TIDMBCE

RNS Number : 5290M

Beacon Energy PLC

15 September 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE UNITED STATES,

CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL.

This Announcement does not constitute a prospectus or offering

memorandum or an offer in respect of any securities and is not

intended to provide the basis for any investment decision in

respect of Beacon Energy plc or other evaluation of any securities

of Beacon Energy plc or any other entity and should not be

considered as a recommendation that any investor should purchase

any such securities .

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE UK VERSION OF THE MARKET ABUSE REGULATION (EU NO. 596/2014)

AS IT FORMS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 AS AMED BY VIRTUE OF THE MARKET ABUSE

(AMMENT) (EU EXIT) REGULATIONS 2019 ("UK MAR"). UPON THE

PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION

SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE

PUBLIC DOMAIN.

15 September 2023

Beacon Energy plc

("Beacon Energy" or the "Company")

Result of oversubscribed Fundraise to raise GBP4.3 million

Beacon Energy plc (AIM:BCE), the full-cycle oil and gas company

with a portfolio of production, development, appraisal and

exploration onshore German assets through its wholly-owned

subsidiary, Rhein Petroleum GmbH, is pleased to announce, further

to its announcement of 14 September 2023, that it has successfully

completed its oversubscribed Placing with new and existing

institutional investors and PrimaryBid Offer, which have now

closed. The Company has raised, in aggregate, approximately GBP4.3

million (before expenses) via the issue of 2,667,000,000 Placing

Shares and 200,000,000 PrimaryBid Shares at the Issue Price

(together, the "Fundraise Shares").

The Placing was undertaken through an accelerated bookbuilding

process managed by Tennyson Securities.

Larry Bottomley, CEO of Beacon Energy, commented:

"We are delighted to have received such strong support in this

process from both existing and new investors. The Fundraise was

significantly oversubscribed, bringing a number of new high quality

institutional investors onto the shareholder register - a testament

to the quality of the Company's asset base and the scope for

material value creation. The fundraise provides welcome additional

working capital to support bringing the SCHB-2(2.) well into

commercial production. We would like to thank our new and existing

investors for their support and look forward to providing further

updates on our operational progress in due course."

Admission and Total Voting Rights

The Placing and PrimaryBid Offer are conditional on the

admission of the Fundraise Shares to trading on AIM ("Admission").

Application has been made to the London Stock Exchange for

Admission of the 2,867,000,000 Fundraise Shares. Subject to the

Placing Agreement not having been terminated in accordance with its

terms, it is anticipated that Admission will occur at 8.00 a.m. on

or around 20 September 2023. The Fundraise Shares will rank pari

passu with the existing Ordinary Shares.

Upon Admission, the Company will have 13,374,679,620 Ordinary

Shares in issue. From Admission, t his figure may be used by

Shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the FCA's

Disclosure Guidance and Transparency Rules. The Fundraise Shares

will represent , in aggregate, approximately 21.4 per cent. of the

Company ' s e nlarged s hare c apital on Admission . The Company

holds no Ordinary Shares in Treasury.

Defined terms used in this announcement shall have the same

meaning as in the Company's announcement dated 14 September 2023

unless otherwise defined herein.

Enquiries:

Beacon Energy plc

L arry Bottomley (CEO)

Stewart MacDonald (CFO) +44 (0)1624 681 250

Strand Hanson Limited (Financial and Nominated Adviser)

Rory Murphy / James Bellman +44 (0)20 7409 3494

Buchanan (Public Relations)

Ben Romney / Jon Krinks +44 (0)20 7466 5000

Tennyson Securities Limited (Broker)

Peter Krens / Ed Haig-Thomas +44 (0)20 7186 9030

IMPORTANT INFORMATION

This Announcement has been issued by, and is the sole

responsibility of, the Company. No representation or warranty

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by

Tennyson or by any of their respective Affiliates as to or in

relation to, the accuracy or completeness of this Announcement or

any other written or oral information made available to or publicly

available to any interested party or its advisers, and any

liability therefore is expressly disclaimed.

This Announcement does not constitute, or form part of, a

prospectus relating to the Company, nor does it constitute or

contain any invitation or offer to any person, or any public offer,

to subscribe for, purchase or otherwise acquire any shares in the

Company or advise persons to do so in any jurisdiction, nor shall

it, or any part of it (other than the Appendix in relation to

Placees) form the basis of or be relied on in connection with any

contract or as an inducement to enter into any contract or

commitment with the Company. In particular, the Placing Shares have

not been, and will not be, registered under the United States

Securities Act of 1933, as amended (the "Securities Act")or

qualified for sale under the laws of any state of the United States

or under the applicable laws of any of Canada, Australia, the

Republic of South Africa, or Japan and, subject to certain

exceptions, may not be offered or sold in the United States or to,

or for the account or benefit of, US persons (as such term is

defined in Regulation S under the Securities Act) or to any

national, resident or citizen of Canada, Australia, the Republic of

South Africa or Japan.

The distribution or transmission of this Announcement and the

offering of the Placing Shares in certain jurisdictions may be

restricted or prohibited by law or regulation. Persons distributing

this Announcement must satisfy themselves that it is lawful to do

so. Any failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction. No

action has been taken by the Company or the Broker that would

permit an offering of such shares or possession or distribution of

this Announcement or any other offering or publicity material

relating to such shares in any jurisdiction where action for that

purpose is required. Persons into whose possession this

Announcement comes are required by the Company and the Broker to

inform themselves about, and to observe, such restrictions. In

particular, this Announcement may not be distributed, directly or

indirectly, in or into the United States, Canada, the Republic of

South Africa, Australia or Japan. Overseas Shareholders and any

person (including, without limitation, nominees and trustees), who

have a contractual or other legal obligation to forward this

document to a jurisdiction outside the UK should seek appropriate

advice before taking any action.

This Announcement contains "forward-looking statements" which

includes all statements other than statements of historical fact,

including, without limitation, those regarding the Company's

financial position, business strategy, plans and objectives of

management for future operations, or any statements preceded by,

followed by or that include the words "targets", "believes",

"expects", "aims", "intends", "will", "may", "anticipates",

"would", "could", "indicative", "possible" or similar expressions

or negatives thereof. Such forward-looking statements involve known

and unknown risks, uncertainties and other important factors beyond

the Company's control that could cause the actual results,

performance or achievements of the Group to be materially different

from future results, performance or achievements expressed or

implied by such forward-looking statements. Such forward-looking

statements are based on numerous assumptions regarding the

Company's present and future business strategies and the

environment in which the Company will operate in the future. These

forward-looking statements speak only as at the date of this

Announcement. The Company expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statements contained herein to reflect any change

in the Company's expectations with regard thereto or any change in

events, conditions or circumstances on which any such statements

are based unless required to do so by applicable law or the AIM

Rules.

No statement in this Announcement is intended to be a profit

forecast and no statement in this Announcement should be

interpreted to mean that earnings or losses per share of the

Company for the current or future financial years would necessarily

match or exceed the historical published earnings or losses per

share of the Company.

Tennyson is authorised and regulated by the FCA in the United

Kingdom. Tennyson is acting as broker exclusively for the Company

and no one else in connection with the Bookbuild, Placing and

Admission and the contents of this Announcement, and will not

regard any other person (whether or not a recipient of this

Announcement) as its client in relation to the Bookbuild or the

contents of this Announcement nor will it be responsible to anyone

other than the Company for providing the protections afforded to

its clients or for providing advice in relation to the contents of

this Announcement. Apart from the responsibilities and liabilities,

if any, which may be imposed on Tennyson by FSMA or the regulatory

regime established thereunder, Tennyson accepts no responsibility

whatsoever, and makes no representation or warranty, express or

implied, for the Bookbuild or the contents of this Announcement

including its accuracy, completeness or verification or for any

other statement made or purported to be made by it, or on behalf of

it, the Company or any other person, in connection with the Company

and the contents of this Announcement, whether as to the past or

the future. Tennyson accordingly disclaims all and any liability

whatsoever, whether arising in tort, contract or otherwise (save as

referred to above), which it might otherwise have in respect of the

contents of this Announcement or any such statement.

Strand Hanson Limited ("Strand Hanson") is acting as Nominated

Adviser to the Company in connection with the Placing and

Admission. Strand Hanson has not authorised the contents of, or any

part of, this Announcement, and no liability whatsoever is accepted

by Strand Hanson for the accuracy of any information or opinions

contained in this Announcement or for the omission of any material

information. The responsibilities of Strand Hanson as the Company's

Nominated Adviser under the AIM Rules for Companies and the AIM

Rules for Nominated Advisers are owed solely to London Stock

Exchange plc and are not owed to the Company or to any director or

shareholder of the Company or any other person, in respect of its

decision to acquire shares in the capital of the Company in

reliance on any part of this Announcement, or otherwise.

The Appendix to this Announcement (which forms part of this

Announcement) sets out the terms and conditions of the Placing. By

participating in the Placing, each person who is invited to and who

chooses to participate in the Placing by making or accepting an

oral and legally binding offer to acquire Placing Shares will be

deemed to have read and understood this Announcement in its

entirety (including the Appendix) and to be making such offer on

the terms and subject to the conditions set out in this

Announcement and to be providing the representations, warranties,

undertakings, agreements and acknowledgements contained in the

Appendix. The Company, the Broker and their respective affiliates,

agents, directors, officers and employees will rely upon the truth

and accuracy of the representations, warranties, undertakings,

agreements and acknowledgements contained in the Appendix.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

Information to Distributors

UK Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Rules"), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the UK Product Governance Rules) may otherwise have with respect

thereto, the Placing Shares have been subject to a product approval

process, which has determined that the Placing Shares are: (a)

compatible with an end target market of (i) retail clients, as

defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as

it forms part of the law of England and Wales by virtue of EUWA and

as from time to time modified by or under the EUWA or other English

law and any subordinate legislation made under it; (ii) investors

who meet the criteria of professional clients, as defined in

Regulation (EU) No 600/2014 as it forms part of the law of England

and Wales by virtue of EUWA and as from time to time modified by or

under the EUWA or other English law and any subordinate legislation

made under it; and (iii) eligible counterparties, as defined in the

FCA Handbook Conduct of Business Sourcebook ("COBS"); and (b)

eligible for distribution through all distribution channels as are

permitted by EU Directive 2014/65/EU on markets in financial

instruments, as it forms part of the law of England and Wales by

virtue of EUWA and as from time to time modified by or under the

EUWA or other English law and any subordinate legislation made

under it (the "UK Target Market Assessment"). Notwithstanding the

UK Target Market Assessment, distributors should note that: the

price of Placing Shares may decline and investors could lose all or

part of their investment; the Placing Shares offer no guaranteed

income and no capital protection; and an investment in the Placing

Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The UK Target Market Assessment is

without prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Placing.

Furthermore, it is noted that, notwithstanding the UK Target Market

Assessment, the Broker will only procure investors who meet the

criteria of professional clients and eligible counterparties. For

the avoidance of doubt, the UK Target Market Assessment does not

constitute: (a) an assessment of suitability or appropriateness for

the purposes of COBS; or (b) a recommendation to any investor or

group of investors to invest in, or purchase, or take any other

action whatsoever with respect to the Placing Shares.

EU Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the

"Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the Product Governance

Requirements) may otherwise have with respect thereto, the Placing

Shares have been subject to a product approval process, which has

determined that the Placing Shares are: (i) compatible with an end

target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, each

as defined in MiFID II; and (ii) eligible for distribution through

all distribution channels as are permitted by MiFID II (the "EU

Target Market Assessment"). Notwithstanding the EU Target Market

Assessment, Placees should note that: the price of the Placing

Shares may decline and investors could lose all or part of their

investment; Placing Shares offer no guaranteed income and no

capital protection; and an investment in Placing Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result therefrom.

The EU Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Placing. Furthermore, it is noted

that, notwithstanding the EU Target Market Assessment, the Broker

will only procure investors who meet the criteria of professional

clients and eligible counterparties. For the avoidance of doubt,

the EU Target Market Assessment does not constitute: (a) an

assessment of suitability or appropriateness for the purposes of

MiFID II; or (b) a recommendation to any investor or group of

investors to invest in, or purchase, or take any other action

whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIFZGMLZDLGFZZ

(END) Dow Jones Newswires

September 15, 2023 02:00 ET (06:00 GMT)

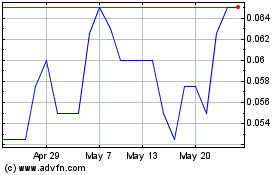

Beacon Energy (LSE:BCE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Beacon Energy (LSE:BCE)

Historical Stock Chart

From Mar 2024 to Mar 2025