UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934 (Amendment No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Material Pursuant to Rule 14a-12

Pressure

BioSciences, Inc.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee paid previously with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Pressure

BioSciences, Inc.

480

Neponset St.

Canton,

MA 02021

(508)

230-1828 (T)

(508)

230-1829 (F)

www.pressurebiosciences.com

February

26, 2024

Dear

Stockholder:

You

are cordially invited to attend the Special Meeting in Lieu of the Annual Meeting of Stockholders (the “Meeting”) of Pressure

BioSciences, Inc. (the “Company”) to be held on April 18, 2024 at 4:30 PM EST at the Company’s principal executive

offices located at 480 Neponset St., Canton, MA 02021.

The

matters to be voted on at the Meeting by the holders of our common stock, par value $0.01 per share (“Common Stock”), are:

(i) the election of one Class III Director to our board of directors (our “Board”) to hold office until the 2026 Annual Meeting

of Stockholders; (ii) the ratification of the appointment of MaloneBailey LLP as our independent registered public accounting firm for

2024; (iii) the approval of the Pressure BioSciences, Inc. 2024 Equity Incentive Plan (the “Plan”); and (iv) the approval,

on an advisory basis, of the compensation paid to our named executive officers, as disclosed in the proxy statement detailing the business

to be conducted at the Meeting We may also transact such other business that may properly come before the Meeting. Our Board recommends

that you vote in accordance with our Board’s recommendations on all proposals.

Shareholders

of record at the close of business on February 21, 2024 entitled to notice of and are cordially invited to, attend the Meeting, or any

adjournments or postponements thereof.

Whether

or not you plan to attend the Meeting, we encourage you to vote as soon as possible so that your shares are represented. We urge you

to vote TODAY via the Internet, by phone, or by fax as set forth in the Notice of Internet Availability of Proxy Materials with respect

to the Meeting (the “Notice”). If you request to receive a paper copy of the proxy materials, you may also vote by completing,

signing and dating the accompanying proxy card and mailing it in the enclosed postage pre-paid envelope. Voting by any of these methods

will not prevent you from attending the Meeting but will ensure that your vote is counted if you are unable to attend.

The

Notice is first being mailed, and the proxy statement and form of proxy card with respect to the Meeting are first being made available,

to shareholders on or about February 29, 2024.

If

you plan to attend the Meeting in person, please remember to bring a form of personal identification with you and, if you are acting

as a proxy for another stockholder, please bring written confirmation from the record owner that you are acting as a proxy. A complete

list of shareholders entitled to vote at the Meeting will be available for inspection for a period of ten days prior to the Meeting,

at the Company’s office, located at 480 Neponset St., Canton, MA 02021.

Sincerely,

Jeffrey

N. Peterson

Chairman

of the Board of Directors

TABLE

OF CONTENTS

PRESSURE

BIOSCIENCES, INC.

480

Neponset St.

Canton,

MA 02021

(508)

230-1828 (T)

(508)

230-1829 (F)

www.pressurebiosciences.com

NOTICE

OF SPECIAL MEETING

IN

LIEU OF THE ANNUAL MEETING OF STOCKHOLDERS

To

be Held on April 18, 2024

Important

Notice Regarding the Availability of Proxy Materials for the

Special

Meeting in Lieu of the Annual

Meeting

of Stockholders to be Held on April 18, 2024

The

Proxy Statement, a form of proxy card for the Meeting, and our Annual Report on Form 10-K for the year ended December 31, 2022 are available

at

https://ir.pressurebiosciences.com/proxy-statements

NOTICE

is hereby given that a Special Meeting in Lieu of the Annual Meeting of Stockholders (the “Meeting”) of Pressure BioSciences,

Inc. (“PBI” or the “Company”) will be held on April 18, 2024, at 4:30 p.m. EST at the Company’s principal

executive offices located at 480 Neponset St., Canton MA 02021, for the following purposes, as more fully described in the Proxy Statement

accompanying this notice:

| 1. |

To

elect one Class III Director to hold office until the 2026 Annual Meeting of Stockholders and until a successor is duly elected and

qualified; |

| |

|

| 2. |

To

ratify the appointment of MaloneBailey LLP as our independent registered public accounting firm for 2024; |

| |

|

| 3. |

To

consider and act on the Pressure BioSciences, Inc. 2024 Equity Incentive Plan; |

| |

|

| 4. |

To

ratify proposal as a non-binding resolution to approve executive compensation, and |

| |

|

| 5. |

To

consider any matters incidental to the foregoing purposes and any other matters which may properly come before the Meeting or any

adjourned session thereof. |

The

Board of Directors (the “Board”) has fixed the close of business on February 21, 2024 the record date for determining

the stockholders entitled to notice of, and to vote at, the Meeting.

YOUR

VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Meeting, we hope you will vote as soon as possible so that your voice

is heard. We urge you to VOTE TODAY via the Internet, by phone, or by fax by following the instructions on the Notice of Internet Availability

of Proxy Materials with respect to the Meeting (the “Notice”) that the Company has mailed to all shareholders. If you request

to receive a paper copy of the proxy materials, you may also vote by completing, signing, dating and returning the accompanying proxy

card in the postage-paid envelope provided. Voting by any of these methods does not deprive you of your right to attend and to vote your

shares at the Meeting in person. More information on voting and attending the Meeting can be found in the accompanying Proxy Statement.

Please refer to the instructions on the form of proxy card and the Notice. If you are the beneficial owner of your shares (that is, you

hold your shares in “street name” through an intermediary such as a broker, bank or other nominee), you will receive instructions

from your broker, bank or other nominee as to how to vote your shares or submit a proxy to have your shares voted. We urge you to instruct

your broker, bank or other nominee to vote your shares “FOR” our Board’s director nominees and “FOR” Proposals

2, 3, and 4.

OUR

BOARD STRONGLY RECOMMENDS VOTING “FOR” EACH OF OUR BOARD’S DIRECTOR NOMINEES UNDER PROPOSAL 1 AND “FOR”

PROPOSALS 2, 3, AND 4.

By

Order of the Board of Directors:

Richard

T. Schumacher

Clerk

Canton,

Massachusetts

February

26, 2024

The

notice is first being mailed to stockholders of the Company on or about February 29, 2024.

PRESSURE

BIOSCIENCES, INC.

PROXY

STATEMENT

FOR

THE SPECIAL MEETING IN LIEU OF

THE

ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD ON APRIL 18, 2024

General

This

Proxy Statement is being furnished to the shareholders of Pressure BioSciences, Inc., a Massachusetts corporation (“PBI”,

the “Company”, “we”, or “us”) in connection with the solicitation of proxies by the Board of Directors

(the “Board of Directors” or the “Board”) of PBI, with its principal executive offices located at 480 Neponset

St., Canton MA 02021., for use at the Special Meeting in Lieu of the Annual Meeting of Stockholders to be held on April 18, 2024 at 4:30

p.m. EST and at any adjournments or postponements thereof (the “Meeting”) for the purposes set forth herein and in the accompanying

Notice of Special Meeting in Lieu of the Annual Meeting of Stockholders.

The

enclosed proxy relating to the Meeting is solicited on behalf of the Board and the cost of such solicitation will be borne by the Company.

Certain of the Company’s officers and regular employees may solicit proxies by correspondence, telephone, or in person, without

extra compensation. We will also pay to banks, brokers, nominees, and certain other fiduciaries their reasonable expenses incurred in

forwarding proxy material to the beneficial owners of securities held by them. This Proxy Statement, a form of proxy card for the Meeting,

and the Company’s annual report on Form 10-K for the year ended December 31, 2022 are available to shareholders at https://ir.pressurebiosciences.com/proxy.

Voting

Securities and Record Date

Stockholders

of record of the Company’s common stock, $0.01 par value (the “Common Stock”), at the close of business on February

21, 2024 (the “Record Date”) the record date for the Meeting, will be entitled to receive notice of, and to vote at, the

Meeting. As of the Record Date, there were issued and outstanding 25,740,123 shares of Common Stock, all of which are entitled to vote

representing approximately holders of record. Each share of Common Stock outstanding at the close of business on the record date is entitled

to one vote on each matter that is voted. In addition, as of the Record Date, there were issued and outstanding 8,601 shares of the Company’s

Series AA Convertible Preferred Stock, par value $0.01 per share (“Series AA Preferred Stock”), 858 shares of the Company’s

Series BB Convertible Preferred Stock, par value $0.01 per share (“Series BB Preferred Stock”) and 21 shares of the Company’s

Series CC Convertible Preferred Stock, par value $0.01 per share (“Series CC Preferred Stock”). The shares of Preferred Stock

are not entitled to vote on any proposal to be presented at the Meeting.

Quorum

A

quorum, consisting of the holders of a majority of the shares of Common Stock issued, outstanding, and entitled to vote at the Meeting,

will be required to be present in person or by proxy for the transaction of business at the Meeting. Stockholders of record present at

the Meeting in person or by proxy, abstentions, and “broker non-votes” (as defined below) are counted as present or represented

at the Meeting for the purpose of determining whether a quorum exists. A “broker non-vote” occurs when a broker, bank, or

representative (“broker or representative”) does not vote on a particular matter because it either does not have discretionary

voting authority on that matter or it does not exercise its discretionary voting authority on that matter.

What

if other matters come up at the Meeting?

At

the date this Proxy Statement went to press, we did not know of any matters to be properly presented at the Meeting other than those

referred to in this Proxy Statement. If other matters are properly presented at the meeting or any adjournment or postponement thereof

for consideration, and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have

the discretion to vote on those matters for you.

Revocability

of Proxies

All

Proxies that are properly completed, signed and returned prior to the Meeting or voted via the Internet, by phone or by fax by following

the instructions on the Notice, and that have not been revoked, will be voted in favor of the proposals described in this Proxy Statement

unless otherwise directed. A shareholder may revoke his or her Proxy at any time before it is voted either by filing with the Clerk of

the Company, at its principal executive offices located at 480 Neponset St., Canton, MA 02021, a written notice of revocation or by submitting

a later dated Proxy by mail, over the Internet, by phone or by fax or by attending the Meeting and voting in person.

Manner

of Voting

Stockholders

of Record

Shares

entitled to be voted at the Meeting can only be voted if the stockholder of record of such shares is present at the Meeting or returns

a proxy. Shares represented by a valid proxy will be voted in accordance with your instructions.

A

stockholder of record who votes his or her shares by returning a proxy card, may revoke the proxy at any time before the stockholder’s

shares are voted at the Meeting by written notice to the Clerk of the Company received prior to the Meeting, by submitting a later dated

Proxy by mail, over the Internet, by phone or by fax, or by voting by ballot at the Meeting.

Beneficial

Stockholders

If

you hold your shares through a broker or representative, you can only vote your shares in the manner prescribed by the broker or representative.

The proxy materials have been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares,

the stockholder of record. Detailed instructions from your broker or representative will generally be included with your proxy material.

These instructions may also include information on whether your shares can be voted by telephone or over the Internet or the manner in

which you may revoke your votes. If you choose to vote your shares by telephone, fax or over the Internet, you should follow the instructions

provided by the broker or representative.

Voting

of Proxies

The

votes of stockholders present in person or represented by proxy at the Meeting will be tabulated by an inspector of elections appointed

by the Company. Shares represented by proxy will be voted in accordance with your specific instructions. For shareholders who received

a Notice and Access card (because you hold shares in “street name”), go to proxyvote.com. To vote by mail, if you requested

to receive printed proxy materials, fill out the enclosed Proxy, sign and date it, and return it in the enclosed postage-paid envelope.

To vote by fax, if you requested to receive printed proxy materials, fill out the enclosed Proxy, sign and date it, and fax it to (508)

230-1829. Voting by proxy will not limit your right to vote at the Meeting if you attend the Meeting and vote in person. However, if

your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy executed in your favor, from the

holder of record to be able to vote at the Meeting. If you sign and return your proxy card without indicating specific instructions,

your shares will be voted “FOR” our Board’s director nominees and “FOR” Proposals 2, 3, and 4. If any other

matters shall properly come before the Meeting, the authorized proxy will be voted by the proxies in accordance with their best judgment.

All valid proxies received prior to the Meeting will be voted. The Board recommends that you vote by proxy even if you plan to attend

the Meeting.

If

you hold your shares as a beneficial owner rather than a stockholder of record, your broker or representative will vote the shares that

it holds for you in accordance with your instructions (if timely received) or, in the absence of such instructions, your broker or representative

may vote on certain matters for which it has discretionary voting authority. Your broker will be permitted to vote your shares on Proposal

No. 2 without your instructions. All other proposals are considered “non-routine” matters, and your broker or representative

does not have discretionary voting authority with respect to these matters. Therefore, the shares that do not receive voting instructions

will be treated as “broker non-votes.”

Required

Vote

Abstentions

and broker non-votes are included in the number of shares present or represented for purposes of a quorum but are not considered as shares

voting or votes cast with respect to any matter presented at the Meeting.

The

affirmative vote of the holders of a plurality of the votes cast by stockholders at the Meeting is required for Proposal No. 1 to elect

the one nominee as a Class III Director of the Company. Abstentions and broker non-votes will not have any effect on Proposal No. 1.

With

respect to Proposal No. 2, our Amended and Restated Bylaws, as amended, do not require that our stockholders ratify the appointment of

MaloneBailey LLP as our independent registered public accounting firm. However, we are submitting the proposal for ratification as a

matter of good corporate governance. If our stockholders do not ratify the appointment, the Audit Committee will reconsider whether or

not to retain MaloneBailey LLP. Even if the appointment is ratified, the Audit Committee, at its discretion, may change the appointment

at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its

stockholders. Ratification of the appointment of MaloneBailey LLP as the Company’s independent registered public accounting firm

requires the affirmative vote of the holders of a majority of the votes cast at the Meeting for Proposal No. 2. As abstentions are not

considered to be “votes cast”, abstentions will not have any effect on Proposal No. 2. As Proposal No. 2 is considered to

be a “routine” matter for which a stockholder’s broker is permitted to vote a stockholder’s shares without such

stockholder’s instructions, there will not be any broker non-votes with regard to Proposal No. 2.

The affirmative vote of the holders of a majority of the votes cast at the Meeting is required to approve Proposal No. 3. Abstentions

and broker non-votes will not have any effect on Proposal No. 3.

The

affirmative vote of the holders of a majority of the votes cast by stockholders at the Meeting is required for Proposal No. 4 to approve,

on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Proxy Statement accompanying

this notice. As abstentions and broker non-votes are not considered to be “votes cast”, abstentions and broker non-votes

will not have any effect on Proposal No. 4.

Shareholders

List

For

a period of at least ten days prior to the Meeting, a complete list of shareholders entitled to vote at the Meeting will be available,

upon appointment, at the principal executive offices of the Company located at 480 Neponset St., Canton, MA 02021, so that shareholders

of record may inspect the list only for proper purposes.

Expenses

of Solicitation

The

Company will pay the cost of preparing, assembling and mailing this proxy-soliciting material, and all costs of solicitation, including

certain expenses of brokers and nominees who mail proxy material to their customers or principals.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND

MANAGEMENT

The

following table sets forth certain information as of the Record Date concerning the beneficial ownership of Common Stock for: (i) each

director and director nominee, (ii) each named executive officer in the Summary Compensation Table under “Executive Compensation”

below, (iii) all executive officers and directors as a group, and (iv) each person (including any “group” as that term is

used in Section 13(d)(3) of the Exchange Act) known by the Company to be the beneficial owner of 5% or more of the Company’s Common

Stock. Except as indicated below, the address for each of the persons below who are beneficial owners of 5% or more of the Company’s

Common Stock is the Company’s corporate address at 480 Neponset St., Canton, MA 02021.

Beneficial

ownership has been determined in accordance with the rules of the Securities and Exchange Commission (“SEC”) and is calculated

based on 25,740,123 shares of our Common Stock issued and outstanding as of the Record Date. Shares of Common Stock subject to options,

warrants, preferred stock or other securities convertible into Common Stock that are currently exercisable or convertible, or exercisable

or convertible within 60 days of the Record Date are deemed outstanding for computing the ownership percentage of the person holding

the option, warrant, preferred stock, or convertible security but are not deemed outstanding for computing the ownership percentage of

any other person.

Except

as indicated by the footnotes below, the Company believes, based on the information furnished to it, that the persons and entities named

in the table below have sole voting and investment power with respect to all shares of Common Stock that they beneficially own.

| Name of Beneficial Owner | |

Common Shares Owned | | |

Convertible Securities that can be converted into Common Shares | | |

Total Beneficial Ownership | | |

Percent of Class | |

| Richard T. Schumacher(1) | |

| 55,535 | | |

| 800,368 | | |

| 855,903 | | |

| 3.3 | % |

| Jeffrey N. Peterson(2) | |

| 70,558 | | |

| 572,023 | | |

| 642,581 | | |

| 2.5 | % |

| Kevin A. Pollack(3) | |

| 33,873 | | |

| 274,379 | | |

| 308,252 | | |

| 1.2 | % |

| Michael S. Urdea(4) | |

| 30,287 | | |

| 240,380 | | |

| 270,667 | | |

| 1.1 | % |

| Vito J. Mangiardi(5) | |

| 15,479 | | |

| 225,446 | | |

| 240,925 | | |

| 0.9 | % |

| Edmund Y. Ting, Ph.D.(6) | |

| 815 | | |

| 194,913 | | |

| 195,728 | | |

| 0.8 | % |

| Alexander V. Lazarev, Ph.D.(7) | |

| 14,782 | | |

| 239,812 | | |

| 254,594 | | |

| 1.0 | % |

| All Executive Officers and Directors as a Group | |

| 221,329 | | |

| 2,547,321 | | |

| 2,768,650 | | |

| 10.8 | % |

| |

1) |

Convertible

securities include: (i) 736,186 shares of Common Stock issuable upon exercise of options within 60 days; (ii) 32,091 shares of Common

Stock issuable upon the exercise of warrants, and (iii) 32,091 shares of common stock issuable upon conversion of Series AA Convertible

Preferred Stock. Does not include 672 shares of Common Stock held by Mr. Schumacher’s minor son as Mr. Schumacher’s wife

exercises all voting and investment control over such shares. |

| |

2) |

Convertible

securities include: (i) 441,623 shares of Common Stock issuable upon exercise of options within 60 days; (ii) 65,200 shares of Common

Stock issuable upon the exercise of warrants, and (iii) 65,200 shares of common stock issuable upon conversion of Series AA Convertible

Preferred Stock. |

| |

3) |

Convertible

securities include: (i) 233,311 shares of Common Stock issuable upon exercise of options within 60 days; (ii) 20,534 shares of Common

Stock issuable upon the exercise of warrants, and (iii) 20,534 shares of common stock issuable upon conversion of Series AA Convertible

Preferred Stock. |

| |

4) |

Convertible

securities include: (i) 199,980 shares of Common Stock issuable upon exercise of options within 60 days; (ii) 20,200 shares of Common

Stock issuable upon the exercise of warrants, and (iii) 20,200 shares of common stock issuable upon conversion of Series AA Convertible

Preferred Stock. |

| |

5) |

Convertible

securities include: (i) 216,646 shares of Common Stock issuable upon exercise of options within 60 days; (ii) 4,400 shares of Common

Stock issuable upon the exercise of warrants, and (iii) 4,400 shares of common stock issuable upon conversion of Series AA Convertible

Preferred Stock. |

| |

6) |

Convertible

securities are 194,913 shares of Common Stock issuable upon exercise of options within 60 days. |

| |

7) |

Convertible

securities include: (i) 186,892 shares of Common Stock issuable upon exercise of options within 60 days; (ii) 26,460 shares of Common

Stock issuable upon the exercise of warrants, and (iii) 26,400 shares of common stock issuable upon conversion of Series AA Convertible

Preferred Stock. |

PROPOSAL

NO. 1

ELECTION

OF DIRECTORS

At

the Meeting, one Class III Director is to be elected to serve until the 2027 Annual Meeting of Stockholders and until their respective

successors have been duly elected and qualified. The Board, upon the recommendation of the Nominating Committee, has nominated Mr. Richard

Schumacher as a Class III Director. Mr. Schumacher is currently a director of the Company and has not been nominated pursuant to any

arrangement or understanding with any person.

The

Company’s Restated Articles of Organization, as amended (the “Articles of Organization”), and Amended and Restated

Bylaws, as amended (the “Bylaws”), provide that our Board shall be divided into three classes. At each annual meeting of

stockholders, the directors elected to succeed those whose terms expire are identified as being in the same class as the directors they

succeed and are elected to hold office for a term to expire at the third annual meeting of stockholders after their election, and until

their respective successors are duly elected and qualified unless an adjustment in the term to which an individual director shall be

elected is made because of a change in the number of directors.

Our

Articles of Organization and Bylaws do not require our stockholders to elect any directors in a class for which the term of office extends

beyond the Meeting. The term of office of Mr. Schumacher, the Company’s Class III Director, expires at the Meeting. The terms of

office of the Class I Directors and Class II Directors, comprised of Jeffrey N. Peterson, Dr. Mickey Urdea, Mr. Vito Mangiardi, and Mr.

Kevin Pollack, continue after the Meeting.

At

the Meeting, it is the intention of the person named as proxies to vote for the election of Mr. Schumacher as the Class III Director.

In the unanticipated event that Mr. Schumacher should be unable to serve, the persons named as proxies will vote the proxy for such substitute(s),

if any, as the present Board may designate or the present Board may reduce the number of directors.

In

selecting members for our Board, we consider each individual’s unique and diversified background and expertise. We believe that

selecting directors with a wide range of talents and skills provides a functional diversity that allows our Board to provide strong leadership.

The following noteworthy experience, qualifications, attributes and skills for each Board member, together with the biographical information

for each nominee described below, led to our conclusion that the person should serve as a director of PBI in light of our business and

structure:

| |

● |

Mr.

Jeffrey N. Peterson, age 68, is the Chairman of our Board. He serves as the CEO of Target Discovery, Inc., a personalized medicine

diagnostics and analytical testing solutions company; Chairman and CEO of Veritomyx, Inc., a high-performance SaaS (cloud computing)

scientific signal- processing company; a board member of MassWerx, Inc.; and was Chairman of Imaging3, a company that was traded

on the OTC Markets during Mr. Peterson’s tenure, a medical and industrial imaging company, from March 2018 through July 2019.

He has broad executive, general management, multi-functional, multi-business, and international experience, including 20 years at

Abbott Laboratories and General Electric, and leadership in multiple trade organizations. |

| |

|

|

| |

● |

Mr.

Vito J. Mangiardi, age 75, has broad executive, general management, multi-functional, multi-business, and international experience,

specifically in the life sciences field. Mr. Mangiardi is the founding partner, President and CEO of Marin Bay Partners, LLC (MBP),

a consulting firm focused in life sciences, pharmaceutical development and clinical diagnostics. |

| |

|

|

| |

● |

Dr.

Michael S. “Mickey” Urdea, age 71, founded and is a Partner for Halteres Associates, a biotechnology consulting firm.

He serves as an expert consultant to the life sciences industry and philanthropic organizations and is on the scientific advisory

boards and boards of directors of a number of biotechnology and diagnostics companies. |

| |

|

|

| |

● |

Mr.

Kevin A. Pollack, age 53, provides a wealth of knowledge and experience in financial and administrative matters. Mr. Pollack served

as Chief Financial Officer and Director of Opiant Pharmaceuticals, Inc. from 2012 to 2017 and as an advisor from 2017 to 2018. Opiant

was listed on the Nasdaq Capital Market from 2017 to 2023. Mr. Pollack previously worked as a securities attorney focusing on corporate

finance and mergers and acquisitions. He also serves as our audit committee financial expert. |

| |

|

|

| |

● |

Mr.

Richard T. Schumacher, age 73, the Company’s founder, provides valuable operational, sales and marketing, financial, and managerial

experience and expertise and has significant knowledge of the Company’s technology, markets, and products. In the years since

the Company’s formation, Mr. Schumacher has served the Company in various roles, including Chief Executive Officer, President,

Treasurer, Secretary (Clerk), and Chairman. Prior to founding the Company, Mr. Schumacher spent over 13 years working in scientific

research and clinical laboratory management at the Center for Blood Research, a Harvard Medical School affiliated laboratory. Mr.

Schumacher was also the co- Founder of Panacos Pharmaceuticals (NASDAQ: PANC), an anti-HIV drug discovery and development company;

co-Founder of Trinity Biotech (NASDAQ: TRIB), a worldwide provider of diagnostic test kits; and the Founder of Boston Biomedica,

Inc. (NASDAQ: BBII), which developed the first-in-kind quality control products for infectious diseases testing worldwide. Mr. Schumacher

was the recipient of the 1987 International AIDS Award from the World Federation of Health. |

Vote

Required to Elect the Nominees as Directors

The

affirmative vote of the holders of a plurality of the votes cast at the Meeting is required for the election of Richard Schumacher as

a Class III Director of the Company.

Board

Recommendation

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF RICHARD SCHUMACHER AS A CLASS

III DIRECTOR OF THE COMPANY.

Information

on Nominees and Other Directors

The

following information includes additional information as of the date of this Proxy Statement about each nominee and director whose term

extends beyond the Meeting, including his age, all positions he holds with us, his principal occupation and business experience during

the past five years, the names of other publicly-held companies for which he currently serves as a director or held a directorship during

the past five years, and the year in which each nominee’s term would expire, if elected.

| Name |

|

Age |

|

Position |

|

Director

Since |

|

Year

Term Expires,

if

Elected, and Class |

| Jeffrey

N. Peterson(1) |

|

68 |

|

Chairman

of the Board |

|

2011 |

|

2024

Class I |

| Michael

S. Urdea |

|

71 |

|

Director |

|

2013 |

|

2024

Class I |

| Vito

J. Mangiardi(1) |

|

75 |

|

Director |

|

2012 |

|

2025

Class II |

| Kevin

A. Pollack(1) |

|

53 |

|

Director |

|

2012 |

|

2025

Class II |

| Richard

T. Schumacher* |

|

73 |

|

Director,

President, Chief Executive Officer, Interim Chief Financial Officer, Treasurer, and Clerk |

|

1978 |

|

2026

Class III |

*Nominee

for Class III Director.

| (1) |

Member

of the Audit Committee, Compensation Committee, and Nominating Committee |

Mr.

Jeffrey N. Peterson has served as a director of the Company since July 2011 and as Chairman of the Board starting in 2012. Since

1999, he has served as the Chief Executive Officer of TargetDiscovery, Inc. (“TDI”), a personalized medicine diagnostics

(PMDx) and analytical testing solutions company. Mr. Peterson also serves as Chairman and CEO of TDI’s majority-owned subsidiary,

Veritomyx, Inc., a high-performance SaaS (cloud computing) scientific signal-processing company, and as a board member of MassWerx, Inc.,

a related company also serving the diagnostics and analytical testing markets. Mr. Peterson served as Chairman of the Board of Imaging3,a

company that was traded on the OTC Markets during Mr. Peterson’s tenure , an innovative medical and industrial imaging company,

from March 2018 through July 2019. Prior to incorporating and founding TDI, Mr. Peterson served as CEO of Sharpe, Peterson, Ocheltree

& Associates, an international business development consulting firm assisting Fortune 500 and many smaller firms in business expansion

and strategy. Prior to that, he spent 9 years in key management roles in Abbott Laboratories’ Diagnostics and International (Pharmaceuticals,

Hospital Products, Nutritionals, and Consumer) businesses, last serving as CEO and General Manager of Abbott South Africa. Mr. Peterson’s

experience prior to Abbott Laboratories included 11 years with General Electric’s Engineered Materials and Plastics businesses,

spanning roles in strategic planning, business development, technology licensing, marketing and sales, operations, quality control and

R&D. Mr. Peterson holds BSChE and MSChE (Chemical Engineering) degrees from MIT, as well as 6 issued US patents. He served as Chair

Emeritus of the BayBio Institute, a non-profit organization serving the life science community, and on the Board of BayBio, a trade association

for the life sciences industry in Northern California. He served as a cofounder of the Coalition for 21st Century Medicine,

and of BIO’s Personalized Medicine & Diagnostics Working Group. He served on the Board of Advisors for the Center for Professional

Development and Entrepreneurship at the University of Texas MD Anderson Cancer Center. He currently serves on the Advisory Board of the

California Technology Council.

Dr.

Michael S. Urdea has served as a director of the Company since February 8, 2013. Dr. Urdea founded and is a Partner for Halteres

Associates, a biotechnology consulting firm. He also founded and served as Chief Executive Officer of Tethys Biosciences, a proteomics-based

diagnostics company involved in preventative personalized medicine. Additionally, Dr. Urdea is a founder and the Chairman of Catalysis

Foundation for Health, an organization addressing gaps in global healthcare caused by inefficiencies in disease diagnosis and monitoring.

He serves as an expert consultant to the life sciences industry and is on the scientific advisory boards and boards of directors of several

biotechnology, diagnostics, and philanthropic organizations. Prior to his current business activities, Dr. Urdea founded the Nucleic

Acid Diagnostics group at Chiron Corporation, and with colleagues, invented branched DNA molecules for amplification of signal in nucleic

acid complexes. Application of this technology resulted in the first commercial products for quantification of human hepatitis B, hepatitis

C, and human immunodeficiency viruses (HBV, HCV, and HIV, respectively). He then became business head of the Molecular Diagnostics Group

and Chief Scientific Officer at Bayer Diagnostics. He continues to serve as a diagnostics industry, product development and scientific

advisor to numerous organizations and companies. He has also worked with the Bill and Melinda Gates Foundation as co-chair of two of

the Grand Challenges grant review committees and served as a member of its Diagnostic Forum heading the Technology Committee. Dr. Urdea

is an author on nearly 200 peer-reviewed scientific publications, nearly 300 abstracts and international scientific presentations, and

more than 100 issued and pending patents. He received his BS in Biology and Chemistry from Northern Arizona University in Flagstaff and

his Ph.D. in Biochemistry from Washington State University. In 2022, he also received an honorary Ph.D. from Northern Arizona University.

Mr.

Vito J. Mangiardi has served as a director of the Company since July 2012. Mr. Mangiardi is an accomplished senior executive

with proven experience as a President, CEO and COO in the Life Sciences and Bio-Energy product and service sectors. He is a strong P&L

performer and corporate strategist in General Management, Operations, Sales/Marketing, and Science. Mr. Mangiardi has held positions

as a Research Chemist for Bio-Rad Laboratories, Inc.; Sales & Marketing Director for Baxter Travenol, Inc.; Executive VP and COO

for Quintiles Transnational Corp.; President and CEO of Diagnostics Laboratories, Inc., Clingenix, Inc., and Bilcare, Inc.; and President

of AAI Pharma, Inc. More recently he was the COO/Deputy Director of Operations and Production at the University of California Lawrence

Berkeley National Laboratory Joint Genome Institute. Mr. Mangiardi has experience with three start-ups, two midsize, and several mature

companies, and has international experience leading and managing organizations on four continents. He has vast experience in leading

alliances, acquisitions, due diligence, and post-acquisition assimilation. Mr. Mangiardi has been on the Board of Directors of three

companies and has proven success in working with both national and international investment groups to raise funds. Mr. Mangiardi earned

a BS in Biology/Chemistry from Eastern Illinois University and two MBA degrees from Golden Gate University - in General Management and

in Marketing. Mr. Mangiardi is listed as an inventor in four patents and various publications in protein separation techniques in the

area of metabolism, thyroid, anemia/hematology and cancer, and is a member of numerous professional organizations. Mr. Mangiardi is the

founding partner, President and CEO of Marin Bay Partners, LLC (MBP), a consulting firm focused on life sciences, pharmaceutical development

and clinical diagnostics.

Mr.

Kevin A. Pollack has served as a director of the Company since July 2012. From 2017 to 2018, Mr. Pollack served as an advisor

to Opiant Pharmaceuticals, Inc., a pharmaceutical company with a mission to create best-in-class medicines for the treatment of addictions

and drug overdose. Opiant was listed on the Nasdaq Capital Market from 2017 to 2023. He previously served as its Chief Financial Officer

and as a member of its Board of Directors from 2012 until 2017. He also has served as President of Short Hills Capital LLC. Previously,

Mr. Pollack worked in asset management at Paragon Capital LP, focusing primarily on U.S.-listed companies, and as an investment banker

at Banc of America Securities LLC, focusing on corporate finance and mergers and acquisitions. Mr. Pollack started his career at Sidley

Austin LLP (formerly Brown & Wood LLP) as a securities attorney focusing on corporate finance and mergers and acquisitions. He served

on the Board of Directors of Taronis Fuels, Inc. 2019 to 2021 and served on the Board of Directors of BBHC, Inc. from 2012 until 2020.

Mr. Pollack graduated magna cum laude from the Wharton School of the University of Pennsylvania and received a dual J.D./M.B.A. from

Vanderbilt University, where he graduated with Beta Gamma Sigma honors.

Mr.

Richard T. Schumacher, the founder of the Company, has served as a director of the Company since the Company’s formation.

He has served as the Company’s Chief Executive Officer since April 16, 2004, and President since September 14, 2004. He previously

served as Chief Executive Officer and Chairman of the Board of the Company from 1992 to February 2003. From July 9, 2003, until April

14, 2004, he served as a consultant to the Company under a consulting agreement. He served as President of the Company from August 1978

to August 1999. Mr. Schumacher served as the Director of Infectious Disease Services for Clinical Sciences Laboratory, a New England-based

medical reference laboratory, from 1986 to 1988. From 1972 to 1985, Mr. Schumacher was a research scientist and clinical laboratory director

at the Center for Blood Research, a nonprofit medical research institute associated with Harvard Medical School. Mr. Schumacher received

a B.S. in Zoology from the University of New Hampshire.

Corporate

Governance

Board

of Directors and Committee Meetings; Annual Meeting Attendance. The Board held 11 meetings between January 1, 2023 and December 31,

2023. All of the directors attended at least 80% of those meetings. All the Company’s directors are encouraged to attend the Company’s

annual meetings of stockholders. All the outside directors participated telephonically in the Company’s 2021 Special Meeting in

Lieu of the Annual Meeting of Stockholders.

Board

Independence. The Board has reviewed the qualifications of each of Messrs. Mangiardi, Peterson, Urdea and Pollack, constituting more

than a majority of the Company’s current directors, and has affirmatively determined that each individual is, or at the time of

their service was, “independent” as such term is defined under the current listing standards of the Nasdaq Stock Market.

The Board has determined that none of these directors has a material relationship with the Company that would interfere with the exercise

of independent judgment. In addition, each member of the Audit Committee is independent as required under Section 10A(m)(3) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”).

Stockholder

Communications. Any stockholder wishing to communicate with any of the Company’s directors regarding the Company may write

to the director, c/o Clerk, Pressure BioSciences, Inc., 480 Neponset St., Canton, MA 02021. The Clerk will forward any reasonable communications

directly to the director(s).

Code

of Ethics. Pursuant to Section 406 of the Sarbanes-Oxley Act of 2002, the Company has adopted a Code of Ethics for Senior Financial

Officers that applies to the Company’s principal executive officer, principal financial officer, principal accounting officer,

controller, and other persons performing similar functions. A copy of the code of ethics is posted on and may be obtained free of charge

from the investor relations portion of the Company’s website at www.pressurebiosciences.com. If the Company makes any amendments

to its Code of Ethics or grants any waiver, including any implicit waiver, from a provision of this Code of Ethics to the Company’s

principal executive officer, principal financial officer, principal accounting officer, controller, or other persons performing similar

functions, the Company will disclose the nature of such amendment or waiver, the name of the person to whom the waiver was granted and

the date of waiver in a Current Report on Form 8-K.

Availability

of Corporate Governance Information

For

additional information on our corporate governance, including Board committee charters, our corporate governance guidelines, our code

of ethics and whistle blower policy, visit our investor relations website at https://ir.pressurebiosciences.com/governance-docs.

Board

Leadership Structure and Role in Risk Oversight

The

Board has responsibility for establishing broad corporate policies and reviewing our overall performance rather than day-to-day operations.

The Board’s primary responsibility is to oversee the management of the Company and, in so doing, serve the best interests of the

Company and its stockholders. The Board selects, evaluates and provides for the succession of executive officers and, subject to stockholder

election, directors. It reviews and approves corporate objectives and strategies and evaluates significant policies and proposed major

commitments of corporate resources. The Board participates in decisions that have a potential major economic impact on the Company and

its stockholders. Management keeps the directors informed of Company activity through regular written reports and presentations at Board

and committee meetings.

The

Board of Directors is led by its Chairman, Mr. Peterson. Each of our Audit, Nominating and Compensation Committees provide oversight

and assess risk in their respective areas. In addition, the Board and each committee have an active role in overseeing management of

our Company’s risk. The Board regularly reviews information regarding our operations, credit, and liquidity, as well as the risks

associated with each.

Board

Committees

Standing

committees of the Board of Directors include an Audit Committee, a Compensation Committee, and a Nominating Committee.

Audit

Committee.

Messrs.

Mangiardi, Peterson and Pollack are currently the members of the Audit Committee, with Mr. Pollack serving as Chairman.

The

Board of Directors has determined that Mr. Pollack qualifies as an “audit committee financial expert” as defined in Item

407(d)(5) of Regulation S-K.

The

Audit Committee operates pursuant to a written charter (the “Audit Committee Charter”), a current copy of which is publicly

available on the investor relations portion of the Company’s website at www.pressurebiosciences.com. Under the provisions of the

Audit Committee Charter, the primary functions of the Audit Committee are to assist the Board of Directors with the oversight of (i)

the Company’s financial reporting process, accounting functions, and internal controls, and (ii) the qualifications, independence,

appointment, retention, compensation, and performance of the Company’s independent registered public accounting firm. The Audit

Committee is also responsible for the establishment of “whistle-blowing” procedures, and the oversight of other compliance

matters. The Audit Committee held four (4) meetings during fiscal 2023.

Compensation

Committee.

General

Messrs.

Mangiardi, Peterson and Pollack are currently the members of the Compensation Committee, with Mr. Mangiardi serving as Chairman. The

Compensation Committee operates pursuant to a written charter, a current copy of which is publicly available on the investor relations

portion of the Company’s website at www.pressurebiosciences.com. The primary functions of the Compensation Committee include (i)

reviewing and approving our executive compensation, (ii) reviewing the recommendations of the President and Chief Executive Officer regarding

the compensation of our executive officers, (iii) evaluating the performance of the President and Chief Executive Officer, (iv) overseeing

the administration and approval of grants of stock options and other equity awards under our equity incentive plans, and (v) recommending

compensation for our Board of Directors and each committee thereof for review and approval by the Board of Directors. The Compensation

Committee held five (5) meetings during fiscal 2023.

The

Compensation Committee may form and delegate authority to one or more subcommittees as it deems appropriate from time to time under the

circumstances (including (a) a subcommittee consisting of a single member and (b) a subcommittee consisting of at least two members,

each of whom qualifies as a “non-employee director,” as such term is defined from time to time in Rule 16b-3 promulgated

under the Exchange Act.

Compensation

Objectives

Considering

the relatively early stage of commercialization of our products, we recognize the importance of attracting and retaining key employees

with sufficient experience, skills, and qualifications in areas vital to our success, such as operations, finance, sales and marketing,

research and development, engineering, and individuals who are committed to our short- and long-term goals. The Compensation Committee

has designed our executive compensation programs with the intent of attracting, motivating, and retaining experienced executives and,

subject to our limited financial resources, rewarding them for their contributions by offering them a competitive base salary, potential

for annual cash incentive bonuses, and long-term equity-based incentives, typically in the form of stock options. The Compensation Committee

strives to balance the need to retain key employees with financial prudence given our history of operating losses, limited financial

resources and the early stage of our commercialization.

Executive

Officers and Director Compensation Process

The

Compensation Committee considers and determines executive compensation according to an annual objective setting and measurement cycle.

Specifically, corporate goals for the year are initially developed by our executive officers and are then presented to the Board of Directors

and Compensation Committee for review and approval. Individual goals are intended to focus on contributions that facilitate the achievement

of the corporate goals. Individual goals are first proposed by each executive officer, other than the President and Chief Executive Officer,

then discussed by the entire senior executive management team and ultimately compiled and prepared for submission to the Board of Directors

and the Compensation Committee, by the President and Chief Executive Officer. The Compensation Committee sets and approves the goals

for the President and Chief Executive Officer. Generally, corporate and individual goals are set during the first quarter of each calendar

year. The objective setting process is coordinated with our annual financial planning and budgeting process so our Board of Directors

and Compensation Committee can consider overall corporate and individual objectives in the context of budget constraints and cost control

considerations. Annual salary increases, bonuses, and equity awards, such as stock option grants, if any, are tied to the achievement

of these corporate and individual performance goals as well as our financial position and prospects.

Under

the annual performance review program, the Compensation Committee evaluates individual performance against the goals for the recently

completed year. The Compensation Committee’s evaluation generally occurs in the first quarter of the following year. The evaluation

of each executive (other than the President and Chief Executive Officer) begins with a written self-assessment submitted by the executive

to the President and Chief Executive Officer. The President and Chief Executive Officer then prepares a written evaluation based on the

executive’s self-assessment, the President and Chief Executive Officer’s evaluation, and input from others within the Company.

This process leads to a recommendation by the President and Chief Executive Officer for a salary increase, bonus, and equity award, if

any, which is then considered by the Compensation Committee. In the case of the President and Chief Executive Officer, the Compensation

Committee conducts his/her performance evaluation and determines his/her compensation, including salary increase, bonus, and equity awards,

if any. We generally expect, but are not required, to implement salary increases, bonuses, and equity awards, for all executive officers,

if and to the extent granted, by April 1 of each year.

Non-employee

director compensation is set by our Board of Directors upon the recommendation of the Compensation Committee. In developing its recommendations,

the Compensation Committee is guided by the following goals: compensation should be fair relative to the required services for directors

of comparable companies in our industry and at our company’s stage of development; compensation should align directors’ interests

with the long-term interest of stockholders; the structure of the compensation should be simple, transparent, and easy for stockholders

to understand; and compensation should be consistent with the financial resources, prospects, and competitive outlook for the Company.

In

evaluating executive officer and director compensation, the Compensation Committee considers the practices of companies of similar size,

geographic location, and market focus. In order to develop reasonable benchmark data, the Compensation Committee has referred to publicly

available sources such as Salary.com and the BioWorld Survey. While the Compensation Committee does not believe benchmarking is appropriate

as a stand-alone tool for setting compensation due to the unique aspects of our business objectives and current stage of development,

the Compensation Committee generally believes that gathering this compensation information is an important part of its compensation-related

decision making process.

The

Compensation Committee has the authority to hire and fire advisors and compensation consultants as needed and approve their fees. During

fiscal 2022, the Compensation Committee did not hire any compensation consultants.

The

Compensation Committee is also authorized to delegate any of its responsibilities to subcommittees or individuals, as it deems appropriate.

The Compensation Committee did not delegate any of its responsibilities in fiscal 2022.

Nominating

Committee.

Messrs.

Mangiardi, Peterson and Pollack are currently the members of the Company’s Nominating Committee with Mr. Peterson serving as Chairman.

The Nominating Committee operates pursuant to a written charter, a current copy of which is publicly available on the investor relations

portion of the Company’s website at www.pressurebiosciences.com. The Nominating Committee held one (1) meeting during fiscal year

2023.

The

primary functions of the Nominating Committee are to (i) identify, review, and evaluate candidates to serve as directors of the Company,

(ii) make recommendations of candidates to the Board of Directors for all directorships to be filled by the stockholders or the Board

of Directors, and (iii) serve as a focal point for communication between such candidates, the Board of Directors, and management.

The

Nominating Committee may consider candidates recommended by stockholders as well as from other sources such as other directors or officers,

third party search firms, or other appropriate sources. For all potential candidates, the Nominating Committee may consider all factors

it deems relevant, such as a candidate’s personal integrity and sound judgment, business and professional skills and experience,

independence, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need on the Board of

Directors, and concern for the long-term interests of the stockholders. These criteria include whether the candidate assists in achieving

a mix of Board members that represents diversity of background and professional experience, including with respect to ethnic background,

age and gender. In general, persons recommended by stockholders will be considered on the same basis as candidates from other sources.

If a stockholder wishes to recommend a candidate for director for election at the 2022 Special Meeting in Lieu of Annual Meeting of Stockholders,

he or she must follow the procedures described below under “Stockholder Proposals.”

Audit

Committee Report

The

Audit Committee has reviewed and discussed the Company’s audited financial statements for the year ended December 31, 2022 with

management of the Company. The Audit Committee also discussed with MaloneBailey LLP (“MaloneBailey”), the Company’s

independent registered public accounting firm for 2022, the matters required to be discussed by the Auditing Standards Board Statement

on Auditing Standards No. 61, as amended, as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee

has also received and reviewed the required written disclosures and a confirming letter from MaloneBailey under applicable requirements

of the Public Accounting Oversight Board regarding MaloneBailey’s independence and has discussed the matter with MaloneBailey.

Based

upon its review and discussions of the foregoing, the Audit Committee recommended to the Board of Directors that the Company’s

audited financial statements for the year ended December 31, 2022 be included in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2022.

Audit

Committee:

Kevin

A. Pollack, Chair

Vito

J. Mangiardi

Jeffrey

N. Peterson

2022

Director Compensation

The

following table sets forth certain information regarding compensation earned or paid to our non-employee directors during fiscal 2022.

| Name | |

Fees Earned or Paid in Cash ($) (1) | | |

Stock

Awards

($) | | |

Option

Awards

($) | | |

Total

($) | |

| Vito J. Mangiardi | |

| 70,000 | | |

| - | | |

| - | | |

| 70,000 | |

| Jeffrey N. Peterson | |

| 107,500 | | |

| - | | |

| - | | |

| 107,500 | |

| Kevin A. Pollack | |

| 72,500 | | |

| - | | |

| - | | |

| 72,500 | |

| Michael S. Urdea, Ph. D. | |

| 50,000 | | |

| - | | |

| - | | |

| 50,000 | |

Our

non-employee directors receive the following compensation for service as a director:

(1)

Each director currently earns a quarterly stipend of $10,000 for attending meetings of the full board of directors (whether telephonic

or in-person) and fees ranging from $5,000 to $20,000 for chairing and attending committee meetings in 2022. Mr. Peterson currently earns

$20,000 per quarter as chairman of the board of directors. There is no limit to the number of board of directors or committee meetings

that may be called.

The

following table shows the total number of outstanding stock options as of December 31, 2022 that have been issued as director compensation.

The Company did not issue any stock options as director compensation in 2022.

| Name | |

Aggregate Number of Stock Options Outstanding | |

| | |

| |

| Vito J. Mangiardi | |

| 70,408 | |

| Jeffrey N. Peterson | |

| 120,312 | |

| Kevin A. Pollack | |

| 70,408 | |

| Michael S. Urdea, Ph. D. | |

| 52,072 | |

EXECUTIVE

COMPENSATION

Summary

Compensation Table

The

Summary Compensation Table below sets forth the total compensation paid or earned for the fiscal years ended December 31, 2022 and 2021

for: (i) each individual serving as our chief executive officer (“CEO”) or acting in a similar capacity during any

part of fiscal 2022; and (ii) the other two most highly paid executive officers (collectively, the “Named Executive Officers”)

who were serving as executive officers at the end of fiscal 2022.

| Name and Principal Position | |

Fiscal Year | | |

Salary(1) | | |

Bonus | | |

Stock Awards(2) | | |

Option

Awards(3) | | |

Non-Qualified Deferred Compensation Earning | | |

All other

Compensation(4) | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Richard T. Schumacher | |

| 2022 | | |

$ | 309,185 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 11,350 | | |

$ | 320,535 | |

| President, CEO | |

| 2021 | | |

| 308,962 | | |

| - | | |

| 58,228 | | |

| - | | |

| - | | |

| 46,216 | | |

| 413,406 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Edmund Ting, Ph.D. | |

| 2022 | | |

| 207,536 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7,627 | | |

| 215,163 | |

| Senior Vice President of Engineering | |

| 2021 | | |

| 207,480 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 49,439 | | |

| 256,919 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Alexander Lazarev, Ph.D. | |

| 2022 | | |

| 200,089 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,183 | | |

| 202,272 | |

| Vice President of | |

| 2021 | | |

| 200,000 | | |

| - | | |

| 66,151 | | |

| - | | |

| - | | |

| 2,338 | | |

| 268,489 | |

| Research and Development | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

(1)

Salary refers to base salary compensation paid through our normal payroll process. No bonus was paid to any named executive officer for

2022 or 2021.

(2)

Amounts represent common stock issued at $2.50 per share for the Company’s PTO buyback program.

(3)

Amounts shown do not reflect compensation received by the Named Executive Officers. Instead, the amounts shown are the aggregate grant

date fair value as determined pursuant to FASB ASC 718, Compensation-Stock Compensation. Please refer to Note 3, xiii, “Accounting

for Stock-Based Compensation” in the accompanying Notes to Consolidated Financial Statements for the fiscal year ended December

31, 2022, for the relevant assumptions used to determine the valuation of stock option grants.

(4)

“All Other Compensation” includes our Company match to the executives’ 401(k) contribution, premiums paid on life insurance

for the executives, and cash compensation for the Company’s PTO buyback program. All these benefits are available to all of our

employees. In the case of Mr. Schumacher, “All Other Compensation” also includes $8,379 in premiums we paid for a life insurance

policy to which Mr. Schumacher’s wife is the beneficiary. “All Other Compensation” for Dr. Ting includes $6,000 paid

to Dr. Ting in lieu of his participation in the medical benefit plan offered by the Company.

Outstanding

Equity Awards at Fiscal Year End

The

following table sets forth certain information regarding outstanding stock options awards for each of the Named Executive Officers as

of December 31, 2022.

| | |

Option Awards | | |

| | |

|

| Name | |

Number of Securities Underlying Unexercised Options Exercisable | | |

Number of Securities Underlying Unexercised Options Unexercisable (1) | | |

Option Exercise Price | | |

Option Expiration Date |

| Richard T. Schumacher | |

| 10,000 | | |

| - | | |

$ | 0.69 | | |

7/18/2028 |

| President, CEO | |

| 422,668 | | |

| - | | |

$ | 0.69 | | |

12/19/2028 |

| | |

| | | |

| | | |

| | | |

|

| Edmund Y. Ting, Ph.D | |

| 21,185 | | |

| - | | |

$ | 0.69 | | |

7/18/2028 |

| Senior Vice President of Engineering | |

| 85,555 | | |

| - | | |

$ | 0.69 | | |

12/19/2028 |

| | |

| | | |

| | | |

| | | |

|

| Alexander V. Lazarev, Ph.D | |

| 17,835 | | |

| - | | |

$ | 0.69 | | |

7/18/2028 |

| Vice President of Research & Development | |

| 73,505 | | |

| - | | |

$ | 0.69 | | |

12/19/2028 |

| |

(1) |

All

unvested stock options listed in this column were granted to the Named Executive Officer pursuant to our 2013 Equity Incentive Plan.

On December 19, 2019, all outstanding options were repriced and re-issued pursuant to this plan. All options expire ten years after

the date of grant. Unvested stock options become fully vested and exercisable upon a change of control of our company. |

Retirement

Plan

All

employees, including the named executive officers, may participate in our 401(k) Plan. Under the 401(k) Plan, employees may elect to

make before tax contributions of up to 60% of their base salary, subject to current Internal Revenue Service limits. The 401(k) Plan

does not permit an investment in our Common Stock. We match employee contributions up to 50% of the first 2% of the employee’s

earnings. Our contribution is 100% vested immediately.

Severance

Arrangements

Each

of Mr. Schumacher, Dr. Ting, and Dr. Lazarev, executive officers of the Company, are entitled to receive a severance payment if terminated

by us without cause. The severance benefits would include a payment in an amount equal to one year of such executive officer’s

annualized base salary compensation plus accrued paid time off. Additionally, the officer will be entitled to receive medical and dental

insurance coverage for one year following the date of termination.

Change-in-Control

Arrangements

Pursuant

to severance agreements with each of Mr. Schumacher, Dr. Ting, and Dr. Lazarev, each such executive officer is entitled to receive a

change in control payment in an amount equal to one year (other than Mr. Schumacher) of such executive officer’s annualized base

salary compensation, accrued paid time off, and medical and dental coverage, in the event such executive officer is terminated without

“Cause” (as defined in the Severance Agreement) or resigns from the Company for “Good Reason” (as defined in

the Severance Agreement) following a change in control of our Company. In the case of Mr. Schumacher, his payment is equal to two years

of annualized base salary compensation, accrued paid time off, and two years of medical and dental coverage.

Pursuant

to our equity incentive plans, any unvested stock options held by a named executive officer will become fully vested upon a change in

control (as defined in the 2013, 2021 and 2024 Equity Incentive Plan) of our Company.

Pay

Versus Performance

In

accordance with rules adopted by the Securities and Exchange Commission (“SEC”) pursuant to the Dodd-Frank Wall Street Reform

and Consumer Protection Act of 2010, we provide the following disclosure regarding executive “Compensation Actually Paid”

(“CAP”) and certain performance measures required for Smaller Reporting Companies. The following table provides the information

required for our NEOs for each of the fiscal years ended December 31, 2022 and December 31, 2021, along with the financial information

required for each fiscal year:

| Year | |

Summary compensation table total CEO (1)(2) | | |

Compensation actually paid to CEO (1)(3) | | |

Average summary compensation table total for non-CEO NEOs (2)(4) | | |

Average compensation actually paid to non-CEO NEOs (3)(4) | | |

Value of Initial Fixed $100 Investment based on Total shareholder return | | |

Net Loss | |

| 2022 | |

$ | 320,535 | | |

$ | 309,185 | | |

$ | 208,718 | | |

$ | 203,813 | | |

$ | 56.28 | | |

$ | (17,803,953 | ) |

| 2021 | |

$ | 413,406 | | |

$ | 308,962 | | |

$ | 262,704 | | |

$ | 203,740 | | |

$ | 108.96 | | |

$ | (22,685,459 | ) |

| (1) |

For

each year shown the PEO was Richard Schumacher. |

| (2) |

Amounts

in this column represent the “Total Compensation” column set forth in the Summary Compensation Table (“SCT”)

on page [11]. See the footnotes to the SCT for further detail regarding the amounts in these columns. |

| (3) |

The

dollar amounts reported in these columns represent the amounts of “compensation actually paid.” The Amounts are computed

in accordance with Item 402(v) of Regulation S-K by deducting and adding the following amounts from the “Total” column

of the SCT (pursuant to SEC rules, fair value at each measurement date is computed in a manner consistent with the fair value methodology

used to account for share-based payments in our financial statements under GAAP). |

| (4) |

Non-CEO

NEOs reflect the compensation of Edmund Ting, Ph.D. and Alexander Lazarev, Ph.D. |

| | |

2022 | | |

2021 | |

| | |

Richard Schumacher | | |

Average Non-CEO NEOs | | |

Richard Schumacher | | |

Average Non-CEO NEOs | |

| Total Compensation from Summary Compensation Table | |

$ | 320,535 | | |

$ | 208,718 | | |

$ | 413,406 | | |

$ | 262,704 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjustments for Equity Awards | |

| | | |

| | | |

| | | |

| | |

| Adjustment for grant date values in the Summary Compensation Table | |

| - | | |

| - | | |

| - | | |

| - | |

| Year-end fair value of unvested awards granted in the current year | |

| - | | |

| - | | |

| - | | |

| - | |

| Year-over-year difference of year-end fair values for unvested awards granted in prior years | |

| - | | |

| - | | |

| - | | |

| - | |

| Fair values at vest date for awards granted and vested in current year | |

| - | | |

| - | | |

| - | | |

| - | |

| Difference in fair values between prior year-end fair values and vest date fair values for awards granted in prior years | |

| - | | |

| - | | |

| - | | |

| - | |

| Forfeitures during current year equal to prior year-end fair value | |

| - | | |

| - | | |

| - | | |

| - | |

| Dividends or dividend equivalents not otherwise included in total compensation | |

| - | | |

| - | | |

| - | | |

| - | |

| Total Adjustments for Equity Awards | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Compensation Actually Paid (as calculated) | |

$ | 320,535 | | |

$ | 208,718 | | |

$ | 413,406 | | |

$ | 262,704 | |

Narrative

Disclosure: Pay Versus Performance Table

The

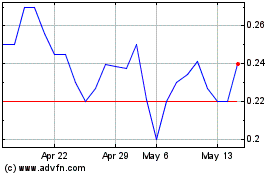

illustrations below provide a graphical description of CAP (as calculated in accordance with the SEC rules) and the following measures:

PBI’s

cumulative Total Shareholder Return (“TSR”) is the cumulative total shareholder return measured by dividing the sum of the

cumulative amount of dividends for the measurement period (which PBIO had none), assuming dividend reinvestment, and the difference between

the registrant’s share price at the end and the beginning of the measurement period; by the share price at the beginning of the

measurement period.

CAP

and Cumulative TSR

CAP

vs. Net Income

PROPOSAL

NO. 2

RATIFICATION

OF THE APPOINTMENT OF THE

INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

You

are being asked to ratify the Board of Directors’ appointment of MaloneBailey LLP as our independent registered public accounting

firm for the fiscal year ending December 31, 2023. MaloneBailey LLP has served as the Company’s independent registered public accounting

firm since July 1, 2015. A representative of MaloneBailey LLP is expected to attend the Meeting by telephone and will have an opportunity

to make a statement and respond to appropriate questions.

Our

Bylaws do not require that our stockholders ratify the appointment of MaloneBailey LLP as our independent registered public accounting

firm. However, we are submitting the proposal for ratification as a matter of good corporate governance. If our stockholders do not ratify

the appointment, the Audit Committee will reconsider whether or not to retain MaloneBailey LLP. Even if the appointment is ratified,

the Audit Committee, at its discretion, may change the appointment at any time during the year if the Audit Committee determines that

such a change would be in the best interests of the Company and its stockholders.

The

Audit Committee appointed MaloneBailey LLP (“MaloneBailey”), an independent registered public accounting firm, to audit the

Company’s consolidated financial statements for the fiscal year ending December 31, 2023. A representative of MaloneBailey will

be available during the Meeting to make a statement if such representative desires to do so and to respond to questions.

The

following is a summary of the fees billed to the Company by MaloneBailey LLP, the Company’s independent registered public accounting

firm, respectively for the fiscal year ended December 31, 2022 and 2021:

| | |

Fiscal 2022 Fees | | |

Fiscal 2021 Fees | |

| Audit Fees | |

$ | 174,000 | | |

$ | 160,000 | |

| Audit-Related Fees | |

| - | | |

| - | |

| Tax and Other Fees | |

| - | | |

| - | |

| | |

$ | 174,000 | | |

$ | 160,000 | |

Audit

Fees. Consists of fees billed for professional services performed for the audit of our annual financial statements, the review of

interim financial statements, and related services that are normally provided in connection with registration statements, including the

registration statement for our public offering.

Audit-Related

Fees. Consists of aggregate fees billed for assurance and related services that are reasonably related to the performance of the

audit or review of the Company’s consolidated financial statements and are not reported under “Audit Fees.”

Audit

Committee Policy on Pre-Approval of Services

The

Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent registered

public accounting firm. These services may include audit services, audit-related services, tax services, and other services. Pre-approval

is generally provided for up to one year. The Audit Committee may also pre-approve particular services on a case-by-case basis.

Vote

Required

The

affirmative vote of the holders of a majority of the votes cast at the Meeting is required to approve Proposal No. 2.

Board

Recommendation

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL NO. 2, THE RATIFICATION OF THE APPOINTMENT

OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

PROPOSAL

NO. 3

APPROVAL

OF PRESSURE BIOSCIENCES, INC. 2024 EQUITY INCENTIVE PLAN

The

Board of Directors has approved, subject to stockholder approval, the Pressure BioSciences, Inc. 2024 Equity Incentive Plan (the “2024

Equity Incentive Plan”), which provides for the issuance of an aggregate of 5,000,000 shares of Common Stock issuable upon exercise

of stock options, restricted stock and other stock-based awards granted or issued under the 2024 Equity Incentive Plan to qualified employees,

officers, directors, consultants and advisors of the Company from time to time.

Summary

of the 2024 Equity Incentive Plan

The

following is a summary description of the 2024 Equity Incentive Plan and is qualified in its entirety by reference to the text of the

2024 Equity Incentive Plan which is attached as Exhibit A to this proxy statement.

Description

of the 2024 Equity Incentive Plan

Purpose

and Eligibility. The purpose of the 2024 Equity Incentive Plan is to award stock options, stock issuances, and other equity interests