Form DFAN14A - Additional definitive proxy soliciting materials filed by non-management and Rule 14(a)(12) material

February 24 2025 - 4:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive Proxy Statement |

| |

|

| ☐ |

Definitive Additional Materials |

| |

|

| ☒ |

Soliciting Material under §240.14a-12 |

| BEACON ROOFING SUPPLY, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

QXO, INC.

BRAD JACOBS

Ihsan Essaid

Matt Fassler

Mark Manduca

Sheree Bargabos

Paul A.

Camuti

Karel Czanderna

Jonathan

F. Foster

Mauro Gregorio

Michael

C. Lenz

Teresa May

Stephen

D. Newlin

Joseph W.

Reitmeier

Wendy Whiteash

|

| (Name of Person(s) Filing Proxy Statement, if other than the

Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee paid previously with preliminary materials |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

QXO, Inc. (“QXO”) and the other participants named herein

intend to file a preliminary proxy statement and accompanying WHITE universal proxy card with the Securities and Exchange Commission (the

“SEC”) to be used to solicit proxies for, among other matters, the election of its slate of director nominees at the 2025

Annual Meeting of stockholders of Beacon Roofing Supply, Inc. (“Beacon”).

On February 24, 2025, QXO issued the following search

engine marketing advertisements.

QXO www.qxo.com/beacon QXO’s Offer for Beacon Roofing - Best Interest

of Shareholders QXO’s all-cash $ 124.25-per-share offer for Beacon Roofing Supply is highly compelling. A higher price than Beacon’s

stock has ever traded. Delivers immediate cash at a 37% premium to the unaffected 90-day VWAP. Highly Attractive Significant premium,

no regulatory delays, financing risks or due diligence condition. A higher price than Beacon's stock has ever traded.

Forward-Looking Statements

This communication contains forward-looking statements. Statements

that are not historical facts, including statements about beliefs, expectations, targets, goals, regulatory approval timing and nominating

directors are forward-looking statements. These statements are based on plans, estimates, expectations and/or goals at the time the statements

are made, and readers should not place undue reliance on them. In some cases, readers can identify forward-looking statements by the use

of forward-looking terms such as “may,” “will,” “should,” “expect,” “opportunity,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“potential,” “target,” “goal,” or “continue,” or the negative of these terms or other

comparable terms. Forward-looking statements involve inherent risks and uncertainties and readers are cautioned that a number of important

factors could cause actual results to differ materially from those contained in any such forward-looking statements. Such factors include

but are not limited to: the ultimate outcome of any possible transaction between QXO and Beacon, including the possibility that the parties

will not agree to pursue a business combination transaction or that the terms of any definitive agreement will be materially different

from those proposed; uncertainties as to whether Beacon will cooperate with QXO regarding the proposed transaction; the ultimate result

should QXO commence a proxy contest for election of directors to Beacon’s Board of Directors; QXO’s ability to consummate

the proposed transaction with Beacon; the conditions to the completion of the proposed transaction, including the receipt of any required

shareholder approvals and any required regulatory approvals; QXO’s ability to finance the proposed transaction; the substantial

indebtedness QXO expects to incur in connection with the proposed transaction and the need to generate sufficient cash flows to service

and repay such debt; that operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining

relationships with employees, customers or suppliers) may be greater than expected following the proposed transaction or the public announcement

of the proposed transaction; QXO’s ability to retain certain key employees; and general economic conditions that are less favorable

than expected. QXO cautions that forward-looking statements should not be relied on as predictions of future events, and these statements

are not guarantees of performance or results. Forward-looking statements herein speak only as of the date each statement is made. QXO

does not assume any obligation to update any of these statements in light of new information or future events, except to the extent required

by applicable law.

Important Additional Information and Where to Find It

This communication is for informational purposes only and does

not constitute a recommendation, an offer to purchase or a solicitation of an offer to sell Beacon securities. QXO and Queen MergerCo,

Inc. (the “Purchaser”) filed a Tender Offer Statement on Schedule TO with the SEC on January 27, 2025, and Beacon filed a

Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer with the SEC on February 6, 2025. Investors

and security holders are urged to carefully read the Tender Offer Statement (including the Offer to Purchase, the related Letter of Transmittal

and certain other tender offer documents, as each may be amended or supplemented from time to time) and the Solicitation/Recommendation

Statement as these materials contain important information that investors and security holders should consider before making any decision

regarding tendering their common stock, including the terms and conditions of the tender offer. The Tender Offer Statement, Offer to

Purchase, Solicitation/Recommendation Statement and related materials are filed with the SEC, and investors and security holders may

obtain a free copy of these materials and other documents filed by QXO and Beacon with the SEC at the website maintained by the SEC at

www.sec.gov. In addition, the Tender Offer Statement and other documents that QXO and the Purchaser file with the SEC will be made available

to all investors and security holders of Beacon free of charge from the information agent for the tender offer: Innisfree M&A Incorporated,

501 Madison Avenue, 20th Floor, New York, NY 10022, toll-free telephone: +1 (888) 750-5834.

QXO and the other participants intend to file a preliminary proxy

statement and accompanying WHITE universal proxy card with the SEC to be used to solicit proxies for, among other matters, the election

of its slate of director nominees at the 2025 Annual Meeting of stockholders of Beacon. QXO strongly advises all stockholders of Beacon

to read the preliminary proxy statement, any amendments or supplements to such proxy statement, and other proxy materials filed by QXO

with the SEC as they become available because they will contain important information. Such proxy materials will be available at no charge

on the SEC’s website at www.sec.gov and at QXO’s website at investors.qxo.com. In addition, the participants in this proxy

solicitation will provide copies of the proxy statement, and other relevant documents, without charge, when available, upon request. Requests

for copies should be directed to the participants’ proxy solicitor.

Certain Information Concerning the Participants

The participants in the proxy solicitation are anticipated to be

QXO, Brad Jacobs, Ihsan Essaid, Matt Fassler, Mark Manduca, Sheree Bargabos, Paul Camuti, Karel Czanderna, Jonathan Foster, Mauro Gregorio,

Michael Lenz, Teresa May, Stephen Newlin, Joseph Reitmeier and Wendy Whiteash. As of the date of this communication, QXO owns 100 shares

of common stock of Beacon in record name and Ms. Czanderna may be deemed to beneficially own 10 shares of common stock of Beacon held

in a trust, for which Ms. Czanderna’s husband serves as trustee. As of the date of this communication, none of the other participants

has any direct or indirect interest, by security holdings or otherwise, in Beacon.

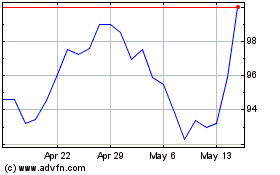

Beacon Roofing Supply (NASDAQ:BECN)

Historical Stock Chart

From Jan 2025 to Feb 2025

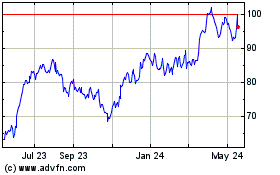

Beacon Roofing Supply (NASDAQ:BECN)

Historical Stock Chart

From Feb 2024 to Feb 2025