Diamondback Energy, Inc. Receives Stockholder Approval for Proposed Transaction with Endeavor Energy Resources, L.P.

April 26 2024 - 3:01PM

Diamondback Energy, Inc. (NASDAQ: FANG) (“Diamondback” or the

“Company”) today announced that its stockholders have approved the

issuance of shares of Diamondback common stock in connection with

the proposed business combination with Endeavor Energy Resources,

L.P. (“Endeavor”).

Additionally, Diamondback stockholders approved a proposal to

amend the Company’s certificate of incorporation to increase the

authorized number of shares of Diamondback common stock.

The final voting results from Diamondback’s special meeting of

stockholders will be set forth in a Form 8-K to be filed by

Diamondback with the U.S. Securities and Exchange Commission.

The business combination with Endeavor is subject to customary

closing conditions, including termination or expiration of the

waiting period under the Hart-Scott-Rodino Antitrust Improvements

Act of 1976.

About Diamondback

Diamondback is an independent oil and natural gas company

headquartered in Midland, Texas focused on the acquisition,

development, exploration and exploitation of unconventional,

onshore oil and natural gas reserves in the Permian Basin in West

Texas.

Investor Contact:

Adam Lawlis +1 432.221.7467 alawlis@diamondbackenergy.com

Forward Looking Statements

This press release may contain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Exchange Act of 1934, as amended,

which involve risks, uncertainties, and assumptions. All

statements, other than statements of historical fact, including

statements regarding the anticipated timing of the proposed

transaction are forward-looking statements. When used in this press

release, the words “aim,” “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “future,” “guidance,”

“intend,” “may,” “model,” “outlook,” “plan,” “positioned,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” and similar expressions (including the negative of

such terms) are intended to identify forward-looking statements,

although not all forward-looking statements contain such

identifying words. Although Diamondback believes that the

expectations and assumptions reflected in its forward-looking

statements are reasonable as and when made, they involve risks and

uncertainties that are difficult to predict and, in many cases,

beyond Diamondback’s control. Accordingly, forward looking

statements are not guarantees of future performance and actual

outcomes could differ materially from what Diamondback has

expressed in its forward-looking statements.

Factors that could cause the outcomes to differ materially

include (but are not limited to) the following: the completion of

the proposed transaction on anticipated terms and timing or at all,

including regulatory approval and satisfying other conditions to

the completion of the transaction; uncertainties as to whether the

proposed transaction, if consummated, will achieve its anticipated

benefits and projected synergies within the expected time period or

at all; Diamondback’s ability to integrate Endeavor’s operations in

a successful manner and in the expected time period; the occurrence

of any event, change, or other circumstance that could give rise to

the termination of the proposed transaction; risks that the

anticipated tax treatment of the proposed transaction is not

obtained; unforeseen or unknown liabilities; unexpected future

capital expenditures; potential litigation relating to the proposed

transaction; the possibility that the proposed transaction may be

more expensive to complete than anticipated, including as a result

of unexpected factors or events; the effect of the pendency, or

completion of the proposed transaction on the parties’ business

relationships and business generally; risks that the proposed

transaction disrupts current plans and operations of Diamondback or

Endeavor and their respective management teams and potential

difficulties in retaining employees as a result of the proposed

transaction; the risks related to Diamondback’s financing of the

proposed transaction; potential negative effects of the pendency or

completion of the proposed transaction on the market price of

Diamondback’s common stock and/or operating results; rating agency

actions and Diamondback’s ability to access short- and long-term

debt markets on a timely and affordable basis; changes in supply

and demand levels for oil, natural gas, and natural gas liquids,

and the resulting impact on the price for those commodities; the

impact of public health crises, including epidemic or pandemic

diseases and any related company or government policies or actions;

actions taken by the members of OPEC and Russia affecting the

production and pricing of oil, as well as other domestic and global

political, economic, or diplomatic developments, including any

impact of the ongoing war in Ukraine and the Israel-Hamas war on

the global energy markets and geopolitical stability; instability

in the financial markets; concerns over a potential economic

slowdown or recession; inflationary pressures; rising interest

rates and their impact on the cost of capital; regional supply and

demand factors, including delays, curtailment delays or

interruptions of production, or governmental orders, rules or

regulations that impose production limits; federal and state

legislative and regulatory initiatives relating to hydraulic

fracturing, including the effect of existing and future laws and

governmental regulations; physical and transition risks relating to

climate change; those risks described in Item 1A of Diamondback’s

Annual Report on Form 10-K, filed with the SEC on February 22,

2024, and those risks disclosed in its subsequent filings on Forms

10-Q and 8-K, which can be obtained free of charge on the SEC’s

website at http://www.sec.gov and Diamondback’s website at

www.diamondbackenergy.com/investors/; and those risks more fully

described in the definitive proxy statement on Schedule 14A filed

with the SEC in connection with the proposed transaction. In light

of these factors, the events anticipated by Diamondback’s

forward-looking statements may not occur at the time anticipated or

at all. Moreover, Diamondback operates in a very competitive and

rapidly changing environment and new risks emerge from time to

time. Diamondback cannot predict all risks, nor can it assess the

impact of all factors on its business or the extent to which any

factor, or combination of factors, may cause actual results to

differ materially from those anticipated by any forward-looking

statements it may make. Accordingly, you should not place undue

reliance on any forward-looking statements. All forward-looking

statements speak only as of the date of this press release or, if

earlier, as of the date they were made. Diamondback does not intend

to, and disclaims any obligation to, update or revise any

forward-looking statements unless required by applicable law.

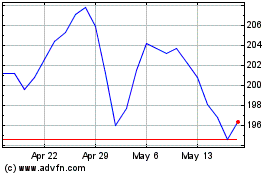

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Feb 2024 to Feb 2025