TIDMBBB

RNS Number : 5490K

Bigblu Broadband PLC

29 August 2023

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

Bigblu Broadband plc

('BBB', the 'Group' or the 'Company')

Interim Results

Trading in line with expectations, Operational Improvements

Bigblu Broadband plc (AIM: BBB.L), a leading provider of

alternative super-fast and ultra-fast broadband services, announces

its unaudited interim results for the six months period ending 31

May 2023 (the "Period"). The Company has operations in Australia,

Norway and a residual stake in Quickline Communications

("Quickline").

There was progress across the Company's business units in the

period, with the focus on the introduction of new products and

systems improvements. The Company is therefore well positioned for

the second half of the year.

Financial Highlights

-- Total revenue was GBP15.0m (1H22: GBP14.9m)

-- Adjusted EBITDA(1) increased 2.1% to GBP2.1m (1H22: GBP2.0m)

-- Like for like revenue(2) and adjusted EBITDA growth, on a

constant currency basis increased by 3.1% and 21.4%

respectively

-- Adjusted Free cash inflow(3) of GBP0.2m (1H22: inflow GBP0.4m)

-- Net debt(4) as at 31 May 2023 was GBP0.3m (1H22: Net Cash

GBP4.5m) following the Acquisition in Australia, as well as one off

restructuring payments made in Norway and Central.

Operational Highlights

-- SkyMesh completed the acquisition of the satellite operations

of Harbour ISP PTY LTD, a subsidiary of Uniti Group LTD in

Australia (the "Acquisition") at a cost of c.GBP2.7m which included

net 5.2k customers

-- Total customers at period end were 62.6k (1H22: 60.4k), including the Acquisition

-- The Company has pro-actively undertaken a reorganisation of

the Norwegian business and restructured the central costs within

the business. This has resulted in a reduction in the Norwegian

workforce of approximately 30%, and a reduction of c.75% of our UK

head office. Together bringing annual savings of GBP0.9m

-- In Norway we completed the planned separation of the business

into two legal entities, recognising the different attributes of

each being our satellite and 5G technology business, typically

lower capex, and our infrastructure business, typically higher

capex.

-- Quickline continues to be well supported by Northleaf with an

addressable base of over 350,000 premises at the half year, with

its hybrid Fixed Wireless (FWA) and Full Fibre infrastructure. The

Company retains a 3.1% stake holding following further investment

since the year end with a current carrying value of GBP5.9m.

Northleaf have invested GBP110m in total since they acquired the

majority stake.

1 Adjusted EBITDA is stated before interest, taxation,

depreciation, amortisation, share based payments and exceptional

items. It also excludes property lease costs which, under IFRS 16,

are replaced by depreciation and interest charges.

2 Like for like (LFL) revenue and EBITDA is adjusted for new or

divested businesses in both the current and prior year and adjusts

for constant currency.

3 Adjusted Operating cash flow relates to the amount of cash

generated from the Group's operating activities and is calculated

as follows: Profit/(Loss) before Tax adjusted for Depreciation,

Amortisation, Share Based Payments and adjusting for changes in

Working Capital and non-cash items and excludes items identified as

exceptional in nature. Adjusted Free cash flow being cash

(used)/generated by the Group after investment in capital

expenditure, servicing of debt and payment of taxes and excludes

items identified as exceptional in nature.

4 Cash / Net debt excludes lease-related liabilities of GBP0.9m

of under IFRS 16 (FY22 GBP1.4m).

Andrew Walwyn, Chief Executive Officer of Bigblu Broadband plc,

commented:

"The overall performance of the Group is in line with the

Board's expectations. We are carefully extending our product

offerings with our partners in each region, thereby increasing our

addressable markets, at the same time implementing new systems in

each territory and cutting central headcount / other costs.

We have reorganised our Norwegian business and our Australian

business has completed another important bolt on acquisition. We

continue to develop products and solutions with our network

partners that will enable customers to operate as effectively as

possible, particularly at a time where large numbers of customers

are likely to be working from home, whether full or part time.

Specifically, following the recent acquisitions by SkyMesh in

Australia, the Board believes that its strategy of organic growth

complemented by further bolt-on acquisitions should accelerate the

Company's presence across Australia with the potential to achieve

80,000 customers over the next three years. Furthermore, the Board

continues to assess all options to realise value for shareholders,

including a potential spin out ASX listing, as previously

announced.

The Board remains focused on maximising value and returns for

shareholders. The combination of market dynamics and opportunities

available to our business units provides a backdrop for delivering

enhanced shareholder value."

For further information:

Bigblu Broadband Group PLC www.bbb-plc.com

Andrew Walwyn, Chief Executive Officer Tel: +44 (0)20 7220

Frank Waters, Chief Financial Officer 0500

finnCap (Nomad and Broker) Tel: +44 (0)20 7220

Marc Milmo / Simon Hicks / Charlie Beeson 0500

(Corporate Finance)

Tim Redfern / Harriet Ward (ECM)

About Bigblu Broadband plc

Bigblu Broadband plc (AIM: BBB.L), is a leading provider of

alternative superfast and ultrafast broadband solutions throughout

Australia and Norway. BBB delivers a portfolio of superfast and

ultrafast wireless broadband products for consumers and businesses

typically unserved or underserved by fibre.

High levels of recurring revenue, increasing economies of scale

and Government stimulation of the alternative broadband market in

many countries provide a solid foundation for significant organic

growth as demand for alternative ultrafast broadband services

increases around the world.

BBB's range of solutions includes satellite, next generation

fixed wireless and 4G/5G FWA delivering between 30 Mbps and 500Mbps

for consumers, and up to 1 Gbps for businesses. BBB provides

customers with a full range of services including hardware supply,

installation, pre-and post-sale support, billings, and collections,

whilst offering appropriate tariffs depending on each end user's

requirements.

Importantly, as its core technologies evolve, and more

affordable capacity is made available, BBB continues to offer

ever-increasing speeds and higher data throughputs to satisfy

market demands for broadband services. BBB's alternative broadband

offerings present a customer experience that is broadly similar to

that offered by wired broadband and the connection can be shared in

the normal way with PCs, tablets and smart phones.

CHIEF EXECUTIVE'S REPORT

Overview

The first half of this financial year has been a further period

where we have had to contend with the challenges created by the

global economy and inflationary issues. In the context of these

global challenges, our long-term relationships with our network

partners were vital as we worked together to ensure we could deal

with the growing demand for rural and remote broadband

services.

In early 2023, our fully owned Australian business, SkyMesh PTY

LTD, completed the acquisition of the Satellite operations of

Harbour ISP PTY LTD, a subsidiary of Uniti Group LTD in Australia

(the "Acquisition"). The total cash consideration, including

deferred payments, was AUD$4.72m (GBP2.7m). The cash consideration

was satisfied from existing cash resources including our revolving

credit facilities with Santander. The satellite operations acquired

consisted of net 5.2k customers and in 1H23 contributed GBP0.9m of

revenue, GBP0.3m of EBITDA and GBP0.3m of cash generation. Post

this acquisition the Board continues to explore all options to

realise value for BBB shareholders from SkyMesh, which could

include an ASX listing of SkyMesh.

Key Financials for the continuing operations

Net customer growth after the Acquisition in the first half of

2023 was 3.6% to 62.6k (1H22: 2.6%). There was a big focus on

driving new products, with Telenor 4G/5G FWA in Norway and fixed

line in Australia together with continued marketing campaigns to

migrate c.1k customers to more suitable products which the Board

believe should help to reduce churn in the future.

Total revenue was GBP15.0m, up 0.5% (1H22: GBP14.9m). This

increase in revenue reflected a net increase in customers,

including the acquisition (GBP0.5m) and ARPU progression (GBP0.1m)

but reduced by impact of negative FX rates (GBP0.5m) in the period.

Recurring airtime revenue, defined as revenue generated from the

Company's broadband airtime, which is typically linked to

contracts, was GBP14.0m representing 93% of total revenue (1H22:

95%). Total like-for-like (LFL) revenue for the Continuing Group in

the period was GBP14.6m representing 3.1% growth on a constant

currency basis.

Gross profit margins reduced to 39.0% in 1H23 (1H22: 41.8%), due

to planned product mix changes with the increase in 5G FWA

customers being at slightly lower margins than existing recurring

margins for fixed wireless, but which have a higher lifetime value,

as well as plan switching in Australia.

Overheads, before items identified as exceptional in nature,

reduced to GBP3.8m (1H22: GBP4.2m), representing 25.2% of revenue

(1H22: 28.3%) due in the main to reduced headcount costs of c.9 FTE

(GBP0.4m).

Consequently, adjusted EBITDA for the period increased 2.1% to

GBP2.1m (1H22: GBP2.0m), alongside an adjusted EBITDA margin of

13.8% (1H22: 13.6%). Total like-for-like (LFL) adjusted EBITDA for

the Continuing Group on a constant currency basis in the period was

GBP1.8m (1H22: GBP1.5m) representing 21.4% growth.

Australia

SkyMesh remains the leading Australian satellite broadband

service provider having been named Best Satellite NBN Provider for

the fifth year in succession (2019-2023). SkyMesh commanded a 55

per cent market share of net new adds under the NBN scheme in the

period to 31 May 2023.

SkyMesh ended the period with customer numbers at 55.1k - up

5.9% on the prior year (1H22: 52.0k), which includes the net

customers acquired from Uniti (5.2k) and revenues of GBP12.8m.

Gross margins were c.35% (down c.1% on 1H22) due to the slightly

lower margin from the Harbour customer base acquisition (34%) and

less data packs sold in the period. With new products being

implemented in the second half of the year, as well as price

increases, we expect gross margins to increase to around 36%.

Adjusted EBITDA was in line with prior year at GBP2.2m

supporting both a positive adjusted operating cash inflow of

GBP1.4m and generating a positive adjusted underlying free cash

flow before group transfers of GBP1.2m.

The acquisition of customers from Harbour continues SkyMesh's

strategy of expanding its presence across Australia.

The Board believes that it can continue to complement organic

growth opportunities by accretive acquisitions and partnerships

that could accelerate the Company's presence across Australia.

The emergence of 5G and LEO satellite technologies has

accelerated the uptake of non-fibre broadband internet services in

Australia. Starlink has continued to target our market with strong

promotional offers which continue to impact current churn rates,

and we are monitoring such promotion and marketing activity. We

believe we can counter such challenges to the business by expanding

our product offerings to increase our addressable market. In this

regard and working with our network partners, c.25% of the base has

been transferred to new product offerings from NBN Co, and although

early, we are seeing far higher customer satisfaction and reduced

churn.

Norway

Our Norwegian business ended 1H23 with customer numbers of 7.5k

(1H22: 8.4k) and underlying churn has reduced to 12.1% (1H22:

16.7%).

Revenues remained in line with prior year at GBP1.9m. Gross

margin decreased in line with expectations to a blended 55.0%

(1H22: 62.3%) with lower margins in our Satellite base of 46.2%

(1H22: 47.5%), our 4G/5G FWA base of 57.3% (1H22: 59.2%) and our

fixed wireless base of 66.0% (1H22: 67.2%). The 4G/5G FWA revenue

stream continues to strengthen and is now contributing in excess of

70% of net new customers and revenue on a monthly basis.

Adjusted EBITDA for Norway was GBP0.2m (1H22: GBP0.5m), Adjusted

operating cash was an inflow of GBP0.4m (1H22: Outflow GBP0.6m) and

adjusted underlying free cash flow was an inflow of GBP0.2m (1H22:

Outflow GBP1.1m) following capital expenditure of GBP0.2m.

The Company has pro-actively undertaken a reorganisation and

restructuring of our Norwegian business and consequently reduced

the workforce by approximately 30%, with an annualised cost saving

going forward of c.GBP0.5m

The Directors consider that each of the remaining business units

in Australia and Norway are progressing in line with expectations;

product offerings are being widened, increasing the addressable

markets, and costs reduced. The Directors are carefully balancing

new initiatives with the desire to realise shareholder value.

Specifically

Strategy

The demand for our products has increased with an element of

home working in the countries we operate being the norm, and the

consequential need for faster broadband solutions to the home.

Whilst recognising the pressure on individuals and companies'

disposal income and profits, we believe that the solution set the

Group offers its customers is important and a necessary utility

cost.

The Directors consider that, each of the remaining business

units in Australia and Norway are progressing in line with

expectations in terms of, carefully widening product offerings and

therefore addressable markets, reducing costs. The Directors are

carefully balancing new initiatives with the desire to realise

shareholder value. Specifically

-- For the SkyMesh business in Australia, the Board believes

that it could complement organic growth opportunities by additional

acquisitions that could accelerate the Company's presence across

Australia's addressable market. As noted previously, the Board

believes the business has the potential to achieve 80,000 customers

in the region over the next three years through organic and

acquisitive growth. Post the recent acquisition the Board continues

to explore all options to realise value for BBB shareholders from

SkyMesh including an ASX listing.

-- Norway is showing early signs of stabilising, but we

recognise the importance of limiting further cash requirements.

Current Trading and Outlook

During the period to 31 May 2023, the Company continued to grow

its customer base while still benefiting from the strong visibility

afforded by the high percentage of recurring revenues. This will

prove to be key to the Group as we seek to maximise shareholder

value from our Australian and Norwegian businesses.

The Board will continue to consider such opportunities as they

arise including, but not limited to, capitalising on organic growth

and considering acquisition targets in Australia to further

solidify our position in the region, create scale and at the same

time reigniting our Norway operation with a smaller, more

profitable footprint, reduced churn and new product offerings to

our customers.

In the current environment, part of our continued growth, and

improvement year on year, is satisfying the increased demand for

high-speed broadband in rural areas as more and more employees work

from home. We closely monitor a number of KPIs daily that impact on

the businesses, to ensure that the economic pressures faced by our

customers and suppliers don't materially impact our operations and

financial performance. These KPIs include customer sales,

activations, churn, customers inflight, FOREX, cash and stock

levels.

Following typical seasonal trends, we expect a positive second

half and remain comfortable with financial market expectations for

the current year.

Andrew Walwyn

CEO

FINANCIAL REVIEW

This financial review describes the performance of the Company

during the Period.

Total customers at the Period end for the Group were c.62.6k

(1H22: c.60.4k). During the period the Company had gross adds of

7.5k, (1H22: 8.5k) and underlying churn of 8.2k (1H22: 7.5k) giving

c.0.7k net organic churn (1H22: net organic adds c.1.0k). In

addition, there were net 5.2k customers acquired with the

acquisition of Harbour satellite customers. The exceptional churn

c.1.3k (1H22: c.1.6k) resulted in the main from demounting

equipment on Norwegian masts that are no longer profitable. This is

summarised as follows:

Unaudited Unaudited Audited

As at As at As at

31-May-23 31-May-22 30-Nov-22

Opening base 59.4 58.8 58.8

---------- ---------- ----------

Gross Additions (1) 7.5 8.5 16.7

Churn - Underlying

(2) (8.2) (7.5) (16.5)

Migrated / Switched

out (3) (1.0) (4.0) (9.0)

Migrated / Switched

in (3) 1.0 4.0 9.0

---------- ---------- ----------

Underlying Net Additions

/ (Churn) (0.7) 1.0 0.2

Acquisition 5.2 2.2 2.2

---------- ---------- ----------

Net Additions 4.5 3.2 2.4

Churn - Exceptional(4) (1.3) (1.6) (1.8)

Net growth 3.2 1.6 0.6

---------- ---------- ----------

Closing Base 62.6 60.4 59.4

---------- ---------- ----------

(1) Customers where orders have been received but not activated

(0.5k) and Customers who have taken a contract out and commenced

service (7.0k)

(2) Underlying churn is where customers have cancelled their

contract

(3) Customers who have been specifically targeted to switch

their contract and renew with a new product and contract

(4) Exceptional churn is where we or a customer cancels their

contract due to uncontrollable circumstances impacting their

service such as cyber event and demounting

Significant focus in 1H23 was on launching 4G/5G FWA services in

Norway and "right sizing" the business across all territories.

Total Churn (defined as the number of subscribers who discontinue

their service as a percentage of the average total number of

subscribers within the period, including the exceptional churn),

increased slightly to an average annualised churn rate of 32.3%

(Excluding exceptional churn 28.3%) in 1H23 from 30.7% in 1H22

(Excluding exceptional churn 25.3%). The main areas of exceptional

churn were the continued demounting of loss making fixed wireless

customers in Norway.

Total revenue increased 0.5% to GBP15.0m (1H22: GBP14.9m). This

reflects the higher customer numbers (GBP0.5m) and increased

underlying ARPU (GBP0.1m), reduced by currency movement (GBP0.5m).

ARPU improved from GBP40.64 to GBP40.88 as we sought to offer

better packages to customers, more appropriate to increasing

demands for speed and data, with increased revenue from services

and installations. Importantly Like for like revenue in the period

increased 3.1% to GBP14.6m (1H22: GBP14.1m).

The sales revenue mix across the Company at the end of the

period was c.75% Satellite, c.21% Fixed Wireless and 4% 4G / 5G FWA

(1H22: c.76% Satellite, c.22% Fixed Wireless and 2% 4G / 5G

FWA).

Gross margin was lower due to the product mix associated with

the introduction of 5G FWA products in Norway and the gross margin

from the Harbour acquisition slightly lower than the existing run

rate in Australia. Overheads reduced GBP0.4m (10.4%) on 1H22, due

to lower staff costs following the Group restructuring.

Depreciation reduced in the period to GBP0.7m (1H22: GBP1.0m)

following the write down of fixed assets in Norway at last year

end.

Amortisation of intangible assets increased to GBP0.8m (1H22:

GBP0.2m), due to the customer contracts acquired with Clear

(GBP0.3m) and Harbour (GBP0.5m), which are being amortised over 24

months.

The Company incurred charges identified as exceptional in nature

during the period of GBP2.3m (1H22 GBP0.9m), including costs

related to internal restructuring/redundancy (GBP1.3m), legal and

related costs associated with acquisition and disposal activities

(GBP0.4m), system costs (GBP0.5m) and other costs deemed

exceptional to ordinary activities (GBP0.1m).

Interest costs increased during the period to GBP0.1m (1H22:

GBP0.1m) as a result of a draw down of the revolving credit

facility in 1H23 of GBP2.1m to support M&A activity, working

capital and the restructuring costs.

Unaudited Unaudited Audited

As at As at As at

31 May 31 May 30 Nov

2023 2022 2022

GBP000 GBP000 GBP000

Underlying Interest 100 18 78

Interest element of lease

payments 17 34 46

Reported Interest 117 52 124

---------- ---- ------- ---------

Statutory Results and EBITDA Reconciliation

Adjusted EBITDA (before share based payments and exceptional

items) for the half year increased 2.1% to GBP2.1m (1H22: GBP2.0m).

A reconciliation of the adjusted EBITDA to statutory operating loss

of GBP1.7m (1H22: GBP0.1m loss) and to adjusted PAT of GBP1.2m

(1H22: GBP0.5m profit) is shown below:

Unaudited 6 months to 31 Unaudited 6 months to 31 Audited 12 months to 30

May 2023 May 2022 November 2022

GBP000 GBP000 GBP000

Adjusted EBITDA 1 2,062 2,020 5,101

Depreciation 2 (688) (979) (2,076)

Impairment of Fixed Assets 2 - - (966)

Amortisation 3 (808) (188) (702)

--------------------------- --------------------------- ---------------------------

Adjusted EBIT 566 853 1,357

Share based payments - (154) (309)

--------------------------- --------------------------- ---------------------------

Continuing Operations

operating profit -

pre-exceptional items 566 699 1,048

Exceptional items 4 (2,272) (830) (2,707)

--------------------------- --------------------------- ---------------------------

Continuing Operations

Statutory operating loss

- post exceptional items (1,706) (131) (1,659)

--------------------------- --------------------------- ---------------------------

Adjusted EBIT 566 853 1,357

Underlying interest (117) (52) (124)

Tax charge (91) (330) (1,031)

Impairment of Fixed Assets - - 966

Amortisation 808 - 702

Deferred taxation

adjustment in Norway - - 714

--------------------------- --------------------------- ---------------------------

Continuing Adjusted PAT 1,166 471 2,584

--------------------------- --------------------------- ---------------------------

Company

1) Adjusted EBITDA (before share based payments, depreciation,

intangible amortisation, acquisition, employee related costs, deal

related costs, and start-up costs) was GBP2.1m (1H22: GBP2.0m).

2) Depreciation reduced to GBP0.7m in 1H23 from GBP1.0m in 1H22,

following the impairment of fixed assets in Norway at the year

end.

3) Amortisation of intangible assets increased to GBP0.8m (1H22:

GBP0.2m), due to the customer contracts acquired with Clear

(GBP0.3m) and Harbour (GBP0.5m) being amortised over 24 months.

4) The Company incurred expenses in the period that are

considered exceptional in nature and appropriate to identify. These

comprise:

a. GBP1.3m (1H22: GBP0.1m) employee termination and redundancy

costs where internal restructuring has occurred.

b. GBP0.4m (1H22: GBP0.5m) of net acquisition, deal, legal and

other costs relating to M&A activities and fundraising during

the period. These costs comprise mainly professional and legal fees

associated with the Harbour acquisition.

c. System development related costs of GBP0.5m (1H22: GBPnil).

d. GBP0.1m of other one-off costs (1H22: GBP0.2m)

Total Revenue and Adjusted EBITDA in 1H23 and the comparative

period is analysed as follows:

Revenue Adjusted EBITDA(2)

----------------------------------------- ----------

Unaudited Unaudited Audited Unaudited Unaudited Audited

6 months 6 months 12 months 6 months 6 months 12 months

to to to to to to

31 May 31 May 30 Nov 31 May 31 May 30 Nov

2023 2022 2022 2023 2022 2022

GBPm GBPm GBPm GBPm GBPm GBPm

Australia 12.8 12.6 26.5 2.2 2.2 5.0

Norway 1.9 1.9 4.0 0.2 0.5 1.0

------------------- -------------------- ----------- ---------- ---------- -----------

Pre-Central 14.7 14.5 30.5 2.4 2.7 6.0

Central Revenue

and Costs(1) 0.3 0.4 0.7 (0.3) (0.7) (0.9)

Total 15.0 14.9 31.2 2.1 2.0 5.1

------------------- -------------------- ---------- ----------

(1) Central costs include finance, IT, marketing and plc

costs

(2) Adjusted EBITDA includes the impact of adoption of

IFRS16

The Company's total customer base of c.62.6k as at 31 May 2023

(1H22: c.60.4k) was split as follows: Australia: 87% (1H22: 86%),

Norway: 13% (1H22: 14%).

The year-on-year analysis from both a revenue and EBITDA

perspective is explained as follows:

Australia

-- Revenue increased from GBP12.6m to GBP12.8m and is analysed as follows

o increase in revenue following customer acquisition from

Harbour - GBP0.9m

o decrease in revenue from net underlying Churn - (GBP0.2m)

o impact of currency reduced revenue - (GBP0.5m)

-- Adjusted EBITDA remained constant year-on-year at GBP2.2m and is analysed as follows

o Increase following acquisition - GBP0.3m

o Reduced GM% from 36% to 35% - (GBP0.4m)

o Cost reductions positive impact GBP0.1m

Norway

-- Revenue is in line with prior half year at GBP1.9m and is analysed as follows

o decrease due to the cyber-attack last year impacting 1.3k

customers - (GBP0.3m)

o fixed wireless decreased by mainly due to the demounting of

identified loss-making masts in period - (GBP0.1m)

o Revenue in 5G increased - GBP0.4m

-- Adjusted EBITDA decreased from GBP0.5m in 1H22 to GBP0.2m in

1H23 and is analysed as follows

o Reduction following cyber-attack and demounting -

(GBP0.3m)

o Increased from 5G - GBP0.1m

o Reduced GM% from 62% to 55% - (GBP0.5m)

o Cost reductions positive impactGBP0.4m

Central

-- Revenue reduced from GBP0.4m to GBP0.3m

o Due to a reduction in services to third parties -

(GBP0.1m)

-- Adjusted EBITDA improved from a loss of GBP0.7m to a loss of GBP0.3m

o Reduced from impact of lower revenue - (GBP0.1m)

o Cost reductions with positive impact GBP0.5m

Cash Flow Analysis:

Underlying Cashflow performance

The underlying cash flow performance analysis seeks to clearly

identify underlying cash generation within the Company and

separately identify the cash impact of M&A activities,

identified exceptional items and the treatment of IFRS 16 and is

presented as follows:

Unaudited Unaudited Audited

6 months 6 months 12 months

to to to

31 May 2023 31 May 2022 30 Nov 2022

GBP000 GBP000 GBP000

Adjusted EBITDA 2,062 2,020 5,101

Underlying movement of working capital 1 (870) (1,314) 777

Forex and non-cash 2 (556) 595 (113)

------------- ------------- -------------

Underlying operating cash flow before interest, tax, Capex and

exceptional items 3 636 1,301 5,765

Tax and interest paid 4 (208) (382) (663)

Purchase of Assets 5 (216) (526) (1,432)

------------- ------------- -------------

Underlying free cash flow before exceptional and M&A items 212 393 3,670

Exceptional items 6 (1,500) 448 (2,707)

Investing activities 7 (2,621) (1,192) (1,154)

Movement in cash from discontinued operations 8 - - (120)

Proceeds from Loans 9 2,100 - -

Financing activities 10 (634) (308) (695)

------------- ------------- -------------

Decrease in cash balance (2,443) (659) (1,006)

------------- ------------- -------------

1) Underlying movement in working capital was an outflow of

GBP0.9m (1H22: outflow GBP1.3m), an improved working capital

position of GBP0.4m due in the main to

o an decrease in Trade & Other Receivables GBP0.6m

o a reduction in Trade Payables (GBP1.1m)

o lower inventory GBP0.6m

o and improved working capital movements GBP0.3m

2) Forex and non-cash outflow of GBP0.6m (1H22: inflow GBP0.6m)

relate to the exchange movement in the Consolidated Statement of

Comprehensive Income and the Consolidated Statement of Financial

Position (GBP0.5m) where AUD and NOK values are translated to GBP

for the Group reporting currency, as well as costs/income which

have no impact on operating cashflow (GBP0.1m).

3) This resulted in an underlying operating cash flow before

Interest, Tax, Capital expenditure and Exceptional items of GBP0.6m

(1H22: GBP1.3m inflow) and an underlying operating cash flow to

EBITDA conversion of 30.9% (1H22: 64.4%).

4) Tax and interest paid was GBP0.2m (1H22: GBP0.4m). Tax paid

relates to the prepayment in Australia on the monthly revenue

(GBP0.1m), with the interest element being the fee on the undrawn

and drawn funds from the RCF

5) Purchases of assets were GBP0.2m (1H22 GBP0.5m). These relate

to Norwegian 5G FWA stock capitalised (GBP0.2m).

This resulted in an underlying Free Cash inflow before

exceptional items, M&A activities and financing activities in

the period of GBP0.2m (1H22: inflow GBP0.4m) and an underlying free

cash flow to EBITDA conversion of 74.4% (1H22: (10.0%)). Excluding

the currency translational impact this would have been an

underlying operating cash flow to EBITDA conversion of 95.1% (1H22:

34.9%).

6) Exceptional items of GBP1.5m (1H22: Inflow GBP0.4m) covers

completion payments (GBP0.1m) in respect of earlier M&A

activity, staff restructuring/redundancy costs in Norway (GBP0.4m)

and central (GBP0.5m), disposals and acquisitions (GBP0.2m) and

others (GBP0.3m).

7) Investing activities included the purchase of Uniti of

GBP2.7m (1H22: purchase of Clear Networks for GBP1.2m)

8) There were no operations discontinued during 1H23 (1H22: GBPnil).

9) Proceeds from the RCF facility with Santander.

10) In 1H23 the financing activities related to the principal

element of lease payments of GBP0.6m (1H22: GBP0.3m).

Statutory Cash flow Analysis

Underlying operating cash inflow was GBP0.6m in 1H23 (1H22:

Inflow of GBP1.3m).

Tax and interest paid increased to GBP0.2m in 1H23 from GBP0.4m

in 1H22, covering the monthly corporation tax payments on account

in Australia as well as interest payments.

The net summary of the above is an equity free cash inflow of

GBP0.2m in 1H23 (1H22: GBP0.4m inflow) which is summarised as

follows:

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

31 May 31 May 30 Nov

2023 2022 2022

GBP000 GBP000 GBP000

Underlying Operating Cash Flows(1) 636 1,301 5,765

Purchase of assets (216) (526) (663)

Interest and Tax (208) (382) (1,432)

------------- ------------- --------------

Equity free cash flow inflow 212 393 3,670

------------- ------------- --------------

Underlying Operating cash flow analysis - Underlying Operating Cash

Flow /Adjusted EBITDA 30.9 % 64.4% 113.0%

Underlying Operating cash flow analysis - Adjusted for currency -

Underlying Operating Cash

Flow (currency adjusted) /Adjusted EBITDA 95.1 % 34.9% 115.2%

Underlying Free cash flow analysis - Adjusted for currency -

Underlying Free Cash Flow (currency

adjusted) /Adjusted EBITDA 74.4 % (10.0%) 74.1%

(1) Underlying Operating Cash flows is before interest, tax and

exceptional items relating to M&A, integration costs and

investment in network partnerships

Net Cash / (debt) comprises:

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

31 May 31 May 30 Nov

2023 2022 2022

GBP000 GBP000 GBP000

Cash 1,752 4,542 4,195

Debt (2,100) - -

------------- ------------- --------------

Net Cash / (Debt) (348) 4,542 4,195

------------- ------------- --------------

In the last twelve months (LTM) period, comparing 1H23 with

1H22, cash decreased by cGBP2.8m to GBP1.8m, from GBP4.5m,

excluding IFRS 16 liabilities. Along with the drawdown from the RCF

this results in a net debt position of GBP0.3m (1H22: GBPnil).

In the LTM period, we generated cash inflows of GBP5.1m, and

this was utilised as follows;

- investment in fixed assets of GBP1.1m

- purchase of intangibles GBP2.7m

- interest and tax GBP0.5m

- and other working capital elements GBP0.8m.

The table above excludes the lease liabilities of GBP0.9m

relating to IFRS 16 (1H22: GBP1.4m). Including this amount would

give a total net debt of GBP1.2m (1H22: net cash GBP3.1m).

Balance Sheet

Non-current assets have decreased in the last 12 months by

GBP1.1m to GBP17.1m (1H22: GBP18.2m) and are analysed as

follows

- Increased due to the acquisition of customer contracts from Harbour (Uniti) GBP2.7m

- Decreased by depreciation in the year (GBP2.7m)

- Decreased by amortisation in the year (GBP1.3m)

- Increased due to currency translation GBP0.2m

Capital expenditure in 1H23 was GBP0.2m (1H22: GBP0.5m) relate

to Norwegian 5G FWA stock capitalised.

Intangible Assets of GBP8.7m comprise Goodwill and other

intangibles (1H22: GBP7.9m). Of the increase of GBP0.8m,

- GBP2.7m relates to the customer acquisition by SkyMesh of the Harbour customer base,

- offset by a reduction in deferred consideration payments of GBP0.5m and

- amortisation of GBP1.4m.

Working Capital

Inventory days decreased to 19 days (1H22: 31 days) due to stock

sold to support the increasing 5G FWA sales in Norway.

Debtor days increased to 14 days (1H22: 10 days) due to delayed

collections associated with the Harbour acquisition and transfer of

base.

Creditor days decreased to 64 days (1H22: 87 days) due to cash

being used to improve our credit position with our suppliers,

specifically in our Norwegian business.

Total net debt, excluding lease liabilities, increased in the

year to GBP0.3m (FY22: Net cash GBP4.5m) and is explained further

in the Cash Flow Analysis section.

Statutory EPS and Adjusted EPS for total company including

discontinued operations

Statutory EPS loss per share increased to 3.3p from 1.1p.

Statutory EPS Pence

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

31 May 31 May 30 Nov

2023 2022 2022

Basic EPS attributable to ordinary shareholders (3.3) (1.1) (5.0)

Diluted EPS from continuing operations (3.3) (0.9) (4.8)

Statutory basic EPS shows a loss of 3.3p (1H22: Loss 1.1p).

Diluted EPS increased to a loss of 3.3p (1H22: Loss 0.9p).

Frank Waters

CFO

Bigblu Broadband plc

Consolidated statement of comprehensive income

6 months ended 31 May 2023

Note

Unaudited Unaudited Audited

6 months 6 months to 12 months

to 31 May to

31 May 2022 30 Nov

2023 2022

GBP000 GBP000 GBP000

Revenue 14,965 14,894 31,220

Cost of goods sold (9,131) (8,662) (18,121)

------------ -------------- ------------

Gross Profit 5,834 6,232 13,099

Distribution and administration expenses 2 (6,044) (5,196) (11,014)

Depreciation (688) (979) (3,042)

Amortisation (808) (188) (702)

Operating Loss (1,706) (131) (1,659)

Interest Payable (117) (52) (124)

Loss before Tax (1,823) (183) (1,783)

Taxation charge (91) (330) (1,031)

------------ -------------- ------------

Loss from continuing operations (1,914) (513) (2,814)

Loss from discontinued operations - (101) (120)

------------ -------------- ------------

Loss for the period (1,914) (614) (2,934)

Foreign currency translation difference (570) 226 206

------------ -------------- ------------

Total comprehensive expense for the period (2,484) (388) (2,728)

------------ -------------- ------------

(Loss) / Profit per share

Total - Basic EPS 3 (3.3p) (1.1p) (5.0p)

Total - Diluted EPS 3 (3.3p) (1.1p) (5.0p)

Continuing operations - Basic EPS 3 (3.3p) (0.9p) (4.8p)

Continuing operations - Diluted EPS 3 (3.3p) (0.9p) (4.8p)

Discontinued operations - Basic EPS 3 - (0.2p) (0.2p)

Discontinued operations - Diluted EPS 3 - (0.2p) (0.2p)

Adjusted earnings per share from continuing operations

Total - Basic EPS 3 2.0p 0.8p 4.4p

Total - Diluted EPS 3 2.0p 0.8p 4.4p

Bigblu Broadband plc

Consolidated statement of financial position

As at 31 May 2023

Note Unaudited Unaudited Audited

As at As at As at

31 May 31 May 2022 30 Nov

2023 2022

GBP000 GBP000 GBP000

Non-Current Assets

Intangible assets 8,730 7,880 7,433

Property Plant and Equipment 2,209 3,879 2,881

Investments 5,911 5,750 5,830

Deferred Tax asset 282 717 303

---------

Total Non-Current Assets 17,132 18,226 16,447

---------- ------------- ---------

Current Assets

Inventory 937 1,577 1,142

Trade Debtors 1,215 851 773

Other Debtors 431 1,354 1,562

Cash and Cash Equivalents 1,752 4,542 4,195

Total Current Assets 4,335 8,324 7,672

---------- ------------- ---------

Current Liabilities

Trade Payables (3,242) (4,364) (4,223)

Recurring Creditors and Accruals (2,326) (2,958) (2,363)

Other Creditors (54) (991) (534)

Payroll taxes and VAT (587) (359) (924)

Lease liabilities (633) (487) (795)

Provisions for liabilities

and charges (685) (685) (685)

Total Current Liabilities (7,527) (9,844) (9,524)

---------- ------------- ---------

Non-Current Liabilities

Loans and debt facilities (2,100) - -

Lease liabilities (300) (865) (559)

Deferred taxation (601) (288) (646)

---------- ------------- ---------

Total Non-Current Liabilities (3,001) (1,153) (1,205)

---------- ------------- ---------

Total Liabilities (10,528) (10,997) (10,729)

---------- ------------- ---------

Net Assets 10,939 15,553 13,390

---------- ------------- ---------

Equity

Share Capital 8,777 8,755 8,763

Share Premium 8,608 8,589 8,589

Other Reserves 4 19,777 20,178 20,347

Revenue Reserves (26,223) (21,969) (24,309)

---------- ------------- ---------

Total Equity 10,939 15,553 13,390

---------- ------------- ---------

Bigblu Broadband plc

Consolidated Cash Flow Statement

6 months ended 31 May 2023

Unaudited Unaudited Audited

6 months 6 months 12 months

ended ended ended

31 May 2023 31 May 2022 30 Nov

2022

GBP000 GBP000 GBP000

Loss after tax from Continuing operations (1,914) (513) (2,814)

(Loss)/Profit after tax from Discontinued

operations - (101) (120)

------------ ------------ ------------

(Loss)/Profit for the year including

Discontinued operations (1,914) (614) (2,934)

Interest 117 52 124

Taxation 91 330 1,031

Amortisation of intangible assets 808 188 702

Depreciation of property, plant and

equipment - owned assets 424 699 2,281

Depreciation of property, plant and

equipment - ROU assets 264 280 761

Share based payments - 154 309

Foreign exchange variance and other

non-cash items (556) 595 (102)

Movement in working capital (217) (2,879) (2,021)

------------ ------------ ------------

Operating cash flows after movements

in working capital (983) (1,195) 151

Interest paid (117) (52) (124)

Tax paid (91) (330) (539)

------------ ------------ ------------

Net cash generated/(used) in operating

activities (1,191) (1,577) (512)

Investing activities

Purchase of property, plant and equipment (216) (526) (1,191)

Purchase of intangibles and investments (2,621) (1,091) (1,452)

Payment of deferred consideration (310) - -

Proceeds from sale of subsidiary - 2,843 2,843

------------ ------------ ------------

Net cash generated / (used) in investing

activities (3,147) 1,226 200

------------ ------------ ------------

Financing activities

Proceeds from issue of ordinary share

capital 36 6 14

Loans drawn down 2,100 - -

Principal elements of lease payments (241) (314) (708)

------------ ------------ ------------

Cash generated/(used) from financing

activities 1,895 (308) (694)

------------ ------------ ------------

Net increase / (decrease) in cash and

cash equivalents (2,443) (659) (1,006)

Cash and cash equivalents at beginning

of period 4,195 5,201 5,201

Cash in disposal group held for sale - - -

------------ ------------ ------------

Cash and cash equivalents at end of

period 1,752 4,542 4,195

------------ ------------ ------------

Bigblu Broadband plc

Condensed consolidated Reserves Movement

6 months ended 31 May 2023

Share

Capital Share Premium Other Reserves Revenue Reserve Total

GBP000 GBP000 GBP000 GBP000 GBP000

Note 4

--------- -------------- --------------- ---------------- -----------

At 31 May 2022 8,755 8,589 20,178 (21,969) 15,553

--------- -------------- --------------- ---------------- -----------

Profit for the

period - - - (2,320) (2,320)

Issue of shares 8 - - - 8

Share option

reserve - - 155 - 155

Foreign Exchange

Translation - - 14 (20) (6)

At 30 November

2022 8,763 8,589 20,347 (24,309) 13,390

Loss for the

period - - - (1,914) (1,914)

Issue of shares 14 19 - - 33

Foreign Exchange

Translation - - (570) - (570)

--------- -------------- --------------- ---------------- -----------

At 31 May 2023 8,777 8,608 19,777 (26,223) 10,939

--------- -------------- --------------- ---------------- -----------

Bigblu Broadband plc

Notes to the financial statements

For the period ended 31 May 2023

1. Presentation of financial information and accounting

policies

Basis of preparation

The condensed consolidated financial statements are for the half

year ending 31 May 2023.

The nature of the Company's operations and its principal

activities is the provision of last mile (incorporating Satellite

and Wireless) broadband telecommunications and associated / related

services and products.

The Company prepares its consolidated financial statements in

accordance with International Accounting Standards ("IAS") and

International Financial Reporting Standards ("IFRS") as adopted by

the UK. The financial statements have been prepared on the

historical cost basis, except for the revaluation of financial

instruments.

The preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of policies and reported amounts in the

financial statements. The areas involving a higher degree of

judgement or complexity, or areas where assumptions or estimates

are significant to the financial statements are disclosed further.

The principal accounting policies set out below have been

consistently applied to all the periods presented in these

financial statements, except as stated below.

Going concern

The Company's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Chief Executive Report. The financial position

of the Company, its cash flows and liquidity position are described

in the Finance Review.

As at 31 May 2023 the Company generated an adjusted EBITDA

before exceptional items in the Consolidated statement of financial

position, of GBP2.1m (1H22: GBP2.0m), and with cash inflow from

operations of GBP0.6m (1H22: inflow of GBP1.3m) and a net decrease

in cash and cash equivalents of GBP2.8m in the year (1H22: increase

GBP0.4m). The Company balance sheet showed net debt at 31 May 2023

of GBP0.3m (1H22: net cash GBP4.5m). Having reviewed the Company's

budgets, projections and funding requirements, and taking account

of reasonable possible changes in trading performance over the next

twelve months, particularly in light of the current global economy

situation and counter measures, the Directors believe they have

reasonable grounds for stating that the Company has adequate

resources to continue in operational existence for the foreseeable

future.

The Board has concluded that no matters have come to its

attention which suggest that the Company will not be able to

maintain its current terms of trade with customers and suppliers or

indeed that it could not adopt relevant measures as outlined in the

Strategic report to reduce costs and free cash flow. The latest

management information in terms of volumes, debt position and ARPU

are showing a positive position compared to prior year and current

forecasts. The forecasts for the combined Company projections,

taking account of reasonably possible changes in trading

performance, indicate that the Company has sufficient cash

available to continue in operational existence throughout the

forecast year and beyond. The Board has considered various

alternative operating strategies should these be necessary and are

satisfied that revised operating strategies could be adopted if and

when necessary.

Furthermore, the continuing arrangements with key banking

partners gives the Board further comfort on the going concern

concept.

As a consequence, the Board believes that the Company is well

placed to manage its business risks, and longer-term strategic

objectives, successfully.

Estimates and judgments

The preparation of a condensed set of financial statements

requires management to make judgments, estimates and assumptions

about the carrying amounts of assets and liabilities at each period

end. The estimates and associated assumptions are based on

historical experience and other factors that are considered to be

relevant. Actual results may differ from these estimates. The

estimates and underlying assumptions are reviewed on an ongoing

basis.

In preparing this set of consolidated financial statements, the

significant judgments made by management in applying the Company's

accounting policies and the key sources of estimating uncertainty

were principally the same as those applied to the Company's

financial statements for the year ended 30 November 2022.

Basis of consolidation

The condensed consolidated financial statements comprise the

financial statements of Bigblu Broadband plc and its controlled

entities. The financial statements of controlled entities are

included in the consolidated financial statements from the date

control commences until the date control ceases. The financial

statements of subsidiaries are prepared for the same reporting

period as the parent company, using consistent accounting policies.

All inter-company balances and transactions have been eliminated in

full.

2. Distribution and Administration Expenditure

Distribution and administration costs are analysed as

follows:

Unaudited Unaudited Audited

As at As at As at

31 May 2023 31 May 2022 30 Nov 2022

GBP000 GBP000 GBP000

Employee related costs 2,160 2,608 5,164

Marketing and communication

costs 720 711 1,339

Finance, Legal, IT, banking,

insurance, logistics, domains

AIM and Other costs 892 893 1,495

--------------------------------------- ------------ ------------- -------------

Underlying costs 3,772 4,212 7,998

% of Revenue 25.2% 28.3% 25.6%

--------------------------------------- ------------ ------------- -------------

Share based payments - 154 309

Professional and legal related

costs associated with corporate

activity and restructuring /

redundancy costs 2,272 830 2,707

Identified Exceptional Costs 2,272 984 3,016

% of Revenue 15.2% 6.6% 9.6%

Total 6,044 5,196 11,014

---------------------------------- ----------------- ------------- -------------

% of Revenue 40.4% 34.9% 35.2%

3. Earnings per share

Basic (loss)/profit per share is calculated by dividing the loss

or profit attributable to shareholders by the weighted average

number of ordinary shares in issue during the period.

IAS 33 requires presentation of diluted EPS when a company could

be called upon to issue shares that would decrease earnings per

share or increase the loss per share. For a loss-making company

with outstanding share options, net loss per share would be

decreased by the exercise of options. Therefore, as per IAS33:36,

the antidilutive potential ordinary shares are disregarded in the

calculation of diluted EPS.

Reconciliation of the loss and weighted average number of shares

used in the calculation are set out below:

Unaudited Unaudited

6 months 6 months Audited

to to 12 months

31 May 31 May to 30 Nov

2023 2022 2022

GBP000 GBP000 GBP000

----------- ----------- -----------

Loss for the period (1,914) (614) (2,934)

----------- ----------- -----------

Loss for the period from

continuing operations (1,914) (513) (2,814)

Loss for the period from

discontinued operations - (101) (120)

----------- ----------- -----------

Loss attributable to shareholders (1,914) (614) (2,934)

Add exceptional items 2,272 830 2,707

Add Share Based Payment - 154 309

Add loss from discontinued

operations - 101 120

Impairment of Fixed Assets - - 966

Amortisation 808 - 702

Deferred taxation adjustment

in Norway - - 714

----------- ----------- -----------

Adjusted profit attributable

to shareholders 1,166 471 2,584

------------------------------------ ----------- ----------- -----------

EPS Pence

Basic EPS(1) (3.3p) (0.9p) (4.8p)

Basic EPS from discontinued

operations(2) - (0.2p) (0.2p)

----------- ----------- -----------

Total basic EPS attributable

to ordinary shareholders(3) (3.3p) (1.1p) (5.0p)

----------- ----------- -----------

Adjusted basic EPS(4) 2.0p 0.8p 4.4p

----------- ----------- -----------

Diluted EPS from continuing

operations(1) (3.3p) (0.9p) (4.8p)

Diluted EPS from discontinued

operations(2) - (0.2p) (0.2p)

----------- ----------- -----------

Total diluted EPS attributable

to ordinary shareholders(3) (3.3p) (1.1p) (5.0p)

----------- ----------- -----------

Adjusted diluted EPS(4) 2.0p 0.8p 4.4p

----------- ----------- -----------

Weighted average shares 58,505,079 58,352,525 58,376,211

Weighted average diluted

shares 58,874,820 59,880,537 58,828,959

------------------------------------ ----------- ----------- -----------

(1) Basic and diluted EPS from continuing operations is the loss

for the period divided by the weighted average shares and weighted

average diluted shares respectively. None of these losses are

attributable to non-controlling interests.

(2) Basic and diluted EPS from discontinued operations is the

(loss)/profit for the period less the amounts attributable to

non-controlling interests divided by the weighted average shares

and weighted average diluted shares respectively. The loss incurred

in 1H22 of GBP101k was in relation to the costs incurred with the

Eutelsat claim, which is classified as exceptional in nature and

specific to the discontinued business.

(3) Total basic and diluted EPS attributable to ordinary

shareholders is the sum of (losses)/profits from continuing and

discontinued operations less the amounts attributable to

non-controlling interests, divided by the weighted average shares

and weighted average diluted shares respectively.

(4) Adjusted basic and diluted EPS is the loss for the period

from continuing operations before exceptional expenses, exceptional

interest and share based payments, divided by the weighted average

shares and weighted average diluted shares respectively. None of

these losses are attributable to non-controlling interests. This is

a non-GAAP measure.

4. Other capital reserves

Foreign

Listing Reverse exchange Share Capital Total

Cost acquisition translation option redemption capital

Reserve Reserve reserve reserve reserve reserves

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 31 May 2022 (219) (3,317) (2,560) 154 26,120 20,178

-------- ------------ ------------ -------- ---------- ---------

Foreign Exchange

Translation - - 14 - - 14

Equity settled Share

based payments - - - 155 - 155

-------- ------------ ------------ -------- ---------- ---------

At 30 November

2022 (219) (3,317) (2,546) 309 26,120 20,347

Foreign Exchange

Translation - - (570) - - (570)

At 31 May 2023 (219) (3,317) (3,116) 309 26,120 19,777

-------- ------------ ------------ -------- ---------- ---------

-- Listing cost reserve

-- The listing cost reserve arose from expenses incurred on AIM listing.

-- Reverse acquisition reserve

-- The reverse acquisition reserve relates to the reverse

acquisition of Bigblu Operations Limited (Formerly Satellite

Solutions Worldwide Limited) by Bigblu plc (Formerly Satellite

Solutions Worldwide Group plc) on 12 May 2015.

-- Foreign exchange translation reserve

-- The foreign exchange translation reserve is used to record

exchange differences arising from the translation of the financial

statements of foreign operations.

-- Share option reserve

-- The share option reserve is used for the issue of share

options during the year plus charges relating to previously issued

options.

-- Capital Redemption reserve

-- The capital redemption reserve relates to the cash redemption

of the bonus B shares issued in order to return c.GBP26m to

ordinary shareholders.

5. Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed within the financial statements or related notes.

6. Intangible assets recognised in a business combination

Intangible assets acquired in a business combination and

recognised separately from goodwill are initially recognised at

their fair value at the acquisition date.

Amortisation is charged to profit or loss on a straight-line

basis (Within administration expenses) over the estimated useful

lives of the intangible asset unless such lives are indefinite.

These charges are included in other expenses in profit or loss.

Intangible assets with an indefinite useful life are tested for

impairment annually. Other intangible assets are amortised from the

date they are available for use. The useful lives are as

follows:

-- Customer Contracts - 2 years

-- Intellectual Property - 3 years

7. Availability of the Half Year Report

A copy of these results will be made available for inspection at

the Company's registered office during normal business hours on any

weekday. The Company's registered office is at 60 Gracechurch

Street, London, EC3V 0HR. The Company is registered in England No.

9223439.

A copy can also be downloaded from the Company's website at

https://www.bbb-plc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DBGDILBDDGXI

(END) Dow Jones Newswires

August 29, 2023 02:00 ET (06:00 GMT)

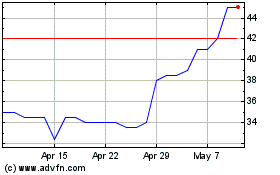

Bigblu Broadband (LSE:BBB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Bigblu Broadband (LSE:BBB)

Historical Stock Chart

From Mar 2024 to Mar 2025