false000151722800015172282025-01-312025-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2025

COMMSCOPE HOLDING COMPANY, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-36146 |

|

27-4332098 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

3642 E. US Highway 70

Claremont, North Carolina 28610

(Address of principal executive offices)

Registrant’s telephone number, including area code: (828) 459-5000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

COMM |

The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01. Completion of Acquisition or Disposition of Assets.

On January 31, 2025, (the “Closing Date”), CommScope Holding Company, Inc. (the “Company” or “CommScope”) completed the previously announced sale of its Outdoor Wireless Networks business segment (the “OWN Business”) as well as the Distributed Antenna Systems business unit of its Networking, Intelligent Cellular & Security Solutions segment (the “DAS Business”) to Amphenol Corporation (“Amphenol”) pursuant to the Purchase Agreement (the “Purchase Agreement”), dated as of July 18, 2024. Pursuant to the Purchase Agreement, Amphenol acquired the OWN Business and the DAS Business on a cash-free, debt-free basis, in exchange for approximately $2.1 billion in cash, subject to certain adjustments.

The proceeds from the sale of the OWN Business and the DAS Business will be used to pay fees and expenses associated with the transactions and to repay all outstanding amounts under the Company’s asset-backed revolving credit facility, to repay in part the Company’s 4.750% Senior Secured Notes due 2029 and to repay in full the Company’s 6.000% Senior Secured Notes due 2026 (collectively, the “Debt Repayment”). In connection with the repayment of all outstanding amounts under the Company's asset-backed revolving credit facility, the committed amount thereunder will be reduced to $750.0 million, subject to borrowing base limitations. Following the consummation of the Debt Repayment, we expect that the conditions precedent will be met for a 25 basis point reduction in the applicable margin on the Company’s Senior Secured Term Loan.

A description of the Purchase Agreement was set forth in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on July 23, 2024 (the “Prior 8-K”), but such description does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, which was attached as Exhibit 2.1 to the Prior 8-K.

Item 9.01. Financial Statements and Exhibits.

(b) Unaudited Pro Forma Condensed Consolidated Financial Information

The following unaudited pro forma condensed consolidated financial statements of CommScope reflecting the disposition of the OWN Business and the DAS Business pursuant to the Purchase Agreement, are filed as Exhibit 99.1 to this Current Report on Form 8-K and are incorporated herein by reference:

•Unaudited Pro Forma Condensed Consolidated Balance Sheet as of September 30, 2024;

•Unaudited Pro Forma Condensed Consolidated Statements of Operations for the nine months ended September 30, 2024 and the years ended December 31, 2024, 2022 and 2021; and

•Notes to the Unaudited Pro Forma Condensed Consolidated Financial Statements.

(d) Exhibits

The following exhibits are hereby filed as part of this Current Report on Form 8-K.

Exhibit. Description.

99.1 CommScope Holding Company , Inc. Unaudited Pro Forma Condensed Consolidated Financial Information

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

CommScope Holding Company, Inc. |

Date: February 5, 2025 |

|

|

|

By: |

/s/ Kyle D. Lorentzen |

|

Name: |

Kyle D. Lorentzen |

|

Title: |

Executive Vice President and Chief Financial Officer |

DISCLAIMER

This information and PwC US Business Advisory LLP’s and/or its affiliates’ (“PwC”) services (collectively, “Information”) are confidential and access, use and distribution are restricted.

If you are not PwC’s client or otherwise authorized by PwC and its client, you may not access or use the Information.

PwC performed and prepared the Information at client’s direction and exclusively for client’s sole internal benefit and use pursuant to its client agreement.

THE INFORMATION MAY NOT BE RELIED UPON BY ANY PERSON OR ENTITY OTHER THAN PWC’S CLIENT. PWC MAKES NO REPRESENTATIONS OR WARRANTIES REGARDING THE INFORMATION AND EXPRESSLY DISCLAIMS ANY CONTRACTUAL OR OTHER DUTY, RESPONSIBILITY OR LIABILITY TO ANY PERSON OR ENTITY OTHER THAN ITS CLIENT.

The Information was performed or prepared in accordance with the Standards for Consulting Services of the American Institute of Certified Public Accountants (“AICPA”) and, where applicable, the AICPA Standards for Reports on the Application of Accounting Principles or the AICPA Statements on Standards for Tax Services. The Information does not constitute legal or investment advice, broker dealer services, a fairness or solvency opinion, an estimate of value, an audit, an examination of any type, an accounting or tax opinion, or other attestation or review services in accordance with standards of the AICPA, the Public Company Accounting Oversight Board or any other professional or regulatory body. The Services cannot provide assurance that matters of significance to Client will be disclosed and the Services are not intended or likely to identify or disclose fraud, error or misrepresentation, any financial statement misstatements or to identify or disclose any wrongdoing or noncompliance with laws and regulations. PwC provides no opinion or other form of assurance with respect to the Information. Client, in consultation with its independent accountants, is responsible for the presentation and preparation of its financial statements and related disclosures.

The Information shall be maintained in strict confidence and may not be discussed with, distributed or otherwise disclosed to any third party, in whole or in part, without PwC’s prior written consent, nor may the Information be associated with, referred to or quoted in any way in any offering memorandum, prospectus, registration statement, public filing, loan or other agreement. Information provided by or through third parties is provided “as is”, without any representations or warranties by PwC or such third parties. PwC and such third parties disclaim any contractual or other duty, responsibility or liability to Client or any other person or entity that accesses such information. Client has no obligation of confidentiality with respect to any information related to the tax structure or tax treatment of any transaction.

Client is responsible for the information used to prepare any prospective financial statements or other forward-looking information, including forecasts or projections (collectively, “PFI”) referred to in this report, and for any decisions, assumptions or projections relating to PFI or any outputs therefrom. PwC’s observations on PFI and any quantified alternatives, sensitivities or vulnerabilities do not represent PwC’s assurance, concurrence, conclusion or opinion on any PFI, nor PwC’s advocacy, endorsement or promotion of any results therefrom; they are only an illustration of PwC’s advice to Client regarding Client’s evaluation or determination of PFI. It is Client’s responsibility to make its own decisions regarding PFI. As events and circumstances frequently do not occur as expected, there may be material differences between PFI and actual results; PwC disclaims any responsibility and liability for PFI or based on any differences between PFI and any actual results achieved.

On January 31, 2025, (the “Closing Date”), CommScope Holding Company, Inc. (“CommScope”, the “Company”) completed the sale of its Outdoor Wireless Networks (“OWN”) segment and Distributed Antenna Systems (“DAS”) business unit of its Networking, Intelligent Cellular & Security Solutions segment (collectively, the “Business”) (the “Disposal”), to Amphenol Corporation (“Amphenol”, the “Buyer”). The OWN segment provides wireless infrastructure for mobile networks, including macro and small cell site solutions. The DAS business unit provides solutions for cellular infrastructure inside venues, campuses and enterprises. Pursuant to the Purchase Agreement, CommScope sold the Business to Amphenol in exchange for $2.1 billion in cash, on a cash-free, debt-free basis.

The following unaudited pro forma condensed consolidated financial statements were derived from the historical consolidated financial statements of CommScope, which were prepared in accordance with generally accepted accounting principles in the United States of America ("GAAP"). The unaudited pro forma condensed consolidated financial statements were prepared in accordance with Article 11 of Regulation S-X. The unaudited pro forma condensed consolidated financial statements were prepared for illustrative and informational purposes only and are not intended to represent what CommScope’s results of operations or financial position would have been had the Disposal occurred on the dates indicated. The unaudited pro forma condensed consolidated financial statements should not be considered indicative of CommScope’s future results of operations or financial position. The actual financial position and results of operations may differ significantly from the unaudited pro forma condensed consolidated financial statements presented herein due to a variety of factors.

The unaudited pro forma condensed consolidated financial statements as of and for the nine months ended September 30, 2024, have been derived from the historical unaudited condensed consolidated financial statements of CommScope, included in CommScope’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2024, filed with the Securities and Exchange Commission (“SEC”) on November 7, 2024. The unaudited pro forma condensed consolidated financial statements for the years ended December 31, 2023, 2022, and 2021 have been derived from the historical audited consolidated financial statements of CommScope, included in CommScope’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024. The unaudited pro forma condensed consolidated financial statements and accompanying notes should be read in conjunction with CommScope’s historical consolidated financial statements and accompanying notes.

The unaudited pro forma condensed consolidated statements of operations for the nine months ended September 30, 2024, and for the years ended December 31, 2023, 2022 and 2021 reflect pro forma results of CommScope’s operations as if the Disposal had occurred on January 1, 2021. The unaudited pro forma condensed consolidated balance sheet as of September 30, 2024, gives effect to the Disposal as if it had occurred on that date. The adjustments in the “Other Separation Adjustments” column in the unaudited pro forma condensed consolidated statements of operations and unaudited pro forma condensed consolidated balance sheet give effect to the Other Separation Adjustments as if they occurred as of January 1, 2023, and September 30, 2024, respectively.

In the third quarter of 2024, the Disposal met the criteria under ASC 205-20, Presentation of Financial Statements, for discontinued operations, and the Company started presenting the Disposal as a discontinued operation in the Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2024. The Company believes that the adjustments included within the “Discontinued Operations of the Business” column of the unaudited pro forma condensed consolidated financial statements are consistent with the guidance for discontinued operations under GAAP. CommScope’s current estimates on a discontinued operations basis are subject to change as the Company finalizes discontinued operations accounting to be reported in its Annual Report on Form 10-K for the year ended December 31, 2024.

Article 11 of Regulation S-X requires that pro forma financial information include the following pro forma adjustments to the historical financial statements of the registrant as follows:

•Transaction Accounting Adjustments:

oAdjustments that reflect only the application of required accounting to the acquisition, disposition, or other transaction.

•Autonomous Entity Adjustments:

oAdjustments that are necessary to reflect the operations and financial position of the registrant as an autonomous entity when the registrant was previously part of another entity.

In addition, Regulation S-X permits registrants to reflect adjustments that depict synergies or dis-synergies of the acquisitions and dispositions for which pro forma effect is being given in the disclosures as management adjustments.

The following unaudited pro forma condensed consolidated statements of operations and unaudited pro forma condensed consolidated balance sheet reflect the following transactions in conjunction with the Disposal:

•Discontinued Operations of the Business:

oThe historical financial results directly attributable to the OWN segment and DAS business unit in accordance with ASC 205

•Other Separation Adjustments:

oEstimated unaccrued one-time transaction costs;

oContractual arrangements including a transition services agreement (“TSA Agreement” or the “TSA”) for a time period not expected to exceed 36 months.

The unaudited pro forma condensed consolidated financial statements do not contain any autonomous entity adjustments or potential synergies or dis-synergies that may occur in connection with the Disposal.

CommScope Holding Company, Inc.

Unaudited Pro Forma Condensed Consolidated Balance Sheet

As of September 30, 2024

(In millions, except share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Transaction Accounting Adjustments |

|

|

|

Historical CommScope |

|

Discontinued Operations of the Business (a) |

|

Other Separation Adjustments |

|

Notes |

|

Pro Forma |

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

392.1 |

|

$ |

- |

|

$ |

303.5 |

|

(c) |

|

$ |

695.6 |

Accounts receivable, net |

|

664.8 |

|

|

- |

|

|

- |

|

|

|

|

664.8 |

Inventories, net |

|

843.5 |

|

|

- |

|

|

- |

|

|

|

|

843.5 |

Prepaid expenses and other current assets |

|

178.0 |

|

|

- |

|

|

- |

|

|

|

|

178.0 |

Current assets held for sale |

|

1,345.5 |

|

|

(1,345.5) |

|

|

- |

|

|

|

|

- |

Total current assets |

$ |

3,423.9 |

|

$ |

(1,345.5) |

|

$ |

303.5 |

|

|

|

$ |

2,381.9 |

Property, plant and equipment, net |

|

365.0 |

|

|

- |

|

|

- |

|

|

|

|

365.0 |

Goodwill |

|

2,906.9 |

|

|

- |

|

|

- |

|

|

|

|

2,906.9 |

Other intangible assets, net |

|

1,276.2 |

|

|

- |

|

|

- |

|

|

|

|

1,276.2 |

Deferred income taxes |

|

553.6 |

|

|

- |

|

|

- |

|

|

|

|

553.6 |

Other noncurrent assets |

|

285.1 |

|

|

- |

|

|

- |

|

|

|

|

285.1 |

Total assets |

$ |

8,810.7 |

|

$ |

(1,345.5) |

|

$ |

303.5 |

|

|

|

$ |

7,768.7 |

Liabilities and Stockholders’ Deficit |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

$ |

381.7 |

|

$ |

- |

|

$ |

- |

|

|

|

|

381.7 |

Accrued and other liabilities |

|

527.0 |

|

|

- |

|

|

7.4 |

|

(d)(g) |

|

|

534.4 |

Current portion of long term debt |

|

1,306.6 |

|

|

- |

|

|

- |

|

|

|

|

1,306.6 |

Current liabilities held for sale |

|

235.4 |

|

|

(235.4) |

|

|

- |

|

|

|

|

- |

Total current liabilities |

$ |

2,450.7 |

|

$ |

(235.4) |

|

$ |

7.4 |

|

|

|

$ |

2,222.7 |

Long-term debt |

|

7,966.4 |

|

|

- |

|

|

(1,791.9) |

|

(g) |

|

|

6,174.5 |

Deferred income taxes |

|

101.0 |

|

|

- |

|

|

- |

|

|

|

|

101.0 |

Other noncurrent liabilities |

|

404.4 |

|

|

- |

|

|

- |

|

|

|

|

404.4 |

Total liabilities |

$ |

10,922.5 |

|

$ |

(235.4) |

|

$ |

(1,784.5) |

|

|

|

$ |

8,902.6 |

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A convertible preferred stock, $0.01 par value |

|

1,210.7 |

|

|

- |

|

|

- |

|

|

|

|

1,210.7 |

Stockholders' deficit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value: Authorized shares: 200,000,000; Issued and outstanding shares: 1,210,682 shares Series A convertible preferred stock |

|

- |

|

|

- |

|

|

- |

|

|

|

|

- |

Common stock, $0.01 par value: Authorized shares: 1,300,000,000; Issued and outstanding shares: 215,857,513 shares |

|

2.3 |

|

|

- |

|

|

- |

|

|

|

|

2.3 |

Additional paid-in capital |

|

2,522.9 |

|

|

- |

|

|

- |

|

|

|

|

2,522.9 |

Accumulated deficit |

|

(5,300.9) |

|

|

(1,110.1) |

|

|

2,088.0 |

|

(f) |

|

|

(4,323.0) |

Accumulated other comprehensive loss |

|

(243.2) |

|

|

- |

|

|

- |

|

|

|

|

(243.2) |

Treasury stock, at cost: 15,636,515 shares |

|

(303.6) |

|

|

- |

|

|

- |

|

|

|

|

(303.6) |

Total stockholders' deficit |

|

(3,322.5) |

|

|

(1,110.1) |

|

|

2,088.0 |

|

|

|

|

(2,344.6) |

Total liabilities and stockholders' deficit |

$ |

8,810.7 |

|

$ |

(1,345.5) |

|

$ |

303.5 |

|

|

|

$ |

7,768.7 |

See notes to unaudited pro forma condensed consolidated financial statements

CommScope Holding Company, Inc.

Unaudited Pro Forma Condensed Consolidated Statement of Operations

For the nine months ended September 30, 2024

(In millions, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Transaction Accounting Adjustments |

|

|

|

Historical CommScope |

|

Other Separation Adjustments |

|

Notes |

|

Pro Forma |

Net sales |

$ |

3,036.7 |

|

$ |

- |

|

|

|

$ |

3,036.7 |

Cost of sales |

|

1,909.9 |

|

|

- |

|

|

|

|

1,909.9 |

Gross profit |

|

1,126.8 |

|

|

- |

|

|

|

|

1,126.8 |

Transition service agreement income, net |

|

22.4 |

|

|

3.1 |

|

(e) |

|

|

25.5 |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

565.5 |

|

|

- |

|

|

|

|

565.5 |

Research and development |

|

235.2 |

|

|

- |

|

|

|

|

235.2 |

Amortization of purchased intangible assets |

|

181.4 |

|

|

- |

|

|

|

|

181.4 |

Restructuring costs, net |

|

30.6 |

|

|

- |

|

|

|

|

30.6 |

Asset impairments |

|

- |

|

|

- |

|

|

|

|

- |

Total operating expenses |

|

1,012.7 |

|

|

- |

|

|

|

|

1,012.7 |

Operating income |

|

136.5 |

|

|

3.1 |

|

|

|

|

139.6 |

Other income, net |

|

1.7 |

|

|

- |

|

|

|

|

1.7 |

Interest expense |

|

(503.2) |

|

|

78.2 |

|

(g) |

|

|

(425.0) |

Interest income |

|

8.3 |

|

|

- |

|

|

|

|

8.3 |

Loss from continuing operations before income taxes |

|

(356.7) |

|

|

81.3 |

|

|

|

|

(275.4) |

Income tax expense |

|

(41.2) |

|

|

(19.9) |

|

(i) |

|

|

(61.1) |

Loss from continuing operations |

|

(397.9) |

|

|

61.4 |

|

|

|

|

(336.5) |

Series A convertible preferred stock dividends |

|

(48.6) |

|

|

- |

|

|

|

|

(48.6) |

Net loss from continuing operations attributable to common stockholders |

$ |

(446.5) |

|

$ |

61.4 |

|

|

|

$ |

(385.1) |

|

|

|

|

|

|

|

|

|

|

|

Loss per share from continuing operations: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(2.09) |

|

|

|

|

|

|

$ |

(1.80) |

Diluted |

$ |

(2.09) |

|

|

|

|

|

|

$ |

(1.80) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

213.9 |

|

|

|

|

|

|

|

213.9 |

Diluted |

|

213.9 |

|

|

|

|

|

|

|

213.9 |

See notes to unaudited pro forma condensed consolidated financial statements

CommScope Holding Company, Inc.

Unaudited Pro Forma Condensed Consolidated Statement of Operations

For the year ended December 31, 2023

(In millions, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Transaction Accounting Adjustments |

|

|

|

|

|

Historical CommScope |

|

Discontinued Operations of the Business (b) |

|

Notes |

|

Other Separation Adjustments |

|

Notes |

|

Pro Forma |

Net sales |

$ |

5,789.2 |

|

$ |

(1,224.0) |

|

|

|

$ |

- |

|

|

|

$ |

4,565.2 |

Cost of sales |

|

3,640.9 |

|

|

(742.3) |

|

|

|

|

- |

|

|

|

|

2,898.6 |

Gross profit |

|

2,148.3 |

|

|

(481.7) |

|

|

|

|

- |

|

|

|

|

1,666.6 |

Transition service agreement income, net |

|

- |

|

|

- |

|

|

|

|

35.0 |

|

(e) |

|

|

35.0 |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

873.3 |

|

|

(90.3) |

|

|

|

|

- |

|

|

|

|

783.0 |

Research and development |

|

459.7 |

|

|

(76.6) |

|

|

|

|

- |

|

|

|

|

383.1 |

Amortization of purchased intangible assets |

|

327.1 |

|

|

(26.1) |

|

|

|

|

- |

|

|

|

|

301.0 |

Restructuring costs, net |

|

29.7 |

|

|

(4.4) |

|

|

|

|

- |

|

|

|

|

25.3 |

Asset impairments |

|

571.4 |

|

|

- |

|

|

|

|

- |

|

|

|

|

571.4 |

Total operating expenses |

|

2,261.2 |

|

|

(197.4) |

|

|

|

|

- |

|

|

|

|

2,063.8 |

Operating loss |

|

(112.9) |

|

|

(284.3) |

|

|

|

|

35.0 |

|

|

|

|

(362.2) |

Other income, net |

|

59.7 |

|

|

6.4 |

|

|

|

|

- |

|

|

|

|

66.1 |

Interest expense |

|

(675.8) |

|

|

- |

|

|

|

|

97.1 |

|

(g) |

|

|

(578.7) |

Interest income |

|

11.1 |

|

|

- |

|

|

|

|

- |

|

|

|

|

11.1 |

Loss from continuing operations before income taxes |

|

(717.9) |

|

|

(277.9) |

|

|

|

|

132.1 |

|

|

|

|

(863.7) |

Income tax expense |

|

(133.4) |

|

|

65.9 |

|

(h) |

|

|

(32.4) |

|

(i) |

|

|

(99.9) |

Loss from continuing operations |

|

(851.3) |

|

|

(212.0) |

|

|

|

|

99.7 |

|

|

|

|

(963.6) |

Series A convertible preferred stock dividends |

|

(61.8) |

|

|

- |

|

|

|

|

- |

|

|

|

|

(61.8) |

Net loss from continuing operations attributable to common stockholders |

$ |

(913.1) |

|

$ |

(212.0) |

|

|

|

$ |

99.7 |

|

|

|

$ |

(1,025.4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share from continuing operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(4.33) |

|

|

|

|

|

|

|

|

|

|

|

$ |

(4.86) |

Diluted |

$ |

(4.33) |

|

|

|

|

|

|

|

|

|

|

|

$ |

(4.86) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

210.9 |

|

|

|

|

|

|

|

|

|

|

|

|

210.9 |

Diluted |

|

210.9 |

|

|

|

|

|

|

|

|

|

|

|

|

210.9 |

See notes to unaudited pro forma condensed consolidated financial statements

CommScope Holding Company, Inc.

Unaudited Pro Forma Condensed Consolidated Statement of Operations

For the year ended December 31, 2022

(In millions, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Transaction Accounting Adjustments |

|

|

|

Historical CommScope |

|

Discontinued Operations of the Business (b) |

|

Notes |

|

Pro Forma |

Net sales |

$ |

7,524.7 |

|

$ |

(1,735.8) |

|

|

|

$ |

5,788.9 |

|

Cost of sales |

|

4,930.7 |

|

|

(1,127.4) |

|

|

|

|

3,803.3 |

|

Gross profit |

|

2,594.0 |

|

|

(608.4) |

|

|

|

|

1,985.6 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

1,040.9 |

|

|

(133.1) |

|

|

|

|

907.8 |

|

Research and development |

|

543.6 |

|

|

(92.0) |

|

|

|

|

451.6 |

|

Amortization of purchased intangible assets |

|

440.0 |

|

|

(39.9) |

|

|

|

|

400.1 |

|

Restructuring costs, net |

|

63.0 |

|

|

(21.1) |

|

|

|

|

41.9 |

|

Asset impairments |

|

1,119.6 |

|

|

- |

|

|

|

|

1,119.6 |

|

Total operating expenses |

|

3,207.1 |

|

|

(286.1) |

|

|

|

|

2,921.0 |

|

Operating loss |

|

(613.1) |

|

|

(322.3) |

|

|

|

|

(935.4) |

|

Other expense, net |

|

(0.5) |

|

|

0.6 |

|

|

|

|

0.1 |

|

Interest expense |

|

(588.9) |

|

|

- |

|

|

|

|

(588.9) |

|

Interest income |

|

2.8 |

|

|

- |

|

|

|

|

2.8 |

|

Loss from continuing operations before income taxes |

|

(1,199.7) |

|

|

(321.7) |

|

|

|

|

(1,521.4) |

|

Income tax benefit |

|

15.0 |

|

|

76.3 |

|

(h) |

|

|

91.3 |

|

Loss from continuing operations |

|

(1,184.7) |

|

|

(245.4) |

|

|

|

|

(1,430.1) |

|

Series A convertible preferred stock dividends |

|

(59.0) |

|

|

- |

|

|

|

|

(59.0) |

|

Net loss from continuing operations attributable to common stockholders |

$ |

(1,243.7) |

|

$ |

(245.4) |

|

|

|

$ |

(1,489.1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share from continuing operations |

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(6.00) |

|

|

|

|

|

|

$ |

(7.18) |

|

Diluted |

$ |

(6.00) |

|

|

|

|

|

|

$ |

(7.18) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

207.4 |

|

|

|

|

|

|

|

207.4 |

|

Diluted |

|

207.4 |

|

|

|

|

|

|

|

207.4 |

|

See notes to unaudited pro forma condensed consolidated financial statements

CommScope Holding Company, Inc.

Unaudited Pro Forma Condensed Consolidated Statement of Operations

For the year ended December 31, 2021

(In millions, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Transaction Accounting Adjustments |

|

|

|

Historical CommScope |

|

Discontinued Operations of the Business (b) |

|

Notes |

|

Pro Forma |

Net sales |

$ |

6,737.4 |

|

$ |

(1,680.2) |

|

|

|

$ |

5,057.2 |

Cost of sales |

|

4,297.8 |

|

|

(1,087.2) |

|

|

|

|

3,210.6 |

Gross profit |

|

2,439.6 |

|

|

(593.0) |

|

|

|

|

1,846.6 |

Operating expenses: |

|

|

|

|

- |

|

|

|

|

|

Selling, general and administrative |

|

1,082.9 |

|

|

(122.2) |

|

|

|

|

960.7 |

Research and development |

|

565.0 |

|

|

(98.3) |

|

|

|

|

466.7 |

Amortization of purchased intangible assets |

|

510.0 |

|

|

(53.1) |

|

|

|

|

456.9 |

Restructuring costs, net |

|

85.1 |

|

|

(0.7) |

|

|

|

|

84.4 |

Asset impairments |

|

- |

|

|

- |

|

|

|

|

- |

Total operating expenses |

|

2,243.0 |

|

|

(274.3) |

|

|

|

|

1,968.7 |

Operating loss |

|

196.6 |

|

|

(318.7) |

|

|

|

|

(122.1) |

Other expense, net |

|

(26.5) |

|

|

(2.3) |

|

|

|

|

(28.8) |

Interest expense |

|

(561.2) |

|

|

- |

|

|

|

|

(561.2) |

Interest income |

|

1.9 |

|

|

- |

|

|

|

|

1.9 |

Loss from continuing operations before income taxes |

|

(389.2) |

|

|

(321.0) |

|

|

|

|

(710.2) |

Income tax benefit |

|

39.2 |

|

|

80.0 |

|

(h) |

|

|

119.2 |

Loss from continuing operations |

|

(350.0) |

|

|

(241.0) |

|

|

|

|

(591.0) |

Series A convertible preferred stock dividends |

|

(57.3) |

|

|

- |

|

|

|

|

(57.3) |

Net loss from continuing operations attributable to common stockholders |

$ |

(407.3) |

|

$ |

(241.0) |

|

|

|

$ |

(648.3) |

|

|

|

|

|

|

|

|

|

|

|

Loss per share from continuing operations |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(2.00) |

|

|

|

|

|

|

$ |

(3.18) |

Diluted |

$ |

(2.00) |

|

|

|

|

|

|

$ |

(3.18) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

Basic |

|

203.6 |

|

|

|

|

|

|

|

203.6 |

Diluted |

|

203.6 |

|

|

|

|

|

|

|

203.6 |

See notes to unaudited pro forma condensed consolidated financial statements

CommScope Holding Company, Inc.

Notes to the Unaudited Pro Forma Condensed Consolidated Financial Statements

(In millions, unless otherwise noted)

The historical financial information as of and for the nine months ended September 30, 2024, has been derived from and should be read in conjunction with the historical unaudited condensed consolidated financial statements of CommScope, included in CommScope’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2024, and the assumptions outlined in Note 2 below. The historical financial information for the years ended December 31, 2023, 2022, and 2021 has been derived from and should be read in conjunction with the historical audited consolidated financial statements of CommScope, included in CommScope’s Annual Report on Form 10-K for the years ended December 31, 2023, 2022, and 2021 and the assumptions outlined in Note 2 below.

2.PRO FORMA ADJUSTMENTS AND ASSUMPTIONS

The following adjustments have been reflected in the unaudited pro forma condensed consolidated financial statements:

a)The “Discontinued Operations of the Business” column in the unaudited pro forma condensed consolidated balance sheet eliminates the assets and liabilities of the Business, which were reported as “held for sale” in the unaudited condensed consolidated balance sheet in CommScope’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2024.

b)The “Discontinued Operations of the Business” column in the unaudited pro forma condensed consolidated statement of operations represents the historical financial results directly attributable to the OWN segment and DAS business unit in accordance with ASC 205. This adjustment is not required for the unaudited condensed consolidated statement of operations for the nine months ended September 30, 2024 as the Company began reporting the results of the Business in discontinued operations in CommScope’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2024.

c)The unaudited pro forma condensed consolidated balance sheet reflects the cash consideration received in exchange for the sale of the Business and the Debt Repayment as follows:

|

|

|

|

|

Amount |

Cash consideration received for sale of the Business |

$ |

2,111.2 |

|

Partial repayment of 4.750% Senior Secured Notes due 2029 |

|

(299.0) |

|

Full repayment of 6.000% Senior Secured Notes due 2026 |

|

(1,500.0) |

|

Accrued interest as of September 30, 2024 |

|

(8.7) |

|

Pro forma adjustment to cash and cash equivalents |

$ |

303.5 |

|

CommScope also used cash proceeds from the sale of the Business to repay $250.0 outstanding under the Company’s asset-based revolving credit facility. This is not reflected in these pro forma adjustments as CommScope drew upon this facility subsequent to September 30, 2024, which is the date of the unaudited pro forma condensed consolidated balance sheet included herein.

d)Estimated unaccrued one-time transaction costs of $16.1 were recorded as an accrual in the unaudited pro forma condensed consolidated balance sheet within accrued and other liabilities. These costs consist of accounting, financial, and legal advisory fees.

e)In conjunction with the Disposal, the Company entered into a TSA. Under the TSA, the Company will provide and receive certain post-closing services on a transitional basis. The TSA has an initial term of up to 36 months for certain services and provides for options to extend services for up to two renewal terms of six months each. For services provided, a pro forma adjustment recognizing the related monthly fixed fee income was included in transition services agreement income, net of $3.1 and $35.0 for the nine months ended September 30, 2024, and year ended December 31, 2023, respectively.

f)The adjustment made to the accumulated deficit in the unaudited pro forma condensed consolidated balance sheet consists of the following adjustments:

|

|

|

|

Amount |

Cash consideration received for sale of the Business |

$ |

2,111.2 |

Estimated unaccrued one-time transaction costs |

|

(16.1) |

Write-off of unamortized debt issuance costs related to Debt Repayment |

|

(7.1) |

Pro forma adjustment to accumulated deficit |

$ |

2,088.0 |

g)The adjustment to long-term debt in the unaudited pro forma condensed consolidated balance sheet reflects the impacts of the Debt Repayment as follows:

|

|

|

|

Amount |

Partial repayment of 4.750% Senior Secured Notes due 2029 |

$ |

(299.0) |

Full repayment of 6.000% Senior Secured Notes due 2026 |

|

(1,500.0) |

Write-off of unamortized debt issuance costs |

|

7.1 |

Pro forma adjustment to long-term debt |

$ |

(1,791.9) |

Additionally, cash proceeds were used to pay $8.7 of accrued interest, which is reflected as a reduction of accrued and other liabilities in the unaudited pro forma condensed consolidated balance sheet.

The adjustment to interest expense in the unaudited proforma condensed consolidated statements of operations for the nine months ended September 30, 2024 and year ended December 31, 2023 reflects the following:

|

|

|

|

|

|

|

Nine Months ended September 30, 2024 |

|

Year ended December 31, 2023 |

Reduced interest expense in connection with the Debt Repayment |

$ |

78.2 |

|

$ |

104.2 |

Write-off of unamortized debt issuance costs |

|

- |

|

|

(7.1) |

Pro forma adjustment to interest expense |

$ |

78.2 |

|

$ |

97.1 |

h)The income tax impacts of discontinued operations have been estimated using the applicable statutory income tax rate in the respective jurisdictions, adjusted for effective tax rate impacts related to permanent differences and income tax credits. The estimated income tax adjustments are subject to change and actual amounts will differ from the results reflected herein.

i)Represents the tax impact of the pro forma adjustments at the applicable blended statutory income tax rates.

v3.25.0.1

Document and Entity Information

|

Jan. 31, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 31, 2025

|

| Entity Registrant Name |

COMMSCOPE HOLDING COMPANY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Central Index Key |

0001517228

|

| Entity File Number |

001-36146

|

| Entity Tax Identification Number |

27-4332098

|

| Entity Address, Address Line One |

3642 E.

|

| Entity Address, Address Line Two |

US Highway 70

|

| Entity Address, City or Town |

Claremont

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28610

|

| City Area Code |

828

|

| Local Phone Number |

459-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

COMM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

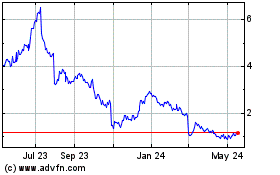

CommScope (NASDAQ:COMM)

Historical Stock Chart

From Jan 2025 to Feb 2025

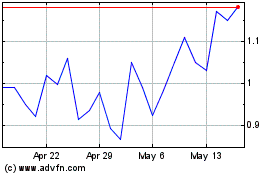

CommScope (NASDAQ:COMM)

Historical Stock Chart

From Feb 2024 to Feb 2025