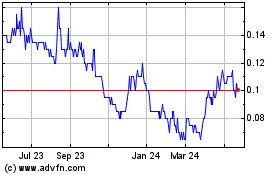

Wallbridge Mining (TSX:WM)

Historical Stock Chart

From Feb 2024 to Feb 2025