Correction: Correction: 2021 Spineway fiscal year results : significant improvement and sound dynamic

February 02 2022 - 5:10AM

Correction: Correction: 2021 Spineway fiscal year results :

significant improvement and sound dynamic

Press Release

Ecully,

February 1st, 2022 – 6

pm

Further

improvement on 2021

results

- 27%1 increase in

revenue

- 36% growth in gross

margin

- 26% improvement in operating

performance

- Strategic ambition

strengthened by investment capacity

|

In thousands of euros |

2021 |

2020 |

% Variation |

|

Consolidated accounts |

|

Consolidated accounts |

4 290 |

3 379 |

27% |

|

Cost of goods sold |

- 1 398 |

- 1 260 |

-11% |

|

Gross Margin |

2 892 |

2 119 |

36% |

|

Turnover % |

67,40% |

62,70% |

|

Operating costs |

- 4 301 |

- 4 029 |

-7% |

|

Including operational costs |

- 1 941 |

- 2 269 |

14% |

|

Including personnel expenses |

- 2 479 |

- 2 278 |

-9% |

|

Operating income |

- 1 409 |

- 1 910 |

26% |

|

Financial income |

223 |

- 12 279 |

|

|

Including Negma financial one-offs1 |

0 |

- 11 978 |

|

Non-recurring items |

-397 |

84 |

|

|

Net income |

- 1 583 |

- 14 105 |

|

|

Including adjusted net

income 2 |

- 1 583 |

- 2 127 |

26% |

Spineway’s Board of Directors met on 31 January

2022 under the chairmanship of Stéphane Le Roux, and approved the

annual accounts (corporate and consolidated) as of 31 December,

2021.

Spineway confirms sound orientation of its 2021

fiscal year with a turnover of €4.3 million1 up 27% compared

to 2020, despite the still penalizing pandemic context. This growth

is driven by a fourth quarter at €1.3 million (+26%) and is

accompanied by an improvement in all the Group's results.

Continued improvement in overall

results

During the year, Spineway's performance improved

significantly, benefiting from revenue growth and a sales mix

oriented towards higher value-added products. Gross

margin reached €2.9 million in 2021, up 36% compared to

2020, while the gross margin rate increased by

7.5%, or 4.7 margin points, from 62% in 2020 to 67% in 2021.

Sound management of operating expenses during

the year, combined with the increase in sales, enabled

the operating result to improve by 26% compared to

2020 and by 39% compared to 2019 to reach

€1.4

million. It should be

noted that a high level of regulatory expenditure, particularly in

studies and clinical tests, is necessary to prepare for the

transition to the new CE/MDR regulations, which will take place in

May 2024 at the latest. In this respect, the company has already

obtained a first MDR certificate for its instruments.

Financial

revenue amounted to €0.2 million compared

with a loss of €12.3 million in 2020. The 2020

result was penalized by the posting of an exceptional financial

charge related to the compensation mechanism of the Negma2

financing contract. Adjusted for the exceptional

financial charge, it would have been €0.3

million. Thus, the financial

revenue for 2021 improved by €0.5 million.

The exceptional revenue

(-€0.4

million in 2021) is

essentially linked to the impact of a depreciation of R&D

costs. The Group continues to invest in innovation, in line with

its product strategy. Therefore, the management team has been

strengthened by the arrival of an R&D manager in the fall of

2021. This dynamic is in line with a strategy of developing

high-margin growth markets.

The net result is also in line

with this positive trajectory at

-€1.6 million compared to a loss of €14.1

million last year (€2.1 million adjusted for the above-mentioned

exceptional financial charge). The latter thus

improves by 45% compared to 2019 and by 26% compared to the 2020

net result adjusted for the exceptional

charge.

Reinforced

assets

The year was accompanied by a significant

strengthening of the company's assets with a total of €25.6 million

compared to €14.7 million at the end of December 2020. This

securing of assets is mainly linked to the financing contract with

Negma, which strengthens the company's financial position.

The valuation of assets (equity investments) was

also strengthened by the Geneva arbitration tribunal, which issued

an award on January 20, 2022 in favor of Spineway in the dispute

with Integral Medical Solutions (IMS). IMS was ordered to pay

Spineway the full purchase price of the shares, plus interest for

late payment and reimbursement of arbitration costs. IMS has a

period of 30 days to appeal this decision, it being specified that

this appeal, except in special cases, would not have suspensive

effect. In addition, this award remains subject to collection

procedures in the countries where the IMS group is established.

Strengthened financial position

with €13.9 million in cash

In order to finance its development projects and

operational needs, the Group saw a capital increase of €1.6 million

over the year associated with a premium over par of €11.6 million

linked to its Negma financing agreement. This

operation strengthened Spineway's

equity (€20.9 million) and brought the company's cash

position to €13.9 million at December 31, 2021. Similarly, cash net

of financial debts improved to €11.5 million compared to €2 million

last year.

The purpose of this contract is to finance the

Group's strategy until Spineway's results allow it to self-finance

its growth. To date, there remains €15.5 million in additional

financing under the Negma agreement, which has provided €18.6

million in cash since its conclusion. This strategy of securing

cash has enabled the company to complete its first external growth

project with the acquisition of Distimp in June 2021.

This fiscal year marks a further

improvement in Spineway's

performance despite a complicated economic environment and

demonstrates the Group's ability to carry out its strategic plan

with the ambition of becoming a leading European player in spine

surgery with Premium positioning. Thank to good

results and unchanged investment capacity,

Spineway will continue its mixed growth

combining organic development and targeted

acquisitions.

Upcoming: General

Shareholders Meeting – 23

March 2022

The annual accounts are available on the

company’s website in the Investors

SPINEWAY IS ELIGIBLE FOR THE

PEA-PME (EQUITY SAVINGS PLANS FOR SMES)Find out all about

Spineway at www.spineway.com

This press release has been prepared in

both English and French. In case of discrepancies, the French

version shall prevail.

Spineway designs, manufactures and

markets innovative implants and surgical instruments for treating

severe disorders of the spinal

column. Spineway has an

international network of over 50 independent distributors and 90%

of its revenue comes from

exports. Spineway, which is

eligible for investment through FCPIs (French unit trusts

specializing in innovation), has received the OSEO Excellence award

since 2011 and has won the Deloitte Fast 50 award (2011). Rhône

Alpes INPI Patent Innovation award (2013) – INPI Talent award

(2015). ISIN: FR0011398874 -

ALSPW

Contacts:

|

SPINEWAYShareholder-services

lineAvailable Tuesday through Thursday+33 (0)806

706 060 |

Eligible PEA / PMEALSPWEuronext Growth |

AELIUMFinance & CommunicationInvestor

relationsSolène Kennisspineway@aelium.fr |

1 Breakdown as per press release of 18 january 20222 The

recording of a one-time financial expense representing compensation

for the Negma financing agreement (see January 25, 2021 press

release)

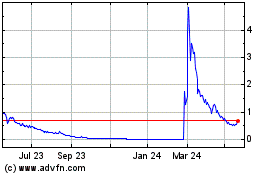

Spineway (EU:ALSPW)

Historical Stock Chart

From Dec 2024 to Jan 2025

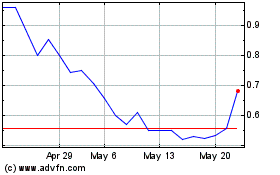

Spineway (EU:ALSPW)

Historical Stock Chart

From Jan 2024 to Jan 2025