Eguana Technologies Inc. (TSXV: EGT) (OTCQB:

EGTYF) ("

Eguana" or the

“

Company”), a leading developer and manufacturer

of high-performance energy storage systems, is pleased to announce

that, further to the Company’s news release dated November 23,

2023, it has closed the first tranche of a non-brokered private

placement offering of units of the Company (the

“

Units”). The Company issued 11,300,000 Units at a

price of $0.04 per Unit for gross proceeds of $452,000 (the

“

Offering”).

Each Unit is comprised of one common share (each

a “Common Share” and collectively, the

“Common Shares”) and one common share purchase

warrant (the “Warrant”). Each Warrant entitles the

holder thereof to purchase one additional Common Share at a price

of $0.06 per Common Share for a period of 24 months following the

closing date of the Offering.

The Company anticipates using the net proceeds

of the Offering to fund operations and working capital.

The Units and any securities issuable upon

conversion thereof are subject to a statutory hold period of four

months and one day from the date of issuance of the Units. The

Offering is subject to final approval by the TSX Venture Exchange

(the “TSXV”).

The Units were offered and sold by private

placement in Canada pursuant to exemptions from the prospectus

requirements under National Instrument 45-106 Prospectus

Exemptions, and in certain other jurisdictions on a basis which

does not require the qualification or registration of the

securities issued pursuant to the Offering.

The subscription by insiders pursuant to the

Offering is considered to be a related party transaction subject to

Multilateral Instrument 61-101 (“MI 61-101”). The

Company intends to rely on exemptions from the formal valuation and

minority shareholder approval requirements provided under sections

5.5(a) and 5.7(1) (a) of MI 61-101 on the basis that participation

in the private placement by insiders will not exceed 25% of the

fair market value of the Company's market capitalization. The

Company did not file a material change report in respect of the

related party transaction at least 21 days before the closing of

the first tranche of the Offering, which the Company deems

reasonable in the circumstances in order to complete the Offering

in an expeditious manner. The Company anticipates closing the

second tranche on or about December 22, 2023.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities in any state in which such offer,

solicitation or sale would be unlawful. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended (the "1933

Act") and may not be offered or sold to, or for the

account or benefit of, persons in the United States or "U.S.

persons" (as such term is defined in Regulation S under the 1933

Act) absent registration or an applicable exemption from the

registration requirements of the 1933 Act any application state

securities laws.

Corporate Update

Alongside the financing activities to bridge

short term liquidity concerns, for the remainder of 2023, the

Company will furlough employees related to its North American

business channels, where renewable markets remain constrained due

to larger macro-economic factors. Australian and European

subsidiaries, where market activities appear to be recovering at a

faster pace and where the Company has near term sales momentum,

will remain unaffected.

“We’ve seen an increase in utility engagements

related to virtual power plant (VPP) rollouts and with acceptance

into seven VPP programs currently, we are optimistic looking into

2024 and are continuing our grid modernization strategy,” commented

Justin Holland, Chief Executive Officer of Eguana. “With major

objectives rolling out in Europe and Australia, US market recovery

predicted in mid-2024, and recurring revenue opportunities, we

anticipate seeing revenue growth and stronger financial performance

in 2024.”

This decision to reduce short term operational

costs related to North American channels was based on typical

seasonality patterns, where sales and installations generally drop

through the second half of December, combined with the overall

slowness of the renewable energy sector in the US. Management has

also begun working to transfer the North American sales team to its

US partner, to continue building out distribution and retail sales

channels under the DPC brand, further reducing 2024 operational

costs. Additionally, the Company received approval from its lending

partner to defer its December 1st payment, under its long-term debt

agreement, to December 15th.

About Eguana Technologies

Inc.

Eguana Technologies Inc. (EGT: TSX.V) (OTCQB:

EGTYF) designs and manufactures high performance residential and

commercial energy storage systems. The Company also markets and

sells a suite of micro inverter products, which are integrated with

its energy storage platform, providing consumers with full solar +

storage system architecture, for residential and commercial

applications. Eguana has two decades of experience delivering grid

edge power electronics for fuel cell, photovoltaic and battery

applications, and delivers proven, durable, high-quality solutions

from its high-capacity manufacturing facilities in North America,

Europe, and Australia.

With thousands of its proprietary energy storage

inverters deployed in the European and North American markets,

Eguana is one of the leading suppliers of power controls for solar

self-consumption, grid services and demand charge applications at

the grid edge. Focused on distributed energy storage applications

located at the point of energy consumption, Eguana provides

cost-effective solutions to modernize the power grid, from the

consumer to the electricity retailer, the distribution utility, and

the system operator.

To learn more, visit

www.EguanaTech.com or follow us on Twitter

@EguanaTech

Company Inquiries

Justin HollandCEO, Eguana Technologies Inc. +1.416.728.7635

Justin.Holland@EguanaTech.com

Forward Looking Statements and

Risks

The reader is advised that all information

herein, other than statements of historical fact, may constitute

forward-looking statements and forward-looking information

(together, "forward-looking statements") within the meaning

assigned by National Instrument 51-102 - Continuous Disclosure

Obligations and other relevant securities legislation.

Forward-looking statements include, among other

things, statements regarding the timing and completion of the

Offering, the use of proceeds of the Offering, receipt of TSXV

approval, future profitability, and financial outlook for 2024.

Forward-looking statements are not a guarantee of future

performance and involve a number of risks and uncertainties. Many

factors could cause the Company's actual results, performance or

achievements, or future events or developments, to differ

materially from those expressed or implied by the forward-looking

information. Such factors include, but are not limited

to, risks associated with: failure to obtain necessary

regulatory approvals to close the Offering; failure by the Company

to close the Offering as contemplated; failure by the Company to

properly allocate use of proceeds for immediate needs, such as debt

service, payroll and payments; failure by the Company to receive

the desired effect of the furlough to bridge short term liquidity

concerns; failure by the Company to further reduce operational

costs; with respect to VPP rollouts, there is no certainty that

despite being accepted to seven VPP programs, that this will

translate into revenue for the Company; macro-economic conditions

affecting the renewable energy sector; failure by the Company to

raise additional funds to fund working capital requirements or to

solve its current cash flow constraints, which would impact the

viability of the business to continue operating as a going concern

or the viability of the business to continue operating altogether;

and other factors as set out in the "Risk Factors" section of the

Company's management's discussion and analysis for the three and

nine months ended September 30, 2023 and annual information form

dated May 1, 2023, which may be found on its website or at

www.sedarplus.ca.

Readers are cautioned not to place undue

reliance on forward-looking information, which speaks only as of

the date hereof. The Company does not undertake any obligation to

release publicly any revisions to forward-looking statements

contained herein to reflect events or circumstances that occur

after the date hereof or to reflect the occurrence of unanticipated

events, except as may be required under applicable securities

laws.

Neither the TSXV nor its Regulation

Services Provider (as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy or accuracy of this

news release.

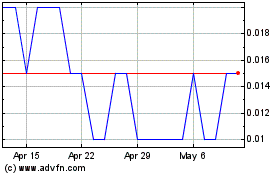

Eguana Technologies (TSXV:EGT)

Historical Stock Chart

From Jan 2025 to Feb 2025

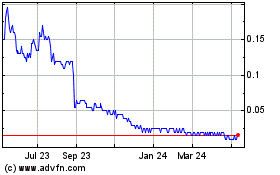

Eguana Technologies (TSXV:EGT)

Historical Stock Chart

From Feb 2024 to Feb 2025