Amendment of Short-Term Loan Facility into new Term Loan Facility With Oaktree

October 07 2022 - 6:00AM

The information contained within this

announcement is deemed by the Group to constitute inside

information as stipulated under the Market Abuse Regulation (EU)

No. 596/2014 (as it forms part of domestic law by virtue of the

European Union (Withdrawal) Act 2018). Upon the publication of this

announcement via the Regulatory Information Service, this inside

information is now considered to be in the public domain.

Amendment of

Short-Term Loan Facility into new Term Loan

Facility With Oaktree

- Partial repayment and

amendment of $85 million Oaktree loan facility

completed

- Extended relationship with

Oaktree via a new four-year term loan facility of $50 million with

a variable interest rate capped at 10.25% per annum

Oxford, UK

– 7 October

2022: Oxford Biomedica plc (LSE:OXB) (“Oxford

Biomedica” or “the Company”), a leading gene and cell therapy

group, today announces that it has refinanced the US$85 million

secured 12 month loan facility from funds managed by Oaktree

Capital Management, L.P. ("Oaktree") (the "Short Term Loan

Facility") previously announced in March 2022.

Under the terms of

such refinancing, the Company has partially repaid the outstanding

amounts under the Short-Term Loan Facility and amended the facility

into a new senior secured four year term loan facility provided by

Oaktree in a principal amount of US$50 million (the “Term

Loan”).

The amended Term Loan

contains similar terms to the prior 12 month loan facility and

includes the usual and customary provisions relating to mandatory

prepayments, covenants and representations and warranties. The Term

Loan will mature four years after the date of completion and will

not amortise, with the full aggregate principal and outstanding

amount being repayable on the final maturity date.

The Term Loan will be

secured by substantially all of the present and subsequently

acquired assets of the Company and its wholly owned subsidiaries

and be guaranteed by the Company’s wholly-owned subsidiaries, with

customary exceptions. The Term Loan carries a variable interest

rate, which is capped at 10.25% per annum and payable quarterly in

cash, with up to 50% of interest for the first twelve months

payable in kind as additional loan principal, at the option of the

Company. The interest rate is subject to downward adjustment

following the satisfaction of certain commercial conditions.

The Company also has

secured the option, subject to customary conditions and available

for a three-year period, to drawdown a further US$25 million from

Oaktree to fund certain permitted acquisitions.

Stuart

Paynter, Chief Financial Officer of Oxford

Biomedica, commented: “We are pleased to complete the

refinancing of this loan, which will give us continued operational

flexibility as we progress on delivering our strategic objectives.

We continue to have a strong net cash position and have

significantly extended the term of this facility which was

originally taken out at the time we established Oxford Biomedica

Solutions.”

Aman Kumar, Co-Portfolio Manager of Life

Sciences Lending at Oaktree, commented: “We are pleased to

have the opportunity to extend our long-term relationship with

Oxford Biomedica via this non-dilutive term financing. Since our

initial investment in 2017, we have been impressed by the company’s

progress to cement itself as a leader in viral vector

manufacturing.”

-Ends-

Enquiries:

Oxford Biomedica plc:

Stuart Paynter, Chief Financial Officer – T: +44 (0)1865 783

000Taylor Boyd, VP, Head of IR – T: +1 919 539 1234Sophia

Bolhassan, VP, Corporate Affairs and IR – T: +44 (0) 7394 562

425

Consilium Strategic Communications: T:

+44 (0)20 3709 5700 / E:

oxfordbiomedica@consilium-comms.com

Mary-Jane Elliott / Matthew

Cole / Angela

Gray

About Oxford Biomedica

Oxford Biomedica (LSE:OXB) is an innovative

leading viral vector specialist focused on delivering life changing

therapies to patients.

Oxford Biomedica plc and its subsidiaries (the

Group) work across key viral vector delivery systems including

those based on lentivirus, adeno-associated virus (AAV) and

adenovirus, providing innovative solutions to cell and gene therapy

biotechnology and biopharma companies for their process

development, analytical development and manufacturing needs. Oxford

Biomedica has built a sector leading lentiviral vector delivery

system, LentiVector® platform, and is working on programmes from

pre-clinical to commercial stage across a range of therapeutic

areas with global partners.

Oxford Biomedica is based across several

locations and headquartered in Oxfordshire, UK. In 2022, the Group

established Oxford Biomedica Solutions, a US based subsidiary AAV

manufacturing and innovation business, based near Boston, US.

Further information is available at

www.oxb.com.

About Oaktree

Oaktree is a leader among global investment

managers specializing in alternative investments, with $159 billion

in assets under management as of June 30, 2022. The firm emphasizes

an opportunistic, value-oriented and risk-controlled approach to

investments in credit, private equity, real assets and listed

equities. The firm has over 1,000 employees and offices in 20

cities worldwide. For additional information, please visit

Oaktree’s website at http://www.oaktreecapital.com.

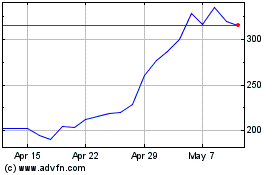

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Feb 2025 to Mar 2025

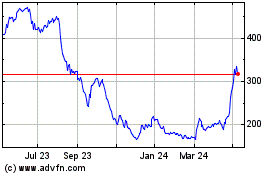

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Mar 2024 to Mar 2025