TIDMADME

RNS Number : 9675D

ADM Energy PLC

27 June 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

27 June 2023

ADM Energy PLC

("ADM", the "Group" or the "Company")

Final Results, Publication of Annual Report and Notice of

AGM

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC), a natural

resources investing company, announces its audited full year

results for the 12 months ended 31 December 2022.

Aje Field, OML 113

-- In July 2022, PetroNor E&P Limited's ("PetroNor")

completed its acquisition of Panoro Energy ASA's ("Panoro")

interest in OML 113

-- In August 2022, completed the 17(th) Lifting at the Aje Field

totalling 94,187 barrels with a net share of 8,683 barrels to ADM,

which equates to ADM's profit interest of approximately 9.2%

-- JV Partners are progressing development plans for the Aje

Field, including replacement of the Floating Production Storage and

Offloading ("FPSO"), and as a result there is currently a pause in

production

Post period, Investment in Onshore US Oil Leases and Work

Programme

-- Invested in five oil leases through an acquisition of Blade Oil V, LLC for US$1,614,000 (the "acquisition"). The focus of the acquisition is one lease in the Midway-Sunset Oilfield, one of the largest fields in the US

-- Primary focus of US portfolio is a 70.0% working interest

participation in an initial three well drilling programme to target

shallow oil production on the Altoona Lease

-- Concurrent with the acquisition, ADM has entered into

subscription agreements to issue secured convertible loan notes

("SCLN") with an aggregate face value of up to US$1.5 million

Corporate and Financial Highlights

-- Made directorate changes with appointments of Stefan Olivier

as CEO, previously co-founder of MX Oil plc (now ADM Energy plc),

and Claudio Coltellini as Non-executive Director

-- Revenue was GBP0.7m (2021: GBP1.8m)

-- Operating costs reduced by 81% to GBP0.4m (2021: GBP1.9m)

-- Loss before and after tax was GBP2.1m (2021: GBP2.5m)

-- In January 2022, the Company completed an equity fundraising

of approximately GBP561,000 with Optima Resources Holding

Limited

-- In October 2022, the Company completed an equity fundraising

of approximately GBP725,000 through a subscription and loan from

OFX Holdings, LLC (formerly TN Black Gold, LLC) ("OFX")

Stefan Olivier, CEO of ADM Energy, said: " Having recently

joined ADM, I am really excited about the period that lies ahead of

us. Since becoming CEO, we have been honing our strategy, which

focuses on identifying investment opportunities that are near-term

producing assets in proven oil and gas jurisdictions to enhance our

investment portfolio. In light of this, I am very pleased that we

have already made our first investment, acquiring Blade V which

owns a portfolio of North American Oil and Gas assets in a highly

prospective region. We are hugely excited to add these assets to

our investment portfolio and the opportunity to add significant

value for shareholders.

"Looking forward, we are aiming to progress both the development

plans at Aje alongside the JV partners, as well as developing these

new North American assets. Consequently, both the Board and I can

see a great opportunity to bring value to ADM and its shareholders

and we look forward to updating the market on our progress on these

milestones in due course."

Annual Report and Accounts and Notice of AGM

The Company will shortly be publishing its Annual Report and

Accounts including a Notice of AGM. These will be made available on

the Company's website at www.admenergyplc.com . The AGM is to be

held at the offices of Shakespeare Martineau, 60 Gracechurch St,

London EC3V 0HR at 10.00 a.m. on 25 July 2023.

Enquiries:

ADM Energy plc +44 20 7459 4718

Stefan Olivier, CEO

www.admenergyplc.com

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Hybridan LLP +44 20 3764 2341

(Broker)

Claire Louise Noyce

ODDO BHF Corporates & Markets AG +49 69 920540

(Designated Sponsor)

Michael B. Thiriot

Gracechurch Group +44 20 4582 3500

(Financial PR)

Harry Chathli, Alexis Gore, Henry Gamble

About ADM Energy PLC

ADM Energy is a natural resources investment company with oil

and gas assets in Nigeria and the US. We hold a 9.2% profit

interest in the Aje Field, part of OML 113 in Nigeria. We also hold

a portfolio of interests in oil and gas projects, the primary focus

of which is a 70.0% working interest participation in an initial

three well drilling programme to target shallow oil production on

the Altoona Lease, in the Midway-Sunset Oilfield, California, the

third largest oil field in the US.

We are seeking to build on our existing asset base and target

other investment opportunities across the West African region in

the oil and gas sector. These will be based on attractive risk

reward profiles such as proven nature of reserves, level of

historic investment, established infrastructure, route to early

cash flow and exploration upside.

Operating Review

ADM's strategy focuses on identifying investment opportunities

that are near-term producing assets in proven oil and gas

jurisdictions to enhance our investment portfolio.

Acquisition of Blade V

In May 2023, ADM invested in a portfolio of interests via the

acquisition of Blade V from OFX Holdings LLC (Formerly TN Black

Gold, LLC ("OFX"), a total maximum consideration of

US$1,614,000.

Blade V owns a portfolio of interests in oil and gas projects,

the primary focus of which is a 70.0% working interest

participation in an initial three well drilling programme to target

shallow oil production on the Altoona Lease located in the

Midway-Sunset Oilfield, Kern County, California.

The Midway Sunset Oil Field has produced in excess of 3 billion

barrels of oil since production began in 1889. It is the largest

known oilfield in California and the third largest in the United

States. Chevron Corporation has been operating in the San Joaquin

Valley for over 100 years and its interests in the area represent

its core, onshore USA assets. The Altoona Lease is a highly unique

opportunity for a small company to benefit from substantial

investment and de-risking of the target opportunities by a major

company. Surrounded by Chevron on three sides, the project is a

direct beneficiary of the infrastructure and pipelines built to

service Chevron's production in the area.

In addition, the interests held by Blade V comprise:

-- 100.0% working interest in the Schweitzer Lease in Graham

County, Kansas where a work-over programme to restore production

from two wells is currently in process.

-- 50.0% fully funded working interest in a three well workover

programme in Texas targeting initiation of production from three

wells.

-- 50.0% working interest in the Pearson, Oberlin and Moon

Leases, a three well workover programme.

-- Total gross and net leasehold acreage associated with the

acquisition is 423 acres and 295.5 acres, respectively.

-- ADM will be a non-operating financial investor in the interests.

Further information regarding the Blade V portfolio can be found

in the acquisition announcement of 25 May 2023. Details of ADM's

interests are as follows:

Lease/Well County, Working Net Revenue Operator (1)

State Interest Interest

------------ ------------ ---------- ------------ -----------------

To Be Determined

Altoona Kern, CA 70.0% 52.5% (1)

Pearson Grimes, TX 50.0% 37.5% Guardian (2)

Oberlin Upshur, TX 50.0% 37.5% Guardian (2)

Moon Upshur, TX 50.0% 37.5% Guardian (2)

Schweitzer Graham, KS 100.0% 75.0% Tex Oil, LLC(3)

Notes:

1. Altoona: a California licensed and bonded contract operator to be determined by OFX and ADM.

2. Guardian Energy Operating Co., LLC is a registered Texas operator 75.0% owned by OFX.

3. Tex Oil, LLC is a registered Kansas operator.

The acquisition of Blade V ties into my vision for ADM to expand

our investment portfolio by bringing in quality, near term

production assets with low risk and high upside that can add

significant value to the Company.

Aje Field

In July 2022, the Joint Venture development of Aje took an

important step forwards when PetroNor E&P Limited ("PetroNor")

announced that it had completed the purchase of 100% of Aje

Interests of Panoro Energy ASA ("Panoro"). PetroNor agreed to

acquire Panoro's interest in OML 113 for an upfront consideration

of USD 10 million, with a contingent consideration of up to USD

16.67 million based on future gas production volumes. The

completion of a purchase of interests in Aje from an established,

heavyweight partner such as PetroNor demonstrates the strong value

proposition posed by the asset. With the transaction completed, the

next stage will be for the JV Partners to agree on the long-term

field development plans for the Aje Field.

Discussions are continuing with the JV partners regarding plans

to replace the current Floating Production Storage and Offloading

("FPSO") to increase gas handling capacity and support development

plans to monetise the field's significant wet gas potential, which

is estimated at potentially 1.2 trillion cubic feet of wet gas

resources.

In August 2022, the 17th lifting at the Aje Field was carried

out for a total of 94,187 barrels with a net share of 8,683 to ADM.

This lifting was drawn from oil previously stored on the FPSO as

there was no oil production from the Aje Field (Aje-4 and Aje-5) in

2022. As previously announced, the JV partners implemented a

suspension of production at Aje to upgrade the FPSO and increase

the capacity and production capability in line with the development

plans.

Barracuda

ADM is currently following legal proceedings in respect of its

interest in the Barracuda oil field. As announced on 13 December

2021, the Company and K.O.N.H. (UK) Ltd ("KONH") obtained an

interim injunction at the Federal High Court of Nigeria, Lagos

("Court") restraining Noble Hill-Network Limited ("NHNL"), its

officers, agents, privies, or person howsoever connected from

selling, disposing, divesting, or tampering with the 70%

shareholding interest of KONH in NHNL to third-party investors or

in any other manner whatsoever. The interim injunction continues to

stand.

During the period, the Company announced the result of the CPR

on the Barracuda Field with a 2U (P50) case, the NPV10 is +$99mm

with an IRR of 45%, assuming at least 70mmbbls STOIIP is

discovered.

Following the appointment of a new CEO (and subsequent

investment and focus on developing the Blade V assets) and the

protracted legal proceedings and settlement discussions, the

management team and Board have made the decision to write-down the

investment in Barracuda for prudence.

New leadership and board changes

The Board was pleased to appoint Stefan Olivier as CEO in April

2023, replacing former CEO, Osa Okhomina. Stefan has extensive

corporate broking and oil and gas experience, including as the

co-founder of MX Oil plc, now ADM Energy. He played a pivotal role

in securing and financing the participation of ADM in the Aje field

and in securing the support of OFX prior to its initial investment

in the Company.

Stefan has been on the Boards of several other public and

private companies and brings years of experience of working in

natural resources. He will drive forward our strategy of building a

multi-asset portfolio, as evidenced in his short time here by the

acquisition of Blade V.

The board was also strengthened by the addition of Claudio

Coltellini as Non-executive Director. Claudio has invested in the

U.S. oil and gas sector for approximately 15 years and is CEO of

four private US oil and gas companies focused on investment in the

states of Texas, California, Kansas and Louisiana, and well placed

to share his expertise to help capitalise on the Company's

acquisition of Blade V.

Financial Review

For the year ended 31 December 2022, the Group's revenue

decreased by 62.2% to GBP0.7 million (2021 GBP1.8 million),

reflecting the suspension of production at Aje.

Operating costs decreased by 80.5% to GBP0.4 million (2021

GBP1.9 million).

Decommissioning provision amounted to GBP1.6 million (2021

GBP1.3 million). Depreciation & amortisation expense increased

by 38.3% to GBP0.07 million (2021: GBP0.05 million).

Administrative expenses decreased by 26.3% to GBP1.7 million

(2021: GBP2.3 million). Finance costs increased to GBP0.12 million

(2021 GBP0.06 million).

Loss after taxation decreased 16.5% to GBP2.1 million (2021:

GBP2.5 million loss). The Directors do not propose a dividend (2021

GBPnil).

As of 31 December 2022, the Group had cash and cash equivalents

of GBP0.025 million 31 December (2021 GBP0.3 million).

Funding

The Company raised a total of GBP1.29 million through two

fundraises in 2022. In January 2022, the Company raised a total of

GBP561,000 through a subscription with Optima Resources Limited,

with funds used for general working capital expenditures. In

October 2022, the Company then raised approximately GBP725,000

through a subscription and a loan from OFX Holdings, LLC (formerly

TN Black Gold, LLC) ("OFX") . The subscription raised a total of

GBP500,000, combined with a $250,000 loan facility.

In May 2023 the Company announced, alongside the acquisition of

Blade V, that it has entered into subscription agreements to issue

secured convertible loan notes ("SCLN") with an aggregate face

value of up to US$1.5 million, of which US$900,000 has been

subscribed for and US$600,000 remaining available for subscription.

The SCLNs subscriptions have been received and no SCLNs will be

issued until cash has been received. The SCLN has a three-year

term, an interest rate payable-in-kind (which maybe settle with

cash or non-cash payments) of 8.0% per annum and the principal

together with any interest due may be converted at any time at a

share price of 1.2p per share.

In addition to the subscriptions, the Company agreed with

certain directors and creditors to convert outstanding contractual

liabilities of GBP683,117 into 56,926,417 new ordinary shares in

the Company at the price of 1.2p per new ordinary share.

Going Concern

At 31 December 2022, the Group recorded a loss for the year of

GBP2.12m and had net current liabilities of GBP2.13m, after

allowing for cash balances of GBP25k. In 2022 the company raised

GBP1.29m through two fund raises. In May 2023 the Company

announced, alongside the acquisition of Blade V, that it has

entered into subscription agreements to issue secured convertible

loan notes ("SCLN") with an aggregate face value of up to US$1.5

million, of which US$900,000 has been subscribed for and US$600,000

remaining available for subscription. The SCLN has a three-year

term, an interest rate payable-in-kind (which may be settled with

cash or non-cash payments) of 8.0% per annum and the principal

together with any interest due may be converted at any time at a

share price of 1.2p per share. In addition to the subscriptions,

the Company agreed with certain directors and creditors to convert

outstanding contractual liabilities of GBP683,117 into 56,926,417

new ordinary shares in the Company at the price of 1.2p per new

ordinary share, helping the company reduce the liabilities on the

balance sheet. Also with the change of management the focus of the

company is now on finding near term producing assets so the company

can start earning revenue. In May 2023 the company announced the

investment in Blade V which holds an interest across 5 different

wells in USA, all with near term revenue potential. As part of this

deal, the company also has circa $251k available under its debt

facility with OFX.

The Directors have prepared cashflow forecasts for the period to

June 2024 to assess whether the use of the going concern basis for

the preparation of the financial statements is appropriate. In the

short term, between the loan facility, potential revenue and CLN

proceeds the Group does not expect to need short term funding to

meet its liabilities as they fall due however the group does expect

in the period that more funding might be needed. The Directors have

a reasonable expectation based on past performance and current

discussions of support from stakeholders that additional finance

would be available should it be needed. Accordingly, the directors

consider it reasonable to prepare the financial statements on the

going concern basis.

Outlook

ADM has undergone a period of change, reflected in the recent

additions to our management team and the acquisition of Blade V,

that has solidified the Company's foundations.

Blade V provides ADM with an exciting portfolio of oil and gas

assets including acreage in one of the largest oil fields in North

America, a tier-one jurisdiction. The acquisition, and its

significant potential upside, can be a gamechanger for ADM and we

are excited by the opportunity ahead of us. The coming year will be

an important period as we progress the well drilling programmes at

Blade V and the JV partners progress with plans for Aje.

In addition to our current portfolio, we think the strength and

experience of our Board and technical team places us in an ideal

position to capitalise on new opportunities as they arise,

particularly as recent global events this past year have

underscored the vital importance of stable global oil and gas

supply. The Company and the Board is confident that it can

effectively leverage its knowledge and expertise across its

portfolio to generate value for the Company.

Group Income Statement and Statement of Comprehensive Income

For the year ended 31 December 2022

2022 2021

Note GBP'000 GBP'000

Continuing operations

Revenue 3 662 1,751

Operating costs (369) (1,895)

Administrative expenses (1,723) (2,340)

Impairment of investment 11 (576) -

Operating loss 4 (2,006) (2,484)

Movement in fair value of investments - -

Finance costs 5 (116) (56)

Loss on ordinary activities before taxation (2,122) (2,540)

Taxation 7 - -

Loss for the year (2,122) (2,540)

--------------------------------------------- ----- -------- --------

Other Comprehensive income:

Exchange translation movement 1,339 141

--------------------------------------------- ----- -------- --------

Total comprehensive income for the year (783) (2,399)

--------------------------------------------- ----- -------- --------

Basic and diluted loss per share: 8

From continuing and total operations (0.8)p (1.6)p

Group and Company Statements of Financial Position

As at 31 December 2022

GROUP COMPANY

2022 2021 2022 2021

Notes GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- ------ --------- --------- --------- ---------

NON-CURRENT ASSETS

Intangible assets 9 17,899 16,149 - -

Investment in subsidiaries 10 - - 12,343 12,335

Fixed asset investments 11 - 576 - 576

17,899 16,725 12,343 12,911

---------------------------------- ------ --------- --------- --------- ---------

CURRENT ASSETS

Investments held for trading 12 28 28 28 28

Inventory 13 36 33 - -

Trade and other receivables 14 22 130 17 130

Cash and cash equivalents 15 25 110 25 109

---------------------------------- ------ --------- --------- --------- ---------

111 301 70 267

---------------------------------- ------ --------- --------- --------- ---------

CURRENT LIABILITIES

Trade and other payables 16 2,240 1,534 2,207 1,515

Convertible loans 17 - 212 - 212

2,240 1,746 2,207 1,727

---------------------------------- ------ --------- --------- --------- ---------

NET CURRENT LIABILITIES (2,129) (1,445) (2,137) (1,460)

NON-CURRENT LIABILITIES

Other borrowings 17 287 247 287 247

Other payables 16 2,718 2,783 - -

Decommissioning provision 18 1,557 1,264 - -

---------------------------------- ------ --------- --------- --------- ---------

4,562 4,294 287 247

---------------------------------- ------ --------- --------- --------- ---------

NET ASSETS 11,208 10,986 9,919 11,204

---------------------------------- ------ --------- --------- --------- ---------

EQUITY

Share capital 19 11,194 10,267 11,194 10,267

Share premium 19 38,090 38,014 38,090 38,014

Other reserves 20 962 960 962 960

Currency translation reserve 630 (709) - -

Retained deficit (39,668) (37,546) (40,327) (38,037)

---------------------------------- ------ --------- --------- --------- ---------

Equity attributable to owners

of the Company and total equity 11,208 10,986 9,919 11,204

---------------------------------- ------ --------- --------- --------- ---------

Group Statement of Changes in Equity

For the year ended 31 December 2022

Exchange

Share Share translation Retained Total

capital premium reserve Other reserves deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------- -------- ------------ -------------- -------- -------

At 1 January 2021 9,450 36,591 (850) 817 (35,006) 11,002

Loss for the year - - - - (2,540) (2,540)

Exchange translation

movement - - 141 - - 141

-------------------------- -------- -------- ------------ -------------- -------- -------

Total comprehensive

income /(expense)

for the year - - 141 - (2,540) (2,399)

-------------------------- -------- -------- ------------ -------------- -------- -------

Issue of new shares 817 1,517 - - - 2,334

Share issue costs - (94) - 27 - (67)

Issue of convertible

loans - - - 2 - 2

Warrants issued in

settlement of fees - - - 114 - 114

At 31 December 2021 10,267 38,014 (709) 960 (37,546) 10,986

Loss for the year - - - - (2,122) (2,122)

Exchange translation

movement - - 1,339 - - 1,339

-------------------------- -------- -------- ------------ -------------- -------- -------

Total comprehensive

income / (expense)

for the year - - 1,339 - (2,122) (783)

-------------------------- -------- -------- ------------ -------------- -------- -------

Issue of new shares 927 134 - - - 1,061

Share issue costs - (56) - - - (56)

Issue of warrants - (2) - 2 - -

Settlement of convertible

loans - - - (19) 19 -

At 31 December 2022 11,194 38,090 630 943 (39,649) 11,208

-------------------------- -------- -------- ------------ -------------- -------- -------

Group Statement of Changes in Equity

For the year ended 31 December 2022

Share Share Retained Total

capital premium Other reserves deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ -------- -------- -------------- -------- -------

At 1 January 2021 9,450 36,591 817 (35,770) 11,088

Loss for the period and

total comprehensive expense - - - (2,267) (2,267)

------------------------------ -------- -------- -------------- -------- -------

Issue of new shares 817 1,517 - - 2,334

Share issue costs - (94) 27 - (67)

Issue of convertible loans - - 2 - 2

Warrants issued in settlement

of fees - - 114 - 114

At 31 December 2021 10,267 38,014 960 (38,037) 11,204

------------------------------ -------- -------- -------------- -------- -------

Loss for the period and

total comprehensive expense - - - (2,290) (2,290)

------------------------------ -------- -------- -------------- -------- -------

Issue of new shares 927 134 - - 1,061

Share issue costs - (56) - - (56)

Issue of warrants - (2) 2 - -

Settlement of convertible

loans - - (19) 19 -

At 31 December 2022 11,194 38,090 943 (40,308) 9,919

------------------------------ -------- -------- -------------- -------- -------

Group and Company Statements of Cash Flows

For the year ended 31 December 2022

GROUP COMPANY

Note 2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- ----- -------- -------- -------- --------

OPERATING ACTIVITIES

Loss for the period (2,122) (2,540) (2,290) (2,267)

Adjustments for:

Warrants issued in settlement

of fees - 114 - 114

Finance costs 5 116 56 116 56

Impairment of investment 11 576 - 576 -

Depreciation and amortisation 9 65 47 - -

Decommissioning provision 18 138 215 - -

Operating cashflow before working

capital changes (1,227) (2,108) (1,598) (2,097)

Increase in inventories - - - -

Decrease/(increase) in receivables 108 (21) 113 (21)

Increase/(decrease) in trade

and other payables 138 570 522 545

------------------------------------- ----- -------- -------- -------- --------

Net cash outflow from operating

activities (981) (1,559) (963) (1,573)

------------------------------------- ----- -------- -------- -------- --------

INVESTMENT ACTIVITIES

Acquisition of subsidiary - (180) - (180)

Proceeds on disposal of investments - 850 - 850

Loans to subsidiary operation 8 - - (8) (19)

Net cash outflow from investment

activities - 670 (8) 651

------------------------------------- ----- -------- -------- -------- --------

FINANCING ACTIVITIES

Continuing operations:

Issue of ordinary share capital 19 1,061 1,406 1,061 1,406

Share issue costs 19 (56) (67) (56) (67)

Repayment of borrowings (328) (338) (328) (338)

Proceeds from borrowings 210 - 210 -

Net cash inflow from financing

activities 887 1,001 887 1,001

------------------------------------- ----- -------- -------- -------- --------

Net (decrease)/increase in

cash and cash equivalents from

continuing and total operations (94) 112 (84) 79

Exchange translation difference 9 (32) - -

Cash and cash equivalents at

beginning of period 110 30 109 30

C ash and cash equivalents at

end of period 15 25 110 25 109

------------------------------------- ----- -------- -------- -------- --------

Notes to the Financial Statements

For the year ended 31 December 2022

1 general information

The Company is a public limited company incorporated in the

United Kingdom and its shares are listed on the AIM market

of the London Stock Exchange. The Company also has secondary

listings on the Quotation Board Segment of the Open Market

of the Berlin Stock Exchange ("BER") and Xetra, the electronic

trading platform of the Frankfurt Stock Exchange ("FSE").

The Company is an investing company, mainly investing in natural

resources and oil and gas projects. The registered office and

principal place of business of the Company is as detailed in

the Company Information section of the report and accounts

on page 2.

The information included in this announcement has been extracted

from the Company's report and accounts and, therefore, references

and page numbers may be incorrect. Shareholders should read

the Company's report and accounts in full which will shortly

be found on its website.

2 PRINCIPAL ACCOUNTING POLICIES

The principal accounting policies adopted in the preparation

of these financial statements are set out below. These policies

have been consistently applied throughout all periods presented

in the financial statements.

As in prior periods, the Group and Parent Company financial

statements have been prepared in accordance with International

Financial Reporting Standards, International Accounting Standards

and interpretations issued by the International Accounting

Standards Board (IASB) UK-adopted International Financial Reporting

Standards (adopted IFRSs). The financial statements have been

prepared using the measurement bases specified by IFRS for

each type of asset, liability, income and expense. The measurement

bases are more fully described in the accounting policies below.

The current period covered by these financial statements is

the year to 31 December 2022. The comparative figures relate

to the year ended 31 December 2021. The financial statements

are presented in pounds sterling (GBP) which is the functional

currency of the Group.

An overview of standards, amendments and interpretations to

IFRSs issued but not yet effective, and which have not been

adopted early by the Group are presented below under 'Statement

of Compliance'.

STATEMENT OF COMPLIANCE

New standards, amendments and interpretations adopted by the

Company

The company has applied the following standards and amendments

for the first time for its annual reporting period after 1

January 2022:

* Amendment to "IFRS 4 "Insurance Contracts - deferral

of IFRS 9" supports the companies implementing the

new IFRS 17 standard and it makes it simpler to

report their financial performances.

* The amendments to IFRS 9, IAS 39, IFRS 7, IFRS 4 and

IFRS 16 "Interest Rate Benchmark Reform - Phase 2"

integrate the amendments made in 2019. The amendments

referred in phase 2, address issues that might affect

financial reporting when an existing interest rate

benchmark is replaced with an alternative benchmark

interest rate (i.e. replacement issue) and assist

companies in the application of IFRS when changes are

made to contractual cash flows or hedging

relationships due to the interest rate reform, and in

providing useful information to users of the

financial statements.

* The Amendment to IFRS 16, "Covid-19-Related Rent

Concessions beyond 30 June 2021" extends the period

of application of the 2020 amendment to IFRS 16,

relative to the lessees' accounting of concessions

granted as a result of Covid-19, by one year.

The adoption of the standards and interpretations described

above, already in effect at the date of this report, did not

have a material impact on the measurement of the Group's assets,

liabilities, costs and revenues.

3 GOING CONCERN

At 31 December 2022, the Group recorded a loss for the year

of GBP2.13m and had net current liabilities of GBP2.13m, after

allowing for cash balances of GBP25k. Production was suspended

at Aje in the year as part of the development and expansion

plans being undertaken at the field.

In 2022 the company raised GBP1.29m through two fund raises.

In May 2023 the Company announced, alongside the acquisition

of Blade V, that it has entered into subscription agreements

to issue secured convertible loan notes ("SCLN") with an aggregate

face value of up to US$1.5 million, of which US$900,000 has

been subscribed for and US$600,000 remaining available for

subscription. The SCLN has a three-year term, an interest rate

payable-in-kind (which maybe settle with cash or non-cash payments)

of 8.0% per annum and the principal together with any interest

due may be converted at any time at a share price of 1.2p per

share.

In addition to the subscriptions, the Company agreed with certain

directors and creditors to convert outstanding contractual

liabilities of GBP683,117 into 56,926,417 new ordinary shares

in the Company at the price of 1.2p per new ordinary share,

helping the company reduce the liabilities on the balance sheet.

Also with the change of management the focus of the company

is now on finding near term producing assets so the company

can start earning revenue. In May 2023 the company announced

the purchase of Blade V which holds an interest across 5 different

wells in USA, all with near term revenue potential. As part

of this deal, the company also has circa $251k available under

its debt facility with OFX.

The Directors have prepared cashflow forecasts for the period

to June 2024 to assess whether the use of the going concern

basis for the preparation of the financial statements is appropriate.

In the short term, between the loan facility, potential revenue

and CLN proceeds the Group does not expect to need short term

funding to meet its liabilities as they fall due however the

group does expect in the period that more funding might be

needed. The Directors have a reasonable expectation based on

past performance and current discussions of support from stakeholders

that additional finance would be available should it be needed.

Accordingly, the directors consider it reasonable to prepare

of the financial statements on the going concern basis.

4 EARNINGS AND NET ASSET VALUE PER SHARE

Earnings

The basic and diluted earnings per share is calculated by dividing

the loss attributable to owners of the Group by the weighted

average number of ordinary shares in issue during the year.

2022 2021

GBP'000 GBP'000

-------------------------------------------- ------------- ------------

Loss attributable to owners of the

Group

- Continuing operations (2,122) (2,540)

--------------------------------------------- ------------- ------------

Continuing and discontinued operations (2,122) (2,540)

--------------------------------------------- ------------- ------------

2022 2021

Weighted average number of shares

for calculating basic and fully diluted

earnings per share 252,369,021 155,014,671

--------------------------------------------- ------------- ------------

2022 2021

pence pence

-------------------------------------------- ------------- ------------

Earnings per share:

Loss per share from continuing and

total operations (0.8) (1.6)

--------------------------------------------- ------------- ------------

The weighted average number of shares used for calculating the

diluted loss per share for 2022 and 2021 was the same as that used

for calculating the basic loss per share as the effect of exercise

of the outstanding share options was anti-dilutive.

Net asset value per share ("NAV")

The basic NAV is calculated by dividing the loss total net

assets attributable to the owners of the Group by the number

of ordinary shares in issue at the reporting date. The fully

diluted NAV is calculated by adding the cost of exercising

any extant warrants and options to the total net assets and

dividing the resulting total by the sum of the number of shares

in issue and the number of warrants and options extant at the

reporting date.

2022 2021

GBP'000 GBP'000

-------------------------------------------- ------------ ------------

Total net assets of the Group 11,208 10,986

Cost of exercise of warrants 1,159 1,318

--------------------------------------------- ------------ ------------

Total net assets for calculation of

fully diluted NAV 12,367 12,304

--------------------------------------------- ------------ ------------

2022 2021

Number of shares in issue at the reporting

date 297,147,530 204,480,863

Number of extant warrants 26,748,410 31,581,012

--------------------------------------------- ------------ ------------

Total number of shares for calculation

of fully diluted NAV 323,895,940 236,061,875

--------------------------------------------- ------------ ------------

2022 2021

-------------------------------------------- ------------ ------------

NAV - Basic (pence per share) 3.8p 5.4p

--------------------------------------------- ------------ ------------

NAV - Fully diluted (pence per share) 3.8p 5.2p

--------------------------------------------- ------------ ------------

5 AGM

The Company will shortly be publishing its Annual Report and

Accounts including a Notice of AGM. These will be made available

on the Company's website at www.admenergyplc.com . The AGM

is to be held at the offices of Shakespeare Martineau, 60 Gracechurch

St, London EC3V 0HR at 10.00 a.m. on 25 July 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FFMLTMTJTBTJ

(END) Dow Jones Newswires

June 27, 2023 02:00 ET (06:00 GMT)

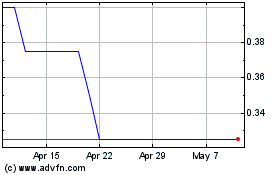

Adm Energy (LSE:ADME)

Historical Stock Chart

From Dec 2024 to Jan 2025

Adm Energy (LSE:ADME)

Historical Stock Chart

From Jan 2024 to Jan 2025