UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

(Amendment

No. 3)

Under

the Securities Exchange Act of 1934

Gold

Reserve Inc.

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

38068N108

(CUSIP

Number)

Eric

Shahinian

Camac

Partners, LLC

350

Park Avenue, 13th Floor

New

York, NY 10022

914-629-8496

(Name,

Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

10/21/2022

(Date

of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☒

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule

13d-7 for other parties to whom copies are to be sent.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| 1 |

|

NAMES

OF REPORTING PERSONS |

| |

|

Camac

Partners, LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

(a)

☐ |

| |

|

(b)

☐ |

| 3 |

|

SEC

USE ONLY |

| |

|

|

| 4 |

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS) |

| |

|

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION |

| |

|

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

|

SOLE

VOTING POWER |

| |

|

0 |

| 8 |

|

SHARED

VOTING POWER |

| |

|

15,352,599 |

| 9 |

|

SOLE

DISPOSITIVE POWER |

| |

|

0 |

| 10 |

|

SHARED

DISPOSITIVE POWER |

| |

|

15,352,599 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

15,352,599 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

15.4% |

| 14 |

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

|

OO |

| 1 |

|

NAMES

OF REPORTING PERSONS |

| |

|

Camac

Capital, LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

(a)

☐ |

| |

|

(b)

☐ |

| 3 |

|

SEC

USE ONLY |

| |

|

|

| 4 |

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS) |

| |

|

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION |

| |

|

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

|

SOLE

VOTING POWER |

| |

|

0 |

| 8 |

|

SHARED

VOTING POWER |

| |

|

15,352,599 |

| 9 |

|

SOLE

DISPOSITIVE POWER |

| |

|

0 |

| 10 |

|

SHARED

DISPOSITIVE POWER |

| |

|

15,352,599 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

15,352,599 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

15.4% |

| 14 |

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

|

OO |

| 1 |

|

NAMES

OF REPORTING PERSONS |

| |

|

Camac

Fund, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

(a)

☐ |

| |

|

(b)

☐ |

| 3 |

|

SEC

USE ONLY |

| |

|

|

| 4 |

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS) |

| |

|

WC |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION |

| |

|

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

|

SOLE

VOTING POWER |

| |

|

0 |

| 8 |

|

SHARED

VOTING POWER |

| |

|

8,020,319 |

| 9 |

|

SOLE

DISPOSITIVE POWER |

| |

|

0 |

| 10 |

|

SHARED

DISPOSITIVE POWER |

| |

|

8,020,319 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

8,020,319 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

8.1% |

| 14 |

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

|

PN |

| 1 |

|

NAMES

OF REPORTING PERSONS |

| |

|

Camac

Fund II, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

(a)

☐ |

| |

|

(b)

☐ |

| 3 |

|

SEC

USE ONLY |

| |

|

|

| 4 |

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS) |

| |

|

WC |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION |

| |

|

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

|

SOLE

VOTING POWER |

| |

|

0 |

| 8 |

|

SHARED

VOTING POWER |

| |

|

7,332,280 |

| 9 |

|

SOLE

DISPOSITIVE POWER |

| |

|

0 |

| 10 |

|

SHARED

DISPOSITIVE POWER |

| |

|

7,332,280 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

7,332,280 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

7.4% |

| 14 |

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

|

PN |

| 1 |

|

NAMES

OF REPORTING PERSONS |

| |

|

Eric

Shahinian |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

(a)

☐ |

| |

|

(b)

☐ |

| 3 |

|

SEC

USE ONLY |

| |

|

|

| 4 |

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS) |

| |

|

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION |

| |

|

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

|

SOLE

VOTING POWER |

| |

|

0 |

| 8 |

|

SHARED

VOTING POWER |

| |

|

15,352,599 |

| 9 |

|

SOLE

DISPOSITIVE POWER |

| |

|

0 |

| 10 |

|

SHARED

DISPOSITIVE POWER |

| |

|

15,352,599 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

15,352,599 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

15.4% |

| 14 |

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

|

IN |

Item

1. Security and Issuer

This

Amendment No. 3 (this “Amendment”) amends and supplements the Schedule 13D filed with the Securities and Exchange Commission

on December 8, 2021 (the “Schedule 13D”) as amended on June 9, 2022, and August 15, 2022, by the Reporting Person with respect

to the Common Stock of Gold Reserve Inc. (the “Issuer” or the “Company”). Information reported in the Schedule

13D remains in effect except to the extent that it is amended, restated, or superseded by information contained in this Amendment. Capitalized

terms used but not defined in this Amendment have the respective meanings set forth in the Schedule 13D. All references in the Schedule

13D and this Amendment to the “Statement” will be deemed to refer to the Schedule 13D as amended and supplemented by this

Amendment.

Item

3. Source and Amount of Funds or Other Consideration

The

Shares purchased by Camac Fund, LP (“Camac Fund”) and Camac Fund II, LP (“Camac Fund II”) were purchased with

working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business). The

aggregate purchase price of the 8,020,319 Shares beneficially owned by Camac Fund is approximately $13,230,222, including brokerage commissions.

The aggregate purchase price of the 7,332,280 Shares beneficially owned by Camac Fund II is approximately $9,873,612, including brokerage

commissions.

Item

4. Purpose of Transaction

The

Reporting Persons purchased the securities of the Issuer reported herein based on the Reporting Persons’ belief that such securities,

when purchased, were undervalued and represented an attractive investment opportunity. Depending upon overall market conditions, other

investment opportunities available to the Reporting Persons, and the availability of securities of the Issuer at prices that would make

the purchase or sale of such securities desirable, the Reporting Persons may endeavor to (i) increase or decrease their respective positions

in the Issuer through, among other things, the purchase or sale of securities of the Issuer on the open market or in private transactions

or otherwise, on such terms and at such times as the Reporting Persons may deem advisable and/or (ii) enter into transactions that increase

or hedge their economic exposure to the securities of the Issuer without affecting their beneficial ownership of the Shares.

Except

as set forth herein or such as would occur upon completion of any actions discussed herein, Reporting Person does not have any present

plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a) - (j) of Item 4 of Schedule 13D.

With respect to subparagraph (d) of Item 4, the Reporting Persons will engage in verbal communications and discussions with other stockholders

of the Issuer with respect to effecting changes in the composition of the Issuer’s Board of Directors (the “Board”)

and intend to solicit proxies from other stockholders to effect such changes. The Reporting Persons may engage in further discussions

with other stockholders of the Issuer concerning, among other things, Board composition and corporate governance, levels of expenditures,

and appropriate compensation levels of management and the Board, and may engage in similar discussions with the Board.

The

Reporting Persons may, at any time and from time to time, review or reconsider their purpose and/or formulate new plans or proposals

with respect thereto.

Item

5. Interest in Securities of the Issuer

(a)

The aggregate percentage of shares of Common Stock reported owned by each person named herein is based upon 99,547,710 shares of Common

Stock outstanding, which is the total number of shares of Common Stock reported outstanding as of the Issuer’s Quarterly Report

on Form 6-K, filed with the Securities and Exchange Commission on August 5, 2022.

As

of the close of business on the date hereof, Camac Fund beneficially owned 8,020,319 shares of Common Stock and Camac Fund II beneficially

owned 7,332,280 shares of Common Stock.

Percentage:

Approximately 8.1% for Camac Fund and 7.4% for Camac Fund II.

(b)

By virtue of their respective positions with Camac Fund and Camac Fund II, each of Camac Partners, Camac Capital, and Eric Shahinian

may be deemed to have shared power to vote and dispose of the Shares reported owned by Camac Fund.

(c)

Schedule A annexed hereto lists all transactions in securities of the Issuer by the Reporting Persons during the past 60 days.

(d)

No person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from,

or proceeds from the sale of, the shares of Common Stock.

(e)

Not applicable.

Item

7. Material to be Filed as Exhibits

SIGNATURES

After

reasonable inquiry and to the best of our knowledge and belief, the undersigned certify that the information set forth in this statement

is true, complete and correct.

Dated:

October 25, 2022

| Camac

Partners, LLC |

|

| |

|

|

| By: |

Camac

Capital, LLC, |

|

| its

manager |

|

| |

|

|

| By: |

/s/

Eric Shahinian |

|

| Eric

Shahinian |

|

| Managing

Member |

|

| |

|

|

| Camac

Capital, LLC |

|

| |

|

|

| By: |

/s/

Eric Shahinian |

|

| Eric

Shahinian |

|

| Managing

Member |

|

| |

|

|

| By: |

/s/

Eric Shahinian |

|

| Eric

Shahinian |

|

| |

|

|

| Camac

Fund, LP |

|

| |

|

|

| By: |

Camac

Capital, LLC, |

|

| its

general partner |

|

| |

|

|

| By: |

/s/

Eric Shahinian |

|

| Eric

Shahinian |

|

| Managing

Member |

|

| |

|

|

| Camac

Fund II, LP |

|

| |

|

|

| By: |

Camac

Capital, LLC, |

|

| its

general partner |

|

| |

|

|

| By: |

/s/

Eric Shahinian |

|

| Eric

Shahinian |

|

| Managing

Member |

|

SCHEDULE

A

Transactions

in the Shares by the Reporting Persons During the Past 60 Days

The

following table sets forth all transactions with respect to the Common Stock effected in the last 60 days by or on behalf of the Reporting

Persons, inclusive of any transactions effected through 4:00 p.m., Eastern time, on October 25, 2022. Unless otherwise indicated, all

such transactions were effected in the open market.

Date of Purchase | |

Shares of Common Stock Purchased | |

Price Per Share ($USD)1 |

| CAMAC FUND II, LP |

| 10/20/2022 | |

7,000 | |

1.0322 (CAD 1.4014) |

| 10/18/2022 | |

1,000 | |

1.0200 |

| 10/13/2022 | |

4,500 | |

1.0200 |

| 10/12/2022 | |

81,200 | |

1.1074 (CAD 1.4014) |

| 10/10/2022 | |

3,143 | |

1.0200 |

| 10/6/2022 | |

6,100 | |

0.9371 (CAD 1.2744) |

| 10/5/2022 | |

27,998 | |

0.9900 |

| 10/3/2022 | |

17 | |

0.9900 |

| 9/29/2022 | |

5,500 | |

0.9679 |

| 9/29/2022 | |

105,203 | |

0.9810 |

| 9/29/2022 | |

74,300 | |

0.9788 (CAD 1.3413) |

| 9/28/2022 | |

25,000 | |

0.9550 |

| 9/27/2022 | |

13,500 | |

0.9586 |

| 9/26/2022 | |

1,900 | |

0.9637 |

| 9/23/2022 | |

51,500 | |

0.9719 |

| 9/22/2022 | |

5,200 | |

0.9687 |

| 9/15/2022 | |

1,000 | |

0.9550 |

| 9/13/2022 | |

9,500 | |

0.9700 |

| 9/12/2022 | |

70,000 | |

0.9540 |

| 9/12/2022 | |

10,100 | |

0.9460 (CAD 1.2212) |

| 9/2/2022 | |

39,500 | |

0.9349 (CAD 1.2212) |

| 8/31/2022 | |

1,800 | |

0.9147 (CAD 1.1612) |

| 8/26/2022 | |

7,000 | |

0.8918 (CAD 1.1488) |

| 8/22/2022 | |

12 | |

0.8900 |

| 8/19/2022 | |

10,727 | |

0.8900 |

| 8/19/2022 | |

19,000 | |

0.8532 (CAD 1.1060) |

| 8/18/2022 | |

50,000 | |

0.8900 |

| |

1. |

Purchases

on 10/20, 10/12, 10/6, 9/29 (74,300), 9/12 (10,100), 9/2, 8/31, 8/26, and 8/19 were made in Canadian dollars. These purchases were

converted to United States dollars using the prevailing conversion rate existing at the time of the purchases and included in the

chart as converted to United States dollars. In the table above, the purchase price per share in Canadian dollars is set forth in

parentheses next to the United States dollar purchase price per share. |

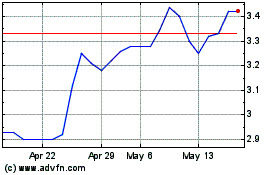

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Feb 2024 to Feb 2025