WestBond Increases Sales and Profits for the Quarter ended June 30, 2022 and Announces Quarterly Dividend

August 18 2022 - 2:41PM

WestBond Enterprises Corporation (TSX-V: WBE) has posted a profit

of $415,352 ($0.012 per share) for the three months ended June 30,

2022, compared to a profit of $69,688 ($0.002 per share) for the

same period last year. Sales were $3,321,418 for the three months

ended June 30, 2022, which is 22.6% higher than for the three

months ended June 30, 2021 and 16.8% higher than for the three

months ended March 31, 2022.

Despite the supply-chain and labour challenges faced in our

industry, our sales and profits have improved significantly when

compared with the same period last year and in the previous

quarter.

We are pleased to declare a quarterly dividend of $0.005 per

share which will be paid on September 23, 2022 to shareholders of

record on September 5, 2022. The dividends are eligible dividends

for the purposes of the Income Tax Act (Canada).

The quarterly report and other information are available on the

company’s website at www.westbond.ca and on SEDAR at

www.sedar.com.

Cautionary Note Regarding Forward

Looking Statements: This release includes certain

statements and information that constitute forward-looking

information within the meaning of applicable Canadian securities

laws, including statements regarding the Company’s intentions.

Generally, forward-looking statements and information can be

identified by the use of forward-looking terminology such as

“intends” or “anticipates”, or variations of such words and phrases

or statements that certain actions, events or results “may”,

“could”, “should” or “would” occur. Forward-looking statements are

based on certain material assumptions and analysis made by the

Company and the opinions and estimates of management as of the date

of this press release, including the ability to sustain or develop

markets and increase profitability. Although the Company considers

these assumptions to be reasonable based on information currently

available to it, they may prove to be incorrect, and the

forward-looking statements in this release are subject to numerous

risks, uncertainties and other factors that may cause future

results to differ materially from those expressed or implied in

such forward-looking statements. Such risk factors may include,

among others, changes in operating performance, availability of and

prices for raw materials, availability of trained labour, foreign

currency exchange rate fluctuations, unexpected competition and

other technical, market and economic factors. Although management

of the Company has attempted to identify important factors that

could cause actual results to differ materially from those

contained in forward-looking statements or forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements and forward-looking

information. Readers are cautioned that reliance on such

information may not be appropriate for other purposes. The Company

does not undertake to update any forward-looking statement,

forward-looking information or financial out-look that is

incorporated by reference herein, except in accordance with

applicable securities laws. We seek safe harbour.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information please contact:

Gennaro Magistrale

Chief Executive Officer, President and Director

WestBond Enterprises Corporation

101 – 7403 Progress Way, Delta, B.C. V4G 1E7

Tel: (604) 940-3939

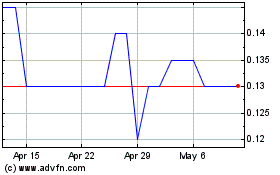

WestBond Enterprises (TSXV:WBE)

Historical Stock Chart

From Feb 2025 to Mar 2025

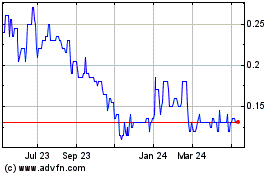

WestBond Enterprises (TSXV:WBE)

Historical Stock Chart

From Mar 2024 to Mar 2025