Hotels & Lodging Stock Outlook - April 2014 - Zacks Analyst Interviews

March 31 2014 - 4:02AM

Zacks

The U.S. hotel & lodging industry wrapped up the year 2013 on a

mixed note as the economy struggled to gradually get back to

health. The year was led by strong demand from business as well as

leisure travelers which, along with limited supply, gave hoteliers

strong pricing power throughout the year.

In fact, important factors like higher barriers to entry and lower

reliance on third-party wholesalers have positioned the hoteliers

to attain peak levels not seen since the onset of the global

economic crisis in 2007. The hoteliers are making every effort to

improve their primary performance metrics like occupancy and

revenue per available room (RevPAR).

However, higher cost and expenses incurred for continued

renovation and other initiatives taken by leading hoteliers to

improve traffic have dampened the bottom line. Moreover, economic

and political uncertainty in most parts of the world remained as

challenges.

In spite of these headwinds, the lodging performance indicators

showed year-over-year improvements. According to Smith Travel

Research (“STR”), the leading information and data provider for the

lodging industry, the average daily rate (“ADR”) at U.S. hotels in

2013 was up 3.9% year over year. Overall occupancy was up

1.5% year over year.

Notwithstanding the common macroeconomic hurdles, the lodging

sector is expected to continue to recover this year, thanks to an

improving U.S. business as well as strong international travel and

tourism volumes. In fact, the uptrend visible in occupancy rate,

average daily rate as well as RevPar for the first and second weeks

of March, if it is any clue, speaks well for 2014 on the whole.

Statistics bear out this relatively favorable environment. A recent

report by Price Waterhouse Coopers shows that the lodging sector

will continue to outperform in 2014 and 2015 on the back of robust

booking trend and a solid travel and tourism market. The market

researcher expects RevPAR growth of 6.0% in 2014, driven by

increased ADR of 4.5% which is better than 3.9% in 2013.

As per Price Waterhouse Coopers, 2014 will be the fifth

consecutive year of positive RevPAR growth. Price Waterhouse

Coopers also added that high-priced segments will be the major

driver of industry growth.

Furthermore, mega sporting events in South America scheduled in

2014 through 2016 is expected to boost tourism. As owners and

operators strive to enhance value and competitiveness,

industry-best practices, like sustainability and brand refreshment,

will remain industry priorities.

OPPORTUNITIES

Demand Exceeds Supply: A gradual recovery in the broader

economy has boosted the hotel industry as demand picks up for both

leisure and transient business travel. With limited supply and

strong demand, the room rates are seeing a northward movement.

Smith Travel Research expects the sector’s demand growth to be 2.4%

in 2014 in the U.S. with only a 0.1% increase in supply.

According to Hyatt Hotels Corporation (H) and

Hilton Worldwide Holdings Inc. (HLT), the

supply-demand environment in the business is favorable with healthy

demand growth outpacing levels of supply growth that are still well

below long-term averages. This would lead to incremental rate

increases, thereby driving RevPar higher.

The North American Recovery: System-wide occupancies in

North America appear to be pretty steady and above the prior peak

level achieved in 2006 following the gradual improvement in the

economy.

With the boost in the economic sector and an improving travel and

tourism industry, hotel companies are well poised for growth. North

America is still the largest market for Starwood Hotels

& Resorts Worldwide Inc. (HOT). In 2014, the company

expects another year of robust growth in North America and plans to

open about one-third of its new hotels in the region.

International Expansion: Owing to the saturation in the

U.S market, major hoteliers are exploring growth opportunities

abroad. Some international markets offer greater potential based on

the higher pace of economic growth. The demand for hotels in the

international market is greater than in the U.S. and the pace of

recovery is particularly faster. The positive fundamentals in

foreign markets have spurred hoteliers to grab a larger piece of

the overseas pie.

A number of U.S.-based hoteliers are targeting the unsaturated

markets of Asia-Pacific, Brazil, Russia and Africa. Within Asia,

China promises lucrative growth opportunities with visits expected

to increase substantially in 2014. China is in fact a major

contributor to both Starwood Hotels and Marriott

International, Inc. (MAR) revenues.

Apart from China, India is now becoming a hot spot for western

hoteliers, as the country is emerging as a global business hub.

Major players in the industry are also eyeing the Latin American

countries, particularly Brazil and Mexico. Brazil primarily

attracts affluent domestic tourists in the flush of an economic

resurgence.

Moreover, with major events like the FIFA World Cup in 2014 and the

Summer Olympics in 2016, the Brazilian government has turned its

focus on improving the country’s infrastructure. The events will

significantly increase tourism in the country and the demand for

hotel rooms will shoot up.

In Europe, too, the scenario is improving. In fact, select markets

in Southern Europe, which were hard hit during the recession, have

begun to report growth. The bullish trend can be validated by

Starwood’s system-wide occupancy data in the fourth quarter, which

was an impressive 68.0% in Europe. Other major players like Hilton

Worldwide, Choice Hotels International Inc. (CHH)

and Wyndham Worldwide Corporation (WYN) are also

eyeing the European market.

Asset Disposition Strategy: Since late 2010, the

transition to an ‘asset light’ business model has gained momentum

in the hotels and REIT industry. Asset sale remains a long-term

strategy for greater financial flexibility. The companies are

likely to grow through management and licensing arrangements

instead of direct ownership of real estate. A higher concentration

of management and franchise fees reduces earnings volatility and

provides a more stable growth profile.

Several hoteliers like Marriott International, Hyatt Hotels and

Starwood Hotels followed this industry trend to rebalance their

portfolios.

Renovation to Boost Growth: Hotel companies are diligently

working on guest satisfaction to enhance their position in a

cut-throat environment. Hence, brand conversion and remodeling has

become the in thing for major hoteliers. Many leading hoteliers

like Starwood Hotels, Marriott International,

Orient-Express Hotels Ltd. (OEH), Hyatt Hotels and

The Marcus Corporation (MCS) have tread the same

path.

There are several well-positioned, older hotels in metro markets

which are good candidates for restructuring. In view of that, we

foresee several renovations this year.

Currently, we have Marcus Corporation as a Zacks Rank #1 (Strong

Buy) stock. However, Sands China Ltd. (SCHYY) and

Marriott International hold a Zacks Rank #2 (Buy). Despite the

Zacks Rank #3 (Hold) tag, we are optimistic on Hyatt Hotels and

Huazhu Hotels Group Ltd (HTHT) based on its strong

fourth quarter results and an optimistic outlook for 2014.

Similarly, we are also positive on Zacks Ranked #3 (Hold) company

Starwood Hotels given the momentum in its underlying

businesses.

WEAKNESSES

Operating Margins Under Pressure: Though RevPAR has fairly

picked up since the recovery in the industry in 2009, operating

margins have yet to reach the industry peak of 2007 in the U.S.

This is due to the spike in overall inflation. As a result of

economic uncertainty, it is now estimated that peak levels will not

be achieved anytime soon.

Lingering Uncertainty in Other Regions: Despite its

immense growth potential, the hoteliers are still caught up with

several macroeconomic issues like the probability of further

tapering by the Fed, ongoing austerity measures in Europe resulting

from the sovereign debt crisis and decelerating growth in Asia.

Moreover, a deteriorating political situation and a weak economy

have put the brakes on overall Latin American sales. The

upcoming elections in Brazil make the situation much more

unpredictable. Additionally, the situation in Argentina has gone

from bad to worse as police strikes led to chaos across several

cities in Dec 2013.

The troubles in Egypt and Syria cast a shadow over the performance

of the entire African and Middle Eastern region. Economic headwinds

and political unrest have hampered growth in other parts of the

world as well. Saudi visa restrictions due to the continuing

renovation activity in Mecca also remain an issue.

Uncertainty over the new government’s policy in China is also a

concern. The new leadership in China has asked government officials

to put an end to their extravagant ways. Tighter government

spending is expected to affect the food and beverage business of

the company, particularly in the north and west where the

government is a major customer. The situation in India remains

uncertain with elections coming up while the controversial

anti-government protests in Thailand have significantly hurt

business in this crucial market for hoteliers.

Health Care Reforms to Hurt Profitability: Federal health

care legislation mandates employers to provide health coverage to

full-time employees who log in more than 30 hours per week. With

this provision going into effect, it would increase the cost of the

leading hoteliers.

There are some names in the space that induce our

cautious-to-bearish outlook. These include Home Inns &

Hotels Management Inc. (HMIN), Intercontinental

Hotels Group plc (IHG), Choice Hotels International, and

Orient-Express Hotels, each carrying a Zacks Rank #4 (Sell). We

have no companies carrying a Zacks Rank #5 (Strong Sell) for now.

Intrawest Resorts Holdings, Inc. (SNOW),

Marriott Vacations Worldwide Corp. (VAC), Hilton

Worldwide and Wyndham Worldwide all hold a Zacks Rank #3 (Hold) on

the back of sluggish results in the last reported quarter.

Zacks Industry Rank

Within the Zacks Industry classification, we rank all the 260 plus

industries in the 16 Zacks sectors based on the earnings outlook

and fundamental strength of the constituent companies in each

industry. To learn more visit: About Zacks Industry Rank.

As a guideline, the outlook for industries in the top 1/3rd of all

Industry Ranks or a Zacks Industry Rank of #88 and lower is

'Positive'; the middle 1/3rd or industries with Zacks Industry Rank

between #89 and #176 is 'Neutral' and the bottom 1/3rd or Zacks

Industry Rank of #177 and higher is 'Negative.'

The Zacks Industry Rank for the hotels/motels industry is currently

#104. This is in the middle 1/3rd of all industries ranked,

highlighting the group’s near-term neutral outlook. The group’s

neutral Zacks Rank placement is essentially a function of many a

company improving on their top line but floundering on their bottom

line due to higher expenses.

Earnings Trends

The hotel industry falls under the broader Consumer Discretionary

sector. The fourth quarter of 2013 results for the sector has been

decent in terms of both beat ratios (percentage of companies coming

out with positive surprises) and growth.

The earnings "beat ratio" was 50.0%, while the revenue "beat ratio"

was 53.1%. Total earnings for this sector increased 12.0% in the

fourth quarter, compared with 12.1% in the third quarter. Total

revenue grew 3.3% in the quarter versus a 3.2% increase in the

previous quarter.

First quarter 2014 earnings are expected to rise 5.4%, thereby

pegging the full-year 2014 growth outlook at 12.5%. For 2015, the

sector’s earnings are poised to expand around 15.7%.

Revenue is expected to grow 3.7% in the first quarter of 2014,

pegging the full-year 2014 growth outlook at 4.5%. For 2015, the

sector is poised to expand around 4.4% with 6.2% growth in full

year 2014.

For more details about earnings for this sector and others, please

read our ‘Earnings Trends’ report.

The fourth-quarter earnings season has shown a mixed trend in the

hotel and motel industry.

While Starwood Hotels beat Zacks earnings expectations, it missed

the same on revenues. On the other hand, Wyndham Worldwide missed

the Consensus mark on the earnings front while surpassing revenue

estimates. Marriott International missed the Zacks Consensus

Estimate squarely on both earnings and revenues while Hyatt Hotels

easily surpassed on both lines.

A look at the Earnings ESP in the table below shows that

Extended Stay America, Inc. (STAY), Hyatt Hotels,

Marcus Corp. and Marriott International could miss the Zacks

Consensus Estimate in the next quarter (first quarter 2014) while

Wyndham Worldwide could easily surpass the same.

Bottom Line

We firmly believe that despite a few stumbles, the lodging sector

offers a worthy investment proposition for 2014 given the ongoing

recovery in the economy as well as the low supply scenario in the

hotel industry.

Our proprietary Zacks Rank indicates the movement of the stocks

over the short term (1 to 3 months). At present, 20.0% and 53.3% of

the stocks hold a positive and neutral outlook, respectively, while

the remaining 26.7% are negative.

CHOICE HTL INTL (CHH): Free Stock Analysis Report

HYATT HOTELS CP (H): Free Stock Analysis Report

HILTON WW HLDG (HLT): Free Stock Analysis Report

HOME INNS&HOTEL (HMIN): Free Stock Analysis Report

STARWOOD HOTELS (HOT): Free Stock Analysis Report

CHINA LODGING (HTHT): Free Stock Analysis Report

INTERCONTL HTLS (IHG): Free Stock Analysis Report

MARRIOTT INTL-A (MAR): Free Stock Analysis Report

MARCUS CORP (MCS): Free Stock Analysis Report

ORIENT EXP HOTL (OEH): Free Stock Analysis Report

SANDS CHINA LTD (SCHYY): Get Free Report

INTRAWEST RESRT (SNOW): Free Stock Analysis Report

EXTENDED STAY (STAY): Free Stock Analysis Report

MARRIOT VAC WW (VAC): Free Stock Analysis Report

WYNDHAM WORLDWD (WYN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

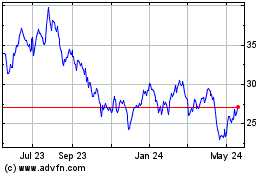

Sands China (PK) (USOTC:SCHYY)

Historical Stock Chart

From Dec 2024 to Jan 2025

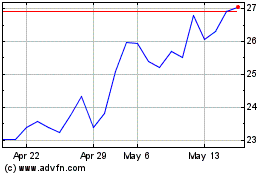

Sands China (PK) (USOTC:SCHYY)

Historical Stock Chart

From Jan 2024 to Jan 2025