RNS Number:5587S

Castle Bidco Limited

08 March 2007

Not for release, publication or distribution, in whole or in part, in or into or

from any jurisdiction where to do so would constitute a violation of the

relevant laws of such jurisdiction

Castle Bidco reserves the right, with the consent of the Takeover Panel, to

implement the acquisition of Crest Nicholson by way of a takeover offer under

the Takeover Code

8 March 2007

RECOMMENDED PROPOSALS FOR THE ACQUISITION

of

CREST NICHOLSON PLC

by

CASTLE BIDCO LIMITED

to be effected

by means of a Scheme of Arrangement

Summary

* The boards of Castle Bidco and Crest Nicholson are pleased to announce

that they have reached agreement on the terms of a recommended acquisition by

Castle Bidco of the entire issued and to be issued share capital of Crest

Nicholson (other than that already owned by Castle Bidco) for 620 pence per

Crest Nicholson Share in cash.

* The terms of the Acquisition value the entire issued and to be issued

share capital of Crest Nicholson at approximately #715 million. A Loan Note

Alternative will, subject to the terms and conditions which will be set out in

the Scheme Circular and the Form of Election, also be made available to Crest

Nicholson Shareholders (other than any Loan Note Restricted Overseas Person).

* Crest Nicholson will also pay an interim dividend of 9.7 pence per

Crest Nicholson Share in respect of the six month period ended 31 October 2006

to Crest Nicholson Shareholders whose names appear on the register as at

9 March 2007. This Interim Dividend will be paid on 10 April 2007.

* If the Scheme becomes effective, Crest Nicholson Shareholders (other

than Castle Bidco, whose Crest Nicholson Shares are not subject to the Scheme

and who will only therefore receive the Interim Dividend) will therefore

receive, in aggregate, 629.7 pence per Crest Nicholson Share.

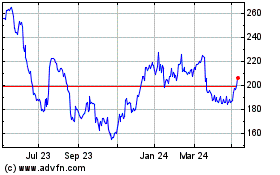

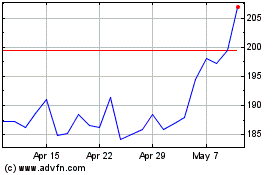

* This aggregate price per Crest Nicholson Share represents a premium

of:

- 18.5 per cent. to 531.3 pence per Crest Nicholson Share, being the average

Closing Price over the six month period to 9 November 2006; and

- 10.2 per cent. to 571.5 pence per Crest Nicholson Share, being the Closing

Price on 9 November 2006,

being the last Business Day prior to the date on which Crest Nicholson made an

announcement noting receipt of an approach from a third party regarding a

possible offer for Crest Nicholson.

The aggregate price per Crest Nicholson Share also represents:

- 2.4 times Crest Nicholson's published net asset value per issued Crest

Nicholson Share as at 31 October 2006; and

- a price earnings ratio of 12.4 times based on Crest Nicholson's fully diluted

earnings per share for the financial year ended 31 October 2006.

* Castle Bidco is a company that has been formed for the purposes of the

Acquisition. Castle Bidco is indirectly owned by Bank of Scotland (through its

wholly-owned subsidiary, Uberior) and West Coast Capital (through Pacific Shelf

1410 which it indirectly wholly owns).

* The Acquisition is proposed to be effected by means of a Scheme of

Arrangement under section 425 of the Companies Act, subject to the requisite

Court and Crest Nicholson Shareholder approvals being obtained.

* The Crest Nicholson Board unanimously recommend the Acquisition and

that Crest Nicholson Shareholders vote in favour of the resolutions to be

proposed at the Court Meeting and at the EGM.

* The Crest Nicholson Board, which has been so advised by the Company's

financial adviser, Dresdner Kleinwort, considers the terms of the Acquisition to

be fair and reasonable. In giving its advice to the Crest Nicholson Board,

Dresdner Kleinwort has taken into account the commercial assessments of the

Crest Nicholson Directors. Accordingly, each of the Crest Nicholson Directors

who has any entitlement to Crest Nicholson Shares has irrevocably undertaken to

vote in favour of the resolutions to be proposed at the Court Meeting and at the

EGM in respect of their own beneficial holdings which, in aggregate, at the

Reference Date total 745,767 Crest Nicholson Shares (representing approximately

0.66 per cent. of the existing issued share capital of Crest Nicholson). All of

these irrevocable undertakings will continue to be binding if a Competing Offer

is made.

* Castle Bidco currently holds 26,310,243 Crest Nicholson Shares,

representing approximately 23.26 per cent. of the existing issued share capital

of Crest Nicholson. Castle Bidco is precluded from voting at the Court Meeting.

Crest Nicholson Shares held by Castle Bidco will not therefore count towards the

majority required at the Court Meeting to approve the Scheme. Castle Bidco is

not, however, precluded from voting at the EGM.

* Bank of Scotland has arranged and underwritten all the debt facilities

on behalf of Castle Bidco.

* Approval of the Acquisition will be sought from the Crest Nicholson

Shareholders at the Court Meeting and at the EGM. In order to become effective,

the Scheme must be approved at the Court Meeting by the passing of a resolution

by a majority in number of the Scheme Shareholders present and voting, either in

person or by proxy, representing not less than 75 per cent. in value of the

Crest Nicholson Shares that are voted by such Scheme Shareholders. In addition,

the Special Resolution must be passed by Crest Nicholson Shareholders

representing at least 75 per cent. of the votes cast at the EGM. Implementation

of the Scheme will also require the sanction of the Scheme by the Court.

* It is expected that the Scheme Circular will be posted to Crest

Nicholson Shareholders on or around 21 March 2007. The Court Meeting and the EGM

are expected to be held on 16 April 2007 and, subject to the requisite

Shareholder and Court approvals being obtained, it is expected that the Scheme

will become effective on 3 May 2007. All dates in this announcement which relate

to the implementation of the Scheme are, however, subject to the approval of the

Court and are therefore subject to change.

Commenting on the Acquisition, John Matthews, Chairman of Crest Nicholson, said:

"Crest Nicholson is proud of its track record of delivering shareholder value

and the Board believes that this deal with Castle Bidco delivers fair value to

shareholders. The Board also see it as a positive development for the business

and its prospects. Crest Nicholson has become one of the leading providers of

sustainable developments and is meeting the challenges of producing more

environmentally responsible housing. The Board believes that Castle Bidco's

support will help Crest Nicholson take further advantage of the significant

opportunities for the future growth of its regeneration, mixed use and

traditional house building businesses."

Commenting on the Acquisition, Jim McMahon, Director of Castle Bidco said:

"We are delighted that the Board of Crest Nicholson has unanimously recommended

our offer. Castle Bidco is excited about the acquisition of Crest Nicholson, a

company with a strong underlying business and market position in urban

regeneration, as well as traditional house building. We very much look forward

to working with the Crest Nicholson management team and its employees."

Dresdner Kleinwort is acting as financial and Rule 3 adviser and broker to Crest

Nicholson. Rothschild and Panmure Gordon are acting as financial adviser and

broker, respectively, to Castle Bidco.

This summary should be read in conjunction with the full text of the following

announcement and the Appendices. The Acquisition will be subject to the

conditions set out in Appendix I to this announcement and to the further terms

to be set out in the Scheme Circular.

This announcement is not intended to, and does not, constitute or form part of

any offer to sell or an invitation to purchase any securities or the

solicitation of any vote or approval in any jurisdiction. The Proposals will be

made solely through the Scheme Circular. Any acceptance or other response to the

Proposals should be made only on the basis of the information in the Scheme

Circular. Crest Nicholson Shareholders are advised to read carefully the formal

documentation in relation to the Acquisition once it has been despatched.

Appendix II contains the sources and bases of information used in this

announcement.

Appendix III contains the definitions of certain expressions used in this

announcement.

All times referred to are London times unless otherwise stated.

Enquiries:

Rothschild (Financial Adviser to Castle Bidco) Tel: +44 (0)20 7280 5000

Alex Midgen

Kevin Ramsden

Panmure Gordon (Broker to Castle Bidco) Tel: +44 (0)20 7459 3600

Tim Linacre

Richard Gray

Crest Nicholson PLC Tel: +44 (0)1932 580 555

John Matthews

Stephen Stone

Dresdner Kleinwort (Financial and Rule 3 Adviser and Broker Tel: +44 (0)20 7623 8000

to Crest Nicholson)

Charles Batten

Michael Covington

Angus Kerr (Corporate Broking)

Brunswick (Public Relations Adviser to Crest Nicholson) Tel: +44 (0)20 7404 5959

Andrew Fenwick

Kate Miller

Rothschild, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting for Castle Bidco and for no-one else in

relation to the Proposals and will not be responsible to anyone other than

Castle Bidco for providing the protections afforded to clients of Rothschild or

for affording advice in relation to the Proposals or any matters referred to

herein.

Panmure Gordon, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting for Castle Bidco and for no-one else in

relation to the Proposals and will not be responsible to anyone other than

Castle Bidco for providing the protections afforded to clients of Panmure Gordon

or for affording advice in relation to the Proposals or any matters referred to

herein.

Dresdner Kleinwort, which is authorised and regulated by the Financial Services

Authority, is acting for Crest Nicholson and for no-one else in relation to the

Proposals and will not be responsible to anyone other than Crest Nicholson for

providing the protections afforded to customers of Dresdner Kleinwort or for

affording advice in relation to the Proposals or any matters referred to herein.

Further information in relation to the Proposals

The distribution of this announcement and the availability of the Proposals in

jurisdictions other than the UK may be restricted by law and therefore any

persons who are subject to the laws of any jurisdiction other than the UK should

inform themselves about, and observe, any applicable requirements. This

announcement has been prepared for the purpose of complying with English law and

the Takeover Code and the information disclosed may not be the same as that

which would have been disclosed if this announcement had been prepared in

accordance with the laws of jurisdictions outside England.

Copies of this announcement are not being, and must not be, directly or

indirectly, mailed or otherwise forwarded, distributed or sent in or into or

from any jurisdiction where to do so would violate the laws of that jurisdiction

and persons receiving this announcement (including custodians, nominees and

trustees) must not mail or otherwise forward, distribute or send it in, into or

from any such jurisdiction.

Castle Bidco reserves the right, with the consent of the Takeover Panel, to

implement the acquisition of Crest Nicholson by way of a takeover offer under

the Takeover Code. If the Acquisition is implemented by way of an Offer (unless

otherwise determined by Castle Bidco and permitted by applicable law and

regulation), the Offer may not be made, directly or indirectly, in or into or by

the use of mails of, or by any other means or instrumentality (including,

without limitation, electronic mail, facsimile transmission, telex, telephone,

internet or other forms of electronic communication) of interstate or foreign

commerce of, or any facility or a national state or securities exchange of, any

jurisdiction where to do so would violate the laws of that jurisdiction and the

Offer may not be capable of acceptance by any such use, means, instrumentality

or facility.

The Acquisition will be subject to the applicable rules and regulations of the

UK Listing Authority, the London Stock Exchange and the Takeover Code.

The Loan Notes that may be issued in connection with the Acquisition pursuant to

the Loan Note Alternative have not been, nor will they be, listed on any stock

exchange and have not been, nor will they be, registered under the US Securities

Act or under the securities laws of any state or other jurisdiction of the

United States (or under the securities laws of any other jurisdiction, the

residents of which Castle Bidco is advised to treat as Loan Note Restricted

Overseas Persons); the relevant clearances have not been, and will not be,

obtained from the securities commission of any province of Canada; nor has any

prospectus been lodged with, or registered by, the Australian Securities and

Investments Commission; nor have any steps been taken, nor will any steps be

taken, to enable the Loan Notes to be offered in compliance with the applicable

securities laws of Japan or any other jurisdiction if to do so would constitute

a violation of the relevant laws of, or require registration thereof in such

jurisdiction. Accordingly, unless the relevant clearances are obtained or an

exemption under such act or securities laws is available or unless otherwise

determined by Castle Bidco or required by the Takeover Code and permitted by

applicable law and regulation, the Loan Notes may not be offered, sold, resold,

delivered or transferred, directly or indirectly, in or into the United States,

Canada, Australia or Japan or any other jurisdiction if to do so would

constitute a violation of the relevant laws of, or require registration thereof

in, such jurisdiction or to, or for the account or benefit of, a person located

in the United States, Canada, Australia or Japan or such other jurisdiction.

Accordingly, subject to certain limitations and exceptions, the Loan Notes will

not be available to any Loan Note Restricted Overseas Person.

Neither the US Securities and Exchange Commission nor any US state securities

commission has approved or disapproved of the Loan Notes, or determined if this

announcement is accurate or complete. Any representation to the contrary is a

criminal offence.

Forward looking statements

This document contains certain forward-looking statements with respect to the

financial condition, results of operations and business of Crest Nicholson and

the Crest Nicholson Group and certain plans and objectives of the boards of

directors of Crest Nicholson and Castle Bidco. These forward-looking statements

can be identified by the fact that they do not relate only to historical or

current facts. Forward-looking statements often use words such as "anticipate",

"target", " expect", "estimate", "intend", "plan", "goal", "believe", "will",

"may", "should", "would", "could" or other words of similar meaning. These

statements are based on assumptions and assessments made by the boards of

directors of Crest Nicholson and Castle Bidco in light of their experience and

their perception of historical trends, current conditions, expected future

developments and other factors they believe appropriate. By their nature,

forward-looking statements involve risk and uncertainty, and the factors

described in the context of such forward-looking statements in this document

could cause actual results and developments to differ materially from those

expressed in or implied by such forward-looking statements.

Should one or more of these risks or uncertainties materialise, or should

underlying assumptions prove incorrect, actual results may vary materially from

those described in this document. Crest Nicholson and Castle Bidco assume no

obligation to update or correct the information contained in this document.

Dealing Disclosure Requirements

Under the provisions of Rule 8.3 of the Takeover Code, if any person is, or

becomes, "interested" (directly or indirectly) in one per cent. or more of any

class of "relevant securities" of Crest Nicholson, all "dealings" in any such

"relevant securities" of that company (including by means of an option in

respect of, or a derivative referenced to, any such "relevant securities") must

be publicly disclosed by no later than 3.30 pm on the London business day

following the date of the relevant transaction. This requirement will continue

until the date on which the Scheme become effective, lapses, or is withdrawn, or

upon the "offer period" otherwise ending (or, if Castle Bidco elects to effect

the Acquisition by way of an Offer, until the date on which such Offer becomes,

or is declared, unconditional as to acceptances, lapses or is otherwise

withdrawn or on which the period for which such Offer is open for acceptance

otherwise ends). If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire an "interest" in "relevant

securities" of Crest Nicholson, they will be deemed to be a single person for

the purpose of Rule 8.3.

Under the provisions of Rule 8.1 of the Takeover Code, all "dealings" in

"relevant securities" of Crest Nicholson by Castle Bidco or by Crest Nicholson,

or by any of their respective "associates", must be disclosed by no later than

12 noon on the London business day following the date of the relevant

transaction.

A disclosure table, giving details of the companies in whose "relevant

securities" "dealings" should be disclosed, and the number of such securities in

issue, can be found on the Takeover Panel's website at http://

www.thetakeoverpanel.org.uk/.

"Interests in securities" arise, in summary, when a person has long economic

exposure, whether conditional or absolute, to changes in the price of

securities. In particular, a person will be treated as having an "interest" by

virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the Takeover Code, which can also be

found on the Takeover Panel's website. If you are in any doubt as to whether or

not you are required to disclose a "dealing" under Rule 8, you should consult

the Takeover Panel.

Not for release, publication or distribution, in whole or in part, in or into or

from any jurisdiction where to do so would constitute a violation of the

relevant laws of such jurisdiction

Castle Bidco reserves the right, with the consent of the Takeover Panel, to

implement the acquisition of Crest Nicholson by way of a takeover offer under

the Takeover Code

8 March 2007

RECOMMENDED PROPOSALS FOR THE ACQUISITION

of

CREST NICHOLSON PLC

by

CASTLE BIDCO LIMITED

to be effected

by means of a Scheme of Arrangement

1. Introduction

The boards of Castle Bidco and Crest Nicholson are pleased to announce that they

have reached agreement on the terms of a recommended cash acquisition by Castle

Bidco of the entire issued and to be issued share capital of Crest Nicholson

(other than that already owned by Castle Bidco).

Castle Bidco is a company that has been formed for the purposes of the

Acquisition. Castle Bidco is owned by Bank of Scotland (through its wholly-owned

subsidiary, Uberior) and West Coast Capital (through Pacific Shelf 1410 which it

indirectly wholly owns).

2. The Acquisition

It is intended that the Acquisition will be effected by way of a Court

sanctioned scheme of arrangement under section 425 of the Companies Act. Under

the terms of the Scheme, which will be subject to the Conditions and the other

terms set out in this announcement and to the further terms and conditions to be

set out in the Scheme Circular, Crest Nicholson Shareholders (other than Castle

Bidco) will receive:

for each Crest Nicholson Share 620 pence in cash

The Acquisition values the entire issued and to be issued share capital of Crest

Nicholson at approximately #715 million.

Crest Nicholson will also pay an interim dividend of 9.7 pence per Crest

Nicholson Share in respect of the six month period ended 31 October 2006 to

Crest Nicholson Shareholders whose names appear on the register as at

9 March 2007. This Interim Dividend will be paid on 10 April 2007. Therefore, if

the Scheme becomes effective, Crest Nicholson Shareholders (other than Castle

Bidco, whose Crest Nicholson Shares are not subject to the Scheme and who will

therefore only receive the Interim Dividend) will receive, in aggregate,

629.7 pence per Crest Nicholson Share. This aggregate price per Crest Nicholson

Share represents a premium of:

- 18.5 per cent. to 531.3 pence per Crest Nicholson Share, being the average

Closing Price over the six month period to 9 November 2006; and

- 10.2 per cent. to 571.5 pence per Crest Nicholson Share, being the Closing

Price on 9 November 2006,

being the last Business Day prior to the date on which Crest Nicholson made an

announcement noting receipt of an approach from a third party regarding a

possible offer for Crest Nicholson.

3. The Loan Note Alternative

As an alternative to some or all of the cash consideration of 620 pence per

Crest Nicholson Share which would otherwise be receivable under the terms of the

Acquisition, Crest Nicholson Shareholders (other than any Loan Note Restricted

Overseas Person) will, subject to the terms and conditions which will be set out

in the Scheme Circular and the Form of Election, be able to elect to receive

Loan Notes issued by Castle Bidco on the following basis:

for each #1 of cash consideration #1 nominal value of Loan Notes

The Loan Note Alternative will be conditional upon the Scheme becoming effective

in accordance with its terms and will remain open for six months after the

Effective Date. Further details of the Loan Notes and the Loan Note Alternative

will be contained in the Scheme Circular.

The repayment of the principal amount of the Loan Notes will be guaranteed by

Bank of Scotland.

4. Background to and reasons for the Acquisition

Listed since 1972, Crest Nicholson is a residential and mixed-use development

company with an emphasis on creating sustainable communities. It operates six

regional businesses (South East, South, Eastern, Chiltern, South West and

Midlands) and an urban regeneration business. Its stated mission is to meet its

customers' expectations through the provision of environmentally sensitive and

well-built developments. Crest Nicholson is dedicated to excellence in design

and construction and to providing high quality locations and customer service.

This emphasis on quality and customer service has resulted in Crest Nicholson

receiving a number of awards, and has allowed it to maintain one of the leading

market positions in both urban regeneration (including mixed use developments)

and traditional house building.

Crest Nicholson's increasing focus on urban regeneration and larger brownfield

sites has also begun to produce increasing returns for Crest Nicholson

Shareholders and has helped the Company build one of the longest land banks in

the sector at approximately five years.

Against this background, Crest Nicholson has achieved significant growth during

the last five years, with annual unit sales growing from 1,543 to 2,946 over

that period. Over the same period, pre-tax profit has grown from #50.5 million

to #80.1 million, a compound annual growth rate of approximately 9.7%, net

assets have grown from #214.0 million to #298.5 million, a compound annual

growth rate of approximately 6.9% and earnings per share has grown from 30.8

pence to 51.2 pence, a compound annual growth rate of approximately 10.7%.

Crest Nicholson announced its preliminary results for the year ended 31 October

2006 on 25 January 2007. In respect of the financial year ended 31 October 2006,

the Company recorded consolidated turnover of #690.7 million (#699.0 million to

31 October 2005), consolidated profit before tax of #80.1 million (#78.9 million

to 31 October 2005), consolidated total assets of #841.1 million (#889.0 million

as at 31 October 2005) and consolidated net assets of #298.5 million (#263.3

million as at 31 October 2005).

The Board would like to acknowledge the contribution that Crest Nicholson's

employees have made over the years and the Company's current success is, in no

small part, due to their loyalty and dedication.

For the financial year ending 31 October 2007, Crest Nicholson remains on track

to increase both open market and affordable housing completions by around 15% as

a result of Crest Nicholson's regeneration business beginning to make a full

contribution. The volume gains will benefit the second half of 2007 due to the

trading pattern of apartment completions. Crest Nicholson's average sale price

is expected to remain similar to that achieved in 2006.

The UK house building industry is trading well and is experiencing a strong wave

of consolidation. Whilst the Board sees no reasons why a steady housing market

should not continue, external factors such as interest rates and land supply

issues can have a material impact on the prospects for the sector. Against this

background, the Board believes the Acquisition represents good and certain cash

value for Crest Nicholson Shareholders and reflects fairly the Company's current

prospects and asset position. In particular, the proposed aggregate price

(including the Interim Dividend) of 629.7 pence per Crest Nicholson Share

represents:

- 2.4 times Crest Nicholson's published net asset value per issued Crest

Nicholson Share as at 31 October 2006; and

- a price earnings ratio of 12.4 times based on Crest Nicholson's fully diluted

earnings per share for the financial year ended 31 October 2006.

5. Recommendation

The Crest Nicholson Board, which has been so advised by the Company's financial

adviser Dresdner Kleinwort, considers the terms of the Acquisition to be fair

and reasonable. In giving its advice to the Crest Nicholson Board, Dresdner

Kleinwort has taken into account the commercial assessments of the Crest

Nicholson Directors.

The Crest Nicholson Directors believe that the terms of the Acquisition are in

the best interests of Crest Nicholson Shareholders as a whole and unanimously

recommend that Crest Nicholson Shareholders vote in favour of the resolutions to

be proposed at the Court Meeting and the EGM. Each of the Crest Nicholson

Directors who has any entitlement to Crest Nicholson Shares has also irrevocably

undertaken to vote in favour of the Scheme at the Court Meeting and in favour of

the Special Resolution at the EGM, in respect of his own beneficial holdings

which, in aggregate, at the Reference Date total 745,767 Crest Nicholson Shares

(representing approximately 0.66 per cent of the existing issued share capital

of Crest Nicholson). All of these irrevocable undertakings will continue to be

binding if a Competing Offer is made.

6. Interests in Crest Nicholson Shares

As at the close of business on the Reference Date, save as disclosed below,

neither Castle Bidco (nor any of its directors) nor any other member of the

Castle Bidco Group, nor, so far as Castle Bidco is aware and save as described

below, any person deemed by the Takeover Panel to be acting in concert with

Castle Bidco, owns or controls any Crest Nicholson Shares or any securities

convertible or exchangeable into Crest Nicholson Shares (including pursuant to

any long exposure, whether conditional or absolute, to changes in the prices of

securities) or any rights to subscribe for or purchase the same, or holds any

options (including traded options) in respect of, or has any option to acquire,

any Crest Nicholson Shares or has entered into any derivatives referenced to,

Crest Nicholson Shares ("Relevant Crest Nicholson Securities") which remain

outstanding, nor does any such person hold any short positions in relation to

Relevant Crest Nicholson Securities (whether conditional or absolute and whether

in the money or otherwise), including any short position under a derivative, any

agreement to sell or any delivery obligation or right to require another person

to purchase or take delivery, nor does any such person have any arrangement in

relation to Relevant Crest Nicholson Securities. An "arrangement" also includes

any indemnity or option arrangement and any agreement or understanding, formal

or informal, of whatever nature, relating to Relevant Crest Nicholson Securities

which may be an inducement to deal or refrain from dealing in such securities.

Save as described in the following paragraph, in view of the requirement of

confidentiality and therefore the availability to Castle Bidco of all relevant

persons within the HBOS Group to provide information, it has not been possible

to ascertain all of the interests and dealings (if more than the interests

disclosed in the following paragraph) of relevant persons within the HBOS Group

in Crest Nicholson Shares. Any such additional interest(s) or dealing(s) will be

discussed with the Takeover Panel and, if appropriate, will be disclosed to

Crest Nicholson Shareholders in the Scheme Circular or announced earlier if

requested by the Takeover Panel.

As at the close of business on the Reference Date:

(i) Castle Bidco was the owner of 26,310,243 Crest Nicholson Shares,

representing approximately 23.26% of the existing issued share capital of Crest

Nicholson; and

(ii) members of the HBOS Group (excluding Castle Bidco) were interested in a

total of 4,990,830 Crest Nicholson Shares, representing approximately 4.41% of

the existing issued share capital of Crest Nicholson. Of these, interests in

937,107 Crest Nicholson Shares, representing approximately 0.83% of the existing

issued share capital of Crest Nicholson, were discretionary interests and

interests in 3,868,616 Crest Nicholson Shares, representing approximately 3.42%

of the existing issued share capital of Crest Nicholson, were beneficial

interests.

The Crest Nicholson Shares held by Castle Bidco and the Crest Nicholson Shares

held by relevant members of the HBOS Group (in respect of which they are

beneficially interested or have a discretionary interest) are precluded from

voting at the Court Meeting. Crest Nicholson Shares held by Castle Bidco and

such interests of the members of the HBOS Group will not therefore count towards

the majority required at the Court Meeting to approve the Scheme. Castle Bidco

and the relevant members of the HBOS Group holding Crest Nicholson Shares are

not, however, precluded from voting at the EGM.

7. Information on Castle Bidco, Castle Topco and the Castle

Consortium

(a) Castle Bidco

Castle Bidco is a limited liability company incorporated in England and Wales

for the purposes of the Acquisition. Castle Bidco is a wholly-owned subsidiary

of Castle Midco, which in turn is a wholly-owned subsidiary of Castle Topco

(further details of which are contained in paragraph (b) below). Castle Bidco

has not traded since its date of incorporation, nor has it entered into any

obligations, other than in connection with the acquisition of 26,310,243 Crest

Nicholson Shares during November 2006 and the Acquisition.

The current directors of Castle Bidco are John Moran, Joanna Bannerman, Paul

Davidson and Jim McMahon. The registered office of Castle Bidco is 21-23 Hill

Street, Mayfair, London W1J 5JW and its registered number is 5988526.

(b) Castle Topco

Castle Topco is a limited liability company incorporated in England and Wales in

connection with the Acquisition. Castle Topco is a consortium company which is

owned by Bank of Scotland (through its wholly-owned subsidiary, Uberior) (as to

50.0 per cent.) and West Coast Capital (through Pacific Shelf 1410 which it

indirectly wholly owns) (as to 50.0 per cent.). Castle Topco has not traded

since its date of incorporation, nor has it entered into any obligations, other

than in connection with the acquisition by Castle Bidco of 26,310,243 Crest

Nicholson Shares during November 2006 and the Acquisition.

The current directors of Castle Topco are John Moran, Joanna Bannerman, Paul

Davidson and Jim McMahon. The registered office of Castle Topco is 21-23 Hill

Street, Mayfair, London W1J 5JW and its registered number is 5988581.

(c) The Castle Consortium

Uberior

Uberior was incorporated as a limited company in Scotland (Registered Number

SC235067) on 7 August 2002 and is ultimately a wholly-owned subsidiary of HBOS.

HBOS was formed from the merger of Halifax plc with Bank of Scotland in

September 2001 and is a diversified financial services company providing, inter

alia, corporate and treasury services in addition to retail banking services to

consumers and companies in the UK and overseas.

Uberior operates as a holding company for investments arranged by Bank of

Scotland Joint Ventures team, part of Bank of Scotland's Corporate division

within HBOS. The investments are made for HBOS' own account in a broad range of

asset backed business sectors.

Bank of Scotland is both an active investor in and lender to the commercial

property and retail markets. Its Joint Ventures team is engaged in the business

of providing funding strips including senior debt, mezzanine debt and equity to

asset backed sectors such as commercial property, leisure, hotels and house

building. The Joint Ventures team currently has 120 joint ventures in its

portfolio, with committed funding of over #12 billion.

The latest audited consolidated annual accounts of Uberior in respect of the

financial year ended 31 December 2005, disclosed operating income of #46 million

(#37 million to 31 December 2004), profit before tax of #112 million (#43

million to 31 December 2004), total assets of #584 million (#483 million

(restated) as at 31 December 2004) and net assets of #59 million (#36 million

(restated) as at 31 December 2004).

The registered office of Uberior is Level 1, Citymark, 150 Fountainbridge,

Edinburgh, EH3 9PE. The directors of Uberior are B.S. Anderson, D.K. Gateley,

H.C. McMillan, J.C. Moran, E.J. Morrison, I Robertson and G.R.A. Shankland. The

authorised share capital of Uberior is #1,000 divided into 1,000 shares of #1

each of which 1 share has been issued.

Following the Scheme becoming effective, Uberior will be the legal and

beneficial owner of 50.0 per cent. of the issued share capital of Castle Topco.

West Coast Capital/Pacific Shelf 1410

Pacific Shelf 1410 is a limited liability company incorporated in Scotland on 12

January 2007 for the purpose of holding TBH Investments' interest in Castle

Bidco. Pacific Shelf 1410 is wholly-owned by TBH Investments. The current

directors of Pacific Shelf 1410 are Jim McMahon and Paul Davidson. The

registered office of Pacific Shelf 1410 is Marathon House, Olympic Business

Park, Drybridge Road, Dundonald, Ayrshire KA2 9AE and its registered number is

SC314564.

TBH Investments is an investment holding company based in Ayrshire, Scotland.

TBH Investments' primary activity is investing in the property sector in the UK

using funding made available by West Coast Capital and, where appropriate,

external debt funding. TBH Investments has interests in a number of joint

venture vehicles which have acquired or established substantial property

portfolios.

TBH Investments is indirectly wholly-owned by West Coast Capital, a private

equity fund established in February 2001 and owned and funded by the retail

entrepreneur Sir Tom Hunter, and by Jim McMahon and Paul Davidson. West Coast

Capital is a partnership established in Scotland which invests mainly in the

retail and property sectors and has substantial liquid reserves available for

investment, often co-investing with other major investors and institutions.

TBH Investments was incorporated in Scotland as a private limited company on 6

November 1992 with registered number 02762478. The registered office is c/o

McGrigors, 5 Old Bailey, London EC4M 7BA. The directors of TBH Investments are

Jim McMahon and Paul Davidson. The authorised capital of TBH Investments is

#1,000 divided into 200 ordinary shares of #1.00 each and 800 A ordinary shares

of #1.00 each, of which 140 ordinary shares of #1.00 each and 560 A ordinary

shares of #1.00 each are in issue.

The audited group accounts of TBH Investments for the 12 month period ended 31

March 2006 disclosed profit before tax of #31.5 million (#7.5 million to 31

March 2005), total assets of #173.1 million (#87.7 million as at 31 March 2005)

and net assets of #89.8 million (#56.6 million as at 31 March 2005).

Following the Scheme becoming effective, Pacific Shelf 1410 will be the legal

and beneficial owner of 50.0 per cent. of the issued share capital of Castle

Topco.

8. Future plans for Crest Nicholson

Castle Bidco believes that the next stage of Crest Nicholson's development would

be best achieved under private ownership, under which the executive management

team and employees will be able to fully concentrate on the long-term

development of the business without the short-term targets and reporting

requirements imposed on companies by the public markets. Castle Bidco views

Crest Nicholson as being a market leading player in both the urban regeneration

and traditional house building sectors and considers that such characteristics

should help ensure its successful future expansion and development. Castle Bidco

has confirmed that it attaches great importance to the skills and experience of

the existing management and employees of Crest Nicholson and believes that they

will be key factors in the future success of Crest Nicholson and will

accordingly look to financially incentivise key employees of the Crest Nicholson

Group. Discussions regarding the terms of such incentivisation will commence s

hortly after the Scheme becomes effective.

In this context, Castle Bidco has provided assurances to the Crest Nicholson

Board that:

- the existing employment rights and terms and conditions of employees of Crest

Nicholson will be safeguarded on the Scheme becoming effective;

- in accordance with the agreement reached with the Pension Fund Trustees,

details of which are set out in paragraph 9 below, the participating employers

in the Crest Nicholson Defined Benefit Scheme will fund the deficit in the Crest

Nicholson Defined Benefit Scheme over a period of 10 years, by paying an

increased funding rate to the Crest Nicholson Defined Benefit Scheme and Castle

Bidco has no intention to make detrimental changes to the benefits provided

under the Defined Benefit Scheme;

- it does not currently anticipate job losses in the business over those

envisaged by the Crest Nicholson management team, as a result of the change of

ownership to be effected pursuant to the Scheme;

- its strategic plans for Crest Nicholson do not envisage any change to the

principal locations of the Crest Nicholson business or any redeployment of any

material fixed assets whether owned or controlled by Crest Nicholson; and

- it intends to support management's strategy of achieving profitable growth

through increasing the scale and capital available to the business. This

strategy includes the addition of new regions in due course and further growing

Crest Nicholson's land and operational resources to take full advantage of

future value-enhancing growth opportunities.

The Board of Crest Nicholson welcomes these assurances.

Bank of Scotland has provided debt and/or equity finance to a number of partners

in the house building sector. Bank of Scotland may in the future review

appropriate combinations with other house building vehicles financed by members

of the HBOS Group, although Bank of Scotland has confirmed that there are

currently no ongoing discussions regarding any such combinations.

Castle Bidco has indicated to the Crest Nicholson Board that, as soon as

practicable after the Scheme becomes effective, it intends to appoint David

Shearer (a current non-executive director of HBOS) as the non-executive chairman

of Crest Nicholson.

9. Pensions

The Pension Fund Trustees of the Crest Nicholson Defined Benefit Scheme have

agreed to a proposal from Castle Bidco which provides, amongst other things,

that following the Scheme becoming effective:

9.1 Bank of Scotland will provide a guarantee to the Pension Fund

Trustees in the sum of up to #50 million for a period of 10 years in respect of

the liability of the participating employers in the Crest Nicholson Defined

Benefit Scheme under section 75 of the Pensions Act 1995 ("Section 75") on the

occurrence of an "insolvency event" within the meaning of section 121 of the

Pensions Act 2004 in relation to one or more of those employers, or on the

winding up of the Crest Nicholson Defined Benefit Scheme, or, in the sum of the

unpaid contribution. The guarantee reduces at a rate of #4 million per annum on

a straight-line basis and expires on the tenth anniversary of the Effective

Date;

9.2 the participating employers will pay the following

contributions to the Crest Nicholson Defined Benefit Scheme:

9.2.1 the sum of #5 million on or shortly after the Scheme becomes

effective;

9.2.2 #4 million per annum in equal monthly instalments from the

seventh month after the date on which the Scheme becomes effective for a period

of 9 years and 6 months; and

9.2.3 the sum of #15 million by the date which is 10 years after the

date when the Scheme becomes effective,

and the Pension Fund Trustees have agreed to adopt a schedule of contributions

reflecting the obligations in paragraphs 9.2.1 to 9.2.3 above for the purposes

of the recovery plan required under the Pensions Act 2004 arising from the

actuarial valuation of the Crest Nicholson Defined Benefit Scheme as at 1

February 2007; and

9.3 in consideration of the above matters, the Pension Fund

Trustees have provided a non-legally binding letter of comfort that their

current intention is not to require employer contributions towards the past

service deficit in the Crest Nicholson Defined Benefit Scheme which exceed the

amounts specified in paragraphs 9.2.1 to 9.2.3 above and that the Pension Fund

Trustees will not alter the investment strategy of the Crest Nicholson Defined

Benefit Scheme without first consulting with the participating employers.

10. Crest Nicholson Share Schemes

Appropriate proposals will be made to participants in the Crest Nicholson Share

Schemes in due course. Details of these proposals will be set out in separate

letters to be sent to participants in the Crest Nicholson Share Schemes.

11. Financing

The Acquisition will be funded by a combination of equity and debt funding. The

equity funding will be provided by the members of the Castle Consortium and debt

facilities of #1.12 billion have been arranged and fully underwritten by Bank of

Scotland. These debt facilities will also be used to refinance the existing debt

of Crest Nicholson, provide working capital for Crest Nicholson after completion

of the Acquisition and pay certain fees and expenses associated with the

Acquisition.

Under the agreements for the provision of the debt facilities, Castle Bidco has

agreed, save as may be required by the Court, not to waive or amend any term or

condition to the Scheme without the prior written consent of Bank of Scotland.

Rothschild has confirmed that it is satisfied that sufficient resources are

available to Castle Bidco to satisfy the full cash consideration payable to

Crest Nicholson Shareholders under the terms of the Acquisition.

Further information on the financing of the Acquisition will be set out in the

Scheme Circular.

12. Implementation and Inducement Fee Agreements

As an inducement to Castle Bidco carrying out its due diligence in respect of

the Acquisition and devoting management time and resources in connection with

the Acquisition, Crest Nicholson has agreed, at the request of Castle Bidco, to

pay Castle Bidco an inducement fee equal to #7,150,005 (unless such fee is

consideration for a taxable supply by Castle Bidco or any member of the Castle

Bidco Group, in which case the inducement fee shall be the amount as, after

taking into account any available refund or credit in respect of such VAT

available to Crest Nicholson or the relevant member of the Crest Nicholson

Group, will involve a net cost to Crest Nicholson of #7,150,005).

This fee becomes payable if:

* any of the Crest Nicholson Directors withdraws or qualifies their

recommendation of the Proposals or modifies it in a manner which is adverse to

Castle Bidco and the Acquisition subsequently fails or otherwise fails to become

effective; or

* the Company fails to take the actions it has agreed to take in

connection with the Scheme, pursuant to the Implementation Agreement and the

Acquisition subsequently fails or otherwise fails to become effective; or

* before the Acquisition becomes effective, lapses or is withdrawn, a

Competing Offer is made and (a) such offer becomes or is declared unconditional

in all respects or is otherwise completed or implemented or (b) such offer is

publicly recommended by the Crest Nicholson Directors or such of the Crest

Nicholson Directors as are independent at the relevant time (as the case may

be);

Castle Bidco and Crest Nicholson have also entered into the Implementation

Agreement which governs their relationship during the period until the Scheme

becomes effective, lapses or is withdrawn. Amongst other things, the parties

have agreed to cooperate to implement the Acquisition and Crest Nicholson has

entered into certain undertakings concerning the conduct of its business and the

provision of certain further information during that period.

The full terms of the Implementation Agreement and the Inducement Fee Agreement

will be summarised in the Scheme Circular.

13. Scheme of Arrangement

It is intended that the Acquisition will be effected by means of a Scheme of

Arrangement between Crest Nicholson and the Scheme Shareholders under section

425 of the Companies Act (although Castle Bidco reserves the right, with the

consent of the Takeover Panel, to effect the Acquisition by way of an Offer).

The purpose of the Scheme is to allow Castle Bidco to become the owner of the

entire issued share capital of Crest Nicholson not currently owned by Castle

Bidco.

This is to be achieved by:

* the cancellation of the Cancellation Shares held by Cancellation

Shareholders and the application of the reserve arising from such cancellation

in paying up in full a number of New Crest Nicholson Shares (which is equal to

the number of Cancellation Shares cancelled) and issuing the New Crest Nicholson

Shares to Castle Bidco in consideration for which Cancellation Shareholders will

receive 620 pence per Crest Nicholson Share on the basis set out in paragraph 2

to this announcement; and

* the transfer by Crest Nicholson Shareholders of the Loan Note

Elected Shares in accordance with the Scheme in consideration for which relevant

Scheme Shareholders will be issued by Castle Bidco with Loan Notes (instead of

the cash to which they would otherwise have been entitled), on the basis set out

in paragraph 3 of this announcement.

The implementation of the Acquisition is subject to the satisfaction or waiver

of all the Conditions and the further terms to be set out in the Scheme of

Arrangement. In particular, the Scheme requires the passing of a resolution at

the Court Meeting by a majority in number of the Scheme Shareholders present and

voting, either in person or by proxy, representing not less than 75 per cent. in

value of the Crest Nicholson Shares voted by such Scheme Shareholders.

The Crest Nicholson Shares held by Castle Bidco and the Crest Nicholson Shares

held by relevant members of the HBOS Group (in respect of which they are

beneficially interested or have a discretionary interest) are precluded from

voting at the Court Meeting. The Crest Nicholson Shares held by Castle Bidco and

such interests of the members of the HBOS Group will not therefore count towards

the majority required at the Court Meeting to approve the Scheme. Castle Bidco

and the relevant members of the HBOS Group holding Crest Nicholson Shares are

not, however, precluded from voting at the EGM.

Implementation of the Scheme will also require the passing of the Special

Resolution at the EGM, requiring the approval of Crest Nicholson Shareholders

representing at least 75 per cent. of the votes cast at the EGM, which will be

held immediately after the Court Meeting. Castle Bidco and the relevant members

of the HBOS Group holding Crest Nicholson Shares will be entitled to attend and

vote at the EGM.

Following the Meetings, the Scheme will only become effective following sanction

by the Court and delivery of the Court Order to and, in the case of the Capital

Reduction, registration of the Court Order by, the Registrar of Companies.

Upon the Scheme becoming effective, it will be binding on all Scheme

Shareholders, irrespective of whether or not they attended or voted at the Court

Meeting or the EGM (and if they attended and voted, whether or not they voted in

favour).

Expected timetable of principal events:

Posting of Scheme Circular 21 March 2007

Court Meeting 16 April 2007

Extraordinary General Meeting 16 April 2007

Court hearing to sanction the Scheme and to confirm the 2 May 2007

Capital Reduction

(if sanctioned by the Crest Nicholson Shareholders)

Effective Date of the Scheme 3 May 2007

(if sanction and confirmation of the Court is received)

Latest date for consideration to be posted to 17 May 2007

Shareholders (if Scheme becomes effective on 3 May 2007)

All dates in this announcement which relate to the implementation of the Scheme

are subject to the approval of the Court and are therefore subject to change.

Further details of the Scheme will be contained in the Scheme Circular.

14. Delisting, cancellation of trading and re-registration

If the Scheme becomes effective, it is intended that applications be made to the

UK Listing Authority for the listing of Crest Nicholson Shares on the Official

List to be cancelled and to the London Stock Exchange for the cancellation of

trading of Crest Nicholson Shares on its market for listed securities, in each

case to take effect on the day that is two Business Days after the Effective

Date.

It is proposed that, following the Scheme becoming effective and after the Crest

Nicholson Shares have been de-listed, Crest Nicholson will be re-registered as a

private limited company.

15. General

Dresdner Kleinwort is acting as financial and Rule 3 adviser and broker to Crest

Nicholson. Rothschild and Panmure Gordon are acting as financial adviser and

broker respectively to Castle Bidco.

The Proposals will be subject to the conditions set out in Appendix I to this

announcement but will be made solely through, and be subject to the further

terms set out in, the Scheme Circular, which will contain the full terms and

conditions of the Acquisition, including details of how to vote in favour of the

Scheme. Any acceptance or other response to the Proposals should be made only on

the basis of the information in the Scheme Circular. Crest Nicholson

Shareholders are advised to read carefully the formal documentation in relation

to the Proposals once it has been despatched. The Scheme Circular will also

include full details of the Scheme, together with notices of the Court Meeting

and the EGM.

The Acquisition will be governed by English law and be subject to the applicable

requirements of the Takeover Code, the Takeover Panel, the London Stock Exchange

and the Financial Services Authority.

The implications of the Scheme for persons not resident in the UK may be

affected by the laws of the relevant jurisdiction. Any persons who are subject

to the laws of any jurisdiction other than the UK should inform themselves about

and observe any applicable requirements.

Appendix II contains the sources and bases of information used in this

announcement.

Appendix III contains the definitions of certain expressions used in this

announcement.

All times referred to are London times unless otherwise stated.

Enquiries:

Rothschild (Financial Adviser to Castle Bidco) Tel: +44 (0)20 7280 5000

Alex Midgen

Kevin Ramsden

Panmure Gordon (Broker to Castle Bidco) Tel: +44 (0)20 7459 3600

Tim Linacre

Richard Gray

Crest Nicholson PLC Tel: +44 (0)1932 580 555

John Matthews

Stephen Stone

Dresdner Kleinwort (Financial and Rule 3 Adviser and Broker Tel: +44 (0)20 7623 8000

to Crest Nicholson)

Charles Batten

Michael Covington

Angus Kerr (Corporate Broking)

Brunswick (Public Relations Adviser to Crest Nicholson) Tel: +44 (0)20 7404 5959

Andrew Fenwick

Kate Miller

Rothschild, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for Castle Bidco and for

no-one else in relation to the Proposals and will not be responsible to anyone

other than Castle Bidco for providing the protections afforded to clients of

Rothschild or for affording advice in relation to the Proposals or any matters

referred to herein.

Panmure Gordon, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for Castle Bidco and for

no-one else in relation to the Proposals and will not be responsible to anyone

other than Castle Bidco for providing the protections afforded to clients of

Panmure Gordon or for affording advice in relation to the Proposals or any

matters referred to herein.

Dresdner Kleinwort, which is authorised and regulated by the Financial Services

Authority, is acting for Crest Nicholson and for no-one else in relation to the

Proposals and will not be responsible to anyone other than Crest Nicholson for

providing the protections afforded to customers of Dresdner Kleinwort or for

affording advice in relation to the Proposals or any matters referred to herein.

Further information in relation to the Acquisition

The distribution of this announcement and the availability of the Proposals in

jurisdictions other than the UK may be restricted by law and therefore any

persons who are subject to the laws of any jurisdiction other than the UK should

inform themselves about, and observe, any applicable requirements. This

announcement has been prepared for the purpose of complying with English law and

the Takeover Code and the information disclosed may not be the same as that

which would have been disclosed if this announcement had been prepared in

accordance with the laws of jurisdictions outside England.

Copies of this announcement are not being, and not must be, directly or

indirectly, mailed or otherwise forwarded, distributed or sent in or into or

from any jurisdiction where to do so would violate the laws in that jurisdiction

and persons receiving this announcement (including custodians, nominees and

trustees) must not mail or otherwise forward, distribute or send it in, into or

from any such jurisdiction.

The Acquisition will be subject to the applicable rules and regulations of the

UK Listing Authority, the London Stock Exchange and the Takeover Code.

Castle Bidco reserves the right, with the consent of the Takeover Panel, to

implement the acquisition of Crest Nicholson by way of a takeover offer under

the Takeover Code. If the Acquisition is implemented by way of an Offer, unless

otherwise determined by Castle Bidco and permitted by applicable law and

regulation, the Offer may not be made, directly or indirectly, in or into or by

the use of mails of, or by any other means or instrumentality (including,

without limitation, electronic mail, facsimile transmission, telex, telephone,

internet or other forms of electronic communication) of interstate or foreign

commerce of, or any facility or a national state or securities exchange of, any

jurisdiction where to do so would violate the laws of that jurisdiction and the

Offer may not be capable of acceptance by any such use, means, instrumentality

or facility.

The Loan Notes that may be issued in connection with the Acquisition pursuant to

the Loan Note Alternative have not been, nor will they be, listed on any stock

exchange and have not been, nor will they be, registered under the US Securities

Act or under the securities laws of any state or other jurisdiction of the

United States (or under the securities laws of any other jurisdiction, the

residents of which Castle Bidco is advised to treat as Loan Note Restricted

Overseas Persons); The relevant clearances have not been, and will not be,

obtained from the securities commission of any province of Canada; nor has any

prospectus been lodged with, or registered by, the Australian Securities and

Investments Commission; nor have any steps been taken, nor will any steps be

taken, to enable the Loan Notes to be offered in compliance with the applicable

securities laws of Japan or any other jurisdiction if to do so would constitute

a violation of, or require registration thereof under, the relevant laws in such

jurisdiction. Accordingly, unless the relevant clearances are obtained or an

exemption under such act or securities laws is available or unless otherwise

determined by Castle Bidco or required by the Takeover Code and permitted by

applicable laws and regulations, the Loan Notes may not be offered, sold,

resold, delivered or transferred, directly or indirectly, in or into the United

States, Canada, Australia or Japan or any other jurisdiction if to do so would

constitute a violation of the relevant laws of, or require registration thereof

in, such jurisdiction or to, or for the account or benefit of, a person located

in the United States, Canada, Australia or Japan or such other jurisdiction.

Accordingly, subject to certain limitations and exceptions, the Loan Notes will

not be available to, inter alia, Loan Note Restricted Overseas Persons.

Neither the US Securities and Exchange Commission nor any US state securities

commission has approved or disapproved of the Loan Notes, or determined if this

announcement is accurate or complete. Any representation to the contrary is a

criminal offence.

Forward looking statements

This document contains certain forward-looking statements with respect to the

financial condition, results of operations and business of Crest Nicholson and

the Crest Nicholson Group and certain plans and objectives of the boards of

directors of Crest Nicholson and Castle Bidco. These forward-looking statements

can be identified by the fact that they do not relate only to historical or

current facts. Forward-looking statements often use words such as "anticipate",

"target", " expect", "estimate", "intend", "plan", "goal", "believe", "will",

"may", "should", "would", "could" or other words of similar meaning. These

statements are based on assumptions and assessments made by the boards of

directors of Crest Nicholson and Castle Bidco in light of their experience and

their perception of historical trends, current conditions, expected future

developments and other factors they believe appropriate. By their nature,

forward-looking statements involve risk and uncertainty, and, inter alia, the

factors described in the context of such forward-looking statements in this

document could cause actual results and developments to differ materially from

those expressed in or implied by such forward-looking statements.

Should one or more of these risks or uncertainties materialise, or should

underlying assumptions prove incorrect, actual results may vary materially from

those described in this announcement. Crest Nicholson and Castle Bidco assume no

obligation to update or correct the information contained in this announcement.

Dealing Disclosure Requirements

Under the provisions of Rule 8.3 of the Takeover Code, if any person is, or

becomes, "interested" (directly or indirectly) in one per cent. or more of any

class of "relevant securities" of Crest Nicholson, all "dealings" in any such

"relevant securities" of that company (including by means of an option in

respect of, or a derivative referenced to, any such "relevant securities") must

be publicly disclosed by no later than 3.30 pm on the London business day

following the date of the relevant transaction. This requirement will continue

until the date on which the Scheme become effective, lapses, or is withdrawn, or

upon the "offer period" otherwise ending (or, if Castle Bidco elects to effect

the Acquisition by way of an Offer, until the date on which such Offer becomes,

or is declared, unconditional as to acceptances, lapses or is otherwise

withdrawn or on which the period for which such Offer is open for acceptance

otherwise ends). If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire an "interest" in "relevant

securities" of Crest Nicholson, they will be deemed to be a single person for

the purpose of Rule 8.3. Under the provisions of Rule 8.1 of the Takeover Code,

all "dealings" in "relevant securities" of Crest Nicholson by Castle Bidco or by

Crest Nicholson, or by any of their respective "associates", must be disclosed

by no later than 12 noon on the London business day following the date of the

relevant transaction.

A disclosure table, giving details of the companies in whose "relevant

securities" "dealings" should be disclosed, and the number of such securities in

issue, can be found on the Takeover Panel's website at http://

www.thetakeoverpanel.org.uk/.

"Interests in securities" arise, in summary, when a person has long economic

exposure, whether conditional or absolute, to changes in the price of

securities. In particular, a person will be treated as having an "interest" by

virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the Takeover Code, which can also be

found on the Takeover Panel's website. If you are in any doubt as to whether or

not you are required to disclose a "dealing" under Rule 8, you should consult

the Takeover Panel.

Appendix I: Conditions to the implementation of the Acquisition

1. The Acquisition will be conditional upon the Scheme

becoming unconditional and becoming effective by not later than 7 July 2007 or

such later date (if any) as Crest Nicholson and Castle Bidco may, with the

consent of the Takeover Panel, agree and (if required) the Court may allow.

2. The Scheme will be conditional upon:

(a) approval of the Scheme by a majority in number, representing

75 per cent. or more in value of Crest Nicholson Shareholders (other than Castle

Bidco) present and voting, either in person or by proxy, at the Court Meeting;

(b) the resolution(s) in connection with or required to approve

and implement the Scheme being duly passed by the requisite majority at the EGM;

and

(c) the sanction of the Scheme and the confirmation of the

Capital Reduction by the Court (in either case, with or without modifications on

terms acceptable to Crest Nicholson and Castle Bidco) and the delivery of a

certified copy of the Court Order and the minute of such reduction attached

thereto to the Registrar of Companies in England and Wales and the registration,

in relation to the Capital Reduction, of such Court Order by him.

3. Crest Nicholson and Castle Bidco have agreed that, subject

as stated in condition 4 below, the Acquisition will be conditional upon the

following matters and, accordingly, the office copy of the Court Order will not

be delivered to the Registrar of Companies in England and Wales and the

registration of the Court Order with the Registrar of Companies will not occur

unless the Conditions (as amended if appropriate) have been satisfied or waived:

(a) no government or governmental, quasi-governmental,

supranational, statutory or regulatory body or association, institution or

agency (including any trade agency) or any court or other body (including any

professional or environmental body) or person in any relevant jurisdiction (each

a "Relevant Authority") having decided to take, instituted, implemented or

threatened any action, proceeding, suit, investigation, enquiry or reference or

enacted, made or proposed and there not continuing to be outstanding any

statute, regulation, order or decision that would or might be reasonably

expected to:

(i) make the Acquisition or its implementation or the

acquisition of any shares in, or control of, Crest Nicholson by any member of

the Wider Castle Bidco Group void, unenforceable or illegal under the laws of

any relevant jurisdiction or directly or indirectly prohibit or otherwise

materially restrict, prevent or delay or interfere with the implementation of,

or impose additional material conditions or obligations with respect to, or

otherwise challenge or materially interfere with the Acquisition or the

acquisition of any shares in, or control of, Crest Nicholson by any member of

the Wider Castle Bidco Group;

(ii) require the divestiture by any member of the Wider Castle

Bidco Group or by any member of the Wider Crest Nicholson Group of all or any

part of their respective businesses, assets or properties or impose any

limitation on their ability to conduct all or any part of their respective

businesses and to own or control any of their respective assets or properties

which, in any such case, is material in the context of the Wider Castle Bidco

Group or the Wider Crest Nicholson Group in either case taken as a whole;

(iii) impose any limitation on, or result in any delay in, the

ability of any member of the Wider Castle Bidco Group to acquire or hold or to

exercise effectively, directly or indirectly, all or any rights of ownership of

shares or other securities (or the equivalent) in, or to exercise voting or

management control over, any member of the Wider Crest Nicholson Group or on the

ability of any member of the Wider Crest Nicholson Group to hold or exercise

effectively, directly or indirectly, all or any rights of ownership of shares or

other securities (or the equivalent) in, or to exercise management control over,

any other member of the Wider Crest Nicholson Group which, in any such case, is

material in the context of the Wider Castle Bidco Group or the Wider Crest

Nicholson Group in either case taken as a whole;

(iv) require any member of the Wider Castle Bidco Group or of the

Wider Crest Nicholson Group to acquire or offer to acquire any shares or other

securities (or the equivalent) in any member of the Wider Crest Nicholson Group

or any asset owned by any third party (other than the acquisition of Crest

Nicholson Shares in the implementation of the Acquisition) which, in any such

case, is material in the context of the Wider Castle Bidco Group or the Wider

Crest Nicholson Group in either case taken as a whole;

(v) impose any limitation on the ability of any member of the

Wider Castle Bidco Group or the Wider Crest Nicholson Group to conduct its

business which, in any such case, is material in the context of the Wider Castle

Bidco Group or the Wider Crest Nicholson Group in either case taken as a whole;

or

(vi) otherwise adversely affect any or all of the business, assets,

financial or trading position or profits or prospects of any member of the Wider

Castle Bidco Group or of the Wider Crest Nicholson Group to an extent which is

material in the context of the Wider Castle Bidco Group or of the Wider Crest

Nicholson Group in either case taken as a whole,

and all applicable waiting and other time periods during which any such Relevant

Authority could decide to take, institute, implement or threaten any such

action, proceeding, suit, investigation, enquiry or reference or take any other

step under the laws of any jurisdiction in respect of the Acquisition or the

proposed acquisition of any shares in Crest Nicholson having expired, lapsed or

been terminated;

(b)

(i) all necessary notifications, filings or applications which

are the responsibility of any member of the Crest Nicholson Group having been

made in connection with the Acquisition;

(ii) all statutory or regulatory obligations in any jurisdiction

having been complied with and all applicable waiting periods (including any

extensions thereof) under any applicable legislation or regulation of any

relevant jurisdiction having expired, lapsed or been terminated in each case in

respect of the Acquisition or the acquisition by any member of the Wider Castle

Bidco Group of any shares in, or control of, Crest Nicholson and, save as

Disclosed, all other necessary statutory or regulatory obligations in any

relevant jurisdiction having been complied with by the Wider Crest Nicholson

Group;

(iii) all authorisations, orders, grants, recognitions,

confirmations, licences, consents, clearances, permissions and approvals

(together "Authorisations") reasonably necessary for the implementation of the

Acquisition having been obtained in terms and in a form reasonably satisfactory

to Castle Bidco (where failure to obtain such Authorisations would have a

material adverse effect on the Wider Crest Nicholson Group, the Wider Castle

Group or the ability of Castle Bidco to implement the Acquisition) from

appropriate Relevant Authorities or, save as Disclosed, from any persons or

bodies with whom any member of the Wider Crest Nicholson Group has entered into

contractual arrangements; and

(iv) such Authorisations together with all material Authorisations

necessary for any member of the Wider Crest Nicholson Group to carry on its

business remaining in full force and effect and no notice of any intention to

revoke, suspend, restrict or modify or not to renew any of the same having been

made at the time at which the Scheme becomes effective.

(c) save as Disclosed, there being no provision of any agreement,

arrangement, licence, permit or other instrument to which any member of the

Wider Crest Nicholson Group is a party or by or to which any such member or any

of its assets is or may be bound, entitled or subject which, as a result of the

making or implementation of the Acquisition or the acquisition or proposed

acquisition by any member of the Wider Castle Bidco Group of any shares in, or

change in the control or management of, Crest Nicholson or otherwise, would or

might reasonably be expected to result in, to an extent which is material in the

context of the Wider Crest Nicholson Group taken as a whole:

(i) any monies borrowed by or any other indebtedness (actual or

contingent) of any such member of the Wider Crest Nicholson Group becoming

repayable or capable of being declared repayable immediately or earlier than the

stated repayment date or the ability of such member to borrow monies or incur

any indebtedness being withdrawn or inhibited or becoming capable of being

withdrawn or inhibited;

(ii) the creation or enforcement of any mortgage, charge or other

security interest over the whole or any part of the business, property or assets

of any such member of the Wider Crest Nicholson Group or any such security

interest (whenever arising or having arisen) becoming enforceable;

(iii) any assets or interest of, or any asset the use of which is

enjoyed by, any such member of the Wider Crest Nicholson Group being or falling

to be disposed of or charged or any right arising under which any such asset or

interest could be required to be disposed of or charged or could cease to be

available to any member of the Wider Crest Nicholson Group;

(iv) the interest or business of any such member of the Wider Crest

Nicholson Group in or with any other person, firm or company (or any agreements

or arrangements relating to such interest or business) being terminated or

adversely affected;

(v) any such member of the Wider Crest Nicholson Group ceasing to

be able to carry on business under any name under which it presently does so;

(vi) the value of any such member of the Wider Crest Nicholson

Group or its financial or trading position or prospects being prejudiced or

adversely affected;

(vii) any liability of any member of the Wider Crest Nicholson Group

to make any severance, termination, bonus or other payment to any of the

directors or the officers;

(viii) any such agreement, arrangement, licence or other instrument or

the rights, liabilities, obligations or interests of any such member thereunder

being terminated or adversely modified or any onerous obligation arising or any

adverse action being taken or any obligation or liability arising thereunder; or

(ix) the creation of any liabilities (actual or contingent) by any

such member of the Wider Crest Nicholson Group;

and no event having occurred which, under any provision of any agreement,

arrangement, licence, permit or other instrument to which any member of the

Wider Crest Nicholson Group is a party or by or to which any such member or any

of its assets may be bound or be subject, could reasonably be expected to result

in any of the events or circumstances as are referred to in subparagraphs (i) to

(ix) of this condition (c);

(d) except as Disclosed, no member of the Wider Crest Nicholson

Group having since 31 October 2005:

(i) save as between Crest Nicholson and wholly-owned

subsidiaries of Crest Nicholson and save for Scheme Shares issued pursuant to

the Crest Nicholson Share Schemes or options granted or awards of shares

thereunder, issued or agreed to issue or authorised the issue or grant of

additional shares of any class, or securities, or securities convertible into,

or exchangeable for, or rights, warrants or options to subscribe for or acquire,

any such shares or convertible securities;

(ii) other than the Interim Dividend, recommended, declared, paid