TIDMDPLM

RNS Number : 3310Z

Diploma PLC

15 May 2023

DIPLOMA PLC 10-11 CHARTERHOUSE SQUARE,

LONDON EC1M 6EE

TELEPHONE: +44 (0)20 7549

5700

FACSIMILE: +44 (0)20 7549

5715

This announcement contains inside information

HALF YEAR RESULTS FOR THE SIX MONTHSED 31 MARCH 2023

Strong first half, upgrading full year guidance

HY 2023 HY 2022 Y/y change

---------- ---------- -----------

Revenue GBP582.8m GBP448.5m +30%

Organic revenue growth

(1) 10% 16%

Adjusted operating profit

(2) GBP109.7m GBP82.5m +33%

Adjusted operating margin

(2) 18.8% 18.4% +40bps

Statutory operating profit GBP92.5m GBP58.2m +59%

Free cash flow (3) GBP51.8m GBP37.7m +37%

Free cash flow conversion

(3) 70% 64%

Adjusted earnings per

share (2) 59.1p 47.0p +26%

Basic earnings per share 47.3p 28.6p +65%

Leverage 0.7x 1.2x

Interim dividend per share 16.5p 15.0p +10%

ROATCE 17.8% 17.5%

---------------------------- ---------- ---------- -----------

(1) Adjusted for acquisition and disposal contribution and currency

effects; (2) Before acquisition related and other charges and acquisition

related finance charges; (3) Before cash flows on acquisitions,

disposals and dividends. All alternative performance measures are

defined in note 13 to the condensed consolidated financial statements.

Strong half year financial performance

* Continued strong organic revenue growth of 10%,

mainly volume driven by our revenue diversification

activity.

* Reported revenue growth of 30% with a 12%

contribution from acquisitions and positive FX

benefit of 8%.

* Very strong adjusted operating margin: up 40 bps to

18.8%, reflecting our value-add proposition, and

benefiting from operational leverage net of continued

scaling investments.

* Free cash flow conversion of 70%, ahead of last year.

* ROATCE improved to 17.8%, after an investment of

GBP66m in acquisitions, net of disposals, during the

period.

* 26% growth in adjusted EPS, continuing our long term

track record of double-digit growth.

* Leverage reduced to 0.7x following the recent

placing.

Revenue diversification driving organic growth, building scale

and increasing resilience

* Controls +13% : Sustained double-digit growth at

Windy City Wire ("WCW") and excellent International

Controls momentum. International Controls benefiting

from structural tailwinds and market share gains in

civil aerospace, defence and energy markets.

* Seals +8% : Double-digit growth in International

Seals led by a great contribution from R&G. In North

America, Aftermarket again delivered very strong

geographical market share gains.

* Life Sciences +4% : Momentum accelerating as hospital

staffing and surgical procedures continue to recover

and we benefit from normalising clinical diagnostics

investment post-pandemic.

Targeted acquisitions accelerate organic growth

* Acquired Tennessee Industrial Electronics ("TIE") for

GBP76m, entering the strategically important

Industrial Automation end market in the US. Strong

organic growth potential at accretive operating

margins.

* Small bolt-ons to our core business lines. Completed

seven for total consideration of GBP23m (one of which

was completed in April 2023); average EBIT multiple

under 5x; GBP24m of annual revenue; accretive EBIT

margins; and 20% year one ROATCE.

* Continued portfolio management discipline: disposed

of a non-core, lower margin heating control business

in March, for total consideration of GBP23m.

* Strong near-term M&A pipeline with c.GBP1bn of active

opportunities; we remain disciplined.

Strong cash flow and balance sheet provides further capacity for

growth

* Low capital intensity, cash-generative business model

delivering strong free cash flow with conversion of

70%, ahead of last year.

* Working capital as a percentage of revenue reduced by

60 bps to 17.1% as inventory levels reduce.

* Net debt reduced to GBP154m and Leverage to 0.7x

following GBP233m of cash generated from the recent

capital raise.

Scaling effectively for sustainable growth

* In the businesses: developing target operating models

to deliver customer proposition at scale, supported

by investments in talent, management systems and new

facilities in a number of businesses.

* As a Group: evolving our structure, capability and

culture to support the development of an expanding

Group.

* Submitted net zero targets for SBTi validation.

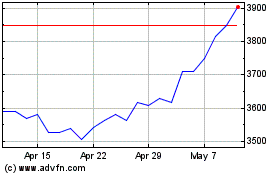

Increasing full year guidance

* We have delivered a strong first half and the second

half has started positively.

* As we enter the second half we face a very strong

comparative performance period, particularly Q3.

* Our continued strong growth and increasing resilience,

however, give us the confidence to increase our

guidance for the full year:

o We expect organic revenue growth of c.7% for the full year, and

a further c.7% growth from acquisitions, net of disposals.

o We expect operating margin to be at the top of our previously

guided range, c.19%.

o Free cash flow conversion of c.90% which would drive year end

leverage to less than 0.4x before any future acquisition investment.

Commenting, Johnny Thomson, Diploma's Chief Executive said:

"I thank all my brilliant Diploma colleagues for their dedication

to consistently improving our businesses and to delivering great

service to our customers. We have had an excellent first half.

The strong performance, with volume-led growth, encouraging margin

progress and +26% EPS, builds on Diploma's long term compounding

track record. Our upgrade for the full year underscores our increasing

resilience as well as the strength of the business model.

Strategically, we focus on building high quality scalable businesses

for sustainable organic growth. And we have made great progress,

continuing to diversify our organic growth through exciting end

market exposures, penetrating core geographies, and expanding addressable

market with product extension.

We also welcomed eight great new businesses which will help drive

that future organic growth, while incrementally investing in scaling

the businesses and our Group. Our very significant potential for

growth, as we strengthen our business model and margins, gives

us confidence in delivering further resilient quality compounding

in the future. We remain very positive about our short and long

term prospects."

Investor Seminar 2023

On 27(th) June 2023 Diploma will host an Investor Seminar for analysts

and institutional investors in Central London. The event will provide

an opportunity to hear from members of the senior management team

who will provide insight into Diploma's differentiated value-add

business model, why they are excited about the Group's organic

growth potential, and how they scale their businesses and the Group

to ensure sustainable long-term delivery. The event will be broadcast

live at www.diplomaplc.com from 14:00 BST. Those wishing to attend

in person are requested to email ava.jarman@teneo.com for further

details.

---------------------------------------------------------------------------------

Notes:

1. Diploma PLC uses alternative performance measures as key

financial indicators to assess the underlying performance of the

Group. These include adjusted operating profit, adjusted profit

before tax, adjusted earnings per share, free cash flow, leverage

and ROATCE. All references in this Announcement to "organic"

revenues refer to reported results on a constant currency basis,

and after adjusting for any contribution from acquired or disposed

businesses. The narrative in this Announcement is based on these

alternative measures and an explanation is set out in note 13 to

the condensed consolidated financial statements in this

Announcement.

2. Certain statements contained in this Announcement constitute forward-looking statements. Such forward-looking statements involve risks, uncertainties and other factors which may cause the actual results, performance or achievements of Diploma PLC, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such statements. Such risks, uncertainties and other factors include, among others, exchange rates, general economic conditions and the business environment.

There will be a presentation of the results to analysts and

investors at 9:00 BST this morning via audio conference call and

webcast. Conference call dial in details:

-- Dial in: +44 (0) 33 0551 0200 (UK-Wide)

-- Confirmation code: Diploma Half Year Results

Register your attendance for the webcast at:

https://brrmedia.news/diploma_plc_hyresults

This presentation will be available after the conference call

at: https://www.diplomaplc.com/investors/financial-presentations/

.

A replay of the audio will be available on the same link after

the event.

For further information please contact:

Diploma PLC - +44 (0)20 7549 5700

Johnny Thomson, Chief Executive Officer

Chris Davies, Chief Financial Officer

Kellie McAvoy, Head of Investor Relations

Teneo - +44 (0)20 7353 4200

Martin Robinson

Olivia Peters

NOTE TO EDITORS:

Diploma PLC is a decentralised, value-add distribution Group.

Our businesses deliver practical and innovative solutions that keep

key industries moving - from energy and infrastructure to

healthcare.

We are a distribution group with a difference. Our businesses

have the technical expertise, specialist knowledge, and long-term

relationships required to deliver value-add products and services

that make our customers' lives easier. These value-add solutions

drive customer loyalty, market share growth and strong margins.

Our decentralised model means our specialist businesses are

agile and empowered to deliver the right solutions for their

customers, in their own way. As part of Diploma, our businesses can

also leverage the additional resources, opportunities and expertise

of a large, international and diversified Group to benefit their

customers, colleagues, suppliers and communities.

We employ c.3,000 colleagues across our three Sectors of

Controls, Seals and Life Sciences. Our principal operating

businesses are located in the UK, Northern Europe, North America

and Australia.

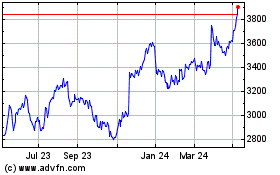

Over the last fifteen years, the Group has grown adjusted

earnings per share (EPS) at an average of c.15% p.a. through a

combination of organic growth and acquisitions. Diploma is a member

of the FTSE 250 with a market capitalisation of c.GBP3.6bn.

Further information on Diploma PLC can be found at

www.diplomaplc.com

The person responsible for releasing this Announcement is John

Morrison, Company Secretary.

LEI: 2138008OGI7VYG8FGR19

HALF YEAR REVIEW TO 31 MARCH 2023

Strong half year performance

The Group has once again delivered a successful six months,

reflecting the benefits of our strategy, value-add proposition and

decentralised model. These, underpinned by the commitment of our

colleagues to deliver excellent customer service, have enabled us

again to deliver double-digit organic growth at high teens

margins.

Revenue in the first half of 2023 was up 30% to GBP582.8m (2022:

GBP448.5m). Organic growth was 10%, mainly volume, driven by our

revenue diversification initiatives. Acquisitions, net of a small

disposal, contributed 12% to reported revenue while foreign

exchange translation added a further 8%.

Positive operational leverage, strong pricing and cost

management have enabled us to invest in scaling our businesses,

while still increasing adjusted operating margin to a strong 18.8%

(2022: 18.4%). Our adjusted operating profit increased by 33% to

GBP109.7m (2022: GBP82.5m). Statutory operating profit rose 59% to

GBP92.5m (2022: GBP58.2m).

Adjusted EPS grew by 26%, continuing our long-term compounding

track record (15% CAGR EPS over 15 years).

Our cash-generative business model supported strong first half

free cash flow conversion of 70% (2022: 64%). Together with the

recent equity raise, this led to net debt of GBP154.0m or 0.7x

leverage at 31 March 2023 (31 March 2022: GBP209.5m and 1.2x).

Returns on capital are a central underpin of our compounding

financial model and we were pleased to report another strong period

with ROATCE of 17.8% (2022: 17.5%).

In light of the strong H1 performance and our confidence in the

Group's prospects, we have declared a 10% increase in the interim

dividend to 16.5p per share (2022: 15.0p). The dividend is payable

on 9 June 2023 to shareholders on the register on 26 May 2023 with

a corresponding ex-dividend date of 25 May 2023.

Revenue diversification strategy driving organic growth

The Group's strategy is to build high quality, scalable

businesses for organic growth. All of our businesses drive this

growth in three ways: capitalising on structurally growing end

markets; increasing penetration of core geographies; and expanding

addressable markets through product range extension. The collective

success of our businesses' growth initiatives drove organic growth

of 10%, with strong trading momentum sustained throughout the first

half.

Revenue GBPm Organic growth

H1 23 H1 22 Change H1 23 H1 22

--------------- ------- ------ ------- -------- -------

Controls 278.8 224.0 +24% +13% +28%

Seals 198.4 137.4 +44% +8% +15%

Life Sciences 105.6 87.1 +21% +4% (7)%

--------------- ------- ------ ------- -------- -------

Group 582.8 448.5 +30% +10% +16%

--------------- ------- ------ ------- -------- -------

Some examples of how our businesses are delivering organic

growth are set out below, with further detail provided in the

Sector reviews on pages 8 to 12.

Positioning to take advantage of structurally growing end

markets. Across the Group we have continued to drive growth through

expansion in structurally growing end markets. A number of

businesses in our Controls sector are gaining share in aerospace,

energy and telecoms markets as well as penetrating the wider

electrification ecosystem. Across our Seals businesses, we are well

exposed to US infrastructure spend and we have diversified into

exciting growing markets such as water treatment and renewable

energy. In Life Sciences, in addition to benefiting from the

recovery of surgical procedures to c.90% of pre-pandemic levels,

our businesses are continuing to diversify, in particular across

diagnostic areas such as molecular testing, allergy and auto-immune

testing, haematology and cancer screening.

Penetration of core developed economies. Over the last six

months we have made progress developing our US and European

exposure. In Controls, for example, we continue to win market share

in the German energy market delivering very strong double-digit

growth. In Seals, we are winning market share in the western and

mid-west states of the US, leveraging the investment in the

facility in Louisville. R&G has enjoyed a very strong first

year in the Group, building out our UK regional position and

product offerings to drive excellent organic growth. In Life

Sciences, we now have a scaled European platform following the

integration of Accuscience, which better positions us for

recovering healthcare markets.

Product range extension. New product development forms an

ongoing component of all our businesses' organic growth

strategies.

-- Controls has delivered outstanding growth from speciality

adhesives having entered that segment through the acquisition of

Techsil in 2021, and Windy City Wire continues to innovate products

to diversify into new markets, leveraging its scaled business model

and strong customer relationships.

-- Following the acquisition of R&G last year, Seals

continues to diversify into wider fluid power products from its

traditional strength across seals and gaskets.

-- Product development is an intrinsic component of our Life

Sciences businesses. The Canadian businesses saw significant growth

through the introduction of new technology in the gastrointestinal

and surgical segments. The European businesses saw similar new

product successes with the single use endoscope in the Urology

segment, the introduction of new ultrasound technology and new

product introductions in the lab and pharmaceutical testing

environments.

Strategically important acquisitions to accelerate growth

Acquisitions are an integral part of our growth strategy. We are

disciplined and selective in our acquisition strategy and will only

consider opportunities that display the following core

characteristics:

-- differentiated value-add customer proposition generating sustainable high gross margins;

-- strong organic growth and scale potential; and

-- capable management teams we can back.

Since 30 September 2022, we have acquired eight high quality

businesses for a total of GBP98m (one of which was completed in

April 2023).

In March, we acquired Tennessee Industrial Electronics ("TIE")

for GBP76m, entering the strategically important Industrial

Automation end market in the US. TIE is a high growth, market

leading value-add distributor of aftermarket parts and repair

services for robotics and CNC machines. It differentiates through

speed to market and superior technical support, driving a strong

organic growth track record and strong margins. The business is

growth, margins and earnings accretive in the first year.

Since 30 September 2022, we have also completed seven bolt-on

acquisitions for a total consideration of GBP23m (one of which was

completed in April 2023), at an average EBIT multiple of under 5x

EBIT. These will add GBP24m of annual revenue to the group at

accretive EBIT margins, driving ROATCE of over 20% from their first

full year.

Continuing our disciplined approach to portfolio management, we

disposed of the lower growth, lower margin Hawco business (heating

controls within the Controls Sector) in March, for a total

consideration of GBP23m.

The Group's acquisition pipeline is very strong and reflects the

Group's focus in recent years to take a more strategic and

structured approach to developing a pipeline across our businesses.

This pipeline is made up of small and mid-sized opportunities

totalling c.GBP1bn in value and with an average target size of

c.GBP20m. In fragmented markets, the pipeline is well diversified

by sector and geography. We remain committed to disciplined

investment of capital and are excited about the opportunities in

this pipeline, which will support the Group's future organic

growth, and deliver compounding earnings growth at high returns

over the long term.

Scaling the Businesses and the Group

To deliver our strategy of building high quality businesses for

sustainable organic growth requires that we scale the businesses,

developing their operating models to continue to deliver great

customer propositions at scale; and at the same time, develop the

Group, optimising structures and practices to support this

growth.

Scaling the Businesses

We have a framework which allows our businesses to make the

journey towards their future stated target operating model. We have

a common set of core competencies (supply chain, operational

excellence, commercial discipline, value-add and route to market)

which underpin their model. We engage leaders from around the Group

in a bespoke development programme - leadership at scale - where

they benefit from best practice sharing in each of these competency

areas.

As well as developing core competencies, scaling our businesses

requires selective investment in capability, in the form of talent,

technology, and facilities. Incrementally reinvesting some of the

benefits we gain from operational leverage and performance

improvement as we grow is a critical aspect of our financial model.

During the period, we have invested in functional leadership across

a number of our businesses, creating or upgrading roles in areas

such as supply chain management, operations, route to market and

support functions. Across each of our Sectors, we are integrating

smaller businesses to create scale platforms such as an integrated

Australian Life Sciences business or an integrated UK Wire &

Cable business. From a technology perspective, we have ERP upgrade

projects underway across a number of businesses as well as

automated warehouse system upgrades in a number of Seals and

Controls businesses. In terms of facilities, we have upgrades and

relocations underway in each of our three Sectors to drive

efficiency and improved customer service as those businesses

continue to grow.

Scaling the Group

Portfolio discipline is key to ensuring the Group scales

sustainably. The right acquisitions, effective integration, and

selective disposals have meant that while the Group has doubled in

size in the last four years, our business unit verticals have

reduced from 20 to 16.

We have clear Group-wide strategic and performance frameworks

which allows us to align through the Sectors and business units.

With a lean, upskilled Executive, Head Office and Senior Leadership

Team, this allows effective execution of our objectives as the

Group scales.

We have brilliant people. We operate the Group through a

decentralised culture, empowering our management teams to own their

people, service, culture and strategic/performance delivery.

Increasingly we complement this with the benefits of the Diploma

Group. This provides access to a network, to a body of best

practice, to leadership development, all of which together

continuously improve our business.

Delivering Value Responsibly

We are making good progress across our businesses with

Delivering Value Responsibly ("DVR"), our Environmental, Social,

and Governance (ESG) programme. During the period we have hired an

experienced Group Sustainability Director and submitted our net

zero targets for validation from the Science Based Targets

initiative (SBTi).

DVR is focused on five core areas.

-- We have strong levels of Colleague Engagement at 79%. We have

engagement plans in each of our businesses.

-- Potential hazard reporting and training are enhancing our Health & Safety culture.

-- Workshops and listening groups are also helping to further

our Diversity, Equity & Inclusion agenda. Over the last four

years our gender diversity has improved, with females now

representing 28% of our senior team (20% in 2019).

-- Our businesses are stepping up engagement with their Supply Chains on our Supplier Code.

-- Further focus on the Environment, including energy workshops,

has seen our businesses diverting waste from landfill and putting

new actions in place across facilities to reduce emissions such as

LED lighting and efficiency initiatives. We have started to

implement solar solutions on our facilities and expect to progress

this further in the coming year.

We are also focused on the positive impact that our Group has on

society and the environment by delivering innovative and

life-saving healthcare solutions, playing a role in renewable

energy generation or contributing to a circular business model both

in the way we partner externally with our customers and suppliers

as well as the way we operate internally.

Increasing full year guidance

We have delivered a strong first half and the second half has

started positively. As we enter the second half we face a very

strong comparative performance period, particularly Q3. Our

continued strong growth and increasing resilience, however, give us

the confidence to increase our guidance for the full year:

-- We expect organic revenue growth of c.7% for the full year,

and a further c.7% growth from acquisitions, net of disposals.

-- We expect operating margin to be at the top of our previously guided range, c.19%.

-- Free cash flow conversion of c.90% which would drive year end

leverage to less than 0.4x before any future acquisition

investment.

SECTOR REVIEW: CONTROLS

The Controls Sector businesses supply specialised wiring, cable,

connectors, fasteners, control devices and adhesives for a range of

technically demanding applications.

Half Year

2023 2022 Change

---------------------------- ------------- --------- -------

Revenue GBP278.8m GBP224.0m +24%

Organic revenue growth +13% +28%

Statutory operating profit GBP57.7m GBP33.8m +71%

Adjusted operating profit GBP64.3m GBP47.0m +37%

Adjusted operating margin 23.1% 21.0% +210bps

---------------------------- ------------- --------- -------

H1 2023 highlights

-- Very strong performance in International Controls with organic revenue growth of 15%.

-- Windy City Wire ("WCW") delivered organic growth of 10%,

building on a very strong comparative period in H1 FY22.

-- Adjusted operating profit increased significantly, 37% higher

at GBP64.3m (2022: GBP47.0m) with a 210bps year-on-year increase in

adjusted operating margin to 23.1% (2022: 21.0%). Both WCW and

International Controls contributed to margin expansion driven by

positive operating leverage and mix into higher margin

products.

-- Strategic acquisition of TIE builds scale and gives access to

the important Industrial Automation end market.

International Controls (51% of Controls Sector revenue)

delivered 15% organic growth in the half, benefiting from market

share gains in recovering civil aerospace markets and structural

tailwinds in UK defence and German energy markets as investment in

these areas remains a critical focus for governments .

Windy City Wire (49% of Controls Sector revenue) continues to

perform strongly, with organic revenue growth of 10% in the period,

following a very strong comparative period of 42% organic growth.

This was driven by a favourable mix of higher value products.

Revenue diversification driving organic growth

The Sector continues to diversify its end markets, gaining share

in Space and Telecoms and benefiting from the wider move to

electrification and green energy as it continues to deliver growth

in the electric vehicles ("EV") and renewable energy end

markets.

Interconnect continues to win market share in structurally

growing end markets across the UK and Europe such as energy,

defence and automotive which are all benefiting from increased

investment and easing supply chain constraints.

The Sector's Fasteners business continues to win market share

and benefit from strong customer demand in the recovering civil

aerospace market in both the UK and US. The business also secured

key contract wins in seats and cabin hardware and has also seen

further diversification of its end markets with good momentum into

space and unmanned aerial vehicles ("UAVs").

Adhesives delivered strong double-digit growth in the period in

its key automotive end markets as well as continued share gains in

the telecommunications and EV markets.

Targeted acquisitions to accelerate growth

During the period, the Sector completed the acquisition of TIE

for GBP76m providing it with access to the important Industrial

Automation end market, which has been a strategic target end market

for some time. TIE also drives product extension (robotics and CNC

machines) as well as deepening geographic penetration in the key US

market.

Two smaller bolt-on acquisitions were completed in the period,

with Eurobond further broadening our product offering in the

Adhesives sector and Shrinktek expanding the sector's offering into

the UK Wire and Cable markets.

Building scale

Significant investment in technology and facilities is underway

as the sector seeks to combine two of its UK Wire and Cable

locations into one state-of-the-art facility and a common ERP

platform.

Sales resource has been added to the European Fasteners business

as part of the strategy to expand in the civil aerospace market and

capitalise on the ongoing strong recovery. Focused investments in

sales resources are also being made into the adhesives market to

capitalise on long-term aerospace and defence opportunities.

Sector review: SEALS

The Seals Sector businesses supply a range of seals, gaskets,

cylinders, components and kits used in heavy mobile machinery and a

diverse range of fluid power products with OEM, Aftermarket and MRO

applications.

Half Year

2023 2022 Change

--------------------------- --------- --------- ------

Revenue GBP198.4m GBP137.4m +44%

Organic revenue growth +8% +15%

Statutory operating profit GBP29.3m GBP17.1m +71%

Adjusted operating profit GBP35.7m GBP25.8m +38%

Adjusted operating margin 18.0% 18.8% -80bps

--------------------------- --------- --------- ------

H1 2023 highlights

-- Very strong International Seals performance with strong

organic growth from R&G following acquisition.

-- Robust performance in North American Seals, benefiting from

returns on the investment into the Aftermarket facility in

Louisville; and very strong performance in our MRO business.

-- Adjusted operating profit increased by 38% to GBP35.7m (2022: GBP25.8m).

-- Invested in scaling projects focusing on automation and

supply chain efficiencies through facilities upgrades.

International Seals (48% of Sector revenue) delivered very

strong organic growth of 12%, principally driven by an excellent

trading performance from R&G in the UK and strong recovery of

capital projects in Australia.

North American Seals (52% of Sector revenue) delivered robust

organic growth of 4% against a very strong comparator (2022: +19%)

with strong growth in our North American Aftermarket and MRO

businesses partly offset by some destocking in industrial OEM end

markets.

Revenue diversification driving organic growth

In International Seals, our UK businesses benefited from

initiatives to diversify into product adjacencies and new end

markets such as wastewater treatment and potash mining. R&G has

made a significant contribution to the organic growth of the sector

since acquisition, driven by strong sales into capital projects

particularly in the pneumatics and industrial markets, underpinned

by solid MRO volumes. Our Australian pump businesses delivered

strong growth fuelled by investments in infrastructure such as

tunnels and wastewater. Anti-Corrosion Technology ("ACT"), which

was acquired in late FY22, has doubled since acquisition,

capitalising on asset protection projects in the oil and gas

industry.

North American Aftermarket delivered strong growth in the repair

segment, driven by increased infrastructure spending. The

investment in our Aftermarket facility in Louisville, Kentucky is

continuing to deliver accelerated growth and market share gains,

particularly in western states, and this is supported by positive

demand in the US infrastructure sector. Our MRO business delivered

strong double-digit growth with the introduction of new value added

products focused on late cycle opportunities in the transportation

sector.

Targeted acquisitions to accelerate growth

In International Seals, three bolt-on acquisitions were added

into the R&G Group. Hedley Hydraulics and Fluid Power Services

bring complementary products, capabilities and geographical

expansion to R&G's Hydraulics sector. Valves Online will

complement and strengthen R&G's capabilities in the online

route to market.

In North American Seals, Hercules OEM completed the bolt-on

acquisition of ITG, a distributor of seals and adhesives for use in

electrical connectors, valves, medical devices and industrial

equipment. ITG is highly complementary and presents the opportunity

to capitalise on operational synergies.

Building scale

The Sector is selectively integrating smaller businesses to form

better scaled platforms and during the period completed the

integration of TotalSeal into FITT Resources in Australia.

Further scaling investments in facilities to establish national

hubs are being made, with examples including a national

distribution hub for R&G and the construction of a new M Seals

facility in Denmark that will become the Nordic hub for the

Sector.

In North American Seals, we have focused on improving the supply

chain; investing in facilities, talent and processes to improve

supply-demand planning and optimise inventory. The Sector continues

to make major investments in warehouse automation and is currently

progressing work to expand the Autostore in Louisville.

Sector review: LIFE SCIENCES

The Life Sciences Sector businesses supply a range of equipment,

consumables, instrumentation and related services to the Healthcare

industry.

Half Year

2023 2022 Change

--------------------------- --------- -------- --------

Revenue GBP105.6m GBP87.1m +21%

Organic revenue growth 4% (7)%

Statutory operating profit GBP16.7m GBP17.2m (3)%

Adjusted operating profit GBP20.9m GBP19.6m +7%

Adjusted operating margin 19.8% 22.5% (270)bps

--------------------------- --------- -------- --------

H1 2023 highlights

-- Organic revenue +4% (2022:(7%)): The Sector has returned to

growth, with momentum accelerating, driven by the recovery of

surgical and operating room procedures to c.90% of pre-Covid

levels.

-- Exciting outlook as governments act to address the

surgical/diagnostics backlogs and increase funding of capital

projects.

-- As expected, the operating margin for the Sector has

declined, primarily due to the acquisition of Accuscience which has

a lower margin with lower capital intensity, plus scaling

investments.

-- Continued investments being made to build scale in the

facilities and systems in Canada and Europe following the

successful completion of the scaling project in Australasia.

Revenue diversification driving organic growth

The Sector's mid to longer-term prospects are exciting. All

businesses in the sector have successfully diversified revenue

streams to capitalise on the recovery of surgical and operating

room procedures; as well as the increased funding for capital

projects. During the period, we have secured contracts across

Canada, the Nordics and Australia as governments and hospitals

increase capacity to clear the surgical backlogs and reinvest in

new medical research laboratories. Growth opportunities remain

positive with a good trajectory of surgical and operating room

procedures fully recovering towards pre-Covid levels as capacity

constraints and staffing shortages in hospitals continue to

ease.

It is also pleasing to see an increasing number of projects won

in early diagnostics and intervention. This was a trend that was

identified early on by the Sector and is now coming to fruition, as

healthcare systems increasingly recognise the importance of testing

and diagnostics capabilities and continually increase investment

into areas such as molecular infectious disease testing and

molecular oncology diagnostics. The Canadian businesses saw

significant growth through the introduction of new technology in

the gastrointestinal and surgical segments. The European businesses

saw similar new product successes with the single use endoscope in

the Urology segment, the introduction of new ultrasound technology

and new product introductions in the lab and pharmaceutical testing

environments.

Looking forward to the product pipeline for H2 and beyond, the

Canadian businesses expect to benefit from the introduction of

pathology automation technology that will bring positive impacts to

laboratory workflow. There is an equally exciting product pipeline

for the European businesses with the entry into a new segment in

Haematology testing and further growth in diagnostic

technologies.

Building scale

In Australia, we have successfully combined the operations of

our two businesses to generate operational efficiencies such as

warehouse process improvements and freight consolidation. Similar

projects are underway in the Canadian and European businesses,

focusing on facilities and ERP systems. Together, these projects

will build three scaled platform businesses to enable the Sector to

capitalise on future growth opportunities.

FINANCE

Summary income statement

Six months to 31 March 2023 Six months to 31 March 2022

----------------

Adjusted(1) Adjust-ments(1) Total Adjusted(1) Adjust-ments(1) Total

GBPm GBPm GBPm GBPm GBPm GBPm

---------------- ---------------- ------------------ ---------- --------------- ------------------ ----------

R evenue 582.8 - 582.8 448.5 - 448.5

Operating expenses (473.1) (17.2) (490.3) (366.0) (24.3) (390.3)

-------------------------- --------- -------------- ----------- -------------- ------------------- -----------

Operating profit 109.7 (17.2) 92.5 82.5 (24.3) 58.2

Financial expense,

net (11.0) (2.8) (13.8) (3.9) (2.0) (5.9)

-------------------------- --------- -------------- ----------- -------------- ------------------- -----------

Profit before

tax 98.7 (20.0) 78.7 78.6 (26.3) 52.3

Tax expense (24.2) 5.2 (19.0) (19.8) 3.4 (16.4)

-------------------------- --------- -------------- ----------- -------------- ------------------- -----------

Profit for the

period 74.5 (14.8) 59.7 58.8 (22.9) 35.9

-------------------------- --------- -------------- ----------- -------------- ------------------- -----------

Earnings per

share

(p)

Adjusted/Basic 59.1p (11.8p) 47.3p 47.0p (18.4p) 28.6p

-------------------------- --------- -------------- ----------- -------------- ------------------- -----------

(1) The Group reports under International Financial Reporting

Standards (IFRS) and references alternative performance measures

where the Board believes that they help to effectively monitor the

performance of the Group and support readers of the Financial

Statements in drawing comparisons with past performance. Certain

alternative performance measures are also relevant in calculating a

meaningful element of Executive Directors' variable remuneration

and our debt covenants. Alternative performance measures are not

considered to be a substitute for, or superior to, IFRS measures.

These are detailed in note 13 to the Condensed Consolidated

Financial Statements.

Reported revenue increased by 30% to GBP582.8m (2022:

GBP448.5m), consisting of organic growth of 10%, a 12% net

contribution from acquisitions and disposals, and an 8% benefit

from foreign exchange translation.

Adjusted operating profit increased by 33% to GBP109.7m (2022:

GBP82.5m) as the operational leverage from the increased revenue,

net of continued investment in scaling projects across the Group,

drove a 40bps year-on-year improvement in the adjusted operating

margin to 18.8% (2022: 18.4%). Statutory operating profit increased

59% to GBP92.5m (2022: GBP58.2m), benefiting from a GBP12.2m profit

on disposal of Hawco at the end of the period, compared with a

small loss of GBP1.6m in the prior year relating to the disposal of

Kentek.

Adjusted profit before tax increased 26% to GBP98.7m (2022:

GBP78.6m). Net adjusted interest expense increased to GBP11.0m

(2022: GBP3.9m), driven both by increased average gross debt, as

borrowings increased to finance acquisitions prior to the share

placing in March, and higher interest rates. The all-in, blended

cost of bank debt increased to 5.5% (2022: 2.1%). Statutory profit

before tax was 50% higher year-on-year at GBP78.7m (2022:

GBP52.3m).

The Group's adjusted effective rate of tax on adjusted profit

before tax was 24.5% (September 2022: 25.0%) marginally reduced

from the year ended 30 September 2022.

Adjusted earnings per share increased by 26% to 59.1p (2022:

47.0p). Basic earnings per share increased by 65% to 47.3p (2022:

28.6p). An equity placing was completed in March 2023, resulting in

a 7.5% increase (9,350,965 new shares) in the issued ordinary share

capital. As at 31 March 2023, the average number of ordinary shares

(which includes any potentially dilutive shares) was 125,927,286

(2022: 124,932,661) and the weighted average number of ordinary

shares in issue was 125,360,523 (2022: 124,520,917).

Cash management

Free cash flow increased by 37% to GBP51.8m (2022:GBP37.7m).

Statutory cash flow from operating activities increased by 53% to

GBP98.1m (2022: GBP64.0m).

Six months Six months

ended ended

31 March 31 March

2023 2022

Funds flow GBPm GBPm

------------------------------------------ ------------ ----------- -----------

Adjusted operating profit 109.7 82.5

Depreciation and other non-cash items 15.2 10.6

Working capital movement (22.8) (27.3)

Interest paid, net (excluding borrowing

fees) (9.8) (2.7)

Tax paid (22.2) (19.9)

Capital expenditure, net of disposal

proceeds (9.5) 3.6

Lease repayments (6.9) (6.3)

Notional purchase of own shares on exercise

of options (1.9) (2.8)

Free cash flow 51.8 37.7

------------------------------------------------ ------ ----------- -----------

Acquisition and disposals (net of cash

acquired/disposed) including acquisition

expenses and deferred consideration (75.9) (24.9)

Proceeds from issue of share capital 232.5 -

(net of fees)

Dividends paid to shareholders and minority

interests (48.6) (37.7)

Foreign exchange 15.1 (3.2)

Net funds flow 174.9 (28.1)

------------------------------------------------ ------ ----------- -----------

Net debt (154.0) (209.5)

------------------------------------------------ ------ ----------- -----------

Working capital increased by GBP22.8m, driven by an increase in

inventories of GBP11.5m and an increase in receivables of GBP17.8m,

both reflective of the revenue growth during the period.

Depreciation and other non-cash items includes GBP13.4m (2022:

GBP10.9m) of depreciation and amortisation of tangible, intangible

and right of use assets and GBP1.8m (2022: deduction of GBP0.3m) of

non-cash items, primarily share-based payments expense.

Interest payments increased by GBP7.1m to GBP9.8m (2022:

GBP2.7m) in line with increased interest charges. Tax payments in

the first half of the year increased by GBP2.3m to GBP22.2m (2022:

GBP19.9m) with the cash tax rate reducing marginally to 22% (2022:

23%).

Capital expenditure increased by GBP4.5m, largely driven by

facility investments in Shoal Group and Hercules Aftermarket. The

prior period benefited from GBP9.3m of proceeds from disposal of

property, plant and equipment. The Group funded the Company's

Employee Benefit Trust with GBP1.9m (2022: GBP2.8m) in connection

with the Company's long term incentive plan.

The Group generated free cash flow of GBP51.8m (2022: GBP37.7m)

a very strong 37% increase on the prior year, resulting in free

cash flow conversion of 70% (2022: 64%).

Net total acquisition expenditure of GBP75.9m (2022: GBP24.9m)

comprises the cash spend for TIE (GBP75.1m), the cash spend for

other acquisitions (GBP10.3m), acquisition fees (GBP4.0m), and

payments in respect of acquisitions completed in prior periods

(GBP8.0m) partially offset by the proceeds received, net of cash

disposed, in respect of the disposal of Hawco (GBP21.5m).

The Group received net proceeds of GBP232.5m from the equity

placing completed in March 2023. Dividends of GBP48.6m (2022:

GBP37.7m) were paid to ordinary and minority interest

shareholders.

Net debt

The Group has a debt facility agreement ("SFA") originally

entered into on 13 October 2020. At 31 March 2023, the SFA

comprises a committed multi-currency revolving facility for an

aggregate principal amount of GBP359.7m, an amortising term loan

for an aggregate principal amount of GBP89.3m ($110.5m), a bullet

term loan for an aggregate principal amount of GBP53.3m ($66.0m)

and a further bullet term loan for an aggregate principal amount of

GBP45.3m. The SFA was recently extended until December 2025.

The Group continues to maintain a robust balance sheet with net

debt (excluding IFRS 16 liabilities) of GBP154.0m (2022: GBP209.5m)

comprised of borrowings of GBP226.1m (2022: GBP342.0m), less cash

funds of GBP72.1m (2022: GBP132.5m). The equity placing completed

in March 2023 drove the reduction in the Group's borrowings.

At 31 March 2023, net debt of GBP154.0m (2022: GBP209.5m)

represented leverage of 0.7x (2022: 1.2x) against a banking

covenant of 3.0x. The Group maintains strong liquidity, with period

end headroom (comprised of undrawn committed facilities and cash

funds) of GBP390m (2022: GBP199m).

The table below outlines the composition of the Group's net debt

at 31 March 2023:

Type Currency Amount GBP equivalent Interest rate exposure

Term loan USD $176.5m GBP142.6m SOFR fixed at 3%

------------ ----------- --------------- -----------------------

RCF USD $29.0m GBP23.4m

------------ ----------- --------------- -----------------------

Term loan GBP GBP45.3m Floating

------------ ----------- --------------- -----------------------

RCF EUR EUR21.0m GBP18.5m Floating

------------ ----------- --------------- -----------------------

Capitalised debt fees net of accrued GBP(3.7)m

interest

--------------- -----------------------

Gross debt drawn at 31 March 2023 GBP226.1m

--------------- -----------------------

Cash & equivalents at period end GBP(72.1)m

--------------- -----------------------

Net debt at 31 March 2023 GBP154.0m

--------------- -----------------------

Defined Benefit Pension

The Group maintains a legacy closed defined benefit pension

scheme in the UK. In the period, the Group funded this scheme with

cash contributions of GBP0.3m (2022: GBP0.2m) which increases

annually on 1 October by 2%.

In Switzerland, local law requires our Kubo business to provide

a contribution-based pension for all employees, which is funded by

employer and employee contributions. The cash contribution to the

scheme was GBP0.2m (2022: GBP0.2m).

Both the UK defined benefit scheme and the Kubo contribution

scheme are accounted for in accordance with IAS 19 (revised). At 31

March 2023, the aggregate accounting pension surplus in these two

schemes was GBP8.8m, compared to a GBP6.4m surplus as at 30

September 2022, reflecting higher returns on the Scheme's assets,

partly offset by a fall in corporate bond yields over the period.

The next formal triennial funding valuation of the UK scheme is

expected to be completed in the second half of FY2023.

Exchange rates

A significant proportion of the Group's revenues (c.75%) are

derived from businesses located outside the UK, principally in the

US, Canada, Australia and Northern Europe. Since 30 September 2022,

Sterling has strengthened against some of the major currencies in

which the Group operates, in particular the US, Canadian, and

Australian dollar, whilst weakening marginally against the Euro and

Danish krone. Compared with the first half of last year, the

average Sterling exchange rate is weaker against all of the major

currencies in which the Group operates. The impact from translating

the results of the Group's overseas businesses into UK sterling has

led to an increase in Group revenues of GBP32.7m; an increase in

the Group's adjusted operating profit of GBP7.3m; and an increase

in net debt of GBP9.9m, compared with the same period last

year.

Going concern

The Directors have assessed the relevant factors surrounding

going concern.

The Group continues to operate against a backdrop of

macroeconomic disruption, including widespread global inflation and

rising interest rates. Accordingly, the Directors have again

considered a comprehensive going concern view. The Group has

carried out an assessment of its projected trading for the 18-month

period through to the year ending 30 September 2024. This

assessment incorporated a downside scenario which demonstrates that

the Group has sufficient liquidity, resources and covenant headroom

to continue in operation for the foreseeable future.

The Group has considerable financial resources, together with a

broad spread of customers and suppliers across different geographic

areas and sectors, often secured with longer term agreements. As a

consequence, the Directors believe that the Group is well placed to

manage its business risks successfully. The Directors confirm there

are no material uncertainties which may cast significant doubt on

the Group's ability to continue as a going concern and these

condensed consolidated financial statements have therefore been

prepared on a going concern basis.

RISKS AND UNCERTAINTIES

The principal risks and uncertainties which may have the largest

impact on performance in the second half of the year are the same

as those described in detail in pages 82-88 of the 2022 Annual

Report & Accounts. In summary these are:

-- Downturn/instability in major markets : adverse changes in

the major markets that the businesses operate in could result in

slowing revenue growth due to reduced or delayed demand for

products and services, or margin pressures due to increased

competition.

-- Supply Chain : the risk that existing distribution agreements

are cancelled, therefore losing access to key distribution

channels; a supplier taking away exclusivity; lead times increasing

as a result of supply chain shortages.

-- Inflationary environment : significant or unexpected cost

increases by suppliers due to the pass through of higher commodity

prices or other price increases, higher trade tariffs and/or

foreign currency fluctuations, could adversely impact profits if

businesses are unable to pass on such cost increases to

customers.

-- Unsuccessful acquisition : the Group may overpay for a

target; the acquired business may experience limited growth

post-acquisition; loss of key customers or suppliers post

integration; potential cultural misfit.

-- Geopolitical disruptions : interruption of trade agreements;

tariffs; change of trade relationships amongst countries in which

we operate; Government budget spending; political elections.

-- Health & safety : our businesses are exposed to health

& safety risks in the environment in which their employees,

contractors, customers, and suppliers operate.

-- Technology & cyber : any disruption or denial of service

may delay or impact decision-making if reliable data is

unavailable; poor information handling or interruption of business

may also lead to reduced service to customers; unintended actions

of employees caused by a cyber-attack may also lead to disruption,

including fraud.

-- Talent & diversity : the loss of key personnel can have

an impact on performance for a limited time period; not having the

right talent or diversity at all levels of the organisation to

deliver our strategy, resulting in reduced financial

performance.

-- Product liability : products supplied by a Group business may

fail in service, which could lead to a claim (notwithstanding the

fact that the Group has liability insurance in place providing

cover for each business).

-- Foreign currency : transactional foreign exchange risk arises

principally with respect to the Group's Canadian and Australian

businesses, where a large proportion of purchases are denominated

in US dollars and Euros.

-- Non-compliance with laws : the Group's businesses are

affected by various statutes, regulations and standards in the

countries and markets in which they operate. Diploma PLC itself is

a listed entity subject to regulation and governance

requirements.

The Directors confirm that the principal risks and uncertainties

and the processes for managing them have not changed materially

since the publication of the 2022 Annual Report & Accounts and

that they remain relevant for the second half of the financial

year.

Chris Davies

Chief Financial Officer 15 May 2023

Responsibility Statement of the Directors in respect of the Half

Year Report 2023

The directors confirm that Condensed Consolidated Financial

Statements have been prepared in accordance with UK adopted

International Accounting Standard 34, 'Interim Financial Reporting'

and the Disclosure Guidance and Transparency Rules sourcebook of

the United Kingdom's Financial Conduct Authority and that the

interim management report includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- material related-party transactions in the first six months and any material changes in the related-party transactions described in the last annual report.

The Directors of Diploma PLC and their respective

responsibilities are listed in the Annual Report & Accounts for

2022 and on the Company's website at www.diplomaplc.com .

By Order of the Board

JD Thomson C Davies

Chief Executive Officer Chief Financial Officer

15 May 2023 15 May 2023

Independent review report to Diploma PLC

Report on the condensed consolidated interim financial

statements

Our conclusion

We have reviewed Diploma PLC's condensed consolidated interim

financial statements (the "interim financial statements") in the

Half Year Report 2023 of Diploma PLC for the 6 month period ended

31 March 2023 (the "period").

Based on our review, nothing has come to our attention that

causes us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with UK adopted

International Accounting Standard 34, 'Interim Financial Reporting'

and the Disclosure Guidance and Transparency Rules sourcebook of

the United Kingdom's Financial Conduct Authority.

The interim financial statements comprise:

-- the Condensed Consolidated Statement of Financial Position as at 31 March 2023;

-- the Condensed Consolidated Income Statement and Condensed

Consolidated Statement of Comprehensive Income for the period then

ended;

-- the Condensed Consolidated Cash Flow Statement for the period then ended;

-- the Condensed Consolidated Statement of Changes in Equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the Half Year

Report 2023 of Diploma PLC have been prepared in accordance with UK

adopted International Accounting Standard 34, 'Interim Financial

Reporting' and the Disclosure Guidance and Transparency Rules

sourcebook of the United Kingdom's Financial Conduct Authority.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, 'Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity' issued by the Financial Reporting Council for use in the

United Kingdom ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and,

consequently, does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

We have read the other information contained in the Half Year

Report 2023 and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the interim financial statements.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed. This conclusion is based on

the review procedures performed in accordance with ISRE (UK) 2410.

However, future events or conditions may cause the group to cease

to continue as a going concern.

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the directors

The Half Year Report 2023, including the interim financial

statements, is the responsibility of, and has been approved by the

directors. The directors are responsible for preparing the Half

Year Report 2023 in accordance with the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority. In preparing the Half Year Report 2023,

including the interim financial statements, the directors are

responsible for assessing the group's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the group or to cease

operations, or have no realistic alternative but to do so.

Our responsibility is to express a conclusion on the interim

financial statements in the Half Year Report 2023 based on our

review. Our conclusion, including our Conclusions relating to going

concern, is based on procedures that are less extensive than audit

procedures, as described in the Basis for conclusion paragraph of

this report. This report, including the conclusion, has been

prepared for and only for the company for the purpose of complying

with the Disclosure Guidance and Transparency Rules sourcebook of

the United Kingdom's Financial Conduct Authority and for no other

purpose. We do not, in giving this conclusion, accept or assume

responsibility for any other purpose or to any other person to whom

this report is shown or into whose hands it may come save where

expressly agreed by our prior consent in writing.

PricewaterhouseCoopers LLP

Chartered Accountants

London

15 May 2023

Condensed Consolidated Income Statement

For the six months ended 31 March 2023

Unaudited Unaudited Audited

Six months to 31 March Six months to 31 March Year

2023 2022 to 30

Sept

2022

Adjusted Adjust- Total Adjusted Adjust- Total Total

(1) ments (1) ments

(1) (1)

Note GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------------- ----- --------- -------- -------- --------- -------- -------- --------

R evenue 3 582.8 - 582.8 448.5 - 448.5 1,012.8

Operating expenses 2 (473.1) (17.2) (490.3) (366.0) (24.3) (390.3) (868.5)

----------------------- ----- --------- -------- -------- --------- -------- -------- --------

Operating profit 109.7 (17.2) 92.5 82.5 (24.3) 58.2 144.3

Financial expense,

net 4 (11.0) (2.8) (13.8) (3.9) (2.0) (5.9) (14.8)

----------------------- ----- --------- -------- -------- --------- -------- -------- --------

Profit before

tax 98.7 (20.0) 78.7 78.6 (26.3) 52.3 129.5

Tax expense 5 (24.2) 5.2 (19.0) (19.8) 3.4 (16.4) (34.1)

----------------------- ----- --------- -------- -------- --------- -------- -------- --------

Profit for the

period 74.5 (14.8) 59.7 58.8 (22.9) 35.9 95.4

----------------------- ----- --------- -------- -------- --------- -------- -------- --------

Attributable to:

Shareholders of

the Company 6 74.1 (14.8) 59.3 58.5 (22.9) 35.6 94.7

Minority interests 0.4 - 0.4 0.3 - 0.3 0.7

----------------------- ----- --------- -------- -------- --------- -------- -------- --------

74.5 (14.8) 59.7 58.8 (22.9) 35.9 95.4

------------------------- ----- --------- -------- -------- --------- -------- -------- --------

Earnings per share

(p)

Adjusted / Basic 6 59.1p (11.8p) 47.3p 47.0p (18.4p) 28.6p 76.1p

Adjusted / Diluted 58.8p (11.7p) 47.1p 46.9p (18.4p) 28.5p 75.9p

----------------------- ----- --------- -------- -------- --------- -------- -------- --------

(1) Adjusted figures exclude certain items as set out and

explained in the Financial Review and as detailed in Notes 2, 3, 4,

5 and 6. All amounts relate to continuing operations.

The Group has re-presented the Condensed Consolidated Income

Statement to reflect the analysis of expenses based on their

nature. Together with note 2, this provides more information that

is relevant to the users of the financial statements and better

aligns to how management information is reported internally.

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 31 March 2023

Unaudited Unaudited Audited

31 March 31 March 30 Sept

2023 2022 2022

GBPm GBPm GBPm

--------------------------------------------------- ----- ------------------ -------------- ---------

Profit for the period 59.7 35.9 95.4

---------------------------------------------------------- ------------------ -------------- ---------

Items that will not be reclassified

to the Consolidated Income Statement

Actuarial gains in the defined benefit

pension scheme 2.0 - 10.6

Deferred tax on items that will not

be reclassified (0.6) - (2.8)

---------------------------------------------------------- ------------------ -------------- ---------

1.4 - 7.8

---------------------------------------------------------- ------------------ -------------- ---------

Items that may be reclassified to the

Consolidated Income Statement

Exchange rate (losses)/gains on foreign

currency net investments (49.2) 13.7 76.8

(Losses)/gains on fair value of cash

flow hedges (0.3) (0.5) 4.5

Net changes to fair value of cash flow

hedges transferred to the Consolidated

Income Statement (0.7) - (0.4)

Deferred tax on items that may be reclassified 0.2 0.2 (1.1)

-------------------------------------------------------------- ------------------ -------------- ---------

(50.0) 13.4 79.8

------------------------------------------------------------ ------------------ -------------- ---------

Total Comprehensive Income for the period 11.1 49.3 183.0

---------------------------------------------------------- ------------------ -------------- ---------

Attributable to:

Shareholders of the Company 10.7 49.1 182.2

Minority interests 0.4 0.2 0.8

-------------------------------------------------------------- ------------------ -------------- ---------

11.1 49.3 183.0

------------------------------------------------------------ ------------------ -------------- ---------

Condensed Consolidated Statement of C hanges in Equity

For the six months ended 31 March 2023

Share Share Transl-ation Hedging Retained Share-holders' Minority Total

capital premium reserve reserve earnings equity interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------- -------- ------------- ------------- -------- --------- --------------- ------------ -----------

At 1 October

2021

(audited) 6.3 188.6 12.1 0.2 329.1 536.3 4.7 541.0

Total

comprehensive

income - - 13.8 (0.3) 35.6 49.1 0.2 49.3

Share-based

payments - - - - 1.4 1.4 - 1.4

Notional

purchase

of own shares - - - - (2.8) (2.8) - (2.8)

Disposal of

business - - - - - - (1.3) (1.3)

Minority

interest

put option

disposal - - - - 1.2 1.2 - 1.2

Dividends - - - - (37.5) (37.5) (0.2) (37.7)

--------------- -------- ------------- ------------- -------- --------- --------------- ------------ -----------

At 31 March

2022

(unaudited) 6.3 188.6 25.9 (0.1) 327.0 547.7 3.4 551.1

Total

comprehensive

income - - 62.9 3.3 66.9 133.1 0.6 133.7

Share-based

payments - - - - 1.4 1.4 - 1.4

Tax on items

recognised

directly in

equity - - - - 0.4 0.4 - 0.4

Acquisition of

business - - - - - - 2.5 2.5

Minority

interest

put option on

acquisition - - - - (1.9) (1.9) - (1.9)

Minority

interest

acquired - - - - - - (0.3) (0.3)

Dividends - - - - (18.7) (18.7) - (18.7)

--------------- -------- ------------- ------------- -------- --------- --------------- ------------ -----------

At 30

September

2022

(audited) 6.3 188.6 88.8 3.2 375.1 662.0 6.2 668.2

Total

comprehensive

income - - (49.2) (0.8) 60.7 10.7 0.4 11.1

Issue of share

capital

(note 6) 0.5 231.6 - - - 232.1 - 232.1

Share-based

payments - - - - 2.1 2.1 - 2.1

Notional

purchase

of own shares - - - - (1.9) (1.9) - (1.9)

Dividends - - - - (48.3) (48.3) (0.3) (48.6)

--------------- -------- ------------- ------------- -------- --------- --------------- ------------ -----------

At 31 March

2023

(unaudited) 6.8 420.2 39.6 2.4 387.7 856.7 6.3 863.0

--------------- -------- ------------- ------------- -------- --------- --------------- ------------ -----------

Condensed Consolidated Statement of Financial Position

As at 31 March 2023

Unaudited Unaudited Audited

31 March 31 March 30 Sept

2023 2022 2022

Note GBPm GBPm GBPm

--------------------------------------- ------ ---------- ---------- ---------

Non-current assets

Goodwill 9 374.6 269.9 372.3

Acquisition intangible assets 9 451.5 342.2 455.0

Other intangible assets 4.1 3.5 4.1

Property, plant and equipment 49.3 36.4 49.6

Leases - right of use of assets 54.6 53.8 62.4

Retirement benefit assets 8.8 - 6.4

Deferred tax assets 0.4 0.3 0.2

----------------------------------------- ----- ---------- ---------- ---------

943.3 706.1 950.0

--------------------------------------- ----- ---------- ---------- ---------

Current assets

Inventories 216.3 165.1 217.4

Trade and other receivables 173.7 135.4 169.9

Assets held for sale - 2.9 -

Cash and cash equivalents 8 72.1 132.5 41.7

----------------------------------------- ----- ---------- ---------- ---------

462.1 435.9 429.0

--------------------------------------- ----- ---------- ---------- ---------

Current liabilities

Borrowings 8 (29.1) (21.4) (30.5)

Trade and other payables (180.2) (138.0) (189.5)

Current tax liabilities (11.6) (9.1) (11.8)

Other liabilities (14.4) (5.6) (19.0)

Lease liabilities (12.3) (10.1) (12.7)

(247.6) (184.2) (263.5)

--------------------------------------- ----- ---------- ---------- ---------

Net current assets 214.5 251.7 165.5

----------------------------------------- ----- ---------- ---------- ---------

Total assets less current liabilities 1,157.8 957.8 1,115.5

Non -current liabilities

Retirement benefit obligations - ( 4.9 -

)

Borrowings 8 (197.0) (320.6) (340.1)

Lease liabilities (49.3) (50.2) (56.4)

Other liabilities (11.4) (12.1) (12.4)

Deferred tax liabilities (37.1) (18.9) (38.4)

----------------------------------------- ----- ---------- ---------- ---------

Net assets 863.0 551.1 668.2

----------------------------------------- ----- ---------- ---------- ---------

Equity

Share capital 6.8 6.3 6.3

Share premium 420.2 188.6 188.6

Translation reserve 39.6 25.9 88.8

Hedging reserve 2.4 (0.1) 3.2

Retained earnings 387.7 327.0 375.1

----------------------------------------- ----- ---------- ---------- ---------

Total shareholders' equity 856.7 547.7 662.0

Minority interests 6.3 3.4 6.2

----------------------------------------- ----- ---------- ---------- ---------

Total equity 863.0 551.1 668.2

----------------------------------------- ----- ---------- ---------- ---------

Condensed Consolidated Cash Flow Statement

For the six months ended 31 March 2023

Unaudited Unaudited Audited

31 March 31 March 30 Sept

2023 2022 2022

Note GBPm GBPm GBPm

---------------------------------------- ---------- ------------- ---------- ---------

Cash flow from operating activities 7 98.1 64.0 180.6

Interest paid, net (including borrowing

fees) (11.3) (2.7) (15.0)

Tax paid (22.2) (19.9) (40.6)

---------------------------------------------- ---- ------------- ---------- ---------

Net cash from operating activities 64.6 41.4 125.0

---------------------------------------------- ---- ------------- ---------- ---------

Cash flow from investing activities

Acquisition of businesses (net of

cash acquired) (85.4) (21.9) (173.0)

Deferred consideration paid (8.0) (5.4) (7.1)

Proceeds from sale of business (net

of cash disposed) 21.5 4.2 13.7

Purchase of property, plant and

equipment (9.4) (5.2) (14.3)

Purchase of other intangible assets (0.8) (0.5) (1.1)

Proceeds from sale of property,

plant and equipment 0.7 9.3 9.9

Net cash used in investing activities (81.4) (19.5) (171.9)

---------------------------------------------- ---- ------------- ---------- ---------

Cash flow from financing activities

Proceeds from issue of share capital 236.1 - -

Share issue costs (3.6) - -

Dividends paid to shareholders 11 (48.3) (37.5) (56.2)

Dividends paid to minority interests (0.3) (0.2) (0.2)

Acquisition of minority interests - - (0.3)

Lease repayments (6.9) (6.3) (10.9)

Notional purchase of own shares

on exercise of options (1.9) (2.8) (2.8)

Proceeds from borrowings 8 45.3 141.7 154.8

Repayment of borrowings 8 (171.6) (9.7) (20.0)

Net cash from financing activities 48.8 85.2 64.4

---------------------------------------------- ---- ------------- ---------- ---------

Net increase in cash and cash equivalents 8 32.0 107.1 17.5

Cash and cash equivalents at beginning

of period 41.7 24.8 24.8

Effect of exchange rates on cash

and cash equivalents (1.6) 0.6 (0.6)

---------------------------------------------- ---- ------------- ---------- ---------

Cash and cash equivalents at end of

period 72.1 132.5 41.7

---------------------------------------------------- ------------- ---------- ---------

Notes to the Condensed Consolidated Financial Statements

For the six months ended 31 March 2023

1. BASIS OF PREPARATION AND PRINCIPAL ACCOUNTING POLICIES

Diploma PLC (the "Company") is a public limited company

registered and domiciled in England and Wales. The condensed set of

consolidated financial statements (the "financial statements") for

the six months ended 31 March 2023 comprise the Company and its

subsidiaries (together referred to as "the Group").

The condensed information presented for the financial year ended

30 September 2022 does not constitute full statutory accounts as

defined in section 434 of the Companies Act 2006. Those statutory

accounts have been reported on by the Company's auditor and

delivered to the Registrar of Companies. The report of the auditor

was (i) unqualified, (ii) did not include a reference to any

matters to which the auditors drew attention by way of emphasis

without qualifying their report, and (iii) did not contain a

statement under section 498 (2) or (3) of the Companies Act 2006.

Except where otherwise stated, the figures for the six months ended

31 March 2022 were extracted from the 2022 Half Year Report, which

was unaudited.

The Group's audited consolidated financial statements for the

year ended 30 September 2022 are available on the Company's website

( www.diplomaplc.com ) or upon request from the Company's

registered office at Diploma PLC, 10-11 Charterhouse Square,

London, EC1M 6EE.

1.1 Statement of compliance

The financial statements included in this Half Year Announcement

for the six months ended 31 March 2023 have been prepared on a

going concern basis and in accordance with UK-adopted International

Accounting Standard 34, Interim Financial Reporting and the

Disclosure Guidance and Transparency Rules of the Financial Conduct

Authority. The financial statements do not include all of the

information required for full annual consolidated financial

statements and should be read in conjunction with the Group's

audited consolidated financial statements for the year ended 30

September 2022.

The Half Year financial statements were approved by the Board of

Directors on 15 May 2023; they have not been audited by the

Company's auditor.

1.2 Significant accounting policies

The accounting policies applied by the Group in this set of

financial statements are the same as those applied by the Group in

its audited consolidated financial statements for the year ended 30

September 2022, except for the amount included in the Half Year

Report in respect of taxation.

As in previous Half Year Announcements, taxation has been

calculated by applying the Directors' best estimate of the annual

rates of taxation to taxable profits for the period. In the audited

consolidated financial statements for the full year, the taxation

balances are based on draft tax computations prepared for each

business within the Group.

1.3 Risk management

The Group's overall management of financial risks is carried out

by a central team under policies and procedures which are reviewed

by the Board. The financial risks to which the Group is exposed are

those of credit, liquidity, foreign currency, interest rate and

capital management. An explanation of each of these risks and how

the Group manages them is included in the Annual Report &

Accounts for the year ended 30 September 2022. Further explanation

of the Group's principal risks and uncertainties and Going Concern

are set out in the narrative of this Half Year Report.