Petro-Reef Resources Announces the Successful Completion of Its 11-12-56-27W4 Detrital Oilwell

May 01 2012 - 3:38PM

Marketwired Canada

Petro-Reef Resources Ltd. (TSX VENTURE:PER), ("Petro-Reef" or the "Company")

Petro-Reef Resources announces the successful completion of its 11-12-56-27W4

Detrital sand oilwell, which was drilled in March of this year. The Company is

operator of and has a 94 percent working interest in the well. As mentioned in

an earlier press release, the well is an approximate half-mile step-out to our

Detrital oilpool (26 degree API) that was discovered in 2009. The well is

Petro-Reef's fifth oilwell in the pool.

The 11-12 well encountered 7 meters of net pay, split into an upper and lower

sand. Only the lower sand was completed at this time, with swabbing for 10 hours

recovering 24 cubic meters (150 barrels) of clean oil with negligible water

(less than one percent). We expect the well to initially produce at its

allowable of 20 cubic meters (125 barrels) per day. Petro-Reef is proceeding to

tie the well into our gathering system, and, weather permitting, production

should commence by the end of the second quarter.

Based on seismic interpretation, up to four more delineation wells remain to be

drilled on the Detrital oil pool to confirm its extent on Company lands.

Petro-Reef has working interests ranging from 79 to 94 percent in future

development wells.

Petro-Reef's total current production is approximately 825 barrels of oil

equivalent per day, 42 percent of which is oil and natural gas liquids.

Forward-Looking Statements: All statements, other than statements of historical

fact, set forth in this news release, including without limitation, assumptions

and statements regarding reservoirs, resources and reserves, future production

rates, exploration and development results, financial results, and future plans,

operations and objectives of the Corporation are forward-looking statements that

involve substantial known and unknown risks and uncertainties. Some of these

risks and uncertainties are beyond management's control, including but not

limited to, the impact of general economic conditions, industry conditions,

fluctuation of commodity prices, fluctuation of foreign exchange rates,

environmental risks, industry competition, availability of qualified personnel

and management, availability of materials, equipment and third party services,

stock market volatility, timely and cost effective access to sufficient capital

from internal and external sources. The reader is cautioned that assumptions

used in the preparation of such information, although considered reasonable by

the Corporation at the time of preparation, may prove to be incorrect. There can

be no assurance that such statements will prove to be accurate and actual

results and future events could differ materially from those anticipated in such

statements.

Reference is made to barrels of oil equivalent (BOE). Barrels of oil equivalent

may be misleading, particularly if used in isolation. In accordance with

National Instrument 51-101, a BOE conversion ratio for natural gas of 6 Mcf: 1

bbl has been used, which is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead.

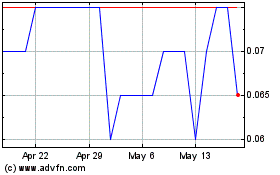

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Apr 2024 to May 2024

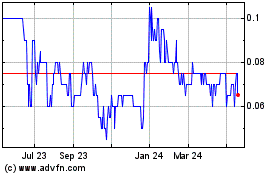

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From May 2023 to May 2024