Questor Technology Inc. (“Questor” or the “Company”) (TSX-V: QST)

announced today its financial and operating results for the third

quarter 2022.

Questor’s Unaudited Condensed Consolidated

Financial Statements and Management’s Discussion and Analysis for

the quarter ended September 30, 2022 are available on the Company’s

website www.questortech.com/investors and through SEDAR

at www.sedar.com.

Unless otherwise noted, all financial figures

are presented in Canadian dollars, prepared in accordance with

International Financial Reporting Standards and are unaudited for

the three and nine months ended September 30, 2022 and 2021.

THIRD QUARTER 2022 FINANCIAL

RESULTS

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

For the |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

(Stated in CDN $) |

|

|

|

|

|

Revenue |

|

1,673,929 |

|

|

1,644,314 |

|

|

6,715,865 |

|

|

4,376,745 |

|

|

Gross profit (loss) |

|

484,374 |

|

|

38,298 |

|

|

1,547,079 |

|

|

(52,954 |

) |

|

Loss for the period |

|

(12,311 |

) |

|

(453,744 |

) |

|

(835,842 |

) |

|

(2,212,845 |

) |

|

Loss per share - basic and diluted |

$(0.00 |

) |

$(0.02 |

) |

$(0.03 |

) |

$(0.08 |

) |

|

As at |

September 30, 2022 |

|

December 31, 2021 |

|

|

(Stated in CDN $) |

|

|

|

|

|

Working capital1 |

|

|

15,986,190 |

|

|

|

16,274,715 |

|

|

Total assets |

|

|

34,204,852 |

|

|

|

35,047,855 |

|

|

Total equity |

|

|

30,172,581 |

|

|

|

30,482,081 |

|

1 Working capital is defined as

total current assets less total current liabilities.

The Company’s financial performance in the three

and nine months ended September 30, 2022 has improved compared to

2021. Revenue for the three and nine months ended September 30,

2022 was $1.7 million and $6.7 million versus $1.6 million and $4.4

million for the same periods in 2021. This is an increase of 52

percent compared to the nine months ended September 30, 2021, due

to an increase in equipment sales. During the third quarter of

2022, requests for proposals from customers remained strong and

subsequent to the quarter, the Company closed a further $1.2

million of equipment sales.

Gross profit increased $0.4 million and $1.6

million for the three and nine months ended September 30, 2022, and

overall loss decreased $0.4 million and $1.4 million for the three

and nine months ended September 30, 2022, compared to the same

periods in 2021. This increase in gross profit and decrease in

overall loss, is due to improved equipment sales and margins and

continued cost control. This improvement was partially offset by

$0.5 million additional costs being incurred for the waste heat to

power project in Mexico for the nine months ended September 30,

2022.

The Company continues to have a strong financial

position at September 30, 2022 including cash and cash equivalents

of $14.7 million and working capital of $16.0 million.

THIRD QUARTER 2022 HIGHLIGHTS AND

SUBSEQUENT EVENTS

During the quarter the Company continued its

work to complete the commissioning of three waste heat to power

facilities in Mexico. In November the Company started up two of the

units and is working on rectifying a few small deficiencies that

have delayed the final testing. The Company is still waiting for

certain materials required to complete work on the third unit to

arrive at the site. The Company is working closely with its

customer to finish commissioning of these units by the end of the

year.

During the third quarter, the Company continued

its research and development on its waste heat to power project and

started receiving materials to assemble the prototype for its

1500kw unit.

In prior years, the Company filed a claim

against three former employees and their company, Emission

Rx. The three former employees resigned from the Company over

a period of two months, in 2018. After the former employees

resigned, the Company learned that the former employees had

incorporated Emission Rx on November 14, 2017, several months prior

to their departures, and had developed a low-pressure burner

technology which they then marketed and sold through Emission Rx.

The Company sought injunctive relief to prevent Emission Rx

competing in the market against the Company and infringing the

Company’s intellectual property.

The Company asserts ownership of Emission Rx’s

LP Burner Technology, through: (i) the terms of the employment

agreements signed by the three former employees; or (ii) the

application of the common law. The court declined to issue the

injunction in 2019, however ordered the defendants to deliver all

remaining confidential information belonging to the Company. The

court’s decision included the statement that the Company has

demonstrated that it has a prima facie case with respect to its

claim that the defendants breached their fiduciary duties and

contractual duties of confidentiality. The Company applied to the

court to order additional disclosure of evidence from the

Defendants, which the court granted in September 2022. The

Defendants have since provided further disclosure.

PRESIDENT’S MESSAGE

There is global recognition that cutting methane

emissions to the atmosphere is the fastest way to reduce near term

warming and is necessary to keep a 1.5°C temperature limit within

reach. A report by the World Meteorological Organization,

released last month, showed that methane levels in the atmosphere

are continuing to climb to new highs, reaching 262 percent of

preindustrial levels. Worse yet, methane emissions from oil, gas

and coal operations are estimated to be 70 percent higher than

what countries are reporting. A recent report by the Global Energy

Monitor shows that just 30 oil and gas companies are responsible

for 43 percent of the energy sector’s global methane emissions. As

a result, Methane emissions were one of the top agenda items during

the recently held COP27 meeting of the UN Climate Change

Convention.

Dominating the discussion was how to implement

the voluntary Global Methane Pledge that more than 130 countries

had signed onto to reduce global methane emissions by 30 percent

below 2020 levels by 2030. At the meeting, many major

countries including Canada and the US unveiled significant funding

and regulatory overhauls with an aim to reduce global methane

emissions. Recent U.S. policy addresses methane emissions from the

fossil fuel industry, including a significant new fee imposed on

methane leaks, enacted as part of the Inflation Reduction Act.

The Inflation Reduction Act (“IRA”; H.R. 5376)

recently passed is the most significant investment the U.S.

government has made in fighting climate change, putting more than

$369 billion toward projects that will reduce planet-warming

emissions. IRA would include supplemental appropriations of

$850 million to the Environmental Protection Agency to provide

grants to facilities subject to the methane charge for a range of

objectives, including “improving and deploying industrial equipment

and processes” that reduce methane emissions. The act also includes

supplemental appropriations of $700 million for “marginal

conventional wells” for the same purposes.

These funds could support technology adoption at

smaller oil and natural gas facilities or sites where the volumes

are insufficient to justify infrastructure capital but significant

enough to require technology like Questor’s to ensure that methane

and other hazardous pollutants are destroyed at a guaranteed high

efficiency. Additionally, to address domestic methane emissions,

the IRA will impose a fee of “$900 per

metric ton of methane starting in 2024,

increasing to $1,500 per metric ton after two years”. Speaking at

COP27 this week, Marcelo Mena, CEO of the Methane Hub and former

Environment Minister of Chile, “said the U.S. fee sends an

important global signal and could incentivize trading partners to

follow suit, for example through a carbon border adjustment

mechanism for methane.”

Questor was invited to present at the Global

Methane Initiative and Clean Air Coalition forum in Washington in

October as a precursor to COP27. There was significant interest in

our ISO 14034 certified clean combustion technology solutions that

guarantee 99.99% elimination of methane emissions from offshore

petroleum and natural gas production; onshore petroleum and natural

gas production; onshore natural gas processing; onshore natural gas

transmission compression; underground natural gas storage;

liquefied natural gas storage; liquefied natural gas import and

export equipment; onshore petroleum and natural gas gathering and

boosting; and onshore natural gas transmission pipelines.

There is a recognition that methane emissions

from leaks, maintenance and equipment failure from all these

facilities have not been appropriately recognized or accounted for.

As Methane emissions tracking becomes more sophisticated and there

is more corporate accountability, there will be no other choice

than to ensure all facilities have zero methane emitted. These are

all facilities that Questor has a 25-year track record supporting

with our technology.

Requests for proposals have increased

significantly from both international and domestic companies, who

are exploring opportunities to use Questor’s integrated solutions

to reduce greenhouse gas emissions, eliminate flaring and venting

to meet the new regulations focused on methane. The pressure from

the public, government and investors is expected to result in

companies focusing their efforts to reduce emissions and achieve

their emissions reduction commitments resulting in increased demand

for the Company’s cost-effective high efficiency clean combustion

systems, waste heat to power and data solutions.

Questor’s rental fleet can decrease non-routine

vented gas emissions at a cost of less than ten cents per tonne.

Similarly, the Company’s clean combustion combined with its waste

heat to power solutions, can reduce emissions at a cost of less

than $10 per tonne. The Company is well positioned to assist its

clients to meet their emissions reductions targets today using its

proven cost-effective technology solutions.

FORWARD LOOKING STATEMENTS

Certain information in this news release

constitutes forward-looking statements. When used in this news

release, the words “may”, “would”, “could”, “will”, “intend”,

“plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”,

“expect”, and similar expressions, as they relate to the Company,

are intended to identify forward-looking statements. In particular,

this news release contains forward-looking statements with respect

to, among other things, business objectives, expected growth,

results of operations, performance, business projects and

opportunities and financial results. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. Such statements

reflect the Company’s current views with respect to future events

based on certain material factors and assumptions and are subject

to certain risks and uncertainties, including without limitation,

changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out

in the Company’s public disclosure documents. Many factors could

cause the Company’s actual results, performance or achievements to

vary from those described in this news release, including without

limitation those listed above. These factors should not be

construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this news release and such

forward-looking statements included in, or incorporated by

reference in this news release, should not be unduly relied upon.

Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to

update these forward-looking statements. The forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement.

ABOUT QUESTOR TECHNOLOGY

INC.

Questor Technology Inc., incorporated in Canada

under the Business Companies Act (Alberta) is an environmental

emissions reduction technology company founded in 1994, with global

operations. The Company is focused on clean air technologies that

safely and cost effectively improve air quality, support energy

efficiency and greenhouse gas emission reductions. The Company

designs, manufactures and services high efficiency clean combustion

systems that destroy harmful pollutants, including Methane,

Hydrogen Sulfide gas, Volatile Organic Hydrocarbons, Hazardous Air

Pollutants and BTEX (Benzene, Toluene, Ethylbenzene and Xylene)

gases within waste gas streams at 99.99 percent efficiency. This

enables its clients to meet emission regulations, reduce greenhouse

gas emissions, address community concerns and improve safety at

industrial sites.

The Company also has proprietary heat to power

generation technology and is currently targeting new markets

including landfill biogas, syngas, waste engine exhaust, geothermal

and solar, cement plant waste heat in addition to a wide variety of

oil and gas projects. The Company is also doing research and

development on data solutions to deliver an integrated system that

amalgamates all of the emission detection data available and

demonstrates how Questor’s clean combustion and power generation

technologies can be used to help clients achieve zero emission

targets.

The Company’s common shares are traded on the

TSX Venture Exchange under the symbol “QST”. The address of the

Company’s corporate and registered office is 2240, 140–4 Avenue

S.W. Calgary, Alberta, Canada, T2P 3N3.

QUESTOR TRADES ON THE TSX VENTURE

EXCHANGE UNDER THE SYMBOL ‘QST’

|

Audrey Mascarenhas |

Ann-Marie Osinski |

|

Chief Executive Officer |

Chief Financial Officer |

|

Phone: |

(403) 539-4369 |

Phone: |

(403) 539-4371 |

|

Facsimile: |

(403) 571-1539 |

Facsimile: |

(403) 571-1539 |

|

Email: |

amascarenhas@questortech.com |

Email: |

aosinski@questortech.com |

|

|

|

|

|

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This document is not intended for dissemination

or distribution in the United States.

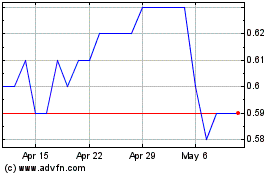

Questor Technology (TSXV:QST)

Historical Stock Chart

From Nov 2024 to Dec 2024

Questor Technology (TSXV:QST)

Historical Stock Chart

From Dec 2023 to Dec 2024