Filed by GlycoMimetics, Inc.

pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: GlycoMimetics, Inc.

Commission File No.: 001-36177

Date: February 27, 2025

This

filing relates to the proposed transaction pursuant to the terms of that certain Agreement and Plan of Merger and Reorganization dated

as of October 28, 2024, by and among GlycoMimetics, Inc., a Delaware corporation (“GlycoMimetics”), Gemini Merger Sub Corp.,

a Delaware corporation and a wholly-owned subsidiary of GlycoMimetics (“First Merger Sub”), Gemini Merger Sub II, LLC, a Delaware

limited liability company and wholly-owned subsidiary of GlycoMimetics (“Second Merger Sub” and, together with First Merger

Sub, the “Merger Subs”), and Crescent Biopharma, Inc., a Delaware corporation (“Crescent”) (the “Merger

Agreement”), pursuant to which, among other matters, and subject to the satisfaction or waiver of the conditions set forth

in the Merger Agreement, (i) First Merger Sub will merge with and into Crescent, with Crescent continuing as a wholly owned subsidiary

of GlycoMimetics and the surviving corporation of the merger (the “First Merger”) and (ii) immediately following the First

Merger and as part of the same overall transaction as the First Merger, Crescent will merge with and into Second Merger Sub (the “Second

Merger” and, together with the First Merger, the “Merger”).

On February 24, 2025, Crescent published the following communication:

Crescent

Biopharma Strengthens Leadership Team with Appointment of Three Key Executives

Crescent Biopharma

Feb 24, 2025, 16:30 ET

New appointees reinforce the Company's momentum

in building a leading oncology therapeutics company

Lead asset CR-001, a tetravalent PD-1 x VEGF

bispecific antibody, on track for IND filing in the fourth quarter of 2025

Novel ADCs CR-002 and CR-003 on track for

development as single agents and in combination with CR-001

WALTHAM, Mass., Feb. 24, 2025 /PRNewswire/ -- Crescent Biopharma,

Inc. ("Crescent"), a private biotechnology company developing novel precision engineered molecules targeting validated biology

to advance care for patients with solid tumors, today announced the appointment of three industry veterans to its leadership team. Appointments

include Dr. Wenjie Cheng as Senior Vice President of Technical Operations, Ryan Lynch as Chief Accounting Officer, and Barbara

Bispham as General Counsel.

"I am excited to welcome these talented and experienced individuals

to Crescent during this phase of rapid growth for the Company," said Dr. Jonathan Violin, Crescent's Interim Chief Executive Officer.

"Their contributions will be critical as we advance our pipeline and continue to build the Company. Our lead asset CR-001 remains

on track for IND filing in the fourth quarter of this year, with first clinical data readout anticipated in the second half of 2026. Likewise,

our novel ADCs CR-002 and CR-003 remain on track, with an IND for CR-002 expected in mid-2026. We continue to expect our reverse merger

with GlycoMimetics to close in the second quarter of 2025, and the addition of these new leaders, along with the wealth of industry experience

they bring, ensures we are well positioned to continue our momentum and capitalize on the rich set of opportunities before us."

Wenjie Cheng, Ph.D., joins Crescent as Senior Vice President of Technical

Operations, and will lead CMC strategy and oversee manufacturing operations across the Company's therapeutic portfolio. Dr. Cheng brings

more than twenty years of experience in the biopharmaceutical industry, with deep expertise in process development and manufacturing for

antibody and antibody drug conjugate (ADC) therapeutics. She previously served as Vice President, Head of U.S. Development and Manufacturing

Center at WuXi Biologics Inc., where she was responsible for ensuring high-quality, scalable, and regulatory-compliant bioprocesses for

U.S.-based clients and facilities. Before joining WuXi Biologics, Dr. Cheng held various leadership roles at ImmunoGen, Inc., a biotechnology

company specializing in ADC therapeutics that has since been acquired by AbbVie. She began her career as a scientist at Biogen. Dr. Cheng

earned her Ph.D. and M.S. in Biophysics from New York University and her B.Sc. in Applied Chemistry at Shandong University.

Ryan Lynch has served as Crescent's Chief Accounting Officer since December

2024. Prior to joining Crescent, Mr. Lynch was Vice President of Finance at Kelonia Therapeutics, Inc., a biotechnology company developing

gene delivery technologies for oncology applications, where he oversaw the company's finance and accounting functions. Prior to Kelonia,

Mr. Lynch was Senior Director, Corporate Controller at Morphic Therapeutic Inc., a wholly owned subsidiary of Nasdaq-listed Morphic Holding,

Inc. that developed integrin therapies for serious chronic diseases and was later acquired by Eli Lilly & Company. Earlier, he held

positions of increasing responsibility at Concert Pharmaceuticals Inc., most recently serving as Senior Director and Corporate Controller.

Mr. Lynch earned his M.S. in Accounting and his B.B.A. in Accounting from the University of Massachusetts Amherst. He is a licensed

certified public accountant in Massachusetts.

Barbara Bispham joined Crescent as General Counsel and Corporate

Secretary in January 2025. Prior to joining Crescent, she served as Senior Vice President, General Counsel and Corporate Secretary

at Sail Biomedicines, where she oversaw the company's legal and intellectual property operations. Prior to Sail, Ms. Bispham served as

Senior Vice President, General Counsel and Corporate Secretary at Senda Biosciences, Inc., a biotechnology company and subsidiary of Flagship

Pioneering, Inc., until it merged with LARONDE, Inc., also a Flagship Pioneering subsidiary, to form Sail Biomedicines in October

2023. Prior to joining Senda, Ms. Bispham held positions of increasing responsibility at BridgeBio Pharma, Inc., most recently serving

as Vice President, Head of Legal, where she oversaw legal, transactional, employment, governance, litigation, privacy, compliance, and

intellectual property operations. While at BridgeBio Pharma, Ms. Bispham supported key activities in connection with the commercialization

of the company's first two FDA-approved drugs, NULIBRY® (fosdenopterin) and TRUSELTIQ® (infigratinib). Earlier, she was a member

of Goodwin Procter LLP's Tech and Life Sciences Group and a Corporate Associate at Cooley LLP. Ms. Bispham earned her J.D. from Cornell

Law School and her B.A. at the University of Pennsylvania.

About

CR-001

CR-001 is a tetravalent PD-1 x VEGF bispecific antibody in development

for treating solid tumors. It was designed to recapitulate the targeting, geometry, and cooperativity of ivonescimab, another tetravalent

PD-1 x VEGF bispecific antibody that demonstrated efficacy superior to market-leading pembrolizumab in a large Phase 3 clinical trial.

CR-001 was specifically designed to avoid mechanistic risks that could perturb the balance of efficacy and safety that define this new

class of immunotherapy.

About

Crescent Biopharma

Crescent Biopharma is a biotechnology company dedicated to advancing

novel precision engineered molecules targeting validated biology to advance care for patients with solid tumors. The company's pipeline

of three programs harnesses proven biology to accelerate the path to market for potentially best in class therapeutics. The company's

lead program is CR-001, a tetravalent PD-1 x VEGF bispecific antibody; it is also advancing CR-002 and CR003, antibody-drug conjugates

with topoisomerase inhibitor payloads for undisclosed targets. For more information, visit www.crescentbiopharma.com.

Media

Contact

Deerfield Group

Lia Dangelico

540-303-0180

lia.dangelico@deerfieldgroup.com

Investor

Contact

Argot Partners

Dawn Schottlandt

212-600-1902

dawn@argotpartners.com

SOURCE Crescent Biopharma

Forward-Looking

Statements

This

communication contains forward-looking statements (including within the meaning of Section 21E of the Exchange Act and Section 27A

of the Securities Act) concerning GlycoMimetics, Crescent, the proposed transactions and other matters. These forward-looking statements

include express or implied statements relating to the structure, timing and completion of the proposed Merger; the combined company’s

listing on Nasdaq after closing of the proposed Merger; expectations regarding the ownership structure of the combined company; the expected

executive officers and directors of the combined company; each company’s and the combined company’s expected cash position

at the closing of the proposed Merger (including completion of GlycoMimetics’s private placement) and cash runway of the combined

company; the expected contribution and payment of dividends in connection with the Merger, including the timing thereof; the future operations

of the combined company; the nature, strategy and focus of the combined company; the development and commercial potential and potential

benefits of any product candidates of the combined company; anticipated preclinical and clinical drug development activities and related

timelines, including the expected timing for data and other clinical results; the combined company having sufficient resources to advance

its pipeline candidates; and other statements that are not historical fact. The words “anticipate,” “believe,”

“contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “will,” “would” and similar expressions (including the negatives of these terms or variations

of them) may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects.

There can be no assurance that future developments affecting GlycoMimetics, Crescent or the proposed transaction will be those that have

been anticipated.

The forward-looking

statements contained in this communication are based on current expectations and beliefs concerning future developments and their potential

effects and therefore subject to other risks and uncertainties. These risks and uncertainties include, but are not limited to, risks associated

with the possible failure to satisfy the conditions to the closing or consummation of the Merger, including GlycoMimetics’ failure

to obtain stockholder approval for the Merger, risks associated with the potential failure to complete the financing transaction in a

timely manner or at all, risks associated with the uncertainty as to the timing of the consummation of the Merger and the ability of each

of GlycoMimetics and Crescent to consummate the transactions contemplated by the Merger, risks associated with GlycoMimetics’ continued

listing on Nasdaq until closing of the Merger, the failure or delay in obtaining required approvals from any governmental or quasi-governmental

entity necessary to consummate the Merger; the occurrence of any event, change or other circumstance or condition that could give rise

to the termination of the Merger prior to the closing or consummation of the Merger, risks associated with the possible failure to realize

certain anticipated benefits of the Merger, including with respect to future financial and operating results; the effect of the completion

of the Merger on the combined company’s business relationships, operating results and business generally; risks associated with

the combined company’s ability to manage expenses and unanticipated spending and costs that could reduce the combined company’s

cash resources; risks related to the combined company’s ability to correctly estimate its operating expenses and other events; changes

in capital resource requirements; risks related to the inability of the combined company to obtain sufficient additional capital to continue

to advance its product candidates or its preclinical programs; the outcome of any legal proceedings that may be instituted against the

combined company or any of its directors or officers related to the Merger Agreement or the transactions contemplated thereby; the ability

of the combined company to obtain, maintain and protect its intellectual property rights, in particular those related to its product candidates;

the combined company’s ability to advance the development of its product candidates or preclinical activities under the timelines

it anticipates in planned and future clinical trials; the combined company’s ability to replicate in later clinical trials positive

results found in preclinical studies and early-stage clinical trials of its product candidates; the combined company’s ability to

realize the anticipated benefits of its research and development programs, strategic partnerships, licensing programs or other collaborations;

regulatory requirements or developments and the combined company’s ability to obtain necessary approvals from the U.S. Food and

Drug Administration or other regulatory authorities; changes to clinical trial designs and regulatory pathways; competitive responses

to the Merger and changes in expected or existing competition; unexpected costs, charges or expenses resulting from the Merger; potential

adverse reactions or changes to business relationships resulting from the completion of the Merger; legislative, regulatory, political

and economic developments; and those risks and uncertainties and other factors more fully described in filings with the Securities and

Exchange Commission, including reports filed on Form 10-K, 10-Q and 8-K and in other filings made by GlycoMimetics

with the SEC from time to time and available at www.sec.gov. These forward-looking statements are based on current expectations, and with

regard to the proposed transaction, are based on GlycoMimetics’ current expectations, estimates and projections about the expected

date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s beliefs

and certain assumptions made by GlycoMimetics, all of which are subject to change. Such forward-looking statements are made as of the

date of this release, and the parties undertake no obligation to update such statements to reflect subsequent events or circumstances,

except as otherwise required by securities and other applicable law.

No Offer or Solicitation

This communication is not intended to and does

not constitute (i) a solicitation of a proxy, consent or approval with respect to any securities or in respect of the proposed transaction

or (ii) an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any

securities pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction

in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of the

Securities Act or an exemption therefrom. Subject to certain exceptions to be approved by the relevant regulators or certain facts to

be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute

a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation,

facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange,

of any such jurisdiction.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR

DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS COMMUNICATION IS TRUTHFUL OR COMPLETE.

Important Additional Information About the

Proposed Transaction Will be Filed with the SEC

This communication does not substitute for

the Proxy Statement or for any other document that GlycoMimetics may file with the SEC in connection with the proposed transaction. In

connection with the proposed transaction between GlycoMimetics and Crescent, GlycoMimetics intends to file relevant materials with the

SEC, including a proxy statement of GlycoMimetics. GlycoMimetics URGES INVESTORS AND STOCKHOLDERS TO READ THE PROXY STATEMENT

AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY

AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GlycoMimetics, CRESCENT,

THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and stockholders will be able to obtain free copies of the Proxy Statement and

other documents filed by GlycoMimetics with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov.

In addition, investors and stockholders should note that GlycoMimetics communicates with investors and the public using its website (www.glycomimetics.com)

and the investor relations website (www.glycomimetics.com/investor-relations) where anyone will be able to obtain free copies of

the Proxy Statement and other documents filed by GlycoMimetics with the SEC and stockholders are urged to read the Proxy Statement and

the other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction.

Participants in the Solicitation

GlycoMimetics, Crescent and their respective

directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with

the proposed transaction. Information about GlycoMimetics’s directors and executive officers including a description of their interests

in GlycoMimetics is included in GlycoMimetics’s most recent definitive proxy statement, as filed with the SEC on April 1, 2024.

Additional information regarding these persons and their interests in the proposed transaction will be included in the Proxy Statement

relating to the proposed transaction when it is filed with the SEC. These documents can be obtained free of charge from the sources indicated

above.

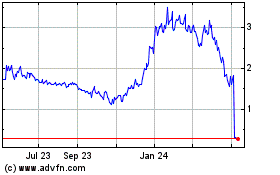

GlycoMimetics (NASDAQ:GLYC)

Historical Stock Chart

From Feb 2025 to Mar 2025

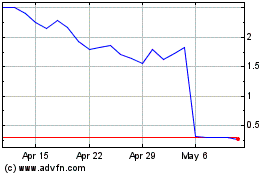

GlycoMimetics (NASDAQ:GLYC)

Historical Stock Chart

From Mar 2024 to Mar 2025