The technology sector, which missed out on all the fun in the first

half of the year, turned around in the third quarter earnings

season with impressive growth rates and beat ratios. Thanks to

improving developed economies and revived emerging nations, the

sector is back on track.

Though broad tech is delivering handsome returns to investors in

the year-to-date time frame, Internet is leading the way driven by

improving fundamentals, impressive outlooks, and broad investor

interest (read: The Incredible Run for NFLX Puts These ETFs in

Focus).

Strong performances from some major companies like Netflix (NFLX),

Google (GOOG), Yahoo (YHOO), Facebook (FB) and Amazon (AMZN), also

support the bullish trend in the space. Further, four of the six

Zacks Industries that are classified as being in the Internet space

have positive outlooks, suggesting busy trading for this segment in

the coming months.

Given the positive trends in the Internet space, a good way to seek

entry into the broad tech world is by tilting toward ETFs in this

segment. While there are a number of ways to invest in this surging

corner of the market, a look at the top ranked ETF with a lower

level of risk could be a good idea (read: 3 Internet ETFs Leading

the Tech World Higher).

One way to find a top ranked ETF in the tech space is by using the

Zacks ETF Ranking system.

About the Zacks ETF Rank

A look at the top ranked Internet ETFs can be done by using the

Zacks ETF Rank. This technique provides a recommendation for the

ETF in the context of our outlook on the underlying industry,

sector, style box or asset class. Our proprietary methodology also

takes into account the risk preferences of investors.

The aim of our model is to select the best ETFs within each risk

category. We assign each ETF one of five ranks within each risk

bucket. Thus, the Zacks Rank reflects the expected return of an ETF

relative to other ETFs with a similar level of risk.

Using this strategy, we have found one ETF –

First Trust

Dow Jones Internet Index (FDN) – in the space that has a

Zacks ETF Rank of 1 or ‘Strong Buy’ rating with a ‘Medium’ risk

outlook (read: all the Top Ranked ETFs). The details are

highlighted below:

FDN in Focus

This ETF offers exposure to the Internet segment of the broad tech

sector by tracking the Dow Jones Internet Composite Index. The

benchmark measures the performance of the companies that primarily

earn half of their annual revenues from Internet business and have

a trading history of at least three months.

In total, the fund holds a small basket of 41 securities, with

Google as the top firm with 11.19% of assets. Amazon and Facebook

occupy the next two positions at 8.74% and 6.68%, respectively.

This suggests that the fund is largely concentrated on its top 10

holdings, which dominate the fund’s return. Meanwhile large cap

accounts for 56% of the assets, mid (27%) and small (17%) caps take

the remainder of the basket (read: Internet ETFs in Focus on Amazon

Sales Beat).

However, the product has a certain tilt toward growth stocks, as

these account for three-fourths of the portfolio which could be

considered beneficial for this fund. This is because growth

investing can be thought of as a momentum play, which makes it a

great strategy in a trending market (i.e. a market characterized by

a prolonged uptrend).

Stocks in the growth ETF portfolio harness their momentum in

earnings to create a positive bias in the market, resulting in

rocketing share prices. This is especially true given the

securities included in the fund’s portfolio are enjoying a huge

rally this year, thereby raising the price for FDN.

From a sector look, Internet and mobile segments account for more

than half the portfolio, followed closely by Internet retail at 24%

of assets. The rest of the portfolio provides a nice mix in a

variety of related industries including software, communications

and asset management.

Last but not least, FDN is among the most popular and liquid ETFs

in the broad tech space with AUM of over $1.7 billion and average

daily volume of more than 250,000 shares. This suggests that bid

ask spreads are tight and that total costs may not come in much

higher than the 57 bps expense ratio.

In terms of performance, the ETF added nearly 42% year-to-date,

easily crushing the broad tech fund (XLK) and U.S. market fund

(SPY) by wide margins (see: all the Technology ETFs here).

Further, the ETF is up about 49% over the trailing one-year period

and 62% over the past two years.

Bottom Line

This ETF has delivered solid returns not only this year, but also

over the long term. This trend is expected to continue given a

string of earnings beats and rising IT consumer spending.

So, investors looking for tech ETFs should consider FDN for their

exposure, as it is a top rated ETF that is poised to lead the way

higher in the coming months.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

FT-DJ INTRNT IX (FDN): ETF Research Reports

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

NETFLIX INC (NFLX): Free Stock Analysis Report

SPDR-TECH SELS (XLK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

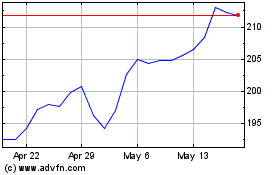

Technology Select Sector (AMEX:XLK)

Historical Stock Chart

From Nov 2024 to Dec 2024

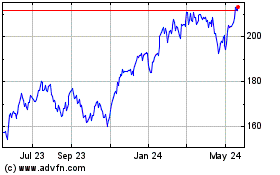

Technology Select Sector (AMEX:XLK)

Historical Stock Chart

From Dec 2023 to Dec 2024