false

0000729580

0000729580

2025-02-18

2025-02-18

0000729580

belfb:ClassACommonStockCustomMember

2025-02-18

2025-02-18

0000729580

belfb:ClassBCommonStockCustomMember

2025-02-18

2025-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 18, 2025

BELFUSE INC /NJ

BELFUSE INC /NJ

BEL FUSE INC.

(Exact Name of Registrant as Specified in its Charter)

|

New Jersey

|

|

0-11676

|

|

22-1463699

|

|

(State of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

300 Executive Drive, Suite 300, West Orange, New Jersey

|

|

07052

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (201) 432-0463

|

Not Applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Exchange on Which Registered

|

|

Class A Common Stock ($0.10 par value)

|

|

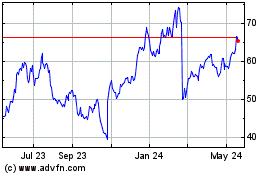

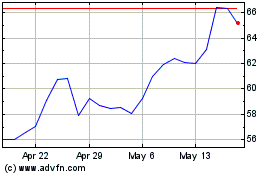

BELFA

|

|

Nasdaq Global Select Market

|

|

Class B Common Stock ($0.10 par value)

|

|

BELFB

|

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 18, 2025, Bel Fuse Inc. ("Bel" or the "Company") issued a press release regarding results for the fourth quarter and year ended December 31, 2024. A copy of this press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Adoption of Israeli Appendix to the Company’s 2020 Equity Compensation Plan

As previously announced, on November 14, 2024, Bel completed its acquisition of 80% of the share capital on a fully-diluted basis of Enercon Technologies Ltd. (“Enercon”) which is based in Israel. On February 12, 2025, Bel’s Board adopted an Israeli Appendix (the “Israeli Appendix”) to the Bel Fuse Inc. 2020 Equity Compensation Plan, as amended and restated effective as of May 4, 2020 (the “Company Equity Plan”), applicable to Company Equity Plan participants who are residents of the State of Israel or who are deemed residents of the State of Israel for tax purposes (“Israeli Participants”). The Israeli Appendix is intended to facilitate participation in the Company Equity Plan by employees, directors and other service providers of Enercon who are Israeli Participants, including in order for grants and awards under the Company Equity Plan to Israeli Participants to qualify for favorable tax treatment under Israeli law. The Israeli Appendix establishes certain rules and limitations applicable to participation in the Company Equity Plan by Israeli Participants, in compliance with the tax and other applicable laws currently in force in the State of Israel and to comply with and be subject to the Israeli Income Tax Ordinance (New Version), 1961 (the “Israeli Tax Ordinance”) and provisions of Section 102 of the Israeli Tax Ordinance, as amended from time to time.

The foregoing description of the Israeli Appendix to the Company Equity Plan is a summary only and is qualified in its entirety by reference to the full text of the Israeli Appendix, a copy of which is filed as 10.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: February 18, 2025

|

BEL FUSE INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

By:

|

/s/Daniel Bernstein

|

|

|

Daniel Bernstein

|

|

|

President and Chief Executive Officer

|

EXHIBIT INDEX

Exhibit 10.1

BEL FUSE INC.

2020 EQUITY COMPENSATION PLAN

Israeli Appendix

| |

1.1

|

This appendix (the “Appendix”) shall apply only to participants who are residents of the State of Israel or those who are deemed residents of the State of Israel for the purposes of tax payment (the “Israeli Participants”). The provisions specified hereunder shall form an integral part of the Bel Fuse, Inc. 2020 Equity Compensation Plan (the “Plan”) of Bel Fuse, Inc. (the “Company”).

|

| |

1.2

|

This Appendix is effective with respect to Israeli Participants’ Awards to be granted according to the resolution of the Administrator as such term is defined in the Plan and shall comply with the Israeli Tax Ordinance (New Version), 1961 (the “Ordinance”).

|

| |

1.3 |

This Appendix is a continuation of the Plan, and only refers to Awards granted to Israeli Participants, to comply with the requirements set by the Israeli law in general, and with the provisions of Section 102 of the Ordinance, and any regulations, rules, orders, or procedures promulgated thereunder, as may be amended or replaced from time to time. For the avoidance of doubt, this Appendix does not add to or modify the Plan in respect of any other category of participants.

|

| |

1.4

|

The Plan and this Appendix are complementary to each other and shall be deemed one. In any case, of contradiction, whether explicit or implied, between the provisions of this Appendix and the Plan, the provisions set out in this Appendix shall prevail to the extent necessary to comply with the requirements set by the Israeli law in general, and, with the provisions of the Ordinance, as may be amended or replaced from time to time.

|

| |

1.5

|

Any capitalized terms not specifically defined in this Appendix shall be construed according to the interpretation given to them in the Plan.

|

| |

2.1

|

“Affiliate” means any “Employing Corporation”.

|

| |

2.2

|

“Approved 102 Award” means an Award granted pursuant to Section 102(b) of the Ordinance and held in trust, or controlled, or supervised, by a Trustee for the benefit of the Israeli Participant.

|

| |

2.3 |

“Award” means any award or benefit granted to an Israeli Participant under the Plan, including, without limitation, the grant of Stock Options, Stock Appreciation Rights, Restricted Stock and/or Restricted Stock Units.

|

| |

2.4

|

“Award Agreement” means the agreement between the Company and an Israeli Participant that sets out the terms and conditions of the award.

|

| |

2.5

|

“Capital Gain Award” or “CGA” means an Approved 102 Award elected and designated by the Committee to qualify under the capital gain tax treatment in accordance with the provisions of Section 102(b)(2) of the Ordinance.

|

| |

2.6

|

“Companies Law” means the Israeli Companies Law -1999.

|

| |

2.7

|

“Controlling Shareholder” means a controlling shareholder (“Ba’al Shlita”) as such term defined in Section 32(9) of the Ordinance.

|

| |

2.8

|

“Employee” means an individual who is employed by an Israeli resident Affiliate, including an individual serving as an Office Holder but excludes any Controlling Shareholder.

|

| |

2.9

|

“Employing Corporation” means any subsidiary or affiliate of the Company, within the meaning of Section 102(a) of the Ordinance.

|

| |

2.10

|

“ITA” means the Israeli Tax Authorities.

|

| |

2.11

|

“Non-Employee” means a consultant, adviser, service provider, Controlling Shareholder or any other person who is not an Employee.

|

| |

2.12

|

“Office Holder” (“Nose Misra”) has the meaning of such term as it is defined in the Companies Law, 1999, including, inter alios, any other person who is part of the upper management of the Company or an Affiliate and who performs managerial services to the Company or an Affiliate.

|

| |

2.13

|

“Ordinary Income Award” or “OIA” means an Approved 102 Award elected and designated by the Committee to qualify under the ordinary income tax treatment in accordance with the provisions of Section 102(b)(1) of the Ordinance.

|

| |

2.14

|

“102 Award” means an Award that may only be settled in Shares that is granted pursuant to Section 102 which shall only be granted to Employees of the Company or an Affiliate who are not Controlling Shareholders and shall be subject to and construed consistently with the requirements of Section 102 of the Ordinance. The Company shall have no liability to a Participant or to any other party, if an Award (or any part thereof), which is intended to be a 102 Award, is not a 102 Award. Approved 102 Awards may be classified as either Capital Gain Awards or Ordinary Income Awards.

|

| |

2.15

|

“3(i) Award” means an Award that does not contain such terms as will qualify under Section 102 of the tax Ordinance.

|

| |

2.16

|

“Section 102” means section 102 of the Ordinance and any regulations, rules, orders, or procedures promulgated thereunder as now in effect or as hereafter amended.

|

| |

2.17

|

“Trustee” means any individual appointed by the Company to serve as a trustee and approved by the ITA, all in accordance with the provisions of Section 102(a) of the Ordinance.

|

| |

2.18

|

“Unapproved 102 Award” means an Award granted pursuant to Section 102(c) of the Ordinance and not held in trust by a Trustee.

|

| |

3.

|

ISSUANCE OF AWARDS; SECTION 102 ELECTION

|

| |

|

|

| |

3.1 |

The Committee may designate Awards granted to Israeli Participants pursuant to Section 102 as Approved 102 Awards or Unapproved 102 Awards.

|

| |

3.2

|

Employees may receive only Approved 102 Awards or Unapproved 102 Awards under this Appendix. Participants, who are not Employees, may be granted only 3(i) Awards under this Appendix.

|

| |

3.3

|

Approved 102 Awards may be classified as either Capital Gain Awards or Ordinary Income Awards.

|

| |

3.4

|

The Option Agreement shall indicate whether the grant is an Approved 102 Award, an Unapproved 102 Award or a 3(i) Award; and, if the grant is an Approved 102 Award, whether it is a Capital Gains Award or an Ordinary Income Award.

|

| |

3.5

|

The grant of Approved 102 Awards shall be made under this Appendix adopted by the Committee and shall be conditioned upon the approval of this Appendix by the ITA.

|

| |

3.6 |

The Committee’s election of the type of Approved 102 Awards as CGA or OIA granted to the Israeli Participants (the “Election”), shall be appropriately filed with the ITA at least 30 days before the date of grant of an Approved 102 Award under the Election. Such Election shall become effective beginning with the first date of grant of an Approved 102 Award under the Election and shall remain in effect until the end of the year following the year during which the Company first granted Approved 102 Awards under such Election. In case the Company chooses to change its election after the end of the following year as mentioned above, the new election will remain in effect until the end of the year following the year during which the Company first granted Approved 102 Awards under the new election. For the avoidance of doubt, such Election shall not prevent the Company from granting Unapproved 102 Awards simultaneously.

|

| |

3.7 |

Each Approved 102 Award and all Shares issued pursuant to the grant or the vesting/exercise of an Award, shall be issued to and registered in the name of a Trustee, as described in Section 4 below, or supervised by the Trustee according to the terms of a special tax ruling from The ITA which approve the supervising trust mechanism (the “Supervising Trustee Ruling”), for the benefit of the Israeli Participants, in accordance with the provisions of Section 102.

|

| |

3.8

|

For the avoidance of any doubt, the designation of Approved 102 Awards and Unapproved 102 Awards shall be subject to the terms and conditions set forth in Section 102 of the Ordinance, and the regulations promulgated thereunder.

|

| |

4.1 |

Approved 102 Awards, which shall be granted under the Plan, and/or any Awards allocated or issued upon vesting/exercise of such Approved 102 Awards shall be allocated and issued to the Trustee and registered in the Trustee’s name, or supervised by the Trustee, in case of obtaining a Supervising Trustee Ruling, and held for the benefit of the Israeli Participants for such period of time as required by Section 102 (the “Restricted Period”). All Shares issued pursuant to the vesting/exercise of an Award shall be deposited with and held by the Trustee or controlled or supervised by the Trustee until such time that such Awards are released from the previously mentioned trust or the supervision of the Trustee as herein provided. In case the requirements for Approved 102 Awards are not met, then the Approved 102 Awards may be treated as Unapproved 102 Awards, all in accordance with the provisions of Section 102.

|

| |

4.2

|

Notwithstanding anything to the contrary, the Trustee shall not release any Awards allocated or issued upon vesting/exercise of Approved 102 Awards prior to the full payment of the Participants’ tax liabilities arising from the Awards.

|

| |

4.3 |

With respect to any Approved 102 Award, subject to the provisions of Section 102, a Participant shall not be entitled to sell or release from trust or from the supervision of the Trustee any Shares received upon the vesting/exercise of an Approved 102 Award received subsequently following any realization of rights, until the lapse of the Restricted Period required under Section 102. Notwithstanding the above, if any such sale or release occurs during the Restricted Period it will result in adverse tax consequences to the Participant under Section 102 of the Ordinance, which shall apply to and shall be borne solely by such Participant.

|

| |

4.4

|

Upon receipt of any Approved 102 Award, the Participant will sign an undertaking to release the Trustee from any liability in respect of any action or decision duly taken and bona fide executed in relation with the Plan and this Appendix, or any Approved 102 Awards granted to the Participant thereunder.

|

| |

5.

|

FAIR MARKET VALUE FOR TAX PURPOSES

|

Without derogating from the above, solely for the purpose of determining the tax liability pursuant to Section 102(b)(3) of the Ordinance, the Fair Market Value of an Award at the date of grant shall be determined in accordance with the average value of the Company’s Shares on the thirty (30) trading days preceding the date of grant.

| |

6.

|

INTEGRATION OF SECTION 102 AND TAX COMMISSIONER’S PERMIT

|

| |

6.1

|

Regarding Approved 102 Awards, the provisions of the Plan and/or any Award Agreement entered into in conjunction with the grant of any Award (the “Award Agreement”) shall be subject to the provisions of Section 102 and the ITA’s permit, and the said provisions and permit shall be deemed an integral part of the Appendix and of the Award Agreement.

|

| |

6.2

|

Any provision of Section 102 and/or the said permit which is necessary to receive and/or to keep any tax benefit pursuant to Section 102 that is not expressly specified in the Appendix, or the Award Agreement shall be considered binding upon the Company and the Israeli Participants.

|

Subject to the Company’s Articles of Association, with respect to all Shares (but excluding, for avoidance of any doubt, any unexercised Options and any unvested Restricted Stock Units) allocated or issued upon the exercise of Options or upon the vesting of Restricted Stock Units and held by the Israeli Participant or by the Trustee as the case may be, the Israeli Participant shall be entitled to receive dividends in accordance with the quantity of such Shares, and subject to any applicable taxation on distribution of dividends, and when applicable subject to the provisions of Section 102 and the rules, regulations or orders promulgated thereunder. With regards to Approved 102 Awards, the Trustee shall transfer the dividend proceeds to the Participant in accordance with the Plan after deduction of taxes in compliance with applicable withholding requirements, and subject to any other requirements imposed by the ITA.

| |

8.1

|

To the extent permitted by applicable laws, any tax consequences arising from the grant or exercise/vesting of any Award, from the payment for Awards covered thereby or from any other event or act (of the Company, and/or its Affiliates, and/or the Trustee or the Israeli Participant), hereunder, shall be borne solely by the Israeli Participant with the exception of any taxes usually borne by the employer, including but not limited to employer social security contributions. The Company and/or its Affiliates and/or the Trustee shall withhold taxes according to the requirements under the applicable laws, rules, and regulations, including withholding taxes at source. Furthermore, the Israeli Participant agrees to indemnify the Company and/or its Affiliates and/or the Trustee and hold them harmless against any liability for any such tax or interest or penalty thereon, including without limitation, liabilities relating to the necessity to withhold, or to have withheld, any such tax from any payment made to the Participant.

|

| |

8.2

|

The Company and/or the Trustee shall not be required to release any Shares to a Participant until all Tax consequences (if any) arising from the exercise or sale of such Awards are resolved in a manner reasonably acceptable to the Company, or where the Participant provides, at the Company’s request, a written certificate from the ITA approving the release of the Shares underlying such Awards.

|

| |

8.3

|

With respect to Unapproved 102 Awards, if the Israeli Participant ceases to be employed by the Company or any Affiliate, the Israeli Participant shall extend to the Company and/or its Affiliate a security or guarantee for the payment of tax due at the time of sale of Shares, all in accordance with the provisions of Section 102 and the rules, regulation or orders promulgated thereunder.

|

| |

9.

|

GOVERNING LAW & JURISDICTION

|

Notwithstanding the governing law provisions of the Plan and the Award Agreement, solely for the purpose of determining the Israeli tax treatment of Awards granted pursuant to this Appendix, this Appendix shall be governed by, and interpreted in accordance with, the laws of the state of Israel. The competent courts of Tel Aviv-Yafo shall have sole jurisdiction to adjudicate any dispute that may arise in connection with the application, interpretation or enforcement of this Appendix and of Section 102 including (without limitation) matters involving the Trustee.

BEL FUSE INC.

Exhibit 99.1

|

|

FOR IMMEDIATE RELEASE

|

Bel Fuse Inc.

300 Executive Drive

Suite 300

West Orange, NJ 07052

www.belfuse.com

tel 201.432.0463

|

Bel Reports Fourth Quarter and Full Year 2024 Results

WEST ORANGE, NJ, Tuesday, February 18, 2025-- Bel Fuse Inc. (Nasdaq: BELFA and BELFB) today announced preliminary financial results for the fourth quarter and full year of 2024.

Fourth Quarter 2024 Highlights

|

•

|

Net sales of $149.9 million compared to $140.0 million in Q4-23. Excluding $20.8 million of contribution from Enercon, organic sales down 7.8% from Q4-23.

|

|

•

|

Gross profit margin of 37.5%, up from 36.6% in Q4-23

|

| • |

GAAP net loss attributable to Bel shareholders of $1.8 million versus GAAP net earnings attributable to Bel shareholders of $12.0 million in Q4-23 |

| • |

Non-GAAP net earnings attributable to Bel shareholders of $19.0 million versus $19.5 million in Q4-23 |

| • |

Adjusted EBITDA of $30.3 million (20.2% of sales) as compared to $27.3 million (19.5% of sales) in Q4-23 |

| • |

Completed acquisition of Enercon, making aerospace and defense Bel's largest end market served

|

Full Year 2024 Highlights

|

•

|

Net sales of $534.8 million compared to $639.8 million in 2023. Excluding contribution from Enercon, organic sales down 19.7%.

|

|

•

|

Gross profit margin of 37.8%, up from 33.7% in 2023

|

|

•

|

GAAP net earnings attributable to Bel shareholders of $41.0 million versus $73.8 million in 2023

|

| • |

Non-GAAP net earnings attributable to Bel shareholders of $72.1 million versus $89.6 million in 2023 |

|

•

|

Adjusted EBITDA of $101.9 million (19.0% of sales), down from $116.8 million (18.3% of sales) in 2023

|

"Bel's profitability levels remained strong throughout 2024 despite a challenging top line environment", said Daniel Bernstein, President and CEO. "Our recent initiatives in operational efficiencies and global mindset of financial discipline has strengthened Bel's foundation, enabling us to thrive despite the macro conditions we faced. We could not be more pleased with our acquisition of Enercon, both operationally and from a team perspective. We are excited to embark on 2025 as a new team, working together to progress on revenue synergy opportunities that we have identified across our two businesses. On a personal note, as recently announced, I look forward to working with Farouq in the coming months as I transition the roles of President and CEO to the next generation", concluded Mr. Bernstein.

Farouq Tuweiq, CFO, added, "Our priority for 2024 was to take actions to drive future top line growth and further refine our organizational structure to enhance operational efficiencies. In this regard, we were successful in achieving a series of initiatives. During the fourth quarter, we closed on our acquisition of Enercon, the largest transaction in Bel’s history. Enercon adds scale, diversity and a strong financial profile to Bel’s legacy business. Further, in October 2024, Uma Pingali joined Bel as our first Global Head of Sales. Under Uma’s leadership, we are laying the foundation of a new cohesive global sales structure and strategy aimed at driving top line growth across all product groups, geographies and end markets. On the internal initiative side, we announced two additional facility consolidation projects in 2024 and have initiated a strategic focus on global procurement with the hiring of Anubhav Gothi. Each of these actions completed in 2024 will serve to support Bel’s growth and profitability objectives for 2025.

"Looking ahead, we are encouraged to see the tide turning in terms of demand from our networking and distribution partners. We anticipate the rebound in these areas will be slow and steady throughout 2025. Based on information available today, GAAP net sales in the first quarter of 2025 are expected to be in the range of $144 to $154 million, with gross margin in the range of 36% to 38%. We are excited entering 2025 as a more nimble organization and look forward to executing on the growth opportunities in the year ahead", concluded Mr. Tuweiq.

Non-GAAP financial measures, such as Non-GAAP net earnings attributable to Bel shareholders, Non-GAAP EPS, Non-GAAP Operating Income and Adjusted EBITDA, adjust corresponding GAAP measures for provision for income taxes, other income/expense, net, interest income/expense, and depreciation and amortization, and also exclude, where applicable for the covered period presented in the financial statements, certain unusual or special items identified by management such as restructuring charges, gains/losses on sales of businesses and properties, acquisition related costs, impairment charges, noncontrolling interest ("NCI") adjustments from fair value to redemption value, and certain litigation costs. In addition, in the fourth quarter of 2024, we modified our presentation of Non-GAAP financial measures, including revising our definitions of Adjusted EBITDA and Non-GAAP EPS, to additionally exclude from these Non-GAAP measures (i) stock-based compensation, (ii) amortization of intangibles (which primarily relates to the amortization of finite-lived customer relationships and technology associated with the Company's historical acquisitions, including those associated with the recent acquisition of Enercon), and (iii) unrealized foreign currency exchange (gains) losses. We believe this change enhances investor insight into our operational performance. We have applied this modified definition of Adjusted EBITDA and Non-GAAP EPS to all periods presented. Non-GAAP adjusted net sales exclude expedite fee revenue. Please refer to the financial information included with this press release for reconciliations of GAAP financial measures to Non-GAAP financial measures and our explanation of why we present Non-GAAP financial measures.

Conference Call

Bel has scheduled a conference call for 8:30 a.m. ET on Wednesday, February 19, 2025 to discuss these results. To participate in the conference call, investors should dial 877-407-0784, or 201-689-8560 if dialing internationally. The presentation will additionally be broadcast live over the Internet and will be available at https://ir.belfuse.com/events-and-presentations. The webcast will be available via replay for a period of at least 30 days at this same Internet address. For those unable to access the live call, a telephone replay will be available at 844-512-2921, or 412-317-6671 if dialing internationally, using access code 13750153 after 12:30 pm ET, also for 30 days.

About Bel

Bel (www.belfuse.com) designs, manufactures and markets a broad array of products that power, protect and connect electronic circuits. These products are primarily used in the networking, telecommunications, computing, general industrial, high-speed data transmission, defense, commercial aerospace, transportation and eMobility industries. Bel's portfolio of products also finds application in the automotive, medical, broadcasting and consumer electronics markets. Bel's product groups include Power Solutions and Protection (front-end, board-mount and industrial power products, module products and circuit protection), Connectivity Solutions (expanded beam fiber optic, copper-based, RF and RJ connectors and cable assemblies), and Magnetic Solutions (integrated connector modules, power transformers, power inductors and discrete components). The Company operates facilities around the world.

Company Contact:

Farouq Tuweiq

Chief Financial Officer

ir@belf.com

Investor Contact:

Three Part Advisors

Jean Marie Young, Managing Director or Steven Hooser, Partner

631-418-4339

jyoung@threepa.com; shooser@threepa.com

Cautionary Language Concerning Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, our guidance for the first quarter of 2025; our statements regarding our expectations for future periods generally including anticipated financial performance, projections and trends for the remainder of the 2025 year ahead and other future periods; our statements regarding future events, performance, plans, intentions, beliefs, expectations and estimates, including statements regarding matters such as trends and expectations as to our sales, gross margin, products, product groups, customers, geographies and end markets; statements about the anticipated benefits of the recently-closed Enercon acquisition, including our beliefs about the potential future advantages of the acquisition for Bel’s operations, team, and with respect to revenue synergy opportunities; statements expressing management’s optimism for 2025 and for the future generally; statements about the process of transitioning the roles of President and CEO to the next generation; statements regarding Bel’s plans and intentions in respect of corporate projects and objectives, including plans for initiatives and efficiencies, and including statements about the intention to drive future top line growth and refine the organizational structure to enhance operational efficiencies; statements about the anticipated future contributions of new employees recently joining Bel and the role of such newly-created positions in the corporate team; statements about Bel’s sales structure and strategy aimed at driving top line growth across product groups, geographies and end markets; statements about facility consolidation projects and strategic focus on global procurement, and the anticipated benefits thereof including with respect to supporting Bel’s growth and profitability objectives for 2025; Anticipated demand from networking and distribution partners; size and capabilities of the organization; statements about executing on growth opportunities; statements regarding our expectations and beliefs regarding trends in the Company's business and industry and the markets in which Bel operates, and about broader market trends and the macroeconomic environment generally, and other statements regarding the Company's positioning, its strategies, future progress, investments, plans, targets, goals, and other focuses and initiatives, and the expected timing and potential benefits thereof. These forward-looking statements are made as of the date of this release and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “forecast,” “outlook,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Bel’s control. Bel’s actual results could differ materially from those stated or implied in our forward-looking statements (including without limitation any of Bel’s projections) due to a number of factors, including but not limited to, difficulties associated with integrating previously acquired companies, including any unanticipated difficulties, or unexpected or higher than anticipated expenditures, relating to the Enercon acquisition which closed in November 2024, and including, without limitation, the risk that Bel is unable to integrate the Enercon business successfully or difficulties that result in the failure to realize the expected benefits and synergies within the expected time period (if at all); the possibility that the Bel’s intended acquisition of the remaining 20% stake in Enercon is not completed in accordance with the shareholders agreement as contemplated for any reason, and any resulting disruptions that may result to Bel’s business and our currently 80% owned Enercon subsidiary as a result thereof; trends in demand which can affect our products and results, including that demand in Enercon’s end markets can be cyclical, impacting the demand for Enercon’s products, which could be materially adversely affected by reductions in defense spending; the market concerns facing our customers, and risks for the Company’s business in the event of the loss of certain substantial customers; the continuing viability of sectors that rely on our products; the effects of business and economic conditions, and challenges impacting the macroeconomic environment generally and/or our industry in particular; the effects of rising input costs, and cost changes generally, including the potential impact of inflationary pressures; capacity and supply constraints or difficulties, including supply chain constraints or other challenges; the impact of public health crises; difficulties associated with the availability of labor, and the risks of any labor unrest or labor shortages; risks associated with our international operations, including our substantial manufacturing operations in China, and following Bel’s acquisition of Enercon which closed in November 2024, risks associated with operations in Israel, which may be adversely affected by political or economic instability, major hostilities or acts of terrorism in the region; risks associated with restructuring programs or other strategic initiatives, including any difficulties in implementation or realization of the expected benefits or cost savings; product development, commercialization or technological difficulties; the regulatory and trade environment including the potential effects of trade restrictions that may impact Bel, its customers and/or its suppliers; risks associated with fluctuations in foreign currency exchange rates and interest rates; uncertainties associated with legal proceedings; the market's acceptance of the Company's new products and competitive responses to those new products; the impact of changes to U.S. and applicable foreign legal and regulatory requirements, including tax laws, trade and tariff policies, such as any new or increase in tariffs imposed either by the U.S. government on foreign imports or by a foreign government on US. exports related to the countries in which Bel transacts business; and the risks detailed in Bel’s most recent Annual Report on Form 10-K and in subsequent reports filed by Bel with the Securities and Exchange Commission, as well as other documents that may be filed by Bel from time to time with the Securities and Exchange Commission. In light of the risks and uncertainties impacting our business, there can be no assurance that any forward-looking statement will in fact prove to be correct. Past performance is not necessarily indicative of future results. The forward-looking statements included in this press release represent Bel’s views as of the date of this press release. Bel anticipates that subsequent events and developments will cause its views to change. Bel undertakes no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing Bel’s views as of any date subsequent to the date of this press release.

Non-GAAP Financial Measures

The Non-GAAP financial measures identified in this press release as well as in the supplementary information to this press release (Non-GAAP adjusted net sales, Non-GAAP net earnings attributable to Bel shareholders, Non-GAAP EPS, Non-GAAP Operating Income and Adjusted EBITDA) are not measures of performance under accounting principles generally accepted in the United States of America ("GAAP"). These measures should not be considered a substitute for, and the reader should also consider, income from operations, net earnings, earnings per share and other measures of performance as defined by GAAP as indicators of our performance or profitability. Our non-GAAP measures may not be comparable to other similarly-titled captions of other companies due to differences in the method of calculation. We present results adjusted to exclude the effects of certain unusual or special items and their related tax impact that would otherwise be included under U.S. GAAP, to aid in comparisons with other periods. We believe that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to our financial condition and results of operations. We use these non-GAAP measures to compare the Company’s performance to that of prior periods for trend analysis and for budgeting and planning purposes. We also believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with other similarly situated companies in our industry, many of which present similar non-GAAP financial measures to investors. We also use non-GAAP measures in determining incentive compensation. For additional information about our use of non-GAAP financial measures in connection with our Incentive Compensation Program for 2023, please see the Executive Compensation discussion appearing in our Definitive Proxy Statement filed with the Securities and Exchange Commission on April 1, 2024.

Website Information

We routinely post important information for investors on our website, www.belfuse.com, in the "Investor Relations" section. We use our website as a means of disclosing material, otherwise non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investor Relations section of our website, in addition to following our press releases, Securities and Exchange Commission (SEC) filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this document.

[Financial tables follow]

Bel Fuse Inc.

Supplementary Information(1)

Condensed Consolidated Statements of Operations

(in thousands, except per share amounts)

(unaudited)

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

149,859 |

|

|

$ |

140,010 |

|

|

$ |

534,792 |

|

|

$ |

639,813 |

|

|

Cost of sales

|

|

|

93,652 |

|

|

|

88,827 |

|

|

|

332,434 |

|

|

|

423,964 |

|

|

Gross profit

|

|

|

56,207 |

|

|

|

51,183 |

|

|

|

202,358 |

|

|

|

215,849 |

|

|

As a % of net sales

|

|

|

37.5 |

% |

|

|

36.6 |

% |

|

|

37.8 |

% |

|

|

33.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development costs

|

|

|

6,934 |

|

|

|

5,966 |

|

|

|

23,586 |

|

|

|

22,487 |

|

|

Selling, general and administrative expenses

|

|

|

34,831 |

|

|

|

24,942 |

|

|

|

110,616 |

|

|

|

99,091 |

|

|

As a % of net sales

|

|

|

23.2 |

% |

|

|

17.8 |

% |

|

|

20.7 |

% |

|

|

15.5 |

% |

|

Impairment of CUI tradename

|

|

|

400 |

|

|

|

- |

|

|

|

400 |

|

|

|

- |

|

|

Restructuring charges

|

|

|

1,669 |

|

|

|

3,808 |

|

|

|

3,459 |

|

|

|

10,114 |

|

|

Gain on sale of property

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(3,819 |

) |

|

Income from operations

|

|

|

12,373 |

|

|

|

16,467 |

|

|

|

64,297 |

|

|

|

87,976 |

|

|

As a % of net sales

|

|

|

8.3 |

% |

|

|

11.8 |

% |

|

|

12.0 |

% |

|

|

13.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of Czech Republic business

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

980 |

|

|

Interest expense

|

|

|

(2,815 |

) |

|

|

(448 |

) |

|

|

(4,078 |

) |

|

|

(2,850 |

) |

|

Interest income

|

|

|

1,013 |

|

|

|

- |

|

|

|

4,754 |

|

|

|

- |

|

|

Other expense, net

|

|

|

(3,186 |

) |

|

|

(2,520 |

) |

|

|

(3,165 |

) |

|

|

(2,806 |

) |

|

Earnings before income taxes

|

|

|

7,385 |

|

|

|

13,499 |

|

|

|

61,808 |

|

|

|

83,300 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

953 |

|

|

|

1,463 |

|

|

|

12,616 |

|

|

|

9,469 |

|

|

Effective tax rate

|

|

|

12.9 |

% |

|

|

10.8 |

% |

|

|

20.4 |

% |

|

|

11.4 |

% |

|

Net earnings

|

|

$ |

6,432 |

|

|

$ |

12,036 |

|

|

$ |

49,192 |

|

|

$ |

73,831 |

|

|

As a % of net sales

|

|

|

4.3 |

% |

|

|

8.6 |

% |

|

|

9.2 |

% |

|

|

11.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net earnings attributable to noncontrolling interest

|

|

|

484 |

|

|

|

- |

|

|

|

484 |

|

|

|

- |

|

|

Redemption value adjustment attributable to noncontrolling interest

|

|

|

7,748 |

|

|

|

- |

|

|

|

7,748 |

|

|

|

- |

|

|

Net (loss) earnings attributable to Bel Fuse Shareholders

|

|

$ |

(1,800 |

) |

|

$ |

12,036 |

|

|

$ |

40,960 |

|

|

$ |

73,831 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A common shares - basic and diluted

|

|

|

2,115 |

|

|

|

2,142 |

|

|

|

2,124 |

|

|

|

2,142 |

|

|

Class B common shares - basic and diluted

|

|

|

10,429 |

|

|

|

10,628 |

|

|

|

10,491 |

|

|

|

10,634 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) earnings per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A common shares - basic and diluted

|

|

$ |

(0.14 |

) |

|

$ |

0.90 |

|

|

$ |

3.09 |

|

|

$ |

5.52 |

|

|

Class B common shares - basic and diluted

|

|

$ |

(0.14 |

) |

|

$ |

0.95 |

|

|

$ |

3.28 |

|

|

$ |

5.83 |

|

(1) The supplementary information included in this press release for 2024 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission.

Bel Fuse Inc.

Supplementary Information(1)

Condensed Consolidated Balance Sheets

(in thousands, unaudited)

| |

|

December 31, 2024

|

|

|

December 31, 2023

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

68,253 |

|

|

$ |

89,371 |

|

|

Held to maturity U.S. Treasury securities

|

|

|

950 |

|

|

|

37,548 |

|

|

Accounts receivable, net

|

|

|

111,376 |

|

|

|

84,129 |

|

|

Inventories

|

|

|

161,370 |

|

|

|

136,540 |

|

|

Other current assets

|

|

|

31,581 |

|

|

|

33,890 |

|

|

Total current assets

|

|

|

373,530 |

|

|

|

381,478 |

|

|

Property, plant and equipment, net

|

|

|

47,879 |

|

|

|

36,533 |

|

|

Right-of-use assets

|

|

|

25,125 |

|

|

|

20,481 |

|

|

Related-party note receivable

|

|

|

2,937 |

|

|

|

2,152 |

|

|

Equity method investment

|

|

|

9,265 |

|

|

|

10,282 |

|

|

Goodwill and other intangible assets, net

|

|

|

439,984 |

|

|

|

76,033 |

|

|

Other assets

|

|

|

51,069 |

|

|

|

44,672 |

|

|

Total assets

|

|

$ |

949,789 |

|

|

$ |

571,631 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities, redeemable noncontrolling interests and stockholders' equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

49,182 |

|

|

$ |

40,441 |

|

|

Operating lease liability, current

|

|

|

7,954 |

|

|

|

6,350 |

|

|

Other current liabilities

|

|

|

70,933 |

|

|

|

63,818 |

|

|

Total current liabilities

|

|

|

128,069 |

|

|

|

110,609 |

|

|

Long-term debt

|

|

|

287,500 |

|

|

|

60,000 |

|

|

Operating lease liability, long-term

|

|

|

17,763 |

|

|

|

14,212 |

|

|

Other liabilities

|

|

|

75,295 |

|

|

|

46,252 |

|

|

Total liabilities

|

|

|

508,627 |

|

|

|

231,073 |

|

|

Redeemable noncontrolling interests

|

|

|

80,586 |

|

|

|

- |

|

|

Stockholders' equity

|

|

|

360,576 |

|

|

|

340,558 |

|

|

Total liabilities, redeemable noncontrolling interests and stockholders' equity

|

|

$ |

949,789 |

|

|

$ |

571,631 |

|

(1) The supplementary information included in this press release for 2024 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission.

Bel Fuse Inc.

Supplementary Information(1)

Condensed Consolidated Statements of Cash Flows

(in thousands, unaudited)

| |

|

Year Ended

|

|

|

| |

|

December 31,

|

|

|

| |

|

2024

|

|

|

2023

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

|

Net earnings

|

|

$ |

49,192 |

|

|

$ |

73,831 |

|

|

|

Adjustments to reconcile net earnings to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

16,457 |

|

|

|

13,312 |

|

|

|

Stock-based compensation

|

|

|

3,738 |

|

|

|

3,486 |

|

|

|

Amortization of deferred financing costs

|

|

|

151 |

|

|

|

33 |

|

|

|

Deferred income taxes

|

|

|

(6,267 |

) |

|

|

(3,872 |

) |

|

|

Net unrealized losses on foreign currency revaluation

|

|

|

1,456 |

|

|

|

1,356 |

|

|

|

Gain on sale of property

|

|

|

- |

|

|

|

(2,117 |

) |

|

|

Gain on sale of Czech Republic business

|

|

|

- |

|

|

|

(980 |

) |

|

|

Other, net

|

|

|

2,347 |

|

|

|

(1,037 |

) |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net

|

|

|

(6,817 |

) |

|

|

22,500 |

|

|

|

Unbilled receivables

|

|

|

7,800 |

|

|

|

5,451 |

|

|

|

Inventories

|

|

|

15,121 |

|

|

|

33,613 |

|

|

|

Accounts payable

|

|

|

139 |

|

|

|

(22,745 |

) |

|

|

Accrued expenses

|

|

|

(7,068 |

) |

|

|

5,356 |

|

|

|

Accrued restructuring costs

|

|

|

215 |

|

|

|

(1,228 |

) |

|

|

Income taxes payable

|

|

|

(1,009 |

) |

|

|

(4,976 |

) |

|

|

Other operating assets/liabilities, net

|

|

|

2,199 |

|

|

|

(13,634 |

) |

|

|

Net cash provided by operating activities

|

|

|

77,654 |

|

|

|

108,349 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment

|

|

|

(14,108 |

) |

|

|

(12,126 |

) |

|

|

Purchases of held to maturity U.S. Treasury securities

|

|

|

(131,309 |

) |

|

|

(59,992 |

) |

|

|

Proceeds from held to maturity securities

|

|

|

167,907 |

|

|

|

19,918 |

|

|

|

Payment for equity method investment

|

|

|

- |

|

|

|

(10,282 |

) |

|

|

Investment in related party notes receivable

|

|

|

(785 |

) |

|

|

(2,152 |

) |

|

|

Proceeds from sale of property, plant and equipment

|

|

|

883 |

|

|

|

6,036 |

|

|

|

Payment of acquisition, net of cash acquired

|

|

|

(324,071 |

) |

|

|

|

|

|

|

Proceeds from sale of business

|

|

|

- |

|

|

|

5,063 |

|

|

|

Net cash used in investing activities

|

|

|

(301,483 |

) |

|

|

(53,535 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

|

Dividends paid to common stockholders

|

|

|

(3,453 |

) |

|

|

(3,492 |

) |

|

|

Deferred financing costs

|

|

|

(1,736 |

) |

|

|

- |

|

|

|

Repayments under revolving credit line

|

|

|

(15,000 |

) |

|

|

(40,000 |

) |

|

|

Borrowings under revolving credit line

|

|

|

242,500 |

|

|

|

5,000 |

|

|

|

Purchases of common stock

|

|

|

(16,053 |

) |

|

|

(105 |

) |

|

|

Net cash provided by (used in) financing activities

|

|

|

206,258 |

|

|

|

(38,597 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

(3,547 |

) |

|

|

2,888 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash and cash equivalents

|

|

|

(21,118 |

) |

|

|

19,105 |

|

|

|

Cash and cash equivalents - beginning of period

|

|

|

89,371 |

|

|

|

70,266 |

|

|

|

Cash and cash equivalents - end of period

|

|

$ |

68,253 |

|

|

$ |

89,371 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Supplementary information:

|

|

|

|

|

|

|

|

|

|

|

Cash paid during the period for:

|

|

|

|

|

|

|

|

|

|

|

Income taxes, net of refunds received

|

|

$ |

22,952 |

|

|

$ |

25,056 |

|

|

|

Interest payments

|

|

$ |

5,795 |

|

|

$ |

4,729 |

|

|

|

ROU assets obtained in exchange for lease obligations

|

|

$ |

6,870 |

|

|

$ |

5,999 |

|

|

(1) The supplementary information included in this press release for 2024 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission.

Bel Fuse Inc.

Supplementary Information(1)

Product Group Highlights

(dollars in thousands, unaudited)

| |

|

Sales

|

|

|

Gross Margin

|

|

| |

|

Q4-24

|

|

|

Q4-23

|

|

|

% Change

|

|

|

Q4-24

|

|

|

Q4-23

|

|

|

Basis Point Change

|

|

|

Power Solutions and Protection

|

|

$ |

78,073 |

|

|

$ |

68,971 |

|

|

|

13.2 |

% |

|

|

40.6 |

% |

|

|

40.2 |

% |

|

|

40 |

|

|

Connectivity Solutions

|

|

|

52,548 |

|

|

|

50,562 |

|

|

|

3.9 |

% |

|

|

36.6 |

% |

|

|

29.3 |

% |

|

|

730 |

|

|

Magnetic Solutions

|

|

|

19,238 |

|

|

|

20,477 |

|

|

|

-6.1 |

% |

|

|

29.1 |

% |

|

|

17.1 |

% |

|

|

1,200 |

|

|

Total

|

|

$ |

149,859 |

|

|

$ |

140,010 |

|

|

|

7.0 |

% |

|

|

37.5 |

% |

|

|

36.6 |

% |

|

|

90 |

|

| |

|

Sales

|

|

|

Gross Margin

|

|

| |

|

FY 2024

|

|

|

FY 2023

|

|

|

% Change

|

|

|

FY 2024

|

|

|

FY 2023

|

|

|

Basis Point Change

|

|

|

Power Solutions and Protection

|

|

$ |

245,551 |

|

|

|

314,105 |

|

|

|

-21.8 |

% |

|

|

42.4 |

% |

|

|

38.1 |

% |

|

|

430 |

|

|

Connectivity Solutions

|

|

|

220,370 |

|

|

|

210,572 |

|

|

|

4.7 |

% |

|

|

37.1 |

% |

|

|

34.2 |

% |

|

|

290 |

|

|

Magnetic Solutions

|

|

|

68,871 |

|

|

|

115,136 |

|

|

|

-40.2 |

% |

|

|

25.3 |

% |

|

|

22.0 |

% |

|

|

330 |

|

|

Total

|

|

$ |

534,792 |

|

|

$ |

639,813 |

|

|

|

-16.4 |

% |

|

|

37.8 |

% |

|

|

33.7 |

% |

|

|

410 |

|

(1) The supplementary information included in this press release for 2024 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission.

Bel Fuse Inc.

Supplementary Information(1)

Reconciliation of GAAP Net Sales to Non-GAAP Adjusted Net Sales(2)

Reconciliation of GAAP Net Earnings to Non-GAAP Operating Income and Adjusted EBITDA(2)(3)

(in thousands, unaudited)

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net sales

|

|

$ |

149,859 |

|

|

$ |

140,010 |

|

|

$ |

534,792 |

|

|

$ |

639,813 |

|

|

Expedite fee revenue

|

|

|

- |

|

|

|

425 |

|

|

|

57 |

|

|

|

14,850 |

|

|

Non-GAAP adjusted net sales

|

|

$ |

149,859 |

|

|

$ |

139,585 |

|

|

$ |

534,735 |

|

|

$ |

624,963 |

|

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net earnings

|

|

$ |

6,432 |

|

|

$ |

12,036 |

|

|

$ |

49,192 |

|

|

$ |

73,831 |

|

|

Provision for income taxes

|

|

|

953 |

|

|

|

1,463 |

|

|

|

12,616 |

|

|

|

9,469 |

|

|

Other income/expense, net

|

|

|

3,186 |

|

|

|

2,520 |

|

|

|

3,165 |

|

|

|

2,806 |

|

|

Interest income

|

|

|

(1,013 |

) |

|

|

- |

|

|

|

(4,754 |

) |

|

|

- |

|

|

Interest expense

|

|

|

2,815 |

|

|

|

448 |

|

|

|

4,078 |

|

|

|

2,850 |

|

|

GAAP Operating Income

|

|

$ |

12,373 |

|

|

$ |

16,467 |

|

|

$ |

64,297 |

|

|

$ |

88,956 |

|

|

Restructuring charges

|

|

|

1,669 |

|

|

|

3,808 |

|

|

|

3,459 |

|

|

|

10,114 |

|

|

Acquisition related costs

|

|

|

8,592 |

|

|

|

- |

|

|

|

12,884 |

|

|

|

- |

|

|

Amortization of inventory step-up

|

|

|

639 |

|

|

|

- |

|

|

|

639 |

|

|

|

- |

|

|

Impairment of CUI tradename

|

|

|

400 |

|

|

|

- |

|

|

|

400 |

|

|

|

- |

|

|

Loss on liquidation of foreign subsidiary

|

|

|

- |

|

|

|

2,724 |

|

|

|

- |

|

|

|

2,724 |

|

|

MPS litigation costs

|

|

|

- |

|

|

|

128 |

|

|

|

- |

|

|

|

3,031 |

|

|

Gain on sale of Czech Republic business

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(980 |

) |

|

Gain on sale of properties

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(3,819 |

) |

|

Stock compensation

|

|

|

956 |

|

|

|

774 |

|

|

|

3,738 |

|

|

|

3,486 |

|

|

Non-GAAP Operating Income

|

|

$ |

24,629 |

|

|

$ |

23,901 |

|

|

$ |

85,417 |

|

|

$ |

103,512 |

|

|

Depreciation and amortization

|

|

|

5,698 |

|

|

|

3,350 |

|

|

|

16,457 |

|

|

|

13,312 |

|

|

Adjusted EBITDA

|

|

$ |

30,327 |

|

|

$ |

27,251 |

|

|

$ |

101,874 |

|

|

$ |

116,824 |

|

|

% of net sales

|

|

|

20.2 |

% |

|

|

19.5 |

% |

|

|

19.0 |

% |

|

|

18.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) The supplementary information included in this press release for 2024 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission.

(2) In this press release and supplemental information, we have included Non-GAAP financial measures, including Non-GAAP adjusted net sales, Non-GAAP net earnings attributable to Bel shareholders, Non-GAAP EPS, Non-GAAP Operating Income and Adjusted EBITDA. We present results adjusted to exclude the effects of certain specified items and their related tax impact that would otherwise be included under GAAP, to aid in comparisons with other periods. We believe that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to our financial condition and results of operations. We use these non-GAAP measures to compare the Company’s performance to that of prior periods for trend analysis and for budgeting and planning purposes. We also believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with other similarly situated companies in our industry, many of which present similar non-GAAP financial measures to investors. We also use non-GAAP measures in determining incentive compensation. See the section above captioned “Non-GAAP Financial Measures” for additional information.

(3) In the fourth quarter of 2024, we modified our presentation of Non-GAAP financial measures, including revising our definitions of Adjusted EBITDA and Non-GAAP EPS, to additionally exclude from these Non-GAAP measures (i) stock-based compensation, (ii) amortization of intangibles (which primarily relates to the amortization of finite-lived customer relationships and technology associated with the Company's historical acquisitions, including those associated with the recent acquisition of Enercon), and (iii) unrealized foreign currency exchange (gains) losses. We believe this change enhances investor insight into our operational performance. We have applied this modified definition of Adjusted EBITDA and Non-GAAP EPS to all periods presented.

Bel Fuse Inc.

Supplementary Information(1)

Reconciliation of GAAP Measures to Non-GAAP Measures(2)(4)

(in thousands, except per share data) (unaudited)

The following tables detail the impact that certain unusual or special items had on the Company's net earnings per common Class A and Class B basic and diluted shares ("EPS") and the line items in which these items were included on the consolidated statements of operations.

| |

|

Three Months Ended December 31, 2024

|

|

|

Three Months Ended December 31, 2023

|

|

|

Reconciling Items

|

|

Earnings before taxes

|

|

|

Provision for income taxes

|

|

|

Net Earnings Attributable to Bel Fuse Shareholders

|

|

|

Class A EPS(3)

|

|

|

Class B EPS(3)

|

|

|

Earnings before taxes

|

|

|

Provision for income taxes

|

|

|

Net Earnings Attributable to Bel Fuse Shareholders

|

|

|

Class A EPS(3)

|

|

|

Class B EPS(3)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP measures

|

|

$ |

7,385 |

|

|

$ |

953 |

|

|

$ |

(1,800 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.14 |

) |

|

$ |

13,499 |

|

|

$ |

1,463 |

|

|

$ |

12,036 |

|

|

$ |

0.90 |

|

|

$ |

0.95 |

|

|

Restructuring charges

|

|

|

1,669 |

|

|

|

270 |

|

|

|

1,399 |

|

|

|

0.11 |

|

|

|

0.11 |

|

|

|

3,808 |

|

|

|

675 |

|

|

|

3,133 |

|

|

|

0.24 |

|

|

|

0.25 |

|

|

Acquisition related costs

|

|

|

8,592 |

|

|

|

1,516 |

|

|

|

7,076 |

|

|

|

0.54 |

|

|

|

0.57 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Redemption value adjustment on redeemable NCI

|

|

|

- |

|

|

|

- |

|

|

|

7,748 |

|

|

|

0.59 |

|

|

|

0.62 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Amortization of inventory step-up

|

|

|

639 |

|

|

|

147 |

|

|

|

492 |

|

|

|

0.04 |

|

|

|

0.04 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Impairment of CUI tradename

|

|

|

400 |

|

|

|

92 |

|

|

|

308 |

|

|

|

0.02 |

|

|

|

0.02 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Loss on liquidation of foreign subsidiary

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,724 |

|

|

|

681 |

|

|

|

2,043 |

|

|

|

0.15 |

|

|

|

0.16 |

|

|

MPS litigation costs

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

128 |

|

|

|

29 |

|

|

|

99 |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

Share-based compensation

|

|

|

956 |

|

|

|

197 |

|

|

|

759 |

|

|

|

0.06 |

|

|

|

0.06 |

|

|

|

774 |

|

|

|

160 |

|

|

|

614 |

|

|

|

0.05 |

|

|

|

0.05 |

|

|

Amortization of intangibles

|

|

|

2,843 |

|

|

|

493 |

|

|

|

2,349 |

|

|

|

0.18 |

|

|

|

0.19 |

|

|

|

1,160 |

|

|

|

254 |

|

|

|

906 |

|

|

|

0.07 |

|

|

|

0.07 |

|

|

Unrealized foreign currency exchange (gains) losses

|

|

|