Parlane Closes Big Bear Transaction and Private Placement

January 05 2011 - 11:59AM

Marketwired Canada

Parlane Resource Corp. (TSX VENTURE:PPP) (the "Company") has closed the

transaction with Derrick Strickland of Vancouver, British Columba ("Strickland")

whereby Parlane can acquire (the "Option") an undivided 100% interest in 31

claims covering approximately 14,366 hectares located in the prolific Omineca

Mining Division of British Columbia, generally collectively known and described

as the NW1 Project, and now called the Big Bear Project ("Big Bear") (See press

release dated November 29, 2010).

The Company has made a cash payment of $150,000 to Mr. Strickland, and issued

300,000 shares and 300,000 warrants as the first year's consideration for the

Option. Additionally, a finder's fee related to the transaction was paid to an

arms' length party in the form of cash ($14,000) and 34,000 shares for Year 1.

All securities issued pursuant to the transaction are restricted from trading

for a period of four months and one day.

The Big Bear Project is located in central B.C., southwest of Prince George, and

is accessible by road from Vanderhoof. The optioned claims lie in proximity to

the Blackwater Gold Project owned by Richfield Ventures Corp. (Symbol: RVC -

TSXV). The Blackwater Gold Project has historically been viewed as a high grade

gold vein target and was explored with that premise by previous operators.

Richfield Ventures recently reported identifying high grade gold on their

property, with drilling focused on testing the continuity and size of their bulk

tonnage gold system (see Richfield's press release of November 2, 2010).

Financing

The Company also announces that it has closed a non-brokered private placement

of 5,000,000 Units at a price of $0.20 per unit, for gross proceeds of

$1,000,000. Each unit is comprised of one common share of Parlane and one-half

of one common share purchase warrant, each whole warrant exercisable for a

period of two years from the date of issue to purchase one common share of

Parlane at a price of $0.35 per share. The private placement includes an

accelerated expiry feature that can be triggered at the discretion of management

should the shares of Parlane trade over $0.50 for a period of 20 consecutive

trading days on the Exchange. Should the Company issue notice of such

accelerated expiry, the warrants will expire 60 days thereafter.

Finder's fees in the aggregate amount of $45,600 and 285,000 warrants were paid

to various finders for portions of the financing attributable to such finders'

efforts. In addition to working capital, proceeds of the financing will be

applied toward the Company's commitments and exploration programs.

All securities issued pursuant to the financing are restricted from trading for

a period of four months and one day.

The Company also announces that pursuant to TSX Venture Exchange (the

"Exchange") policies and the Company's rolling Stock Option Plan approved by

shareholders, an aggregate of 534,000 incentive stock options have been granted

to directors, officers, key employees and consultants at a price of $0.20 per

share. The options are exercisable for a period of five years, ending on January

5, 2016, and are subject to the requirements of the Exchange.

ON BEHALF OF THE BOARD

Robert Eadie, President, Chief Executive Officer and Director

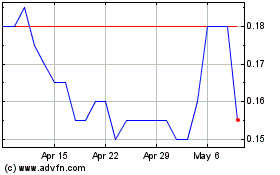

Prospector Metals (TSXV:PPP)

Historical Stock Chart

From Nov 2024 to Dec 2024

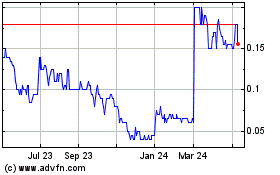

Prospector Metals (TSXV:PPP)

Historical Stock Chart

From Dec 2023 to Dec 2024