Oakley Capital Investments Limited Acquisition of Plesk (8036D)

May 02 2017 - 1:01AM

UK Regulatory

TIDMOCL

RNS Number : 8036D

Oakley Capital Investments Limited

02 May 2017

2 May 2017

Oakley Capital Investments Limited

Acquisition of Plesk

Oakley Capital Investments Limited(1) (AIM:OCL, the "Company")

is pleased to announce that Oakley Capital Private Equity III(2)

("Fund III") has completed a deal to acquire the assets and

operations of Plesk, at an enterprise value of $105 million, as a

carve out from the Parallels Group. Fund III has invested $27.4

million for a 51% controlling stake in the business. The Company's

indirect contribution through its interest in Fund III is

approximately GBP10.0 million (GBP/USD = 1.29).

The investment in Plesk represents another primary, proprietary

deal in one of Oakley's core sectors, originating from

long-standing relationships within the hosting industry.

First released in 1999, Plesk is one of the most widely used

control panels and software platforms for simplifying the lives of

Web Professionals. Plesk's web-server management tools secure and

automate server and website administration as well as operations.

Key features include the automation and management of domain names,

email accounts, web applications, programming languages, databases

and infrastructure tasks to provide a ready-to-code environment and

strong security across all layers and operating systems. The Plesk

software platform operates on more than 350,000 servers globally,

supporting the operations of more than 10 million websites and 18

million email boxes. Plesk is available in 32 languages globally

and many of the top cloud and hosting service providers partner

with Plesk.

Plesk generated revenues of $28 million and EBITDA of

approximately $14 million for the year ended 31 December 2016. The

business is expected to drive growth through a number of clearly

identified revenue and operational initiatives, made possible by

focussed management following its separation from the Parallels

Group.

Peter Dubens, Director of OCL, commented:

"We are delighted to be investing in Plesk, which is a widely

used software platform with significant growth potential in a

sector we know well. We are excited to be partnering with a strong

management team and we believe that our combined experience will

support the business as it moves into the next phase of its

development."

For further information please contact:

Oakley Capital Investments Limited

+44 20 7766 6900

Peter Dubens, Director

Steven Tredget, Investor Relations

FTI Consulting LLP

+44 20 3727 1000

Edward Bridges / Stephanie Ellis

Liberum Capital Limited (Nominated Adviser & Broker)

+44 20 3100 2000

Steve Pearce / Henry Freeman / Jill Li

(1) About Oakley Capital Investments Limited ("OCL")

Oakley Capital Investments Limited is a Bermudan company listed

on AIM. OCL seeks to provide investors with long term capital

appreciation through its investment in Oakley Capital Private

Equity L.P., Oakley Capital Private Equity II, Oakley Capital

Private Equity III and through co-investment opportunities.

(2) About Oakley Capital Private Equity L.P. ("Fund I"), Oakley

Capital Private Equity II ("Fund II") and Oakley Capital Private

Equity III ("Fund III")

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II and Oakley Capital Private Equity

III, are unlisted mid-market private equity funds with the aim of

providing investors with significant long term capital

appreciation. The investment strategy of the funds is to focus on

buy-out opportunities in industries with the potential for growth,

consolidation and performance improvement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQEAFSFEDAXEAF

(END) Dow Jones Newswires

May 02, 2017 02:01 ET (06:01 GMT)

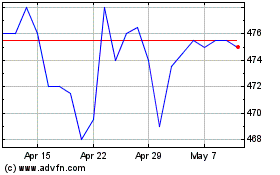

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Apr 2024 to May 2024

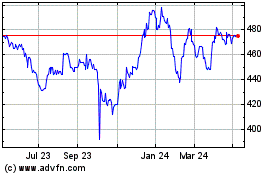

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From May 2023 to May 2024