Nostra Terra Oil & Gas Company PLC Record Revenue and Production Rate at Pine Mills (9004G)

March 07 2018 - 1:00AM

UK Regulatory

TIDMNTOG

RNS Number : 9004G

Nostra Terra Oil & Gas Company PLC

07 March 2018

7 March 2018

Nostra Terra Oil and Gas Company plc

("Nostra Terra" or the "Company")

Record Revenue and Production Rate at Pine Mills

Nostra Terra (AIM:NTOG), the oil and gas exploration and

production company with a portfolio of assets in the USA and Egypt,

is pleased to announce two new records at the Pine Mills oil field.

During February Nostra Terra generated record revenue at Pine

Mills, and so far in March has set and held a new daily production

record.

Highlights:

-- Estimated net revenue during February was US$161,000, a new monthly record

-- Average daily oil sold in February for Pine Mills was 126 bopd

o This represents a 30% increase on average production in H1

2017

-- Pine Mills has been a significant contributor to Nostra Terra

becoming cash flow positive at the Plc level

Pine Mills

Nostra Terra owns a 100% Working Interest in Pine Mills. In

February, Nostra Terra announced that it became cash flow positive

on a plc basis for that month. Net cash flow generation at Pine

Mills made a significant contribution to this milestone.

Average gross production in January was 109 bopd, increasing in

February to 114 bopd. Late February workovers have increased

production, despite weather-related preventive shut-ins for several

days during late February due to heavy rain.

The net result is Nostra Terra delivering the highest daily

production rate and highest monthly revenues yet. Current average

daily production at Pine Mills for March has averaged 129 bopd.

Nostra Terra will continue to perform workovers on identified

targets and aims to increase production further over the coming

months.

Nostra Terra's stabilised average production target at Pine

Mills remains between 130 and 150bopd. This should further add to

free cash flow generated by the Pine Mills asset.

Matt Lofgran, Chief Executive Officer of Nostra Terra,

commented:

"We're excited to see Pine Mills have a record month with

revenue, and also reach a new record on daily production. This was

achieved by reinvesting net income from the field into workovers.

The lifting costs remain relatively constant, while production and

revenue increase, resulting in an increase in net income from the

field, which contributes further to remaining cashflow positive at

the Plc level."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, visit www.ntog.co.uk or contact:

Nostra Terra Oil and Gas Company

plc

Matt Lofgran, CEO +1 480 993 8933

Strand Hanson Limited

(Nominated & Financial Adviser and

Joint Broker) +44 (0) 20 7409 3494

Rory Murphy / Ritchie Balmer / Jack

Botros

Smaller Company Capital Limited (Joint

Broker) +44 (0) 20 3651 2910

Rupert Williams / Jeremy Woodgate

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLGMGGFRVMGRZM

(END) Dow Jones Newswires

March 07, 2018 02:00 ET (07:00 GMT)

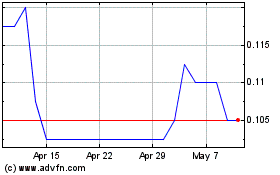

Nostra Terra Oil And Gas (LSE:NTOG)

Historical Stock Chart

From Apr 2024 to May 2024

Nostra Terra Oil And Gas (LSE:NTOG)

Historical Stock Chart

From May 2023 to May 2024