UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of October 2024

Commission File Number 001-38896

Luckin Coffee Inc.

(Exact Name of Registrant as Specified in Its Charter)

28th Floor, Building T3, Haixi Jingu Plaza

1-3 Taibei Road

Siming District, Xiamen City, Fujian

People’s Republic of China, 361008

+86-592-3386666

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

Luckin Coffee Inc. |

| |

|

|

|

|

| Date: |

October 30, 2024 |

|

By: |

/s/ Jing An |

| |

|

|

|

Name: |

Jing An |

| |

|

|

|

Title: |

Chief Financial Officer |

EXHIBIT INDEX

Exhibit 99.1

Luckin

Coffee Inc. Announces Third Quarter 2024 Financial Results

Quarterly Revenue

Exceeded RMB10 Billion; Year-on-Year Increase of 41.4%

Profitability

Improved with GAAP Operating Margin of 15.3%

1,382

Net New Store Openings; Ended Quarter With More Than 21,300 Stores

BEIJING,

October 30, 2024 (GLOBE NEWSWIRE) — Luckin

Coffee Inc. (“Luckin Coffee” or the “Company”) (OTC: LKNCY) today announced its unaudited financial results for

the three months ended September 30, 2024.

THIRD

QUARTER 2024 HIGHLIGHTS1

| · | Total

net revenues in the third quarter were RMB10,180.8 million (US$1,452.1 million), representing

an increase of 41.4% from RMB7,200.0 million in the same quarter of 2023. |

| · | Net

new store openings during the third quarter was 1,382, resulting in a quarter-over-quarter

store unit growth of 6.9% from the number of stores at the end of the second quarter of 2024,

ending the third quarter with 21,343 stores which include 13,936 self-operated stores and

7,407 partnership stores. |

| · | Average

monthly transacting customers in the third quarter was 79.8 million, representing an

increase of 36.5% from 58.5 million in the same quarter of 2023. |

| · | Revenues

from self-operated stores in the third quarter were RMB7,501.4 million (US$1,069.9 million),

representing an increase of 45.9% from RMB5,141.0 million in the same quarter of 2023. |

| · | Same-store

sales growth for self-operated stores in the third quarter was negative 13.1%, compared

to positive 19.9% in the same quarter of 2023. |

| · | Store

level operating profit – self-operated stores in the third quarter was RMB1,745.6

million (US$249.0 million) with store level operating profit margin of 23.3%, compared to

RMB1,185.4 million with store level operating profit margin of 23.1% in the same quarter

of 2023. |

| · | Revenues

from partnership stores in the third quarter were RMB2,341.3 million (US$333.9 million),

representing an increase of 27.2% from RMB1,840.8 million in the same quarter of 2023. |

| · | GAAP

operating income in the third quarter was RMB1,557.5 million (US$222.1 million), representing

a GAAP operating margin of 15.3%, compared to RMB961.7 million, or a GAAP operating

margin of 13.4%, in the same quarter of 2023. Non-GAAP operating income in

the third quarter, which adjusts for share-based compensation expenses, was RMB1,655.6 million

(US$236.1 million), representing a non-GAAP operating margin of 16.3%, compared to

RMB1,025.5 million, or a non-GAAP operating margin of 14.2%, in the same quarter of

2023. |

| · | Additional information on international business. The Company recognizes

the importance of the international market and is actively pursuing global expansion. The international market encompasses diverse regions,

each requiring long-term investment before realizing substantial financial returns. |

We have strategically chosen Singapore as the launch point

for our international expansion, given its status as a key hub in Southeast Asia. Our first store in Singapore opened in 2023, and in

the third quarter, we added eight new stores, bringing the total to 45 self-operated stores. We are also actively evaluating opportunities in the United States and other

markets. Given the maturity, saturation, and competitiveness of the U.S. coffee market, we intend to approach our expansion strategy there

with careful consideration and a disciplined execution plan.

For the nine months ended September 30, 2024, net revenues

from Singapore reached RMB91.4 million, while costs and expenses, primarily including store operations, regional expenses, and support

costs incurred at headquarters, totaled approximately RMB167.7 million. We remain committed to investing in our international growth,

although we do not anticipate profitability in this area in the near term. Similar to our strategy in China, the international business

will need to reach significant scale to achieve profitability.

1

Please refer to the section “KEY DEFINITIONS” on Page 4 for detailed definitions

on certain terms used.

COMPANY STATEMENT

“I’m pleased to report that Luckin delivered outstanding

results in the third quarter of 2024,” said Dr. Jinyi Guo, Chairman and Chief Executive Officer of Luckin Coffee. “With

the hard work and dedication of our team and the loyalty of our customers, we achieved record net revenue and operating profit while maintaining

a healthy margin. Despite the many coffee options available in China, Luckin remains a preferred choice for customers, as reflected in

our record average monthly transaction user count and the addition of 1,382 net new stores. In line with our commitment to invest in a

high-quality supply chain and boost efficiency, we also broke ground in August on our new state-of-the-art Innovation and Production Center

in Qingdao, a strategically important economic hub in China. Looking forward, we are focused on continuing to expand our market share

by offering innovative, high-quality products, enhancing brand recognition, and expanding our footprint.”

CHANGES

TO BOARD OF DIRECTORS (THE “BOARD”)

Mr. Gary (Shaoqiang) Liu, a director of the Company, has resigned from

his positions on the Board for personal reasons. Mr. Guiyi Chen has been appointed as a new director and a member of the Compensation

Committee.

“I am grateful to Mr. Gary Liu for his valuable contributions

during his tenure and wish him all the best in his future endeavors,” said Dr. Jinyi Guo, Chairman and Chief Executive Officer of

Luckin Coffee. “I am also pleased to welcome Mr. Guiyi Chen to our Board and look forward to collaborating with him as we pursue

our mission and deliver sustainable, long-term value to our shareholders.”

Mr. Guiyi Chen brings extensive experience in law, banking, investment,

and management, with expertise in both domestic and international capital markets. He is currently a managing director at Centurium Capital

Management (HK) Ltd (“Centurium Capital”). Prior to joining Centurium Capital, Mr. Chen held senior roles at Jingtian &

Gongcheng LLP, W&G Investment Management Co., Ltd., and Loeb & Loeb LLP. Mr. Chen holds a bachelor’s degree in legal studies

from the China Youth University of Political Science and a master’s degree in law from the University of Groningen, Netherlands.

THIRD

QUARTER 2024 FINANCIAL RESULTS

Total net revenues

were RMB10,180.8 million (US$1,452.1 million) in the third quarter of 2024, representing an increase of 41.4% from RMB7,200.0 million

in the same quarter of 2023. Driven by the increase in the number of products sold, stores in operation and monthly transacting customers,

our net revenues has shown strong increase despite the decrease in average selling price of the Company’s products.

| · | Revenues

from product sales

were RMB7,839.5 million (US$1,118.2 million) in the third quarter of 2024, representing an

increase of 46.3% from RMB5,359.3 million in the same quarter of 2023. |

| · | Net

revenues from freshly brewed drinks were RMB7,210.8

million (US$1,028.5 million), representing 70.8% of total net revenues in the third quarter

of 2024, compared to RMB4,869.7 million, representing 67.6% of total net revenues, in the

same quarter of 2023. |

| · | Net

revenues from other products were RMB476.9 million (US$68.0

million), representing 4.7% of total net revenues in the third quarter of 2024, compared

to RMB345.3 million, representing 4.8% of total net revenues, in the same quarter of 2023. |

| · | Net

revenues from others were RMB151.8 million (US$21.6 million),

representing 1.5% of total net revenues in the third quarter of 2024, compared to RMB144.4

million, representing 2.0% of total net revenues, in the same quarter of 2023. |

| · | Revenues

from partnership stores were RMB2,341.3 million (US$333.9 million), representing 23.0%

of total net revenues in the third quarter of 2024, which represents an increase of 27.2%

compared to RMB1,840.8 million, representing 25.6% of total net revenues, in the same quarter

of 2023. For the third quarter of 2024, revenues from partnership stores included sales of

materials of RMB1,651.7 million (US$235.6 million), profit sharing of RMB293.4 million (US$41.8

million), delivery service of RMB230.4 million (US$32.9 million), sales of equipment of RMB147.1

million (US$21.0 million), and other services of RMB18.8 million (US$2.7 million). |

Total

operating expenses were RMB8,623.3 million (US$1,229.9

million) in the third quarter of 2024, representing an increase of 38.2% from RMB6,238.3 million in the same quarter of 2023. The increase

in total operating expenses was predominantly the result of the Company’s business expansion. Meanwhile, operating expenses as a

percentage of net revenues was 84.7% in the third quarter of 2024, slightly lower than 86.6% in the same quarter of 2023, mainly due to

the decrease in cost of materials as a percentage of net revenues resulting from the changes in product matrix provided to consumers in

the third quarter.

| · | Cost

of materials were RMB3,955.4 million (US$564.2 million)

in the third quarter of 2024, representing an increase of 24.9% from RMB3,166.6 million in

the same quarter of 2023, mainly due to the increase in the number of products sold and the

increase in sales of materials to partnership stores. |

| · | Store

rental and other operating costs were RMB2,284.9

million (US$325.9 million) in the third quarter of 2024, representing an increase of 60.3%

from RMB1,425.5 million in the same quarter of 2023, mainly due to the increase in labor

costs, store rental as well as utilities and other store operating costs as a result of the

increased number of stores and items sold in the third quarter of 2024 compared to the same

period last year. |

| · | Depreciation

and amortization expenses were RMB309.7 million

(US$44.2 million) in the third quarter of 2024, representing an increase of 93.5% from RMB160.1

million in the same quarter of 2023, mainly due to the increase in amortization of leasehold

improvements for the stores and the increase in depreciation expenses of additional equipment

put into use in new stores in the third quarter of 2024. |

| · | Delivery

expenses were RMB927.7 million (US$132.3 million) in the third quarter of 2024, representing

an increase of 57.9% from RMB587.5 million in the same quarter of 2023, mainly due to the

increase in the number of delivery orders. |

| · | Sales

and marketing expenses were RMB589.0 million (US$84.0 million) in the third quarter of

2024, representing an increase of 53.2% from RMB384.4 million in the same quarter of 2023,

mainly driven by the increase in (i) advertising and other promotion expenses as the

Company continued to make strategic investments in its branding through various channels,

and (ii) commissions to third-party delivery platforms. Sales and marketing expenses

amounted to 5.8% of total net revenues in the third quarter of 2024, compared to 5.3% of

total net revenues in the same quarter of 2023. |

| · | General

and administrative expenses were RMB636.6 million

(US$90.8 million) in the third quarter of 2024, representing an increase of 32.3% from RMB481.3

million in the same quarter of 2023. The increase in general and administrative expenses

was mainly driven by the increase in (i) payroll costs for general and administrative staff, (ii) research

and development expenses, (iii) share-based compensation for restricted share units

and options issued to management and employees, and (iv) expenditures for office supplies.

General and administrative expenses amounted to 6.3% of total net revenues in the third quarter

of 2024, compared to 6.7% of total net revenues in the same quarter of 2023. |

| · | Store

preopening and other expenses were RMB13.5 million

(US$1.9 million) in the third quarter of 2024, representing a decrease of 55.2% from RMB30.1

million in the same quarter of 2023, mainly due to fewer stores preparing to be opened in

the third quarter of 2024 compared to the same quarter of 2023. Store preopening and other

expenses amounted to 0.1% of total net revenues in the third quarter of 2024, compared to

0.4% of total net revenues in the same quarter of 2023. |

| · | Losses and expenses related to Fabricated Transactions and

Restructuring were negative RMB102.5 million (US$14.6 million)

in the third quarter of 2024, compared to RMB3.0 million in the same quarter of 2023, primarily because the Company became entitled

to receive excess layers compensation of US$15.0 million (approximately RMB105.2 million) under its Directors & Officers

Liability and Company Reimbursement Insurance (the “D&O Insurance”), following the receipt of a base layer

compensation. Losses and expenses related to Fabricated Transactions and Restructuring amounted to negative 1.0% of total net

revenues in the third quarter of 2024, compared to 0.0% of total net revenues in the same quarter of 2023. |

| · | Store

level operating profit margin - self-operated stores was 23.3% in the third quarter of

2024, compared to 23.1% in the same quarter of 2023. |

GAAP

operating income

was RMB1,557.5 million (US$222.1 million) in the third quarter of 2024, representing a GAAP

operating margin of 15.3%, compared to RMB961.7 million, or a GAAP operating

margin of 13.4%, in the same quarter of 2023. Non-GAAP operating income was RMB1,655.6

million (US$236.1 million) in the third quarter of 2024, representing a non-GAAP operating

margin of 16.3%, compared to RMB1,025.5 million, or a non-GAAP operating margin

of 14.2%, in the same quarter of 2023. For more information on the Company’s non-GAAP

financial measures, please see the section “Use of Non-GAAP Financial Measures”

and the table captioned “Reconciliation of Non-GAAP Measures to the Most Directly Comparable

GAAP Measures” set forth at the end of this press release.

Income

tax expenses was RMB352.7 million (US$50.3 million) in the third quarter of 2024, compared to

income tax benefit of RMB82.6 million in the same quarter of 2023. In the third quarter of 2023, as a certain number of the Company’s

operation entities have turned cumulative profits from cumulative losses, in accordance to relevant accounting standards, the Company

re-evaluated the realization of deferred tax assets given the largely reduced uncertainty of the Company’s business performance.

As a result, a certain amount of the valuation allowance against the deferred tax assets was released. Excluding the release of

valuation allowance against the deferred tax assets, income tax expense was approximately RMB169.5 million in the third quarter of 2023.

Income tax expenses increased by RMB183.2 million in the third quarter when compared to the income tax expenses of RMB169.5 million in

the same period of 2023, which was mainly due to the increased profits earned in the third quarter.

Net income

was RMB1,302.6 million (US$185.8 million) in the third quarter of 2024, representing a net margin of 12.8%, compared to net income

of RMB988.0 million, or a net margin of 13.7%, in the same quarter of 2023. Non-GAAP net income was RMB1,400.8 million

(US$199.8 million) in the third quarter of 2024, representing a non-GAAP net margin of 13.8%, compared to RMB1,144.0 million, or a

non-GAAP net margin of 15.9%, in the same quarter of 2023.

Basic

and diluted net income per ADS was RMB4.08 (US$0.56) and RMB4.08 (US$0.56) in the third quarter

of 2024, respectively, compared to basic and diluted net income per ADS of RMB3.12 and RMB3.12 in the same quarter of 2023, respectively.

Non-GAAP

basic and diluted net income per ADS was RMB4.40 (US$0.64) and RMB4.40 (US$0.64) in the third

quarter of 2024, respectively, compared to non-GAAP basic and diluted net income of RMB3.60 and RMB3.60 in the same quarter of 2023,

respectively.

Net

cash provided by operating activities was RMB1,316.1 million (US$187.7 million) in the third

quarter of 2024, compared to net cash provided by operating activities of RMB1,310.1 million in the same quarter of 2023.

Cash

and cash equivalents, restricted cash, term deposits and short-term investments were RMB4,753.2

million (US$678.0 million) as of September 30, 2024, compared to RMB3,752.7 million as of December 31, 2023. The increase was

primarily attributable to the cash inflow generated from the Company’s operations.

KEY OPERATING DATA

| | |

For

the three months ended or as of | |

| | |

Mar 31, | | |

Jun 30, | | |

Sep 30, | | |

Dec 31, | | |

Mar 31, | | |

Jun 30, | | |

Sep 30, | |

| | |

2023 | | |

2023 | | |

2023 | | |

2023 | | |

2024 | | |

2024 | | |

2024 | |

| Total stores | |

| 9,351 | | |

| 10,836 | | |

| 13,273 | | |

| 16,248 | | |

| 18,590 | | |

| 19,961 | | |

| 21,343 | |

| Self-operated stores | |

| 6,310 | | |

| 7,188 | | |

| 8,807 | | |

| 10,628 | | |

| 12,199 | | |

| 13,056 | | |

| 13,936 | |

| Partnership stores | |

| 3,041 | | |

| 3,648 | | |

| 4,466 | | |

| 5,620 | | |

| 6,391 | | |

| 6,905 | | |

| 7,407 | |

| Same-store sales growth

for self-operated stores | |

| 29.6 | % | |

| 20.8 | % | |

| 19.9 | % | |

| 13.5 | % | |

| (20.3 | )% | |

| (20.9 | )% | |

| (13.1 | )% |

| Average monthly transacting

customers (in thousands) | |

| 29,489 | | |

| 43,070 | | |

| 58,477 | | |

| 62,438 | | |

| 59,914 | | |

| 69,689 | | |

| 79,846 | |

KEY DEFINITIONS

| · | Total

net revenues include revenues from product sales and revenues from partnership stores. |

| · | Revenues

from product sales mainly include net revenue from the sales of freshly brewed and non-freshly

brewed items through self-operating stores, unmanned machines, e-commerce and revenue from

delivery for self-operated stores. |

| · | Revenues

from self-operated stores include net revenue from the sales of freshly brewed and non-freshly

brewed items through self-operating stores, and delivery fees derived from self-operated

stores paid by the Company’s customers. Before the first quarter of 2023, revenues

from self-operated stores only included net revenue from the sales of freshly brewed and

non-freshly brewed items through self-operating stores, and beginning from the first quarter

of 2023, we added delivery fees derived from self-operated stores paid by the Company’s

customers to this definition. |

| · | Revenues

from partnership stores include net revenue from

the sales of materials, equipment, and other services including delivery and pre-opening

services provided to partnership stores and profit sharing from partnership stores. |

| · | Same-store

sales growth for self-operated stores. Defined as the growth rate of total revenue from

self-operated stores that (i) were in operation at the beginning of the comparable period

and were not closed before the end of the current period and (ii) maintained an average

of at least 15 operating days per month over both the current and comparable periods. |

| · | Store

level operating profit - self-operated stores. Calculated by deducting cost for self-operated

stores including cost of direct materials (including wastage in stores), cost of delivery

packaging materials, storage and logistics expenses, commissions to third-party delivery

platforms related to revenues from self-operated stores, store depreciation expense (including

decoration loss for store closure), store rental and other operating costs, delivery expense,

transaction fees, store preopening and other expenses from the Company’s self-operated

store revenues. Before the first quarter of 2023, commissions to third-party delivery platforms

related to revenues from self-operated stores was not deducted when calculating this term. |

| · | Store

level operating profit margin - self-operated stores. Calculated by dividing store level

operating profit by total revenues from self-operated stores. |

| · | Total

number of stores. The number of stores open at the end of the period, excluding unmanned

machines. |

| · | Net

new store openings. The number of gross new stores opened during the period minus the

number of stores closed during the period. |

| · | Average

monthly transacting customers. The total of each month’s number of transacting

customers divided by the number of months during the period (includes those of partnership

stores and those only paid with free-coupons). |

| · | Non-GAAP

operating income. Calculated by operating income excluding share-based compensation expenses. |

| · | Non-GAAP

net income. Calculated by net income excluding recurring item of share-based compensation

expenses and non-recurring item of provision for equity litigants. |

| · | Non-GAAP

net income attributable to the Company’s ordinary shareholders. Calculated by adjusting

net income attributable to the Company’s ordinary shareholders excluding recurring

item of share-based compensation expenses and non-recurring item of provision

for equity litigants. |

| · | Non-GAAP

basic and diluted net income per shares. Calculated as non-GAAP net income attributable

to the Company’s ordinary shareholders divided by weighted average number of basic

and diluted share. |

| · | Non-GAAP

basic and diluted net income per ADSs. Calculated as non-GAAP net income attributable

to the Company’s ordinary shareholders divided by weighted average number of basic

and diluted ADS. |

USE OF NON-GAAP FINANCIAL MEASURES

In

evaluating the business, the Company considers and uses non-GAAP operating income/(loss) and non-GAAP

net income/(loss), each a non-GAAP financial measure, in reviewing and assessing the Company’s operating performance. The presentation

of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared

and presented in accordance with Generally Accepted Accounting Principles in the United States (“U.S. GAAP”

or “GAAP”). The Company presents these non-GAAP financial measures because they are used by the Company’s management

to evaluate operating performance and formulate business plans. The Company believes that the non-GAAP financial measures help identify

underlying trends in the Company’s business, provide further information about the Company’s results of operations and enhance

the overall understanding of the Company’s past performance and future prospects.

The non-GAAP financial measures are

not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical

tools. The Company’s non-GAAP financial measures do not reflect all items of income and expense that affect the Company’s

operations and do not represent the residual cash flow available for discretionary expenditures. Furthermore, these non-GAAP measures

may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be

limited. The Company compensates for these limitations by reconciling the non-GAAP financial measures to the nearest U.S. GAAP performance

measure, all of which should be considered when evaluating the Company’s performance. The Company encourages investors and others

to review the Company’s financial information in its entirety and not rely on a single financial measure.

The

Company defines non-GAAP operating income/(loss) as operating income/(loss) excluding share-based

compensation expenses, non-GAAP net income/(loss) as net income/(loss) excluding recurring item of share-based compensation expenses

and non-recurring item of provision for equity litigants, and non-GAAP net income/(loss) attributable to the Company’s ordinary

shareholders as net income/(loss) attributable to the Company’s ordinary shareholders excluding recurring item of share-based compensation

expenses and non-recurring item of provision for equity litigants.

For more information on the non-GAAP

financial measures, please see the table captioned “Reconciliation of Non-GAAP Measures to the Most Directly Comparable GAAP Measures”

set forth at the end of this earnings release.

EXCHANGE RATE INFORMATION

This

earnings release contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the

convenience of the reader. Unless otherwise noted, all translations from RMB to US$ were made at the rate of RMB7.0111

to US$1.00, the exchange rate on September 27, 2024 set forth in the H.10 statistical release of the Federal Reserve Board. The

Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular

rate or at all.

CONFERENCE CALL

The

Company will host a conference call today, on Wednesday, October 30, 2024, at 8:00 am Eastern

Time (or Wednesday, October 30, 2024, at 8:00 pm Beijing Time) to discuss the financial results.

Participants may access the call by

dialing the following numbers:

| United States Toll

Free: |

+1-888-317-6003 |

| International: |

+1-412-317-6061 |

| Mainland China Toll Free: |

400-120-6115 |

| Hong Kong Toll Free: |

800-963-976 |

| Conference ID: |

5935029 |

The

replay will be accessible through November 6, 2024, by dialing the following numbers:

| United States Toll

Free: |

+1-877-344-7529 |

| International: |

+1-412-317-0088 |

| Access Code: |

3696636 |

A

live and archived webcast of the conference call will also be available at the Company's investor relations website at investor.lkcoffee.com.

SAFE HARBOR STATEMENTS

This earnings release contains forward-looking statements within the

meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made under the “safe

harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements can be identified by terminology

such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” “potential,” “continue,” “ongoing,” “targets,”

“guidance” and similar statements. Luckin Coffee may also make written or oral forward-looking statements in its periodic

reports or current reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders,

in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Any

statements that are not historical facts, including statements about Luckin Coffee’s beliefs and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement, including but not limited to the following: the expense, timing and

outcome of existing or future legal and governmental proceedings or investigations in connection with Luckin Coffee; the outcome and effect

of the restructuring of Luckin Coffee’s financial obligations; Luckin Coffee’s growth strategies, including its international

expansion plans; its future business development, results of operations and financial condition; the effect of the non-reliance identified

in, and the resultant restatement of, certain of Luckin Coffee’s previously issued financial results; the effectiveness of its internal

control; its ability to retain and attract its customers; its ability to maintain and enhance the recognition and reputation of its brand;

its ability to maintain and improve quality control policies and measures; its ability to establish and maintain relationships with its

suppliers and business partners; trends and competition in the coffee industry or the food and beverage sector in general; changes in

its revenues and certain cost or expense items; the expected growth of China’s coffee industry or China’s food and beverage

sector in general; governmental policies and regulations relating to Luckin Coffee’s industry; and general economic and business

conditions globally and in China and assumptions underlying or related to any of the foregoing. Further information regarding these and

other risks, uncertainties or factors is included in Luckin Coffee’s filings with the SEC. All information provided in this press

release and in the attachments is as of the date of this press release, and Luckin Coffee undertakes no obligation to update any forward-looking

statement, except as required under applicable law.

STATEMENT REGARDING PRELIMINARY UNAUDITED

FINANCIAL INFORMATION

The unaudited financial information

set out in this earnings release is preliminary and subject to potential adjustments. Adjustments to the consolidated financial statements

may be identified when audit work has been performed for the Company’s year-end audit, which could result in significant differences

from this preliminary unaudited financial information.

ABOUT LUCKIN COFFEE INC.

Luckin Coffee Inc. (OTC: LKNCY) has

pioneered a technology-driven retail network to provide coffee and other products of high quality, high convenience and high affordability

to customers. Empowered by proprietary technologies, Luckin Coffee pursues its mission to build a world-class coffee brand and become

a part of everyone’s daily life. Luckin Coffee was founded in 2017 and is based in China. For more information, please visit investor.lkcoffee.com.

INVESTOR AND MEDIA CONTACTS

Investor Relations:

Luckin Coffee Inc. IR

Email: ir@lkcoffee.com

Bill Zima / Michael Bowen

ICR, Inc.

Phone: 646 880 9039

Media Relations:

Luckin Coffee Inc. PR

Email: pr@lkcoffee.com

Ed Trissel / Spencer Hoffman

Joele Frank, Wilkinson Brimmer Katcher

Phone: 212 355 4449

LUCKIN COFFEE

INC.

CONSOLIDATED

BALANCE SHEET AS OF DECEMBER 31, 2023

AND

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET AS OF SEPTEMBER 30, 2024

(Amounts in thousands

of RMB and US$, except for number of shares)

| | |

As

of | |

| | |

December 31,

2023 | | |

September 30,

2024

(Unaudited) | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 2,925,709 | | |

| 3,802,087 | | |

| 542,295 | |

| Restricted cash | |

| 66,080 | | |

| 5,571 | | |

| 795 | |

| Term deposit- current | |

| 464,019 | | |

| 639,412 | | |

| 91,200 | |

| Short-term investment | |

| 100,000 | | |

| 116,000 | | |

| 16,545 | |

| Accounts receivable, net | |

| 80,665 | | |

| 156,401 | | |

| 22,308 | |

| Receivables from online payment

platforms | |

| 214,163 | | |

| 381,416 | | |

| 54,402 | |

| Inventories, net | |

| 2,204,000 | | |

| 3,118,617 | | |

| 444,811 | |

| Prepaid

expenses and other current assets, net | |

| 1,544,918 | | |

| 1,871,911 | | |

| 266,992 | |

| Total

current assets | |

| 7,599,554 | | |

| 10,091,415 | | |

| 1,439,348 | |

| | |

| | | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 4,169,141 | | |

| 4,861,418 | | |

| 693,389 | |

| Restricted cash | |

| 46,854 | | |

| 40,134 | | |

| 5,724 | |

| Term deposit-non current | |

| 150,000 | | |

| 150,000 | | |

| 21,395 | |

| Other non-current assets, net | |

| 789,492 | | |

| 934,700 | | |

| 133,317 | |

| Deferred tax assets, net | |

| 350,082 | | |

| 254,542 | | |

| 36,306 | |

| Operating

lease, right-of-use assets | |

| 5,186,855 | | |

| 5,761,557 | | |

| 821,776 | |

| Total

non-current assets | |

| 10,692,424 | | |

| 12,002,351 | | |

| 1,711,907 | |

| TOTAL

ASSETS | |

| 18,291,978 | | |

| 22,093,766 | | |

| 3,151,255 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES, MEZZANINE

EQUITY AND SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Short-term bank borrowing | |

| — | | |

| 300,000 | | |

| 42,789 | |

| Accounts payable | |

| 814,655 | | |

| 862,805 | | |

| 123,063 | |

| Accrued expenses and other liabilities | |

| 2,556,977 | | |

| 3,183,424 | | |

| 454,055 | |

| Deferred revenues | |

| 123,422 | | |

| 108,736 | | |

| 15,509 | |

| Payable for equity litigants

settlement | |

| 116,314 | | |

| 114,860 | | |

| 16,383 | |

| Operating

lease liabilities-current | |

| 1,851,310 | | |

| 2,218,176 | | |

| 316,381 | |

| Total

current liabilities | |

| 5,462,678 | | |

| 6,788,001 | | |

| 968,180 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | | |

| | |

| Operating

lease liabilities-non current | |

| 3,114,855 | | |

| 3,294,382 | | |

| 469,881 | |

| Total

non-current liabilities | |

| 3,114,855 | | |

| 3,294,382 | | |

| 469,881 | |

| Total

liabilities | |

| 8,577,533 | | |

| 10,082,383 | | |

| 1,438,061 | |

| | |

| | | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Mezzanine equity | |

| | | |

| | | |

| | |

| Senior Preferred Shares | |

| 1,578,040 | | |

| 1,514,660 | | |

| 216,037 | |

| | |

| | | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | | |

| | |

| Class A Ordinary shares | |

| 23 | | |

| 23 | | |

| 3 | |

| Class B Ordinary shares | |

| 2 | | |

| 2 | | |

| — | |

| Additional paid-in capital | |

| 16,276,991 | | |

| 16,608,582 | | |

| 2,368,898 | |

| Statutory reserves | |

| 168,204 | | |

| 167,868 | | |

| 23,943 | |

| Accumulated deficits | |

| (8,705,759 | ) | |

| (6,614,853 | ) | |

| (943,483 | ) |

| Accumulated other comprehensive

income | |

| 396,944 | | |

| 335,101 | | |

| 47,796 | |

| Total

Company’s ordinary shareholders’ equity | |

| 8,136,405 | | |

| 10,496,723 | | |

| 1,497,157 | |

| TOTAL

LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS’ EQUITY | |

| 18,291,978 | | |

| 22,093,766 | | |

| 3,151,255 | |

LUCKIN COFFEE

INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE

INCOME

(Amounts in thousands

of RMB and US$, except for number of shares and per share data)

| | |

For the three months ended September 30, | | |

For the nine months ended September 30, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net revenues: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenues from product

sales | |

| 5,359,262 | | |

| 7,839,479 | | |

| 1,118,152 | | |

| 13,376,169 | | |

| 19,162,032 | | |

| 2,733,099 | |

| Revenues from partnership stores | |

| 1,840,777 | | |

| 2,341,287 | | |

| 333,940 | | |

| 4,462,026 | | |

| 5,699,505 | | |

| 812,926 | |

| Total net revenues | |

| 7,200,039 | | |

| 10,180,766 | | |

| 1,452,092 | | |

| 17,838,195 | | |

| 24,861,537 | | |

| 3,546,025 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of materials | |

| (3,166,570 | ) | |

| (3,955,439 | ) | |

| (564,168 | ) | |

| (7,382,729 | ) | |

| (10,268,106 | ) | |

| (1,464,550 | ) |

| Store rental and other operating

costs | |

| (1,425,482 | ) | |

| (2,284,889 | ) | |

| (325,896 | ) | |

| (3,465,513 | ) | |

| (6,168,379 | ) | |

| (879,802 | ) |

| Depreciation and amortization

expenses | |

| (160,052 | ) | |

| (309,704 | ) | |

| (44,173 | ) | |

| (396,256 | ) | |

| (858,215 | ) | |

| (122,408 | ) |

| Delivery expenses | |

| (587,455 | ) | |

| (927,693 | ) | |

| (132,318 | ) | |

| (1,543,336 | ) | |

| (1,982,406 | ) | |

| (282,752 | ) |

| Sales and marketing expenses | |

| (384,401 | ) | |

| (588,987 | ) | |

| (84,008 | ) | |

| (887,410 | ) | |

| (1,347,412 | ) | |

| (192,183 | ) |

| General and administrative expenses | |

| (481,281 | ) | |

| (636,645 | ) | |

| (90,805 | ) | |

| (1,267,654 | ) | |

| (1,782,892 | ) | |

| (254,296 | ) |

| Store preopening and other expenses | |

| (30,050 | ) | |

| (13,466 | ) | |

| (1,921 | ) | |

| (64,223 | ) | |

| (55,976 | ) | |

| (7,984 | ) |

| Impairment loss of long-lived

assets | |

| — | | |

| (8,925 | ) | |

| (1,273 | ) | |

| (5,229 | ) | |

| (8,925 | ) | |

| (1,273 | ) |

| Losses and expenses related

to Fabricated Transactions and Restructuring | |

| (3,024 | ) | |

| 102,454 | | |

| 14,613 | | |

| (12,940 | ) | |

| 153,821 | | |

| 21,940 | |

| Total operating expenses | |

| (6,238,315 | ) | |

| (8,623,294 | ) | |

| (1,229,949 | ) | |

| (15,025,290 | ) | |

| (22,318,490 | ) | |

| (3,183,308 | ) |

| Operating income | |

| 961,724 | | |

| 1,557,472 | | |

| 222,143 | | |

| 2,812,905 | | |

| 2,543,047 | | |

| 362,717 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest and investment income | |

| 31,509 | | |

| 25,153 | | |

| 3,588 | | |

| 77,324 | | |

| 54,738 | | |

| 7,807 | |

| Interest and financing expenses | |

| — | | |

| (1,918 | ) | |

| (274 | ) | |

| — | | |

| (2,007 | ) | |

| (286 | ) |

| Foreign exchange gain/(loss),

net | |

| 792 | | |

| 68,090 | | |

| 9,712 | | |

| (121 | ) | |

| 38,882 | | |

| 5,546 | |

| Other income, net | |

| 3,603 | | |

| 6,578 | | |

| 938 | | |

| 44,309 | | |

| 73,956 | | |

| 10,548 | |

| Provision for equity litigants | |

| (92,192 | ) | |

| — | | |

| — | | |

| (92,192 | ) | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income before income

taxes | |

| 905,436 | | |

| 1,655,375 | | |

| 236,107 | | |

| 2,842,225 | | |

| 2,708,616 | | |

| 386,332 | |

| Income tax (expense)/benefit | |

| 82,575 | | |

| (352,734 | ) | |

| (50,311 | ) | |

| (290,693 | ) | |

| (618,046 | ) | |

| (88,153 | ) |

| Net income | |

| 988,011 | | |

| 1,302,641 | | |

| 185,796 | | |

| 2,551,532 | | |

| 2,090,570 | | |

| 298,179 | |

| Net income attributable

to the Company’s ordinary shareholders | |

| 988,011 | | |

| 1,302,641 | | |

| 185,796 | | |

| 2,551,532 | | |

| 2,090,570 | | |

| 298,179 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 0.39 | | |

| 0.51 | | |

| 0.07 | | |

| 1.01 | | |

| 0.82 | | |

| 0.12 | |

| Diluted | |

| 0.39 | | |

| 0.51 | | |

| 0.07 | | |

| 1.00 | | |

| 0.82 | | |

| 0.12 | |

| Net income per ADS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic* | |

| 3.12 | | |

| 4.08 | | |

| 0.56 | | |

| 8.08 | | |

| 6.56 | | |

| 0.96 | |

| Diluted* | |

| 3.12 | | |

| 4.08 | | |

| 0.56 | | |

| 8.00 | | |

| 6.56 | | |

| 0.96 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares

outstanding used in calculating basic and diluted income per share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 2,532,072,783 | | |

| 2,545,551,167 | | |

| 2,545,551,167 | | |

| 2,532,072,783 | | |

| 2,545,551,167 | | |

| 2,545,551,167 | |

| Diluted | |

| 2,542,324,870 | | |

| 2,549,360,432 | | |

| 2,549,360,432 | | |

| 2,542,795,351 | | |

| 2,548,436,166 | | |

| 2,548,436,166 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 988,011 | | |

| 1,302,641 | | |

| 185,796 | | |

| 2,551,532 | | |

| 2,090,570 | | |

| 298,179 | |

| Other comprehensive loss,

net of tax of nil: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation

difference, net of tax of nil | |

| (239 | ) | |

| (90,996 | ) | |

| (12,979 | ) | |

| 2,406 | | |

| (61,843 | ) | |

| (8,821 | ) |

| Total comprehensive income | |

| 987,772 | | |

| 1,211,645 | | |

| 172,817 | | |

| 2,553,938 | | |

| 2,028,727 | | |

| 289,358 | |

| Total comprehensive income

attributable to ordinary shareholders | |

| 987,772 | | |

| 1,211,645 | | |

| 172,817 | | |

| 2,553,938 | | |

| 2,028,727 | | |

| 289,358 | |

*

Each ADS represents eight Class A Ordinary Shares. The per ADS indicators are based on rounded

results of corresponding per share indicators, which could have a rounding difference of absolute amount for not more than 0.04 per ADS.

LUCKIN COFFEE

INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands

of RMB and US$)

| | |

For the three months ended September 30, | | |

For the nine months ended September 30, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net cash provided

by operating activities | |

| 1,310,128 | | |

| 1,316,141 | | |

| 187,722 | | |

| 3,827,171 | | |

| 2,600,897 | | |

| 370,969 | |

| Net cash used in investing activities | |

| (1,880,916 | ) | |

| (988,308 | ) | |

| (140,963 | ) | |

| (3,271,026 | ) | |

| (2,097,443 | ) | |

| (299,161 | ) |

| Net cash provided by financing

activities | |

| — | | |

| — | | |

| — | | |

| — | | |

| 300,000 | | |

| 42,789 | |

| Effect of foreign exchange rate

changes on cash and cash equivalents and restricted cash | |

| (1,138 | ) | |

| 1,642 | | |

| 234 | | |

| 6,907 | | |

| 5,695 | | |

| 812 | |

| Net increase/(decrease) in cash

and cash equivalents and restricted cash | |

| (571,926 | ) | |

| 329,475 | | |

| 46,993 | | |

| 563,052 | | |

| 809,149 | | |

| 115,409 | |

| Cash and cash equivalents

and restricted cash at beginning of period | |

| 4,712,897 | | |

| 3,518,317 | | |

| 501,821 | | |

| 3,577,919 | | |

| 3,038,643 | | |

| 433,405 | |

| Cash and cash equivalents

and restricted cash at end of period | |

| 4,140,971 | | |

| 3,847,792 | | |

| 548,814 | | |

| 4,140,971 | | |

| 3,847,792 | | |

| 548,814 | |

LUCKIN COFFEE

INC.

RECONCILIATION

OF NON-GAAP MEASURES TO THE MOST DIRECTLY COMPARABLE GAAP

MEASURES

(Unaudited, amounts

in thousands of RMB and US$, except for number of shares and per share data)

| | |

For the three months ended September 30, | | |

For the nine months ended September 30, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| A.

Non-GAAP operating income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating income | |

| 961,724 | | |

| 1,557,472 | | |

| 222,144 | | |

| 2,812,905 | | |

| 2,543,047 | | |

| 362,717 | |

| Adjusted for: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based

compensation expenses | |

| 63,759 | | |

| 98,172 | | |

| 14,002 | | |

| 179,311 | | |

| 268,188 | | |

| 38,252 | |

| Non-GAAP

operating income | |

| 1,025,483 | | |

| 1,655,644 | | |

| 236,146 | | |

| 2,992,216 | | |

| 2,811,235 | | |

| 400,969 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| B.

Non-GAAP net income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 988,011 | | |

| 1,302,641 | | |

| 185,797 | | |

| 2,551,532 | | |

| 2,090,570 | | |

| 298,180 | |

| Adjusted for: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation expenses | |

| 63,759 | | |

| 98,172 | | |

| 14,002 | | |

| 179,311 | | |

| 268,188 | | |

| 38,252 | |

| Provision

for equity litigants | |

| 92,192 | | |

| — | | |

| — | | |

| 92,192 | | |

| — | | |

| — | |

| Non-GAAP

net income | |

| 1,143,962 | | |

| 1,400,813 | | |

| 199,799 | | |

| 2,823,035 | | |

| 2,358,758 | | |

| 336,432 | |

| Non-GAAP

net income attributable to the Company’s ordinary shareholders | |

| 1,143,962 | | |

| 1,400,813 | | |

| 199,799 | | |

| 2,823,035 | | |

| 2,358,758 | | |

| 336,432 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| C.

Non-GAAP net income per share | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares

outstanding used in calculating basic and diluted income per share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 2,532,072,783 | | |

| 2,545,551,167 | | |

| 2,545,551,167 | | |

| 2,532,072,783 | | |

| 2,545,551,167 | | |

| 2,545,551,167 | |

| Diluted | |

| 2,542,324,870 | | |

| 2,549,360,432 | | |

| 2,549,360,432 | | |

| 2,542,795,351 | | |

| 2,548,436,166 | | |

| 2,548,436,166 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP net income per share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 0.45 | | |

| 0.55 | | |

| 0.08 | | |

| 1.11 | | |

| 0.93 | | |

| 0.13 | |

| Diluted | |

| 0.45 | | |

| 0.55 | | |

| 0.08 | | |

| 1.11 | | |

| 0.93 | | |

| 0.13 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP net income per

ADS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic* | |

| 3.60 | | |

| 4.40 | | |

| 0.64 | | |

| 8.88 | | |

| 7.44 | | |

| 1.04 | |

| Diluted* | |

| 3.60 | | |

| 4.40 | | |

| 0.64 | | |

| 8.88 | | |

| 7.44 | | |

| 1.04 | |

*

Each ADS represents eight Class A Ordinary Shares. The per ADS indicators are based on rounded

results of corresponding per share indicators, which could have a rounding difference of absolute amount for not more than 0.04 per ADS.

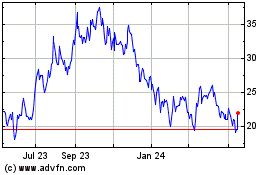

Luckin Coffee (PK) (USOTC:LKNCY)

Historical Stock Chart

From Jan 2025 to Feb 2025

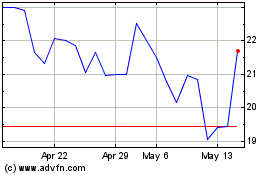

Luckin Coffee (PK) (USOTC:LKNCY)

Historical Stock Chart

From Feb 2024 to Feb 2025