0001426506

false

0001426506

2023-10-02

2023-10-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 2, 2023

SMG INDUSTRIES INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

000-54391 |

|

51-0662991 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 20475 State Hwy 249, Suite 450 |

|

|

| Houston, Texas |

|

77070 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code:

(713-955-3497)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Ticker symbol(s) |

|

Name of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial

Condition.

On October

2, 2023, SMG Industries Inc. (the “Company”) issued a press release announcing certain pro forma financial results for the

year ended December 31, 2022, all giving effect to the acquisition by the Company of Barnhart Transportation, LLC and its affiliates.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The

information contained in this Item 2.02 and Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section,

and shall not be incorporated by reference into any filings made by the Company under the Securities Act of 1933, as amended, or the Exchange

Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Dated: October 2, 2023 |

SMG Industries Inc. |

| |

|

|

| |

By: |

/s/ Bryan S. Barnhart |

| |

Name: |

Bryan S. Barnhart |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

SMG Industries Inc. Releases

Financial Information Recently Filed in a Current Report on Form 8-K and Stockholder Update

HOUSTON, TX, Oct. 02, 2023

(GLOBE NEWSWIRE) -- via NewMediaWire -- SMG Industries Inc. (“SMG” or the “Company”) (OTCQB: SMGI), a growth-oriented

transportation services company specializing in the full-service logistics market, today reported its pro forma financial results in

connection with its July 7, 2023, acquisition of the Barnhart family of companies.

On September 15, 2023, the Company amended

its Current Report on Form 8-K originally filed with the Securities and Exchange Commission (the “SEC”) on July 12, 2023, which

amendment included the financial statements and pro forma financial information required by Item 9.01 of Form 8-K in connection with

its recent acquisition of the Barnhart family of companies that closed July 7, 2023.

As illustrated in the Current Report

on Form 8-K/A filed with the SEC on September 15, 2023, on a pro forma combined basis for fiscal year 2022, revenues were $152,771,088,

gross profit was $16,770,897, net loss from continuing operations was $5,296,586 (which included non-cash expenses of $13,930,353 in

depreciation and amortization expenses), generating a net loss of $5,156,039 including those non-cash items. In addition, as disclosed

in further detail below, pro forma Adjusted EBITDA, a non-GAAP measure, for fiscal year 2022 was $15,046,814 (see reconciliation table

below).

Timothy Barnhart, CFO of SMG said, “Our

team is excited about our future growth prospects and new critical mass in size given the July 7th closing of the Barnhart family of

companies and its added cash flow. In addition to realizing cost synergies, the Company has been very busy with internal integration

of its business and is fortunate to have transportation management systems (TMS) and related infrastructure that are similar and pair

well together. Currently, the team believes this integration, including accounting and information technology, will be concluded prior

to the year-end 2023. We have executed on several of the expense saving initiatives, including national account buying for fuel and other

expenses.” Timothy continued, “The Company’s next Quarterly Report on Form 10-Q for the third quarter 2023 will include the

financial results from the Barnhart acquisition from its effective date of July 7, 2023, through September 30, 2023, within SMG’s consolidated

financial results for the third quarter.”

“We have hundreds of customers

between the legacy business of SMG and the Barnhart family of companies that can be cross-referred to generate growth. Structurally,

we have combined the brokerage business of 5J Logistics Services into the larger Lake Shore Logistics operations, which has generated

positive feedback from our customers accessing expanded transportation service lines,” stated Bryan Barnhart, CEO of SMG. Bryan

continued, “The Company has several revenue synergies underway, including cross-fertilizing customers, introducing additional services

lines from the Barnhart family of companies and SMG/5J companies expanding solutions by building a “one stop shop,” full-service

logistics provider for our customers and delivering seamless logistics solutions spanning the globe. We continue to enjoy diversification

in our end market customer focus with industrial, oilfield and intermodal benefiting from additional activity in the market.”

Select pro forma information

from the Company’s Current Report on Form 8-K/A filed with the SEC on September 15, 2023 is set forth below:

| SMG Industries

Inc. |

| Pro Forma

Combined Statement of Operations |

| For the

Year Ended December 31, 2022 |

| (unaudited) |

| | |

| | |

| | |

| | |

|

| |

| |

| | |

SMG | | |

Barnhart

Companies | | |

Other

Transaction

Adjustments | | |

Pro

Forma

Adjustments |

| |

Pro

Forma

Combined | |

| REVENUE TOTAL | |

| 71,021,862.00 | | |

| 81,749,226.00 | | |

| - | | |

| - |

| |

| 152,771,088.00 | |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| COST OF REVENUE | |

| 65,285,261.00 | | |

| 67,980,193.00 | | |

| - | | |

| 2,734,737.00 |

(j) | |

| 136,000,191.00 | |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| GROSS PROFIT | |

| 5,736,601.00 | | |

| 13,769,033.00 | | |

| - | | |

| (2,734,737.00 |

) | |

| 16,770,897.00 | |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Selling, General & Administrative | |

| 9,079,344.00 | | |

| 8,332,154.00 | | |

| | | |

| 1,482,000.00 |

(k) | |

| 18,893,498.00 | |

| Gain on

disposal of assets | |

| (330,499.00 | ) | |

| - | | |

| - | | |

| (632,524.00 |

)(l) | |

| (963,023.00 | ) |

| Total operating expenses | |

| 8,748,845.00 | | |

| 8,332,154.00 | | |

| - | | |

| 849,476.00 |

| |

| 17,930,475.00 | |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Income (loss) from operations | |

| (3,012,244.00 | ) | |

| 5,436,879.00 | | |

| - | | |

| (3,584,213.00 |

) | |

| (1,159,578.00 | ) |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Other Income (Expense) | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Interest Income | |

| - | | |

| 46,225.00 | | |

| - | | |

| - |

| |

| 46,225.00 | |

| Interest Expense | |

| (9,431,681.00 | ) | |

| (142,532.00 | ) | |

| 4,486,540.00 | (h) | |

| 142,532.00 |

(m) | |

| (4,945,141.00 | ) |

| Gain on extinguishment of debt | |

| 564,814.00 | | |

| - | | |

| | | |

| |

| |

| 564,814.00 | |

| Gain on disposal of assets | |

| | | |

| 632,524.00 | | |

| - | | |

| (632,524.00 |

)(l) | |

| - | |

| Other income | |

| 228,689.00 | | |

| 68,770.00 | | |

| - | | |

| - |

| |

| 297,459.00 | |

| Other expense | |

| (100,365.00 | ) | |

| - | | |

| - | | |

| - |

| |

| (100,365.00 | ) |

| Total other income (expense) | |

| (8,738,543.00 | ) | |

| 604,987.00 | | |

| 4,486,540.00 | | |

| (489,992.00 |

) | |

| (4,137,008.00 | ) |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Net loss from continuing

operations | |

| (11,750,787.00 | ) | |

| 6,041,866.00 | | |

| 4,486,540.00 | | |

| (4,074,205.00 |

) | |

| (5,296,586.00 | ) |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Income (loss)

from discontinued operations | |

| 140,547.00 | | |

| - | | |

| - | | |

| - |

| |

| 140,547.00 | |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Net income (loss) | |

| (11,610,240.00 | ) | |

| 6,041,866.00 | | |

| 4,486,540.00 | | |

| (4,074,205.00 |

) | |

| (5,156,039.00 | ) |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| dividends | |

| - | | |

| - | | |

| (250,000.00 | )(i) | |

| (250,000.00 |

)(n) | |

| (500,000.00 | ) |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Net

income (loss) available to common shareholders | |

| (11,610,240.00 | ) | |

| 6,041,866.00 | | |

| 4,236,540.00 | | |

| (4,324,205.00 |

) | |

| (5,656,039.00 | ) |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Net income (loss) per common

share | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Continuing

operations | |

| (0.32 | ) | |

| | | |

| | | |

| |

| |

| (0.02 | ) |

| Discontinued

operations | |

| (0.00 | ) | |

| | | |

| | | |

| |

| |

| (0.00 | ) |

| Net loss

attributable to common shareholders | |

| (0.32 | ) | |

| | | |

| | | |

| |

| |

| (0.02 | ) |

| | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Weighted Average Shares Outstanding | |

| | | |

| | | |

| | | |

| |

| |

| | |

| Basic | |

| 36,399,788.32 | | |

| | | |

| | | |

| |

| |

| 254,107,078.32 | |

| Diluted | |

| 36,399,788.32 | | |

| | | |

| | | |

| |

| |

| 254,107,078.32 | |

Pro Forma Adjusted EBITDA

SMG defines pro forma Adjusted EBITDA as net loss

plus (i) depreciation, (ii) income taxes, (iii) interest expense, (iv) non-cash stock option expense, (v) non-cash stock option expense,

(vi) transaction-related expenses, (vii) expenses for contract Chief Financial Officer consulting services and Chief Transition Officer

services and (vii) discontinued operations costs.

| Net income (loss) | |

| (11,610,240.00 | ) | |

| 6,041,866.00 | | |

| 4,486,540.00 | | |

| (4,074,205.00 | ) | |

|

|

| (5,156,039.00 | ) |

| Plus: | |

| | | |

| | | |

| | | |

| | | |

|

|

| | |

| Depreciation and amortization | |

| 5,328,366.00 | | |

| 4,385,250.00 | | |

| | | |

| 4,216,737.00 | | |

|

|

| 13,930,353.00 | |

| Interest expense | |

| 9,431,681.00 | | |

| 142,532.00 | | |

| (4,486,540.00 | ) | |

| (142,532.00 | ) | |

|

|

| 4,945,141.00 | |

| Taxes | |

| (130,043.00 | ) | |

| 34,337.00 | | |

| | | |

| | | |

|

|

| (95,706.00 | ) |

| EBITDA | |

| 3,019,764.00 | | |

| 10,603,985.00 | | |

| - | | |

| - | | |

|

|

| 13,623,749.00 | |

| | |

| | | |

| | | |

| | | |

| | | |

|

|

| | |

| Adjustments to EBITDA | |

| | | |

| | | |

| | | |

| | | |

|

|

| | |

| Nnon-cash stock-based compensation | |

| 61,043.00 | | |

| - | | |

| - | | |

| - | | |

|

|

| 61,043.00 | |

| Consulting expenses | |

| 200,161.00 | | |

| 310,543.00 | | |

| - | | |

| - | | |

|

|

| 510,704.00 | |

| Transaction M&A expenses | |

| 36,641.00 | | |

| - | | |

| - | | |

| - | | |

|

|

| 36,641.00 | |

| CTO Services | |

| 249,997.00 | | |

| - | | |

| - | | |

| - | | |

|

|

| 249,997.00 | |

| Gain on sale of equipment | |

| - | | |

| (634,541.00 | ) | |

| - | | |

| - | | |

|

|

| (634,541.00 | ) |

| Consultant CFO Costs | |

| 109,521.00 | | |

| - | | |

| - | | |

| - | | |

|

|

| 109,521.00 | |

| Software Upgrade/Bad Debt | |

| - | | |

| 58,573.00 | | |

| - | | |

| - | | |

|

|

| 58,573.00 | |

| Discontined Operations/Legal | |

| 22,074.00 | | |

| 1,009,053.00 | | |

| - | | |

| - | | |

|

|

| 1,031,127.00 | |

| Total Adjustments | |

| 679,437.00 | | |

| 743,628.00 | | |

| - | | |

| - | | |

|

|

| 1,423,065.00 | |

| | |

| | | |

| | | |

| | | |

| | | |

|

|

| | |

| Adjusted EBITDA | |

| 3,699,201.00 | | |

| 11,347,613.00 | | |

| - | | |

| - | | |

|

|

| 15,046,814.00 | |

Use of Non-GAAP Financial Measures

This news release includes the non-GAAP

financial measure pro forma Adjusted EBITDA, which the Company believes provides management, investors, and creditors with a useful measure

of the operational results of the Company’s business and increases the period-to-period comparability of such results. This non-GAAP

measure is not a substitute for, or more meaningful than, net loss or any other measure prescribed by GAAP, and there are limitations

to using non-GAAP measures. Certain items excluded from this non-GAAP measure are significant components in understanding and assessing

a company’s financial performance, such as a company’s cost of capital, tax structure and the historic costs of depreciable assets. Also,

other companies in SMG’s industry may define this non-GAAP measure differently than SMG does, and as a result, it may be difficult to

use this non-GAAP measure to compare the performance of those companies to SMG’s performance. Because of these limitations, this non-GAAP

measure should not be considered a measure of the income generated by SMG’s business or discretionary cash available to it to invest

in the growth of its business.

You can find the reconciliation of this

non-GAAP measure to the nearest comparable GAAP measure in the table.

About SMG Industries Inc.: SMG

Industries Inc. (OTCQB: SMGI) is a growth-oriented transportation services company specializing in the full-service logistics market.

We strive to provide exceptional end-to-end solutions, ensuring customer satisfaction at every step of their journey. Our business focus

and diverse service offerings make us a strong contender in the dynamic and evolving global logistics market. As a family of transportation

companies, SMG Industries offers comprehensive logistics solutions, serving as a single service provider for shipments of all sizes,

both domestically and internationally.

Our core strengths lie in

our specialized services, spanning heavy haul, super heavy haul, oversized, drilling rig relocations, and driveaway services, and a comprehensive

suite of logistics solutions. This includes full truckload, dry bulk, non-hazardous liquids, intermodal, LTL, drayage, transloading,

warehousing, permitting and escort, commercial tank wash, international freight forwarding NVOCC (Non-Vessel Operating Common Carrier)

services, and an “asset-lite” brokerage business.

SMG Industries Inc. takes

pride in being more than just a transportation services company; we are strategic partners invested in the success of our customers.

Through continuous communication, personalized solutions, focus on safety, and a forward-thinking mindset, we aim to not only meet the

demands of today’s logistics landscape but also anticipate and address the challenges of tomorrow. Read more about SMG Industries and

our operating companies at www.SMGIndustries.com.

Forward-Looking Statements

The statements contained in this news

release that are not historical fact are forward-looking statements (as such term is defined in the Private Securities Litigation Reform

Act of 1995), within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities

Act of 1933, as amended. Forward-looking statements may be identified by the use of forward-looking terminology such as “should,”

“could,” “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,”

“intends,” “continue,” or similar terms or variations of those terms or the negative of those terms. All forward-looking

statements are the Company’s present expectations of future events and are subject to a number of risks and uncertainties that could

cause actual results to differ materially from those described in the forward-looking statements. These statements appear in a number

of places in this news release and include statements regarding the intent, belief or current expectations of SMG Industries Inc. Forward-looking

statements are merely management’s current predictions of future events. Investors are cautioned that any such forward-looking statements

are inherently uncertain, are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially

from the Company’s predictions. There are a number of factors that could negatively affect the Company’s business and the value of its

securities, including, but not limited to, fluctuations in the market price of its common stock; changes in its plans, strategies and

intentions; changes in market valuations associated with its cash flows and operating results; the impact of significant acquisitions,

dispositions and other similar transactions, including the acquisition of the Barnhart Transportation family of companies; the Company’s

ability to attract and retain key employees; changes in financial estimates or recommendations by securities analysts; asset impairments;

decreased liquidity in the capital markets; and changes in interest rates. Such factors could materially affect the Company’s future

operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the

Company. Although the Company has sought to identify the most significant risks to its business, it cannot predict whether, or to what

extent, any of such risks may be realized, nor is there any assurance that it has identified all possible issues that it might face.

In light of these assumptions, risks

and uncertainties, the results and events discussed in the forward-looking statements contained in this news release might not occur.

Stockholders are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this news

release. The Company is not under any obligation, and it expressly disclaims any obligation to update or alter any forward-looking statements,

whether as a result of new information, future events or otherwise except as may be required by applicable law. All subsequent forward-looking

statements attributable to the Company or to any person acting on its behalf are expressly qualified in their entirety by the cautionary

statements contained or referred to in this section. The Company urges readers to carefully review and consider the various disclosures

it makes in this news release and its reports filed with the SEC that attempt to advise interested parties of the risks, uncertainties

and other factors that may affect its business, including the risk factors included under Part I, Item 1A. “Risk Factors” in

its Annual Report on Form 10-K filed with the SEC on April 17, 2023 and under Part II, Item 1A. “Risk Factors” in its subsequent

Quarterly Reports on Form 10-Q filed with the SEC.

Contact:

Matt Flemming, SMG Industries Inc.

Email address: Matt@SMGIndustries.com

SOURCE: SMG Industries Inc.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

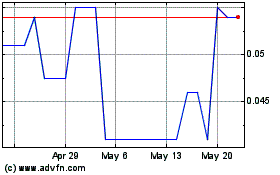

SMG Industries (CE) (USOTC:SMGI)

Historical Stock Chart

From Nov 2024 to Dec 2024

SMG Industries (CE) (USOTC:SMGI)

Historical Stock Chart

From Dec 2023 to Dec 2024