Sequoia Economic Infra Inc Fd Ld Scrip Share Reference Price (6445D)

October 29 2020 - 6:59AM

UK Regulatory

TIDMSEQI

RNS Number : 6445D

Sequoia Economic Infra Inc Fd Ld

29 October 2020

29 October 2020

Sequoia Economic Infrastructure Income Fund Limited

(the "Company")

Scrip Share Reference Price

The reference price of a new Ordinary Share under the Company's

scrip dividend alternative for the second quarterly interim

dividend for the financial period ending 30 September 2020 (the "Q2

Dividend") has been set at 106.04p. This is the average of the

middle market prices of the Company's Ordinary Shares derived from

the London Stock Exchange Daily Official List for the ex-dividend

date and the four subsequent dealing days.

Further information regarding the scrip dividend offered in

respect of the Q2 Dividend and the scrip dividend scheme can be

found in the Scrip Dividend Circular (the "Scrip Circular")

available on the Company's website to view and/or download at

http://www.seqifund.com. The Scrip Circular is also available on

the National Storage Mechanism website at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism. Copies

of the Scrip Circular are also available for inspection at Sarnia

House, Le Truchot, St Peter Port, Guernsey.

If no elections for the scrip dividend alternative are received,

the total cash dividend payable by the Company would be

GBP25,880,530.

If all eligible Shareholders elected, under the scrip dividend

alternative, to receive the Q2 Dividend in the form of new shares

in the capital of the Company ("Ordinary Shares") rather than in

cash in respect of their entire holdings, 24,406,384 Ordinary

Shares would be issued (ignoring any reduction in respect of

fractions), representing approximately 1.47% of the issued Ordinary

Share capital of the Company as at today's date.

The Q2 Dividend payment date and the date for admission and

dealing of the new Ordinary Shares to be issued pursuant to the

Scrip Dividend Alternative is expected to be 27 November 2020.

For further information please contact:

Sequoia Investment Management

Company

Steve Cook

Dolf Kohnhorst

Randall Sandstrom

Greg Taylor +44 (0)20 7079 0480

Jefferies International Limited

(Corporate Broker & Financial

Adviser)

Neil Winward

Gaudi Le Roux +44 (0) 20 7029 8000

Tulchan Communications (Financial

PR)

Elizabeth Snow

Martin Pengelley

Deborah Roney +44 (0)20 7353 4200

Praxis Fund Services Limited

(Company Secretary)

Matt Falla

Katrina Rowe +44 (0)1481 755530

About Sequoia Economic Infrastructure Income Fund Limited

The Company seeks to provide investors with regular, sustained,

long-term distributions and capital appreciation from a diversified

portfolio of senior and subordinated economic infrastructure debt

investments. The Company is advised by Sequoia Investment

Management Company Limited.

LEI: 2138006OW12FQHJ6PX91

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFKLFLBBLEFBE

(END) Dow Jones Newswires

October 29, 2020 07:59 ET (11:59 GMT)

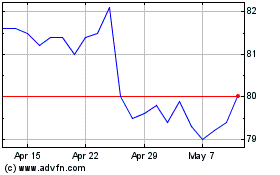

Sequoia Economic Infrast... (LSE:SEQI)

Historical Stock Chart

From Apr 2024 to May 2024

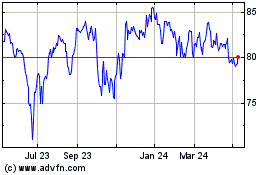

Sequoia Economic Infrast... (LSE:SEQI)

Historical Stock Chart

From May 2023 to May 2024