TIDMBCE

RNS Number : 0758O

Beacon Energy PLC

29 September 2023

29 September 2023

Beacon Energy plc

("Beacon Energy" or the "Company")

Interim Results

Beacon Energy (AIM:BCE), the full-cycle oil and gas company with

a portfolio of production, development, appraisal and exploration

onshore German assets through its wholly-owned subsidiary, Rhein

Petroleum GmbH ("Rhein Petroleum"), is pleased to announce its

Interim Results for the six months ended 30 June 2023.

Mark Rollins, Non-Executive Chairman of Beacon Energy,

commented:

" During the period, the Board has worked tirelessly and has

made excellent progress in delivering the Company's strategy which

is to pursue the acquisition of value enhancing opportunities to

develop and grow a self-funding upstream oil & gas company.

The data we have gathered during the drilling of the SCHB2(2.)

well indicates the potential for substantial reserve and production

upside for the Stockstadt Mitte segment - up to and potentially

more than the High Case (5.8 mmbbls) outlined in the Company's

December 2022 CPR which clearly bodes well for the long-term value

we believe we can realise from the asset.

With the SCHB-2(2.) now safely and successfully completed, the

Company's priority is establishing flowrates through clean-up of

the wellbore, and eventual installation of an Electrical

Submersible Pump.

Based on the technical data acquired through the drill which

demonstrated the high quality reservoir encountered at the well

location, the Company's technical analysis indicates that with a

successful clean-up operation and implementation of artificial lift

initiatives, the well has the potential to deliver in the region of

900 bopd net production to Beacon. At those flow rates, the Company

would expect to deliver operating cash flows in excess of US$1.5

million per month (assuming $80/bbl Brent).

I would like to thank our new and existing shareholders for

their ongoing support of the Company, management team and our

strategy. We are very excited about the year ahead with an active

work programme designed to create long-term value for Beacon's

shareholders."

Enquiries:

Beacon Energy plc

L arry Bottomley (CEO) / Stewart MacDonald

(CFO) +44 (0)20 7466 5000

Strand Hanson Limited (Financial and Nominated

Adviser)

Rory Murphy / James Bellman +44 (0)20 7409 3494

Buchanan (Public Relations)

Ben Romney / Barry Archer / George Pope +44 (0)20 7466 5000

Tennyson Securities Limited (Joint Broker)

Peter Krens / Ed Haig-Thomas +44 (0)20 7186 9030

Chairman's Statement

Dear fellow shareholders,

I am delighted to present the following statement in support of

the interim results for the six months ended 30 June 2023.

During the period, the Board has worked tirelessly and has made

excellent progress in delivering the Company's strategy which is to

pursue the acquisition of value enhancing opportunities to develop

and grow a self-funding upstream oil & gas company.

On 16 December 2022, the Company was pleased to announce that it

had entered into a conditional Share Purchase Agreement with Tulip

Oil Holding B.V. and Deutsche Rohstoff A.G. for the purchase of the

entire issued and to be issued share capital of Rhein Petroleum

GmbH, (the "Transaction"), an established company with a full-cycle

portfolio of largely operated production, development, appraisal

and exploration assets located onshore Germany.

The Company successfully completed a fundraise of GBP6.0 million

with new and existing shareholders in March 2023 despite

challenging market conditions, providing capital to complete the

Transaction. Critically, as the upfront consideration for the

Transaction was paid in shares, the net funds raised for the

acquisition process were to be deployed into the work programme and

the Company was able to acquire the existing production facility,

production, reserves and resources associated with Rhein Petroleum

for zero upfront cash consideration. Following receipt of

shareholder approval, the Company completed the Transaction on 11

April 2023. This represented a transformational, value enhancing

transaction for shareholders, which was fully aligned with Beacon

Energy's growth strategy and provides the Company with a strong

platform, underpinned by core value, to deliver the longer-term

growth strategy.

Immediately upon completion of the Transaction, the Company

secured a drilling rig to drill the SCHB-2 development well on the

Erfelden field. Drilling operations commenced on 19 June 2023.

Notwithstanding operational issues encountered during drilling, the

Schwarzbach-2(2.) ("SCHB-2(2.)") well reached total drill depth of

2,255m metres (1,717 metres True Vertical Depth) on 13 August 2023

with electric wireline well logging completed shortly

thereafter.

On 11 September 2023, the Company announced an update on the

SCHB-2(2.) well. The key updates in respect of the SCHB-2(2.) well

were as follows:

-- The SCHB-2(2.) well encountered an excellent 34-metre gross

interval containing 28 metres of oil-bearing net reservoirs in the

Pechelbronner-Schichten ("PBS") sandstones within the Stockstadt

Mitte segment of the Erfelden field.

-- These oil-bearing reservoirs were encountered approximately

25 metres high and 10 metres thicker than prognosis, with

porosities averaging 18% in the Lower PBS and 21% in the Upper PBS,

with no water-bearing sands in the 42m hydrocarbon column.

-- With all these metrics above or at the top of the range of

pre-drill expectations, the likelihood is that this will result in

a material upgrade to recoverable reserves in Stockstadt Mitte and

a de-risking of 2.4 million barrels of contingent resources already

ascribed to Schwarzbach South.

-- Based on these excellent reservoir properties and the light

oil recovered, standard oil-industry analysis indicates that an

initial production rate in excess of 900 barrels of oil per day

("bopd") could be achieved. Higher rates of production have been

achieved on historic wells in the area.

-- Following perforation and acidization, reservoir clean-up

operations commenced on 8 September 2023, and since that time the

well has produced a mixture of oil, gas and drilling fluids.

-- Given delays in the programme, the drilling rig was released

on 10 September 2023, with clean-up of the well to continue on

site.

As a result of excellent drilling results and increased

expectations around recoverable volumes and production, the Company

successfully completed an oversubscribed fundraise of GBP4.3

million with new and existing shareholders on 15 September 2023.

The additional funds will be utilised to satisfy outstanding costs

associated with the well, fund further activities required to

realise the full potential of the well and provide liquidity during

the well clean-up process. As a result, the Company moves

considerably closer to its goal of becoming a self-funding

business.

Outlook

With the SCHB-2(2.) now safely and successfully completed, the

Company's priority is establishing flowrates through clean-up of

the wellbore, and eventual installation of an Electrical

Submersible Pump. Based on the technical data acquired through the

drill which demonstrated the high quality reservoir encountered at

the well location, the Company's technical analysis indicates that

with a successful clean-up operation and implementation of

artificial lift initiatives, the well has the potential to deliver

in the region of 900 bopd net production to Beacon. At those flow

rates, the Company would expect to deliver operating cash flows in

excess of US$1.5 million per month (assuming $80/bbl Brent).

In parallel, work will commence immediately to quantify expected

reserve and resources increases and existing development plans will

be updated to reflect learnings from the SCHB-2(2.) well and

increased resource base with the aim of accelerating drilling and

maximising the value of this highly attractive asset.

It only remains for me to thank our new and existing

shareholders for their ongoing support of the Company, management

team and our strategy. We are very excited about the year ahead

with an active work programme designed to create long-term value

for Beacon's shareholders. We very much see the acquisition of

Rhein Petroleum and the drilling of our first well as the first

steps in our strategy to build a material international upstream

oil and gas business with a focus on cash generative assets and

those with the potential to add significant value in the short to

medium term.

We look forward to providing updates on our progress as we move

through the rest of the year.

Mark Rollins

Non-Executive Chairman

29 September 2023

Interim Consolidated Statement of Comprehensive Income

Unaudited Unaudited

Six months Six months

ended Audited ended

30 Jun Period ended 31 Oct

2023 31 Dec 2022 2022

Notes $'000 $'000 $'000

------------------------------------ ------ ------------ -------------- ------------------

Income:

Operating income 313 - -

Other income 2 - -

------------------------------------ ------ ------------ -------------- ------------------

Total income 315 - -

------------------------------------ ------ ------------ -------------- ------------------

Crude oil purchase from partners (130) - -

Operating expenses (448) - -

Operating loss (263) -

Other administrative expenses 4 (659) (1,004) (896)

Net loss before Finance Costs

and Taxation (922) (1,004) (896)

Finance costs (201) (47) (55)

Impairment of investment 6 (2,941) - -

Loss before tax (4,064) (1,051) (951)

------------------------------------ ------ ------------ -------------- ------------------

Tax expense 324 - -

------------------------------------ ------ ------------ -------------- ------------------

Loss after tax attributable to

owners of the parent (3,740) (1,051) (951)

------------------------------------ ------ ------------ -------------- ------------------

Total comprehensive loss for

the year attributable to owners

of the parent (3,740) (1,051) (951)

------------------------------------ ------ ------------ -------------- ------------------

Basic and diluted loss per share

attributable to owners of the

parent during the year

(expressed in US cents per share) 7 (0.07) (0.08) (0.07)

------------------------------------ ------ ------------ -------------- ------------------

The accompanying notes from an integral part of these

consolidated financial statements.

Interim Consolidated Statement of Financial Position

Unaudited Audited Unaudited

30 Jun 31 Dec 31 Oct

2023 2022 2022

Notes $'000 $'000 $'000

------------------------------- -------- ---------- --------- ----------

Non-current assets

Property, plant & equipment 11,569 - -

Intangible assets 1,597 - -

13,166 - -

------------------------------- -------- ---------- --------- ----------

Current assets

Other receivables 1,844 564 408

Restricted cash 8 2,075 - -

Cash and cash equivalents 4,491 306 616

8,410 870 1,024

------------------------------- -------- ---------- --------- ----------

Total assets 21,576 870 1,024

------------------------------- -------- ---------- --------- ----------

Current liabilities

Trade and other payables 9 (2,070) (411) (493)

------------------------------- -------- ---------- --------- ----------

Non-current liability 10 (5,571) - -

------------------------------- -------- ---------- --------- ----------

Total liabilities (7,641) (411) (493)

------------------------------- -------- ---------- --------- ----------

Net assets 13,935 459 531

------------------------------- -------- ---------- --------- ----------

Equity attributable to equity holders

of the company

Share premium 54,278 48,128 48,128

Share reserve 2,047 2,036 2,008

Merger reserve 11,055 - -

Accumulated deficit (53,445) (49,705) (49,605)

------------------------------- -------- ---------- --------- ----------

Total shareholder funds 13,935 459 531

------------------------------- -------- ---------- --------- ----------

The accompanying notes from an integral part of these

consolidated financial statements

Interim Consolidated Statement of Changes in Equity

Share Share reserve Merger Reserve Accumulated Total

premium deficit equity

$'000s $'000 $'000 $'000s $'000s

Balance at 1 May 2022 47,656 1,445 - (48,654) 447

Loss for the period to

31 October 2022 (unaudited) - - - (951) (951)

------------------------------ ---------- -------------- --------------- ------------ --------

Total comprehensive loss - - - (951) (951)

Transactions with equity

shareholders of the parent:

Share based payments - 563 - - 563

Proceeds from shares issued 490 - - - 490

Cost of share issue (18) - - - (18)

Balance at 31 October

2022 (unaudited) 48,128 2,008 - (49,605) 531

Loss for the period to

31 December 2022 (audited) - - - (100) (100)

------------------------------ ---------- -------------- --------------- ------------ --------

Total comprehensive loss - - - (100) (100)

Transactions with equity

shareholders of the parent:

Share based payments - 28 - - 28

Balance at 31 December

2022 (audited) 48,128 2,036 - (49,705) 459

------------------------------ ---------- -------------- --------------- ------------ --------

Loss for the period to

30 June 2023 (unaudited) - - - (3,740) (3,740)

------------------------------ ---------- -------------- --------------- ------------ --------

Total comprehensive loss - - - (3,740) (3,740)

Transactions with equity

shareholders of the parent:

Share based payments - 11 - - 11

Proceeds from shares issued 7,496 - - - 7,496

Cost of share issue (1,346) - - - (1,346)

Merger reserve - - 11,055 - 11,055

Balance at 30 June 2023

(unaudited) 54,278 2,047 11,055 (53,445) 13,935

------------------------------ ---------- -------------- --------------- ------------ --------

The accompanying notes from an integral part of these

consolidated financial statements.

Interim Consolidated Cash Flow Statement

Unaudited Audited Unaudited

30 Jun 31 Dec 31 Oct

2023 2022 2022

Notes $'000 $'000 $'000

--------------------------------------- ------- ---------- -------- ----------

Cash flows from operating activities:

Loss before tax (3,740) (1,051) (951)

Adjustments for:

Share-based payment 11 591 563

Impairment at acquisition 2,941 - -

Tax expense (324) - -

Change in working capital items:

Movement in other receivables (1,280) (475) (319)

Movement in trade and other payables 1,659 107 189

--------------------------------------- ------- ---------- -------- ----------

Net cash used in operations (733) (828) (518)

--------------------------------------- ------- ---------- -------- ----------

Cash flows from investing activities

Investment in subsidiary - cash

balances acquired 8 2,196 - -

Purchase of property, plant &

equipment (1,031) - -

Net cash flows from investing

activities 1,165 - -

--------------------------------------- ------- ---------- -------- ----------

Cash flows from financing activities

Proceeds from issue of share

capital 7,496 490 490

Share issue costs (1,346) (18) (18)

Net cash flows from financing

activities 6,150 472 472

--------------------------------------- ------- ---------- -------- ----------

Net (decrease)/increase in cash

and cash equivalents 6,582 (356) (46)

--------------------------------------- ------- ---------- -------- ----------

Effect of exchange rate changes (322) - -

Cash and cash equivalents at

beginning of period 306 662 662

--------------------------------------- ------- ---------- -------- ----------

Cash and cash equivalents at

end of period 6,566 306 616

--------------------------------------- ------- ---------- -------- ----------

The accompanying notes from an integral part of these

consolidated financial statements.

Notes to the Interim Consolidated Financial Statements

1 Reporting entity

Beacon Energy plc (the "Company") is domiciled in the Isle of

Man. The Company's registered office is at 55 Athol Street,

Douglas, Isle of Man IM1 1LA. These consolidated financial

statements comprise the Company and its subsidiaries (together

referred to as the "Group"). The Group is primarily involved in the

E&P business.

Events during the period

On 11 April 2023, the Company acquired the entire issued share

capital of Rhein Petroleum GmbH, an upstream oil and gas business

operating in Germany. The Company's shares were re-admitted to

trading on AIM on 11 April 2023.

2 Basis of accounting

These interim consolidated financial statements have been

prepared in accordance with International Accounting Standard 34

"Interim Financial Reporting". These interim consolidated financial

statements do not include all the information and disclosures

required in the annual financial statements and should be read in

conjunction with the Group's annual financial statements for the

period ended 31 December 2022, which were prepared in accordance

with IFRSs as adopted by the United Kingdom. However, selected

explanatory notes are included to explain events and transactions

that are significant to an understanding of the changes in the

Group's financial position and performance since the last annual

financial statements.

In preparing these interim financial statements, management has

made judgements and estimates that affect the application of

accounting policies and the reported amounts of assets and

liabilities, income and expense. Actual results may differ from

these estimates. The significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those disclosed in the

Group's statutory financial statements for the year ended 31

December 2022.

The interim conciliated financial statements are presented in US

Dollars unless otherwise indicated.

There are no IFRSs or IFRIC interpretations that are effective

for the first time for the financial period beginning on or after 1

May 2022 that would be expected to have a material impact on the

Group.

The consolidated financial statements of the Group as at and for

the period ended 31 December 2022 are available upon request from

the Company's registered office at 55 Athol Street, Douglas, Isle

of Man or the Company's website www.beaconenergyplc.com

These interim consolidated financial statements have been

approved and authorised for issue by the Company's Board of

directors on 29 September 2023.

3 Going concern

The financial statements have been prepared on a going concern

basis. The Group monitors its cash position, cash forecasts and

liquidity on a regular basis and takes a conservative approach to

cash management.

On 11 April 2023, the Group completed the acquisition of Rhein

Petroleum GmbH. Drilling operations for the SCHB-2 well commenced

on 19 June 2023. The well encountered a material oil accumulation

with excellent reservoir properties however, due to significant

operational issues during drilling, delays and additional costs

were experienced and as a result the rig had to be released in

mid-September, prior to completion of the clean-up of the well.

Installation of the rod pump is expected to be undertaken during

October 2023. In the interim period reservoir clean-up will

continue into the wellbore.

Notes to the Interim Consolidated Financial Statements

(continued)

As a result of excellent drilling results and increased

expectations around recoverable volumes and production, the Company

successfully completed an oversubscribed fundraise of GBP4.3

million with new and existing shareholders on 15 September

2023.

As at 28 September 2023, the Group had cash resources excluding

'restricted cash' of approximately US$6.5 million.

Management's base case is that the SCHB-2 well will continue to

clean-up and by the end of November 2023 production flow rates from

the well will be consistent with, or exceed, the "best estimate"

outlined in the Competent Persons Report ("CPR") published in

December 2022.

Management have also considered a number of downside scenarios,

including scenarios where the well clean-up is more protracted, the

production flow rate from the well is materially below the "best

estimate" outlined in the CPR, or additional activities (and

expenditure) are required in order to increase flow rates.

Under the base case forecast, the Group will have sufficient

financial headroom to meet forecast cash requirements for the 12

months from the date of approval of these consolidated financial

statements.

However, in the downside scenarios, in the absence of any

mitigating actions, the Group may have insufficient funds to meet

its forecast cash requirements. Potential mitigants include

deferral and/or reduction of expenditure and raising additional

equity or debt funding.

Accordingly, after making enquiries and considering the risks

described above, the Directors have assessed that the cash balance

and forecast cash flows provide the Group with adequate headroom

for the following 12 months. As a result, the Directors are of the

opinion that the Group is able to operate as a going concern for at

least the next twelve months from the date of approval of these

financial statements.

Nonetheless, these conditions indicate the existence of a

material uncertainty which may cast doubt on the Group's ability to

continue as a going concern. The financial statements do not

include the adjustments that would be required if the Group were

unable to continue as a going concern.

4 Expenses

Administration fees and expenses consist of the following:

Unaudited Audited Unaudited

Six months Six months

ended Period ended ended

30 Jun 2023 31 Dec 2022 31 Oct 2022

$'000 $'000 $'000

-------------- --------------- --------------

Corporate overheads:

* Directors' fees 394 393 292

* Professional fees 170 103 129

* Audit fees 22 20 2

* Administration costs 73 63 48

* Share based payments-warrants - 425 425

* Employee costs - - -

Total expenses 659 1,004 896

-------------- --------------- --------------

Notes to the Interim Consolidated Financial Statements

(continued)

5 Directors' remuneration

The remuneration of those in office during the period ended 30

June 2023 was as follows:

Unaudited Unaudited

Six months Audited Six months

ended ended

30 Jun 2023 Period ended 31 Oct 2022

$'000 31 Dec 2022 $'000

$'000

------------- ---------------- --------------

Salaries paid in cash 171 117 88

Salary deferrals 96 110 66

Accrued entitlement to shares

and warrants 98 166 138

Directors' pension 13 - -

Directors' health insurance 16 - -

394 393 292

------------- ---------------- --------------

It should be noted that (a) the Directors (other than Ross

Warner) have agreed to receive Director Fee Shares in lieu of a

proportion of their proposed fees for the 24 month period following

Admission, calculated on the basis of the Fundraise Price; and (b)

Ross Warner has agreed for the 24 month period following from

Admission to waive one third of the fees due to him under his NED

appointment letter. Larry Bottomley and Mark Rollins have agreed to

take 55 percent. and 50 percent., respectively, of their proposed

fees as Director Fee shares, and Stewart MacDonald, Leo Koot and

Stephen Whyte have agreed to take 33 percent. of their proposed

fees as Director Fee Shares.

Share options and warrants with a value of $98,000 were issued

to employees accrued during the 6- month period to 30 June 2023. In

the period ended 31 December 2022, the warrants issued to employees

and advisors accrued with a value of $166,000.

6 Business Combination

On 11 April 2023, the Company acquired the entire issued share

capital of Rhein Petroleum GmbH, an upstream oil and gas business

operating in Germany. This transaction can be best described as a

business combination under IFRS3.

The reverse takeover transaction consisted of equity

consideration of 3,488,549,633 ordinary shares and an associated

consideration of 1,186,953,301 warrants at a price of 0.11 pence

which is the fair value per share. On the basis that the net assets

acquired exceeded the consideration paid, negative goodwill arose.

This negative goodwill has been written off through the profit and

loss. Details of the purchase consideration and the net assets

acquired are as follows:

Goodwill

$'000

Consideration transferred at Fair value 5,143

Less: Net identifiable assets at acquisition (11,050)

Goodwill at acquisition (5,907)

---------

Less: Adjustments of loan balance acquired (27,463)

Add: Deferred Tax assets on acquisition 30,409

Goodwill at reporting date (2,961)

=========

Notes to the Interim Consolidated Financial Statements

(continued)

7 Earnings per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

Unaudited Audited Unaudited

Outstanding Outstanding Outstanding

at 30 Jun at 31 Dec at 31 Oct

2023 2022 2022

Loss attributable to owners

of the Group

(USD thousands) (3,740) (1,051) (951)

Weighted average number of

ordinary shares in issue (thousands) 5,496,704 1,350,063 1,291,201

Loss per share (US cents) (0.07) (0.08) (0.07)

In accordance with International Accounting Standard 33

'Earnings per share', no diluted earnings per share is presented as

the Group is loss making.

8 Restricted cash

At reporting date, the Group had US$2,075,000 restricted cash,

which is backing guarantees to the mining authority related to

future decommissioning. This amount forms part of the US$2,196,000

cash balances acquired shown within the cash flow statement.

9 Trade and other payables

Trade and other payables are obligations to pay for goods or

services that have been acquired in the ordinary course of

business. Accounts payable are classified as current liabilities if

payment is due within one year or less (or in the normal operating

cycle of the business if longer). If not, they are presented as

non-current liabilities. Trade payables are recognised initially at

fair value, and subsequently measured at amortised cost using the

effective interest method. The increase in trade payables reflects

increased spend related to the SCHB-2(2) well.

Unaudited Audited Unaudited

Outstanding Outstanding Outstanding

at 30 Jun at 31 Dec at 31 Oct

2023 2022 2022

US$'000 US$'000 US$'000

Trade payables 1,793 230 151

Accruals and other payables 277 181 342

------------- ------------- -------------

2,070 411 493

------------- ------------- -------------

Notes to the Interim Consolidated Financial Statements

(continued)

10 Non-current liabilities

The non-current liabilities consist of a loan with Tulip Oil

Holding B.V and provisions in relation to future abandonment and

decommissioning costs.

Unaudited Audited Unaudited

Outstanding Outstanding Outstanding

at 30 Jun at 31 Dec at 31 Oct

2023 2022 2022

US$'000 US$'000 US$'000

Tulip Oil Holding loan payable 3,433 - -

Provision for decommissioning 2,097 - -

Other non-current liabilities 41 - -

------------- ------------- -------------

5,571 - -

------------- ------------- -------------

11 Shares in issue

The number of shares in issue at the beginning of the period was

1,527,613,961. The number of options and warrants on issue at the

start of the period was 618,259,511. On 11 April 2023 there was an

issue of 5,491,516,026 ordinary shares for GBP0.011 to raise GBP6.0

million. A further 3,488,549,633 shares were issued as

consideration shares. The number of ordinary shares in issue at the

end of the period is 10,507,679,620. The number of options and

warrants increased to 2,709,564,441.

Options and warrants in issue:

Outstanding Issued/(Expired) Outstanding

at 31 December during the at 30 June

2022 period 2023

---------------- ----------------- --------------

Options

* Issued Pre 1/2/2020 450,000 - 450,000

* Issued 1/2/2020 13,750,000 - 13,750,000

* Issued 8/7/2020 2,500,000 - 2,500,000

* Issued 19/4/2021 83,710,000 - 83,710,000

* Cancelled options FY 2022 (66,600,000) - (66,600,000)

* Issued during FY 2022 30,000,000 - 30,000,000

* iIssued during FY 2023 - 770,542,318 770,542,318

63,810,000 770,542,318 834,352,318

---------------- ----------------- --------------

Warrants

* Issued 10/12/2020 54,545 - 54,545

* Issued during 19/04/2021 - employee 3,851,159 - 3,851,159

* Issued during 19/04/2021 - adviser 45,553,120 - 45,553,120

* Issued warrants 26/07/2022 500,000,000 - 500,000,000

* Issued warrants 11/04/2023 - 1,325,753,299 1,325,753,299

549,458,824 1,325,753,299 1,875,212,123

---------------- ----------------- --------------

Total options and warrants 613,268,824 1,325,753,299 2,709,564,441

---------------- ----------------- --------------

Notes to the Interim Consolidated Financial Statements

(continued)

12 Commitments and contingencies

There were no capital commitments authorised by the Directors or

contracted other than those provided for in these financial

statements as at 30 June 2023 (31 December 2022: None).

13 Subsequent events

On 15 September 2023, the Company announced that it had issued

2,867,000,000 new ordinary shares by way of placing and a Primary

Bid Offer at a fundraise price of 0.15 pence to raise GBP4.3

million (the "Fundraise"). The net proceeds of the Fundraise

together with the Company's existing cash resources will be used

for general working capital prior to receipt of proceeds from the

sale of commercial production from SCHB-2(2.). Following admission,

the Company now has 13,374,679,620 ordinary shares in issue.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKFBPOBKDNCB

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

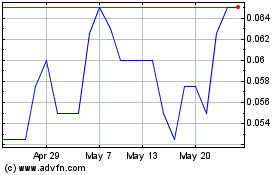

Beacon Energy (LSE:BCE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Beacon Energy (LSE:BCE)

Historical Stock Chart

From Mar 2024 to Mar 2025