false000144419200014441922024-08-092024-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 09, 2024 |

ACASTI PHARMA INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Quebec |

001-35776 |

98-1359336 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

103 Carnegie Center Suite 300 |

|

Princeton, New Jersey |

|

08540 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 818 839-4378 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Shares, no par value per share |

|

ACST |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The following information is furnished pursuant to Item 2.02 "Results of Operations and Financial Condition."

On August 9, 2024, Acasti Pharma Inc. issued a press release announcing its financial results for the fiscal quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

The information in this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such a filing or document.

Item 9.01 Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ACASTI PHARMA INC. |

|

|

|

|

Date: |

August 9, 2024 |

By: |

/s/ Prashant Kohli |

|

|

|

Prashant Kohli

Chief Executive Officer |

Exhibit 99.1

Exhibit 99.1

Acasti Announces First Fiscal Quarter 2025 Financial Results, Provides Business Update

•Surpassed 50% Enrollment Milestone in Pivotal Phase 3 STRIVE-ON Safety Trial of GTX-104

•Company Anticipates Completion of Patient Enrollment in the STRIVE-ON Trial in Late 2024 to Early 2025, with NDA Submission on Track for 1H Calendar 2025

•Projected Cash Runway into Second Calendar Quarter 2026

Princeton, NJ, August 9, 2024 (GLOBE NEWSWIRE)-- Acasti Pharma Inc. (Nasdaq: ACST) (Acasti or the Company), a late-stage, biopharma company advancing GTX-104, its novel injectable formulation of nimodipine that addresses high unmet medical needs for a rare disease, aneurysmal subarachnoid hemorrhage (aSAH), today announced financial results and business highlights for the quarter ended June 30, 2024.

“As a result of unrelenting focus on patient enrollment by the Acasti team and participating clinical trial sites, we surpassed the 50% enrollment milestone in our Phase 3 STRIVE-ON safety trial (the STRIVE-ON trial–NCT05995405),” said Prashant Kohli, CEO of Acasti. “Investigators continue to be very enthusiastic about the potential of GTX-104 for the treatment of aSAH. These patients require intensive management and present with a variety of complications that make consistent administration of oral nimodipine difficult, and GTX-104 may provide an effective IV alternative to the current standard of care. Based on enrollment trends and ongoing engagement with investigators, we anticipate randomizing all 100 patients in late 2024 to early 2025. We believe that the STRIVE-ON trial is on track for a potential New Drug Application (NDA) submission to the U.S. Food and Drug Administration (FDA) in the first half of calendar 2025.”

First Fiscal Quarter 2025 Highlights

•Pivotal Phase 3 STRIVE-ON safety trial surpassed the 50% enrollment milestone.

•100% patient enrollment of STRIVE-ON trial projected for late calendar 2024 or early 2025.

•NDA submission to FDA for GTX-104 anticipated in the first half of calendar 2025.

•Conducted a meeting of STRIVE-ON trial investigators in April 2024.

First Fiscal Quarter 2025 Financial Results

The Company reported a net loss of $2.6 million, or $0.24 loss per share, for the quarter ended June 30, 2024, a decrease of $1.4 million from the net loss of $4.0 million or $0.54 per share for the quarter ended June 30, 2023. The decrease in net loss was primarily due to restructuring costs of $1.5 million during the three months ended June 30, 2023 and a $1.4 million decrease to the fair value of our derivative warrant liabilities, offset in part by a $1.6 million increase in research and development expenses.

Total research and development expenses for the quarter ended June 30, 2024 were $2.7 million, compared to $1.1 million for the quarter ended June 30, 2023. This increase of $1.6 million was primarily due to the increase in our research activities for our GTX-104 pivotal Phase 3 STRIVE-ON safety clinical trial.

Exhibit 99.1

Exhibit 99.1

General and administrative expenses were $2.3 million for the quarter ended June 30, 2024, an increase of $0.4 million from $1.9 million for the year quarter ended June 30, 2023. The increase was primarily a result of increased legal, tax, accounting and other professional fees related to the proposed change in the jurisdiction of incorporation of Acasti from the Province of Québec in Canada to the State of Delaware in the United States.

At June 30, 2024 the Company had cash and cash equivalents of $19.4 million, as compared to $23.0 million, as of March 31, 2024. The Company believes it has sufficient cash to support operations into the second calendar quarter of 2026.

About aneurysmal Subarachnoid Hemorrhage (aSAH)

aSAH is bleeding over the surface of the brain in the subarachnoid space between the brain and the skull, which contains blood vessels that supply the brain. A primary cause of such bleeding is the rupture of an aneurysm. Approximately 70% of aSAH patients experience death or dependence, and more than 30% die within one month of hemorrhage. Approximately 50,000 patients in the United States are affected by aSAH per year, based on market research. Outside of the United States, annual cases of aSAH are estimated at approximately 60,000 in the European Union, and approximately 150,000 in China.

About the Acasti Asset Portfolio

GTX-104 is a clinical stage, novel, injectable formulation of nimodipine being developed for intravenous (IV) infusion in aSAH patients to address significant unmet medical needs. The unique nanoparticle technology of GTX-104 facilitates aqueous formulation of insoluble nimodipine for a standard peripheral IV infusion.

GTX-104 provides a convenient IV delivery of nimodipine in the Intensive Care Unit potentially eliminating the need for nasogastric tube administration in unconscious or dysphagic patients. Intravenous delivery of GTX-104 also has the potential to lower food effects, drug-to-drug interactions, and eliminate potential dosing errors. Further, GTX-104 has the potential to better manage hypotension in aSAH patients. GTX-104 has been administered in over 150 healthy volunteers and was well tolerated with significantly lower inter- and intra-subject pharmacokinetic variability compared to oral nimodipine. The addressable market in the United States for GTX-104 is estimated to be about $300 million, based on market research.

GTX-102 is a novel, concentrated oral-mucosal spray of betamethasone intended to improve neurological symptoms of Ataxia-Telangiectasia (A-T), for which there are currently no FDA-approved therapies. GTX-102 is a stable, concentrated oral spray formulation comprised of the gluco-corticosteroid betamethasone that, together with other excipients can be sprayed conveniently over the tongue of the A-T patient and is rapidly absorbed. The further development of GTX-102 has been deprioritized in favor of our focus on development of GTX-104. It is also possible that we may license or sell our GTX-102 drug candidate.

GTX-101 is a non-narcotic, topical bio-adhesive film-forming bupivacaine spray designed to ease the symptoms of patients suffering with postherpetic neuralgia (PHN). GTX-101 is administered via a metered-dose of bupivacaine spray and forms a thin bio-adhesive topical film on the surface of the patient’s skin, which enables a touch-free, non-greasy application. It also comes in convenient, portable 30 ml plastic bottles. Unlike oral gabapentin and lidocaine patches, we believe that the biphasic delivery mechanism of GTX-101 has the potential for rapid onset of action and continuous pain relief for up to eight hours. No skin sensitivity was reported in a Phase 1 trial. The further development of GTX-101 has been deprioritized in favor of our focus on development of GTX-104. It is also possible that we may license or sell our GTX-101 drug candidate.

About Acasti

Exhibit 99.1

Exhibit 99.1

Acasti is a late-stage biopharma company with drug candidates addressing rare and orphan diseases. Acasti's novel drug delivery technologies have the potential to improve the performance of currently marketed drugs by achieving faster onset of action, enhanced efficacy, reduced side effects, and more convenient drug delivery. Acasti's lead clinical assets have each been granted Orphan Drug Designation by the FDA, which provides seven years of marketing exclusivity post-launch in the United States, and additional intellectual property protection with over 40 granted and pending patents. Acasti's lead clinical asset, GTX-104, is an intravenous infusion targeting aneurysmal Subarachnoid Hemorrhage (aSAH), a rare and life-threatening medical emergency in which bleeding occurs over the surface of the brain in the subarachnoid space between the brain and skull.

For more information, please visit: www.acasti.com.

Forward-Looking Statements

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, as amended, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and "forward-looking information" within the meaning of Canadian securities laws (collectively, "forward-looking statements"). Such forward looking statements involve known and unknown risks, uncertainties, and other factors that could cause the actual results of Acasti to be materially different from historical results or from any future results expressed or implied by such forward-looking statements. In addition to statements which explicitly describe such risks and uncertainties, readers are urged to consider statements containing the terms "believes," "belief," "expects," "intends," "anticipates," "estimates", "potential," "should," "may," "will," "plans," "continue", "targeted" or other similar expressions to be uncertain and forward-looking. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The forward-looking statements in this press release, including statements regarding the Company's anticipated cash runway, the timing of completing full patient enrollment in its Phase 3 STRIVE-ON safety trial of GTX-104, the timing of the Company’s planned NDA submission with the FDA in connection with the Company's Phase 3 STRIVE-ON safety trial, GTX-104’s commercial prospects; the size of the addressable market for GTX-104, the Company’s beliefs regarding the potential benefits of GTX-104, including GTX-104's potential to bring enhanced treatment options to patients suffering from aSAH, and the anticipated benefits and future development, license or sale of the Company's other drug candidates are based upon Acasti's current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, including, without limitation: (i) the success and timing of regulatory submissions of the Phase 3 STRIVE-ON safety trial for GTX-104; (ii) regulatory requirements or developments and the outcome and timing of the proposed NDA application for GTX-104; (iii) changes to clinical trial designs and regulatory pathways; (iv) legislative, regulatory, political and economic developments; and (v) actual costs associated with Acasti's clinical trials as compared to management's current expectations. The foregoing list of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors detailed in documents that have been and are filed by Acasti from time to time with the Securities and Exchange Commission and Canadian securities regulators. All forward-looking statements contained in this press release speak only as of the date on which they were made. Acasti undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by applicable securities laws.

For more information, please contact:

Acasti Contact:

Exhibit 99.1

Exhibit 99.1

Prashant Kohli

Chief Executive Officer

Tel: 450-686-4555

Email: info@acastipharma.com

www.acasti.com

Investor Relations:

LifeSci Advisors

Mike Moyer

Managing Director

Phone: 617-308-4306

Email: mmoyer@lifesciadvisors.com

---tables to follow---

Exhibit 99.1

Exhibit 99.1

ACASTI PHARMA INC.

Condensed Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

March 31,

2024 |

|

(Expressed in thousands except share data) |

|

$ |

|

|

$ |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

19,394 |

|

|

|

23,005 |

|

Short-term investments |

|

|

15 |

|

|

|

— |

|

Receivables |

|

|

398 |

|

|

|

722 |

|

Prepaid expenses |

|

|

622 |

|

|

|

283 |

|

Total current assets |

|

|

20,429 |

|

|

|

24,010 |

|

|

|

|

|

|

|

|

Equipment, net |

|

|

23 |

|

|

|

24 |

|

Intangible assets |

|

|

41,128 |

|

|

|

41,128 |

|

Goodwill |

|

|

8,138 |

|

|

|

8,138 |

|

Total assets |

|

|

69,718 |

|

|

|

73,300 |

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Trade and other payables |

|

|

2,600 |

|

|

|

1,684 |

|

Total current liabilities |

|

|

2,600 |

|

|

|

1,684 |

|

|

|

|

|

|

|

|

Derivative warrant liabilities |

|

|

2,964 |

|

|

|

4,359 |

|

Deferred tax liability |

|

|

4,790 |

|

|

|

5,514 |

|

Total liabilities |

|

|

10,354 |

|

|

|

11,557 |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

Class A common shares, no par value per share; unlimited shares authorized; 10,139,861 and 9,399,404 shares issued and outstanding as of June 30, 2024 and March 31, 2024, respectively |

|

|

261,038 |

|

|

|

261,038 |

|

Class B, C, D and E common shares, no par value per share; unlimited shares authorized; none issued and outstanding |

|

|

— |

|

|

|

— |

|

Additional paid-in capital |

|

|

18,100 |

|

|

|

17,862 |

|

Accumulated other comprehensive loss |

|

|

(6,038 |

) |

|

|

(6,038 |

) |

Accumulated deficit |

|

|

(213,736 |

) |

|

|

(211,119 |

) |

Total shareholders' equity |

|

|

59,364 |

|

|

|

61,743 |

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity |

|

|

69,718 |

|

|

|

73,300 |

|

Exhibit 99.1

Exhibit 99.1

ACASTI PHARMA INC.

Condensed Consolidated Statements of Loss and Comprehensive Loss

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

June 30,

2024 |

|

|

June 30,

2023 |

|

(Expressed in thousands, except share and per share data) |

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

Research and development expenses, net of government assistance |

|

|

(2,708 |

) |

|

|

(1,095 |

) |

General and administrative expenses |

|

|

(2,255 |

) |

|

|

(1,874 |

) |

Restructuring cost |

|

|

— |

|

|

|

(1,485 |

) |

Loss from operating activities |

|

|

(4,963 |

) |

|

|

(4,454 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange (loss) gain |

|

|

(8 |

) |

|

|

8 |

|

Change in fair value of derivative warrant liabilities |

|

|

1,395 |

|

|

|

— |

|

Interest income and other expense, net |

|

|

235 |

|

|

|

134 |

|

Total other income, net |

|

|

1,622 |

|

|

|

142 |

|

Loss before income tax recovery |

|

|

(3,341 |

) |

|

|

(4,312 |

) |

|

|

|

|

|

|

|

Income tax benefit |

|

|

724 |

|

|

|

289 |

|

|

|

|

|

|

|

|

Net loss and total comprehensive loss |

|

|

(2,617 |

) |

|

|

(4,023 |

) |

|

|

|

|

|

|

|

Basic and diluted loss per share |

|

|

(0.24 |

) |

|

|

(0.54 |

) |

|

|

|

|

|

|

|

Weighted-average number of shares outstanding |

|

|

10,928,543 |

|

|

|

7,435,533 |

|

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

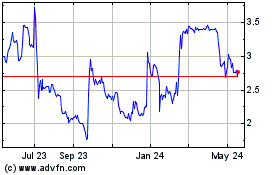

Acasti Pharma (NASDAQ:ACST)

Historical Stock Chart

From Jan 2025 to Feb 2025

Acasti Pharma (NASDAQ:ACST)

Historical Stock Chart

From Feb 2024 to Feb 2025