TIDMRSG

RNS Number : 9970J

Resolute Mining Limited

27 August 2021

27 August 2021

Resolute Mining Limited

(Resolute or the Company)

2021 Half Year Financial Results

-- Total Recordable Injury Frequency Rate (TRIFR) at 30 June 2021 of 1.24

-- Gold production of 163,118 ounces (oz) (H1 20: 217,946oz)

reflecting improvements in production at Syama sulphide operations,

offset by lower Syama oxide production and the open pit cutback at

Mako

-- Revenue of $261.3 million (m) (H1 20: $305.3m) with gold

sales of 151,503oz at an average gold price received of $1,723/oz

(H1 20: 212,668oz at $1,427/oz)

-- Earnings before interest, tax, depreciation, and amortisation

(EBITDA) of $77.7m (H1 20: $101.1m)

-- Net loss after tax of $219.8m inclusive of non-cash charges

including asset impairment of $172.4m, foreign exchange and fair

value movement expense of $26.3m and tax provisions and charges of

$28.6m

-- All-In Sustaining Cost (AISC) of $1,277/oz reflecting lower

production volumes in the H1 21 (H1 20: $1,020/oz)

-- Debt repayments of $29.7m including $20.0m voluntary early

debt repayment on Revolving Credit Facility

-- Net debt decreased to $219.8m (31 Dec 20: $230.4m) with cash

and bullion of $88.8m at 30 June 2021

-- New Board member and key management appointments including CEO, COO and CFO

-- 2021 production and cost guidance of 315,000oz to 340,000oz

at AISC of $1,290/oz to $1,365/oz.

Note: Amounts are presented in United States dollars ($) unless

otherwise stated. All production and financial results for H1 20

include contributions from Ravenswood, which was sold in March

2020.

Resolute Mining Limited (Resolute or the Company) (ASX/LSE: RSG)

presents the Company's half year financial results for the half

year ended 30 June 2021 (H1 21).

Resolute's Chief Executive Officer, Mr Stuart Gale commented:

"Our organisation has been through significant change during the

first half of 2021 which has seen renewed enthusiasm and focus.

Operational performance over this period is reflective of this as

the Syama underground mine achieved record production in the June

quarter which was matched by throughput at both the Syama sulphide

and oxide processing circuits. Unfortunately, this performance was

offset by lower mined grades at the Syama sulphide and oxide

operations. The team at Mako continue to deliver in line with

expectations as they undertake a cut-back of the main pit to extend

the mine life."

"We remain focussed on capitalising on our investments,

unlocking the significant value within our operations to generate

cash and strengthen the balance sheet. With a number of key

initiatives progressed during the half and the implementation of

significant changes to people, processes and systems, we expect to

see improvements to both our operating and financial results."

Environmental, Social and Governance (ESG)

Resolute's vaccination programs have vaccinated 1,114 employees

at Syama and Mako and continue to support the ongoing health and

wellbeing of the workforce and sustainability of operations.

COVID-19 education efforts remain ongoing in the local host

communities.

TRIFR at 30 June 2021 increased to 1.24 from 0.87 at 31 December

2020, reflecting several minor recordable injuries. All affected

employees have now returned to full duties. Resolute continues its

implementation of critical hazard management standards to improve

compliance with the Company's safe systems of work.

Operations

Syama Gold Mine, Mali

During H1 21, production from the Syama sulphide circuit was

70,680oz at an AISC of $1,307/oz. Gold production from the sulphide

circuit increased by 25% in H1 21 compared to H1 20. The

improvement in H1 gold production is driven by record levels of

processing and roaster throughput achieved in the year to date.

This was offset by lower processed grade coinciding with an

increase in ore mined (drawn) from the sub-level cave. The grade

reduction is expected to be temporary and reflect the location of

the current draw points.

During H1 21, production from the Syama oxide operations was

28,932oz at an AISC of $1,379/oz. Oxide ore mining continued at the

Cashew open pit south of Syama with ore supplied being a

combination of run of mine material from Cashew and low-grade

stockpiles.

Mining commenced towards the end of the half at Tabakoroni where

an extension to the previously mined Splay pit is now underway and

will be the principal ore source for the remainder of 2021.

Mako Gold Mine, Senegal

During H1 21, production from Mako was 63,506oz at an AISC of

$1,064/oz. Mako continued to perform to plan, with production lower

in accordance with expectations as a cut-back of the main pit is

currently being undertaken. This will provide access to deeper

sections of the deposit in line with the updated Life of Mine

Plan.

Financial Performance

The financial performance of Resolute for H1 21 is summarised

below:

Profit and Loss Analysis H1 21 H1 20

($'000s) Group Group

----------------------------------------------------------- ---------- ----------

Revenue 261,311 305,291

Cost of sales excluding depreciation and amortisation (132,689) (153,208)

Royalties and other operating expenses (30,173) (35,047)

Administration and other corporate expenses (9,035) (11,329)

Exploration and business development expenditure (11,694) (4,597)

---------- ----------

EBITDA 77,720 101,110

----------------------------------------------------------- ---------- ----------

Depreciation and amortisation (60,626) (92,712)

Net interest and finance costs (7,222) (13,558)

Fair value movements and unrealised treasury transactions (26,282) 15,661

Other (2,281) 305

Impairment expense (172,460) -

Gain on disposal - 41,475

----------------------------------------------------------- ---------- ----------

Net profit/(loss) before tax (191,151) 52,281

----------------------------------------------------------- ---------- ----------

Indirect tax expense (13,101) -

Income tax expense (15,538) (15,988)

Net profit/(loss) after tax (219,790) 36,293

----------------------------------------------------------- ---------- ----------

Revenue for H1 21 was $261.3m from gold sales of 151,503oz at an

average realised price of $1,723/oz compared to the average spot

price over the period of $1,803/oz. Gross Profit from Operations

was $39.0m after depreciation and amortisation of $59.4m.

Resolute reported a Net Loss After Tax of $219.8m after taking

into account non-cash adjustments for impairment expense, foreign

exchange revaluations, inventory adjustments and taxes.

At 30 June 2021 a non-cash impairment expense of $172.5m was

recognised with $167.4m relating to Syama reflecting:

-- Lower assumed gold prices reflecting a 5-10% reduction in the

short to medium term compared to the assessment carried out in

December 2020.

-- An increase in the risk-free rate which underpins the

applicable weighted average cost of capital used in the impairment

assessment.

-- Holding current cost, processing and recovery assumptions

constant, without including expected improvements over the life of

mine, in line with applicable accounting standards.

-- A revision to the CY21 production and cost guidance impacting

Syama (refer to ASX announcement titled "June 2021 Quarterly

Activities Statement" dated 29 July 2021).

This charge has no impact to Resolute's mine plans, gold

reserves and resources, and existing debt covenants. The Group's

carrying value of net assets at 30 June 2021 is $577.6m (31 Dec

2020: $815.1m).

Cashflow

Movements in the cash and bullion balances are summarised in the

cashflow waterfall available in the full version at

www.rml.com.au.

Balance Sheet

At 30 June 2021, Resolute had cash of $52.8m, 20,475oz of

bullion on hand valued at $36.1m, additional liquid investment

assets of $53.3m and a promissory note valued at $40.4m. Resolute

also held receivables of $77.5m associated with Malian VAT paid and

refundable.

Total borrowings at 30 June 2021 were $308.6m comprising $280.0m

drawn on the Company's Term Loan ($150.0m) and Revolving Credit

Facility ($150.0m), overdraft facilities with the Bank of Mali of

$26.1m and asset finance facilities of $2.5m. Resolute retains

$20.0m of undrawn Revolving Credit Facility capacity at the end of

June 2021.

Net debt position, after taking into account cash and bullion

balances at 30 June 2021 was $219.8m.

Resolute continued to invest in the business in H1 21 with

capital cash outlays on development, property, plant and equipment

totalling $31.3m (H1 20: $48.5m) largely for the Mako cutback and

project capital at Syama.

CY21 Guidance

Resolute's gold production and cost guidance for 2021 was

recently updated to reflect first half performance together with

expectations for the remainder of the year (refer to ASX

announcement titled "June 2021 Quarterly Activities Statement"

dated 29 July 2021).

That guidance remains unchanged with total gold production for

2021 expected to be within the range of 315,000oz to 340,000oz at

an AISC/oz of between $1,290/oz and $1,365/oz inclusive of

corporate overheads.

Investor and Analyst Conference Calls

Resolute advises Managing Director and CEO, Mr Stuart Gale, will

host two Conference Calls for investors, analysts and media on

Friday, 27 August 2021, to discuss the Company's Half Year

Financial Results for the period ending 30 June 2021. Both calls

will conclude with a question and answer session.

Please click on the links provided below and follow the prompts

to pre-register for either call. Participants will receive a

calendar invite with dial-in details once the pre-registration

process is complete.

Conference Call 1 (pre-registration required)

Conference Call 1: 09:00 (AWST, Perth) / 11:00 (AEST,

Sydney)

Pre-Registration Link:

https://s1.c-conf.com/diamondpass/10016151-e73vxg.html

Participants will receive a calendar invite with dial-in details

once the pre-registration process is complete.

Conference Call 1 will also be streamed live online at

http://www.openbriefing.com/OB/4418.aspx

Conference Call 2 (via MS Teams Live Event)

Conference Call 2: (MS Teams) 09:00 (BST, London) / 16:00 (AWST,

Perth)

Attendee Link: RSG MS Teams Live Event link

Contact Information

Resolute Berenberg (UK Corporate Broker)

Stuart Gale, Managing Director & CEO Matthew Armitt / Detlir Elezi

Telephone: +61 8 9261 6100 Telephone: +44 20 3207 7800

Email: contact@rml.com.au

Web: www.rml.com.au Tavistock (UK and African media)

Jos Simson

Telephone: +44 207 920 3150 / +44 778 855 4035

Email: resolute@tavistock.co.uk

FTI Consulting (Australian media)

Cameron Morse / James Tranter

Telephone: +61 433 886 871

Email: cameron.morse@fticonsulting.com

Competent Persons Statement

For the purposes of ASX Listing Rule 5.23, Resolute confirms

that it is not aware of any new information or data that materially

affects the information included in the original market

announcements relating to exploration results or estimates of

Mineral Resources or Ore Reserves referred to in this announcement

and, in the case of Mineral Resources and Ore Reserves, that all

material assumptions and technical parameters underpinning the

estimates in the relevant market announcement continue to apply and

have not materially changed. Resolute confirms that the form and

context in which the Competent Person's findings are presented have

not been materially modified from the original market

announcement.

Authorised by Mr Stuart Gale, Managing Director & CEO

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 which

forms part of UK law pursuant to the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via a

Regulatory Information Service (RIS), this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DOCEASPXAEEFEEA

(END) Dow Jones Newswires

August 27, 2021 02:00 ET (06:00 GMT)

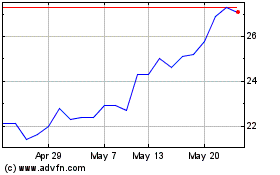

Resolute Mining (LSE:RSG)

Historical Stock Chart

From Mar 2025 to Apr 2025

Resolute Mining (LSE:RSG)

Historical Stock Chart

From Apr 2024 to Apr 2025