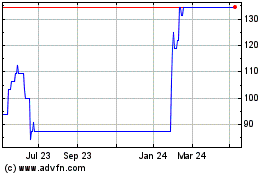

TIDMLSAI

RNS Number : 8105D

Location Sciences Group PLC

26 June 2023

This announcement contains inside information for the purposes

of Regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement via

a Regulatory Information Service, this inside information is now

considered to be in the public domain.

Location Sciences Group PLC

("Location Sciences" or the "Company" or the "Group")

Audited Results for the year ended 31 December 2022

Location Sciences (AIM: LSAI), announces its audited results for

the year ended 31 December 2022.

Financial Performance

-- Revenues from the Verify division in 2022 were GBP110,856

compared to GBP167,940 in 2021 representing a 33.99% decrease in

revenues year-on-year, reflecting the continued headwinds faced by

the business during the year

-- Administrative costs excluding depreciation and amortisation

for the year to 31 December 2022 GBP723,149 (2021: GBP801,432)

-- Loss before exceptional items, amortisation and depreciation

for the year to 31 December 2022 GBP641,651 (2021: GBP699,468)

-- Loss per share from continuing operations decreased from 0.076p in 2021 to 0.029p in 2022

Financial Position at Year End

-- Net assets were GBP4,330,452 (2021: GBP5,178,571)

-- Net current assets were GBP4,195,778 (2021: GBP4,641,080)

-- Cash and cash equivalents of GBP4,125,571 (2021: GBP4,378,825)

-- Borrowings were GBPNil (2021: GBPNil)

-- Potential deferred tax asset of GBP5,423,000 (2021: GBP3,977,000)

A copy of this announcement and the Company's report &

accounts are available on the Company's website

https://www.locationsciencesgroup.ai/investor-relations/

For further information please contact:

Location Sciences Group PLC

via Allenby Capital

Simon Wilkinson, Chairman

Allenby Capital Limited (Nominated Adviser) Tel: +44 (0)20 3328

5656

David Hart

Vivek Bhardwaj

Turner Pope Investments (TPI) Ltd (Broker) Tel: +44 (0)20 3657

0050

James Pope

Andy Thacker

CHAIRMAN'S REPORT FOR THE YEARED 31 DECEMBER 2022

Dear Shareholders,

I write to you today to present the Chairman's statement for the

Location Sciences Group PLC 2022 report and accounts. It is with a

mix of challenges and opportunities that I update you on the

progress we made during the past year.

The year 2022 marked a significant turning point for Location

Sciences Group PLC as we undertook a thorough review of our

strategic options. Amidst market volatility and evolving industry

dynamics, we recognised the need to reevaluate our strategies and

ensure the long-term viability of our company.

Financially, the year presented its share of challenges, with a

decline in revenue compared to the previous year. However, I am

pleased to report that we entered 2022 with a solid financial

foundation. The successful fundraise in 2021 provided us with ample

resources, enabling us to pursue our strategic objectives and

navigate the complex business landscape.

Furthermore, in our pursuit of strategic optimisation, we took

decisive action to streamline our operations. The disposal of our

Insights business to Digital Envoy Inc during 2021 was a key

milestone in this journey. Not only did it allow us to focus on our

core offerings, but it also significantly reduced our overheads and

cash burn. As a result, we are well-funded and with a solid

platform to deliver shareholder value going forward.

Throughout this process, we have remained committed to our key

stakeholders, in particular our shareholders. We recognise that

change brings uncertainty, and we have made every effort to

navigate these challenges with transparency and fairness. Our team

has shown remarkable resilience and adaptability during this period

of transition, and we are grateful for their dedication to our

shared vision.

Looking forward, we remain cautiously optimistic. The strategic

review process has provided us with valuable insights into our

strengths, weaknesses, and potential growth opportunities. Armed

with this knowledge, we are actively exploring avenues for

sustainable expansion and enhancement of our offerings.

Finally, I would like to express my heartfelt gratitude to our

shareholders, clients, and partners for their unwavering support

throughout this transformative period. Your confidence in our

ability to navigate these challenges and capitalise on emerging

opportunities has been instrumental in our progress.

In conclusion, while 2022 presented its fair share of hurdles,

we are well-funded and strategically positioned for the future.

With a solid financial foundation, streamlined operations, and a

focus on delivering a new strategic path going forward, we are

confident in our ability to create long-term value for our

shareholders.

Thank you for your continued trust and support.

INDEPENT DIRECTORS FINANCIAL REVIEW FOR THE YEARED 31 DECEMBER

2022

Dear Shareholders,

As the Independent Director of Location Sciences Group PLC, I am

pleased to present my report alongside the Chairman's statement for

the 2022 report and accounts. As a member of the Board, my role is

to provide an unbiased perspective and act in the best interests of

the company and its shareholders.

Throughout 2022, I actively participated in the strategic review

process and monitored the company's performance, governance, and

risk management. I have assessed the decisions made and actions

taken by the Board, ensuring that they align with the company's

values and objectives.

Financial Performance

The financial performance of Location Sciences Group PLC in 2022

reflected the challenges faced by the company and the broader

market environment. I have scrutinised the financial statements and

worked closely with the team to understand the underlying causes

and evaluate the appropriateness of the strategic initiatives

undertaken. I have enclosed below a summary of the Group's

financial performance and statement of financial position at the

end of the year:

Year to Six months Year to Comparison

All figures 31 December to 31 December to prior year

in GBPGBP (unless 2022 30 June 2021

otherwise stated) 2022

Revenue 110,856 53,073 167,940 (34.0%)

------------- ----------- ------------- ---------------

Administrative

costs 723,149 489,552 801,432 (9.8%)

------------- ----------- ------------- ---------------

Loss before

tax 850,578 492,353 1,199,068 (29.1%)

------------- ----------- ------------- ---------------

Loss per share 0.029p 0.020p 0.076p (61.8%)

------------- ----------- ------------- ---------------

Net assets 4,330,452 4,805,999 5,178,571 (16.4%)

------------- ----------- ------------- ---------------

Net current

assets 4,195,778 4,399,032 4,641,080 (9.6%)

------------- ----------- ------------- ---------------

Cash at bank 4,125,571 4,227,685 4,378,825 (5.8%)

------------- ----------- ------------- ---------------

Group borrowings Nil Nil Nil -

------------- ----------- ------------- ---------------

The Board made further overhead reductions during the year and

the impact of these can be seen in the decreased administration

costs in H2 2022 of GBP233,597 compared to H1 2022 of GBP489,552,

representing a 52.3% reduction. The loss per share was negatively

impacted in H2 2022 by a further right down of our intangible

assets of GBP143,482 (2021: GBP283,210).

Strategic Review and Actions Taken

The Board conducted a thorough strategic review during the year

to identify the most viable options for sustainable growth and

shareholder value creation. This review included the disposal of

the Insights business to Digital Envoy Inc, which significantly

reduced overheads and cash burn, as well as refocusing the company

on its core offerings. We closely scrutinised this disposal and

believe it was a prudent decision that will help streamline

operations and allocate resources more efficiently. We have also

assessed the effectiveness of the board's decision-making process,

ensuring that all potential risks and opportunities were duly

considered.

Corporate Governance

We are committed to upholding the highest standards of corporate

governance. Throughout the year, we monitored the company's

compliance with applicable laws, regulations, and best practices.

We reviewed the effectiveness of internal controls, risk management

systems, and ethical practices. We are pleased to report that

Location Sciences Group PLC has maintained a robust governance

framework, with appropriate checks and balances in place to

safeguard shareholder interests.

Stakeholder Relations

As the Independent Director, I place great importance on the

company's relationships with its key stakeholders. I have closely

monitored the engagement efforts undertaken by the team to foster a

positive team culture, ensure fair treatment, and provide

opportunities for professional growth. Furthermore, I have assessed

the company's relationships with clients, suppliers, and other

stakeholders, ensuring that open lines of communication are

maintained and that their expectations are being met.

Looking Ahead

As the Independent Director, I remain committed to our fiduciary

duties and to serving the best interests of Location Sciences Group

PLC and its shareholders. I will continue to provide oversight,

guidance, and independent perspectives to the Board as the company

navigates the evolving landscape. I will monitor progress against

strategic objectives, evaluate risk management practices, and

advocate for responsible and sustainable business practices.

In conclusion, I express our appreciation for the trust placed

in us by the shareholders of Location Sciences Group PLC. I believe

that the company's strategic initiatives, including the disposal of

the Insights business and the ongoing commitment to find a new

strategic direction for the Group, will position it for long-term

success. I remain vigilant in our oversight role and are dedicated

to the company's continued growth and value creation.

STRATEGIC REPORT FOR THE YEARED 31 DECEMBER 2022

The Directors present their strategic report for the year ended

31 December 2022.

Fair review of the business

The fair review of the business is set out in the Chairman's and

Independent Director's reviews, which describe in detail the

financial results and future plans for Location Sciences.

The Board monitors progress on the overall Group strategy and

the individual strategic elements by reference to KPIs. The primary

measures are revenue, costs, EBITDA before exceptional items and

working capital levels.

The Group is in a transition stage with the benefits of the

refinancing, reorganisation of the Group and the Board's strategic

review yet to deliver the value the Board expects to

shareholders.

Principal risks and uncertainties

The principal and commercial risks to the Group are as

follows:

Description The Group's strategic review does not deliver the expected

improved shareholder returns

Impact The Group may not deliver shareholder value

Mitigation The Board conducted a thorough strategic review during

the year to identify the most viable options for sustainable

growth and shareholder value creation.

Description Location Sciences Group PLC continues to be in a cash

consumption phase.

Impact Going concern has been carefully considered and details

are provided in the Corporate Governance Report below

and in note 2 of the Group's financial statements.

Mitigation The Group had in excess of GBP4 million in net cash

resources as at 31 December 2022, which is more than

sufficient for the Groups requirements for the foreseeable

future.

Description Changes in regulation negatively impact the Group's

market.

Impact The Group may find the demand for its products is reduced

and / or the Group may be forced to change or stop

selling one or more of its products.

Mitigation The Board takes account of commentators and industrial

bodies as to the direction of policy change.

The Board meets regularly to review specific and general risks

that face the Group. The Board strives to position the Group in a

way that any risks can be minimised and met, should the need

arise.

The Group's performance will be dependent on the outcome of the

strategic review and the implementation of the results of this

review. As part of our strategic review, we have thoroughly

analysed market trends, customer needs, and emerging opportunities

to ensure the long-term success and sustainable growth of the

company.

The Group is managing this risk by reducing the overheads of the

Group and continuing to analyse new opportunities as they arise.

The Board are committed to delivering shareholder value in the

long-term.

Strategic risks

Following the strategic review, Location Sciences Group PLC has

identified key initiatives, such as seeking acquisition targets and

optimising operational efficiency. However, a strategic risk lies

in the effective execution of these initiatives. Ensuring

successful implementation, alignment across the organisation, and

timely delivery of desired outcomes require careful planning,

resource allocation, and effective management of change. Any

delays, misalignment, or inadequate execution could impede the

company's ability to achieve its strategic objectives and may

result in lost opportunities, lower competitiveness, and suboptimal

financial performance.

It is important for Location Sciences Group PLC to establish

clear goals, allocate appropriate resources, and monitor the

progress of these strategic initiatives. The company should

implement robust project management practices, establish effective

communication channels, and regularly evaluate and adjust the

execution plan as needed. Additionally, strong leadership and

stakeholder engagement are crucial to drive alignment and foster a

culture of accountability throughout the organisation.

By proactively addressing this strategic risk and implementing

effective execution strategies, Location Sciences Group PLC can

enhance its chances of successfully realising the desired outcomes

of the strategic initiatives and drive long-term value for

shareholders.

This report, in conjunction with the Chairman's statement and

Independent Directors report, form the Strategic Report for the

purposes of s414A of the Companies Act 2006.

Section 172 statement

The Directors believe that they have effectively implemented

their duties under section 172 of the Companies Act 2006 through

adherence to the Quoted Companies Alliance Corporate Governance

Code, as disclosed on pages 14 to 16 and as published on our

website:

www.locationsciencesgroup.ai/investor-relations/board-governance.

The Chairman's Report and Chief Executive's Review details the

Group's future plans to achieve its long-term strategy.

The Group is committed to maintaining an excellent reputation

and strive for high standards, while maintaining an awareness of

the environmental impact of the work that it does and strives to

reduce its carbon footprint.

The Directors recognise the importance of the wider stakeholders

in delivering their strategy and achieving sustainability within

the business; in ensuring that all our stakeholders are considered

as part of every decision process we believe we act fairly between

all members of the company.

CORPORATE GOVERNANCE

The Board recognises the importance of good corporate governance

in order to protect and build upon the substantial investments made

by our diverse shareholder base. We have chosen to apply the Quoted

Companies Alliance Corporate Governance Code (the 'QCA Code'),

which was developed by the QCA in consultation with a number of

significant institutional small company investors, as an

alternative corporate governance code applicable to AIM companies.

The underlying principle of the QCA Code is that "the purpose of

good corporate governance is to ensure that the company is managed

in an efficient, effective and entrepreneurial manner for the

benefit of all shareholders over the longer term". The Board

anticipates that whilst the Company will continue to comply with

the QCA Code, given the Group's size and plans for the future, it

will also endeavour to have regard to the provisions of the UK

Corporate Governance Code as best practice guidance to the extent

appropriate for a company of its size and nature.

An explanation of how these principles have been applied is set

out both below and in the Directors' remuneration, Audit Committee

and internal control sections of this report.

Certain information required under the QCA code is included

within the Strategic report and the Directors Remuneration

Report.

Name Date Appointed Date Resigned Role Committees

Simon Wilkinson 25/05/2021 Chairman Remuneration, Nomination,

Audit

Nigel Burton 25/05/2021 Non-Executive Remuneration, Nomination,

Director

Audit

Mark Slade 24/07/2017 22 June 2022 CEO -

David Rae 12/02/2018 22 June 2022 CFO -

The Board is responsible to the shareholders for the proper

management of the Group through setting the overall strategy of the

business and to review the people, performance, policies and

budgets of the Group. The Board typically meets bi-monthly and also

meets for any other extraordinary matters as they may arise.

Detailed information on matters to be discussed during the meetings

are circulated in advance of the meeting to ensure non-executive

directors can contribute in an educated manner.

Independence of Chairman

The roles of the Chairman, Simon Wilkinson, and the Independent

Director, Dr Nigel Burton, have a formal division. The Chairman is

responsible for delivering the outcome of the strategic review and

ensure the adequate and effective resources are in place to deliver

shareholder value. The Independent Director is responsible for

monitoring the Board and ensuring no individual or group takes

control of the Board's decision making and that all key

stakeholders are fully briefed on matters and their

responsibilities.

Board Balance

A minimum of 50% of the Board will always consist of

non-executive directors including the Chairman. All non-executive

directors are independent of the management team and are not

involved in any other business or relationship, both as an

executive or non-executive, which may impair their independent

nature and judgement.

Nomination Committee

The Group's nomination committee is responsible for reviewing

and making proposals to the Board on the appointment of Directors

and meets as necessary. The Group's nomination committee consists

of Simon Wilkinson, who acts as Non-Executive Chairman of the

committee, and Nigel Burton.

Performance Evaluation and Re-election

The Board has continued to evaluate its effectiveness and

performance during the year, taking into account the Financial

Reporting Council's Guidance on Board Effectiveness. It is

anticipated that following the completion of the Board strategic

review director appraisals will be performed to ensure that their

performance is, and continues to be, effective, that where

appropriate they maintain their independence and that they are

demonstrating continued commitment to the role. The Directors will

be evaluated internally based on their responsibilities to the

Board. New Directors resign and stand for re-election at the

Group's first AGM following their appointment. 50% of continuing

Directors stand for re-election on an annual basis.

The Directors carry out continued professional development

throughout the year where appropriate and each Director keeps up to

date with market changes through the use of market articles and

industry contacts.

Remuneration Committee

The Group's remuneration committee is responsible for the

specific remuneration and incentive packages for each of the

company's executive directors, senior executives and managers. The

Group's Remuneration Committee consists of Nigel Burton and Simon

Wilkinson, who acts as Non-Executive Chairman of the committee.

Further details of the Committee's remit are contained in the

Directors' Remuneration Report on pages 11 to 13.

Relations with Shareholders

The Group encourages two-way communication with both its

institutional and private investors and responds promptly to all

queries received. The Non-Executive Directors communicate regularly

with the Group's institutional shareholders and ensure that their

views are communicated fully to the Board. The Board recognises the

Group's AGM as an important opportunity to meet with the Group's

private shareholders. The Directors are available to listen to the

views of shareholders informally immediately following the AGM.

Annual General Meeting

The Annual General Meeting of the Group provides shareholders

with the opportunity to be updated on the Group's progress and to

ask questions of the Board.

Financial Reporting and Internal Control

The Company has established policies covering the key areas of

internal financial control and the appropriate procedures,

controls, authority levels and reporting requirements which must be

applied throughout the Group.

The key procedures that have been established in respect of

internal financial control are:

-- An annual budget set by the Board

-- Monthly management accounts with comparisons to budget

-- Monthly forecast updates with comparisons to budget

-- Monthly cashflow forecasts with comparisons to budget

-- Weekly meetings of the Executive Directors and Senior

Management to review priorities and issues

-- Restriction of user access to systems, including but not

limited to Financial, HR and Technology.

The above controls have been established to support the growth

of the business and to protect against future risks.

Corporate Culture

It is the Board's view that the Group's corporate culture is

consistent with its objectives, strategy and business model. The

Board is aware that the culture set by the Board will greatly

impact all aspects of the Group and the way that employees behave.

The Board invites employees to provide feedback on their peers and

management.

Consolidated Accounts

The aforementioned Financial Reporting and Internal Controls

apply to all subsidiaries. The accounts of all subsidiaries are

combined with those of the Company to form consolidated accounts

each month. The Chief Financial Officer is responsible for

producing the consolidated accounts, including the elimination of

intercompany transactions and balances.

Audit Committee

The Group's Audit Committee is responsible for ensuring the

financial performance of the Group is properly monitored and

reported on, the effectiveness of accounting systems and financial

reporting procedures. The Group's Audit Committee consists of Nigel

Burton and Simon Wilkinson, who acts as Non-Executive Chairman of

the committee.

The Committee considers all proposals for non-audit services and

ensures that these do not impact on the objectivity and

independence of the auditor. The Audit Committee reviews, with the

external auditor, the safeguards and procedures developed by the

auditor to counter threats or perceived threats to their

objectivity and independence. Non-audit services performed by the

external auditor are assessed for threats to objectivity and

independence on a case-by-case basis.

Board and Committee Attendance

Name Main Board Audit Committee Remuneration Nomination

Committee Committee

Simon Wilkinson 4/4 1/1 1/1 1/1

Nigel Burton 4/4 1/1 1/1 1/1

Mark Slade 2/4 - - -

David Rae 2/4 - - -

Going concern

The directors have taken a view of the Group as a whole.

The Group ended 2022 with cash resources of GBP4,125,571, no

debt and an annualised cash burn of less than GBP0.5 million. The

Group continues to operate Verify which has a global client base

with customers in Europe and South Africa and is seeking strategic

alternatives to deliver shareholder value in the long term.

However, despite the actions of the Board, the Group continued

to operate with a trading loss during the year and the same is

expected throughout 2023. The new funds raised during 2021 will be

utilised for the operation of Verify and for working capital

purposes and future opportunities and enable the Group to also

remain debt free. The Board will continue to monitor cash resources

and progress the ongoing business review.

Based on the current status, after making enquiries and

considering the existing cash resources of the business and the

further cost reductions made during 2022, the Board has a

reasonable expectation that the Group will be able to execute its

plans in the medium term such that the Group will have adequate

resources to continue in operational existence for the foreseeable

future. This provides the Board with assurance on the Group's

ability to continue as a going concern, and therefore adopt the

going concern basis of accounting in preparing the annual financial

statements.

DIRECTORS' REMUNERATION REPORT

As a Company admitted to trading on AIM, Location Sciences Group

PLC is not required to present a directors' remuneration report,

however, a number of voluntary disclosures have been made. The

Company has complied with the disclosure requirements set out in

the AIM Rules for Companies.

Remuneration Committee

The Remuneration Committee, consisting of the chairman Simon

Wilkinson and Nigel Burton, determines the Group's policy for

executive remuneration and the individual remuneration packages for

executive directors. In setting the Group's remuneration policy,

the committee considers a number of factors including:

-- salaries and benefits available to executive directors of

comparable companies; and

-- the need to both attract and retain executives of appropriate

calibre

Remuneration of executive directors

Consistent with this policy, benefit packages awarded to

executive directors comprise a mix of basic salary and performance

-- related remuneration that is designed as an incentive. The

remuneration packages can comprise the following elements:

-- base salary: the Remuneration Committee sets the base

salaries to reflect responsibilities and the skills, knowledge and

experience of the individual;

-- bonus scheme: the executive directors are eligible to receive

a bonus dependent on both individual and Group performance as

determined by the Remuneration Committee;

-- equity: share options; and

-- various other add on benefits such as private medical

insurance.

The executive directors are engaged under separate contracts

which require a notice period of three or six months given at any

time by the individual.

Remuneration of non-executive directors

The fees and equity awarded to non -- executive directors are

determined by the Board. The non -- executive directors do not

receive any other forms of benefit such as private medical

insurance.

Year to 31 December 2022

Share

Salary based

Director and fees Bonus Pension Benefits payments Total

GBP GBP GBP GBP GBP GBP

M Slade

(Executive)* 77,600 - 660 - - 78,260

D Rae

(Executive)* 64,667 - 660 - - 65,327

S Wilkinson

(Non-executive) 101,563 - - - - 101,563

N Burton

(Non-executive) 71,094 - - - - 71,094

----------------- ------------ ---------------- -------------- ------------- ------------------

314,924 - 1,320 - - 316,244

================= ============ ================ ============== ============= ==================

Included within directors' remuneration for S Wilkinson and

Nigel Burton is remuneration of GBP101,563 and GBP71,094

respectively that was settled by issue of shares.

* Resigned 22 June 2022.

Year to 31 December 2021

Share

Salary based

Director and fees Bonus Pension Benefits payments Total

GBP GBP GBP GBP GBP GBP

M Slade

(Executive) 170,654 - 1,318 1,951 15,671 189,594

K Harrison*

(Non-executive) 59,129 - - - - 59,129

D Rae

(Executive) 157,837 - 1,318 - 10,241 169,396

B Chilcott*

(Non-executive) 36,000 - - - - 36,000

S Wilkinson**

(Non-executive) 165,000 - - - - 165,000

N Burton**

(Non-executive) 115,500 - - - - 115,500

------------------ ------------ ------------------ ------------------ ------------ ------------------

704,120 - 2,636 1,951 25,912 734,619

================== ============ ================== ================== ============ ==================

Included within directors' remuneration for S Wilkinson and

Nigel Burton is remuneration of GBP165,000 and GBP115,500

respectively that was settled by issue of shares.

* Resigned 25 May 2021.

** Appointed 25 May 2021.

At 31 December At 31 December

Exercise 2022 2021

Director Grant Date Price Number Number

M Slade (Executive) 29/11/2018 2.25p - 15,555,556

D Rae (Executive) 29/11/2018 2.25p - 7,333,333

Notes: The options were to vest in three equal tranches when

certain share price targets have been reached, the share price

targets are as follows:

-- 4.8 pence per New Ordinary Share

-- 7.3 pence per New Ordinary Share

-- 9.7 pence per New Ordinary Share

The options in place at the end of 31 December 2021 were forfeit

on 22 June 2022 when the option holders ceased to hold office.

Director Warrants

Non-transferable warrants to subscribe for, in aggregate,

120,000,000 Ordinary Shares were issued to the Executive Directors

and the Non-Executive Directors, exercisable at 0.20p for five

years from 25 May 2021, provided that the Ordinary Shares have

traded at a Volume Weighted Average Price (VWAP) at or above 0.30p

for 20 consecutive Business Days, or on a change of control of the

Company.

Name Number of Ordinary Shares subject to Director Warrants

Simon Wilkinson 30,000,000

Dr Nigel Burton 30,000,000

Mark Slade 30,000,000

David Rae 30,000,000

Broker Warrants

Transferable warrants to subscribe for, in aggregate, 41,250,000

Ordinary Shares were issued to the Executive Directors and the

Non-Executive Directors, exercisable at 0.20p for five years from

25 May 2021.

Name Number of Ordinary Shares subject to Broker Warrants

Dr Nigel Burton 25,000,000

Mark Slade 10,000,000

David Rae 6,250,000

Promoter Warrants

Promoter warrants were issued to certain investors in the

fundraising completed on 25 May 2021 in consideration of those

persons assembling and co-ordinating the Concert Party's investment

in the Company. As part of this issuance, non-transferable warrants

to subscribe for, in aggregate, 500,000,000 Ordinary Shares were

issued to Simon Wilkinson, exercisable at 0.20p for five years from

25 May 2021.

DIRECTORS' REPORT FOR THE YEARED 31 DECEMBER 2022

The Directors are pleased to present the annual report and

audited financial statements of Location Sciences Group PLC for the

year ended 31 December 2022.

Dividends

The Directors do not recommend the payment of a dividend.

Board of Directors

Simon Wilkinson, Non-Executive Chairman

Simon joined Location Sciences as Non-Executive Chairman in May

2021. Simon is a highly experienced software executive and

entrepreneur, having been involved with a number of public and

private companies over his career. He was most recently CEO then

Chairman of Mobica, a world-leading, award-winning software

services company offering bespoke development, QA and consultancy.

He was previously Chief Executive Officer of Myriad Group AG, which

was listed in Zurich, and founder and Chief Executive Officer of

Magic4 Ltd, a mobile messaging software market leader, backed by

3i, Philips Ventures and Motorola Ventures.

Nigel Burton, Non-Executive Director

Nigel was appointed as a Non-Executive Director in May 2021.

Nigel spent 14 years as an investment banker at leading City

institutions including UBS Warburg and Deutsche Bank, including as

the Managing Director responsible for the energy and utilities

industries. Following this he spent 15 years as Chief Financial

Officer or Chief Executive Officer of a number of private and

public companies. He is currently a Non-Executive Director of

BlackRock Throgmorton Investment Trust plc, DeepVerge plc, eEnergy

Group plc, Mobile Streams plc and Microsaic Systems plc.

Research and development

Due to the reorganisation of the business following the Board's

strategic review, Location Sciences ceased investing into research

and development. GBPNil (2021: GBP341,441) of development

expenditure has been capitalised as "Intangible Assets".

Financial Risk Management

The Group's financial instruments comprise cash and cash

equivalents, trade receivables and payables and borrowings. The

main risks arising from the Group's financial instruments are

interest rate risk, credit risk, liquidity risk and foreign

currency risk.

Interest rate and credit risk - the principal assets of the

Group are its cash deposits. These are short-term liquid assets and

as a result the exposure to interest rate income risk is not

considered significant. The principal focus of the Directors has

been to minimise any credit risk in relation to its cash deposits

even at the expense of interest income received. Borrowings include

financial instruments on fixed interest rate terms and a revolving

credit facility at a variable rate. As a result, the exposure to

interest rate expense risk is low and no active management of

interest rate risk is undertaken by the Board.

Foreign currency risk - the main functional currency is

sterling. Throughout 2022, the Company's transactions have

primarily been denominated in sterling and the Group has had low

exposure to foreign currency risk.

Liquidity risk - the Board's policy is to ensure that sufficient

cash and cash equivalents are held on a short-term basis at all

times in order to meet the Group's operational needs. The Group

does actively raise funds through market placings and other loan

facilities.

The Group has been operating at a trading loss due to its stage

of development and seeks to ensure that its investments will

deliver long term value to shareholders. Liquidity risk is actively

managed through regular review of cash requirements of the business

in conjunction with the strategic and operational plans for the

Group.

Substantial shareholdings

As at 26 June 2023 the Directors had been notified of the

following holdings representing 3% or more of the issued share

capital of the Company:

Percentage

Number of of issued share

ordinary shares capital

Richard Hughes 200,000,000 7.55%

Mahmud Kamani 200,000,000 7.55%

Turner Pope Investments 132,750,000 5.01%

Darron Lee 125,000,000 4.72%

Simon Wilkinson 100,000,000 3.78%

Dr Nigel Burton 85,000,000 3.21%

Directors

The Directors, who held office during the year, were as

follows:

S Wilkinson

N Burton

D Rae (resigned 22 June 2022)

M Slade (resigned 22 June 2022)

The Company maintains director and officers' liability

insurance.

Statement of Directors' responsibilities

The Directors acknowledge their responsibilities for preparing

the Annual Report and the financial statements in accordance with

applicable law and regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the Directors

have elected to prepare the financial statements in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union. Under company law the directors must not

approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the group

and company and of the profit or loss of the group and company for

that period. In preparing these financial statements, the directors

are required to:

-- select suitable accounting policies and apply them consistently;

-- make judgements and accounting estimates that are reasonable

and prudent;

-- state whether applicable International Financial Reporting

Standards (IFRSs) as adopted by the European Union have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the group's and the

company's transactions and disclose with reasonable accuracy at any

time the financial position of the group and the company and enable

them to ensure that the financial statements comply with the

Companies Act 2006. They are also responsible for safeguarding the

assets of the group and the company and hence for taking reasonable

steps for the prevention and detection of fraud and other

irregularities.

Directors' interests in shares

The directors held the following interests in Location Sciences

Group PLC:

At 31 December 2022 At 31 December 2021

Warrants over Warrants

Ordinary Options over Ordinary Shares Ordinary Options over over Ordinary

Shares of Ordinary Shares of 0.1p each Shares of Ordinary Shares Shares of

0.1p each of 0.1p each 0.1p each of 0.1p each 0.1p each

S Wilkinson 100,000,000 - 530,000,000 75,000,000 - 530,000,000

N Burton 85,000,000 - 55,000,000 67,500,000 - 55,000,000

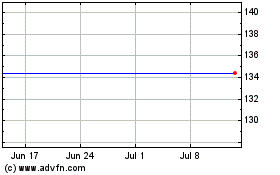

The market price of the Company's shares at the end of the

financial year was 0.13p.

Disclosure of information to auditor

Each of the persons who are directors at the time when this

director's report is approved has confirmed that:

-- so far as that director is aware, there is no relevant audit

information of which the Company's auditor is unaware; and

-- that director has taken all the steps that ought to have been

taken as a director in order to be aware of any relevant audit

information and to establish that the auditor is aware of

that information.

Annual General Meeting

Notice of the forthcoming Annual General Meeting of the Company

together with resolutions relating to the Company's ordinary

business will be given to the members separately.

Reappointment of auditors

The auditors, Hazlewoods LLP, will be proposed for reappointment

in accordance with section 485 of the Companies Act 2006.

INDEPENT AUDITOR'S REPORT TO THE MEMBERS OF LOCATION SCIENCES

GROUP PLC

Opinion

We have audited the financial statements of Location Sciences

Group PLC (the 'parent company') and its subsidiaries (the 'group')

for the year ended 31 December 2022, which comprise the

Consolidated Income Statement, Consolidated Statement of

Comprehensive Income, Consolidated Statement of Financial Position,

Statement of Financial Position, Consolidated Statement of Changes

in Equity, Statement of Changes in Equity, Consolidated Statement

of Cash Flows, Statement of Cash Flows, and Notes to the Financial

Statements, including a summary of significant accounting policies.

The financial reporting framework that has been applied in their

preparation is applicable law and UK adopted international

accounting standards.

In our opinion the financial statements:

-- give a true and fair view of the state of the group's and

the parent company's affairs as at 31 December 2022 and of

the group's loss for the year then ended;

-- have been properly prepared in accordance with United Kingdom

Generally Accepted Accounting Practice; and

-- have been prepared in accordance with the requirements of

the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the group

in accordance with the ethical requirements that are relevant to

our audit of the financial statements in the UK, including the

FRC's Ethical Standard as applied to listed entities, and we have

fulfilled our other ethical responsibilities in accordance with

these requirements. We believe that the audit evidence we have

obtained is sufficient and appropriate to provide a basis for our

opinion.

Our approach to the audit

Our audit approach was based on a thorough understanding of the

Group's business and is risk based. In arriving at our opinions set

out in this report, we highlight the key audit matters that in our

judgment, had the greatest effect on the financial statements.

Key audit matters How our scope addressed this matter

Key audit matters are those matters that, in our professional

judgment, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) we identified, including those which had the greatest effect

on: the overall audit strategy, the allocation of resources in the

audit; and directing the efforts of the engagement team. These

matters were addressed in the context of our audit of the financial

statements as a whole, and in forming our opinion thereon, and we

do not provide a separate opinion on these matters.

Recognition of revenue

Revenue consists of the value Our audit work included but was

of services provided. Revenue not restricted to:

recorded for services is recorded - For revenue recognised in the

to the extent that the Group year our audit work include, assessing

has performed its contractual whether the Group's accounting

obligations. We therefore identified policy for revenue recognition

revenue recognition as a risk was in accordance with IFRS 15

that required particular audit 'Revenue';

attention. - Sampling service sales in the

year and comparing them to usage

reports and stated performance

dates;

- Performing cut-off testing of

sales around the year end; and

- Analytical review of revenue

recognised in the year including

variance review.

Internally generated intangible

assets

The Group has GBP134,674 of Our audit work included, but was

development costs in the year not restricted to:

on the balance sheet. The Group - Assessing the nature of the costs

capitalises development costs capitalised to ensure they met

when the following criteria the required accounting criteria

have been met: The product is for capitalisation;

technically viable, it is intended - Discussions with management to

for sale, a market exists, expenditure ensure that all criteria for capitalisation

can be measured reliably, and had been met and supporting evidence

sufficient resources are available was obtained to corroborate this.

to allow completion of the project. - Considering whether there are

When the Board is sufficiently any impairment indicators and,

confident that these criteria where these exist, reviewing impairment

are met, the costs are capitalised. reviews prepared by management.

We therefore identified internally

generated intangibles as a risk

that required particular audit

attention.

Going concern

Trading performance of the Group Our audit work included, but was

has previously indicated the not limited to:

existence of material uncertainty, - considering funds and resources

which may cast significant doubt available to the Group in the year;

about the Company and the Group's - review of forecasts prepared

ability to continue as a going by management to support the going

concern. concern assumption; and

- consideration of customer contracts.

Our application of materiality

We apply the concept of materiality in planning and performing

our audit, in evaluating the effect of any identified misstatements

and in forming our opinion. For the purpose of determining whether

the group financial statements are free from material misstatement,

we define materiality as the magnitude of a misstatement or an

omission from the financial statements or related disclosures that

would make it probable that the judgement of a reasonable person,

relying on the information would have been changed or influenced by

the misstatement or omission. We also determine a level of

performance materiality, which we used to determine the extent of

testing needed, to reduce to an appropriately low level that the

aggregate of uncorrected and undetected misstatements exceed

materiality of the group financial statements as a whole.

We establish materiality for the financial statements as a whole

to be GBP45,000, which is 1% of the value of the trading

subsidiary's total assets.

Conclusions relating to going concern

In auditing the financial statements, we have concluded that the

director's use of the going concern basis of accounting in the

preparation of the financial statements is appropriate.

Our evaluation of the directors' assessment of the company's

ability to continue to adopt the going concern basis of accounting

included discussions with management to support assumptions

included in forecasts and the Group ongoing strategy and assessing

the level of resource available to the Group.

Based on the work we have performed, we have not identified any

material uncertainties relating to events or conditions that,

individually or collectively, may cast significant doubt on the

company's ability to continue as a going concern for a period of at

least twelve months from when the original financial statements

were authorised for issue.

Our responsibilities and the responsibilities of the directors

with respect to going concern are described in the relevant section

of this report.

Other information

The directors are responsible for the other information. The

other information comprises the information included in the annual

report, other than the financial statements and our auditor's

report thereon. Our opinion on the financial statements does not

cover the other information and, except to the extent otherwise

explicitly stated in our report, we do not express any form of

assurance conclusion thereon.

In connection with our audit of the financial statements, our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

audit or otherwise appears to be materially misstated. If we

identify such material inconsistencies or apparent material

misstatements, we are required to determine whether there is a

material misstatement in the financial statements or a material

misstatement of the other information. If, based on the work we

have performed, we conclude that there is a material misstatement

of this other information, we are required to report that fact.

We have nothing to report in this regard.

Opinion on other matter prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of

the audit:

-- the information given in the Strategic Report and Directors'

Report for the financial year for which the financial statements

are prepared is consistent with the financial statements;

and

-- the Strategic Report and Directors' Report have been prepared

in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of our knowledge and understanding of the group and

the parent company and its environment obtained in the course of

the audit, we have not identified material misstatements in the

Strategic Report and the Directors' Report.

We have nothing to report in respect of the following matters

where the Companies Act 2006 requires us to report to you if, in

our opinion:

-- adequate accounting records have not been kept by the parent

company, or returns adequate for our audit have not been received

from branches not visited by us; or

-- the parent company financial statements are not in agreement

with the accounting records and returns; or

-- certain disclosures of directors' remuneration specified by

law are not made; or

-- we have not received all the information and explanations

we require for our audit.

Responsibilities of directors

As explained more fully in the Directors' Report set out on page

16, the directors are responsible for the preparation of the

financial statements and for being satisfied that they give a true

and fair view, and for such internal control as the directors

determine is necessary to enable the preparation of financial

statements that are free from material misstatement, whether due to

fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the Group's and the parent Company's

ability to continue as a going concern, disclosing, as applicable,

matters related to going concern and using the going concern basis

of accounting unless the directors either intend to liquidate the

Group or the parent Company or to cease operations, or have no

realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

Irregularities, including fraud, are instances of non-compliance

with laws and regulations. We design procedures in line with our

responsibilities, outlined above, to detect material misstatements

in respect of irregularities, including fraud. The extent to which

our procedures are capable of detecting irregularities, including

fraud is detailed below.

Based on our understanding of the company and its activities, we

identified that the principal risks of non-compliance with laws and

regulations related to UK tax legislation and money laundering, and

we considered the extent to which non-compliance might have a

material effect on the financial statements. We also considered

those laws and regulations that have a direct impact on the

preparation of the financial statements such as UK GAAP and the

Companies Act 2006. We evaluated management's incentives and

opportunities for fraudulent manipulation of the financial

statements (including the risk of override of controls), and

determined that the principal risks were related to posting

inappropriate or fictitious journal entries to manipulate the

financial performance or financial position of the company.

As part of an audit in accordance with ISAs (UK), we exercise

professional judgement and maintain professional scepticism

throughout the audit. We also planned and performed audit

procedures including:

-- Gaining an understanding of the legal and regulatory

framework and considering the risk of any acts which may be

contrary to applicable laws and regulations, including fraud.

-- Obtaining an understanding of internal control relevant to

the audit in order to design audit procedures that are appropriate

in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the company's internal control.

-- Evaluation of the appropriateness of accounting policies used

and the reasonableness of accounting estimates and related

disclosures made by the directors.

-- Making inquiries with management including consideration of

known or suspected instances of non-compliance with laws and

regulation and fraud.

-- Testing journal entries and other adjustments for

appropriateness and evaluating the business rationale of any

significant transactions outside the normal course of business.

-- Evaluation of the overall presentation, structure and content

of the financial statements, including the disclosures, and whether

the financial statements represent the underlying transactions and

events in a manner that achieves fair presentation.

-- Conclusion on the appropriateness of the directors' use of

the going concern basis of accounting and, based on the audit

evidence obtained, whether a material uncertainty exists related to

events or conditions that may cast significant doubt on the Group's

ability to continue as a going concern. If we conclude that a

material uncertainty exists, we are required to draw attention in

our auditor's report to the related disclosures in the financial

statements or, if such disclosures are inadequate, to modify our

opinion. Our conclusions are based on the audit evidence obtained

up to the date of our auditor's report. However, future events or

conditions may cause the Group to cease to continue as a going

concern.

There are inherent limitations in the audit procedures described

above. We are less likely to become aware of instances of

non-compliance with laws and regulations that are not closely

related to events and transactions reflected in the financial

statements. Also the risk of not detecting a material misstatement

due to fraud is higher than the risk of not detecting one resulting

from error, as fraud may involve deliberate concealment by, for

example, forgery or intentional misrepresentations or through

collusion.

We communicate with those charged with governance regarding,

among other matters, the planned scope and timing of the audit and

significant audit findings, including any significant deficiencies

in internal control that we identify during our audit.

A further description of our responsibilities is available on

the Financial Reporting Council's website

at:www.frc.org.uk/auditorsresponsibilities. This description forms

part of our auditor's report.

Use of this report

This report is made solely to the company's members, as a body,

in accordance with Chapter 3 of Part 16 of the Companies Act 2006.

Our audit work has been undertaken so that we might state to the

company's members those matters we are required to state to them in

an auditor's report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the company and the company's members as a body,

for our audit work, for this report, or for the opinions we have

formed.

Ryan Hancock (Senior Statutory Auditor)

For and on behalf of Hazlewoods LLP, Statutory Auditor

Staverton Court

Staverton

Cheltenham

GL51 0UX

Date: 26 June 2023

CONSOLIDATED INCOME STATEMENT FOR THE YEARED 31 DECEMBER

2022

2022 2021

Continuing Operations Note GBP GBP

Revenue 4 110,856 167,940

Cost of sales (29,358) (77,243)

---------- ------------

Gross profit 81,498 90,697

Administrative expenses (723,149) (801,432)

Other operating income 5 - 11,267

---------- ------------

Operating loss before exceptional administrative

expenses, amortisation and depreciation (641,651) (699,468)

Amortisation and depreciation (259,335) (216,392)

Exceptional administrative expenses 7 42,040 (283,210)

---------- ------------

Operating loss 7 (858,946) (1,199,070)

Finance income 8 8,368 2

---------- ------------

Loss before tax (850,578) (1,199,068)

Income tax receipt 12 - 113,871

---------- ------------

Loss for the year for the financial

year from continuing operations (850,578) (1,085,197)

Discontinued operations

Profit (loss) for the year from discontinued

operations 6 92,357 (298,161)

---------- ------------

Loss for the financial year (758,221) (1,383,358)

========== ============

Earnings per share

Loss per share - basic and diluted 13 (0.029p) (0.076p)

The above results were derived from continuing operations.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARED 31

DECEMBER 2022

2022 2021

GBP GBP

Loss for the year (758,221) (1,383,358)

Other comprehensive income

Foreign currency translation loss - (4,718)

--------- -----------

Total comprehensive income for the

year attributable to owners of the

parent (758,221) (1,388,076)

========= ===========

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2022

2022 2021

Note GBP GBP

Assets

Non-current assets

Intangible assets 14 134,674 537,491

Property, plant and equipment 15 - -

------------ ------------

134,674 537,491

Current assets

Trade and other receivables 17 228,072 331,559

Tax asset 12 - 113,871

Cash and cash equivalents 4,125,571 4,378,825

------------ ------------

4,353,643 4,824,255

Current liabilities

Trade and other payables 18 (157,864) (183,175)

Net current assets 4,195,778 4,641,080

------------ ------------

Total assets less current liabilities 4,330,453 5,178,571

------------ ------------

Net assets 4,330,453 5,178,571

============ ============

Equity

Share capital 21 16,340,507 16,298,007

Share premium 20,088,118 20,034,993

Merger relief reserve 11,605,556 11,605,556

Capital reserve 209,791 209,791

Reverse acquisition reserve (9,225,108) (9,225,108)

Equity reserve 1,135,319 1,135,319

Retained earnings (35,823,730) (34,879,987)

------------ ------------

Equity attributable to owners of the

company 4,330,453 5,178,571

============ ============

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022

2022 2021

Note GBP GBP

Assets

Non-current assets

Investments 16 3,034,374 3,219,896

Current assets

Trade and other receivables 17 58,797 132,919

Current liabilities

Trade and other payables 18 (76,000) (76,000)

------------ ------------

Net current assets (17,203) 56,919

------------ ------------

Total assets less current liabilities 3,017,171 3,276,815

------------ ------------

Net assets 3,017,171 3,276,815

============ ============

Equity

Share capital 21 16,340,507 16,298,007

Share premium 20,088,118 20,034,993

Merger relief reserve 11,605,556 11,605,556

Equity reserve 1,135,319 1,135,319

Retained earnings (46,152,329) (45,797,060)

------------ ------------

Total equity 3,017,171 3,276,815

============ ============

The Company has taken advantage of the exemption allowed under

section 408 of the Companies Act 2006 and has not presented its own

statement of comprehensive income in these financial statements.

The loss after tax for the parent Company for the year was

GBP169,747 (2021: GBP3,796,912).

Approved by the Board on 26 June 2023 and signed on its behalf

by:

Simon Wilkinson

Director

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31

DECEMBER 2022

Merger Reverse

Share Share relief Capital acquisition Equity Retained

capital premium reserve reserve reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2021 14,280,258 19,315,231 11,605,556 209,791 (9,225,108) - (33,540,223) 2,645,505

Loss for the

year - - - - - - (1,383,358) (1,383,358)

Other

comprehensive

income - - - - - - (4,718) (4,718)

----------- ----------- ----------- -------- ------------ ----------- ------------ ------------

Total

comprehensive

income - - - - - - (1,388,076) (1,388,076)

New share

capital

subscribed 2,017,749 1,855,081 - - - - - 3,872,830

Warrants

issued - (1,135,319) - - - 1,135,319 - -

Share-based

payments - - - - - - 48,312 48,312

----------- ----------- ----------- -------- ------------ ----------- ------------ ------------

At 31 December

2021 16,298,007 20,034,993 11,605,556 209,791 (9,225,108) 1,135,319 (34,879,987) 5,178,571

=========== =========== =========== ======== ============ =========== ============ ============

Merger Reverse

Share Share relief Capital acquisition Equity Retained

capital premium reserve reserve reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2022 16,298,007 20,034,993 11,605,556 209,791 (9,225,108) 1,135,319 (34,879,987) 5,178,571

Loss for the

year - - - - - - (758,221) (758,221)

Total

comprehensive

income - - - - - - (758,221) (758,221)

New share

capital

subscribed 42,500 53,125 - - - - - 95,625

Share-based

payment

credit - - - - - - (185,522) (185,522)

At 31 December

2022 16,340,507 20,088,118 11,605,556 209,791 (9,225,108) 1,135,319 (35,823,730) 4,330,453

=========== =========== =========== ======== ============ =========== ============ ============

STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31 DECEMBER

2022

Merger relief Retained

Share capital Share premium reserve Equity reserve earnings Total

GBP GBP GBP GBP GBP GBP

At 1 January 2021 14,280,258 19,315,231 11,605,556 - (42,048,460) 3,152,585

Loss for the year - - - - (3,796,912) (3,796,912)

------------- ------------- ------------- -------------- ------------ -------------

Total comprehensive income - - - - (3,796,912) (3,796,912)

New share capital subscribed 2,017,749 1,855,081 - - - 3,872,830

Share-based payments - - - 48,312 48,312

Warrants issued - (1,135,319) - 1,135,319 - -

------------- ------------- ------------- -------------- ------------ -------------

At 31 December 2021 16,298,007 20,034,993 11,605,556 1,135,319 (45,797,060) 3,276,815

============= ============= ============= ============== ============ =============

Merger relief Retained

Share capital Share premium reserve Equity reserve earnings Total

GBP GBP GBP GBP GBP GBP

At 1 January 2022 16,298,007 20,034,993 11,605,556 1,135,319 (45,797,060) 3,276,815

Loss for the year - - - - (169,747) (169,747)

------------- ------------- ------------- -------------- ------------ -------------

Total comprehensive income - - - - (169,747) (169,747)

Share-based payment credit - - - - (185,522) (185,522)

New share capital subscribed 42,500 53,125 - - - 95,625

------------- ------------- ------------- -------------- ------------ -------------

At 31 December 2022 16,340,507 20,088,118 11,605,556 1,135,319 (46,152,329) 3,017,171

============= ============= ============= ============== ============ =============

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2022

2022 2021

Cash flows from operating activities Note GBP GBP

Loss for the year from continuing activities (850,758) (1,085,197)

Loss for the year from discontinued activities 92,537 (298,161)

Adjustments to cash flows from non-cash

items:

Depreciation and amortisation 7 259,335 508,862

Impairment charge 7 143,482 283,210

Profit on disposal of discontinued operations - (290,640)

Foreign exchange gain - (4,718)

Finance income 8 (8,368) (2)

Share based payment transactions (185,522) 48,312

Income tax expense - (113,871)

Shares issued other than for cash 85,000 120,000

Uplift in fair value of directors' fees 10,625 195,500

--------- -----------

(453,669) (636,705)

Working capital adjustments

Decrease / (Increase) in trade and other

receivables 103,487 88,225

Decrease in trade and other payables (25,310) (33,114)

--------- -----------

Cash used in operations (375,492) (581,594)

Income taxes received 113,871 166,272

--------- -----------

Net cash flow from operating activities (261,622) (415,322)

--------- -----------

Cash flows from investing activities

Interest received 8 8,368 2

Disposals of discontinued operations - 450,138

Acquisition of intangible assets 14 - (341,441)

--------- -----------

Net cash flows from investing activities 8,368 108,699

--------- -----------

Cash flows from financing activities

Proceeds from issue of ordinary shares,

net of issue costs - 3,557,330

Net cash flows from financing activities - 3,557,330

--------- -----------

Net increase/(decrease) in cash and cash

equivalents (253,254) 3,250,707

Cash and cash equivalents at 1 January 4,378,825 1,128,118

--------- -----------

Cash and cash equivalents at 31 December 4,125,571 4,378,825

========= ===========

2022 2021

GBP GBP

Non-cash financing activities:

Share warrants exercised in year - 10,000

Fees settled by share issues - 120,000

Directors' fees settled by share issues 95,625 163,625

====== =======

For full details on non-cash financing activities

see note 21

STATEMENT OF CASH FLOWS FOR THE YEARED 31 DECEMBER 2022

2022 2021

GBP GBP

Cash flows from operating activities

Loss for the year (169,747) (3,796,912)

Adjustments to cash flows from non-cash

items

Non-cash impairments - 3,314,312

Share issues other than for cash 85,000 120,000

Uplift in fair value of directors' fees 10,625 195,500

--------- -----------

(74,122) (167,100)

Working capital adjustments

Decrease/(increase) in trade and other

receivables 74,122 (132,918)

Increase / (decrease) in trade and other

payables - 57,000

--------- -----------

Net cash flow from operating activities - (243,018)

Cash flows from financing activities

Proceeds from issue of ordinary shares,

net of issue costs - 3,557,330

Decrease in inter-company loans - (3,314,312)

--------- -----------

Net cash flows from financing activities - 243,018

--------- -----------

Net increase in cash and cash equivalents - -

Cash and cash equivalents at 1 January - -

--------- -----------

Cash and cash equivalents at 31 December - -

========= ===========

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEARED 31 DECEMBER

2022

General information

1

The company is a public company limited by share capital,

incorporated and domiciled in England.

The address of its registered office is:

First Floor

St James' House

St James' Square

Cheltenham

Gloucestershire

GL50 3PR

The Company's ordinary shares are traded on the Alternative

Investment Market (AIM) of the London Stock Exchange.

Principal activity

Location Sciences has developed a global platform called Verify,

which brings transparency to the location based mobile advertising

market. Verify allows marketeers to authenticate where their

adverts have been viewed and uses proprietary technology to detect

location ad-fraud, which would otherwise go unnoticed.

Accounting policies

2

Statement of compliance

The group financial statements have been prepared in accordance

with International Financial Reporting Standards and its

interpretations adopted by the EU ("adopted IFRS's").

Summary of significant accounting policies and key accounting

estimates

The principal accounting policies applied in the preparation of

these financial statements are set out below. These policies have

been consistently applied to all the years presented, unless

otherwise stated.

Going concern

The directors have taken a view of the Group as a whole.

The Group ended 2022 with cash resources of GBP4,125,571, no

debt and an annualised cash burn of less than GBP0.5 million. The

Group continues to operate Verify which has a global client base

with customers in Europe and South Africa and is seeking strategic

alternatives to deliver shareholder value in the long term.

However, despite the actions of the Board, the Group continued

to operate with a trading loss during the year and the same is

expected throughout 2023. The new funds raised during 2021 will be

utilised for the operation of Verify and for working capital

purposes and future opportunities and enable the Group to also

remain debt free. The Board will continue to monitor cash resources

and progress the ongoing business review.

Based on the current status, after making enquiries and

considering the existing cash resources of the business and the

further cost reductions made during 2022, the Board has a

reasonable expectation that the Group will be able to execute its

plans in the medium term such that the Group will have adequate

resources to continue in operational existence for the foreseeable

future. This provides the Board with assurance on the Group's

ability to continue as a going concern, and therefore adopt the

going concern basis of accounting in preparing the annual financial

statements.

Basis of consolidation

The group financial statements consolidate the financial

statements of the company and its subsidiary undertakings drawn up

to 31 December 2022 in accordance with IFRS 10.

A subsidiary is an entity controlled by the company. Control is

achieved where the company has the power to govern the financial

and operating policies of an entity so as to obtain benefits from

its activities.

The results of subsidiaries acquired or disposed of during the

year are included in the income statement from the effective date

of acquisition or up to the effective date of disposal, as

appropriate. Where necessary, adjustments are made to the financial

statements of subsidiaries to bring their accounting policies into

line with those used by the group.

The purchase method of accounting is used to account for

business combinations that result in the acquisition of

subsidiaries by the group. The cost of a business combination is

measured as the fair value of the assets given, equity instruments

issued and liabilities incurred or assumed at the date of exchange,

plus costs directly attributable to the business combination.

Identifiable assets acquired and liabilities and contingent

liabilities assumed in a business combination are measured

initially at their fair values at the acquisition date. Any excess

of the cost of the business combination over the acquirer's

interest in the net fair value of the identifiable assets,

liabilities and contingent liabilities recognised is recorded as

goodwill.

Inter-company transactions, balances and unrealised gains on

transactions between the company and its subsidiaries, which are

related parties, are eliminated in full.

Intra-group losses are also eliminated but may indicate an

impairment that requires recognition in the consolidated financial

statements.

Accounting policies of subsidiaries have been changed where

necessary to ensure consistency with the policies adopted by the

group. Non-controlling interests in the net assets of consolidated

subsidiaries are identified separately from the group's equity

therein. Non-controlling interests consist of the amount of those

interests at the date of the original business combination and the

non-controlling shareholder's share of changes in equity since the

date of the combination. Total comprehensive income is attributed

to non-controlling interests even if this results in the

non-controlling interests having a deficit balance.

Changes in accounting policy

For the purpose of the preparation of these consolidated

financial statements, the Group has applied all standards and

interpretations that are effective for accounting periods beginning

on or after 1 January 2022. None of the standards that have been

applied have had a material effect on the financial statements.

New standards, interpretations and amendments not yet

effective

No new standards, amendments or interpretations to existing

standards that have been published and that are mandatory for the

Group's accounting periods beginning on or after 1 January 2022, or

later periods, have been adopted early.

None of the standards, interpretations and amendments which are

effective for periods beginning after 1 January 2022, and which

have not been adopted early, are expected to have a material effect

on the financial statements.

Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker

for the use in strategic decision making and monitoring of

performance. The Group considers the chief operating decision maker

to be the Executive Board.

Revenue recognition

Revenue represents the invoice value of services and software

licences provided to external customers in the period, stated

exclusive of value added tax.

Consideration received from customers in respect of services is

only recorded as revenue to the extent that the Group has performed

its contractual obligations in respect of that consideration.

Management assess the performance of the Group's contractual

obligations against project milestones and work performed to

date.

Revenue from software licences sold in conjunction with services

is invoiced separately from those services and recognised over the

period of the licence.

Revenue from software licences for the use of the technology