0001274494false00012744942025-02-202025-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

February 20, 2025

Date of Report (Date of earliest event reported)

FIRST SOLAR, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-33156 | | 20-4623678 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

350 West Washington Street, Suite 600

Tempe, Arizona 85288

(Address of principal executive offices, including zip code)

(602) 414-9300

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.001 par value | | FSLR | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On February 20, 2025, First Solar issued a press release announcing the final sale amount of Section 45X Advanced Manufacturing Production tax credits generated by the production and sale of solar modules in the United States in 2024, which transaction was previously announced on December 11, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

The information in this Form 8-K and in Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. | | | | | | | | |

| Exhibit Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| FIRST SOLAR, INC. |

| | | |

| Date: February 20, 2025 | By: | | /s/ JASON DYMBORT |

| Name: | | Jason Dymbort |

| Title: | | General Counsel & Secretary |

EXHIBIT 99.1

First Solar Announces Final Sale Amount of 2024 Section 45X Advanced Manufacturing Production Tax Credits

TEMPE, Ariz., February 20, 2025 – First Solar, Inc. (Nasdaq: FSLR) (the “Company” or “First Solar”) today announced the final sale amount of Section 45X Advanced Manufacturing Production tax credits generated by the production and sale of solar modules in the United States in 2024, which transaction was previously announced on December 11, 2024.

The transaction for the sale of $857 million of tax credits was the result of two separate Tax Credit Transfer Agreements announced in December 2024, under which a third party agreed to pay First Solar a price of $0.955 per $1.00 of tax credits. The agreements covered a fixed transaction of $645 million of tax credits, paid for in two parts on December 6 and December 30, 2024, and a variable transaction of $212 million in additional tax credits, the sale of which is expected to be completed by February 28, 2025. Upon completion of the transaction, First Solar expects to receive gross cash proceeds of approximately $819 million.

“This is a case of the Section 45X tax credits working exactly as they were intended, creating and retaining billions in economic value in our country and supporting tens of thousands of American jobs,” said Mark Widmar, chief executive officer, First Solar. “The value of the tax credits is directly tied to the volume of solar panels produced at our facilities in Ohio and Alabama for deployment in power generation projects across America, the highest volume we’ve produced in the US since we began manufacturing in 2002.”

“This transaction strengthens our balance sheet even as we continue to invest in our US manufacturing capacity and research and development infrastructure, which are crucial to our growth,” said Alex Bradley, chief financial officer, First Solar. “As it relates to the 2024 financial year, we expect a pre-tax impact to earnings of approximately $39 million and a post-tax impact to earnings of approximately $45 million. This is expected to reduce our diluted earnings by approximately $0.42 per share for the year.”

The tax credits result from the sale of photovoltaic (“PV”) solar modules produced in 2024 by First Solar’s operational manufacturing footprint in the United States, including three factories in Ohio and a new Alabama facility. The Company’s fully vertically integrated solar manufacturing facilities produce thin film wafers, cells, and modules in a single integrated process that sees a sheet of glass transformed into a fully functional solar panel in approximately four hours.

Having manufactured in the US since 2002, First Solar is the country’s leading PV solar technology and manufacturing company and the only one of the world’s largest solar manufacturers headquartered in the US.

Already the largest solar manufacturer in the Western Hemisphere, the Company is on track to achieve 14 gigawatts of annual domestic energy technology manufacturing capacity in 2026, by which time it is expected to support over 30,000 direct, indirect, and induced jobs across the country, representing almost $2.8 billion in labor income, according to a study commissioned by First Solar and conducted by the University of Louisiana at Lafayette. Each of its factories employs upwards of 800 people, with an average manufacturing salary of $80,000 annually.

The Company is enabled by, and supports the employment of, thousands of hardworking people across the country: soda ash miners in Wyoming; silica miners in Michigan; copper miners in Utah; steelworkers in Alabama, Louisiana, and Ohio; glass workers in Illinois, Ohio, and Pennsylvania; woodworkers in Indiana; and a nationwide network of truckers, railroad workers, and many more.

About First Solar, Inc.

First Solar, Inc. (Nasdaq: FSLR) is America's leading PV solar technology and manufacturing company. The only US-headquartered company among the world's largest solar manufacturers, First Solar is focused on competitively and reliably enabling power generation needs with its advanced, uniquely American thin film PV technology. Developed at research and development labs in California and Ohio, the Company's technology represents the next generation of solar power generation, providing a competitive, high-performance, and responsibly produced alternative to conventional crystalline silicon PV modules. For more information, please visit www.firstsolar.com.

For First Solar Investors

This press release contains various “forward-looking statements” which are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements concerning: (i) the sale of $212 million of 2024 Section 45X Advanced Manufacturing Production tax credits at a price of $0.955 per $1.00 of tax credits expected to be completed by February 28, 2025; (ii) our expectation that we will receive gross cash proceeds of approximately $819 million upon completion of the transaction; (iii) our expectation that this transaction strengthens our balance sheet even as we continue to invest in our US manufacturing capacity and research and development infrastructure; (iv) our expectation that the two transactions for $645 million and $212 million will have a full-year 2024 pre-tax impact to earnings of approximately $39 million and a post-tax impact to earnings of approximately $45 million, resulting in a reduction of 2024 diluted earnings of approximately $0.42 per share; and (v) our expectation of having 14 gigawatts of fully vertically integrated US solar manufacturing capacity by 2026, supporting over 30,000 direct, indirect, and induced jobs across the country, representing almost $2.8 billion in labor income. These forward-looking statements are often characterized by the use of words such as “estimate,” “expect,” “anticipate,” “project,” “plan,” “intend,” “seek,” “believe,” “forecast,” “foresee,” “likely,” “may,” “should,” “goal,” “target,” “might,” “will,” “could,” “predict,” “continue” and the negative or plural of these words and other comparable terminology. Forward-looking statements are only predictions based on First Solar’s current expectations and First Solar’s projections about future events and therefore speak only as of the date of this release. You should not place undue reliance on these forward-looking statements. First Solar undertakes no obligation to update any of these forward-looking statements for any reason, whether as a result of new information, future developments or otherwise. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause First Solar’s actual results, levels of activity, performance, or achievements to differ materially from those expressed or implied by these statements. These factors include, but are not limited to, the expected timing and likelihood of completion of the transaction; the risk that the parties may not be able to satisfy the conditions to the transaction in a timely manner or at all; and the matters discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our most recent Annual Report on Form 10-K and our subsequently filed Quarterly Reports on Form 10-Q, as supplemented by our other filings with the Securities and Exchange Commission. This press release contains references to data and information generated by an economic study conducted by the Kathleen Babineaux Blanco Public Policy Center at the University of Louisiana at Lafayette. The economic study is based on numerous assumptions, estimates and other data as more fully described in the report summarizing the study’s findings, which is available at www. firstsolar.com/USeconomy.

Contacts

Media Investors

Reuven Proença Byron Jeffers

First Solar Media First Solar Investor Relations

media@firstsolar.com investor@firstsolar.com

v3.25.0.1

Document and Entity Information Document

|

Feb. 20, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 20, 2025

|

| Entity Registrant Name |

FIRST SOLAR, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33156

|

| Entity Tax Identification Number |

20-4623678

|

| Entity Address, Address Line One |

350 West Washington Street, Suite 600

|

| Entity Address, City or Town |

Tempe

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85288

|

| City Area Code |

602

|

| Local Phone Number |

414-9300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value

|

| Trading Symbol |

FSLR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001274494

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

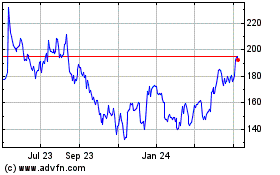

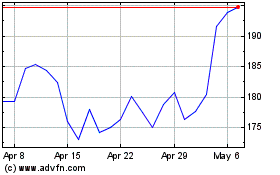

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Jan 2025 to Feb 2025

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Feb 2024 to Feb 2025