Genel Energy PLC: Trading and operations update (1821409)

January 24 2024 - 1:00AM

UK Regulatory

Genel Energy PLC (GENL)

Genel Energy PLC: Trading and operations update

24-Jan-2024 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

24 January 2024

Genel Energy plc

Trading and operations update

Genel Energy plc ('Genel' or 'the Company') issues the following trading and operations update in advance of the

Company's full-year 2023 results, which are scheduled for release on 26 March 2024. The information contained herein

has not been audited and may be subject to further review.

Paul Weir, Chief Executive of Genel, said:

"Since the suspension of exports through the Iraq-Türkiye pipeline in March last year, we have reshaped the business to

provide long-term resilience and maximise potential upside exposure for shareholders.

We have cut all non-essential activity and significantly reduced spend, while developing a new source of income through

domestic sales. We have well over a hundred million dollars in net cash, and expect to be in a position where domestic

proceeds, if sustained at levels seen in the fourth quarter of 2023, would mean that our income covers our ongoing

costs from March onwards, once Sarta and the arbitration hearing workstreams are complete. We also continue to work

hard to add new assets to increase and diversify our income streams.

The past six months have included significant work, and effective spend, on efficiently closing out our activity on

Sarta and minimising our footprint and cost base in Kurdistan. Our workforce has been reduced by over two thirds in the

year. We have progressed civils work in Somaliland, and we continue to defend shareholder value as we progress our

arbitration claim regarding the Miran and Bina Bawi oil and gas assets.

There is real potential in 2024 for significant improvement in cash generation and delivery of shareholder value from

multiple catalysts - the resumption of exports and regular payments, clarity on the timing of the recovery of USD107

million of receivables, delivery on our strategy to add new assets to diversify our production portfolio, and a

successful arbitration result and subsequent collection."

2023 PERFORMANCE

-- Zero lost time incidents in 2023, matching the performance of 2022, with over four million hours worked

since the last lost time incident

-- Net production of 12,410 bopd in 2023 (30,150 bopd in 2022), following the closure of the Iraq-Türkiye

pipeline ('ITP') in March, with minimal sales between April and August inclusive and the subsequent development of

domestic sales

-- Total proceeds of USD101 million (2022: USD473 million):

? USD61 million export sales proceeds relating to sales made in August and September 2022

? USD40 million domestic sales proceeds in H2 2023, of which USD26 million was received in Q4 2023 as

volumes improved from Q3 2023

-- USD107 million remains overdue from the Kurdistan Regional Government ('KRG') for oil sales from October

2022 to March 2023 inclusive

-- Capital expenditure of USD71 million, of which USD24 million was in H2, as Genel cut activity and costs in an

appropriate manner for the external environment

-- Free cash outflow of USD72 million (2022: positive free cash flow of USD235 million)

-- Bond debt reduced by USD26 million nominal at an average price below 95¢

-- Dividends totalling 12¢ per share paid in 2023 (2022: 18¢ per share), a total distribution of USD33.5

million. Due to the lack of visibility on the timing of pipeline exports resuming and the re-establishment of a

reliable record of payments, Genel has suspended its dividend programme

-- Cash of USD363 million at 31 December 2023 (USD495 million at 31 December 2022)

-- Net cash under IFRS of USD119 million at 31 December 2023 (USD228 million at 31 December 2022)

? Total debt of USD248 million at 31 December 2023 (USD274 million at 31 December 2022)

2024 OUTLOOK AND GUIDANCE

-- Should local sales continue at similar levels to Q4 2023, the Tawke PSC would generate sufficient funding

to cover organisational spend from Q2 onwards

-- Organisational spend outside the cash generative Tawke PSC is set to be reduced to around USD3 million per

month by the end of Q1, following completion of final remediation work at Sarta and the Miran and Bina Bawi

arbitration hearing

-- Interest expense is fixed at USD2 million per month, paid half-yearly, with interest income from our cash

currently around USD1.5 million per month

-- This outlook is expected to maintain net cash above USD100 million throughout 2024, and preserves the

financial capability to add new assets

UPDATE ON IRAQ-TÜRKIYE PIPELINE

-- The Iraq-Türkiye pipeline ('ITP') shut on 25 March 2023

-- While there continue to be positive meetings between relevant parties regarding reopening, there remains

a lack of clarity regarding the status and timing of export resumption

-- The Association of the Petroleum Industry of Kurdistan ('APIKUR'), of which Genel is a member, remains

committed to working with the Federal Government of Iraq and the KRG to resume full production and export through

the ITP for the benefit of all stakeholders

ARBITRATION

-- The London-seated international arbitration including Genel's claim for substantial compensation from the

KRG following the termination of the Miran and Bina Bawi PSCs is progressing. The two-week hearing is scheduled to

start in London on 19 February 2024

-- The KRG's claim is that the KRG was entitled to terminate the Bina Bawi and Miran PSCs. Genel's claim is

that the KRG's termination of the PSCs was repudiatory and, as a consequence, is claiming substantial damages. The

KRG is not claiming any damages from Genel

-- In total, Genel spent in excess of USD1.4 billion acquiring and attempting to develop the Bina Bawi and

Miran fields

-- The hearing is confidential and as such we will not be able to update on progress until the Award is

received, with the timing of the Award uncertain, but expected in 2024

OPERATIONS

Gross production Net production Net production

(bopd)

2023 2023 2022

Tawke 46,280 11,570 26,770

Taq Taq 1,360 600 1,980

Sarta 790 240 1,400

Total 48,430 12,410 30,150

-- Tawke PSC (25% working interest)? Gross production from the

Tawke licence increased to 65,780 bopd in Q4 2023, up from 25,980

bopd inQ3, with the field partners selling their entitlement share

into the local market ? In Q4, Genel received proceeds of USD26

million and generated cash flow of USD13 million from the

TawkePSC

-- Sarta (30% working interest and operator).? The Sarta PSC

terminated on 1 December 2023. Remediation activity is now

complete, at a net cost ofofUSD1 million

-- Taq Taq PSC (44% working interest and joint operator)? There

has been no production since 20 May 2023, following closure of the

export pipeline

Monthly costs have been reduced to below USD1 million, with

further cuts expected

-- Somaliland? Required civil work on the Toosan-1 well site on

the SL10B13 block (51% working interest andoperator) at this stage

of the project is now complete ? The Company continues to assess

the timing of further investment

-- Morocco? The farm-out programme on the Lagzira block (75%

working interest and operator) is ongoing

Genel will also host a live presentation on the Investor Meet

Company platform today at 1000 GMT. The presentation is open to all

existing and potential shareholders. Questions can be submitted at

any time during the live presentation. Investors can sign up to

Investor Meet Company for free and add to meet Genel Energy PLC

via: https://

www.investormeetcompany.com/genel-energy-plc/register-investor

-ends-

For further information, please contact:

Genel Energy

+44 20 7659 5100

Andrew Benbow, Head of Communications

Vigo Consulting

+44 20 7390 0230

Patrick d'Ancona

This announcement includes inside information.

Notes to editors:

Genel Energy is a socially responsible oil producer listed on

the main market of the London Stock Exchange (LSE: GENL, LEI:

549300IVCJDWC3LR8F94). Genel has low-cost and low-carbon production

from the Kurdistan Region of Iraq, and continues to seek

opportunities to add new resilient and cash-generative assets to

its portfolio. For further information, please refer to

www.genelenergy.com

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: JE00B55Q3P39, NO0010894330

Category Code: TST

TIDM: GENL

LEI Code: 549300IVCJDWC3LR8F94

Sequence No.: 299221

EQS News ID: 1821409

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1821409&application_name=news

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

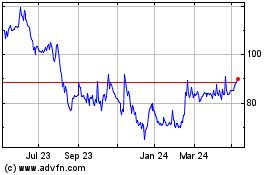

Genel Energy (LSE:GENL)

Historical Stock Chart

From Nov 2024 to Dec 2024

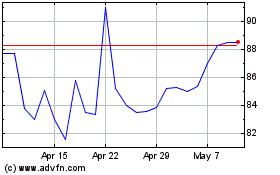

Genel Energy (LSE:GENL)

Historical Stock Chart

From Dec 2023 to Dec 2024