GINSMS Announces Financial Results for the Three and Six Months Ended June 30, 2024

August 12 2024 - 4:00PM

GINSMS Inc. (TSXV: GOK) (the “Corporation”) has announced its

financial results for the second quarter ended June 30, 2024.

The complete financial results for GINSMS are

available at www.sedar.com. Highlights include:

- Revenue of $815,190

for the three-month period ended June 30, 2024 as compared of

$840,372 for the three-month period ended June 30, 2023.

- Gross Profit of

$428,725 for the three-month period ended June 30, 2024 as compared

to gross profit of $306,419 for the three-month period ended June

30, 2023.

- Operating expenses

and finance costs of $232,918 for the three-month period ended June

30, 2024 increased from $211,157 for the three-month period ended

June 30, 2023 .

- Net profit of $203,164 for three-month

period ended June 30, 2024 as compared to a net profit of $102,437

for three-month period ended June 30, 2023.

Selected Profit and Loss Information

|

Financial Highlights |

Three-month period ended June 30, 2024 (Unaudited) |

|

Three-month period ended June 30, 2023 (Unaudited) |

|

Six-month period ended June 30, 2024 (Unaudited) |

|

Six-month period ended June 30, 2023 (Unaudited) |

|

|

Revenues $ |

|

|

|

|

|

A2P Messaging Service |

275,248 |

|

314,359 |

|

424,208 |

|

602,736 |

|

|

Software Products & Services |

539,942 |

|

526,013 |

|

1,101,287 |

|

1,058,293 |

|

|

|

815,190 |

|

840,372 |

|

1,525,495 |

|

1,661,029 |

|

|

|

|

|

|

|

|

Cost of sales $ |

|

|

|

|

|

A2P Messaging Service |

106,119 |

|

242,131 |

|

201,269 |

|

421,889 |

|

|

Software Products & Services |

280,346 |

|

291,822 |

|

594,383 |

|

588,265 |

|

|

|

386,465 |

|

533,953 |

|

795,652 |

|

1,010,154 |

|

|

|

|

|

|

|

|

Gross profit $ |

|

|

|

|

|

A2P Messaging Service |

169,129 |

|

72,228 |

|

222,939 |

|

180,847 |

|

|

Software Products & Services |

259,596 |

|

234,191 |

|

506,904 |

|

470,028 |

|

|

|

428,725 |

|

306,419 |

|

729,843 |

|

650,875 |

|

|

|

|

|

|

|

|

Gross margin % |

|

|

|

|

|

A2P Messaging Service |

61.4% |

|

23.0% |

|

52.6% |

|

30.0% |

|

|

Software Products & Services |

48.1% |

|

44.5% |

|

46.0% |

|

44.4% |

|

|

|

52.6% |

|

36.5% |

|

47.8% |

|

39.2% |

|

|

|

|

|

|

|

|

Adjusted EBITDA(1) $ |

218,861 |

|

118,828 |

|

248,050 |

|

213,611 |

|

|

Adjusted EBITDA margin |

26.8% |

|

14.1% |

|

16.3% |

|

12.9% |

|

|

Net profit/(loss) $ |

203,164 |

|

102,437 |

|

205,078 |

|

174,105 |

|

|

Net profit/(loss) margin |

24.9% |

|

12.2% |

|

13.4% |

|

10.5% |

|

|

Net earnings/(loss) per share $ |

|

|

|

|

|

|

|

|

|

Basic and Diluted (in Canadian cents) |

0.108 |

|

0.054 |

|

0.109 |

|

0.093 |

|

| |

|

|

|

|

|

|

|

|

|

(1) |

Adjusted EBITDA is a non-IFRS measure which does not have any

standardized meaning under IFRS. Adjusted EBITDA is related to cash

earnings and is defined for these purposes as earnings before

income taxes, depreciation and amortization (in both cost of sales

and general and administration expenses), interest expenses, and

also excludes certain non-recurring or non-cash expenditure and

income. This non-IFRS measure is not recognized under IFRS and

accordingly, shareholders are cautioned that this measure should

not be construed as an alternative to net income determined in

accordance with IFRS. The non-IFRS measure presented is unlikely to

be comparable to similar measure presented by other issuers. The

Corporation believes that Adjusted EBITDA is a meaningful financial

metric as it measures cash generated from operations which the

Corporation can use to fund working capital requirements, service

interest and principal debt repayment and fund future growth

initiatives. |

| |

|

About GINSMS

Certain information included in this press

release may contain forward-looking statements. Forward-looking

statements generally can be identified by the use of

forward-looking terminology such as “may”, ”could”, “will”,

“expect”, “intend”, “estimate”, “anticipate”, “believe”, or

“continue” or the negative thereof or variations thereon or similar

terminology. These statements are not historical facts, but reflect

management’s current beliefs and are based on information currently

available to management regarding future results and events.

Particularly, these forward-looking statements are based on

management’s estimate of future events based on technological

advances relating to the Corporation’s services, current market

conditions and past experiences of management in relation to how

certain contracts will affect revenues. Forward-looking statements,

by their very nature, involve significant risks, uncertainties and

assumptions.

A number of factors could cause actual results

to differ materially from the results discussed in the

forward-looking statements, including, but not limited to

dependence on major customers, system failures, delays and other

problems, increasing competition, security and privacy breaches,

dependence on third-party software and equipment, adequacy of

network reliance, network diversity and backup systems, loss of

significant information, insurance coverage, capacity limits, rapid

technology changes, market acceptance, decline in volume of

attractions, retention of key members of the management team,

success of expansion into Chinese and other Asian markets, credit

risk, consolidation of existing customers, dependence on required

licenses, economy and politics in countries where the Corporation

operates, conflicts of interest and residency of directors and

officers. Although the Corporation has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended. Although the forward-looking statements

contained herein are based upon what management believes to be

reasonable assumptions, the Corporation cannot assure the reader

that actual results will be consistent with these forward-looking

statements.

These forward-looking statements are made as of

the date of this press release and the Corporation assumes no

obligation to update or revise them to reflect new events or

circumstances except as may be required by law. Accordingly,

readers should not place undue reliance on the forward-looking

statements. All forward-looking statements contained in this press

release are qualified by this cautionary statement.

For further information, please contact:

GINSMS Inc.Joel Chin, CEOTel: +65-6441-1029Email:

investor.relations@ginsms.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

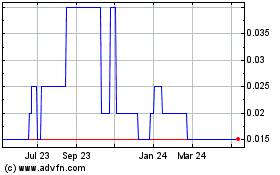

Ginsms (TSXV:GOK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ginsms (TSXV:GOK)

Historical Stock Chart

From Feb 2024 to Feb 2025