BiomX Inc. Announces Stockholder Approval for Conversion of Outstanding Series X Convertible Preferred Stock to Common Stock

July 10 2024 - 5:30AM

BiomX Inc. (NYSE American: PHGE) (“BiomX” or the “Company”), a

clinical-stage company advancing novel natural and engineered phage

therapies that target specific pathogenic bacteria, today announced

that the Company’s stockholders have voted to approve a proposal to

convert BiomX’s outstanding Series X Non-Voting Convertible

Preferred Stock (“Series X Preferred Stock”) into shares of BiomX’s

common stock. The result of the vote was previously disclosed in

the Company’s Current Report on Form 8-K filed with the U.S.

Securities and Exchange Commission on July 9, 2024.

BiomX’s Series X Preferred Stock was issued upon BiomX’s

acquisition of Adaptive Phage Therapeutics, Inc. (“APT”) and a

concurrent $50 million financing (the “Financing”), which were

consummated in March 2024. As a result of the stockholder vote

approving the conversion of BiomX’s Series X Preferred Stock, each

share of Series X Preferred Stock issued in the APT acquisition and

the private placement will be converted into 1,000 shares of BiomX

common stock, subject to certain beneficial ownership limitations

set by certain investors in the Financing. Subject to such

beneficial ownership limitations, the shares of up to 256,887

Series X Preferred Stock will automatically be converted into up to

256,887,000 shares of the Company’s common stock that will be added

to the Company’s outstanding share count. Additional details

regarding the stockholder vote and conversion of BiomX’s Series X

Preferred Stock are contained in BiomX’s Current Report on Form 8-K

filed with the SEC on July 9, 2024.

Due to certain accounting standards, proceeds from the Financing

were not classified as stockholders’ equity in the Company’s

balance sheet as of March 31, 2024. Based upon the stockholder vote

in favor of the conversion of BiomX’s Series X Preferred Stock into

common stock, certain proceeds from the Financing will now be

classified as stockholders’ equity. Accordingly, the Company

expects to regain compliance with the NYSE American’s listing

requirements. BiomX previously announced on May 30, 2024, that it

had received a notification from NYSE American LLC (“NYSE

American”) indicating that the Company was not in compliance with

the requirement for listed companies to have stockholders’ equity

of $2 million or more. The Company has submitted a plan to regain

compliance with NYSE American listing requirements, and is awaiting

NYSE American’s acceptance of such plan.

“We are delighted to have achieved this milestone with respect

to the APT acquisition and concurrent financing,” said Jonathan

Solomon, Chief Executive Officer of BiomX. “Our acquisition of APT

and the related financing have allowed BiomX to create a leading

phage company with two advanced, Phase 2 clinical candidates. Both

programs are anticipated to have important readouts next year. We

are fully focused on achieving these critical inflection points in

our clinical development pipeline, which we anticipate will build

future stockholder value.”

About BiomXBiomX is a clinical-stage company

leading the development of natural and engineered phage cocktails

and personalized phage treatments designed to target and destroy

harmful bacteria for the treatment of chronic diseases with

substantial unmet needs. BiomX discovers and validates proprietary

bacterial targets and applies its BOLT (“BacteriOphage Lead to

Treatment”) platform to customize phage compositions against these

targets. For more information, please visit www.biomx.com, the

content of which does not form a part of this press release.

Safe HarborThis press release contains express

or implied “forward-looking statements” within the meaning of the

“safe harbor” provisions of the U.S. Private Securities Litigation

Reform Act of 1995. Forward-looking statements can be identified by

words such as: “target,” “believe,” “expect,” “will,” “may,”

“anticipate,” “estimate,” “would,” “positioned,” “future,” and

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. For

example, when BiomX discusses its expectation to regain compliance

with NYSE American Continued Listing Standards, the expected timing

for readouts from its clinical programs, and the potential of the

Company to build future stockholder equity, it is using

forward-looking statements. Forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are based only on BiomX management’s current beliefs,

expectations and assumptions. Because forward-looking statements

relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict

and many of which are outside of BiomX’s control. These risks and

uncertainties include, but are not limited to, the acceptance of

BiomX’s compliance plan by NYSE American and BiomX’s ability to

regain compliance with the listing standards by November 23, 2025,

the deadline set forth by NYSE American; changes in applicable laws

or regulations; the possibility that BiomX may be adversely

affected by other economic, business, and/or competitive factors,

including risks inherent in pharmaceutical research and

development, such as: adverse results in BiomX’s drug discovery,

preclinical and clinical development activities, the risk that the

results of preclinical studies and early clinical trials may not be

replicated in later clinical trials, BiomX’s ability to enroll

patients in its clinical trials, and the risk that any of its

clinical trials may not commence, continue or be completed on time,

or at all; decisions made by the FDA and other regulatory

authorities; investigational review boards at clinical trial sites

and publication review bodies with respect to our development

candidates; BiomX’s ability to obtain, maintain and enforce

intellectual property rights for its platform and development

candidates; its potential dependence on collaboration partners;

competition; uncertainties as to the sufficiency of BiomX’s cash

resources to fund its planned activities for the periods

anticipated and BiomX’s ability to manage unplanned cash

requirements; and general economic and market conditions.

Therefore, investors should not rely on any of these

forward-looking statements and should review the risks and

uncertainties described under the caption “Risk Factors” in BiomX’s

Annual Report on Form 10-K filed with the Securities and Exchange

Commission (the “SEC”) on April 4, 2024, and additional disclosures

BiomX makes in its other filings with the SEC, which are available

on the SEC’s website at www.sec.gov. Forward-looking

statements are made as of the date of this press release, and

except as provided by law BiomX expressly disclaims any obligation

or undertaking to update forward-looking statements.

BiomX, Inc.Assaf Oron+97254-2228901assafo@biomx.com

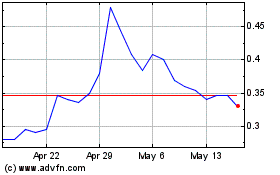

BiomX (AMEX:PHGE)

Historical Stock Chart

From Feb 2025 to Mar 2025

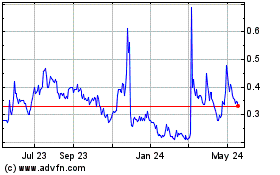

BiomX (AMEX:PHGE)

Historical Stock Chart

From Mar 2024 to Mar 2025