TIDMTPX

RNS Number : 1192F

TPXimpact Holdings PLC

06 July 2023

6 July 2023

TPXimpact Holdings PLC

("TPXimpact", "TPX" or the "Company")

Unaudited preliminary results for the year ended 31 March

2023

Results in line with the trading update made on 30 January

2023;

FY24 outlook unchanged

TPXimpact Holdings PLC (AIM: TPX), the technology-enabled

services company focused on people-powered transformation,

announces its unaudited preliminary results for the year ended 31

March 2023.

FY23 Financial highlights:

-- Performance in line with market consensus(1)

-- Strong momentum in new orders with GBP115m won in the year,

including GBP36m in Q4

-- Revenue up 5.0% to GBP83.7m (2022: GBP79.7m)

-- Like-for-like revenue trends notably better in Q4 (-1.6%),

with momentum continuing into FY24 (+5% in first two months).

FY23 like-for-like revenues declined by 7.2%

-- Adjusted EBITDA(2) of GBP2.5m (2022: GBP12.2m)

-- Adjusted EBITDA margin of 3.0% (2022: 15.3%)

-- Reported operating loss of GBP(19.4)m (2022: operating profit

of GBP3.2m), after including GBP11.8m (2022: GBPNil) non-cash

impairment charge for goodwill/intangible assets

-- Adjusted profit before tax on continuing operations of GBP0.7m

(2022: GBP10.9m)

-- Reported loss before tax on continuing operations of GBP(20.5)m

(2022: profit before tax of GBP2.5m)

-- Adjusted diluted earnings(2) per share from continuing operations

of 0.7p (2022: 11.3p)

-- Reported diluted loss per share from continuing operations

of (21.1)p (2022: diluted earnings per share of 0.9p)

-- Net debt(1) as at 31 March 2023 of GBP17.5m (31 March 2022:

GBP10.1m)

-- New banking arrangements agreed, providing a solid foundation

for future goals

Operational and Impact highlights:

-- New strategy, vision and branding launched as "People Powered

Transformation"

-- 72% of FY23 revenues from public services (2022: 72%)

-- Staff retention rates showing marked improvement to current

annualised run-rate of 84%

-- Hub strategy enhanced with three new leases signed, including

a single London office

-- Integration of Peak Indicators and Swirrl acquisitions into

a new Data & Insights Division

-- Articles of Association amended so that our constitution

now requires the Directors to consider the interests of all

stakeholders in the Company, to support our journey to B-Corp

certification

-- Became a founding customer of CO2.com and have offset our

entire historic carbon liability

Post-period trading and outlook:

-- Trading for the first two months of FY24 in line with management

expectations, with like-for-like revenue growth of over 5%

-- Over GBP90m of new orders won in Q124 (including up to GBP49m

four-year contract with His Majesty's Land Registry (HMLR)

and up to GBP27.5m two-year contract with Department for

Education)

-- Over GBP80m of FY24 revenues are represented by committed

(backlog) spend

-- Net debt(1) at 31 May 2023 of GBP16.8m

-- FY24 outlook unchanged with like-for-like revenue growth

of 15-20% and Adjusted EBITDA margins of 5-6%

-- Our three-year plan targets an Adjusted EBITDA margin of

10-12% in FY26

(1) Consensus figures for FY23: Revenue GBP83m, Adjusted EBITDA

GBP2.5m (2) In measuring our performance, the financial measures

that we use include those which have been derived from our reported

results in order to eliminate factors which distort

period-on-period comparisons. These are considered non-GAAP

financial measures, and include measures such as like-for-like

revenue, adjusted EBITDA and net debt. All are defined in note

7.

Bjorn Conway, Chief Executive Officer, commented:

"After a challenging year, TPXimpact has developed a clear

strategy and a comprehensive three-year plan to leverage its strong

foundations of successful client delivery and new business

wins.

The start of FY23 marked the initiation of an internal change

program aimed at achieving robust top-line growth in the medium to

long term, through the consolidation of component businesses under

a unified brand.

However, the change program faced challenges, and there were

market disturbances due to national events and an uncertain

political landscape, leading to revised market forecasts throughout

the year. Despite these obstacles, I am pleased to report that the

business met the revised forecast, with a robust order backlog

exceeding GBP80m into FY24.

This achievement, driven by the exceptional performance of our

business unit management teams, provides a solid foundation for

improved business performance in FY24 and beyond. Since joining in

October 2022, I have been impressed by the capability, passion, and

commitment of our teams, as well as their positive impact on

clients' organisations. It underscores the immense potential within

TPXimpact to deliver value, foster entrepreneurialism, and achieve

long-term growth while maintaining a sense of purpose."

TPXimpact will be hosting a webinar for analysts at 9:30am

today. If you would like to register for the analyst webinar,

please contact tpx@almapr.co.uk .

The Group will also be hosting a webinar for retail investors at

1:00pm today. Retail investors can register for the webinar using

the following link: https://bit.ly/TPX_FY23_webinar

Enquiries:

TPXimpact Holdings

Bjorn Conway, CEO Via Alma PR

Steve Winters, CFO

Stifel Nicolaus Europe Limited

(Nomad and Joint Broker) +44 (0) 207 710 7600

Alex Price

Fred Walsh

Ben Burnett

Dowgate Capital Limited

(Joint Broker)

James Serjeant

David Poutney +44 (0) 203 903 7715

Alma PR tpx@almapr.co.uk

(Financial PR) +44 (0) 203 405 0209

Josh Royston

Kieran Breheny

Matthew Young

About TPXimpact

We believe in a world enriched by people-powered digital

transformation. Working together in close collaboration, we want to

help our clients reimagine their organisations, services and

experiences to accelerate positive change and build a future where

people, places and the planet are supported to thrive.

Led by passionate people, we care deeply about the work we do

and the impact we have in the world. Working alongside our clients

teams, we work to understand their unique challenges and find new

ways forward together; challenging assumptions, testing new

approaches and building capabilities, leaving them with the tools,

the insight and the confidence to continue iterating and

innovating.

Combining rich heritage and expertise in human-centred design,

data, experience and technology, we bring over 15 years experience

across the public, private and third sectors, creating sustainable

solutions with the flexibility to learn, evolve and change.

The business is being increasingly recognised as a leading

alternative digital transformation provider to the UK public

services sector, with c.72% of its client base representing the

public sector and c.28% representing the commercial sector.

More information is available at www.tpximpact.com.

Chairman's statement

Overview

FY23 has been a year of considerable change for TPXimpact in

which the Group faced a combination of market issues and

significant operational challenges as part of its integration

project. The Board introduced a new management team in Björn Conway

as Chief Executive Officer and Steve Winters as Chief Financial

Officer to continue the good work of our co-founders, Neal Gandhi

and Oliver Rigby.

I would like to reiterate my thanks to Neal and Olly for the

exceptional leadership they showed in setting out their vision for

TPXimpact to achieve its full potential through brand

consolidation, and for their recognition in stepping down that a

different type of leadership was required to take the Group

forward.

Since my update on the HY23 interim results in November 2022,

the focus for the Group has been navigating these internal

operational challenges as we continue our process of consolidating

under one brand. Nevertheless, TPXimpact's core go-to-market

proposition is unchanged, with our teams continuing to deliver

innovative end-to-end digital transformation across our four

divisions: Consultancy, Digital Experience (DX), Data & Insight

and International.

I am delighted with the way Björn and Steve have quickly

embedded themselves within the heart of the organisation and have

set about identifying those processes to help optimise our

transition to one brand, as well as engaging with our teams across

the Group. Following a tough first half which was significantly

impacted by the scale of our consolidation project, and with

trading below expectations into Q3, we were pleased to deliver a Q4

performance above our revised expectations, including a record

number of new business wins and the signature of two significant

contracts with two central government departments.

The Group continues to improve the efficiency of communication

between our teams and systems. The Board remains convinced that

this strategy to bring together our Group businesses under one

unified brand is the correct and necessary decision, enabling

TPXimpact to optimise its efficiency and support long-term and

scalable growth.

It has been a particularly challenging year for the Group, and I

would like to thank all our stakeholders - from our customers, our

valued employees, and our shareholders - for their continued

support throughout the year.

Market dynamics

Through its strong relationships across multiple sectors and

extensive expertise in digital transformation services, TPXimpact

is well-positioned in an attractive and rapidly expanding

market.

More than ever across the public sector there is a need for

organisations of all sizes to communicate more effectively and

achieve efficiency savings. Across this complex and vast landscape,

digital transformation services are poised to replace heritage and

legacy systems. Equally, for those organisations in the commercial

sector, there remains an ongoing need to drive efficiencies and

maintain a competitive edge over their peers. The Group will seek

to maintain a healthily diversified balance of work across Central

Government, Local Government, Health, Charitable and Commercial

sectors.

Our purpose

Despite the considerable change the Group has undergone

operationally, at its core TPXimpact remains a purpose-led

organisation committed to delivering a net benefit to the people,

places and wider planet in which we operate. This sense of purpose

is reflected in the values of the Group and through our colleagues,

who care deeply about the need to accelerate positive change across

society.

As part of our vision to support the next generation of talent,

we are pleased to continue working with our fantastic charity

partners; Apps for Good, Arkwright Scholars, In2Science and Telerik

Academy. Each of these partnerships, alongside our own flagship

Future Leaders programme have been supporting young people from

diverse and underrepresented backgrounds to obtain the skills and

support they need to be successful in the tech industry. This year

our programmes reached over 870 beneficiaries.

Corporate governance

Throughout the challenges of FY23 we have maintained continuity

as a Board. Neal Gandhi, founder and former CEO, joined the Board

in a non-executive capacity and Oliver Rigby, founder and former

CFO, provided transitional support and continues to support the ESG

committee.

The Board of TPXimpact is committed to enhancing the governance

of the organisation on an ongoing basis. We diligently monitor

market conditions and regularly evaluate the key risks that affect

the Group, while being mindful of the broader challenges faced by

our end markets and stakeholders.

We deeply appreciate the trust and support of our shareholders,

as we strive to create long-term value for them through

purpose-driven initiatives. Ensuring that our shareholders are

well-informed and actively involved is of utmost importance to us.

Therefore, we prioritise regular updates and aim to enhance

transparency in all our corporate communications.

People

The collective effort and commitment of all our colleagues

throughout the year has been instrumental in navigating the

challenges we faced, and I extend my gratitude to every member of

our team for their support.

The new vision and strategy for the business has helped to

re-engage employees and we are pleased to see the emphasis that the

new management team has placed on open and transparent

communication. The wider organisation has crowdsourced a new set of

values to guide decision-making and behaviours in a more integrated

Group.

Employee retention improved throughout FY23. The 12 month

run-rate based on Q423 was c.84% and this improvement has continued

into Q124. We are pleased to see the positive response and level of

applicants for the new roles we have created within TPXimpact as

the business grows to deliver the significant new contracts won in

the latter part of FY23 and post-period.

We are pleased to report that our continued focus on D&I has

seen progression during the period with our minority representation

at a senior level increasing from 8% to 11%. We are pleased with

the progress made and will continue to make TPXimpact a diverse and

inclusive workplace for all employees.

Alongside the enhancement of diversity and inclusion in senior

representation, we have achieved a reduction in both our gender pay

gap and median ethnicity pay gap over the past year. Although there

is more progress to be made in closing these gaps, our mean gender

gap currently stands at 15%, aligning closely with the UK average

for all employees in 2022 (14.9%).

We track employee satisfaction through regular pulse surveys and

promptly address any areas for improvement.

Looking ahead

We are seeing the benefits of our broadened range of services

coming through, enabling us to capitalise on the significant market

opportunity available as the ongoing investment in digital

transformation across both the public and commercial sectors

continues.

Increased demand for our services is already being seen through

the record post-period contract wins with the Department for

Education and His Majesty's Land Registry, highlighting the value

placed in our offering and the opportunity available as we increase

efficiencies and operate as a unified brand.

As we continue to progress against our strategy, we are

confident that we have the right team in place to achieve

sustainable growth in an expanding market and build on the momentum

seen so far in FY24.

Mark Smith

Chairman, TPXimpact

CEO Statement

After a challenging year, the Group now has a clear strategy and

three-year plan to build on the already strong foundations of

successful client delivery and new business wins

TPXimpact started FY23 with a plan to achieve strong top-line

growth in the medium to long-term through an internal change

programme to unify its component businesses under a single

brand.

As reported in the September 2022 trading update, several

challenges became evident as the change programme proceeded and our

markets were disturbed by national events and an uncertain

political landscape. As a result, our forecasts for the full year

were revised. These forecasts were revised again in January

2023.

I am pleased to report that the business achieved the revised

forecast with a strong order backlog of over GBP80m into FY24. This

was on the back of a good Q4 performance by the business unit

management teams and is a strong basis on which to build improved

business performance in FY24 and beyond.

The teams at TPXimpact deliver amazing work for our clients,

despite the business itself still requiring significant investment

and development to better support our teams as they deliver good,

predictable, outcomes for our stakeholders. The key challenge is to

improve revenue conversion through to profit.

We have established a three-year strategy and plan to enhance

appropriate governance, processes, systems, and inspiring

leadership at all levels within the business to improve ways of

working and, therefore, efficiency and profitability.

I am pleased with the progress the Group has made to date. We

remain confident in the medium to long-term prospects for TPXimpact

as we continue to appropriately integrate and streamline our

businesses to deliver our services more efficiently to our clients

- the organisations that underpin our society - and deliver

sustainable change and tangible positive impact.

Demand for TPXimpact's differentiated service offering brings

strong future growth opportunities

The market for TPXimpact's services and differentiated

proposition remains strong. In combination with a more stable

internal environment for our teams, this resulted in GBP115m of new

business wins in FY23 and a good start to FY24 with over GBP90m of

new business wins in the first quarter.

Operating under a single brand, TPXimpact has the scale to

assist clients with large and strategically important programmes as

well as offering the intimacy and adaptability to work alongside

clients to improve their engagement with citizens, customers, and

donors. We work right across the spectrum from early community and

customer engagement, through service design and into delivery, and

have the expertise and capability to deliver hybrid cloud solutions

and support complex legacy platforms alongside our sector rich

consulting capabilities.

In Central Government, we continue to see a substantial shift

towards digital transformation to streamline and optimise service

experiences and leverage Government data. Combined with the

increasing use of Digital Marketplace frameworks enabling TPXimpact

to compete directly with traditional large-scale suppliers this

provides a growing market for our valuable services. The potential

of our Central Government business and increasing client confidence

in TPXimpact is evidenced by the growing scale of our contract

wins, from low single digit millions at the start of FY23, to

multi-year and tens of millions at the beginning of FY24.

Our Local Government clients look to TPXimpact to help them be

future-ready and sustainable - whether that is accelerating the

adoption of technology and digital solutions, addressing net zero

targets, or improving financial resilience by helping to re-think

long-term planning approaches, identify savings and develop

flexible delivery models. Our work is led by data and insight and

we are pro-active in collaborating to tackle the most complex

client challenges. We have invested in our local Government client

facing teams to improve access to our services and support

growth.

In Health and Social Care, FY23 was dominated by the merger of

NHS Digital, NHSx and Health Education England into NHS England.

This diverted attention from delivery and in conjunction with

increased scrutiny of the move towards Integrated Care Systems

(ICSs) reduced the opportunities available for us to assist our

clients. We used this period to diversify our business into

frontline trusts and bring a wider range of capabilities to bear

from across TPXimpact to support a more design-led approach to

service transformation - a core, distinctive capability for

TPXimpact. We see Health and Social Care as an exciting growth area

over the next few years.

Our work with NHS Wales, delivered though our Red Cortex

business, continued to be very strong during FY23 due to our long

track record and deep relationships. We won additional contracts

and a place on a new digital transformation framework as TPXimpact.

We have seen some softness in spend at the start of FY24 but expect

normal spending patterns to resume in the second half of the

year.

In our Commercial sector, we see clients continue to prioritise

operational efficiencies leading to a rise in demand for hybrid

cloud solutions and a growing interest in Artificial Intelligence

(AI) driven by media coverage of tools like ChatGPT. In FY23, we

experienced strong demand from existing clients to develop

solutions for resilient, scalable, and secure cloud architectures

and for business intelligence expertise to enable them to make the

best use of their data. As we move into FY24, we are bolstering our

commercial client teams as we look to deploy our experience and

expertise with new clients.

Our fundraising, not for profit, and membership and visits

clients are the cornerstone of our Digital Experience (Dx)

business. FY23 saw charities face challenging economic times with

their audiences feeling the impact of cost-of-living pressures and

a reduction in donor numbers. TPXimpact supports our clients to

provide exceptional experiences and utilises insights from data to

inform audience needs and behaviours to optimise engagement.

Similarly in the memberships and visits sector, member engagement

and meaningful connections help organisations differentiate

themselves, and our deep understanding of their member communities

and needs, enables us to co-develop engaging on-line experiences

supported by our digital tools.

Strong delivery and growing client confidence across our

customer sectors is evidenced by increased engagement sizes and

backlog.

We aim to provide tailored, insight and craft led, high-value

work with, and for, our clients at a fair price that balances our

desire to deliver purposeful work within a commercially sustainable

business model.

Our new strategy underpins our continuing client success and

will simplify and improve the business

Our vision of the future is of a world enriched by what we call

"people powered digital transformation" where, with our help,

organisations improve lives in an equitable and responsible

way.

The main strategic effort is to provide our already successful

client-facing teams with efficient and effective support by

removing points of friction in our business and improving our

conversion of revenue to EBITDA. Our aim is to achieve 10-12%

Adjusted EBITDA margins within 3 years.

Working effectively across its business units, TPXimpact draws

together a unique blend of specialist capabilities to help clients

transform and harness the best of digital technologies. This

approach and the teams and capabilities that lie behind it are very

much in demand with clients seeking better ways to engage with

their customers, and to do so in a more cost-effective way.

The Change programme of early 2022 and subsequent Peak and

Swirrl acquisitions has left the business operating through 7

units:

-- The Consulting business unit

-- The Dx (Digital Experience) business unit,

-- The Data & Insights business unit, formed of the recently

acquired Peak and Swirrl businesses

-- Red Cortex

-- KITS (Keep IT Simple)

-- Questers

-- TPXimpact Norway

Integration within business units was partially complete at the

end of H1 FY23 and much of the work of the last few months has been

bringing teams within these business units together.

During the latter part of FY23 we undertook a number of

initiatives to improve the business:

-- implemented formal performance reporting and reviews underpinned

by budgets and business plans owned by Group businesses

-- improved the forward looking data and information available

to business leaders from our existing systems

-- established an Operational Board to coordinate change

and improve underlying processes and systems

-- recruited a new Chief People Officer at the end of Q3

to improve recruitment, ensure our team member proposition

is strong, equitable, and aligned with our values, and

reinvigorate our Employee Representative Groups

-- increased employee engagement through greater transparency

and access to senior management. As CEO, I communicate

to staff most weeks through a short video and members

of the senior leadership team chair our Employee Forum

by rotation

-- identified a new London HQ building to co-locate our teams

and rationalise our footprint. We also improved our Chesterfield

and Manchester hub facilities

-- commenced a market based pay project to start to tackle

inequalities inherent in a business formed of many acquisitions.

To achieve our vision and improve business operations we have

developed a three-year plan:

Year 1 : focus and balance - establish the Consulting business

as a scalable platform and complete the integration of three

smaller agencies as the Digital Experience business.

Year 2 : form and integrate - bring the Data & Insights, Red

Cortex and KITS businesses onto the Consulting platform as an

integrated Digital Transformation business.

Year 3 : grow and differentiate - as a simpler, more coherent,

and operationally mature business, accelerate our growth and

purpose-led differentiation.

This staged approach is designed to further unify the unique

capabilities of TPXimpact under a single brand, increase

efficiencies, and capitalise on the increasing market opportunity.

It also enables TPXimpact to become a platform for future growth

options, both organic and through acquisition.

As we move through the latter part of FY24 and into FY25, and

the work to simplify and improve the business progresses, we expect

the Group to deliver stronger and more predictable performance.

Underpinning our vision and strategy we have developed a set of

values that help guide all team members in the decisions they make

day-to-day with clients and colleagues. The way our values show up

in our work was crowdsourced from TPXimpact team members and

collectively are our 'PACT':

Purpose - positive change with measurable impact

Accountability - self organisation and accountability

Craft - bringing our best capabilities to bear through a shared

vision of excellence.

Togetherness - long lasting relationships built on honesty,

openness, and trust.

Our purpose in action (ESG)

TPXimpact has been formed on a solid foundation of shared

values. Our people, our clients and our investors are attracted to

us because of this commitment to social responsibility. Our shared

belief that the business that we are building is a good one, that

will positively impact all stakeholders, has been invaluable

through a challenging period of change.

This year we have seen a huge acceleration in Social Value

commitments being embedded into our client contracts, bringing our

commercial and ESG work closer than ever before. A key tenet of our

work over the next year is better integration and balancing our

purpose with commercial outcomes.

We continue to set ambitious targets that ensure our business

operations are positively impacting all stakeholders; investing in

innovative carbon measurement, reduction and removal programmes,

ensuring that we are inclusive by design at every stage of the

employee lifecycle and supporting our communities where possible

with time, skills, funding and opportunities. We fulfilled our

commitments to fully offset our historical CO2 emissions, ran a

successful Future Leaders programme and donated over 2,500 hours

through volunteering programmes.

This year, as we prepare for B Corp certification, we have

formalised our commitment to all stakeholders by amending our legal

Articles of Association. These now enshrine our purpose-led

approach into the legal structure of the business. As ever, we are

committed to complete transparency when it comes to our ESG

performance and we have made excellent progress this year across

People, Planet and Places.

Future opportunities

Our current trading performance is encouraging, but there is

still work to do to improve margin conversion and

predictability.

As we progress against our strategy and improve the operational

structure of the Company, we are putting in place the necessary

measures to ensure TPXimpact will see growth driven by increasing

demand for our services within the market. I am proud of how our

people have faced the challenges during the period and I have every

confidence that we are developing a strong team to achieve

sustainable growth in the future.

Investment in digital transformation is continuing to grow at

pace in the public and commercial sectors and it has become clear

that this is now a necessity for all modern businesses. TPX has the

right portfolio of service offerings to capitalise on the growing

market demand for digital transformation and we have confidence in

the prospects for the Group moving forward.

Post-period we were pleased to announce two digital

transformation contracts with the Department for Education and His

Majesty's Land Registry that will deliver a cumulative value of up

to GBP77 million over a four-year period. The successful execution

of these contracts, which reflect the capabilities we now possess

through our consolidated service offering, represent the increasing

momentum for the Group as we take on larger contracts and give the

Board confidence in the Group's medium to long term prospects.

Through our vision of a 'world empowered by digital

transformation' and our strategy to simplify, streamline, and

balance our purpose and commercial outcomes, we will build a

scalable, coherent and differentiated business capable of

sustaining 10-15% CAGR revenue growth and 10-12% Adjusted EBITDA

margin whilst delivering great outcomes for our clients, people,

places and the planet.

Bjorn Conway

CEO, TPXimpact

Financial review

Prior period comparatives have been restated to exclude the

results of Greenshoot Labs Limited, which was disposed of in May

2022.

Reported revenues were up 5.0% to GBP83.7m, reflecting the

contribution of acquisitions, including Peak Indicators Limited and

Swirrl IT Limited both of which completed in April 2022 (and which

are now fully integrated into a new Data & Insights division),

and RedCortex Limited which completed in December 2021. The

performance of these businesses was very encouraging, with combined

like-for-like revenue growth of almost 30% in the year.

Group revenues were, however, down 7.2% on a like-for-like

basis. A number of factors contributed to this performance,

including a lower-than-normal order book in certain parts of the

business as they entered the financial year and client delays in

implementing projects, which especially impacted Q2 and Q3.

Sequentially, like-for-like revenue fell by 1.6% in Q1, 11.2% in

Q2, 14.6% in Q3 and 1.6% in Q4.

New business wins showed increasing momentum in the second half

of the year with GBP41m in Q3 and GBP36m in Q4, and GBP115m in

total for the year. Since year-end, this encouraging trend has

accelerated even further, with new orders in the first quarter of

FY24 of over GBP90m, largely due to two significant wins: up to

GBP49m with His Majesty's Land Registry (HMLR) over four years and

up to GBP27.5m with the Department for Education over two years,

both of which commenced in May 2023. These wins demonstrate the

value our increasing scale can offer our clients, especially in the

key strategic sector of Central Government.

Public sector clients represented 72% of revenue in the year

ended 31 March 2023 and our top 10 clients represented 39% of

revenue compared to 42% last year.

Gross profit of GBP20.9m was down 14.3% from GBP24.4m on a

reported basis and down over 27% on a like-for-like basis. Cost of

sales was GBP62.8m, an increase of 13.6% on a reported basis and

2.4% on a like-for-like basis, again reflecting the impact of

acquisitions. Gross margins therefore reduced to 25.0% from 30.6%

last year, and from 32.0% on a like-for-like basis.

The Group continually assesses the appropriate mix of permanent

headcount and contractors within cost of sales, with a view to

optimising efficiency in servicing the needs of our clients. In the

first half of the year, however, this efficiency was more

challenging to achieve due to client delays in implementing

projects, which impacted utilisation rates, particularly in our

Consulting division (40% of Group revenues). In view of the level

of new business won in the second half of the year, Consulting has

embarked on a major recruitment campaign to expand permanent staff

resource, although the full benefit of this will not come through

until FY24.

A new benefits package for permanent staff was introduced in

April 2022, which included increases in holiday entitlements,

pensions and other benefits. These enhanced benefits, together with

the effect of salary reviews in March 2022, impacted gross margins.

Nevertheless, management remain committed to offering our staff a

highly attractive benefits package as one of a number of measures

to attract and retain talent, and differentiate TPXimpact as an

employer which truly values the contribution and well-being of our

staff.

Utilisation rates improved markedly in Q4 and we are targeting

continued improvement in FY24 and beyond. The turn-around in Q4 was

entirely attributable to the tenacity and commitment of our people

who are devoted to delivering meaningful insight and value to our

clients. The healthy order book, combined with higher utilisation

rates and capacity, should lead to improved gross margins in FY24.

We are also seeing signs of improved staff retention rates over the

last six months, particularly in Consulting, our largest

business.

On a reported basis, the Group made an operating loss of

GBP(19.4)m compared with an operating profit of GBP3.2m last year.

This reflects the GBP3.5m reduction in gross profit explained

above, as well as the effect of administrative costs increasing to

GBP40.8m from GBP21.7m last year. Administrative costs include

GBP11.8m (2022: GBPNil) of non-cash impairment charges in relation

to goodwill and intangible assets recognised on past acquisitions,

due to management's reassessment of the likely future performance

of certain businesses in the Group.

Staff costs included in administrative costs increased to

GBP12.6m (2022: GBP9.0m), reflecting the acquisitions of Peak

Indicators and Swirrl IT, as well as a continued investment in

talent to support the needs of the business going forwards. On a

like-for-like basis, total Group headcount of 798 (on an FTE basis)

at 31 March 2023 compares with 659 people at 31 March 2022, an

increase of 21.1%. Including contractors, the Group's aggregate

workforce is currently approximately 1,100 people.

Administrative costs also include GBP2.5m of restructuring costs

(2022: GBP1.8m) arising from integration and restructuring actions

aimed at improving the long-term health and efficiency of the

business and GBP7.1m (2022: GBP5.9m) of depreciation and

amortisation charges, primarily in relation to acquired intangible

assets, previously recognised on acquisitions.

Adjusted EBITDA of GBP2.5m compares with GBP12.2m last year,

representing a margin of 3.0% against 15.3%. A reconciliation of

Operating (loss)/profit to Adjusted EBITDA is provided in Note 7 to

the unaudited preliminary results.

The Group made a reported loss before tax on continuing

operations of GBP(20.5)m in the year (2022: profit of GBP2.5m), and

an adjusted profit before tax on continuing operations of GBP0.7m

(2022: GBP10.9m). Finance costs were GBP1.1m in the year (2022:

GBP0.7m), reflecting both higher net debt and increased interest

rates.

Corporation tax amounted to a credit of GBP1.5m (2022: charge of

GBP1.7m) due to the decrease in profitability of the Group.

Adjusted profit after tax on continuing operations was GBP0.6m

(2022: GBP10.0m).

The disposal of Greenshoot Labs gave rise to a gain on disposal

of GBP1.6m which has been included in the income statement within

income from discontinued operations.

Reported diluted earnings per share from continuing operations

for the year was a loss of (21.1) pence per share (2022: earnings

of 0.9 pence per share), reflecting the decrease in profitability

in the year. On an adjusted basis, diluted earnings per share on

continuing operations was 0.7 pence per share (2022: 11.3 pence per

share).

During the year, the Board declared an interim dividend of 0.3

pence per share (2022: 0.3 pence per share), which was paid on 27

January 2023. In view of the Group's financial performance in the

second half of the year, no final dividend will be declared or paid

(2022: 0.6 pence per share). Therefore, total dividends declared

and paid in respect of the year ended 31 March 2023 were 0.3 pence

per share (2022: 0.9 pence per share). The Board is keen to

reinstate a dividend when appropriate and will continue to keep

dividend policy under review.

Cash flow and Net Debt

Net debt (excluding lease liabilities) at 31 March 2023 was

GBP17.5m compared with GBP10.1m at 31 March 2022. The increase in

net debt in the year of GBP7.4m includes GBP2.0m cash paid for

acquisitions (net of cash acquired), GBP1.5m of corporate taxes

paid, GBP1.1m of interest costs paid, GBP0.8m of dividends paid,

GBP0.6m of capital expenditure (including intangible assets) and

GBP0.5m of share repurchases into the Group's EBT. Working capital

improved slightly year on year.

The Company secured a waiver of its lending covenants from its

bankers at 31 March 2023 and agreed a further waiver at 30 June

2023. Amended covenants (based on minimum liquidity and Adjusted

EBITDA levels) will apply until the quarter ending 30 September

2024, at which time the original leverage metrics will be

reinstated (Net debt to Adjusted EBITDA of 2.5x and Adjusted EBITDA

to interest cover at 4.0x). These new lending arrangements provide

renewed stability and a sound basis for the business to reach its

performance goals.

Current trading

For the first two months of FY24, trading was in line with

management expectations, with like-for-like revenue growth of over

5%. With new business wins of over GBP90m in the first quarter, we

are seeing increased momentum in new orders and are well-positioned

for top-line growth in both the short and long term. At the same

time, management are very aware of the need to convert top-line

growth into meaningful margin improvement and have initiated a

number of measures focussed on efficiency, cost control and

profitability.

Net debt (excluding lease liabilities) was GBP16.8m at 31 May

2023, a GBP0.7m decrease on 31 March 2023, largely due to a

continued focus on working capital management. The last remaining

earnout liability in respect of historical acquisitions was settled

in shares on 6 June 2023.

Outlook

There is no change to the Group's previously published targets

for the year ending 31 March 2024, with like-for-like revenue

growth of 15-20% and an Adjusted EBITDA margin of 5-6%, with margin

improvement expected to be weighted to the second half of the year.

Committed (or backlog) revenues in relation to the current

financial year are over GBP80 million, significantly higher than at

the same time last year.

With respect to FY25, management continue to target

like-for-like revenue growth of 10-15% and a further improvement in

Adjusted EBITDA margin of 2-3% on top of that targeted for FY24.

Based on our three-year plan, we are targeting an Adjusted EBITDA

margin of 10-12% in FY26.

TPXimpact has entered the new financial year with renewed

vigour, whilst recognising there is scope to improve our

operational processes to enhance profitability, and respond

positively to a challenging wider economic environment. We continue

to believe the digital transformation market in the UK - in both

the public and private sectors - remains attractive, with plenty of

potential for continued growth, and that the Group is well-placed

to take advantage of these trends.

Steve Winters

CFO, TPXimpact

Consolidated Income Statement

For the year ended 31 March 2023

Unaudited Audited

2023 2022

GBP'000 GBP'000

Revenue 83,680 79,709

Cost of sales (62,775) (55,341)

Gross profit 20,905 24,368

Administrative expenses (40,789) (21,738)

Other income 519 579

Operating (loss)/profit (19,365) 3,209

Finance costs (1,105) (683)

--------------------------------------- ---------- ---------

(Loss)/profit before tax from

continuing operations (20,470) 2,526

Taxation 1,467 (1,706)

--------------------------------------- ---------- ---------

(Loss)/profit after tax from

continuing operations (19,003) 820

Profit/(loss) after tax from

discontinued operations 1,445 (723)

--------------------------------------- ---------- ---------

Net (loss)/profit (17,558) 97

Other comprehensive income/(loss):

Exchange difference on translation

of foreign operations 20 (226)

--------------------------------------- ---------- ---------

Total comprehensive loss for

the period (17,538) (129)

Earnings per share from continuing

and discontinued operations

Basic (p) (19.5p) 0.2p

Fully diluted (p) (19.5p) 0.1p

Earnings per share from continuing

operations

Basic (p) (21.1p) 1.0p

Fully diluted (p) (21.1p) 0.9p

Consolidated Statement of Financial Position

At 31 March 2023

Unaudited Audited

2023 2022

GBP'000 GBP'000

--------------------------------- ---------- ---------

Non-current assets

Goodwill 59,486 66,157

Intangible assets 23,458 28,493

Property, plant and equipment 473 297

Right of use assets 1,438 1,293

Other investments 2,188 -

Deferred tax assets 159 47

---------------------------------- ---------- ---------

Total non-current assets 87,202 96,287

---------------------------------- ---------- ---------

Current assets

Trade and other receivables 17,812 16,924

Contract assets 2,999 3,840

Corporate tax asset 335 -

Cash and cash equivalents 6,772 7,914

Total current assets 27,918 28,678

Assets held for sale - 708

---------------------------------- ---------- ---------

Total assets 115,120 125,673

---------------------------------- ---------- ---------

Current liabilities

Trade and other payables (8,943) (7,718)

Contract liabilities (3,608) (4,536)

Other taxes and social

security costs (4,073) (4,160)

Corporate tax liability - (1,214)

Deferred and contingent

consideration (225) (3,173)

Lease liabilities (564) (416)

Borrowings - (20)

Total current liabilities (17,413) (21,237)

---------------------------------- ---------- ---------

Liabilities directly associated

with assets held for sale - (103)

---------------------------------- ---------- ---------

Non-current liabilities

Deferred tax liabilities (5,796) (6,696)

Deferred and contingent

consideration - (198)

Borrowings (24,317) (18,000)

Lease liabilities (909) (878)

---------------------------------- ---------- ---------

Total non-current liabilities (31,022) (25,772)

Total liabilities (48,435) (47,112)

---------------------------------- ---------- ---------

Net assets 66,685 78,561

---------------------------------- ---------- ---------

Equity

Share capital 919 874

Own shares (983) (356)

Share premium 6,538 6,449

Merger reserve 85,621 78,705

Capital redemption reserve 15 15

Foreign exchange reserve (72) (92)

Retained earnings(1) (25,353) (7,034)

---------------------------------- ---------- ---------

Total equity 66,685 78,561

---------------------------------- ---------- ---------

(1) Prior year figures have been re-presented to include the

share option reserve as part of retained earnings.

Consolidated Statement of Changes in Equity

For the year ended 31 March 2023

Capital

Share Share Merger redemption Own Foreign Retained

capital premium reserve reserve shares exchange earnings Total

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April

2022 874 6,449 78,705 15 (356) (92) (7,034) 78,561

Loss for the

year - - - - - - (17,558) (17,558)

Exchange

differences

on translation

of foreign

operations - - - - - 20 - 20

Transactions

with owners

Shares issued 45 89 6,916 - (90) - - 6,960

Share

utilisations - - - - 11 - (11) -

Dividends paid - - - - - - (815) (815)

Share-based

payments - - - - - - 65 65

Own shares

purchased

by EBT - - - - (548) - - (548)

At 31 March

2023 (Unaudited) 919 6,538 85,621 15 (983) (72) (25,353) 66,685

For the year ended 31 March 2022

Capital

Share Share Merger redemption Own Foreign Retained

capital premium reserve reserve shares exchange earnings(1) Total

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April

2021 804 5,691 60,926 5 - 134 (6,906) 60,654

Profit for

the

year - - - - - - 97 97

Exchange

differences

on

translation

of foreign

operations - - - - - (226) - (226)

Transactions

with owners

Shares issued 80 257 17,779 - (257) - - 17,859

Share

cancellation (10) - - 10 - - - -

Dividends

paid - - - - - - (603) (603)

Other

adjustment - - - - - - (49) (49)

Share-based

payments - - - - - - 427 427

Share options

exercised - 501 - - - - - 501

Own shares

purchased

by EBT - - - - (99) - - (99)

At 31 March

2022

(Audited) 874 6,449 78,705 15 (356) (92) (7,034) 78,561

(1) Prior year figures have been re-presented to include the

share option reserve as part of retained earnings.

Consolidated Statement of Cash Flows

For the year ended 31 March 2023

Unaudited Audited

2023 2022

GBP'000 GBP'000

Cash flows from operating

activities:

(Loss)/profit before taxation

from total operations (18,971) 1,764

Adjustments for:

Depreciation 706 584

Amortisation of intangible

assets 6,347 5,347

Impairment of intangible 1,770 -

assets

Impairment of goodwill 9,995 -

Share-based payments 65 427

Foreign exchange gains (1) (292)

Finance expense 1,105 683

Loss/(gain) from fair value

movement in contingent consideration 188 (152)

Loss on disposal of property,

plant and equipment 6 4

Gain on sale of discontinued (1,606) -

operations

Working capital adjustments:

Decrease/(increase) in trade

and other receivables 1,271 (3,754)

(Decrease)/increase in trade

and other payables (1,141) 3,488

Net cash (used in)/generated

from operations (266) 8,099

Tax paid (1,522) (921)

Net operating cash (used

in)/generated from continuing

operating activities (1,788) 7,178

Net cash used in discontinued

operating activities(1) - (563)

----------------------------------------- ---------- ----------

Net operating cash flows

from total operations (1,788) 6,615

----------------------------------------- ---------- ----------

Cash flows from investing

activities:

Net cash paid on acquisition

of subsidiaries (1,969) (6,840)

Disposal of subsidiaries (127) -

Deferred consideration payment - (467)

Purchase of property, plant

and equipment (340) (249)

Additions to intangibles (244) (292)

Proceeds from sale of property,

plant and equipment - 6

Net cash used in investing

activities from continuing

operations (2,680) (7,842)

Net cash used in investing

in discontinued operations(1) - (165)

----------------------------------------- ---------- ----------

Net cash used in investing

activities for total operations (2,680) (8,007)

----------------------------------------- ---------- ----------

Cash flows from financing

activities:

New borrowings 6,300 5,000

Proceeds from exercise of

share options - 501

Purchase of own shares (548) (99)

Payment of lease liabilities (445) (362)

Interest paid (1,146) (683)

Dividends paid (815) (603)

----------------------------------------- ---------- ----------

Net cash generated from

financing activities 3,346 3,754

----------------------------------------- ---------- ----------

Net (decrease)/increase

in cash and cash equivalents (1,122) 2,362

Cash and cash equivalents

at beginning of the period 7,948 5,734

Effect of exchange rate fluctuations

on cash held (54) (148)

----------------------------------------- ---------- ----------

Cash and cash equivalents

including cash from discontinued

operations 6,772 7,948

Cash from discontinued operations - (34)

----------------------------------------- ---------- ----------

Cash and cash equivalents

at end of the year 6,772 7,914

Comprising:

Cash at bank and in hand 6,717 7,864

Cash held by trust 55 50

----------------------------------------- ---------- ----------

Cash and cash equivalents

at end of the year 6,772 7,914

----------------------------------------- ---------- ----------

(1) The cash flows of discontinued operations are immaterial to

the Consolidated Statement of Cash Flows for the year ended 31

March 2023 and so have not been presented separately for the

current financial year.

Notes to the Consolidated Financial Statements

1. General information

TPXimpact Holdings plc is a public limited company incorporated

in England and Wales under the Companies Act 2006 with registered

number 10533096. The Company's shares are publicly traded on AIM,

part of the London Stock Exchange.

The address of the registered office is 7 Savoy Court, London,

England, WC2R 0EX. The principal activity of the Group is the

provision of digitally native technology services to clients within

the commercial, government and non-government organisation (NGO)

sectors.

The financial information set out in this announcement does not

comprise the Group's statutory accounts as defined in section 434

of the Companies Act 2006 for the year ended 31 March 2023. The

statutory accounts for the year ended 31 March 2023 have not yet

been delivered to the Registrar of Companies, nor have the auditors

yet reported on them. This preliminary announcement does not

constitute statutory accounts under section 435 of the Companies

Act 2006.

2. Basis of preparation

The unaudited consolidated preliminary financial statements have

been prepared in accordance with applicable International Financial

Reporting Standards (IFRS) in conformity with the Companies Act

2006 and the AIM rules for Companies.

The financial statements are presented in pound sterling (GBP),

which is the functional currency of the parent company.

Going concern

The Company secured a waiver of its lending covenants from its

bankers at 31 March 2023 and agreed a further waiver at 30 June

2023. Amended covenants (based on minimum liquidity and Adjusted

EBITDA levels) will apply until the quarter ending 30 September

2024, at which time the original leverage metrics will be

reinstated (Net debt to Adjusted EBITDA of 2.5x and Adjusted EBITDA

to interest cover at 4.0x)

After reviewing the budgets and cash projections for the next

twelve months and beyond, the Directors believe that the Company

has adequate resources to continue operations for the foreseeable

future and to meet the requirements of its debt covenants. For this

reason they continue to adopt the going concern basis in preparing

the financial statements.

3. Accounting policies

The accounting policies used in the preparation of the unaudited

preliminary consolidated financial statements for the year ended 31

March 2023 are in accordance with the recognition and measurement

criteria of IFRS and are consistent with those which were adopted

in the annual statutory financial statements for the year ended 31

March 2022.

The Group disposed of its subsidiary Greenshoot Labs Limited

('GSL') on 24 May 2022 to OpenDialog AI Limited (ODAL).

Consideration of GBP2.2 million was received through the allotment

and issue of ordinary shares by ODAL and is presented as an "Other

investment" on the Group's consolidated statement of financial

position. The operations of GSL is presented as discontinued

operations with the comparatives and related notes restated

accordingly. The disposal generated a gain of GBP1.6 million

included in the profit after tax on discontinued operations in the

year ended 31 March 2023.

4. Business combinations

On 6 April 2022, the Group acquired the entire issued share

capital of Swirrl IT Limited ("Swirrl"), a software and services

business.

On 7 April 2022, the Group acquired the entire issued share

capital of Peak Indicators Limited ("Peak"), a visionary data

science and analytics consultancy offering services such as

analytics, data engineering and data science.

5. Borrowings

In July 2022 HSBC extended their revolving credit facility with

the Group to GBP30 million with a GBP15 million accordion. The new

facility is a sustainability-linked revolving credit facility that

incorporates targets which align with the Group's long-term ESG

objectives.

6. Earnings per share

2023 2022

Number of Number of

shares shares

'000 '000

------------------------------------------- ------------ ------------

Weighted average number of shares

for calculating basic earnings

per share 90,185 86,211

Weighted average number of dilutive

shares 3,839 1,768

------------------------------------------- ------------ ------------

Weighted average number of shares

for calculating diluted earnings

per share 94,024 87,979

------------------------------------------- ------------ ------------

2023 2022

GBP'000 GBP'000

------------------------------------------- ------------ ------------

(Loss)/profit after tax from continuing

operations (19,003) 820

Profit/(loss) after tax from discontinued

operations 1,445 (723)

------------------------------------------- ------------ ------------

(Loss)/profit after tax from total

operations (17,558) 97

------------------------------------------- ------------ ------------

Adjusted profit after tax from

continuing operations(1) 644 9,951

------------------------------------------- ------------ ------------

Earnings per share is calculated

as follows: 2023 2022

Basic earnings per share

Basic earnings per share from continuing

operations (21.1p) 1.0p

Basic earnings per share from discontinued

operations 1.6p (0.8p)

--------------------------------------------- -------- ---------

Basic earnings per share from total

operations (19.5p) 0.2p

--------------------------------------------- -------- ---------

Adjusted basic earnings per share

from continuing operations 0.7p 11.5p

--------------------------------------------- -------- ---------

Diluted earnings per share

Diluted earnings per share from

continuing operations(2) (21.1p) 0.9p

Diluted earnings per share from

discontinued operations(2) 1.6p (0.8p)

--------------------------------------------- -------- ---------

Diluted earnings per share from

total operations(2) (19.5p) 0.1p

--------------------------------------------- -------- ---------

Adjusted diluted earnings per share

from continuing operations 0.7p 11.3p

--------------------------------------------- -------- ---------

(1) Adjusted profit after tax on continuing operations is defined in note 7.

(2) In the year ended 31 March 2023, the weighted average shares

used in the basic EPS calculation has also been used for reported

diluted EPS due to the anti-dilutive effect of the weighted average

shares calculated for the reported diluted EPS calculation.

7. Alternative performance measures (unaudited)

In measuring our performance, the financial measures that we use

include those which have been derived from our reported results in

order to eliminate factors which distort period-on-period

comparisons. These are considered non-GAAP financial measures, and

include measures such as like-for-like revenue, adjusted EBITDA and

net debt. We believe this information, along with comparable GAAP

measurements, is useful to shareholders and analysts in providing a

basis for measuring our financial performance.

Reconciliation of net debt (excluding lease liabilities):

2023 2022

GBP'000 GBP'000

---------------------------- ---------- ----------

Cash and cash equivalents 6,772 7,914

Borrowings due within

one year - (20)

Borrowings due after

one year (24,317) (18,000)

---------------------------- ---------- ----------

Net debt (17,545) (10,106)

---------------------------- ---------- ----------

Reconciliation of operating (loss)/profit to adjusted

EBITDA:

2023 2022

GBP'000 GBP'000

----------------------------------------- ---------- ----------

Operating (loss)/profit (19,365) 3,209

Amortisation of intangible assets 6,347 5,347

Depreciation 706 584

Loss/(gain) from fair value movement

in contingent consideration 188 (152)

Impairment of intangible assets 1,770 -

Impairment of goodwill 9,995 -

Share-based payments 65 427

Costs directly attributable to business

combinations 229 1,013

Costs related to business restructuring 2,541 1,769

------------------------------------------ ---------- ----------

Adjusted EBITDA 2,476 12,197

------------------------------------------ ---------- ----------

Reconciliation of (loss)/profit before tax to adjusted profit

after tax:

2023 2022

GBP'000 GBP'000

--------------------------------------- --------- ---------

(Loss)/profit before tax

on continuing operations (20,470) 2,526

Amortisation of intangible

assets 6,347 5,347

Loss/(gain) from fair value

movement in contingent consideration 188 (152)

Impairment of intangible

assets 1,770 -

Impairment of goodwill 9,995 -

Share-based payments 65 427

Costs directly attributable

to business combinations 229 1,013

Costs related to business

restructuring 2,541 1,769

---------------------------------------- --------- ---------

Adjusted profit before tax

on continuing operations 665 10,930

Tax (excluding impact of

amortisation of intangible

assets) (21) (979)

---------------------------------------- --------- ---------

Adjusted profit after tax

on continuing operations 644 9,951

---------------------------------------- --------- ---------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UPURWMUPWPUA

(END) Dow Jones Newswires

July 06, 2023 02:00 ET (06:00 GMT)

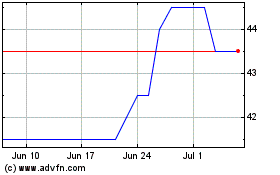

Tpximpact (LSE:TPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tpximpact (LSE:TPX)

Historical Stock Chart

From Apr 2023 to Apr 2024