- We are advancing our

pipeline and accelerating innovation through focused execution of

our Forward, Faster

strategy.

- We are committed to

addressing the high unmet needs of patients through a growing cell

therapy and small molecule pipeline with breakthrough potential.

This includes more than 20 programs, with four assets in clinical

development across 11 indications, and more than 15 preclinical

programs in oncology and immunology.

- We achieved a major

regulatory milestone with the FDA clearance of the Investigational

New Drug (IND) application for the Phase 1/2 ATALANTA-1 study of

our CD19 CAR-T candidate, GLPG5101, in relapsed/refractory

non-Hodgkin lymphoma (R/R NHL), marking an important step forward

in our cell therapy pipeline using our innovative decentralized

manufacturing platform.

- We resumed recruitment in

the Phase 1/2 PAPILIO-1 study with our BCMA CAR-T candidate,

GLPG5301, in relapsed/refractory multiple myeloma (R/R

MM).

- As part of our

collaboration agreement with Blood Centers of America (BCA), we

selected Excellos in the San Diego area as the first decentralized

manufacturing unit (DMU) within BCA’s nationwide network to

manufacture GLPG5101 for the ATALANTA-1 study sites in the

region.

- We further advanced our

early-stage proprietary pipeline and progressed a next-generation

armed, bispecific CAR-T candidate in hemato-oncology and a

potential best-in-class small molecule candidate in immunology into

IND-enabling studies, targeting clinical development in

2025-2026.

- We have €3.3 billion in

cash and financial investments as of September 30, 2024, supporting

our pipeline. We reconfirm the full-year 2024 cash

burni guidance of €370 million to

€410 million.

Webcast

presentation on October

31,

2024, at

13:00

CET / 8:00

am

ET, www.glpg.com

Mechelen, Belgium; October 30, 2024,

21:01 CET; regulated information – Galapagos NV (Euronext &

NASDAQ: GLPG) today announced financial results

for the first nine months of 2024 and provided a business

update.

“I am proud of our team’s commitment in

executing our Forward, Faster strategy,” said Paul Stoffels1, MD,

Galapagos’ CEO and Chair of the Board of Directors. “The FDA's

clearance of the ATALANTA-1 study of GLPG5101, produced on our

decentralized manufacturing platform in patients with

relapsed/refractory non-Hodgkin lymphoma, marks a pivotal step

towards realizing our vision of transforming patient outcomes

through life-changing science and innovation. This is the

first-ever FDA clearance for a clinical study in the U.S. with a

fresh CAR-T product candidate delivered in a median vein-to-vein

time of seven days. We remain focused on advancing our clinical

pipeline in 11 indications and our potential best-in-class

early-stage programs across multiple modalities and

indications.”

“With more than 20 active cell therapy and small

molecule programs in oncology and immunology, we are accelerating

our internal pipeline while we continue to assess business

development opportunities. We reaffirm our 2024 cash burn guidance

in the range of €370-410 million,” Thad Huston, Galapagos’ CFO and

COO, added.

Third quarter and recent business

highlights and anticipated milestonesRegulatory

and pipeline:

- The investigational new drug (IND)

application for the Phase 1/2 ATALANTA-1 study of our CD19

candidate, GLPG5101, in R/R NHL has been cleared by the U.S. Food

and Drug Administration (FDA) and our goal is to activate clinical

study sites and start enrolling patients in the U.S. before the end

of 2024.

- We expect to submit an IND in early

2025 for the Phase 1/2 EUPLAGIA-1 study in relapsed/refractory

chronic lymphocytic leukemia (R/R CLL) and Richter transformation

(RT) of our CD19 CAR-T candidate, GLPG5201.

- Following the submission of a

Clinical Trial Application (CTA) to the European Medicines Agency

(EMA) for the Phase 2 dose expansion study of GLPG5201 in R/R CLL

and RT, we aim to start enrolling patients in 2025.

- We resumed enrolment in the Phase

1/2 PAPILIO-1 study of our BCMA CAR-T candidate, GLPG5301, in R/R

MM.

- We will present new data from the

ATALANTA-1 and EUPLAGIA-1 studies along with pre-clinical data for

uza-cel, our TCR-T cell therapy candidate produced on our

decentralized manufacturing platform in collaboration with

Adaptimmune, at the American Society of Hematology (ASH) Annual

Meeting in December.

- We continued enrolling patients in

the ongoing Phase 2 GALARISSO study in dermatomyositis (DM) and the

Phase 2 GALACELA study in systemic lupus erythematosus (SLE) with

our oral small molecule TYK2 inhibitor, GLPG3667.

- We further advanced our early-stage

proprietary pipeline and progressed a next-generation armed,

bispecific CAR-T candidate in hemato-oncology and a potential

best-in-class small molecule candidate in immunology into

IND-enabling studies, targeting clinical development in

2025-2026.

- We are accelerating our early-stage

pipeline of more than 15 programs in oncology and immunology with

the objective of launching at least four IND/CTA-enabling studies

in 2025 across different modalities and indications. From 2026

onward, our ambition is to fuel the clinical pipeline with at least

two new clinical assets annually in various indications and across

our cell therapy and small molecule portfolio.

Operational:

- As part of our collaboration

agreement with Blood Centers of America (BCA), we selected Excellos

in the San Diego area as the first decentralized manufacturing unit

(DMU) within BCA’s nationwide network to manufacture GLPG5101 for

the ATALANTA-1 study sites in the region.

- We continue to expand our DMU

network in Europe and the U.S. to manufacture our cell therapy

candidates for clinical development and to support pivotal and

commercial readiness.

External innovation:

- We are exploring strategic

partnerships, early-stage research collaborations, licensing, and

bolt-on acquisitions in areas of high unmet medical need to

accelerate our cell therapy and small molecule pipeline in oncology

and immunology.

Corporate:

- The Board of Directors appointed

Mr. Oleg Nodelman as Non-Executive Non-Independent Director by way

of co-optation effective October 7, 2024, replacing Dr. Dan Baker

who stepped down on October 6, 2024.

Financial

performanceKey figures for the first nine months

of 2024 (consolidated)(€ millions, except basic &

diluted earnings per share)

|

|

Nine months ended September 30 |

% Change |

|

|

2024 |

2023 |

|

Supply revenues |

19.1 |

- |

|

|

Collaboration revenues |

181.0 |

179.8 |

+1% |

|

Total net revenues |

200.1 |

179.8 |

+11% |

|

Cost of sales |

(19.1) |

- |

|

|

R&D expenses |

(238.2) |

(167.2) |

+42% |

|

G&Aii and S&Miii expenses |

(93.2) |

(87.4) |

+7% |

|

Other operating income |

24.8 |

32.9 |

-25% |

|

Operating loss |

(125.6) |

(41.9) |

|

|

Fair value adjustments and net exchange differences |

31.8 |

36.3 |

-12% |

|

Net other financial result |

71.7 |

54.0 |

+33% |

|

Income taxes |

1.7 |

(12.2) |

|

|

Net profit/loss (-) from continuing

operations |

(20.4) |

36.2 |

|

|

Net profit from discontinued operations, net of tax |

69.2 |

17.9 |

|

|

Net profit of the period |

48.8 |

54.1 |

|

|

Basic and diluted earnings per share (€) |

0.7 |

0.8 |

|

|

Current financial investments, cash & cash

equivalents |

3,338.8 |

3,811.7 |

|

DETAILS OF THE FINANCIAL RESULTS FOR THE

FIRST NINE MONTHS OF 2024As a consequence of the transfer

of our Jyseleca® business to Alfasigma, the revenues and costs

related to Jyseleca® for the first nine months of 2024 are

presented separately from the results of our continuing operations

in the line ‘Net profit from discontinued operations, net of tax’

in our consolidated income statement. The comparative first nine

months of 2023 have been restated accordingly for the presentation

of the results related to the Jyseleca® business.

Results from our continuing

operationsTotal operating loss from continuing

operations for the nine months ended September 30, 2024,

was €125.6 million, compared to an operating loss of €41.9 million

for the nine months ended September 30, 2023.

- Total net revenues

for the nine months ended September 30, 2024, amounted to €200.1

million, compared to €179.8 million for the nine months ended

September 30, 2023. The revenue recognition related to the

exclusive access rights granted to Gilead for our drug discovery

platform amounted to €172.7 million for the first nine months of

both 2024 and 2023. Our deferred income balance on September 30,

2024, includes €1.1 billion allocated to our drug discovery

platform that is recognized linearly over the remaining period of

our 10-year collaboration.

- Cost of sales for

the nine months ended September 30, 2024, amounted to €19.1 million

and related to the supply of Jyseleca® to Alfasigma under the

transition agreement. The related revenues are reported in total

net revenues.

- R&D expenses

in the first nine months of 2024 amounted to €238.2 million,

compared to €167.2 million for the first nine months of 2023. This

increase was primarily explained by higher costs for cell therapy

and small molecule programs in oncology.

- G&A and

S&M expenses amounted to €93.2 million in

the first nine months of 2024, compared

to €87.4 million in the first nine months of

2023. This increase was primarily due to an increase in legal

and professional fees, mainly related to business development

activities and due to an increase in S&M expenses due to

investments in strategic marketing for oncology. Both increases

were partly offset by a decrease in G&A personnel expenses,

mainly due to a decreased cost for our subscription rights

plans.

- Other operating

income amounted to €24.8 million in the first nine months

of 2024, compared to €32.9 million for the same period last

year. This decrease is mainly driven by lower grants and R&D

incentives.

Net financial income in the

first nine months of 2024 amounted to €103.5 million, compared

to net financial income of €90.3 million for the first nine

months of 2023.

- Fair value adjustments and

net currency exchange results in the first nine months of

2024 amounted to €31.8 million, compared to fair value

adjustments and net currency exchange gains of €36.3 million

for the first nine months of 2023, and were primarily attributable

to €3.1 million of unrealized currency exchange losses on our cash

and cash equivalents and current financial investments at amortized

cost in U.S. dollars, and to €35.7 million of positive changes in

fair value of current financial investments.

- Net other financial

income in the first nine months of 2024 amounted to

€71.7 million, compared to net other financial income of

€54.0 million for the first nine months of 2023, and was

primarily attributable to €70.6 million of interest income, which

increased significantly due to the increase in interest rates.

Net tax income in the first

nine months of 2024 amounted to €1.7 million, compared to net

tax expenses of €12.2 million for the first nine months of

2023. The net tax expenses in 2023 were primarily due to the

re-assessment of net deferred tax liabilities and corporate income

tax payables as a result of a one-off intercompany

transaction.

Net loss from

continuing operations for the first nine months of 2024

was €20.4 million, compared to a net profit from continuing

operations of €36.2 million for the first nine months of

2023.Results from discontinued operations

(€

millions)

|

|

Nine months ended September 30 |

% Change |

|

|

2024 |

2023 |

|

Product net sales |

11.4 |

82.1 |

-86% |

|

Collaboration revenues |

26.0 |

187.0 |

-86% |

|

Total net revenues |

37.4 |

269.1 |

-86% |

|

Cost of sales |

(2.2) |

(13.5) |

-84% |

|

R&D expenses |

(13.6) |

(145.0) |

-91% |

|

G&A and S&M expenses |

(10.8) |

(94.7) |

-89% |

|

Other operating income |

55.2 |

7.1 |

|

|

Operating profit |

66.0 |

23.0 |

|

|

Net financial result |

3.3 |

(3.7) |

|

|

Income taxes |

(0.1) |

(1.4) |

|

|

Net profit from discontinued operations |

69.2 |

17.9 |

|

Total operating profit from discontinued

operations amounted to €66.0 million in the first nine

months of 2024, compared to an operating profit of €23.0 million in

the same period last year.

- Product net sales

of Jyseleca® in Europe were €11.4 million for the first nine months

of 2024 consisting of sales to customers in January 2024. Product

net sales to customers for the first nine months of 2023 amounted

to €82.1 million. As from February 1, 2024, all economics linked to

the sales of Jyseleca® in Europe are to the benefit of

Alfasigma.

- Collaboration

revenues for the development of filgotinib with Gilead

amounted to €26.0 million for the first nine months of 2024,

compared to €187.0 million for the same period last year. The sale

of the Jyseleca® business to Alfasigma on January 31, 2024, led to

the full recognition in revenue of the remaining deferred income

related to filgotinib.

- Cost of sales

related to Jyseleca® net sales were €2.2 million for the first nine

months of 2024. Cost of sales related to Jyseleca® net sales for

the first nine months of 2023 amounted to €13.5 million.

- R&D expenses

for the development of filgotinib for the first nine months of 2024

amounted to €13.6 million, compared to €145.0 million in

the first nine months of 2023. As from February 1, 2024, all

filgotinib development expenses still incurred during the

transition period are recharged to Alfasigma.

- G&A and

S&M expenses related to the Jyseleca® business

amounted to €10.8 million in the first nine months of

2024, compared to €94.7 million in the first nine

months of 2023. As from February 1, 2024, all remaining

G&A and S&M expenses relating to Jyseleca® are recharged to

Alfasigma.

- Other operating

income for the first nine months of 2024 amounted to €55.2

million (€7.1 million for the same period last year) and comprised

€52.3 million related to the gain on the sale of the Jyseleca®

business to Alfasigma. This result as of September 30, 2024, of the

transaction is considering the following elements:

- €50.0 million of upfront payment

received at closing of the transaction of which €40.0 million was

paid on an escrow account. This amount will be kept in escrow for a

period of one year after the closing date of January 31, 2024. We

gave customary representations and warranties which are capped and

limited in time (at September 30, 2024, this €40.0 million is

presented as “Escrow account” in our statement of financial

position).

-

€9.8 million of cash received from Alfasigma related to the closing

the transaction as well as €0.9 million of accrued negative

adjustment for the settlement of net cash and working capital.

-

€47.0 million of fair value on January 31, 2024, of the future

earn-outs payable by Alfasigma to us (the fair value of these

future earn-outs at September 30, 2024, is presented on the lines

“Non-current contingent consideration receivable” and “Trade and

other receivables”). As from February 1, 2024, we are entitled to

receive royalties on net sales of Jyseleca® in Europe from

Alfasigma.

-

€40.0 million of liability towards Alfasigma on January 31, 2024,

for R&D cost contributions of which €15.0 million was paid in

the first nine months of 2024 (at September 30, 2024, €25.0 million

of liabilities for R&D cost contribution is presented in our

statement of financial position on the line “Trade and other

liabilities”).

Net profit from discontinued

operations related to Jyseleca® amounted to €69.2 million for the

first nine months of 2024, compared to a net profit amounting to

€17.9 million for the first nine months of 2023.

Cash, cash equivalents and current

financial investments totaled €3,338.8 million as of

September 30, 2024, as compared to €3,684.5 million as of December

31, 2023. Total net decrease in cash and cash equivalents and

current financial investments amounted to €345.7 million during the

first nine months of 2024, compared to a net decrease of €282.4

million during the first nine months of 2023. This net decrease was

composed of (i) €321.3 million of operational cash burn including

€80.4 million cash impact of business development activities, (ii)

€36.9 million for the acquisition of financial assets held at fair

value through other comprehensive income, (iii) €26.2 million of

net cash in related to the sale of the Jyseleca® business to

Alfasigma of which €40.0 million has been transferred to an escrow

account, offset by (iv) €26.3 million of negative exchange rate

differences, positive changes in fair value of current financial

investments and variation in accrued interest income.

Financial guidanceAs of

September 30, 2024, we have €3.3 billion in cash and current

financial investments to continue to fund our proprietary pipeline

and pursue select, value-enhancing deals. We reiterate our cash

burn guidance, including business development year-to-date, for the

full year 2024, which is expected to be in the range of €370

million to €410 million.

Conference call and webcast

presentationWe will host a conference call and webcast

presentation on October 31, 2024, at 13:00 CET / 8:00 am ET. To

participate in the conference call, please register in advance

using this link. Dial-in numbers will be provided upon

registration. The conference call can be accessed 10 minutes prior

to the start of the call by using the conference access information

provided in the email received after registration, or by selecting

the “call me” feature.

The live webcast is available on glpg.com or via

the following link. The archived webcast will be available for

replay shortly after the close of the call on the investor section

of the website.

Expected

financial calendar 2025

|

February 12, 2025March 27, 2025April 23, 2025April 29, 2025July 23,

2025October 22, 2025 |

Full year 2024 resultsAnnual report 2024First quarter 2025

resultsAnnual Shareholders’ MeetingHalf-year 2025 resultsThird

quarter 2025 results |

(webcast: February 13, 2025) (webcast: April 24, 2025)

(webcast: July 24, 2025)(webcast: October 23, 2025) |

About Galapagos’

Forward, Faster Strategy Our

Forward, Faster strategy is focused on accelerating growth and

value creation by reimagining how we innovate and operate, driven

by our purpose to transform patient outcomes for more years of life

and quality of life across the globe. This strategy focuses on

three pillars:

- Patient-centric research and

development to address medical needs in our key therapeutic areas

of oncology and immunology.

- Build on our current capabilities

and de-risking R&D through multiple drug modalities, including

cell therapy, and by focusing on best-in-class validated targets

with shorter time-to-patient potential.

- Expanding business development

efforts to complement our pipeline, continuing to work with our

collaboration partner Gilead, to bring transformational medicines

to the broadest patient population possible.

About GalapagosWe are a

biotechnology company with operations in Europe and the U.S.

dedicated to transforming patient outcomes through life-changing

science and innovation for more years of life and quality of life.

Focusing on high unmet medical needs, we synergize compelling

science, technology, and collaborative approaches to create a deep

pipeline of best-in-class small molecules and cell therapies in

oncology and immunology. With capabilities from lab to patient,

including a decentralized cell therapy manufacturing platform, and

the financial strength to invest strategically for the near- and

long-term, we are committed to challenging the status quo and

delivering results for our patients, employees, and shareholders.

Our goal is not just to meet current medical needs but to

anticipate and shape the future of healthcare, ensuring that our

innovations reach those who need them most. For additional

information, please visit www.glpg.com or follow us

on LinkedIn or X.

For further information, please

contact:

| Media

inquiries:Srikant Ramaswami+1 412 699 0359 Marieke

Vermeersch +32 479 490 603 Jennifer

Wilson + 44 7539 359 676 media@glpg.com |

Investor

inquiries:Sofie Van Gijsel +1 781 296 1143Sandra

Cauwenberghs +32 495 58 46 63ir@glpg.com |

Forward-looking statementsThis

press release contains forward-looking statements, all of

which involve certain risks and uncertainties. These statements are

often, but are not always, made through the use of words

or phrases such as “believe,” “anticipate,” “plan,” “upcoming,”

“future,” “estimate,” “may,” “will,” “could,” “would,” “potential,”

“forward,” “goal,” “next,” “continue,” “should,” “encouraging,”

“aim,” “progress,” “remain,” “advance,” “ambition,” “outlook,”

“further,” as well as similar expressions. These statements

include, but are not limited to, the guidance from management

regarding our financial results (including guidance regarding the

expected operational use of cash for the fiscal year 2024),

statements regarding our regulatory outlook, statements regarding

the amount and timing of potential future milestones, including

potential milestone payments, statements regarding our R&D

plans, strategy and outlook, including progress on our

oncology or immunology portfolio, and our CAR-T-portfolio, and

potential changes of such plans, statements regarding our

pipeline and complementary technology platforms facilitating future

growth, statements regarding the expected timing, design and

readouts of ongoing and planned clinical trials, including but

not limited to (i) GLPG3667 in SLE and DM, (ii) GLPG5101 in R/R

NHL, (iii) GLPG5201 in R/R CLL and RT, and (iv) GLPG5301 in R/R

MM, statements regarding the potential attributes and

benefits of our product candidates, statements regarding our

commercialization efforts for our product candidates and any of our

future approved products, if any, statements about

potential future commercial manufacturing of T-cell therapies,

statements related to the IND application for the Phase 1/2

ATALANTA-1 study, statements related to the anticipated timing for

submissions to regulatory agencies, including any INDs or CTAs,

statements relating to the development of our distributed

manufacturing capabilities on a global basis, and statements

related to our portfolio goals and business plans. Galapagos

cautions the reader that forward-looking statements are based on

our management’s current expectations and

beliefs and are not guarantees of future

performance. Forward-looking statements may involve known and

unknown risks, uncertainties and other factors which might

cause our actual results, financial conditions and

liquidity, performance or achievements, or the industry

in which we operate, to be materially different from any

historic or future results, financial conditions and liquidity,

performance or achievements expressed or implied by such

forward-looking statements. In addition, even if our results,

performance, financial condition and liquidity, and the development

of the industry in which it operates are consistent with such

forward-looking statements, they may not be predictive of results

or developments in future periods. Such risks include, but are not

limited to, the risk that our expectations and management’s

guidance regarding our 2024 operating expenses, cash burn and other

financial estimates may be incorrect (including because

one or more of our assumptions

underlying our revenue and expense expectations may not

be realized), the risk that ongoing and future clinical trials

may not be completed in the currently envisaged timelines or at

all, the inherent risks and uncertainties associated with

competitive developments, clinical trials, recruitment of patients,

product development activities and regulatory approval requirements

(including the risk that data from our ongoing and

planned clinical research programs in DM, SLE, R/R NHL, R/R

CLL, RT, R/R MM and other immunologic and oncologic

indications or any other indications or diseases, may not

support registration or further development

of our product candidates due to safety or efficacy

concerns or other reasons), the risk that we may not be able

to realize the expected benefits from the appointment (by way of

co-optation) of the new Director, the risk that the preliminary and

topline data from our studies, including the ATALANTA-1, EUPLAGIA-1

and PAPILIO-1-studies, may not be reflective of the final data,

risks related to our reliance on collaborations with third

parties (including, but not limited to, our collaboration

partners Gilead, Lonza, Adaptimmune, BridGene Biosciences and Blood

Centers of America), the risk that the transfer of the Jyseleca®

business will not have the currently expected results for our

business and results of operations, the risk that our plans

with respect to our CAR-T programs may not be achieved on the

currently anticipated timeline or at all, the risk that our

estimates of the commercial potential of our product

candidates (if approved) or expectations regarding the costs and

revenues associated with any commercialization rights may be

inaccurate, the risk that we will not be able to continue

to execute on our currently contemplated business plan

and/or will revise our business plan, and risks

related to our strategic transformation, including the risk that we

may not achieve the anticipated benefits of such exercise on the

currently envisaged timeline or at all. A further list and

description of these risks, uncertainties and other risks can

be found in our filings and reports filed with

the Securities and Exchange Commission (SEC), including

in our most recent annual report on Form 20-F filed with

the SEC and our subsequent filings and reports filed with the SEC.

Given these risks and uncertainties, the reader is

advised not to place any undue reliance on such forward-looking

statements. In addition, even if the result of our

operations, financial condition and liquidity, or the industry in

which we operate are consistent with such forward-looking

statements, they may not be predictive of results, performance or

achievements in future periods. These forward-looking statements

speak only as of the date of publication of

this release. We expressly disclaim any obligation

to update any such forward-looking statements in

this release to reflect any change in our expectations or

any change in events, conditions or circumstances, unless

specifically required by law or regulation.

Addendum

Consolidated statements of income and

comprehensive income/loss (-) (unaudited)

Consolidated income

statement

|

|

Nine months endedSeptember

30 |

|

(thousands of €, except per share data) |

2024 |

2023 |

|

Supply revenues |

19,124 |

- |

|

Collaboration revenues |

181,030 |

179,784 |

|

Total net revenues |

200,154 |

179,784 |

|

Cost of sales |

(19,124) |

- |

|

Research and development expenses |

(238,270) |

(167,211) |

|

Sales and marketing expenses |

(10,177) |

(3,884) |

|

General and administrative expenses |

(83,013) |

(83,556) |

|

Other operating income |

24,813 |

32,950 |

|

Operating loss |

(125,617) |

(41,916) |

|

Fair value adjustments and net currency exchange differences |

31,762 |

36,251 |

|

Other financial income |

72,553 |

55,096 |

|

Other financial expenses |

(814) |

(1,056) |

|

Profit/loss (-) before tax |

(22,116) |

48,375 |

|

Income taxes |

1,710 |

(12,158) |

|

Net profit/loss (-) from continuing

operations |

(20,406) |

36,217 |

|

|

|

|

|

Net profit from discontinued operations, net of

tax |

69,181 |

17,921 |

|

|

|

|

|

Net profit |

48,775 |

54,138 |

|

Net profit attributable to: |

|

|

|

Owners of the parent |

48,775 |

54,138 |

|

Basic and diluted earnings per share |

0.74 |

0.82 |

|

Basic and diluted earnings/loss (-) per share from

continuing operations |

(0.31) |

0.55 |

Consolidated statement of comprehensive

income/loss (–)

|

|

Nine months endedSeptember

30 |

|

(thousands of €) |

2024 |

2023 |

|

Net profit |

48,775 |

54,138 |

|

Items that will not be reclassified subsequently to profit

or loss: |

|

|

|

Re-measurement of defined benefit obligation |

74 |

- |

|

Fair value adjustment financial assets held at fair value through

other comprehensive income |

(1,329) |

- |

|

Items that may be reclassified subsequently to profit or

loss: |

|

|

|

Translation differences, arisen from translating foreign

activities |

338 |

318 |

|

Realization of translation differences upon sale of foreign

operations |

4,095 |

- |

|

Other comprehensive income, net of income tax |

3,178 |

318 |

|

|

|

|

|

Total comprehensive income attributable to: |

|

|

|

Owners of the parent |

51,953 |

54,456 |

|

Total comprehensive income attributable to owners of the

parent arises from: |

|

|

|

Continuing operations |

(21,587) |

36,731 |

|

Discontinued operations |

73,540 |

17,725 |

|

Total comprehensive income, net of income tax |

51,953 |

54,456 |

Consolidated statement of financial

position (unaudited)

|

(thousands of €) |

September 30, 2024 |

December 31, 2023 |

|

Assets |

|

|

|

Goodwill |

69,465 |

69,557 |

|

Intangible assets other than goodwill |

173,431 |

127,906 |

|

Property, plant and equipment |

132,234 |

126,321 |

|

Deferred tax assets |

1,153 |

1,126 |

|

Non-current R&D incentives receivables |

133,401 |

141,252 |

|

Non-current contingent consideration receivable |

42,726 |

- |

|

Equity investments |

49,125 |

13,575 |

|

Other non-current assets |

11,239 |

16,069 |

|

Non-current assets |

612,774 |

495,807 |

|

Inventories |

65,563 |

73,978 |

|

Trade and other receivables |

45,426 |

28,449 |

|

Current R&D incentives receivables |

41,801 |

37,436 |

|

Current financial investments |

3,283,256 |

3,517,698 |

|

Cash and cash equivalents |

55,523 |

166,803 |

|

Escrow account |

40,880 |

- |

|

Other current assets |

26,979 |

15,140 |

|

Current assets from continuing operations |

3,559,428 |

3,839,504 |

|

Assets in disposal group classified as held for sale |

- |

22,085 |

|

Total current assets |

3,559,428 |

3,861,589 |

|

Total assets |

4,172,202 |

4,357,396 |

|

|

|

|

|

Equity and liabilities |

|

|

|

Share capital |

293,937 |

293,937 |

|

Share premium account |

2,736,994 |

2,736,994 |

|

Other reserves |

(7,041) |

(5,890) |

|

Translation differences |

3,128 |

(1,201) |

|

Accumulated losses |

(164,448) |

(228,274) |

|

Total equity |

2,862,570 |

2,795,566 |

|

Retirement benefit liabilities |

2,291 |

2,293 |

|

Deferred tax liabilities |

20,966 |

23,607 |

|

Non-current lease liabilities |

7,240 |

4,944 |

|

Other non-current liabilities |

30,904 |

31,570 |

|

Non-current deferred income |

896,999 |

1,071,193 |

|

Non-current liabilities |

958,400 |

1,133,607 |

|

Current lease liabilities |

4,225 |

4,652 |

|

Trade and other liabilities |

115,858 |

135,201 |

|

Current tax payable |

216 |

56 |

|

Current deferred income |

230,933 |

256,270 |

|

Current liabilities from continuing

operations |

351,232 |

396,179 |

|

Liabilities directly associated with assets in disposal group

classified as held for sale |

- |

32,044 |

|

Total current liabilities |

351,232 |

428,223 |

|

Total liabilities |

1,309,632 |

1,561,830 |

|

Total equity and liabilities |

4,172,202 |

4,357,396 |

Consolidated cash flow statements

(unaudited)

|

|

Nine months endedSeptember

30 |

|

(thousands of €) |

2024 |

2023 |

|

Net profit of the period |

48,775 |

54,138 |

|

Adjustment for non-cash transactions |

24,291 |

44,344 |

|

Adjustment for items to disclose separately under operating cash

flow |

(71,525) |

(40,165) |

|

Adjustment for items to disclose under investing and financing cash

flows |

(68,206) |

(11,809) |

|

Change in working capital other than deferred income |

(50,804) |

(50,329) |

|

Cash used for other liabilities related to the sale of

subsidiaries |

(3,598) |

- |

|

Decrease in deferred income |

(198,927) |

(359,259) |

|

Cash used in operations |

(319,994) |

(363,081) |

|

Interest paid |

(592) |

(3,729) |

|

Interest received |

60,523 |

35,063 |

|

Corporate taxes paid |

(594) |

(7,357) |

|

Net cash flows used in operating activities |

(260,657) |

(339,104) |

|

Purchase of property, plant and equipment |

(11,300) |

(11,073) |

|

Purchase of and expenditure in intangible fixed assets |

(65,110) |

(222) |

|

Proceeds from disposal of property, plant and equipment |

- |

2,304 |

|

Purchase of current financial investments |

(2,021,246) |

(2,615,112) |

|

Investment income received related to current financial

investments |

15,511 |

9,857 |

|

Sale of current financial investments |

2,281,471 |

2,609,023 |

|

Cash out from sale of subsidiaries, net of cash disposed |

(10,209) |

- |

|

Acquisition of financial assets held at fair value through other

comprehensive income |

(36,880) |

- |

|

Net cash flows generated from/used in (-) investing

activities |

152,237 |

(5,222) |

|

Payment of lease liabilities |

(3,320) |

(5,580) |

|

Proceeds from capital and share premium increases from exercise of

subscription rights |

- |

1,770 |

|

Net cash flows used in financing activities |

(3,320) |

(3,810) |

|

|

|

|

|

Decrease in cash and cash equivalents |

(111,740) |

(348,136) |

|

|

|

|

|

Cash and cash equivalents at beginning of the

year |

166,810 |

508,117 |

|

Decrease in cash and cash equivalents |

(111,740) |

(348,136) |

|

Effect of exchange rate differences on cash and cash

equivalents |

453 |

(607) |

|

Cash and cash equivalents at end of the

period |

55,523 |

159,375 |

Consolidated statements of changes in

equity (unaudited)

|

(thousands of €) |

Share capital |

Share premium account |

Translation differences |

Other reserves |

Accumulated losses |

Total |

|

On January 1, 2023 |

293,604 |

2,735,557 |

(1,593) |

(4,853) |

(496,689) |

2,526,026 |

|

Net profit |

|

|

|

|

54,138 |

54,138 |

|

Other comprehensive income/loss (-) |

|

|

397 |

(79) |

|

318 |

|

Total comprehensive income/loss (-) |

|

|

397 |

(79) |

54,138 |

54,456 |

|

Share-based compensation |

|

|

|

|

39,308 |

39,308 |

|

Exercise of subscription rights |

333 |

1,437 |

|

|

|

1,770 |

|

On September 30, 2023 |

293,937 |

2,736,994 |

(1,196) |

(4,932) |

(403,242) |

2,621,560 |

|

|

|

|

|

|

|

|

|

On January 1, 2024 |

293,937 |

2,736,994 |

(1,201) |

(5,890) |

(228,274) |

2,795,566 |

|

Net profit |

|

|

|

|

48,775 |

48,775 |

|

Other comprehensive income/loss (-) |

|

|

4,329 |

(1,151) |

|

3,178 |

|

Total comprehensive income/loss (-) |

|

|

4,329 |

(1,151) |

48,775 |

51,953 |

|

Share-based compensation |

|

|

|

|

15,051 |

15,051 |

|

On September 30, 2024 |

293,937 |

2,736,994 |

3,128 |

(7,041) |

(164,448) |

2,862,570 |

1 Throughout this press release, ‘Dr. Paul

Stoffels’ should be read as ‘Dr. Paul Stoffels, acting via Stoffels

IMC BV’.

i The operational cash burn (or operational cash

flow if this liquidity measure is positive) is equal to the

increase or decrease in our cash and cash equivalents (excluding

the effect of exchange rate differences on cash and cash

equivalents), minus:• the net proceeds, if any, from share capital

and share premium increases included in the net cash flows

generated from/used in (-) financing activities• the net proceeds

or cash used, if any, related to the acquisitions or disposals of

businesses; the acquisition of financial assets held at fair value

through other comprehensive income; the movement in restricted cash

and movement in current financial investments, if any, the cash

advances and loans given to third parties, if any, included in the

net cash flows generated from/used in (-) investing activities• the

cash used for other liabilities related to the acquisition or

disposal of businesses, if any, included in the net cash flows

generated from/used in (-) operating activities.This alternative

liquidity measure is in our view an important metric for a biotech

company in the development stage. The operational cash burn for the

first nine months of 2024 amounted to €321.3 million and can be

reconciled to our cash flow statement by considering the decrease

in cash and cash equivalents of €111.8 million, adjusted by (i) the

net sale of current financial investments amounting to €260.2

million, (ii) the cash-out related to the sale of subsidiaries of

€13.8 million, and (iii) the acquisition of financial assets held

at fair value through other comprehensive income of €36.9

million.ii General and administrativeiii Sales and marketing

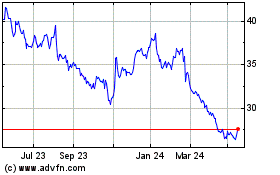

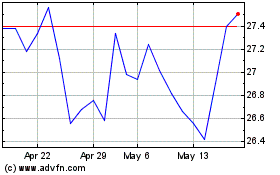

- Galapagos Reports Third Quarter 2024 Financial Results and

Provides Business Update

Galapagos (EU:GLPG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Galapagos (EU:GLPG)

Historical Stock Chart

From Feb 2024 to Feb 2025