UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of February 2025

Commission file number 0-30070

AUDIOCODES

LTD.

(Translation of registrant’s name into English)

6 Ofra Haza Street • Or Yehuda • ISRAEL

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only

permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private

issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally

organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

On February 4, 2025, AudioCodes

Ltd. (the “Registrant”) issued a press release announcing financial results for the fourth quarter and full year periods ended

December 31, 2024, a semi-annual cash dividend, and other matters. A copy of this press release is attached hereto as Exhibit 1 and incorporated

by reference herein.

The information set forth in (a) the first, second, third, fifth, eighth,

ninth and tenth paragraphs following the heading “Details,” the paragraphs following the heading “Share Buy Back Program”

and the paragraphs following the heading “Cash Dividend,” and (b) the condensed consolidated balance sheets, condensed consolidated

statements of operations and condensed consolidated statements of cash flows contained in the press release attached as Exhibit 1 to this

Report on Form 6-K are hereby incorporated by reference into (i) the Registrant’s Registration Statement on Form F-3ASR, File No.

333-238867; (ii) the Registrant’s Registration Statement on Form S-8, File No. 333-11894; (iii) the Registrant’s Registration

Statement on Form S-8, File No. 333-13268; (iv) the Registrant’s Registration Statement on Form S-8, File No. 333-105473; (v) the

Registrant’s Registration Statement on Form S-8, File No. 333-144825; (vi) the Registrant’s Registration Statement on Form S-8, File No. 333-160330; (vii) the Registrant’s Registration Statement on Form S-8, File No. 333-170676; (viii) the Registrant’s

Registration Statement on Form S-8, File No. 333-190437; (ix) the Registrant’s Registration Statement on Form S-8, File No. 333-210438;

(x) the Registrant’s Registration Statement on Form S-8, File No. 333-230388; and (xi) the Registrant’s Registration Statement

on Form S-8, File No. 333-264535.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

AUDIOCODES LTD. |

| |

(Registrant) |

| |

|

| |

By: |

/s/ NIRAN BARUCH |

| |

|

Niran Baruch |

| |

|

Vice President Finance and Chief Financial Officer |

Dated: February 4, 2025

EXHIBIT INDEX

Exhibit 1

|

|

AudioCodes

Press Release

|

| Company

Contacts |

|

|

| |

|

|

Niran Baruch,

Chief Financial Officer

AudioCodes

Tel:

+972-3-976-4000

niran.baruch@audiocodes.com |

|

Roger L. Chuchen,

VP, Investor

Relations

AudioCodes

Tel: 732-764-2552

roger.chuchen@audiocodes.com |

AudioCodes

Reports Fourth Quarter and Full Year 2024 Results and Declares Semi-Annual Dividend of 18 cents per share

Or

Yehuda, Israel – February 4, 2025 - AudioCodes (NASDAQ: AUDC) Press Release

Fourth

Quarter and Full Year 2024 Highlights

| · | Quarterly

revenues decreased by 3.2% year-over-year to $61.6 million; |

full

year 2024 revenues decreased by 0.9% to $242.2 million.

| · | Quarterly

service revenues increased by 10.9% year-over-year to $34.2 million; |

full

year 2024 service revenues increased by 8.2% to $130.2 million.

| o | Quarterly

GAAP gross margin was 66.2%; |

| o | Quarterly

GAAP operating margin was 6.7%; |

| o | Quarterly

GAAP EBITDA was $5.2 million; |

| o | Quarterly

GAAP net income was $6.8 million, or $0.22 per diluted share; and |

| o | Full

year 2024 GAAP net income was $15.3 million, or $0.50 per diluted share. |

| o | Quarterly

Non-GAAP gross margin was 66.5%; |

| o | Quarterly

Non-GAAP operating margin was 12.2%; |

| o | Quarterly

Non-GAAP EBITDA was $8.5 million; |

| o | Quarterly

Non-GAAP net income was $11.6 million, or $0.37 per diluted share; and |

| o | Full

year 2024 Non-GAAP net income was $27.3 million, or $0.87 per diluted share. |

| · | Net

cash provided by operating activities was $15.3 million for the quarter and $35.3 million

for the full year 2024. |

| · | AudioCodes

repurchased 634,533 of its ordinary shares during the quarterly period ended December 31,

2024 at an aggregate cost of $6.0 million. |

| |

|

|

AudioCodes Reports Fourth Quarter and Full Year 2024 Results and Declares Semi-Annual Dividend of 18 cents per share

|

|

Page 1 of 10 |

|

|

AudioCodes

Press Release

|

Details

AudioCodes,

a leading provider of unified communications voice, contact center and conversational AI applications and services for enterprises, today

announced its financial results for the fourth quarter and full year period ended December 31, 2024.

Revenues

for the fourth quarter of 2024 were $61.6 million compared to $60.2 million for the third quarter of 2024 and compared to $63.6 million

for the fourth quarter of 2023. Revenues were $242.2 million in 2024 compared to $244.4 million in 2023.

EBITDA

for the fourth quarter of 2024 was $5.2 million compared to $7.9 million for the fourth quarter of 2023. EBITDA was $21.1 million in

2024 compared to $17.0 million in 2023.

On

a Non-GAAP basis, EBITDA for the fourth quarter of 2024 was $8.5 million compared to $11.2 million for the fourth quarter of 2023. EBITDA

was $31.4 million in 2024 compared to $31.0 million in 2023.

Net

income was $6.8 million, or $0.22 per diluted share, for the fourth quarter of 2024 compared to net income of $3.7 million, or $0.12

per diluted share, for the fourth quarter of 2023. Net income was $15.3 million, or $0.50 per diluted share in 2024, compared to $8.8

million, or $0.28 per diluted share in 2023.

On

a Non-GAAP basis, net income was $11.6 million, or $0.37 per diluted share, for the fourth quarter of 2024 compared to $8.9 million,

or $0.28 per diluted share, for the fourth quarter of 2023. Non-GAAP net income was $27.3 million, or $0.87 per diluted share in 2024

compared to $25.0 million, or $0.77 per diluted share in 2023.

Non-GAAP

net income excludes: (i) share-based compensation expenses; (ii) amortization expenses related to intangible assets; (iii) expenses

related to deferred payments in connection with the acquisition of Callverso Ltd; (iv) financial income (expenses) related to exchange

rate differences in connection with revaluation of assets and liabilities in non-dollar denominated currencies; (v) tax impact which

relates to our Non-GAAP adjustments; (vi) with respect to Q1 2024, non-cash lease expense which is required to be recorded during

the quarter even though this is a free rent period under the lease for the Company’s new headquarters; and (vii) a one-time,

non-recurring settlement expense attributable to the Settlement Agreement (as defined below). A reconciliation of net income on a GAAP

basis to a non-GAAP basis is provided in the tables that accompany the condensed consolidated financial statements contained in this

press release.

On

December 25, 2024, we entered into a settlement (the “Settlement Agreement”) with the landlord of our prior headquarters

in connection with the termination of the related lease agreement. Pursuant to the Settlement Agreement, we incurred a one-time, non-recurring

settlement expense of approximately $1.4 million during the quarterly period in the form of a cash payment made to the landlord.

| |

|

|

AudioCodes Reports Fourth Quarter and Full Year 2024 Results and Declares Semi-Annual Dividend of 18 cents per share

|

|

Page 2 of 10 |

|

|

AudioCodes

Press Release

|

Net

cash provided by operating activities was $15.3 million for the fourth quarter of 2024 and $35.3 million for 2024.

Cash

and cash equivalents, short-term bank deposits, long and short-term marketable securities and long-term financial investments were $93.9

million as of December 31, 2024, compared to $106.7 million as of December 31, 2023. The decrease in cash and cash equivalents,

short-term bank deposits, long and short-term marketable securities and long-term financial investments was the result of the use of

cash for the continued repurchasing of the Company’s ordinary shares pursuant to its share repurchase program, payment of a cash

dividend during each of the first and third quarters of 2024, and the purchase of property and equipment related to leasehold improvements

of our new corporate headquarters in Israel, offset, in part, by cash generated from operating activities.

“I

am pleased to report solid fourth quarter performance, with healthy growth in key business lines, taking us further on our transformative

evolution to a cloud software and services company,” said Shabtai Adlersberg, President and Chief Executive Officer of AudioCodes.

Enterprise

UCaaS and CX business accounted for 92% of revenues in the fourth quarter, within which our UCaaS business performed well, highlighted

by Microsoft business up 13% in the quarter, representing the highest quarterly growth rate this year. Full year Microsoft business

increased 6%, driven mainly by the ongoing transition of our revenue model from perpetual sales to recurrent revenue sales. Live

managed services mix within Microsoft business increased 30% year-over-year, and reached a level of 47% of business, compared to 40%

in the year ago quarter. This growth, coupled with 30% growth in Voice.ai business for the full year 2024, contributed to us ending

2024 with ARR at $65 million, representing 35% year-over-year growth. We expect the recurring revenue business momentum to continue

driving our sales for the UCaaS and CX markets in 2025 and beyond. With the shift in focus for end customers towards Value-Added

Services, we expect to see a rise in demand for our Voice.ai application solutions, and an increased interest in our Live Platform, which

consolidates connectivity, management, and Value-Added Services through one integrated AudioCodes’ platform.

The

significant investments we have in our Voice.ai and conversational AI portfolio over the last several years are paying off. Individual

business units have emerged as leaders in their respective categories. Additionally, with growing customer demand for AI and Gen

AI driven business voice applications and Value-added Services, we have seen a surge in our pipeline of created opportunities in Voice.ai

connect, Voca CIC and Meeting Insights applications. The growth in AI business applications is solid and we expect this segment

to grow 40% to 50% in 2025.

Overall,

we exited 2024 with good operational momentum, particularly with the continued strong growth in our two primary engines, namely our Live

family of managed services and Voice.ai. With the progress we are making in increasing our recurring revenues and the robust pipeline

of opportunities, we expect to see improved top-line growth in 2025 and beyond,” concluded Mr. Adlersberg.

| |

|

|

AudioCodes Reports Fourth Quarter and Full Year 2024 Results and Declares Semi-Annual Dividend of 18 cents per share

|

|

Page 3 of 10 |

|

|

AudioCodes

Press Release

|

Share

Buy Back Program

During

the quarter ended December 31, 2024, the Company acquired 634,533 of its ordinary shares under its share repurchase program for

a total consideration of $6.0 million.

In

December 2024, the Company received court approval in Israel to purchase up to an aggregate amount of $20 million of additional

ordinary shares. The court approval also permits AudioCodes to declare a dividend out of any part of this amount. The approval is valid

through June 14, 2025.

As

of December 31, 2024, the Company had $19 million available under this approval for the repurchase of shares and/or declaration

of cash dividends.

Cash

Dividend

AudioCodes

also announced today that the Company’s Board of Directors has declared a cash dividend in the amount of 18 cents per share. The

aggregate amount of the dividend is approximately $5.3 million. The dividend is payable on March 6, 2025, to all of the Company’s

shareholders of record at the close of trading on the NASDAQ Global Select Market on February 20, 2025.

In

accordance with Israeli tax law, the dividend is subject to withholding tax at source at the rate of 25% of the dividend amount payable

to each shareholder of record, subject to applicable exemptions. If the recipient of the dividend is at the time of distribution or was

at any time during the preceding 12-month period the holder of 10% or more of the Company's share capital, the withholding rate is 30%.

The

dividend will be paid in U.S. dollars on the ordinary shares of AudioCodes Ltd. that are traded on the Nasdaq Global Select Market or

the Tel-Aviv Stock Exchange. The amount and timing of any other dividends will be determined by the Company’s Board of Directors.

Conference

Call & Web Cast Information

AudioCodes

will conduct a conference call at 8:30 A.M., Eastern Time today to discuss the Company's fourth quarter and full year of 2024 operating

performance, financial results and outlook. Interested parties may participate in the conference call by dialing one of the following

numbers:

United

States Participants: 888-506-0062

International

Participants: +1 (973) 528-0011

The

conference call will also be simultaneously webcast. Investors are invited to listen to the call live via webcast at the AudioCodes investor

website at http://www.audiocodes.com/investors-lobby.

| |

|

|

AudioCodes Reports Fourth Quarter and Full Year 2024 Results and Declares Semi-Annual Dividend of 18 cents per share

|

|

Page 4 of 10 |

|

|

AudioCodes

Press Release

|

About

AudioCodes

AudioCodes

(NASDAQ, TASE: AUDC) is a leading innovator of intelligent cloud communications solutions. AudioCodes empowers enterprises and service

providers to build and operate state-of-the-art voice networks, unified communications platforms, and AI-driven productivity tools. The

cutting-edge portfolio includes cloud-native applications, advanced Voice.ai technologies, and comprehensive communication solutions

tailored for the modern digital workplace. Trusted by global Fortune 500 companies and tier-1 operators worldwide, AudioCodes drives

digital transformation through seamless integration, enhanced collaboration, and unparalleled communication experiences.

For

more information, visit http://www.audiocodes.com.

Follow

AudioCodes’ social media channels:

AudioCodes

invites you to join our online community and follow us on: AudioCodes Voice Blog, LinkedIn, Twitter, Facebook,

and YouTube.

Statements

concerning AudioCodes' business outlook or future economic performance; product introductions and plans and objectives related thereto;

and statements concerning assumptions made or expectations as to any future events, conditions, performance or other matters, are "forward-looking

statements'' as that term is defined under U.S. Federal securities laws. Forward-looking statements are subject to various risks, uncertainties

and other factors that could cause actual results to differ materially from those stated in such statements. These risks, uncertainties

and factors include, but are not limited to: the effect of global economic conditions in general and conditions in AudioCodes' industry

and target markets in particular; shifts in supply and demand; market acceptance of new products and the demand for existing products;

the impact of competitive products and pricing on AudioCodes' and its customers' products and markets; timely product and technology

development, upgrades and the ability to manage changes in market conditions as needed; possible need for additional financing; the ability

to satisfy covenants in the Company’s loan agreements; possible disruptions from acquisitions; the ability of AudioCodes to successfully

integrate the products and operations of acquired companies into AudioCodes’ business; possible adverse impact of the COVID-19

pandemic on our business and results of operations; the effects of the current terrorist attacks by Hamas in Israel, and the war and

hostilities between Israel and Hamas, and Israel and Hezbollah as well as the possibility that this could develop into a broader regional

conflict involving Israel with other parties, may affect our operations and may limit our ability to produce and sell our solutions;

any disruption in our operations by the obligations of our personnel to perform military service as a result of current or future military

actions involving Israel; and other factors detailed in AudioCodes' filings with the U.S. Securities and Exchange Commission. AudioCodes

assumes no obligation to update the information in this release.

©2025

AudioCodes Ltd. All rights reserved. AudioCodes, AC, HD VoIP, HD VoIP Sounds Better, IPmedia, Mediant, MediaPack, What’s Inside

Matters, OSN, SmartTAP, User Management Pack, VMAS, VoIPerfect, VoIPerfectHD, Your Gateway To VoIP, 3GX, VocaNom, AudioCodes One Voice,

AudioCodes Meeting Insights, AudioCodes Room Experience are trademarks or registered trademarks of AudioCodes Limited. All other products

or trademarks are property of their respective owners. Product specifications are subject to change without notice.

Summary

financial data follows

| |

|

|

AudioCodes Reports Fourth Quarter and Full Year 2024 Results and Declares Semi-Annual Dividend of 18 cents per share

|

|

Page 5 of 10 |

|

|

AudioCodes

Press Release

|

| AUDIOCODES

LTD. AND ITS SUBSIDIARIES |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| U.S. dollars in thousands |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 58,749 | | |

$ | 30,546 | |

| Short-term and restricted bank deposits | |

| 210 | | |

| 212 | |

| Short-term marketable securities | |

| 3,426 | | |

| 7,438 | |

| Trade receivables, net | |

| 56,016 | | |

| 51,125 | |

| Other receivables and prepaid expenses | |

| 13,012 | | |

| 9,381 | |

| Inventories | |

| 31,463 | | |

| 43,959 | |

| Total current assets | |

| 162,876 | | |

| 142,661 | |

| | |

| | | |

| | |

| LONG-TERM ASSETS: | |

| | | |

| | |

| Long-term Trade receivables | |

$ | 15,753 | | |

$ | 16,798 | |

| Long-term marketable securities | |

| 28,518 | | |

| 65,732 | |

| Long-term financial investments | |

| 3,008 | | |

| 2,730 | |

| Deferred tax assets | |

| 9,838 | | |

| 6,208 | |

| Operating lease right-of-use assets | |

| 32,534 | | |

| 36,712 | |

| Severance pay

funds | |

| 18,004 | | |

| 17,202 | |

| Total long-term assets | |

| 107,655 | | |

| 145,382 | |

| | |

| | | |

| | |

| PROPERTY AND EQUIPMENT, NET | |

| 27,321 | | |

| 10,893 | |

| | |

| | | |

| | |

| GOODWILL, INTANGIBLE ASSETS AND

OTHER, NET | |

| 38,049 | | |

| 38,581 | |

| | |

| | | |

| | |

| Total assets | |

$ | 335,901 | | |

$ | 337,517 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’

EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Trade payables | |

| 7,543 | | |

| 7,556 | |

| Other payables and accrued expenses | |

| 25,823 | | |

| 29,943 | |

| Deferred revenues | |

| 38,438 | | |

| 38,820 | |

| Short-term operating

lease liabilities | |

| 5,954 | | |

| 7,878 | |

| Total current liabilities | |

| 77,758 | | |

| 84,197 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Accrued severance pay | |

$ | 16,387 | | |

$ | 16,662 | |

| Deferred revenues and other liabilities | |

| 19,434 | | |

| 17,142 | |

| Long-term operating

lease liabilities | |

| 30,508 | | |

| 31,404 | |

| Total long-term liabilities | |

| 66,329 | | |

| 65,208 | |

| | |

| | | |

| | |

| Total shareholders’ equity | |

| 191,814 | | |

| 188,112 | |

| Total liabilities and shareholders'

equity | |

$ | 335,901 | | |

$ | 337,517 | |

| |

|

|

AudioCodes Reports Fourth Quarter and Full Year 2024 Results and Declares Semi-Annual Dividend of 18 cents per share

|

|

Page 6 of 10 |

|

|

AudioCodes

Press Release

|

| AUDIOCODES LTD. AND ITS SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS |

| U.S. dollars in thousands, except per share data |

| | |

Year ended | | |

Three months ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Products | |

$ | 111,966 | | |

$ | 123,991 | | |

$ | 27,319 | | |

$ | 32,692 | |

| Services | |

| 130,210 | | |

| 120,392 | | |

| 34,235 | | |

| 30,867 | |

| Total

Revenues | |

| 242,176 | | |

| 244,383 | | |

| 61,554 | | |

| 63,559 | |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | |

| Products | |

| 44,448 | | |

| 47,964 | | |

| 10,325 | | |

| 11,396 | |

| Services | |

| 39,567 | | |

| 38,070 | | |

| 10,510 | | |

| 9,771 | |

| Total Cost

of revenues | |

| 84,015 | | |

| 86,034 | | |

| 20,835 | | |

| 21,167 | |

| Gross profit | |

| 158,161 | | |

| 158,349 | | |

| 40,719 | | |

| 42,392 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development, net | |

| 52,125 | | |

| 57,169 | | |

| 12,345 | | |

| 13,806 | |

| Selling and marketing | |

| 71,167 | | |

| 70,243 | | |

| 18,740 | | |

| 17,496 | |

| General and administrative | |

| 17,678 | | |

| 16,513 | | |

| 5,532 | | |

| 3,856 | |

| Total operating expenses | |

| 140,970 | | |

| 143,925 | | |

| 36,617 | | |

| 35,158 | |

| Operating income | |

| 17,191 | | |

| 14,424 | | |

| 4,102 | | |

| 7,234 | |

| Financial income (expenses), net | |

| (2,095 | ) | |

| (52 | ) | |

| (1,900 | ) | |

| (1,740 | ) |

| Income before taxes on income | |

| 15,096 | | |

| 14,372 | | |

| 2,202 | | |

| 5,494 | |

| Taxes on income, net | |

| 215 | | |

| (5,592 | ) | |

| 4,573 | | |

| (1,839 | ) |

| Net income | |

$ | 15,311 | | |

$ | 8,780 | | |

$ | 6,775 | | |

$ | 3,655 | |

| Basic net earnings per share | |

$ | 0.51 | | |

$ | 0.28 | | |

$ | 0.23 | | |

$ | 0.12 | |

| Diluted net earnings per share | |

$ | 0.50 | | |

$ | 0.28 | | |

$ | 0.22 | | |

$ | 0.12 | |

| Weighted average number of shares used

in computing basic net earnings per share (in thousands) | |

| 30,162 | | |

| 31,401 | | |

| 29,932 | | |

| 30,678 | |

| Weighted average number of shares used

in computing diluted net earnings per share (in thousands) | |

| 30,642 | | |

| 31,579 | | |

| 30,260 | | |

| 30,893 | |

| |

|

|

AudioCodes Reports Fourth Quarter and Full Year 2024 Results and Declares Semi-Annual Dividend of 18 cents per share

|

|

Page 7 of 10 |

|

|

AudioCodes

Press Release

|

| AUDIOCODES LTD. AND ITS SUBSIDIARIES |

| RECONCILIATION OF GAAP NET

INCOME TO NON-GAAP NET INCOME |

| U.S. dollars in thousands, except per share data |

| | |

Year ended | | |

Three months ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| GAAP net income | |

$ | 15,311 | | |

$ | 8,780 | | |

$ | 6,775 | | |

$ | 3,655 | |

| GAAP net earnings per share | |

$ | 0.50 | | |

$ | 0.28 | | |

$ | 0.22 | | |

$ | 0.12 | |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation (1) | |

| 369 | | |

| 388 | | |

| 95 | | |

| 84 | |

| Amortization expenses (2) | |

| 488 | | |

| 501 | | |

| 122 | | |

| 122 | |

| Lease expenses (6) | |

| 304 | | |

| 685 | | |

| - | | |

| 363 | |

| | |

| 1,161 | | |

| 1,574 | | |

| 217 | | |

| 569 | |

| Research and development, net: | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation (1) | |

| 2,108 | | |

| 2,685 | | |

| 466 | | |

| 595 | |

| Deferred payments expenses (3) | |

| - | | |

| 770 | | |

| - | | |

| 408 | |

| Lease expenses (6) | |

| 342 | | |

| 430 | | |

| - | | |

| 55 | |

| | |

| 2,450 | | |

| 3,885 | | |

| 466 | | |

| 1,058 | |

| Selling and marketing: | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation (1) | |

| 2,959 | | |

| 4,297 | | |

| 704 | | |

| 917 | |

| Amortization expenses (2) | |

| 44 | | |

| 44 | | |

| 11 | | |

| 11 | |

| Deferred payments expenses (3) | |

| - | | |

| 86 | | |

| - | | |

| 46 | |

| Lease expenses (6) | |

| 38 | | |

| 430 | | |

| - | | |

| 55 | |

| | |

| 3,041 | | |

| 4,857 | | |

| 715 | | |

| 1,029 | |

| General and administrative: | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation (1) | |

| 2,792 | | |

| 4,010 | | |

| 679 | | |

| 768 | |

| Settlement with former headquarter office landlord (7) | |

| 1,355 | | |

| - | | |

| 1,355 | | |

| - | |

| Lease expenses (6) | |

| 76 | | |

| 171 | | |

| - | | |

| 91 | |

| | |

| 4,223 | | |

| 4,181 | | |

| 2,034 | | |

| 859 | |

| Financial expenses (income): | |

| | | |

| | | |

| | | |

| | |

| Exchange rate differences (4) | |

| 507 | | |

| 205 | | |

| 1,261 | | |

| 1,442 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income taxes: | |

| | | |

| | | |

| | | |

| | |

| Taxes on income, net (5) | |

| 585 | | |

| 1,549 | | |

| 163 | | |

| 302 | |

| Non-GAAP net income | |

$ | 27,278 | | |

$ | 25,031 | | |

$ | 11,631 | | |

$ | 8,914 | |

| Non-GAAP diluted net earnings per share | |

$ | 0.87 | | |

$ | 0.77 | | |

$ | 0.37 | | |

$ | 0.28 | |

| Weighted average number of shares used

in computing Non-GAAP diluted net earnings per share (in thousands) | |

| 31,449 | | |

| 32,637 | | |

| 31,192 | | |

| 31,937 | |

| (1) | Share-based

compensation expenses related to options and restricted share units granted to employees

and others. |

| (2) | Amortization

expenses related to intangible assets. |

| (3) | Expenses

related to deferred payments in connection with the acquisition of Callverso Ltd. |

| (4) | Financial

income (expenses) related to exchange rate differences in connection with revaluation of

assets and liabilities in non-dollar denominated currencies. |

| (5) | Tax

impact which relates to our non-GAAP adjustments. |

| (6) | With

respect to Q1 2024, non-cash lease expense which is required to be recorded during the quarter

even though this is a free rent period under the lease for the Company’s new headquarters. |

| (7) | A

one-time, non-recurring expense attributable to the Settlement Agreement. |

Note:

Non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP.

The Company believes that non-GAAP information is useful because it can enhance the understanding of its ongoing economic performance

and therefore uses internally this non-GAAP information to evaluate and manage its operations. The Company has chosen to provide this

information to investors to enable them to perform comparisons of operating results in a manner similar to how the Company analyzes its

operating results and because many comparable companies report this type of information.

| |

|

|

AudioCodes Reports Fourth Quarter and Full Year 2024 Results and Declares Semi-Annual Dividend of 18 cents per share

|

|

Page 8 of 10 |

|

|

AudioCodes

Press Release

|

AUDIOCODES

LTD. AND ITS SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENT OF CASH FLOWS

U.S.

dollars in thousands

| | |

Year ended | | |

Three months ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| Cash flows from operating activities: | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 15,311 | | |

$ | 8,780 | | |

$ | 6,775 | | |

$ | 3,655 | |

| Adjustments

required to reconcile net income to net cash provided by operating activities: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 3,883 | | |

| 2,596 | | |

| 1,095 | | |

| 624 | |

| Net loss from sale of marketable securities | |

| 882 | | |

| 218 | | |

| 608 | | |

| - | |

| Amortization

of marketable securities premiums and accretion of discounts, net | |

| 1,120 | | |

| 1,130 | | |

| 509 | | |

| 321 | |

| Decrease (increase) in accrued severance pay, net | |

| (1,077 | ) | |

| (362 | ) | |

| (378 | ) | |

| 131 | |

| Share-based compensation expenses | |

| 8,228 | | |

| 11,380 | | |

| 1,944 | | |

| 2,364 | |

| Decrease (increase) in deferred tax assets, net | |

| (4,548 | ) | |

| 1,437 | | |

| (5,374 | ) | |

| 273 | |

| Cash financial loss (income), net | |

| 313 | | |

| (218 | ) | |

| 176 | | |

| 179 | |

| Decrease in operating lease right-of-use assets | |

| 6,009 | | |

| 9,281 | | |

| 1,254 | | |

| 2,593 | |

| Decrease (increase) in operating lease liabilities | |

| (4,651 | ) | |

| (6,914 | ) | |

| (720 | ) | |

| 1,497 | |

| Decrease (increase) in trade receivables, net | |

| (3,846 | ) | |

| 1,600 | | |

| 2,168 | | |

| (3,045 | ) |

| Decrease (increase) in other receivables and prepaid expenses | |

| (3,631 | ) | |

| 625 | | |

| (927 | ) | |

| (947 | ) |

| Decrease (increase) in inventories | |

| 12,283 | | |

| (7,791 | ) | |

| 2,164 | | |

| 814 | |

| Increase (decrease in trade payables | |

| (13 | ) | |

| (3,782 | ) | |

| 2,064 | | |

| 918 | |

| Increase (decrease) in other payables and accrued expenses | |

| 3,223 | | |

| (6,233 | ) | |

| 3,817 | | |

| 181 | |

| Increase (decrease) in deferred revenues | |

| 1,767 | | |

| 3,144 | | |

| 136 | | |

| (279 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net cash provided by operating activities | |

| 35,253 | | |

| 14,891 | | |

| 15,311 | | |

| 9,279 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | | |

| | |

| Proceeds from short-term deposits | |

| 2 | | |

| 4,998 | | |

| (8 | ) | |

| (10 | ) |

| Proceeds from sale of marketable securities | |

| 35,177 | | |

| 3,846 | | |

| 25,186 | | |

| - | |

| Proceeds from financial investment | |

| 132 | | |

| - | | |

| 56 | | |

| - | |

| Proceeds from redemption of marketable securities | |

| 7,450 | | |

| 3,084 | | |

| 4,000 | | |

| - | |

| Proceeds from redemption of financial investments | |

| - | | |

| 14,094 | | |

| - | | |

| - | |

| Purchase of financial investments | |

| (675 | ) | |

| (81 | ) | |

| - | | |

| - | |

| Purchase of property and equipment | |

| (24,280 | ) | |

| (5,965 | ) | |

| (3,512 | ) | |

| (664 | ) |

| Net cash provided by (used in) investing

activities | |

| 17,806 | | |

| 19,976 | | |

| 25,722 | | |

| (674 | ) |

| |

|

|

AudioCodes Reports Fourth Quarter and Full Year 2024 Results and Declares Semi-Annual Dividend of 18 cents per share

|

|

Page 9 of 10 |

|

|

AudioCodes

Press Release

|

| AUDIOCODES LTD. AND ITS SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENT

OF CASH FLOWS |

| U.S. dollars in thousands |

| | |

Year ended | | |

Three months ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | | |

| | |

| Purchase of treasury shares | |

| (14,328 | ) | |

| (18,259 | ) | |

| (5,988 | ) | |

| (6,286 | ) |

| Cash dividends paid to shareholders | |

| (10,896 | ) | |

| (11,399 | ) | |

| - | | |

| - | |

| Proceeds from issuance of shares upon exercise of options | |

| 368 | | |

| 802 | | |

| 182 | | |

| 548 | |

| Net cash used in financing activities | |

| (24,856 | ) | |

| (28,856 | ) | |

| (5,806 | ) | |

| (5,738 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net increase in cash, cash equivalents, and restricted cash | |

| 28,203 | | |

| 6,011 | | |

| 35,227 | | |

| 2,867 | |

| Cash, cash equivalents and restricted

cash at beginning of period | |

| 30,546 | | |

| 24,535 | | |

| 23,522 | | |

| 27,679 | |

| Cash, cash equivalents and restricted

cash at end of period | |

$ | 58,749 | | |

$ | 30,546 | | |

$ | 58,749 | | |

$ | 30,546 | |

| | |

| | | |

| | | |

| | | |

| | |

| |

|

|

AudioCodes Reports Fourth Quarter and Full Year 2024 Results and Declares Semi-Annual Dividend of 18 cents per share

|

|

Page 10 of 10 |

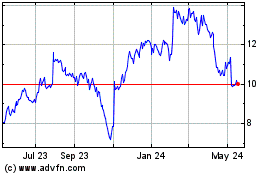

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Jan 2025 to Feb 2025

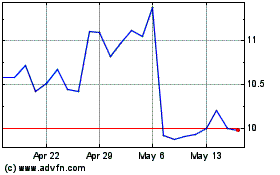

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Feb 2024 to Feb 2025