Dec 310001541157Q3falsetwo years0001541157aktx:EquityIncentivePlan2023And2014Membersrt:MaximumMember2024-01-012024-09-300001541157us-gaap:CommonStockMember2024-06-300001541157sic:Z88802024-01-012024-09-300001541157us-gaap:AdditionalPaidInCapitalMember2022-12-310001541157us-gaap:CommonStockMember2023-09-300001541157us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-09-3000015411572023-01-012023-03-310001541157dei:AdrMemberaktx:DrPrudoAndDrPatelMemberaktx:SeriesCWarrantsMemberus-gaap:PrivatePlacementMember2024-05-310001541157us-gaap:CommonStockMember2024-01-012024-09-3000015411572024-01-012024-03-310001541157aktx:EquityIncentivePlan2023And2014Member2023-12-310001541157sic:Z8880aktx:OctoberTwoThousandTwentyThreeInvestorPrefundedWarrantsMember2023-12-310001541157us-gaap:FairValueInputsLevel3Memberaktx:SeriesBWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001541157us-gaap:SubsequentEventMemberus-gaap:PrivatePlacementMemberaktx:AmericanDepositoryReceiptsMember2024-11-132024-11-130001541157sic:Z88802024-09-300001541157us-gaap:WarrantMember2024-09-300001541157aktx:SeriesDWarrantsMemberus-gaap:SubsequentEventMemberaktx:AmericanDepositoryReceiptsMember2024-11-132024-11-130001541157sic:Z8880aktx:May2024InvestorWarrantsMember2024-09-300001541157aktx:SeriesBWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2024-09-300001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001541157us-gaap:RestrictedStockUnitsRSUMemberaktx:EquityIncentivePlan2014Membersrt:MaximumMember2024-01-012024-09-300001541157us-gaap:CommonStockMember2023-04-012023-06-300001541157aktx:UnvestedStockOptionMember2024-09-300001541157us-gaap:MeasurementInputRiskFreeInterestRateMemberaktx:SeriesWarrantsMember2023-12-310001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001541157aktx:EquityIncentivePlan2023And2014Member2024-09-300001541157us-gaap:CommonStockMember2023-03-310001541157us-gaap:SubsequentEventMemberaktx:AmericanDepositoryReceiptsMember2024-11-140001541157sic:Z8880aktx:PlacementWarrants2019Member2024-09-300001541157aktx:SeriesDWarrantsMemberus-gaap:SubsequentEventMemberaktx:AmericanDepositoryReceiptsMember2024-11-120001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100015411572023-07-012023-09-300001541157us-gaap:CommonStockMember2023-12-310001541157aktx:FullyVestedOrdinarySharesMemberaktx:AmendmentInterimCEOAgreementMember2024-01-012024-09-300001541157us-gaap:RetainedEarningsMember2024-04-012024-06-300001541157us-gaap:RetainedEarningsMember2024-07-012024-09-300001541157aktx:DrPrudoAndDrPatelMemberus-gaap:SubsequentEventMember2024-11-132024-11-130001541157us-gaap:CapitalUnitsMember2023-09-300001541157sic:Z8880aktx:MarchTwoThousandTwentyFourPlacementAgentWarrantsMember2024-09-300001541157us-gaap:PatentsMember2024-07-012024-09-300001541157dei:AdrMemberaktx:SeriesCWarrantsMemberus-gaap:PrivatePlacementMember2024-05-3100015411572023-12-310001541157us-gaap:RetainedEarningsMember2023-03-310001541157us-gaap:CapitalUnitsMember2024-06-300001541157aktx:DirectorOrAffiliateMemberus-gaap:SubsequentEventMember2024-11-122024-11-120001541157us-gaap:CapitalUnitsMember2024-03-310001541157aktx:SeriesBWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001541157sic:Z8880aktx:InvestorWarrants2019Member2023-12-310001541157dei:AdrMemberus-gaap:PrivatePlacementMember2024-03-012024-03-310001541157dei:AdrMemberus-gaap:PrivatePlacementMember2024-05-312024-05-310001541157us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001541157us-gaap:SubsequentEventMemberus-gaap:ConvertibleDebtMemberaktx:AmericanDepositoryReceiptsMember2024-10-012024-10-3100015411572024-01-012024-09-300001541157us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-3000015411572024-04-012024-06-300001541157dei:AdrMemberus-gaap:PrivatePlacementMember2024-05-012024-05-310001541157aktx:SecurityExpiringOnNovemberSixTwoThousandMember2024-11-070001541157aktx:SeriesBWarrantsMember2024-09-300001541157us-gaap:WarrantMember2023-12-310001541157aktx:PeakCommonStockMemberus-gaap:SubsequentEventMember2024-11-140001541157us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001541157aktx:DoctorsLaboratoryMember2024-01-012024-09-300001541157dei:AdrMemberus-gaap:PrivatePlacementMember2023-12-012023-12-310001541157dei:AdrMemberus-gaap:PrivatePlacementMemberaktx:PreFundedWarrantsMember2023-09-012023-09-3000015411572023-04-012023-06-300001541157us-gaap:ConvertibleDebtMember2024-01-012024-09-300001541157us-gaap:ConvertibleDebtMember2024-05-100001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-3000015411572023-09-300001541157aktx:SeriesDWarrantsMemberus-gaap:SubsequentEventMemberaktx:AmericanDepositoryReceiptsMember2024-11-130001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001541157aktx:DoctorsLaboratoryMembersrt:MaximumMember2024-07-012024-09-300001541157aktx:OctoberTwoThousandTwentyThreeInvestorPrefundedWarrantsMembersic:Z88802024-09-300001541157sic:Z8880aktx:OctoberTwoThousandTwentyThreePlacementAgentWarrantsMember2024-09-300001541157us-gaap:WithdrawalFromMultiemployerDefinedBenefitPlanMember2024-01-012024-09-300001541157us-gaap:RetainedEarningsMember2023-09-3000015411572020-12-310001541157us-gaap:SubsequentEventMemberaktx:PaulsonMember2024-11-122024-11-120001541157sic:Z8880aktx:July2021PlacementAgentWarrantsMember2024-09-300001541157us-gaap:PatentsMember2023-01-012023-09-300001541157us-gaap:RelatedPartyMembersrt:MaximumMember2024-07-012024-09-300001541157aktx:WarrantsEquityClassifiedMember2024-01-012024-09-300001541157sic:Z8880aktx:March2022PlacementAgentWarrantsMember2023-12-310001541157aktx:EquityIncentivePlan2023And2014Membersrt:MaximumMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2024-01-012024-09-300001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001541157dei:AdrMemberaktx:RegisteredDirectOfferingMember2023-03-312023-03-3100015411572024-03-310001541157us-gaap:CommonStockMember2023-01-012023-03-310001541157us-gaap:CapitalUnitsMember2023-03-310001541157us-gaap:ResearchAndDevelopmentExpenseMember2024-07-012024-09-300001541157us-gaap:FairValueInputsLevel3Member2023-12-310001541157aktx:EquityIncentivePlan2023Memberus-gaap:SubsequentEventMember2024-11-072024-11-070001541157us-gaap:RelatedPartyMembersrt:MaximumMember2024-01-012024-09-300001541157sic:Z8880aktx:OctoberTwoThousandTwentyThreePlacementAgentWarrantsMember2023-12-310001541157us-gaap:RetainedEarningsMember2023-07-012023-09-300001541157us-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-300001541157aktx:SeriesWarrantsMember2024-01-012024-09-3000015411572024-05-012024-05-010001541157aktx:DrPrudoAndDrPatelMemberus-gaap:SubsequentEventMember2024-11-122024-11-1200015411572023-06-300001541157us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001541157sic:Z8880aktx:December2021InvestorWarrantsMember2024-09-300001541157us-gaap:RetainedEarningsMember2024-03-310001541157us-gaap:CapitalUnitsMember2024-09-300001541157dei:AdrMemberus-gaap:PrivatePlacementMember2023-09-300001541157us-gaap:PatentsMember2024-01-012024-09-300001541157aktx:EquityIncentivePlan2014Memberus-gaap:SubsequentEventMembersrt:MaximumMember2024-11-070001541157us-gaap:RestrictedStockUnitsRSUMember2024-09-300001541157sic:Z8880aktx:May2024PlacementAgentWarrantsMember2024-09-300001541157aktx:DoctorsLaboratoryMembersrt:MaximumMember2023-07-012023-09-300001541157us-gaap:RetainedEarningsMember2024-06-300001541157us-gaap:RelatedPartyMember2023-01-012023-09-300001541157us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001541157us-gaap:RestrictedStockUnitsRSUMember2023-12-310001541157us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001541157sic:Z8880aktx:March2022PlacementAgentWarrantsMember2024-09-300001541157dei:AdrMemberus-gaap:PrivatePlacementMember2024-03-310001541157us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001541157aktx:EquityIncentivePlan2023And2014Memberus-gaap:ShareBasedPaymentArrangementNonemployeeMember2024-01-012024-09-300001541157aktx:SeriesDWarrantsMemberus-gaap:SubsequentEventMember2024-11-120001541157us-gaap:RelatedPartyMembersrt:MaximumMember2023-07-012023-09-300001541157dei:AdrMemberaktx:SeriesCWarrantsMember2024-05-012024-05-310001541157aktx:AmendmentInterimCEOAgreementMember2024-01-012024-09-300001541157us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-300001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001541157us-gaap:AdditionalPaidInCapitalMember2023-09-300001541157aktx:MayTwoThousandTwentyFourPlanMember2024-01-012024-09-300001541157aktx:RestructuringAndOtherCostsMember2024-01-012024-09-300001541157us-gaap:CommonStockMember2023-07-012023-09-300001541157us-gaap:WithdrawalFromMultiemployerDefinedBenefitPlanMembersrt:MaximumMember2024-07-012024-09-300001541157us-gaap:CommonStockMember2024-03-310001541157us-gaap:RetainedEarningsMember2024-09-300001541157sic:Z8880aktx:September2022InvestorWarrantsMemberaktx:SeriesWarrantsMember2024-09-300001541157us-gaap:PatentsMember2024-09-300001541157us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001541157us-gaap:RestrictedStockUnitsRSUMemberaktx:EquityIncentivePlan2014Member2024-01-012024-09-300001541157sic:Z8880aktx:PlacementWarrants2020Member2024-09-300001541157aktx:UnvestedStockOptionMember2024-01-012024-09-300001541157sic:Z8880aktx:September2022InvestorWarrantsMemberaktx:SeriesBWarrantsMember2023-12-310001541157sic:Z8880aktx:December2021InvestorWarrantsMember2023-12-310001541157sic:Z8880aktx:PlacementWarrants2020Member2023-12-310001541157srt:MaximumMemberus-gaap:ConvertibleDebtMember2024-07-012024-09-300001541157sic:Z8880aktx:December2021PlacementAgentWarrantsMember2024-09-300001541157aktx:AmendmentInterimCEOAgreementMembersrt:MaximumMember2024-07-012024-09-300001541157aktx:ChardanMemberus-gaap:SubsequentEventMember2024-11-122024-11-120001541157us-gaap:MeasurementInputRiskFreeInterestRateMemberaktx:SeriesBWarrantsMember2024-09-300001541157us-gaap:CommonStockMember2024-01-012024-03-310001541157us-gaap:CommonStockMember2023-06-3000015411572024-09-300001541157us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300001541157sic:Z8880aktx:InvestorWarrants2020Member2023-12-310001541157us-gaap:CapitalUnitsMember2023-12-310001541157us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001541157sic:Z8880aktx:December2021PlacementAgentWarrantsMember2023-12-310001541157aktx:SeriesBWarrantsMember2023-12-310001541157us-gaap:FairValueMeasurementsRecurringMemberaktx:SeriesWarrantsMember2023-12-310001541157srt:MaximumMember2024-07-012024-09-300001541157us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001541157us-gaap:MeasurementInputPriceVolatilityMemberaktx:SeriesBWarrantsMember2023-12-310001541157us-gaap:SubsequentEventMember2024-11-0700015411572024-06-300001541157dei:AdrMemberus-gaap:PrivatePlacementMemberaktx:PreFundedWarrantsMember2023-09-300001541157aktx:EquityIncentivePlan2023And2014Member2024-01-012024-09-3000015411572024-07-012024-09-300001541157sic:Z8880us-gaap:SubsequentEventMember2024-11-140001541157us-gaap:FairValueInputsLevel3Memberaktx:SeriesBWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001541157aktx:SeriesBWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2023-12-310001541157aktx:PlacementAgentWarrantsMemberus-gaap:PrivatePlacementMember2023-09-012023-09-300001541157us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001541157srt:MaximumMemberus-gaap:ConvertibleDebtMember2024-01-012024-09-300001541157aktx:EquityIncentivePlan2023And2014Membersrt:MaximumMember2023-01-012023-09-300001541157us-gaap:WithdrawalFromMultiemployerDefinedBenefitPlanMember2023-01-012023-09-300001541157aktx:OrdinarySharesMemberus-gaap:SubsequentEventMember2024-11-140001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001541157sic:Z8880aktx:September2022InvestorWarrantsMemberaktx:SeriesBWarrantsMember2024-09-300001541157sic:Z88802023-12-310001541157srt:MaximumMember2023-07-012023-09-300001541157us-gaap:CommonStockMember2022-12-310001541157dei:AdrMemberus-gaap:PrivatePlacementMember2023-09-012023-09-300001541157aktx:OrdinarySharesMemberus-gaap:SubsequentEventMember2024-11-130001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001541157us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberaktx:SeriesWarrantsMember2023-12-310001541157aktx:SeriesBWarrantsMember2024-01-012024-09-300001541157us-gaap:OneTimeTerminationBenefitsMember2024-09-300001541157us-gaap:ConvertibleDebtMember2024-05-102024-05-100001541157aktx:OrdinarySharesMember2020-12-310001541157sic:Z8880aktx:September2022InvestorWarrantsMemberaktx:SeriesWarrantsMember2023-12-310001541157us-gaap:PatentsMember2023-07-012023-09-3000015411572024-02-290001541157aktx:PlacementAgentWarrantsMemberus-gaap:PrivatePlacementMember2024-03-012024-03-310001541157sic:Z8880aktx:July2021PlacementAgentWarrantsMember2023-12-310001541157us-gaap:RetainedEarningsMember2024-01-012024-03-310001541157us-gaap:SubsequentEventMemberaktx:AmericanDepositoryReceiptsMember2024-11-122024-11-120001541157sic:Z8880aktx:SeriesBWarrantsMemberaktx:RegisteredDirectOfferingMember2024-01-012024-09-300001541157aktx:SeriesWarrantsMember2023-12-310001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001541157aktx:MayTwoThousandTwentyFourPlanMembersrt:MaximumMember2024-07-012024-09-300001541157sic:Z88802023-01-012023-12-310001541157us-gaap:AdditionalPaidInCapitalMember2023-06-300001541157aktx:SeriesBWarrantsMemberus-gaap:MeasurementInputSharePriceMember2024-09-300001541157us-gaap:WarrantMember2024-01-012024-09-300001541157aktx:EquityIncentivePlan2014Membersrt:MaximumMember2023-06-300001541157aktx:AmendmentInterimCEOAgreementMembersrt:MaximumMember2024-01-012024-09-300001541157aktx:AmendmentInterimCEOAgreementMember2024-09-162024-09-160001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001541157aktx:SeriesWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-12-310001541157sic:Z8880aktx:March2022InvestorWarrantsMember2024-09-300001541157us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001541157us-gaap:SubsequentEventMemberus-gaap:ConvertibleDebtMember2024-10-012024-10-310001541157aktx:EquityIncentivePlan2023Member2024-09-300001541157aktx:FullyVestedOrdinarySharesMemberaktx:AmendmentInterimCEOAgreementMember2024-07-012024-09-300001541157us-gaap:CapitalUnitsMember2022-12-310001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001541157us-gaap:RelatedPartyMembersrt:MaximumMember2023-12-310001541157us-gaap:RetainedEarningsMember2023-12-310001541157us-gaap:MeasurementInputPriceVolatilityMemberaktx:SeriesBWarrantsMember2024-09-300001541157us-gaap:MeasurementInputRiskFreeInterestRateMemberaktx:SeriesBWarrantsMember2023-12-310001541157aktx:WarrantsEquityClassifiedMember2023-01-012023-09-300001541157aktx:AmendmentInterimCEOAgreementMember2024-07-012024-09-300001541157aktx:PlacementAgentWarrantsMemberus-gaap:PrivatePlacementMember2024-05-012024-05-310001541157us-gaap:AdditionalPaidInCapitalMember2024-03-310001541157us-gaap:CommonStockMember2024-07-012024-09-300001541157dei:AdrMemberaktx:OrdinarySharesMember2024-09-300001541157sic:Z8880aktx:InvestorWarrants2020Member2024-09-300001541157aktx:SeriesWarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-12-310001541157us-gaap:RestrictedStockUnitsRSUMemberaktx:EquityIncentivePlan2014Membersrt:MinimumMember2024-01-012024-09-300001541157us-gaap:RestrictedStockUnitsRSUMemberaktx:EquityIncentivePlan2014Member2023-01-012023-09-300001541157aktx:SeriesBWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001541157aktx:SeriesWarrantsMember2024-09-300001541157us-gaap:AdditionalPaidInCapitalMember2024-06-300001541157sic:Z8880aktx:RegisteredDirectOfferingMemberaktx:SeriesWarrantsMember2024-01-012024-09-300001541157aktx:InterimCeoAgreementMember2024-05-312024-05-310001541157us-gaap:RetainedEarningsMember2022-12-310001541157us-gaap:RetainedEarningsMember2023-06-300001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001541157us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001541157sic:Z8880us-gaap:SubsequentEventMemberus-gaap:ConvertibleDebtMember2024-10-012024-10-3100015411572023-01-012023-09-300001541157aktx:SeriesBWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-12-310001541157sic:Z8880aktx:March2022InvestorWarrantsMember2023-12-310001541157us-gaap:AdditionalPaidInCapitalMember2023-03-310001541157us-gaap:CapitalUnitsMember2023-06-300001541157dei:AdrMemberus-gaap:PrivatePlacementMember2024-05-3100015411572023-03-310001541157us-gaap:CommonStockMember2024-09-300001541157us-gaap:AdditionalPaidInCapitalMember2023-12-310001541157aktx:EquityIncentivePlan2014Member2024-09-300001541157us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001541157us-gaap:WithdrawalFromMultiemployerDefinedBenefitPlanMembersrt:MaximumMember2023-07-012023-09-300001541157us-gaap:ConvertibleDebtMembersrt:MaximumMember2024-09-300001541157us-gaap:CommonStockMember2024-04-012024-06-300001541157aktx:EquityIncentivePlan2023And2014Membersrt:MinimumMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2024-01-012024-09-300001541157us-gaap:RetainedEarningsMember2023-04-012023-06-300001541157us-gaap:RetainedEarningsMember2023-01-012023-03-310001541157aktx:SeriesBWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2024-09-300001541157aktx:SeriesBWarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-12-310001541157us-gaap:WithdrawalFromMultiemployerDefinedBenefitPlanMemberus-gaap:ForeignPlanMember2024-01-012024-09-300001541157us-gaap:MeasurementInputPriceVolatilityMemberaktx:SeriesWarrantsMember2023-12-310001541157us-gaap:FairValueInputsLevel3Member2024-09-300001541157dei:AdrMemberaktx:SeriesCWarrantsMember2024-05-310001541157us-gaap:ConvertibleDebtMember2024-01-012024-09-300001541157aktx:EquityIncentivePlan2023Memberus-gaap:SubsequentEventMembersrt:MaximumMember2024-11-070001541157aktx:EquityIncentivePlan2023And2014Member2023-01-012023-12-310001541157aktx:EquityIncentivePlan2023Membersrt:MaximumMember2023-06-300001541157us-gaap:EmployeeStockOptionMember2024-01-012024-09-300001541157us-gaap:RelatedPartyMembersrt:MaximumMember2024-09-3000015411572022-12-310001541157us-gaap:MeasurementInputExercisePriceMemberaktx:SeriesWarrantsMember2023-12-310001541157sic:Z8880aktx:PlacementWarrants2019Member2023-12-310001541157sic:Z8880aktx:InvestorWarrants2019Member2024-09-3000015411572024-11-150001541157us-gaap:AdditionalPaidInCapitalMember2024-09-30xbrli:purexbrli:sharesiso4217:GBPxbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ____________ to ____________ |

Commission File Number 001-36288

Akari Therapeutics, Plc

(Exact name of Registrant as specified in its Charter)

|

|

England and Wales |

98-1034922 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

22 Boston Wharf Road, FL 7 Boston, Massachusetts |

02210 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (929) 274-7510

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

American Depositary Shares, each representing 2,000 Ordinary Shares, par value $0.0001 per share |

|

AKTX |

|

The Nasdaq Capital Market |

Ordinary Shares, $0.0001 par value per share* |

|

|

|

The Nasdaq Capital Market |

* Trading, but only in connection with the American Depositary Shares.

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The number of shares of Registrant’s Ordinary Shares outstanding as of November 15, 2024 was 49,517,115,523.

TABLE OF CONTENTS

GENERAL INFORMATION

Unless otherwise stated or the context requires otherwise, references in this Quarterly Report on Form 10-Q ("Form 10-Q") to “Akari,” the “company,” the “Company,” “we,” “us,” “our” or similar designations refer to Akari Therapeutics, Plc and its subsidiaries, taken together. All trademarks, service marks, trade names and registered marks used in this report are trademarks, trade names or registered marks of their respective owners.

Statements made in this Quarterly Report on Form 10-Q concerning the contents of any agreement, contract or other document are summaries of such agreements, contracts or documents and are not complete description of all of their terms. If we filed any of these agreements, contracts or documents as exhibits to this Quarterly Report on Form 10-Q or to any previous filing with the Securities and Exchange Commission (“SEC”), you may read the document itself for a complete understanding of its terms.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q and the documents we incorporate by reference contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact, included or incorporated in this report regarding, among other things, our cash resources and projected cash runway, financial position, our strategy, strategic alternatives, future operations, clinical trials (including, without limitation, the anticipated timing enrollment, and results thereof), collaborations, intellectual property, future revenues, projected costs, fundraising and/or financing plans, prospects, developments relating to our competitors and our industry, the timing or likelihood of regulatory actions, filings and approvals for our current and future drug candidates, and the benefits related to the Merger Agreement (as defined below) and the plans and objectives of management are forward-looking statements. The words “believes,” “anticipates,” “estimates,” “plans,” “expects,” “intends,” “may,” “could,” “should,” “potential,” “likely,” “projects,” “intend,” “continue,” “will,” “schedule,” “would,” “aim,” “contemplate,” “estimate,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We cannot guarantee that we will actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties, and other factors, which may be beyond our control, and which may cause the actual results, performance, or achievements of the Company to be materially different from future results, performance, or achievements expressed or implied by such forward-looking statements.

There are a number of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking statements. These important factors include those set forth under Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 (our “Form 10-K”) and Part II “Item 1A. Risk Factors” of this Form 10-Q and in our other disclosures and filings we have made with the SEC. These factors and the other cautionary statements made in this Form 10-Q and the documents we incorporate by reference should be read as being applicable to all related forward-looking statements whenever they appear in this Form 10-Q and the documents we incorporate by reference.

In addition, any forward-looking statements represent our estimates only as of the date that this Form 10-Q is filed with the SEC and should not be relied upon as representing our estimates as of any subsequent date. All forward-looking statements included in this Form 10-Q are made as of the date hereof and are expressly qualified in their entirety by this cautionary notice. We disclaim any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as may be required by law.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

AKARI THERAPEUTICS, PLC

Condensed Consolidated Balance Sheets

(Unaudited, in U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

(In thousands, except share and per share amounts) |

|

2024 |

|

|

2023* |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash |

|

$ |

2,246 |

|

|

$ |

3,845 |

|

Prepaid expenses |

|

|

396 |

|

|

|

299 |

|

Other current assets |

|

|

92 |

|

|

|

197 |

|

Total current assets |

|

|

2,734 |

|

|

|

4,341 |

|

Patent acquisition costs, net |

|

|

— |

|

|

|

14 |

|

Total assets |

|

$ |

2,734 |

|

|

$ |

4,355 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ DEFICIT |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

4,782 |

|

|

$ |

1,671 |

|

Accrued expenses |

|

|

2,605 |

|

|

|

1,566 |

|

Convertible notes, related party |

|

|

1,000 |

|

|

|

— |

|

Warrant liability |

|

|

725 |

|

|

|

1,253 |

|

Other current liabilities |

|

|

316 |

|

|

|

94 |

|

Total current liabilities |

|

|

9,428 |

|

|

|

4,584 |

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ deficit: |

|

|

|

|

|

|

Share capital of $0.0001 par value |

|

|

|

|

|

|

Authorized: 45,122,321,523 ordinary shares at

September 30, 2024 and December 31, 2023, respectively;

issued and outstanding: 24,289,231,523 and 13,234,315,298 at

September 30, 2024 and December 31, 2023, respectively |

|

|

2,430 |

|

|

|

1,324 |

|

Additional paid-in capital |

|

|

183,088 |

|

|

|

174,754 |

|

Capital redemption reserve |

|

|

52,194 |

|

|

|

52,194 |

|

Accumulated other comprehensive loss |

|

|

(926 |

) |

|

|

(1,040 |

) |

Accumulated deficit |

|

|

(243,480 |

) |

|

|

(227,461 |

) |

Total shareholders’ deficit |

|

|

(6,694 |

) |

|

|

(229 |

) |

Total liabilities and shareholders' deficit |

|

$ |

2,734 |

|

|

$ |

4,355 |

|

———————

* The condensed balance sheet at December 31, 2023 has been derived from the audited consolidated financial statements at that date.

The accompanying notes are an integral part of these condensed consolidated financial statements.

AKARI THERAPEUTICS, PLC

Condensed Consolidated Statements of Operations

and Comprehensive Loss

(Unaudited, in U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

(In thousands, except share and per share amounts) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

143 |

|

|

$ |

(314 |

) |

|

$ |

5,736 |

|

|

$ |

2,941 |

|

General and administrative |

|

|

1,709 |

|

|

|

2,821 |

|

|

|

6,616 |

|

|

|

8,775 |

|

Merger-related costs |

|

|

992 |

|

|

|

— |

|

|

|

2,290 |

|

|

|

— |

|

Restructuring and other costs |

|

|

83 |

|

|

|

— |

|

|

|

1,723 |

|

|

|

— |

|

Loss from operations |

|

|

(2,927 |

) |

|

|

(2,507 |

) |

|

|

(16,365 |

) |

|

|

(11,716 |

) |

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

3 |

|

|

|

16 |

|

|

|

7 |

|

|

|

75 |

|

Interest expense |

|

|

(69 |

) |

|

|

— |

|

|

|

(120 |

) |

|

|

— |

|

Change in fair value of warrant liability |

|

|

30 |

|

|

|

(258 |

) |

|

|

528 |

|

|

|

5,889 |

|

Foreign currency exchange gain (loss), net |

|

|

68 |

|

|

|

(100 |

) |

|

|

(67 |

) |

|

|

(72 |

) |

Other expense, net |

|

|

— |

|

|

|

(22 |

) |

|

|

(2 |

) |

|

|

(46 |

) |

Total other income (expense), net |

|

|

32 |

|

|

|

(364 |

) |

|

|

346 |

|

|

|

5,846 |

|

Net loss |

|

$ |

(2,895 |

) |

|

$ |

(2,871 |

) |

|

$ |

(16,019 |

) |

|

$ |

(5,870 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share –– basic and diluted |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

Weighted-average number of ordinary shares used in computing net loss per share –– basic and diluted |

|

|

24,386,005,523 |

|

|

|

10,116,903,598 |

|

|

|

18,911,928,794 |

|

|

|

10,119,421,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,895 |

) |

|

$ |

(2,871 |

) |

|

$ |

(16,019 |

) |

|

$ |

(5,870 |

) |

Other comprehensive income, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

(177 |

) |

|

|

(3 |

) |

|

|

114 |

|

|

|

(58 |

) |

Total other comprehensive income, net of tax |

|

|

(177 |

) |

|

|

(3 |

) |

|

|

114 |

|

|

|

(58 |

) |

Total comprehensive loss |

|

$ |

(3,072 |

) |

|

$ |

(2,874 |

) |

|

$ |

(15,905 |

) |

|

$ |

(5,928 |

) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

AKARI THERAPEUTICS, PLC

Condensed Consolidated Statements of Changes in Shareholders’ Equity (Deficit)

(Unaudited, in U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

Capital |

|

|

Other |

|

|

|

|

|

Total |

|

|

|

Share Capital $0.0001 par value |

|

|

Paid-in- |

|

|

Redemption |

|

|

Comprehensive |

|

|

Accumulated |

|

|

Shareholders’ |

|

(In thousands, except share amounts) |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Reserve |

|

|

Loss |

|

|

Deficit |

|

|

Deficit |

|

Balance, December 31, 2023 |

|

|

13,234,315,298 |

|

|

$ |

1,324 |

|

|

$ |

174,754 |

|

|

$ |

52,194 |

|

|

$ |

(1,040 |

) |

|

$ |

(227,461 |

) |

|

$ |

(229 |

) |

Issuance of share capital related to

financing, net of issuance costs |

|

|

2,641,228,000 |

|

|

|

264 |

|

|

|

1,400 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,664 |

|

Vesting of restricted shares |

|

|

97,578,000 |

|

|

|

10 |

|

|

|

(7 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3 |

|

Share-based compensation |

|

|

— |

|

|

|

— |

|

|

|

296 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

296 |

|

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

279 |

|

|

|

— |

|

|

|

279 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,566 |

) |

|

|

(5,566 |

) |

Balance, March 31, 2024 |

|

|

15,973,121,298 |

|

|

$ |

1,598 |

|

|

$ |

176,443 |

|

|

$ |

52,194 |

|

|

$ |

(761 |

) |

|

$ |

(233,027 |

) |

|

$ |

(3,553 |

) |

Issuance of share capital related to

financing, net of issuance costs |

|

|

8,059,508,000 |

|

|

|

806 |

|

|

|

6,145 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,951 |

|

Issuance of share capital for services |

|

|

91,396,000 |

|

|

|

9 |

|

|

|

(9 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Vesting of restricted shares |

|

|

285,697,400 |

|

|

|

29 |

|

|

|

(29 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Shares withheld for payroll taxes |

|

|

(120,490,000 |

) |

|

|

(12 |

) |

|

|

12 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Share-based compensation |

|

|

— |

|

|

|

— |

|

|

|

445 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

445 |

|

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

12 |

|

|

|

— |

|

|

|

12 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,558 |

) |

|

|

(7,558 |

) |

Balance, June 30, 2024 |

|

|

24,289,232,698 |

|

|

$ |

2,430 |

|

|

$ |

183,007 |

|

|

$ |

52,194 |

|

|

$ |

(749 |

) |

|

$ |

(240,585 |

) |

|

$ |

(3,703 |

) |

Proceeds from issuance of restricted shares |

|

|

— |

|

|

|

— |

|

|

|

26 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

26 |

|

Shares withheld for payroll taxes |

|

|

(1,175 |

) |

|

|

— |

|

|

|

(193 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(193 |

) |

Share-based compensation |

|

|

— |

|

|

|

— |

|

|

|

248 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

248 |

|

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(177 |

) |

|

|

— |

|

|

|

(177 |

) |

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,895 |

) |

|

|

(2,895 |

) |

Balance, September 30, 2024 |

|

|

24,289,231,523 |

|

|

$ |

2,430 |

|

|

$ |

183,088 |

|

|

$ |

52,194 |

|

|

$ |

(926 |

) |

|

$ |

(243,480 |

) |

|

$ |

(6,694 |

) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

AKARI THERAPEUTICS, PLC

Condensed Consolidated Statements of Changes in Shareholders’ Equity (Deficit) (Continued)

(Unaudited, in U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

Capital |

|

|

Other |

|

|

|

|

|

Total |

|

|

|

Share Capital $0.0001 par value |

|

|

Paid-in- |

|

|

Redemption |

|

|

Comprehensive |

|

|

Accumulated |

|

|

Shareholders’ |

|

(In thousands, except share amounts) |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Reserve |

|

|

Loss |

|

|

Deficit |

|

|

Equity |

|

Balance, December 31, 2022 |

|

|

7,444,917,123 |

|

|

$ |

745 |

|

|

$ |

167,076 |

|

|

$ |

52,194 |

|

|

$ |

(771 |

) |

|

$ |

(217,453 |

) |

|

$ |

1,791 |

|

Issuance of share capital related to

financing, net of issuance costs |

|

|

2,666,666,700 |

|

|

|

267 |

|

|

|

3,235 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,502 |

|

Share-based compensation |

|

|

— |

|

|

|

— |

|

|

|

265 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

265 |

|

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

2 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,001 |

|

|

|

1,001 |

|

Balance, March 31, 2023 |

|

|

10,111,583,823 |

|

|

$ |

1,012 |

|

|

$ |

170,576 |

|

|

$ |

52,194 |

|

|

$ |

(769 |

) |

|

$ |

(216,452 |

) |

|

$ |

6,561 |

|

Vesting of restricted shares |

|

|

10,737,700 |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

Share-based compensation |

|

|

— |

|

|

|

— |

|

|

|

276 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

276 |

|

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(57 |

) |

|

|

— |

|

|

|

(57 |

) |

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,000 |

) |

|

|

(4,000 |

) |

Balance, June 30, 2023 |

|

|

10,122,321,523 |

|

|

$ |

1,013 |

|

|

$ |

170,852 |

|

|

$ |

52,194 |

|

|

$ |

(826 |

) |

|

$ |

(220,452 |

) |

|

$ |

2,781 |

|

Vesting of restricted shares |

|

|

2,684,400 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Share-based compensation |

|

|

— |

|

|

|

— |

|

|

|

305 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

305 |

|

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

|

(2 |

) |

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,871 |

) |

|

|

(2,871 |

) |

Balance, September 30, 2023 |

|

|

10,125,005,923 |

|

|

$ |

1,013 |

|

|

$ |

171,157 |

|

|

$ |

52,194 |

|

|

$ |

(828 |

) |

|

$ |

(223,323 |

) |

|

$ |

213 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

AKARI THERAPEUTICS, PLC

Condensed Consolidated Statements of Cash Flows

(Unaudited, in U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

September 30, |

|

(In thousands) |

|

2024 |

|

|

2023 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net loss |

|

$ |

(16,019 |

) |

|

$ |

(5,870 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

13 |

|

|

|

3 |

|

Share-based compensation |

|

|

989 |

|

|

|

846 |

|

Change in fair value of warrant liability |

|

|

(528 |

) |

|

|

(5,889 |

) |

Foreign currency exchange losses (gains) |

|

|

121 |

|

|

|

(54 |

) |

Change in assets and liabilities: |

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

1,114 |

|

|

|

(223 |

) |

Accounts payable and accrued expenses |

|

|

3,882 |

|

|

|

(836 |

) |

Net cash used in operating activities |

|

|

(10,428 |

) |

|

|

(12,023 |

) |

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from issuance of shares, net of issuance costs |

|

|

8,687 |

|

|

|

3,502 |

|

Proceeds from issuance of convertible notes |

|

|

1,000 |

|

|

|

— |

|

Proceeds from issuance of restricted shares |

|

|

29 |

|

|

|

1 |

|

Payments on short-term financing arrangement |

|

|

(882 |

) |

|

|

— |

|

Net cash provided by financing activities |

|

|

8,834 |

|

|

|

3,503 |

|

|

|

|

|

|

|

|

Effect of exchange rates on cash |

|

|

(5 |

) |

|

|

1 |

|

|

|

|

|

|

|

|

Net decrease in cash |

|

|

(1,599 |

) |

|

|

(8,519 |

) |

Cash at beginning of period |

|

|

3,845 |

|

|

|

13,250 |

|

Cash at end of period |

|

$ |

2,246 |

|

|

$ |

4,731 |

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF NONCASH ACTIVITIES: |

|

|

|

|

|

|

Financing costs in accrued expenses |

|

$ |

72 |

|

|

$ |

— |

|

Non-cash seller-financed purchases |

|

$ |

1,105 |

|

|

$ |

— |

|

Payroll taxes on share-based compensation in accrued expenses |

|

$ |

193 |

|

|

$ |

— |

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFO: |

|

|

|

|

|

|

Cash paid during the period for interest |

|

$ |

120 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

AKARI THERAPEUTICS, PLC

Notes to the Condensed Consolidated Financial Statements

(Unaudited)

Note 1. Description of Business

Business Overview

Akari Therapeutics, Plc, (the “Company” or “Akari”) is incorporated in the United Kingdom. The Company is a biotechnology company focused on developing advanced therapies for autoimmune and inflammatory diseases involving the complement component 5 (“C5”) and leukotriene B4 (“LTB4”) pathways. The Company’s activities since inception have consisted of performing research and development activities and raising capital.

The Company is subject to a number of risks similar to those of preclinical stage companies, including dependence on key individuals, uncertainty of product development and generation of revenues, dependence on outside sources of capital, risks associated with preclinical trials of products, dependence on third-party collaborators for research and development operations, need for marketing authorization of products, risks associated with protection of intellectual property, and competition with larger, better-capitalized companies.

To fully execute its business plan, the Company will need, among other things, to complete its research and development efforts and clinical and regulatory activities. These activities may take several years and will require significant operating and capital expenditures in the foreseeable future. There can be no assurance that these activities will be successful. If the Company is not successful in these activities it could delay, limit, reduce or terminate preclinical studies, clinical trials or other research and development activities.

Merger with Peak Bio

As further described in Note 10, on November 14, 2024, the Company closed the previously announced merger with Peak Bio, Inc. (“Peak Bio”). As a result, the Company expanded its pipeline of assets spanning early and late development stages with the addition of Peak Bio’s antibody drug conjugate (“ADC”) toolkit with novel payload and linker technologies as well as the Peak Bio PHP-303 small molecule selective and reversible neutrophil elastase inhibitor. By combining chemotherapy with immunotherapy strategies, the Company aims to develop cutting-edge solutions for cancer patients.

Liquidity and Financial Condition

The Company follows the provisions of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 205-40, Presentation of Financial Statements—Going Concern, which requires management to assess the Company’s ability to continue as a going concern within one year after the date the consolidated financial statements are issued.

The Company has incurred substantial losses and negative cash flows since inception and had an accumulated deficit of $243.5 million as of September 30, 2024. The Company’s cash balance of $2.2 million as of September 30, 2024 is not sufficient to fund its operations for the one-year period after the date these condensed consolidated financial statements are issued. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The condensed consolidated financial statements do not include any adjustments related to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of this uncertainty.

The Company anticipates incurring additional losses until such time, if ever, that it can generate significant sales of its product candidates currently in development. The Company is subject to a number of risks and uncertainties similar to those of other companies of the same size within the biotechnology industry, such as uncertainty of

clinical trial outcomes, uncertainty of additional funding, and history of operating losses. Substantial additional financing will be needed by the Company to fund its operations and to commercially develop its product candidates. Management is currently evaluating different strategies to obtain the required funding for future operations. These strategies may include, but are not limited to: product development financing, private placements and/or public offerings of equity and/or debt securities, and strategic research and development collaborations and/or similar arrangements. There can be no assurance that these future funding efforts will be successful.

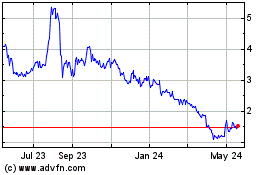

Nasdaq Continued Listing Rules

On April 5, 2024, the Company received a letter (“Letter”) from the Listing Qualifications Staff (the “Staff”) of The Nasdaq Capital Market (“Nasdaq”) notifying the Company that the Company’s shareholders’ equity as reported in its Form 10-K is no longer in compliance with the minimum shareholders’ equity requirement for continued listing on Nasdaq under Nasdaq Listing Rule 5550(b)(1), which requires listed companies to maintain shareholders’ equity of at least $2.5 million (the “Shareholders’ Equity Requirement”). As reported on the Form 10-K, the Company’s shareholders’ deficit as of December 31, 2023 was approximately $0.2 million. As of September 30, 2024, the Company had a shareholders' deficit of $6.7 million and was not in compliance with the Shareholders' Equity Requirement.

In accordance with the Nasdaq Listing Rules, on May 20, 2024, the Company submitted a plan to regain compliance with the Stockholders’ Equity Requirement (the “Compliance Plan”) for the Staff’s consideration. On August 5, 2024, the Company was notified by the Staff that it has been granted an extension until September 30, 2024 to comply with the Compliance Plan and evidence compliance with the Shareholders’ Equity Requirement. On October 1, 2024, the Company received a delisting determination letter (“Delisting Determination Letter”) from the Staff notifying the Company that it did not meet the terms of an extension granted by Nasdaq to regain compliance with the Shareholders’ Equity Requirement. On October 8, 2024, the Company requested a hearing (the “Hearing”) before the Nasdaq Listing Qualifications Panel (“Panel”) to appeal the Staff’s delisting determination.

On November 18, 2024, the Company received a letter from the Nasdaq Office of General Counsel notifying the Company that the Company has regained compliance with the Shareholders’ Equity Requirement, and that the Hearing, originally scheduled for November 21, 2024, has been canceled.

Note 2. Summary of Significant Accounting Policies

Basis of presentation – The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) for interim financial information and the rules and regulations of the SEC and assumes that the Company will continue to operate as a going concern. Accordingly, they do not include all the information and footnotes required by U.S. GAAP for complete financial statements. These condensed consolidated financial statements have been prepared on the same basis as the Company’s annual consolidated financial statements and, in the opinion of management, reflect all adjustments, including normal and recurring adjustments, which the Company considers necessary for the fair statement of financial information. The results of operations and comprehensive loss for the three and nine months ended September 30, 2024 are not necessarily indicative of expected results for the fiscal year ended December 31, 2024 or any other future period. These interim condensed consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements as of December 31, 2023 and notes thereto included in its Form 10-K, as filed with the SEC on March 29, 2024.

Principles of consolidation – The condensed consolidated financial statements include the accounts of the Company, Celsus Therapeutics, Inc., a Delaware corporation, Volution Immuno Pharmaceuticals SA, a private Swiss company, and Akari Malta Limited, a private Maltese company, each wholly-owned subsidiaries. All intercompany transactions have been eliminated.

Foreign currency – The functional currency of the Company is U.S. dollars, as that is the currency of the primary economic environment in which the Company operates as well as the currency in which it has been financed.

The reporting currency of the Company is U.S. dollars. The financial statements of certain of the Company's foreign subsidiaries are measured using their local currency as the functional currency. The Company translates its non-U.S. operations’ assets and liabilities denominated in foreign currencies into U.S. dollars at current rates of exchange as of the balance sheet date and income and expense items at the average exchange rate for the reporting period. Translation adjustments resulting from exchange rate fluctuations are recorded as foreign currency translation adjustments, a component of accumulated other comprehensive loss. Gains or losses from foreign currency transactions are included in foreign currency exchange gains/(losses).

Use of estimates – The preparation of the Company’s condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that may affect the reported amounts of assets, liabilities, expenses and related disclosures. Significant estimates and assumptions reflected in these condensed consolidated financial statements include, but are not limited to, the valuation of share-based awards, the valuation of warrant liabilities, research and development prepayments, accruals and related expenses, and the valuation allowance for deferred income taxes. The Company bases its estimates on historical experience, known trends and other market-specific or other relevant factors that it believes to be reasonable under the circumstances. Estimates are periodically reviewed considering changes in circumstances, facts and experience. Changes in estimates are recorded in the period in which they become known. Actual results may differ from those estimates or assumptions.

Concentration of credit risk – Financial instruments that potentially expose the Company to concentrations of credit risk consist primarily of cash. The Company generally maintains balances in various operating accounts at financial institutions in amounts that may exceed federally insured limits. The Company has not experienced any losses related to its cash and does not believe that it is subject to unusual credit risk beyond the normal credit risk associated with commercial banking relationships.

Fair value measurements – Certain assets and liabilities are carried at fair value under U.S. GAAP. Fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or a liability. As a basis for considering such assumptions, ASC 820, Fair Value Measurements and Disclosures (“ASC 820”) establishes a three-tier value hierarchy, which prioritizes the inputs used in the valuation methodologies in measuring fair value:

•Level 1 – quoted prices in active markets for identical assets and liabilities.

•Level 2 – inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices in active markets for similar assets or liabilities, quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

•Level 3 – unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

Determining which category an asset or liability falls within the hierarchy requires significant judgment. The Company evaluates its hierarchy disclosures each reporting period. The fair value hierarchy also requires the Company to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value.

The carrying values of the Company’s cash, prepaid expenses and other current assets, accounts payable and accrued expenses approximate their fair values due to the short-term nature of these assets and liabilities. The Company’s liability-classified warrants are recorded at their estimated fair value. See Note 4.

Cash – The Company considers all highly-liquid investments with original maturities of 90 days or less at the time of acquisition to be cash equivalents. The Company had no cash equivalents as of September 30, 2024 or December 31, 2023.

Prepaid expenses – Payments made prior to the receipt of goods or services are capitalized until the goods or services are received.

Other current assets – Other current assets as of September 30, 2024 and December 31, 2023 were principally comprised of Value Added Tax (“VAT”) receivables.

Patent acquisition costs – Patent acquisition costs and related capitalized legal fees are amortized on a straight-line basis over the shorter of the legal or economic life. The estimated useful life is 22 years. The Company expenses costs associated with maintaining and defending patents after their issuance in the period incurred. Amortization expense for each of the three and nine months ended September 30, 2024 and 2023 was less than $0.1 million.

Accrued expenses – As part of the process of preparing the condensed consolidated financial statements, the Company estimates accrued expenses. This process involves identifying services that third parties have performed on the Company’s behalf and estimating the level of service performed and the associated cost incurred on these services as of each balance sheet date in the Company’s condensed consolidated financial statements. Examples of estimated accrued expenses include contract service fees in conjunction with pre-clinical and clinical trials, professional service fees and contingent liabilities. In connection with these service fees, the Company’s estimates are most affected by its understanding of the status and timing of services provided relative to the actual services incurred by the service providers. If the Company does not identify certain costs that have been incurred or it under or over-estimates the level of services or costs of such services, the Company’s reported expenses for a reporting period could be understated or overstated. The date on which certain services commence, the level of services performed on or before a given date, and the cost of services are often subject to the Company’s estimation and judgment. The Company makes these judgments based upon the facts and circumstances known to it in accordance with U.S. GAAP. See Note 5.

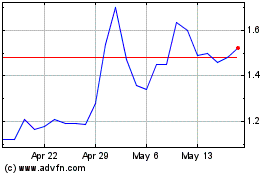

Convertible Notes – On May 10, 2024, the Company entered into unsecured convertible promissory notes (the “May 2024 Notes”) with existing investors: the Company’s Chairman, Dr. Ray Prudo, and Interim President and Chief Executive Officer and director of the Company, Dr. Samir Patel, for an aggregate of $1.0 million in gross proceeds. The May 2024 Notes bear interest at 15% per annum, which may be increased to 17% upon the occurrence of certain events of default as described therein, and the principal and all accrued but unpaid interest is due on the date that is the earlier of (a) ten (10) business days following the Company’s receipt of a U.K. research and development tax credit from HM Revenue and Customs, and (b) November 10, 2024. Provided, however, at any time or times from the date of the note and until the tenth business day prior to closing of the Merger, the note holders are entitled to convert any portion of the outstanding and unpaid amount, including principal and accrued interest, into Company ADSs at a fixed conversion price equal to $1.59, representing the Nasdaq official closing price of the Company’s ADSs on the issuance date, subject to certain restrictions. In October 2024, Drs. Prudo and Patel each elected to convert $125,000 of principal and all accrued interest into Company ADSs, resulting in the issuance of an aggregate of 406,236,000 ordinary shares represented by 203,118 ADSs. The remaining unconverted aggregate principal balance of the May 2024 Notes, or $750,000, was repaid in cash.

The Company accounts for convertible promissory notes in accordance with ASC Topic 470-20, Debt with Conversion and Other Options (“ASC 470-20”) and has not elected the fair value option as provided for within ASC Topics 815 and 825. Accordingly, the Company evaluated the embedded conversion and other features within the May 2024 Notes to determine whether any of the embedded features should be bifurcated from the host instrument and accounted for as a derivative at fair value. Based on management’s evaluation, the Company determined that the May 2024 Notes were not issued at a substantial premium and none of the embedded features were required to be bifurcated and accounted for separately. Accordingly, the May 2024 Notes are accounted for as a single liability measured at its amortized cost. Issuance costs incurred in connection with the issuance of the May 2024 Notes were

immaterial. Interest expense incurred on the May 2024 Notes was less than $0.1 million for the three and nine months ended September 30, 2024. As of September 30, 2024, accrued interest on the May 2024 Notes of less than $0.1 million is included within “Accrued expenses” in the Company’s balance sheets.

Warrant Liability – The Company accounts for ordinary share or ADS warrants as either equity instruments, liabilities or derivative liabilities in accordance with ASC Topic 480, Distinguishing Liabilities from Equity (“ASC 480”) and/or ASC Topic 815, Derivatives and Hedging (“ASC 815”), depending on the specific terms of the warrant agreement. Liability-classified warrants are recorded at their estimated fair values at issuance and are remeasured each reporting period until they are exercised, terminated, reclassified or otherwise settled. Changes in the estimated fair value of liability-classified warrants are recorded in "change in fair value of warrant liability" in the Company’s condensed consolidated statements of operations and comprehensive loss. Equity-classified warrants are recorded within "additional paid-in capital" in the Company's condensed consolidated statements of shareholders' (deficit) equity at the time of issuance and not subject to remeasurement.

In connection with the sale of the ADSs in the September 2022 Registered Direct Offering, the Company issued to the investors registered Series A warrants (“Series A Warrants”) to purchase an aggregate of 755,000 ADSs at $17.00 per ADS and registered Series B warrants (“Series B Warrants”) to purchase an aggregate of 755,000 ADSs at $17.00 per ADS (collectively, the “September 2022 Warrants”).The Company determined that the September 2022 Warrants are not indexed to the Company’s own stock in the manner contemplated by ASC 815-40-15, Determining Whether an Instrument (or Embedded Feature) Is Indexed to an Entity’s Own Stock. Accordingly, the Company classifies the September 2022 Warrants as derivative liabilities in its consolidated balance sheets. In September 2024, all outstanding Series A Warrants expired unexercised.

Other Current Liabilities – In February 2024, the Company entered into a short-term financing arrangement with a third-party vendor to finance insurance premiums. The aggregate amount financed under this agreement was $1.1 million, bearing interest at an annual rate of 7.49%. As of September 30, 2024, the balance of $0.2 million, which is included in “Other current liabilities” in the Company’s balance sheets, is scheduled to be paid in monthly installments through November 2024.

Research and development expenses – Costs associated with research and development are expensed as incurred unless there is an alternative future use in other research and development projects. Research and development expenses include, among other costs, salaries and personnel–related expenses, fees paid for contract research services, fees paid to clinical research organizations, costs incurred by outside laboratories, manufacturers and other accredited facilities in connection with clinical trials and preclinical studies.

Payments made prior to the receipt of goods or services to be used in research and development are capitalized until the goods or services are received. The Company records expenses related to clinical studies and manufacturing development activities based on its estimates of the services received and efforts expended pursuant to contracts with multiple contract research organizations and manufacturing vendors that conduct and manage these activities on its behalf. The financial terms of these agreements are subject to negotiation, vary from contract to contract, and may result in uneven cash flows. There may be instances in which payments made to the Company’s vendors will exceed the level of services provided and result in a prepayment of the expense. Payments under some of these contracts depend on factors such as the successful enrollment of subjects and the completion of clinical study milestones. In amortizing or accruing service fees, the Company estimates the time period over which services will be performed, enrollment of subjects, number of sites activated and the level of effort to be expended in each period. If the actual timing of the performance of services or the level of effort varies from the Company’s estimate, the Company will adjust the accrued or prepaid expense balance accordingly.

The Company accounts for research and development tax credits at the time its realization becomes probable as a credit to research and development expenses in the condensed consolidated statements of operations and comprehensive loss. During the three and nine months ended September 30, 2024 and 2023, the Company recognized research and development tax credits of approximately $1.3 million and $2.6 million, respectively.

Merger-Related Costs – Merger-related costs include direct expenses incurred in connection with the proposed Merger, as more fully described in Note 3, and are comprised primarily of legal and professional fees and other incremental costs directly associated to the Merger. For the three and nine months ended September 30, 2024 merger-related costs totaled $1.0 million and $2.3 million, respectively.

Restructuring and Other Costs – In May 2024, the Company began to implement a reduction-in-force of approximately 67% of its total workforce as a result of the recently announced program prioritization under which the Company’s HSCT-TMA program was suspended. The reduction-in-force was part of an operational restructuring plan (the “May 2024 Plan”) which included the elimination of certain senior management positions and was completed in the third quarter of 2024. The purpose of the restructuring plan, including the reduction-in-force, was to reduce HSCT-TMA related operating costs, while supporting the execution of the Company’s long-term strategic plan. During the three and nine months ended September 30, 2024, the Company has incurred restructuring-related charges of less than $0.1 million and $1.7 million related to the May 2024 Plan, respectively. Of the $1.7 million incurred during the nine months ended September 30, 2024, $1.4 million related to severance and other settlement payments to terminated executives and employees, and $0.3 million was non-cash expenses related to accelerated vesting of equity awards. The Company does not expect to incur additional restructuring-related expenses related to the May 2024 Plan.

As of September 30, 2024, of the $1.7 million total restructuring-related charges incurred, approximately $0.5 million was unpaid and included in accrued expenses in the accompanying condensed consolidated balance sheet. See Note 5. The Company expects these costs to be paid in the fourth quarter of 2024.