TIDMFAR

RNS Number : 2914T

Ferro-Alloy Resources Limited

14 November 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) NO. 596/2014 (INCLUDING AS IT

FORMS PART OF THE LAWS OF ENGLAND AND WALES BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

14 November 2023

Ferro-Alloy Resources Limited

("Ferro-Alloy" or the "Group" or the "Company")

Conversion of Vision Blue Resources Loan Notes

Issue of Equity

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer

and developer of the large Balasausqandiq vanadium deposit in

Southern Kazakhstan , is pleased to announce the conversion of the

outstanding convertible loan notes held by Vision Blue Resources

Limited ("VBR") into 33,520,088 ordinary shares of no par value

("Ordinary Shares") in the Company.

Background

As previously announced on 15 September 2022, the Company

executed a US$6,700,000 convertible loan note instrument (the "2022

CLN Instrument") and issued US$4,200,000 of nil rate convertible

loan notes (the "2022 Loan Notes") to VBR (on substantially similar

terms to the 2021 loan note instrument and the loan notes that

formed part of the initial investment financing between VBR and the

Company as announced on 28 June 2021).

The Company has received notice from VBR under the terms of the

2022 CLN Instrument to convert the 2022 Loan Notes into Ordinary

Shares (the "Conversion Shares") in the Company.

Following the issue of the Conversion Shares, there are no

further convertible instruments outstanding in the Company, other

than under the Company's share option scheme.

Admission

Applications will be made to the Financial Conduct Authority for

the Conversion Shares to be admitted to the standard listing

segment of the Official List and to the London Stock Exchange for

the Conversion Shares to be admitted to trading on its Main Market

for listed securities ("Admission"). It is anticipated that

Admission will become effective, and that dealings in the

Conversion Shares will commence at or around 8.00 a.m. on 20

November 2023. The Conversion Shares will rank pari passu with the

existing Ordinary Shares in issue. The Conversion Shares will

represent approximately 6.9 per cent. of the Company's enlarged

issued share capital in aggregate on Admission (assuming no other

issuance of Ordinary Shares prior to Admission).

Following the conversion of the loan notes for the new Ordinary

Shares, VBR will hold 111,071,783 Ordinary Shares representing

22.99 per cent. of the issued share capital of the Company.

Total Voting Rights

Following Admission of the Conversion Shares the Company's

issued ordinary share capital will comprise 483,222,238 Ordinary

Shares, with none held in treasury, and therefore, the total number

of Ordinary Shares in the Company with voting rights will be

483,222,238. This figure may be used by shareholders in the Company

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the share capital of the Company under

the applicable legal and regulatory requirements.

For further information, visit www.ferro-alloy.com or contact:

Ferro-Alloy Resources Nick Bridgen (CEO) info@ferro-alloy.com

Limited / William Callewaert

(CFO)

Shore Capital Toby Gibbs/Lucy Bowden

(Joint Corporate Broker) +44 207 408 4090

Liberum Capital Limited Scott Mathieson/Kane

(Joint Corporate Broker) Collings +44 20 3100 2000

------------------------ ---------------------

St Brides Partners

Limited

(Financial PR & IR Catherine Leftley/Ana

Adviser) Ribeiro +44 207 236 1177

------------------------ ---------------------

The notification below, m ade in accordance with the

requirements of the UK Market Abuse Regulation, provides further

detail .

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name Vision Blue Resources Limited

-------------------------- --------------------------------------------------

Reason for the notification

2

------------------------------------------------------------------------------

a) Position/status Vision Blue Resources Limited is

a PCA of Ferro Alloy Resources Limited's

Chairman, Sir Mick Davis, who is

a person discharging managerial responsibilities

-------------------------- --------------------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------- --------------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

------------------------------------------------------------------------------

a) Name Ferro Alloy Resources Limited

-------------------------- --------------------------------------------------

b) LEI 2138003T5CF6U9W7Z780

-------------------------- --------------------------------------------------

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------------------

a) Description of the Conversion of 2022 Convertible Loan

financial instrument, Notes for Ordinary Shares

type of instrument

ISIN: GG00BGDYDZ69

Identification code

-------------------------- --------------------------------------------------

b) Nature of the transaction Conversion of 2022 Convertible Loan

Notes

-------------------------- --------------------------------------------------

c) Price(s) and volume(s) Price Volume

9 pence 33,520,088

-----------

-------------------------- --------------------------------------------------

d) Aggregated information

- Aggregated volume Aggregated volume: N/A

- Price Aggregated price: N/A

-------------------------- --------------------------------------------------

e) Date of the transaction 13 November 2023

-------------------------- --------------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- --------------------------------------------------

About Ferro-Alloy Resources Limited:

The Company's operations are all located at the Balasausqandiq

deposit in Kyzylordinskoye Oblast in the South of Kazakhstan.

Currently the Company has two main business activities:

a) the high grade Balasausqandiq vanadium project (the

"Project"); and

b) an existing vanadium concentrate processing operation (the

"Existing Operation")

Balasausqandiq is a very large deposit, with vanadium as the

principal product together with several by-products. Owing to the

nature of the ore, the capital and operating costs of development

are very much lower than for other vanadium projects.

The most recent mineral resource estimate for ore-body one (of

seven) provided an Indicated Mineral Resource of 32.9 million

tonnes at a mean grade of 0.62% V(2) O(5) equating to 203,364

contained tonnes of vanadium pentoxide ("V(2) O(5) "). In the

system of reserve estimation used in Kazakhstan the reserves are

estimated to be over 70m tonnes in ore-bodies 1 to 5 but this does

not include the full depth of ore-bodies 2 to 5 or the remaining

ore-bodies which remain substantially unexplored.

The Project will be developed in two stages, Stage 1 and Stage

2, treating 1m tonnes per year and an additional 3m tonnes per

year. Production will be some 5,600 tonnes of V(2) O(5) from Stage

1, rising to 22,400 tonnes V(2) O(5) after Stage 2 is

commissioned.

There is an existing concentrate processing operation at the

site of the Balasausqandiq deposit. The production facilities were

originally created from a 15,000 tonnes per year pilot plant which

was then expanded and adapted to recover vanadium, molybdenum and

nickel from purchased concentrates.

The existing operation is located on the same site and uses some

of the same infrastructure as the Project, but is a separate

operation which will continue in parallel with the development and

operation of the Project.

About Vision Blue Resources Limited:

Vision Blue was founded in December 2020 by Sir Mick Davis to

create a portfolio of strategic and high returning investments in

clean energy related metal and mineral resource companies essential

to the clean energy transition.

Vision Blue invests in undervalued and undercapitalised mining

and processing companies in established mining jurisdictions that

are strategically important for customers; with well defined,

advanced, scalable assets and committed management; that have low

logistics, processing and technological risks with a clear path to

new or expanded production; that have direct exposure to clean

energy generation, storage and related infrastructure; and that are

implementing a best-in-class ESG framework.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOENKNBDOBDDQDD

(END) Dow Jones Newswires

November 14, 2023 02:00 ET (07:00 GMT)

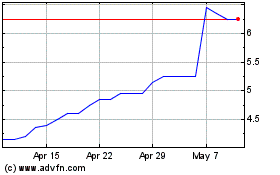

Ferro-alloy Resources (LSE:FAR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ferro-alloy Resources (LSE:FAR)

Historical Stock Chart

From Feb 2024 to Feb 2025