0000034067FALSE00000340672024-12-112024-12-110000034067us-gaap:CommonStockMember2024-12-112024-12-110000034067boom:StockPurchaseRightsMember2024-12-112024-12-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): December 11, 2024

DMC Global Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Delaware | | 001-14775 | | 84-0608431 |

(State or Other Jurisdiction of

Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021

(Address of Principal Executive Offices, Including Zip Code)

(303) 665-5700

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, $0.05 Par Value | | BOOM | | The Nasdaq Global Select Market |

| Stock Purchase Rights | | | | | | | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously reported, the Board of Directors (the “Board”) of DMC Global Inc. (the “Company”) appointed James O’Leary as Interim President and Chief Executive Officer of the Company (“Interim CEO”), effective as of November 29, 2024 (the “Effective Date”). On December 11, 2024, the Company entered into a letter agreement (the “Agreement”) with respect to Mr. O’Leary’s service in such role. The Agreement, which has a term commencing on the Effective Date and continuing through June 30, 2025, unless modified by written agreement of the parties, continues the base salary of $500,000 previously agreed to by the Company and Mr. O’Leary for his service as Executive Chairman of the Company. The Agreement also provides that Mr. O’Leary will be eligible for certain cash payments in the aggregate target amount of $2,000,000. The actual amount of such payments will be determined based on, as applicable, completion of targets or performance of certain ongoing transition services as specified in the Agreement, including, but not limited to: (i) the assumption of all critical pre-existing workstreams and relationships from the former Chairman of the Board and the former President and Chief Executive Officer of the Company, (ii) managing and engaging external parties on potential strategic alternatives or potential strategic capital solutions, respectively, and (iii) preparing and finalizing for Board review and approval individual business unit plans and budgets for each of the Company’s three business segments for fiscal 2025. If Mr. O’Leary’s position as Interim CEO terminates prior to June 30, 2025 due to a termination without Cause (as defined in the Agreement) or his resignation for Good Reason (as defined in the Agreement), he will be paid: (i) in a lump sum, an amount equal to his base salary for the period from the date of such termination through June 30, 2025, and (ii) an amount equal to the then-unpaid aggregate cash payments. The foregoing description of the Agreement is only a summary and is qualified in its entirety by reference to the full text of the Agreement, which is filed herewith as Exhibit 10.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Exhibit Number | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

|

|

|

|

| | | | | DMC Global Inc. | | |

| | | | | | | | |

| Dated: | December 16, 2024 | | | | By: | /s/ Michelle Shepston |

| | | | | | Name: Michelle Shepston |

| | | | | | Title: Executive Vice President and Chief Legal Officer |

| | | | | | |

James O’Leary

Re: Position as Interim President and CEO

Dear Jim:

This letter (this “CEO Letter Agreement”) is effective as of November 29, 2024 and will confirm the terms of the agreement offered to you by DMC Global Inc. (the “Company”) with respect to your role as the Company’s Interim President and Chief Executive Officer, which will be in addition to your role as Executive Chairman.

Position as Executive Chairman. As you know, you are a member of the Board of Directors of the Company (the “Board”) and are currently serving as the Company’s Executive Chairman in accordance with the terms of the letter agreement entered into by and between you and the Company dated effective as of October 16, 2024 (the “Executive Chairman Agreement”). Your position as Executive Chairman will continue pursuant to the terms and conditions of the Executive Chairman Agreement except as modified herein.

Position as Interim President and CEO. Should you accept this offer, you will serve as (Interim) President and Chief Executive Officer (“Interim CEO”) of the Company, reporting to the Board. Your position as Interim CEO will commence effective upon November 29, 2024 and continue through June 30, 2025 (the “Term”), unless such period is modified by mutual written agreement of the parties. However, the Company acknowledges that most of the critical transition services outlined in Attachment A hereto commenced and have been administered by you since your appointment as Executive Chairman.

Base Salary. For the period of time during which you serve both as Executive Chairman and as Interim CEO, you have agreed to maintain your base salary at the level agreed upon in the Executive Chairman Agreement.

Strategic Transition Services. So long as you remain continuously employed as Interim CEO, you will be eligible for certain cash payments in the aggregate target amount of $2,000,000 (the “Target Amount”).

•The actual amount of such cash payments will be determined based on (as applicable) completion of targets (“Target Goals”) or performance of certain ongoing transition services (“Transition Services”) as set forth on Attachment A to this CEO Letter. These will

be reviewed on a bimonthly basis by the Compensation Committee commencing in December 2024 (each review, a “Progress Review”).

•Payments for completed Target Goals shall be made promptly after each Progress Review, and payments for Transition Services shall be made over the Term as part of regular payroll, subject in all cases to applicable taxes and withholdings.

•In order to earn the aggregate cash payments referred to above, you must remain continuously employed as Interim CEO through June 30, 2025; provided, however, if your position as Interim CEO terminates prior to June 30, 2025 due to (i) a termination without “Cause” (as defined in Attachment B hereto), or (ii) a resignation by you for “Good Reason” (as defined in Attachment B hereto), then, so long as you sign a release of claims in a form acceptable to the Company, (A) you will be paid, in a single lump sum, an amount equivalent to your base salary for the period from the date of such termination through June 30, 2025, less all applicable taxes and withholdings, and (B) an amount equivalent to the then-unpaid aggregate cash payments (i.e., the target amount less all amounts previously paid in respect thereof), less all applicable taxes and withholdings, with such payments under (A) and (B) to be made within seventy-five (75) days after such termination.

Benefits. To the extent you are not already eligible in connection with your service as Executive Chairman, you will be eligible for the Company’s standard benefits available to similarly situated employees of the Company, including healthcare benefits and participation in the Company’s 401(k) Plan, subject to the terms and condition of all such benefits plans. You will continue to be eligible for four (4) weeks or twenty (20) days of time off per year. The Company may amend, modify or terminate its benefit plans and policies at any time or from time to time.

Proprietary Information and Inventions Agreement. The Company’s standard proprietary information, inventions, and non-solicitation agreement which you signed in connection with your engagement as Executive Chairman, a copy of which is provided herewith as Attachment C, shall remain in full force and effect.

At-Will Employment. As an at-will employer, the Company cannot guarantee your employment for any specific duration. You are free to quit and the Company is entitled to terminate your employment at any time, with or without cause or prior warning.

IRC Section 409A. The intent of the parties is that payments and benefits under this CEO Letter Agreement comply with, or be exempt from, Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”), to the extent subject thereto, and accordingly, to the maximum extent permitted, this CEO Letter Agreement shall be interpreted and administered to be in compliance therewith. Notwithstanding anything contained herein to the contrary, you will not be considered to have terminated employment with the Company for purposes of any payments under this CEO Letter Agreement which are subject to Section 409A of the Code until you would be considered to have incurred a “separation from service” from the Company within the

meaning of Section 409A of the Code. Each amount to be paid or benefit to be provided under this CEO Letter Agreement shall be construed as a separate identified payment for purposes of Section 409A of the Code. Without limiting the foregoing and notwithstanding anything contained herein to the contrary, to the extent required in order to avoid accelerated taxation and/or tax penalties under Section 409A of the Code, amounts that would otherwise be payable and benefits that would otherwise be provided pursuant to this CEO Letter Agreement or any other arrangement between you and the Company during the six-month period immediately following your separation from service shall instead be paid on the first business day after the date that is six months following your separation from service (or, if earlier, your date of death). To the extent required to avoid an accelerated or additional tax under Section 409A of the Code, amounts reimbursable to you under this CEO Letter Agreement shall be paid to you on or before the last day of the year following the year in which the expense was incurred and the amount of expenses eligible for reimbursement (and in kind benefits provided to you) during one year may not affect amounts reimbursable or provided in any subsequent year. The Company makes no representation that any or all of the payments described in this CEO Letter Agreement will be exempt from or comply with Section 409A of the Code and makes no undertaking to preclude Section 409A of the Code from applying to any such payment.

Governing Law and Choice of Forum. Your employment will be governed by and interpreted under the laws of the State of Colorado without regard to its conflict of law principles. The parties hereby agree that all demands, claims, actions, causes of action, suits, proceedings and litigation between or among the parties or arising out of the employment relationship shall be filed, tried and litigated exclusively in a state or federal court located in Colorado. In connection with the foregoing, the parties hereto irrevocably consent to the jurisdiction and venue of such courts and expressly waive any claims or defenses for lack of jurisdiction, non-convenience, or proper venue by such courts.

Successors and Assigns. You may not assign or transfer your rights or delegate your duties, responsibilities, or obligations under this CEO Letter Agreement to any person, firm, or corporation without the prior written consent of the Company. This CEO Letter Agreement and all of the Company’s rights and obligations hereunder may be assigned, delegated, or transferred by the Company to any affiliate or subsidiary of the Company, or to any business entity which at any time by merger, consolidation or otherwise acquires all or substantially all of the assets of the Company or to which the Company transfers all or substantially all of its assets. This CEO Letter Agreement shall inure to the benefit of and shall be binding upon the parties hereto, and any successors to or assigns of the Company.

Counterparts. This CEO Letter Agreement may be executed in any number of counterparts, each of which when so executed and delivered shall be deemed an original, and all of which together shall constitute one and the same.

Entire Agreement. By signing this CEO Letter Agreement, you agree that the terms in this CEO Letter Agreement, the Executive Chairman Agreement (as modified by this CEO Agreement), and the terms set forth in the standard proprietary information, inventions and non-solicitation

agreement) constitute the entire agreement between the parties and supersede all other agreements or understandings with respect to the subject matter hereof.

To confirm that you agree to the terms stated in this Letter Agreement, please sign and date an enclosed copy of this CEO Letter Agreement and return a scanned copy of the Letter Agreement to me and to Michelle Shepston.

Sincerely,

/s/ Ouma Sananikone

| | | | | | | | |

| Name: | Ouma Sananikone | | | |

| Title: | Lead Independent Director | | | |

| Date | December 11, 2024 | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

ACKNOWLEDGEMENT:

I accept the offer as set forth above.

| | | | | | | | | | | | | | | | | |

| By: | /s/ James O'Leary | | Date: | December 11, 2024 | |

| James O'Leary | | | | |

ATTACHMENT A

•Assume all critical pre-existing workstreams and relationships underway from former Chairman of the Board and current President and Chief Executive Officer including, but not limited to, the recently terminated strategic review process regarding DynaEnergetics and NobelClad businesses.

•Manage and engage external parties on potential strategic alternatives both currently underway and that may arise.

•Complete and present necessary amendments to the Credit Facility and/or obtain an amendment to the Arcadia operating agreement to delay exercisability of the put option.

•Manage and engage external financing parties on potential strategic capital solutions that the Board may consider, including the existing lender group.

•Review any capital allocation initiatives that may require Board approval, including (but not limited to) NobelClad India, and each business unit’s capital plan.

•Prepare and finalize for Board review and approval the individual business unit plans and budgets for Arcadia Products, NobelClad and DynaEnergetics for fiscal 2025.

•Assume responsibilities as Chairman of the Arcadia Products, LLC board and engage with members of Arcadia Products, LLC, as appropriate.

•Assist the Corporate Governance and Nominating (CG&N) Committee with searches for potential candidates, with timing as directed by the CG&N Committee, to fill the roles of Company President and Chief Executive Officer and President of Arcadia Products..

ATTACHMENT B

DEFINITIONS

For the purposes of this CEO Letter Agreement, the following terms shall have the following meanings:

“Cause” shall have the meaning set forth in the Stock Plan; provided, however, the following shall be deemed termination by the Company without Cause: (i) the failure of the Board (or applicable Board committee) to nominate you for reelection to the Company’s Board (unless you have stated in writing you will not seek reelection) or (ii) the Board requests that you resign from the position as Executive Chairman.

“Good Reason” means the occurrence of any of the following related to your role as Interim CEO without your written consent: (i) a reduction in your base salary; (ii) any material and adverse change in your office or title, reporting relationship(s), authority, duties or responsibilities to the Company (except in connection with the end of your service as Interim CEO as provided herein); (iii) any assignment of duties that are inconsistent with and result in any diminution of your position and duties with the Company (except in connection with the end of your service as Interim CEO as provided herein); or (iv) the Company requires that you relocate your principal residence or imposes on you any requirement of a principal workplace, any minimum time requirement at any Company workplace or other location(s) or other similar requirement. Notwithstanding the foregoing, no event shall constitute Good Reason unless (i) you notify the Board in writing of your intention to terminate for Good Reason (describing the condition(s) that you have determined constitute Good Reason) within thirty (30) days after you know or have reason to know of the occurrence of any such event, (ii) the Company does not cure said condition within fifteen (15) days after its receipt of your written notice, and (iii) in the event the Company does not cure said condition, you terminate your employment within thirty (30) days after the period for curing said condition has expired. Your determination of the existence of Good Reason shall be conclusive in the absence of fraud, bad faith or manifest error.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=boom_StockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

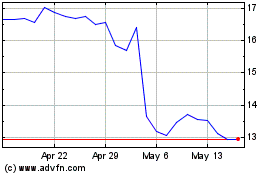

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jan 2025 to Feb 2025

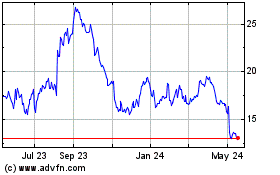

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Feb 2024 to Feb 2025