TIDMTMOR

RNS Number : 8013H

More Acquisitions PLC

31 July 2023

31 July 2023

More Acquisitions plc (LSE: TMOR)

Unaudited interim results for the period ended 30 April 2023

More Acquisitions plc ("More Acquisitions", "More" or "the

Company"), is pleased to announce its unaudited interim results for

the six months ended 30 April 2023 ("the Period").

Financial:

-- The Company recorded a loss of GBP360,481 and had cash

balances of GBP782,250 at the end of the period on 30 April

2023.

Post Period:

-- The search for a suitable acquisition target resumed

following the withdrawal of Megasteel Limited from the proposed

RTO.

The Interim Report will shortly be available to view on the

Company's website http://www.moreacquisitions.co.uk/

Enquiries

More Acquisitions plc

Rod McIllree

Charles Goodfellow

Peterhouse Capital Limited

Financial Adviser

Narisha Ragoonanthun/ Guy Miller Tel: +44 (0) 20 7469 0930

Corporate Broker

Lucy Williams/ Duncan Vasey Tel: +44 (0) 20 7469 0930

CHAIRMAN'S STATEMENT

Business Description and Review of the Period

More Acquisitions Plc was incorporated on 17 September 2021.

Following the publication of its prospectus on 1 March 2022, a

total of 125,000,100 ordinary shares were on 4 March 2022 admitted

to the standard segment of the Official List and to trade on the

main market for listed securities of the London Stock Exchange

plc.

As detailed in its prospectus, the Company raised GBP1,250,001

through an Initial Public Offering ("IPO") fund-raising conducted

amongst High Net Worth and Sophisticated Investors.

Post-Period Review

The principal risks remain those set out in the prospectus dated

1 March 2022.

As laid out in the prospectus, the directors will receive no

cash fees for their ordinary duties prior to completion of an

acquisition. This policy, together with keeping other operating

costs to a minimum, is designed to reserve the highest possible

proportion of cash resources for investment in an acquired business

and therefore helping to maximise the return on investment for all

shareholders.

The company continues to search for an acquisition target and

will be providing further updates concerning the acquisition search

process in due course.

Charles Goodfellow

Chairman

31 July 2023

Responsibility Statement

We confirm that to the best of our knowledge:

-- the Interim Report has been prepared in accordance with UK

adopted international accounting standards; and

-- gives a true and fair view of the assets, liabilities,

financial position and loss of the Company; and

-- the Interim Report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

set of interim financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year.

-- The Interim Report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by:

Charles Goodfellow

Chairman

31 July 2023

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 APRIL 2023

Unaudited

Period

ended

30 April

2023

Notes GBP

------------------------------------------------------------------- ------ ----------

Administrative expenses (360,481)

Operating loss and loss before tax (360,481)

Tax on profit on ordinary activities -

Loss after taxation and total comprehensive income for the period (360,481)

------------------------------------------------------------------- ------ ----------

Loss per share

Basic loss per share (pence) 3 (0.29) p

UNAUDITED STATEMENT OF FINANCIAL POSITION

AS AT 30 APRIL 2023

Unaudited

As at

30 April

2023

GBP

--------------------------- ----------

Current assets

Other receivables 19

Cash and cash equivalents 782,250

Total current assets 782,269

--------------------------- ----------

Current liabilities

Trade and other payables (6,388)

Total current liabilities (6,388)

--------------------------- ----------

Net assets 775,881

--------------------------- ----------

Capital and reserves

Called up share capital 1,250,001

Retained earnings (474,120)

--------------------------- ----------

Total equity 775,881

--------------------------- ----------

UNAUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 APRIL 2023

Share

capital Retained earnings T otal

GBP GBP GBP

============================== =========== ===================== =============

Balance at 31 October 2022 1,250,001 (113,639) 1,136,362

============================== =========== ===================== =============

Total comprehensive expense - (360,481) (360,481)

------------------------------ ----------- --------------------- -------------

Balance at 30 April 2023 1,250,001 (474,120) 775,881

============================== =========== ===================== =============

UNAUDITED STATEMENT OF CASH FLOWS

FOR THE PERIODED 30 APRIL 2023

Unaudited

Period

ended

30 April

2023

GBP

--------------------------------------------------- ----------

Cash flows from operating activities

Operating loss (360,481)

No non-cash adjustments -

Operating cashflow before working capital changes (360,481)

Decrease in receivables 13,480

Decrease in payables (22,420)

---------------------------------------------------- ----------

Net cash outflow from operating activities (369,421)

---------------------------------------------------- ----------

Net decrease in cash in the period (369,421)

Cash and cash equivalents at beginning of period 1,151,671

---------------------------------------------------- ----------

Cash and cash equivalents at end of period 782,250

---------------------------------------------------- ----------

NOTES TO THE UNAUDITED INTERIM ACCOUNTS

FOR THE PERIODED 30 APRIL 2023

1. Basis of preparation

The financial statements included in these interim accounts have

been prepared under the historical cost convention and in

accordance with UK adopted international accounting standards in

conformity with the requirements of the Companies Act 2006 and is

presented in GBP.

The Company was incorporated on 17 September 2021 and in March

2022 was admitted to Standard List of London Stock Exchange. The

interim financial information for the period ending 30 April 2023

has not been audited. The interim financial report has been

approved by the Board on 31 July 2023.

The interim financial information for the six months ended 30

April 2023 does not constitute statutory accounts within the

meaning of section 434 of the Companies Act 2006.

The Company's business activities, together with the factors

likely to affect its future development, performance and position

are set out in this review. The financial position of the Company,

its cash flows and liquidity position are described in this

business review. As highlighted below, the Company meets its day to

day working capital requirements through its on-going cash

flows.

The principal accounting policies used in preparing these

interim accounts are those expected to be applied in the Company's

Financial Statements for the year ending 31 October 2023.

2. Accounting policies

The principal accounting policies adopted in the preparation of

these financial results are set out below.

Segment reporting

The Company is currently a cash shell and the directors believe

that there is no benefit to show any segmental reporting until a

new strategy is undertaken.

Cash and cash equivalents

Cash and cash equivalents include cash in hand and deposits held

at call with banks. Bank overdrafts that are repayable on demand

and form an integral part of the Company's cash management are

included as a component of cash and cash equivalents for the

purpose of the cash flow statement.

Share capital

Ordinary shares

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of ordinary shares and share

options are recognised as a deduction from equity, net of any tax

effects.

Taxation

Income tax payable is provided on taxable profits using tax

rates enacted or substantively enacted at the balance sheet

date.

Deferred taxation is provided in full, using the liability

method on temporary differences arising between the tax bases of

assets and liabilities and their carrying amounts in the

consolidated financial results. Deferred tax is determined using

tax rates (and laws) that have been enacted or substantively

enacted at the balance sheet date and are expected to apply when

the related balance sheet tax asset is realised or the deferred

liability is settled.

Deferred income tax assets are recognised to the extent that it

is possible that future taxable profit will be available against

which temporary differences can be utilised.

Income tax is recognised in the consolidated income statement

except to the extent that it relates to items recognised directly

in equity, in which case it is recognised in equity.

Going concern basis of preparation

The Company had GBP782,250 cash at the period end. The Directors

have prepared the accounts on a going concern basis as they

consider that the company has adequate funding.

3. Earnings (Loss) per share

The basic earnings per share is calculated by dividing the

(loss)/profit attributable to the ordinary shareholders of the

Company by the weighted average number of Ordinary shares in issue

during the period, excluding Ordinary shares purchased by the

Company and held as treasury shares.

Unaudited

Period ended

30 April 2023

GBP

----------------------------------------------------------------------------------------------- --------------

Loss used for calculation of basic and diluted EPS (360,481)

----------------------------------------------------------------------------------------------- --------------

Weighted average number of ordinary shares in issue used for calculation of basic and diluted

EPS 125,000,100

Loss per share (pence per share)

Basic and diluted loss per share: (0.29) p

There are no diluted earnings per share as the warrants

currently in issue do not have a dilutive effect.

4. Distribution of Interim Report and Registered Office

A copy of the Interim Report will be available shortly on the

Company's website http://www.moreacquisitions.co.uk/ and copies

will be available from the Company's registered office, 3(rd)

Floor, 80 Cheapside, London, EC2V 6EE.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SDAFMFEDSEEW

(END) Dow Jones Newswires

July 31, 2023 12:32 ET (16:32 GMT)

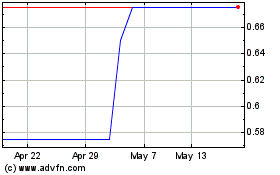

More Acquisitions (LSE:TMOR)

Historical Stock Chart

From Jan 2025 to Feb 2025

More Acquisitions (LSE:TMOR)

Historical Stock Chart

From Feb 2024 to Feb 2025