Form 8-K - Current report

November 19 2024 - 12:22PM

Edgar (US Regulatory)

false

0000102109

0000102109

2024-11-18

2024-11-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 18, 2024

UNIVERSAL SECURITY INSTRUMENTS, INC.

(Exact name of registrant as specified in its charter)

| Maryland |

001-31747 |

52-0898545 |

| (State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

| of Incorporation) |

|

Identification No.) |

11407 Cronhill Drive, Suite A, Owings Mills,

Maryland 21117

(Address of Principal Executive Offices)

Registrant’s telephone number, including

area code: (410) 363-3000

Inapplicable

(Former Name or Former Address if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading symbol |

Name of each exchange on which registered |

| Common Stock |

UUU |

NYSE MKT LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

INFORMATION TO BE INCLUDED IN THE REPORT

| Item 1.01. | Entry into a Material Definitive Agreement. |

As previously reported, on

October 29, 2024, Universal Security Instruments, Inc., a Maryland corporation (“USI”), entered into an Asset

Purchase Agreement (the “Purchase Agreement”) by and among USI, a wholly owned subsidiary of USI and Feit Electric

Company, Inc., a California corporation. On November 18, 2024, Harvey B. Grossblatt, President and Chief Executive Officer of

USI and USI entered into a letter agreement (the “Letter Agreement”) pursuant to which Mr. Grossblatt waived certain

“change of control” payments to which he would be entitled pursuant to the terms of the Second Amended and Restated Employment

Agreement dated as of July 18, 2005 by and between Mr. Grossblatt and USI. The waiver set forth in the Letter Agreement is only

effective with respect to a “change of control” which would occur as a result of the transaction with Feit Electric pursuant

to the terms of the Purchase Agreement.

| Item 9.01. | Financial Statements and Exhibits. |

(c) Exhibits

The following exhibits

are filed herewith:

Exhibit No.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

UNIVERSAL SECURITY INSTRUMENTS, INC. |

| |

(Registrant) |

| |

|

|

| Date: November 19, 2024 |

By: |

/s/ Harvey B. Grossblatt |

| |

|

Harvey B. Grossblatt |

| |

|

President |

Exhibit 10.1

Harvey B. Grossblatt

28 Westspring Way

Lutherville, Maryland 21093

November 18, 2024

Universal Security Instruments, Inc.

11407 Cronhill Drive, Suite A

Owings Mills, Maryland 21117

Gentlemen:

Reference is made to the Second

Amended and Restated Employment Agreement by and between Universal Security Instruments, Inc., a Maryland corporation (the “Company”)

and me, dated July 18, 2005, as amended (the “Employment Agreement”). Capitalized terms not otherwise defined

in this letter have the meanings ascribed to such terms in the Employment Agreement.

Reference is also made to

the Asset Purchase Agreement by and between the Company, USI Electric, Inc., a wholly-owned subsidiary of the Company, and Feit Electric

Company, Inc., a California corporation (“Feit Electric”), dated October 29, 2024 (the “Purchase

Agreement”).

The sale of assets to Feit

Electric pursuant to the terms of the Purchase Agreement would be a Change of Control as defined in the Employment Agreement. Furthermore,

the Company will not renew my employment at the end of the current Employment Period (although it is anticipated that I will be retained

by the Company following the Closing Date (as defined in the Purchase Agreement) to supervise the orderly liquidation of the Company’s

remaining assets on terms to be agreed upon by me and the Company). In addition, following such Closing Date, I will be engaged by

Feit Electric as contemplated by the Purchase Agreement and, in such capacity, the Company will allow me to share confidential information

of the Company with Feit Electric.

In consideration of the above

and the benefits that will accrue to all Company shareholders as a result of the Company’s transaction with Feit Electric pursuant

to the Purchase Agreement, I hereby waive and agree to forever forego all severance and Change of Control payments and benefits due

or which may become due to me pursuant to the terms of the Employment Agreement, other than a lump sum severance payment in an amount

equal to the previous 12 months’ Annual Base Salary and last Bonus payable on, and measured as of, July 31, 2025, the last

day of the Employment Period.

This waiver is only effective

with respect to the closing of the transaction contemplated by the Purchase Agreement and will be void and of no affect in the event the

Closing (as defined in the Purchase Agreement) does not take place for any reason whatsoever or with respect to a different transaction

which would be a Change of Control.

If the Company agrees to the

terms set forth in this letter, please countersign in the space provided below and return the countersigned copy to me. Thank you.

| AGREED: |

|

| |

|

| UNIVERSAL SECURITY INSTRUMENTS, INC. |

|

| |

|

| /s/ |

|

|

| James B. Huff, Vice

President |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

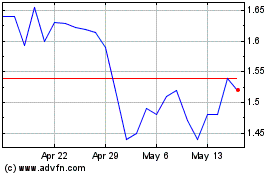

Universal Security Instr... (AMEX:UUU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Universal Security Instr... (AMEX:UUU)

Historical Stock Chart

From Jan 2024 to Jan 2025