TIDMADME

RNS Number : 9145N

ADM Energy PLC

28 September 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

28 September 2023

ADM Energy plc

("ADM" or the "Company")

Half-yearly Results

ADM Energy plc (AIM: ADME; BER and FSE: P4JC), a natural

resources investing company, announces its half-yearly results for

the six months ended 30 June 2023

Investment Highlights:

Blade Oil V, LLC ("Blade V")

-- Acquired Blade V for $1.6 million, containing five oil

leases, including one in the Midway-Sunset Oilfield, a major US

field

-- Primary focus of portfolio is a 70% working interest in a

three-well drilling programme targeting shallow oil production on

the Altoona Lease

-- Concurrent with the acquisition, ADM issued secured

convertible loan notes ("SCLN") worth up to $1.5 million through

subscription agreements

Aje Field, OML 113

-- ADM continues to work with the Aje Partners to progress

development plans for the Aje Field, including replacement of the

Floating Production Storage and Offloading ("FPSO")

Corporate

-- In April 2023, Appointed Stefan Olivier as CEO, previously

co-founder of MX Oil plc (now ADM Energy plc), and Claudio

Coltellini as Non-executive Director

Stefan Olivier, CEO of ADM Energy, said: "I am pleased with the

progress made since joining as CEO of ADM earlier this year. The

acquisition of Blade V, with a portfolio of highly promising North

American oil and gas assets, can be a cornerstone project for the

Company for years to come. During the period, we have also

significantly reduced costs and restructure the short term debt on

our balance sheet, putting ADM on a more solid footing to build on.

Blade V ties in with our strategy to identify near-term cash

generating opportunities in established oil and gas regions to

strengthen our investment portfolio.

"We are excited to forge ahead with plans to drill three wells

at the Altoona Lease which sits within a major US field, the

Midway-Sunset Oilfield. We continue to work with our partners at

Aje to advance development plans as we believe it can be a core

value enhancing asset within our portfolio. The Board and I see a

great opportunity to enhance ADM's value and look forward to

updating the market as we progress."

Enquiries:

ADM Energy plc +44 20 7459 4718

Stefan Olivier, CEO

www.admenergyplc.com

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Hybridan LLP +44 20 3764 2341

(Broker)

Claire Louise Noyce

ODDO BHF Corporates & Markets AG +49 69 920540

(Designated Sponsor)

Michael B. Thiriot

Gracechurch Group +44 20 4582 3500

(Financial PR)

Harry Chathli, Alexis Gore, Henry Gamble

Operating Review

ADM's strategy focuses on identifying investment opportunities

that are near-term producing assets in proven oil and gas

jurisdictions to enhance our investment portfolio.

Acquisition of Blade V

In May 2023, ADM acquired Blade V from OFX Holdings LLC

(Formerly TN Black Gold, LLC ("OFX") for a total maximum

consideration of US$1,614,000. Blade V owns a portfolio of

interests in oil and gas projects, the primary focus of which is a

70% working interest in a three-well drilling programme targeting

shallow oil production on the Altoona Lease in the Midway-Sunset

Oilfield, Kern County, California. The first drill programme is

expected to commence in Q4 2023 and the board is optimistic that

funding for the project will be requested soon under the previously

announced CLN.

The Midway Sunset Oil Field, the largest in California and third

largest in the U.S., has a history of over 3 billion barrels of oil

production since 1889. Surrounded by Chevron Corporation on three

sides, ADM's Altoona Lease is a direct beneficiary of the

infrastructure and pipelines built to service Chevron's production

in the area. The Altoona Lease is a unique opportunity for ADM to

benefit from substantial investment and de-risking of the target

opportunities by a major company.

Aje

Aje remains a core part of our investment portfolio and the next

steps will be for the JV Partners to agree on the long-term field

development plans for the Aje Field. Discussions with JV partners

are ongoing to replace the current FPSO and unlock the field's vast

wet gas potential estimated at 1.2 trillion cubic feet. Production

remains temporarily paused while the partners agree the development

plans and the Company will update the market in due course.

Barracuda

As previously stated, due to the strategic focus of the Company

on the recent acquisition and potential of Blade V, alongside the

protracted legal proceedings at Barracuda, the Company made the

decision to write off the investment in Barracuda for prudence.

New leadership and board changes

Stefan Olivier was appointed as CEO in April 2023. Stefan has

extensive experience in the oil and gas sector, including as the

co-founder of MX Oil plc, now ADM Energy. Stefan has been on the

Boards of several other public and private companies and brings

years of experience of working in natural resources. He will drive

forward our strategy of building a multi-asset portfolio, as

evidenced in his short time here by the acquisition of Blade V.

In addition, the Board further strengthened to Board with the

appointment of Claudio Coltellini as a Non-executive Director. With

approximately 15 years of investment experience in the U.S. oil and

gas sector, Claudio currently holds the position of CEO in multiple

private U.S. oil and gas companies, each with a focus on

investments in Texas, California, Kansas, and Louisiana. His

extensive expertise positions him perfectly to contribute valuable

insights and guidance as we harness the potential of the Company's

Blade V acquisition.

Financial Review

During the period, the Company significantly reduced

administrative expenses to GBP292,000 year-on-year (H1 2022:

GBP897,000 loss).

Loss for the period decreased 55% to GBP460,000 (H1 2022:

GBP834,000 loss)

On 25 May 2023, the Company announced, alongside the acquisition

of Blade V, that it has entered into subscription agreements to

issue secured convertible loan notes ("SCLNs") with an aggregate

face value of up to US$1.5 million, of which US$900,000 has been

subscribed for and US$600,000 remaining available for subscription.

The SCLN has a three-year term, an interest rate payable-in-kind

(which maybe settle with cash or non-cash payments) of 8.0% per

annum and the principal together with any interest due may be

converted at any time at a share price of 1.2p per share.

In addition to the subscriptions, the Company agreed with

certain directors and creditors to convert outstanding contractual

liabilities of GBP683,117 into 56,926,417 new ordinary shares in

the Company at the price of 1.2p per new ordinary share.

The Company also continues to work with its creditors and larger

shareholders to restructure and refinance its short term

liabilities with structure, medium term debt whilst the Company

looks to develop cash generating assets. Accordingly, the Company

has entered into a loan facility for GBP 125,000 from Catalyse

Capital Ltd on a six month basis, maturing on 1 March 2024, with an

interest rate of 15.0% for the term. The proceeds of the loan will

be used for working capital and business development purposes.

Outlook

The Blade V acquisition has provided ADM with highly prospective

assets including, with Altoona, assets in the third largest

oilfield in the United States. These assets offer an exciting

opportunity to add value, as well as diversifying the ADM

portfolio. We are quickly moving forward with the development of

these assets, having now secured the funding to initiate

development activities at the Altoona Lease. In addition, we have

worked to prudently reduce our costs throughout this period, which

provides us with a stronger footing through the second half of the

financial year.

Our newly strengthened Board and experienced technical team

provide us with the ability to fully exploit the significant

opportunity the acquisition of Blade V represents. Following

geopolitical uncertainty and price volatility that has

characterised the last year, we are now seeing a strengthened

commodity price environment which we expect to continue over the

medium term and are confident that we will be able to utilise our

experience and exciting asset portfolio to grow and bring value to

the Company.

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2023

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

Continuing operations

Revenue - 600 662

Operating costs(1) (78 ) (530) (369)

Administrative expenses (292) (897) (1,723)

Impairment of investment (576)

Consultancy fee income -

Operating loss (370) (827) (2,006)

Movement in fair value of investments - - -

Finance costs (90) (7) (116)

Loss on ordinary activities

before taxation (460) (834) (2,122)

Taxation - - -

Loss for the period (460) (834) (2,122)

--------------------------------------- ----------------- ------------ ------------ -------------

Other Comprehensive income:

Exchange translation movement 3 (484) 1,370 1,339

--------------------------------------- ----------------- ------------ ------------ -------------

Total comprehensive loss for

the period (944) 536 (783)

--------------------------------------- ----------------- ------------ ------------ -------------

Basic and diluted loss per

share 2

From continuing and total operations (0.1)p (0.3)p (0.8)p

--------------------------------------- ----------------- ------------ ------------ -------------

(1) ADM Energy's share of operating costs at asset level

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2023

Exchange

Share translation Retained Total

capital Share premium reserve Other reserves deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- ------------- ------------ -------------- -------- -------

At 1 January 2022 10,267 38,014 (709) 960 (37,546) 10,986

Loss for the year - - - - (834) (834)

Exchange translation

movement - - 1,370 - - 1,370

--------------------- ---------- ------------- ------------ -------------- -------- -------

Total comprehensive

expense for the

year - - 1,370 - (834) 536

Issue of new shares 510 51 - - - 561

Share issue costs - (28) - - - (28)

Issue of convertible

loans 10,267 38,014 (709) 960 (37,546) 10,986

Warrants issued

in settlement of

fees - - - - (834) (834)

At 31 December

2022 11,194 38,090 630 943 (39,649) 11,208

Loss for the period - - - - (460) (460)

--------------------- ---------- ------------- ------------ -------------- -------- -------

Exchange translation

movement - - (484) - - (484)

--------------------- ---------- ------------- ------------ -------------- -------- -------

Total comprehensive

gain for the period - - (484) - (460) (944)

--------------------- ---------- ------------- ------------ -------------- -------- -------

Issue of new shares 726 146 - - - 871

Share issue costs - - - - -

At 30 June 2023 11,920 38,236 146 943 (40,109) 11,135

--------------------- ---------- ------------- ------------ -------------- -------- -------

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

Unaudited Unaudited Audited

30 June 30 June 31 December

Notes 2023 2022 2022

GBP'000 GBP'000 GBP'000

--------------------------------------- ------- -------------- -------------- -------------

NON-CURRENT ASSETS

Intangible assets 17,593 17,970 17,899

Fixed asset investments - 576 -

17,593 18,546 17,899

----------------------------------------------- -------------- -------------- -------------

CURRENT ASSETS

Investments held for trading 28 28 28

Inventory 35 36 36

Trade and other receivables 39 201 22

Cash and cash equivalents 86 127 25

------------------------------------------------ -------------- -------------- -------------

188 392 111

----------------------------------------------- -------------- -------------- -------------

CURRENT LIABILITIES

Trade and other payables 1,322 1,920 2,240

Borrowings 67 289 -

1,389 2,209 2,240

----------------------------------------------- -------------- -------------- -------------

NET CURRENT LIABILITIES (1,201) (1,817) (2,129)

NON-CURRENT LIABILITIES

Convertible loans - - -

Other borrowings 1,072 247 287

Other payables 2,626 2,951 2,718

Decommissioning provision 1,559 1,476 1,557

------------------------------------------------ -------------- -------------- -------------

5,257 4,674 4,562

----------------------------------------------- -------------- -------------- -------------

NET ASSETS 11,135 12,055 11,208

------------------------------------------------ -------------- -------------- -------------

EQUITY

Ordinary share capital 11,920 10,777 11,194

Share premium 38,236 38,037 38,090

Other reserves 971 960 962

Currency translation reserve 135 661 630

------------------------------------------------ -------------- -------------- -------------

Retained deficit (40,126) (38,380) (39,668)

------------------------------------------------ -------------- -------------- -------------

Equity attributable to owners of

the Company and total equity 11,135 12,055 11,208

------------------------------------------------ -------------- -------------- -------------

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2023

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

-------------------------------------------- ---------- ---------- -------------

OPERATING ACTIVITIES

Loss for the period (460) (834) (2,122)

Adjustments for:

Fair value adjustment to investments - - -

Warrants issued in settlement of - -

fees -

Finance costs 90 7 116

Share based payment expense 9 - -

Impairment of intangible assets - - 576

Depreciation and amortisation - - 65

Decommissioning charge 73 65 138

Operating cashflow before working

capital changes (288) (762) (1,227)

(Increase) in inventories 1 - -

(Increase)/decrease in receivables (17) (71) 108

Increase/(decrease) in trade and

other payables (720) 241 138

--------------------------------------------- ---------- ---------- -------------

Net cash outflow from operating activities (1024) (592) (961)

--------------------------------------------- ---------- ---------- -------------

INVESTMENT ACTIVITIES

Proceeds on disposal of investments - - -

Acquisition of subsidiary - - -

Net cash outflow from investment

activities - - -

-------------------------------------------- ---------- ---------- -------------

FINANCING ACTIVITIES

Issue of ordinary share capital 682 561 1,061

Share issue costs - (28) (56)

Proceeds from short term loans 595 170 210

Repayment of borrowings (193) (100) (328)

Net cash inflow from financing activities 1,084 603 887

--------------------------------------------- ---------- ---------- -------------

Net increase/(decrease) in cash

and cash equivalents from continuing

and total operations 60 11 (94)

Exchange translation difference 1 6 9

Cash and cash equivalents at beginning

of period 25 110 110

C ash and cash equivalents at end

of period 86 127 25

--------------------------------------------- ---------- ---------- -------------

NOTES TO THE HALF-YEARLY REPORT

1. The financial information set out in this half-yearly report

does not constitute statutory accounts as defined in section 434 of

the Companies Act 2006. The group's statutory financial statements

for the period ended 31 December 2021, prepared under International

Financial Reporting Standards (IFRS), have been filed with the

Registrar of Companies. The auditor's report on those financial

statements was unqualified and did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006.

The half-yearly financial information has been prepared in

accordance with the recognition and measurement principles of

International Financial Reporting Standards (IFRS) and on the same

basis and using the same accounting policies as used in the

financial statements for the year ended 31 December 2021. The

half-yearly financial statements have not been audited or reviewed

in accordance with the International Standard on Review Engagement

2410 issued by the Auditing Practices Board.

Going concern

At 30 June 2023, the Group recorded a loss for the period of

GBP0.46m and had net current liabilities of GBP1.20m, after

allowing for cash balances of GBP86k. In May 2023 the Company

announced, alongside the acquisition of Blade V, that it has

entered into subscription agreements to issue secured convertible

loan notes ("SCLN") with an aggregate face value of up to US$1.5

million, of which US$900,000 has been subscribed for and US$600,000

remaining available for subscription. The SCLN has a three-year

term, an interest rate payable-in-kind (which maybe settle with

cash or non-cash payments) of 8.0% per annum and the principal

together with any interest due may be converted at any time at a

share price of 1.2p per share. In addition to the subscriptions,

the Company agreed with certain directors and creditors to convert

outstanding contractual liabilities of GBP683,117 into 56,926,417

new ordinary shares in the Company at the price of 1.2p per new

ordinary share, helping the company reduce the liabilities on the

balance sheet. Also with the change of management the focus of the

company is now on finding near term producing assets so the company

can start earning revenue. In May 2023 the company announced the

investment in Blade V which holds an interest across 5 different

wells in USA, all with near term revenue potential.

As part of this deal, the company also has circa $251k available

under its debt facility with OFX.

The Directors have prepared cashflow forecasts for the period to

June 2024 to assess whether the use of the going concern basis for

the preparation of the financial statements is appropriate. In the

short term, between the loan facility, potential revenue and CLN

proceeds the Group does not expect to need short term funding to

meet its liabilities as they fall due however the group does expect

in the period that more funding might be needed. The Directors have

a reasonable expectation based on past performance and current

discussions of support from stakeholders that additional finance

would be available should it be needed. Accordingly, the directors

consider it reasonable to prepare the financial statements on the

going concern basis.

2. Earnings per share

The basic loss per share is calculated by dividing the loss

attributable to equity shareholders by the weighted average number

of shares in issue.

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2022 2022 2022

(unaudited) (unaudited) (audited)

------------------------------------------- ------------------ ----------------------- --------------------

Weighted average number of

shares in the period 333,468,072 249,563,736 252,369,021

------------------------------------------- ------------------ ----------------------- --------------------

Loss from continuing and total

operations (GBP460,000) (GBP834,000) (GBP2,122,000)

Basic and diluted loss per

share:

From continuing and total operations (0.1)p (0.3)p (0.8)p

3. Exchange translation movement

For the 6 months to 30 June 2023, the Group has reported

GBP-0.48m as Other comprehensive income, an exchange translation

movement. This loss has been triggered by the impact of movement in

the currency exchange rates between US dollars and GBP. The Group

is exposed to currency risk to the extent that there is a mismatch

between the currency which assets are held and the Group functional

currency. The functional currency of the Group company is GBP. The

currency in which most assets and liabilities are denominated is US

dollars. Foreign currency transactions are translated into the

functional currency using the exchange rates prevailing at the date

of transactions. Foreign currency monetary assets and liabilities

are translated into the functional currency at the rates of

exchange prevailing at the balance sheet date. Foreign exchange

gains and losses resulting from the settlement of foreign currency

transactions and from the translation exchange rates at 30th June

2023 of monetary assets and liabilities denominated in foreign

currencies, are taken to the income statement

4. No interim dividend will be paid.

5. Copies of the half-yearly report can be obtained from: The

Company Secretary, ADM Energy plc, 60, Gracechurch Street, London,

EC3V 0HR and are available to view and download from the Company's

website: www.admenergyplc.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEFEFWEDSEFU

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

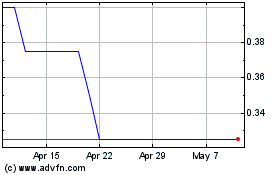

Adm Energy (LSE:ADME)

Historical Stock Chart

From Apr 2024 to May 2024

Adm Energy (LSE:ADME)

Historical Stock Chart

From May 2023 to May 2024