What Next For S&P 500 After It Gains 26% From 52-Week Lows

June 19 2023 - 5:12AM

Finscreener.org

Last Friday saw a slight dip in stocks, which

concluded an impressive week where the Federal Reserve held off on

rate hikes, and inflation data appeared promising. The

S&P 500 was down

by 0.37%, ending at 4,409.59, while the

Dow Jones fell 108.94

points, or 0.32%, to end at 34,299.12. The Nasdaq Composite saw a 0.68% decline to wrap up the session at

13,689.57.

In the last week:

- The S&P 500 saw a 2.6%

increase, marking its best performance since March and its fifth

consecutive positive week, a streak not seen since November 2021.

ItU+02019s also up 26% from its bear market low.

- The Nasdaq Composite experienced

about a 3.3% hike this week, its best performance since March.

ItU+02019s been on an upward trend for eight weeks straight, the

longest winning streak since 2019. The Nasdaq and S&P 500

had six successive days of gains leading to Thursday.

- The Dow Jones saw a weekly

increase of nearly 1.3%, making it the third positive week in a

row. The S&P 500 and Nasdaq achieved their highest levels

since April 2022.

Investors were heartened this

week when the Federal Reserve decided to leave rates as they were

after ten consecutive increases. Although the Fed indicated two

more rate hikes this year, it could soon halt these increases. In

other positive news, the May consumer price index was the lowest in

two years.

Adobe stock gained pace last

week

AdobeU+02019s (NASDAQ: ADBE)

shares rose by 0.9% following a positive results announcement and

promising future guidance. Tech stocks rallied, with

Nvidia (NASDAQ:

NVDA) surging 10% and

Microsoft (NASDAQ: MSFT)

adding 4.7% this week, hitting a record on

Thursday.

The stock market was buoyed by the belief

that the growth of AI isnU+02019t slowing down anytime soon. Ed

Moya, senior market analyst at Oanda, commented that the current

bullish trend might continue if AIU+02019s popularity

persists.

Further good news arrived on

Friday, with one-year inflation expectations for consumers falling

to 3.3% from 4.2%. The University of MichiganU+02019s Survey of

Consumers also presented a higher-than-expected headline reading of

63.9.

Despite these achievements,

traders experienced some volatility on Friday due to fluctuating

stock options, index futures, and index future option contracts.

This marks the end of trading ahead of a long weekend, with

MondayU+02019s closure in observance of Juneteenth.

Housing market data in focus

The National Association of Home

Builders (NAHB) is set to disclose its June Housing Market Index on

Monday, offering insight into homebuildersU+02019 sentiments.

Projections indicate a score of 48, slightly lower than MayU+02019s

50 - the highest level since July of the previous year. This

follows a recovery period this year after the index dropped in 2022

due to soaring mortgage rates deflating housing demand.

On Tuesday, weU+02019ll get a

snapshot of MayU+02019s housing starts and building permits from

the U.S. Census Bureau, indicative of home construction activity

and overall inventory. Expectations suggest a marginal increase in

housing starts to 1.405 million units from AprilU+02019s 1.401

million, which contrasts with the two-year low of 1.34 million

recorded in January.

PowellU+02019s Congressional

Appearance Federal Reserve Chair Jerome Powell is slated to appear

before Congress on Wednesday and Thursday for his biannual update

on monetary policy. This appearance follows last weekU+02019s

Federal Open Market Committee (FOMC) meeting, where Fed officials

decided to keep interest rates unchanged after ten successive hikes

aimed at tempering inflation.

While inflation has significantly

decelerated from the highs seen last summer, the FedU+02019s recent

dot plot implies that if inflation remains high, there could be two

more hikes this year, taking the benchmark fed funds rate to

5.6%.

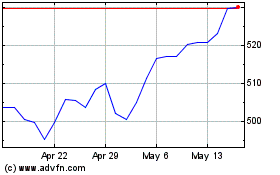

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jan 2025 to Feb 2025

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Feb 2024 to Feb 2025