Graphene Manufacturing Group Ltd. (TSX-V: GMG) (“GMG” or the

“Company”) is pleased to announce that it is commencing a marketed

offering (the “Offering”) of units (the “Units”) of the Company.

Each Unit will consist of one ordinary share of the Company (a

“Common Share”) and one ordinary share purchase warrant (a

“Warrant”).

The Units will be offered under the amended and

restated base shelf prospectus of the Company receipted on January

10, 2024 (the “Base Shelf Prospectus”), as supplemented by a

prospectus supplement (the “Supplement”) to be prepared and filed

in each of the provinces and territories of Canada other than

Québec (collectively, the “Jurisdictions”), in the United States

pursuant to available exemptions from the registration requirements

under applicable United States securities laws, and in such other

jurisdictions outside of Canada and the United States which are

agreed to by the Company and the Underwriter (as defined

below).

The total size of the Offering as well as

certain other terms of the Units and the Warrants (including the

term and the exercise price of each Warrant) will be determined in

the context of the market at the time of pricing. There can be no

assurance as to whether or when the Offering may be completed, or

as to the size or terms of the Offering. The closing of the

Offering remains subject to market and other customary conditions,

including but not limited to, the receipt of all necessary

approvals, including the approval of the TSX Venture Exchange (the

“TSXV”).

PI Financial Corp. is acting as sole underwriter

and bookrunner for the Offering (the “Underwriter”).

The Company intends to grant the Underwriter an

option (the “Over-Allotment Option”) to cover over-allotments and

for market stabilization purposes, exercisable at any time up to 30

days subsequent to the closing of the Offering, to purchase up to

an additional 15.0% of the Units, pursuant to the Offering on the

same terms and conditions of the Offering. The Over-Allotment

Option will be exercisable to acquire Units, Common Shares and/or

Warrants (or any combination thereof) at the discretion of the

Underwriter.

The Company will pay the Underwriter a cash

commission equal to 7.0% of the gross proceeds of the Offering,

including proceeds received from the exercise of the Over-Allotment

Option. In addition, the Company will issue the Underwriter

compensation warrants to purchase up to 7.0% of the aggregate

number of Units issued pursuant to the Offering, including any

Units issued upon exercise of the Over-Allotment Option (the

“Compensation Warrants”). Each Compensation Warrant shall entitle

the Underwriter to purchase one Unit at the Offering Price at any

time on or before the date which is 48 months following closing of

the Offering.

The net proceeds of the Offering are expected to

be used primarily to strengthen the Company's financial position

and provide liquidity to finance ongoing operations, including, in

particular, the Company’s expenses incurred, and expected to be

incurred, in connection with the Company’s research and

development objectives, and for working capital and general

corporate purposes.

Access to the Base Shelf Prospectus, the

Supplement, and any amendment to the documents is provided in

accordance with securities legislation relating to procedures for

providing access to a shelf prospectus supplement, a base shelf

prospectus and any amendment. The Base Shelf Prospectus is, and the

Supplement will be, accessible on SEDAR+ at www.sedarplus.ca.

An electronic or paper copy of the Base Shelf

Prospectus, the Supplement (when filed), and any amendment to the

documents may be obtained, without charge, from PI Financial Corp,

3401 – 40 King St Street, Toronto, ON, Canada, M5H 3Y2, by email

to syndication@pifinancial.com attention: PI Syndication and by

providing the contact with an email address or address, as

applicable. The Base Shelf Prospectus contains and the Supplement

will contain, important detailed information about the Company and

the proposed Offering. Prospective investors should read the

Supplement (when filed) and the Base Shelf Prospectus and the other

documents the Company has filed on SEDAR+ before making an

investment decision.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities in any state in which such offer,

solicitation or sale would be unlawful. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements of the

United States Securities Act of 1933, as amended, and applicable

state securities laws.

About GMG

GMG is a clean-technology company which seeks to

offer energy saving and energy storage solutions, enabled by

graphene, including that manufactured in-house via a proprietary

production process. GMG has developed a proprietary production

process to decompose natural gas (i.e. methane) into its elements,

carbon (as graphene), hydrogen and some residual hydrocarbon gases.

This process produces high quality, low cost, scalable, ‘tuneable’

and low/no contaminant graphene suitable for use in

clean-technology and other applications.

The Company’s present focus is to de-risk and

develop commercial scale-up capabilities, and secure market

applications. In the energy savings segment, GMG has focused on

graphene enhanced heating, ventilation and air conditioning

(“HVAC-R”) coating (or energy-saving coating), lubricants and

fluids.

In the energy storage segment, GMG and the

University of Queensland are working collaboratively with financial

support from the Australian Government to progress R&D and

commercialization of graphene aluminium-ion batteries (“G+AI

Batteries”).

GMG’s 4 critical business objectives are:

- Produce Graphene and improve/scale cell production

processes

- Build Revenue from Energy Savings Products

- Develop Next-Generation Battery

- Develop Supply Chain, Partners

& Project Execution Capability

For further information please contact:

- Craig Nicol, Chief Executive Officer and Managing Director of

the Company at craig.nicol@graphenemg.com, +61 415 445 223

- Leo Karabelas at Focus Communications Investor Relations,

leo@fcir.ca, +1 647 689 6041

www.graphenemg.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accept responsibility for the

adequacy or accuracy of this news release.

Cautionary Note Regarding

Forward-Looking Statements

This news release includes certain statements

and information that may constitute forward-looking information

within the meaning of applicable Canadian securities laws.

Forward-looking statements relate to future events or future

performance and reflect the expectations or beliefs of management

of the Company regarding future events. Generally, forward-looking

statements and information can be identified by the use of

forward-looking terminology such as “intends”, “expects” or

“anticipates”, or variations of such words and phrases or

statements that certain actions, events or results “may”, “could”,

“should”, “would” or will “potentially” or “likely” occur. This

information and these statements, referred to herein as

“forward‐looking statements”, are not historical facts, are made as

of the date of this news release and include without limitation,

the Company's ability to complete the Offering on the terms

announced or at all, the use of the net proceeds of the Offering,

and the receipt of all necessary approvals, including the approval

of the TSXV, the Company’s collaboration with the University of

Queensland, and the Company’s objectives, focus, goals or future

plans.

Such forward-looking statements are based on a

number of assumptions of management, including, without limitation,

assumptions regarding the ability of the Company to obtain all

necessary approvals for the Offering, the ability of the

Underwriter to secure interest in the Offering, the ability of the

Company and the Underwriter to negotiate a definitive agreement

with respect to the Offering, the ability of the Company to achieve

the expected results of its products in research and development,

that the Company will be able to research, develop and produce

certain products as anticipated, that the Company will be able to

engage third parties and develop relationships to assist in the

development, that the Company and the University of Queensland will

continue to progress research and development of the G+AI

Batteries, distribution and sale of its products, and assumptions

regarding the completion of the Offering and the timing thereof.

Additionally, forward-looking information involve a variety of

known and unknown risks, uncertainties and other factors which may

cause the actual plans, intentions, activities, results,

performance or achievements of GMG to be materially different from

any future plans, intentions, activities, results, performance or

achievements expressed or implied by such forward-looking

statements. Such risks include, without limitation: the Offering

will not be completed on the timetable anticipated or at all, the

use of proceeds from the Offering will differ from management’s

current expectations, the engagement of the Underwriter in

connection with the Offering will not continue as expected, the

Company will not obtain all necessary approvals, including the

approval of the TSXV and applicable securities regulatory

authorities, the Company will not be able to use its products as

expected or the performance, safety profile and production and

maintenance requirements of the Company’s products will not be

consistent with management’s expectations, the impact of the

Company’s products will not be consistent with management’s

expectations, the Company will not be able to research, develop and

produce certain products, that the Company’s collaboration with the

University of Queensland will not continue as currently expected by

management, the Company will not be successful in engaging third

parties and developing relationships to assist in the development,

distribution and sale its products, public health crises may

adversely impact the Company’s business and the ability of the

Company to develop its products, risks relating to the extent and

duration of the conflict in the Middle-East and Eastern Europe and

its impact on global markets, the volatility of global capital

markets, political instability, the failure of the Company to

attract and retain skilled personnel, unexpected development and

production challenges, unanticipated costs and the risk factors set

out under the heading “Risk Factors” in the Company’s annual

information form dated October 12, 2023 available for review on the

Company’s profile at www.sedarplus.com.

Although management of the Company has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements or forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements and forward-looking information. Readers are cautioned

that reliance on such information may not be appropriate for other

purposes. The Company does not undertake to update any

forward-looking statement, forward-looking information or financial

out-look that are incorporated by reference herein, except in

accordance with applicable securities laws. We seek safe

harbor.

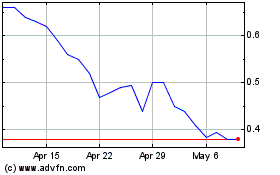

Graphene Manufacturing (TSXV:GMG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Graphene Manufacturing (TSXV:GMG)

Historical Stock Chart

From Jan 2024 to Jan 2025