TIDMADME

RNS Number : 4737G

ADM Energy PLC

30 March 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

30 March 2022

ADM Energy PLC

("ADM" or the "Company")

Barracuda CPR

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC), a natural

resources investing company, announces the result of a competent

person's report on the Barracuda prospect in OML141, offshore

Nigeria.

As announced on 28 April 2021, the Company acquired a 51 per

cent. stake in K.O.N.H (UK) Limited ("KONH") and through that a

controlling interest in a Risk Sharing Agreement ("RSA"), for which

KONH holds a 70 per cent. interest. The Company, together with a

consortium of parties with an interest in the RSA, intends to

provide or procure funding for all capital expenditure ("Capex"),

subject to the joint operators' approval to develop any discovered

hydrocarbons, in return for 235 per cent. of approved Capex to be

recovered plus a 15 per cent. net profit interest ("NPI"). The

equity owners of OML 141 are Emerald Energy Resources Limited

("Emerald") (54 per cent.), Amni International Petroleum

Development Company Limited (44 per cent.) and Supernova Energy

B.V. (2 per cent.).

ADM commissioned Xodus Group Limited ("Xodus") to prepare a CPR

on the Barracuda area and Xodus has calculated gross, unrisked

Prospective Resources for the RSA using standard geological and

engineering approaches applied to the data made available by

ADME.

OML 141 lies predominately within the coastal swamp in the Niger

Delta in Nigeria. The Barracuda area is located in the northwest of

OML 141 in which four exploration wells have previously been

drilled. Three wells were drilled in 1967 and the most recent

exploration well, Barracuda-4 (BX-1), was drilled in 2007 by

Emerald and CNOOC Ltd. This well provides the most relevant data

for classifying the resources. Prior to the publication of this CPR

by Xodus, the Barracuda RSA was the subject of a CPR undertaken by

Ryder Scott in 2016. Xodus has reviewed the available relevant

Barracuda data and has not identified convincing evidence as to the

presence of light, producible hydrocarbons. There are, however,

numerous indications as to the presence of heavy, residual

hydrocarbons from past migration and both Ryder Scott (in 2007) and

Xodus have concluded that the Barracuda resources should be

classified as prospective.

The Company and Xodus identified four potential Agbada Sandstone

reservoirs: C, D1A and D1B plus a 'Deep Prospect'. STOIIPs for

these reservoirs were calculated probabilistically. The prospective

resource has been assessed separately for each individual reservoir

unit and collectively for the combined reservoirs. This approach

aligns with that of previous evaluations. In all cases, Xodus used

a slab model (a range of constant thicknesses over the fixed areas

of reservoir extent).

The estimate of STOIIP pertaining to the combined reservoirs,

C3, D1A, D1B and 'Deep Prospect' is shown below:

STOIIP (UNRISKED) GROSS VOLUMES

Reservoir P90 P50 P10 CoS %

(mmbbl) (mmbbl) (mmbbl)

======================= =========== =========== =========== ========

C3 106 193 343 15%

======================= =========== =========== =========== ========

D1A 15 25 43 30%

======================= =========== =========== =========== ========

D1B 70 103 149 18%

======================= =========== =========== =========== ========

Deep Prospect 20 51 131 25%

======================= =========== =========== =========== ========

Combined 275 397 574

Source : Xodus Group Limited

Xodus based its estimates of reservoir and production parameters

on data provided by ADME supplemented with data from nearby

analogue fields. Xodus used the same drilling and development

schedule as described in the economic model provided by ADME to

calculate prospective resource ranges. These represent resources

for a first phase development plan which ADME designed to exploit

any future discovery in the D1A/B reservoirs. Discovery of larger

volumes would require additional phases of development to recover

the hydrocarbons.

The economic model supplied by ADME has been reviewed against

the RSA scope and provisions to confirm that the economic model

represents the RSA accurately. Xodus has used this model with its

independent production profiles, and CAPEX and OPEX adjustments to

assess the economics of the RSA. For the 2U (P50) case the NPV10 is

+$99mm with an IRR of 45% and therefore the prospect is considered

to be robust for development, assuming at least 70mmbbl STOIIP is

discovered.

PROSPECTIVE RESOURCES (RISKED) GROSS VOLUMES OPERATOR

=============================== ================================= ==================================

1U 2U 3U

(mmbbl) (mmbbl) (mmbbl)

=============================== ========== ========== ========= ==================================

Barracuda RSA OML 141 20.7 24.0 27.8 Emerald Energy Resources Limited

Source : Xodus Group Limited

Osamede Okhomina, CEO of ADM Energy, said: "Following the

rigorous independent analysis from Xodus, the results of the CPR

covering the Barracuda prospect in OML141 show that the prospect is

considered prospective and robust for development, with a 2U (P50)

case, the NPV10 is +$99mm with an IRR of 45%.

"The report provides a solid foundation to continue to the next

stage of technical review which will include further subsurface

analysis. We will also look to procure more analogue data from

neighbouring fields to better understand the trap mechanisms. This

additional work will be required to further appraise the asset and

will bring us closer to making an investment decision."

Enquiries:

ADM Energy plc +44 20 7459 4718

Osamede Okhomina, CEO

www.admenergyplc.com

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Hybridan LLP +44 20 3764 2341

(Broker)

Claire Louise Noyce

ODDO BHF Corporates & Markets AG +49 69 920540

(Designated Sponsor)

Michael B. Thiriot

Luther Pendragon +44 20 7618 9100

(Financial PR)

Harry Chathli, Alexis Gore, Tan Siddique

About ADM Energy PLC

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC) is a natural

resources investing company with an existing asset base in Nigeria.

ADM Energy holds a 9.2% profit interest in the oil producing Aje

Field, part of OML 113, which covers an area of 835km(2) offshore

Nigeria. Aje has multiple oil, gas, and gas condensate reservoirs

in the Turonian, Cenomanian and Albian sandstones with five wells

drilled to date.

ADM Energy is seeking to build on its existing asset base in

Nigeria and target other investment opportunities across the West

African region in the oil and gas sector with attractive risk

reward profiles such as proven nature of reserves, level of

historic investment, established infrastructure and route to early

cash flow.

Forward Looking Statements

Certain statements made in this announcement are forward-looking

statements. These forward-looking statements are not historical

facts but rather are based on the Company's current expectations,

estimates, and projections about its industry; its beliefs; and

assumptions. Words such as 'anticipates,' 'expects,' 'intends,'

'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties, and other factors, some

of which are beyond the Company's control, are difficult to

predict, and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

The Company cautions shareholders and prospective shareholder

holders not to place undue reliance on these forward-looking

statements, which reflect the view of the Company only as of the

date of this announcement. The forward-looking statements made in

this announcement relate only to events as of the date on which the

statements are made. The Company will not undertake any obligation

to release publicly any revisions or updates to these

forward-looking statements to reflect events, circumstances, or

unanticipated events occurring after the date of this announcement

except as required by law or by any appropriate regulatory

authority.

About Xodus

Xodus is an independent, international energy consultancy.

Established in 2005, the company has over 400 subsurface and

surface focused personnel spread across the globe. The wells and

subsurface division specialise in petroleum reservoir engineering,

geology and geophysics and petroleum economics. All of these

services are supplied under an accredited ISO9001 quality assurance

system.

As a global energy consultancy, Xodus unites unique and diverse

people to share knowledge, innovate and inspire change within the

energy industry. We provide support across the energy spectrum,

from advisory services to supply chain advice. Including all of the

engineering and environmental expertise needed in between. Our

people strive to ensure global energy supply as we all work

together to realise a net zero world.

Standard

In compiling the CPR, Xodus used the definitions and guidelines

set out in the 2018 update of the Petroleum Resources Management

System ("PRMS") prepared by the Oil and Gas Reserves Committee of

the Society of Petroleum Engineers ("SPE") and reviewed and jointly

sponsored by the World Petroleum Council ("WPC"), the American

Association of Petroleum Geologists ("AAPG") and the Society of

Petroleum Evaluation Engineers ("SPEE").

CPR and Competent Person's Review

This announcement has been reviewed by Wim Burgers, technical

consultant for the Company, a qualified production geologist with

more than 40 years' experience in the oil and gas industry, who has

also reviewed the CPR report to which it relates.

This announcement has also been reviewed by Jonathan Fuller, a

qualified petroleum engineer and employee of Xodus, the Competent

Person for the purposes of the CPR.

The information above has been extracted from the CPR and

shareholders are advised to read the CPR in full. A copy of the CPR

will shortly be available on the Company's website,

www.admenergyplc.com .

Glossary

1U, 2U and 1U, 2U and 3U represent low, best and high case estimates

3U of Prospective Resources respectively as defined in

PRMS.

P10, P50, The probability, being a 10 per cent., 50 per cent.

P90 or 90 per cent. chance, that the actual volume will

be greater than or equal to that stated.

bbls barrels

bopd barrels of oil per day

CoS (%) Exploration or geological chance of success. The probability,

typically expressed as a percentage that a given outcome

will occur.

gross 100% of the resources attributable to the licence.

MMbbls Million barrels

Prospective Prospective Resources are those quantities of petroleum

estimated, as of a given date, to be potentially recoverable

from undiscovered accumulations by application of future

development projects. Prospective Resources have both

an associated chance of discovery and a chance of development.

Prospective Resources are further subdivided in accordance

with the level of certainty associated with recoverable

estimates assuming their discovery and development and

may be sub-classified based on project maturity.

Reserves Those quantities of petroleum anticipated to be commercially

recoverable by application of development projects to

known accumulations from a given date forward under

defined conditions on production, approved for development

or justified for development. Reserves are also classified

according to the associated risks and probabilities

(1P, 2P and 3P).

Risked With the application of a geologic risk assessment

STOIIP Stock tank oil initially in place

Unrisked Without the application of a geologic risk assessment

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDZGZFMLRGZZZ

(END) Dow Jones Newswires

March 30, 2022 02:00 ET (06:00 GMT)

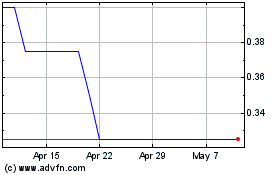

Adm Energy (LSE:ADME)

Historical Stock Chart

From Dec 2024 to Jan 2025

Adm Energy (LSE:ADME)

Historical Stock Chart

From Jan 2024 to Jan 2025