Genel Energy PLC: Trading and operations update

May 09 2024 - 1:00AM

EQS Regulatory News

|

Genel Energy PLC (GENL)

Genel Energy PLC: Trading and operations update

09-May-2024 / 07:00 GMT/BST

9 May 2024

Genel Energy plc

Trading and operations

update

Genel Energy plc ('Genel' or 'the Company') issues the

following trading and operations update relating to Q1 2024, ahead

of the Company's Annual General Meeting, which is being held

today.

Paul Weir, Chief Executive of Genel,

said:

“We have achieved balanced income and expenditure in the

first quarter of the year, which is ahead of schedule.

Local sales from the Tawke licence have been robust to date,

with the sales price increasing marginally and demand staying

strong, and we continue to expect income to cover our

spend over the course of the full year. Local sales volumes going

forward will continue to be dependent on demand, the

view of the field partners on reservoir management, and whether

investment would be cost effective and deliver value to

shareholders.

The business is in a robust financial position, with multiple

potential catalysts for the delivery of significant shareholder

value ahead.”

FINANCIAL

-

Cash of $372 million at 31 March

2023 ($363 million at 31 December 2023)

- The positive improvement in cash is

principally caused by temporary deferral of payables and other

positive working capital movements

- Following the first of the $11 million

bi-annual bond interest payments in April, cash at the end of April

is $361 million

- We expect our costs to be covered by income

for the remainder of the year

-

Net cash under IFRS of $128

million at 31 March 2024 ($120 million at 31 December 2023)

- Total debt of $248 million at 31 March 2024

($248 million at 31 December 2023)

PRODUCTION AND OPERATIONS

-

Zero lost time incidents in 2024

to date, with four and a half million hours worked since the last

incident

-

Gross production of 76,310 bopd

in Q1 2024 (65,770 bopd in Q4 2023), all from the Tawke licence,

where local sales demand remains robust

- Net production of 19,080 bopd in Q1 2024

(16,440 bopd in Q4 2023)

-

Following negotiation with local

buyers, the sales price from the Tawke licence has been raised to

the upper-USD 30s per barrel level

ARBITRATION

-

The London-seated international

arbitration process, which includes Genel’s claim for substantial

compensation from the KRG following the termination of the Miran

and Bina Bawi PSCs, is ongoing. Written closing submissions will

now be made next week, subsequent to which written reply

submissions will be made in the first half of June. The timing of

the result is uncertain, but is expected by the end of

2024

OUTLOOK

-

Genel continues to expect net

cash to remain well above $100 million throughout 2024

-

Talks between stakeholders

regarding the Iraq-Türkiye Pipeline are ongoing, although the

timing of the resumption of exports remains uncertain

-ends-

For further information, please contact:

|

Genel Energy

Andrew Benbow, Head of Communications

|

+44 20 7659 5100

|

|

|

|

|

Vigo Consulting

Patrick d’Ancona

|

+44 20 7390 0230

|

This announcement includes inside

information.

Notes to editors:

Genel Energy is a socially responsible oil producer listed on

the main market of the London Stock Exchange (LSE: GENL, LEI:

549300IVCJDWC3LR8F94). Genel has low-cost and low-carbon production

from the Kurdistan Region of Iraq, and continues to seek

opportunities to add new resilient and cash-generative assets to

its portfolio. For further information, please refer to

www.genelenergy.com

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group.

The issuer is solely responsible for the content of this

announcement.

|

|

| |

| ISIN: |

JE00B55Q3P39, NO0010894330 |

| Category Code: |

TST |

| TIDM: |

GENL |

| LEI Code: |

549300IVCJDWC3LR8F94 |

| Sequence No.: |

320346 |

| EQS News ID: |

1899141 |

| |

| End of Announcement |

EQS News Service |

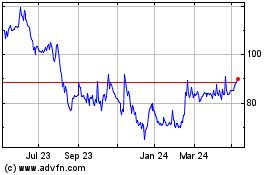

Genel Energy (LSE:GENL)

Historical Stock Chart

From Jan 2025 to Feb 2025

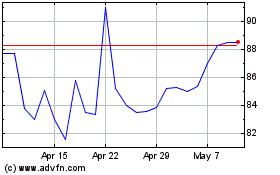

Genel Energy (LSE:GENL)

Historical Stock Chart

From Feb 2024 to Feb 2025